Market analysis from ThinkMarkets

Nvidia delivered another strong quarter, beating expectations on both revenue and EPS. However, shares dropped after hours to around $175, as data centre revenue narrowly missed forecasts and China sales remained absent due to regulatory uncertainty. Technically, if NVDA breaks below $175, bears may target the $170 double bottom support in a dead-cat-bounce...

In this video, we analyse the sharp move in the USDJPY following crucial speeches from Fed Chair Jerome Powell and BOJ Governor Kazuo Ueda at the Jackson Hole Symposium. Powell signalled the possibility of a September rate hike, highlighting ongoing weakness in the US labour market. Meanwhile, Ueda emphasised Japan's strong job market, supported by immigrant...

The Pound is under heavy pressure, trading around 1.3382 after falling below the critical 1.3400 mark. The trend is bearish, with price action contained in a downward channel and repeated failures to break key resistance levels. Fundamental Drivers UK Gilt Yields : 30-year yields have surged to their highest since 1998, raising concerns about the...

Markets are optimistic and consolidating ahead of the Non-Farm Payrolls (NFP) report, with EUR/USD poised for a breakout, plus a quick technical overview of gold, GBP/USD, and USD/JPY. Mood : Buoyant—risk assets and equities are near weekly highs, bond yields are easing. Consensus : A "Goldilocks" NFP (not too hot, not too cold) is expected, supporting a 25bp...

Gold reached fresh all-time highs near $3690 ahead of Wednesday's FOMC meeting. Its rally reflects a perfect storm of Fed dovishness and geopolitical tensions, but technical divergences suggest positioning carefully ahead of Powell's decision. The 100% Fib extension and double divergence setup makes any hawkish surprise particularly dangerous for leveraged...

Ethereum ETFs have recently seen significant inflows, outpacing Bitcoin ETFs, just ahead of the upcoming Fusaka upgrade in November. Ethereum recently broke above its previous record high, a move that was anticipated in earlier analysis, and is pulling back before shooting higher. For a sustained move higher, a strong breakout with increased volume and momentum...

France faces a pivotal confidence vote that could shake up the CAC 40 and broader European markets. We break down the political crisis, market risks, and actionable trading scenarios with technical levels. Big news is breaking out of France as Prime Minister François Bayrou faces a crucial confidence vote, with major implications for the CAC 40 index and the...

In today’s video, we break down the major market moves triggered by the July US CPI report. Headline CPI rose 0.2% month-over-month—right in line with expectations and a slowdown from the previous month. Year-over-year, headline inflation came in at 2.7%, just under the 2.8% forecast, while Core CPI rose 0.3% MoM (matching forecasts) but was a bit hotter at 3.1%...

The FTSE 100 has surged to a new all-time high, defying expectations after UK inflation surprised to the upside at 3.8%. This resilience can be attributed to renewed global interest in undervalued UK stocks, particularly defensives, as investors anticipate a potential end to the BOE’s easing cycle in 2025 due to persistent price pressures. The market remains...

Gold and silver are making headlines as both metals surge amid a mix of macroeconomic and technical factors. Gold is trading just below its all-time record, having recently touched $3,495 per ounce, while silver has soared to a 14-year high of above $40.50. The main catalyst behind this rally is growing confidence that the Federal Reserve will cut interest rates...

Traders are laser-focused on the release of the FOMC meeting minutes, which could prove to be the most significant market-moving event ahead of the Jackson Hole Symposium if Powell offers no insights. With markets already pricing in an 85% chance of a rate cut at the September meeting, the tone and details within the minutes will be crucial. The last FOMC meeting...

EURUSD has broken below the key 1.16 support ahead of the Jackson Hole Symposium, raising the stakes for both bulls and bears as markets become more aware of the likelihood of a hawkish stance. But will it be the case? Let's see what the possible scenarios are at play. Bearish Catalysts : Hawkish Fed Signals: Recent FOMC minutes and a potential hawkish tone...

In this video, we break down what the highly anticipated Trump-Putin talks could mean for the EUR/USD pair. The meeting is set for 21:30 CET, after markets close, so any immediate reaction may happen when they reopen. Key scenarios include: Positive Tone: If Trump and Putin get along, risk appetite could rise, but a potential Ukraine peace deal may reduce EU...

EURUSD has finally broken below the key 1.15 level, triggering a move lower in line with earlier expectations. The drop follows the US imposing fresh tariffs on European goods, a move that traditionally strengthens the currency of the tariff-imposing nation. Supporting the dollar further, the latest ADP and GDP reports came in stronger than forecast, while the...

Oil prices have climbed around 6% this week, driven by two key developments: a trade deal between the EU and the US, and Donald Trump’s warning that the US may impose sanctions on Russian oil buyers within 10 days unless progress is made toward ending the Russia-Ukraine war. Russia accounts for about 10.5% of global oil production. Major buyers like China and...

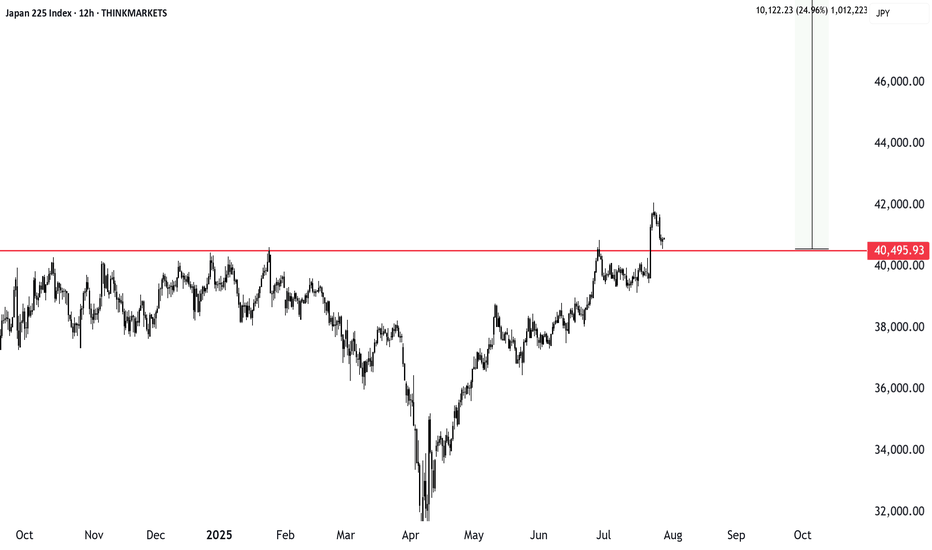

Summer breakouts are tricky with low market participation, but Japan’s stock index just cleared a major level. Whether it’s a rectangle or inverse head and shoulders, the breakout looks valid. We explore how to manage risk, trim stop losses, and aim for a solid reward ratio. Will this push continue? This content is not directed to residents of the EU or UK. Any...

The EURUSD is under pressure today, dropping nearly half a percent. This follows the new US–EU trade deal that introduces a 15 percent baseline import tariff on most goods. That means Americans buying European products must now pay 15 percent more. Naturally, markets are adjusting. When one side of a trade deal takes the hit, its currency often weakens. In this...

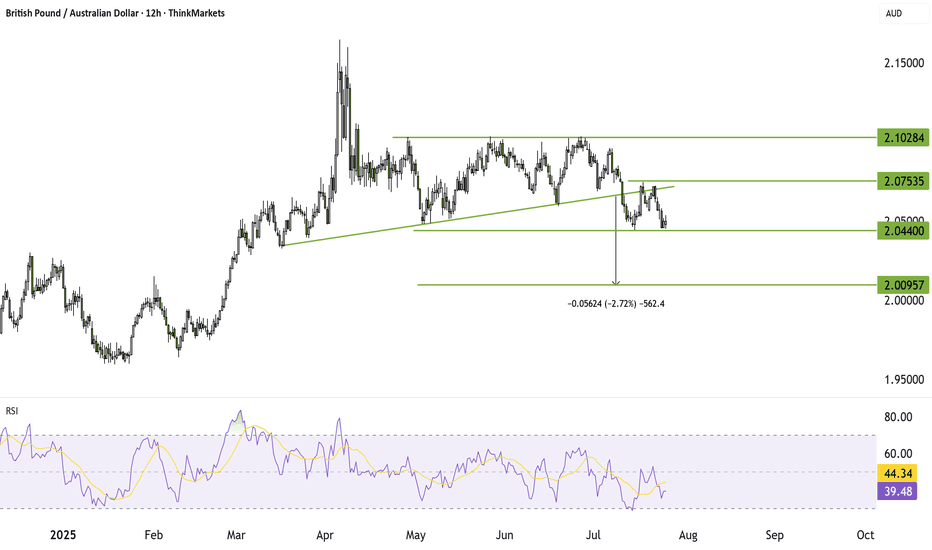

GBPAUD broke below key triangle support, confirming a bearish pattern with a target near 2.00. A failed retest strengthens the case for further downside. Bounces toward 2.06 may face selling pressure. Reward-to-risk remains attractive around 2.55x. This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or...