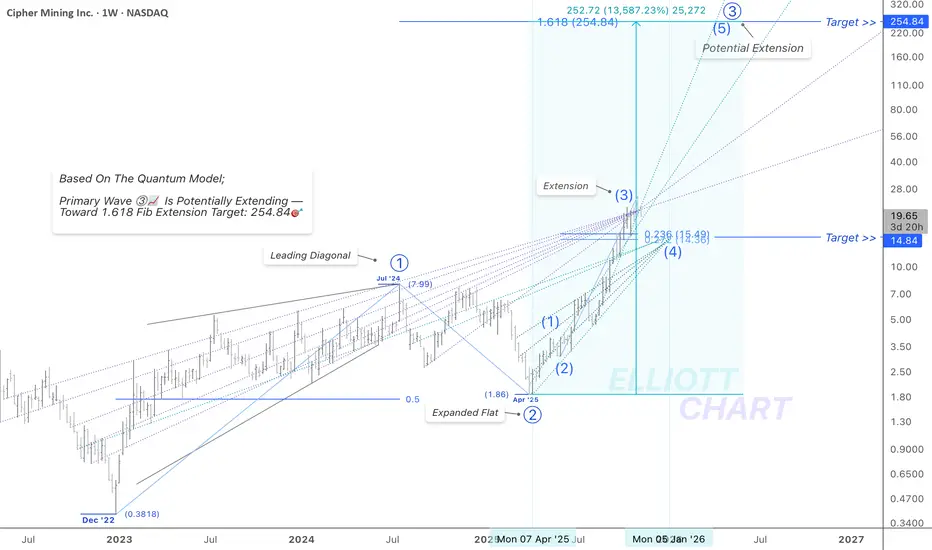

As illustrated in the Quantum Model, since early April, $Cipher has advanced to Intermediate Wave (3) within the potential extension of Primary Wave ⓷, forming the top of the third wave and now consolidating in Intermediate Wave (4).

The projected target for this corrective phase lies near $14.84🎯, positioned at the apex of the convergent equivalence lines — aligning with the 0.236–0.272 Fibonacci retracement zone.

Upon completion of Int. Wave (4), an impulsive Int. Wave (5) may potentially extend within the space of the divergent equivalence lines, targeting around $254.84🎯 — marking the 1.618 Fibonacci extension of the Leading Diagonal that formed Primary Wave ⓵.

🔖 It’s worth noting that the equivalence lines form a core component of my personal framework, which I apply through my Quantum Models methodology.

#MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #FibLevels #FinTwit #TradingView #Investing #CIFR #DataCenters #BitcoinMining #HPC #CryptoMining #CipherMining #BTC #Bitcoin #BTCUSD

#HighPerformanceComputing

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.