__________________________________________________________________________________

Market Overview

__________________________________________________________________________________

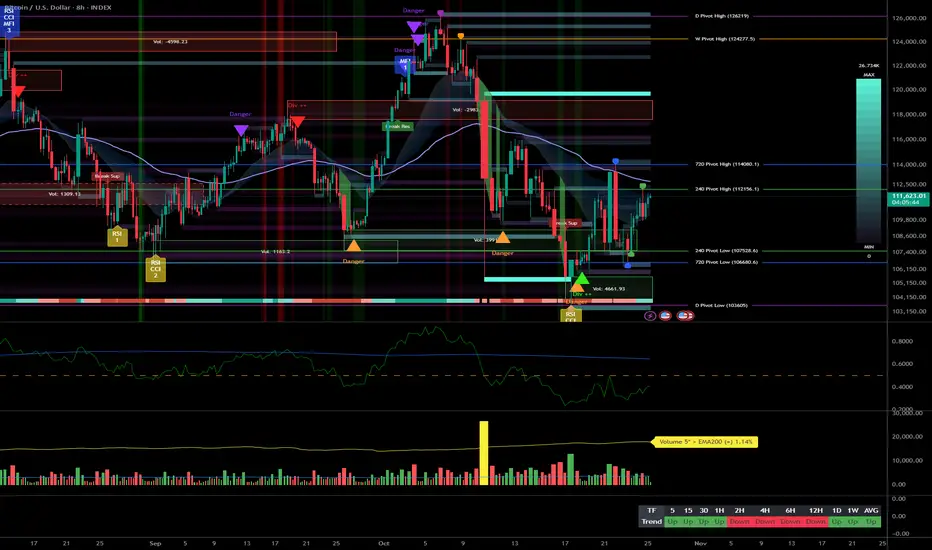

BTC is range-bound below 112,600–114,000, with improving intraday momentum but a firm HTF supply shelf overhead. The broader backdrop stays constructive while supports hold, pending a liquidity catalyst.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

Strategically, the dominant trend is neutral below 112,600–114,000; stay opportunistic: buy a clean breakout or tactically sell a clear rejection.

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Overall, HTFs stay rangey under a stacked resistance shelf, while LTFs press into the 112,600 pivot.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro/on-chain is mixed: potential risk-on via liquidity, but demand signals remain cautious below resistance.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

Range beneath 112,600–114,000 with improving intraday but HTF supply still in control.

- Trend: Neutral, bullish if a clean break above 112,600; key supports at 111,000–110,300 and 108,600.

- Setup: Break & retest > 112,600 toward 114,000/116,000; alternative is disciplined dip-buys on bullish wicks at 110,300–108,600.

- Macro: FOMC + liquidity tone (potential QT end) is the main trigger.

Stay patient: wait for confirmation (close + retest + volume) and let flows lead risk. ⚠️

Market Overview

__________________________________________________________________________________

BTC is range-bound below 112,600–114,000, with improving intraday momentum but a firm HTF supply shelf overhead. The broader backdrop stays constructive while supports hold, pending a liquidity catalyst.

- Momentum: Range with a bullish skew 📈 if 112,600 breaks and holds.

- Key levels:

- Resistances (12H–1D): 112,600–114,000, then 116,000.

- Supports (2H–1D): 111,000–110,300, then 108,600. - Volumes: Normal to moderate (1H–4H), acting as an amplifier on rejections/breakouts.

- Multi-timeframe signals: 1D Up, while 12H/6H/4H remain Down; intraday (2H/1H/30m/15m) Up but capped under 112,600–114,000.

- Risk On / Risk Off Indicator: Mixed read (NEUTRAL SELL vs NEUTRAL BUY) → overall neutral stance, waiting for flow confirmation; this aligns with a range rather than a trend.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

Strategically, the dominant trend is neutral below 112,600–114,000; stay opportunistic: buy a clean breakout or tactically sell a clear rejection.

- Global bias: Neutral with buy-on-breakout skew above 112,600; key invalidation if 1D closes below 108,600.

- Opportunities:

- Breakout long: Close + retest above 112,600 targeting 114,000 then 116,000.

- Buy the dip: 111,000–110,300 (or 108,600) on a bullish 2H–1D rejection.

- Tactical short: Rejection at 112,600–114,000 aiming 111,000 then 110,300. - Risk zones / invalidations:

- Below 108,600 on a 1D close: HTF structure weakens → risk of acceleration toward 106,800.

- Above 114,000 on 4H/1D: invalidates range shorts and opens 116,000. - Macro catalysts (Twitter, Perplexity, news):

- FOMC and liquidity tone (potential QT end) as key driver.

- US equities at ATHs: supportive risk backdrop while it lasts.

- BTC spot ETF flows mixed: uneven tailwind, needs confirmation. - Action plan:

- Entry: 112,650–112,900 (clean break/retest on 1H–4H).

- Stop: below 111,900 (breakout play) or below 110,300 (dip play).

- TP1: 114,000; TP2: 116,000; TP3: 118,500 (if extension).

- Approx R/R: 1.8R to 2.5R depending on stop and scaling.

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Overall, HTFs stay rangey under a stacked resistance shelf, while LTFs press into the 112,600 pivot.

- 1D: Uptrend but capped beneath 112,600–114,000; a clean reclaim/hold would unlock 116,000.

- 12H/6H/4H: Down/corrective; countertrend bounces likely capped at 112,600–114,000 absent confirmed closes.

- 2H/1H/30m/15m: Rising structure with higher lows; continuation on break & hold of 112,600, otherwise rotation risk toward 111,000–110,300.

- Major divergences: Mixed 1D Up vs 12H Down; raises the bar for confirmation (retest + volume) on any breakout.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro/on-chain is mixed: potential risk-on via liquidity, but demand signals remain cautious below resistance.

- Macro events: Fed QT reportedly nearing an end (near-term), risk supportive; US indices at ATHs; FOMC next → primary liquidity tone driver.

- Bitcoin analysis: Pinned between the 200D (~108.5k) and STH cost basis (~113.1k); a daily close above ~113.1–116.0k unlocks higher; loss of ~108.5k risks 100–101k.

- On-chain data: Below STH cost basis, demand fatigue; elevated LTH distribution; cautious options → need flow impulse to validate a breakout.

- Expected impact: Constructive technical bias contingent on a confirmed break; without liquidity impulse, the range can persist.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

Range beneath 112,600–114,000 with improving intraday but HTF supply still in control.

- Trend: Neutral, bullish if a clean break above 112,600; key supports at 111,000–110,300 and 108,600.

- Setup: Break & retest > 112,600 toward 114,000/116,000; alternative is disciplined dip-buys on bullish wicks at 110,300–108,600.

- Macro: FOMC + liquidity tone (potential QT end) is the main trigger.

Stay patient: wait for confirmation (close + retest + volume) and let flows lead risk. ⚠️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.