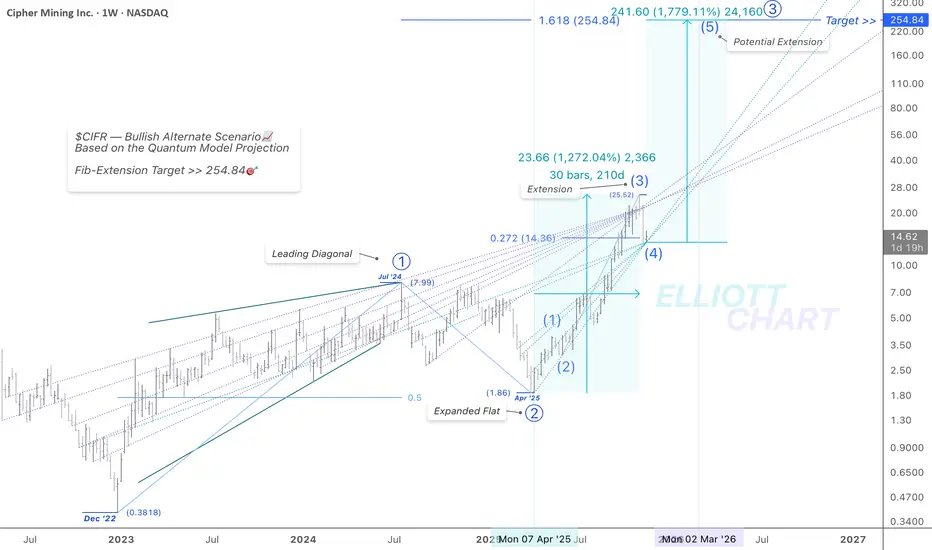

Bullish Alternative — Weekly

As outlined earlier (Nov. 15), Intermediate Wave (4) retraced sharply into the $14.36 target last week and is now resting at the apex of the support equivalence lines.

While there is still room for Intermediate Wave (4) to further evolve into a Flat or Triangle correction, an eventual extension into Intermediate Wave (5) within Primary Wave ⓷ projects toward $254🎯. This aligns with the zone defined by the divergent equivalence lines, marking the 1.618 Fibonacci extension of the Leading Diagonal that formed Primary Wave ⓵ — a structurally bullish formation.

🔖 In my Quantum Models methodology, the equivalence lines function as structural elements, anchoring the model’s internal geometry and framing the progression of alternate paths.

#MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #FibLevels #FinTwit #TradingView #Investing #CIFR #DataCenters #BitcoinMining #HPC #CryptoMining #CipherMining #BTC #Bitcoin #BTCUSD

#HighPerformanceComputing

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.