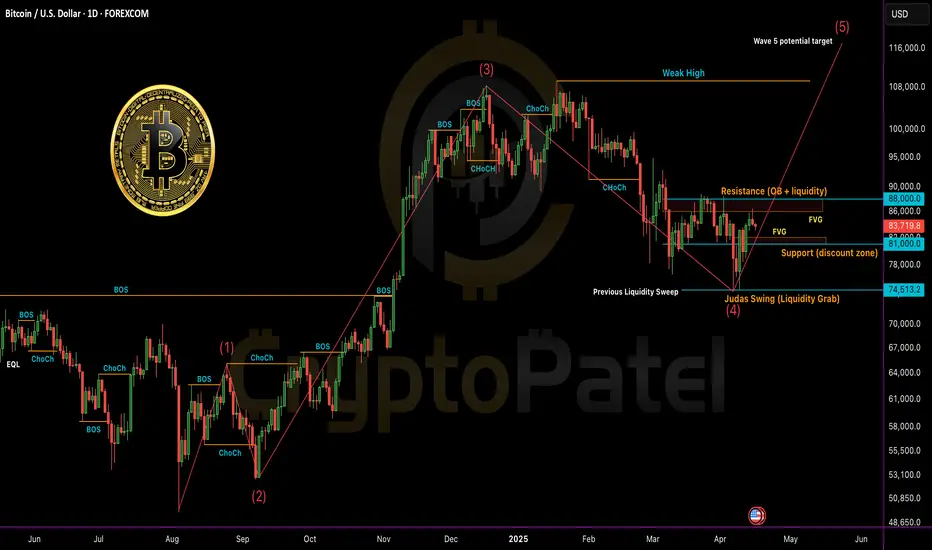

Bitcoin (BTC/USDT) – Full Technical Breakdown - Timeframe: 1D

Market Structure & SMC (Smart Money Concepts)

✅ CHoCH (Change of Character) confirmed from $105K top → current lower high around 88K zone.

88K zone.

📉 Break of Structure (BOS) to the downside occurred at $91K.

🟠 Bearish Order Block (OB): $86K– 88K (price currently reacting here).

88K (price currently reacting here).

Liquidity Levels:

Sell-side: Swept at $76K

Buy-side: Sitting above 88K

88K

Fair Value Gap (FVG): Unfilled zone between $81K– 82K may act as magnet for price.

82K may act as magnet for price.

ICT Model Alignment

Judas Swing: Sharp liquidity grab below $76K → followed by rebound — classic manipulation before real move.

PD Array Setup:

Resistance: 88K (bearish OB + buy-side liquidity)

88K (bearish OB + buy-side liquidity)

Support: $81K (discount zone + FVG)

Elliott Wave Outlook

Wave 1: July–Sept 2024

Wave 3: Nov–Feb rally to $105K (extended wave)

Wave 4: Correction to $76K likely complete

Wave 5 Target: Potential $115K+ if structure holds

Fractal Observation

🔹 Current price structure is mimicking Nov 2023–Jan 2024 pattern

🔹 If history rhymes: consolidation → breakout → retest → parabolic rally

Key Levels to Watch

🔼 Bullish Confirmation: Daily close above 88K → targeting

88K → targeting  92K–$100K

92K–$100K

🔽 Bearish Rejection: Drop below $81K → next support at $74K–$76K

Strategy Summary

🔹 Short-Term Bias: Cautiously Bullish

🔹 Entry Zone: Retest near 82K (FVG + OB)

82K (FVG + OB)

🔹 SL: Below $79.5K

🔹 TP Zones: 88K →

88K →  92K →

92K →  98K

98K

📈 R:R = Minimum 1:5 (High confluence)

Keep your eyes on HTF closures and manage risk. Liquidity traps are in play.

Market Structure & SMC (Smart Money Concepts)

✅ CHoCH (Change of Character) confirmed from $105K top → current lower high around

📉 Break of Structure (BOS) to the downside occurred at $91K.

🟠 Bearish Order Block (OB): $86K–

Liquidity Levels:

Sell-side: Swept at $76K

Buy-side: Sitting above

Fair Value Gap (FVG): Unfilled zone between $81K–

ICT Model Alignment

Judas Swing: Sharp liquidity grab below $76K → followed by rebound — classic manipulation before real move.

PD Array Setup:

Resistance:

Support: $81K (discount zone + FVG)

Elliott Wave Outlook

Wave 1: July–Sept 2024

Wave 3: Nov–Feb rally to $105K (extended wave)

Wave 4: Correction to $76K likely complete

Wave 5 Target: Potential $115K+ if structure holds

Fractal Observation

🔹 Current price structure is mimicking Nov 2023–Jan 2024 pattern

🔹 If history rhymes: consolidation → breakout → retest → parabolic rally

Key Levels to Watch

🔼 Bullish Confirmation: Daily close above

🔽 Bearish Rejection: Drop below $81K → next support at $74K–$76K

Strategy Summary

🔹 Short-Term Bias: Cautiously Bullish

🔹 Entry Zone: Retest near

🔹 SL: Below $79.5K

🔹 TP Zones:

📈 R:R = Minimum 1:5 (High confluence)

Keep your eyes on HTF closures and manage risk. Liquidity traps are in play.

Twitter: twitter.com/CryptoPatel

Telegram: t.me/OfficialCryptoPatel

Instagram: instagram.com/cryptopatel?utm_medium=copy_link

Telegram: t.me/OfficialCryptoPatel

Instagram: instagram.com/cryptopatel?utm_medium=copy_link

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Twitter: twitter.com/CryptoPatel

Telegram: t.me/OfficialCryptoPatel

Instagram: instagram.com/cryptopatel?utm_medium=copy_link

Telegram: t.me/OfficialCryptoPatel

Instagram: instagram.com/cryptopatel?utm_medium=copy_link

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.