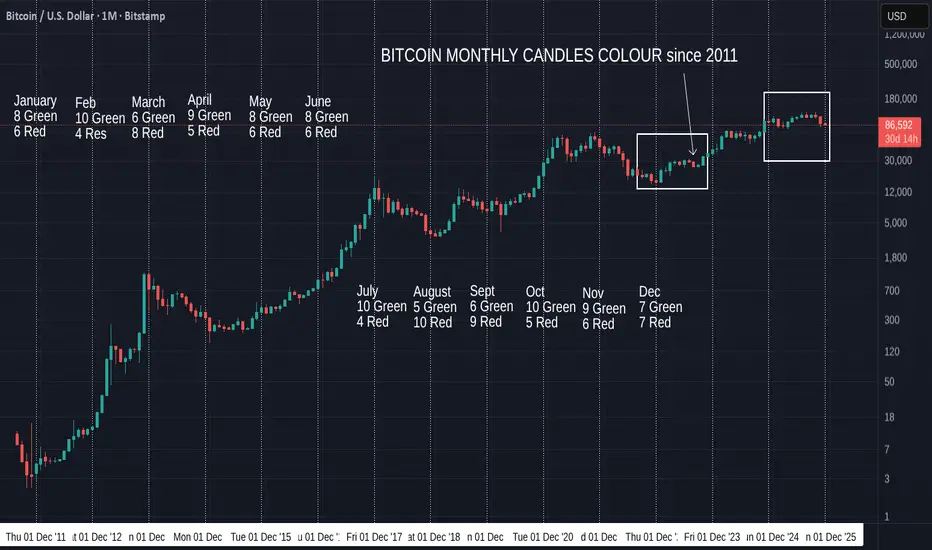

November closed RED as expected and so we have continued to follow Sequence in the left Box, mentioned in the October post.

The left Box shows the only similar monthly Candle sequence, similar to the one we currently have. If you look closely, it is also a very similar "Curve" shape. Descent to low, rise, flatten out.

The Candle Sequence to see is Red, Green. 2 Red. 4 Green, 1 red, 1 Greeno 1

red

That Sequence was followed by a larger Red Candle, which we have just also done.

The Thin down facing arrow in the left Box, points to the equvilant candle to the one we just closed, thought the month was August and not a November.

The left box starting in September 2022 and the Right Box starts in December 2024.

These Sequences run for 11 Months so Far..

This is the only 2 occasions this sequence has ever happened in Bitcoin history...and they are Both in the same "Bull Run"

And I will just mention that the Left Box was the recovery period after the 2022 Bear market.

A Very positive period.

If we continue this Sequence, we should see a Green Candle in December, though maybe not a large one. Some charts point to a Red start to December, so remain cautious.

We should also remember that a pattern workss untill it Stops...but the longer it runs, the higher the chance of that point being reached.

Just to Recap from the October post of this Series.....

"The Red November in 2011 was the bottom and was the start of Bitcoins 2 year push to ATH.

The Red one in November 2022 marked the Bottom of the Bear, though December was red but a small candle.

Nearly half of the Red Novembers called the Bottom of a Bear, a turning point in market behaviour." (There had been only 5 Red Novembers at the time of writing)

What is also very interesting is how the November 2022 Red candle was approx -27% draw down. (Wicks included) -> the following December in 2022 closed a small Red candle.

The Red November we just closed was also approx -27%

However, To follow the Color sequence, we will expect a Green December.

Of the Previous Red NOVEMBER closes, we have only ever had ONE Green December, way back in 2011,

The Odds do point to a Red December close....but hopefully a small one.

If this happens, the color sequence gets broken but I will look at what happened in early 2023 as a possible follow on. The November, December, January candles for sure....

Looking Forward. Previous December closes.

7 Green to 7 Red - A 50 - 50 mix.

Of the previous 7 Red December Closes, 4 were followed by a Green January, the last one being in December 2022 and was followed by a Lovely Green January, marking the start of the current push higher by Bitcoin from 15K usdt low to over 120K usdt.

That January Candle was over 50% rise.

Only one Red December led us into a Deep Bear market, the others signalled change.....

So, While the odds, technically, point to a Red December close, to follow previous moves and sentiments, this may not be a bad thing.

A Red December would break the sequence we have been talking about, as the next in sequence is a GREEN candle. And so were the next 6 Months.

So, December Close will answer Many questions and is, once again, a pivotal month. The Sentiment for the entire year to follow will be set by this months Candle Close..

We currently have a number of pointers suggesting this is an End to a "Bear"....and this Draw back right now has seen PA fall below a number of Key support levels but interestingly, we have got no where near the "traditional " - 80% Bear draw down.

Very confused signals, hinting at moves in either direction.

We have to wait......as ever.... But I am VERY BULLISH

As it stands, a Red or a Green December has the potential to be Good, providing that, obviously, a BEAR market is not confirmed.

My preference is fr a small Red candle this month........

The left Box shows the only similar monthly Candle sequence, similar to the one we currently have. If you look closely, it is also a very similar "Curve" shape. Descent to low, rise, flatten out.

The Candle Sequence to see is Red, Green. 2 Red. 4 Green, 1 red, 1 Greeno 1

red

That Sequence was followed by a larger Red Candle, which we have just also done.

The Thin down facing arrow in the left Box, points to the equvilant candle to the one we just closed, thought the month was August and not a November.

The left box starting in September 2022 and the Right Box starts in December 2024.

These Sequences run for 11 Months so Far..

This is the only 2 occasions this sequence has ever happened in Bitcoin history...and they are Both in the same "Bull Run"

And I will just mention that the Left Box was the recovery period after the 2022 Bear market.

A Very positive period.

If we continue this Sequence, we should see a Green Candle in December, though maybe not a large one. Some charts point to a Red start to December, so remain cautious.

We should also remember that a pattern workss untill it Stops...but the longer it runs, the higher the chance of that point being reached.

Just to Recap from the October post of this Series.....

"The Red November in 2011 was the bottom and was the start of Bitcoins 2 year push to ATH.

The Red one in November 2022 marked the Bottom of the Bear, though December was red but a small candle.

Nearly half of the Red Novembers called the Bottom of a Bear, a turning point in market behaviour." (There had been only 5 Red Novembers at the time of writing)

What is also very interesting is how the November 2022 Red candle was approx -27% draw down. (Wicks included) -> the following December in 2022 closed a small Red candle.

The Red November we just closed was also approx -27%

However, To follow the Color sequence, we will expect a Green December.

Of the Previous Red NOVEMBER closes, we have only ever had ONE Green December, way back in 2011,

The Odds do point to a Red December close....but hopefully a small one.

If this happens, the color sequence gets broken but I will look at what happened in early 2023 as a possible follow on. The November, December, January candles for sure....

Looking Forward. Previous December closes.

7 Green to 7 Red - A 50 - 50 mix.

Of the previous 7 Red December Closes, 4 were followed by a Green January, the last one being in December 2022 and was followed by a Lovely Green January, marking the start of the current push higher by Bitcoin from 15K usdt low to over 120K usdt.

That January Candle was over 50% rise.

Only one Red December led us into a Deep Bear market, the others signalled change.....

So, While the odds, technically, point to a Red December close, to follow previous moves and sentiments, this may not be a bad thing.

A Red December would break the sequence we have been talking about, as the next in sequence is a GREEN candle. And so were the next 6 Months.

So, December Close will answer Many questions and is, once again, a pivotal month. The Sentiment for the entire year to follow will be set by this months Candle Close..

We currently have a number of pointers suggesting this is an End to a "Bear"....and this Draw back right now has seen PA fall below a number of Key support levels but interestingly, we have got no where near the "traditional " - 80% Bear draw down.

Very confused signals, hinting at moves in either direction.

We have to wait......as ever.... But I am VERY BULLISH

As it stands, a Red or a Green December has the potential to be Good, providing that, obviously, a BEAR market is not confirmed.

My preference is fr a small Red candle this month........

Nothing to be taken as Financial advice.

I will always say

"Only invest what you can afford to loose. When you are ready, take out your original investment. This way, it is only your profit that is at risk"

THAT is Financial advice

I will always say

"Only invest what you can afford to loose. When you are ready, take out your original investment. This way, it is only your profit that is at risk"

THAT is Financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Nothing to be taken as Financial advice.

I will always say

"Only invest what you can afford to loose. When you are ready, take out your original investment. This way, it is only your profit that is at risk"

THAT is Financial advice

I will always say

"Only invest what you can afford to loose. When you are ready, take out your original investment. This way, it is only your profit that is at risk"

THAT is Financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.