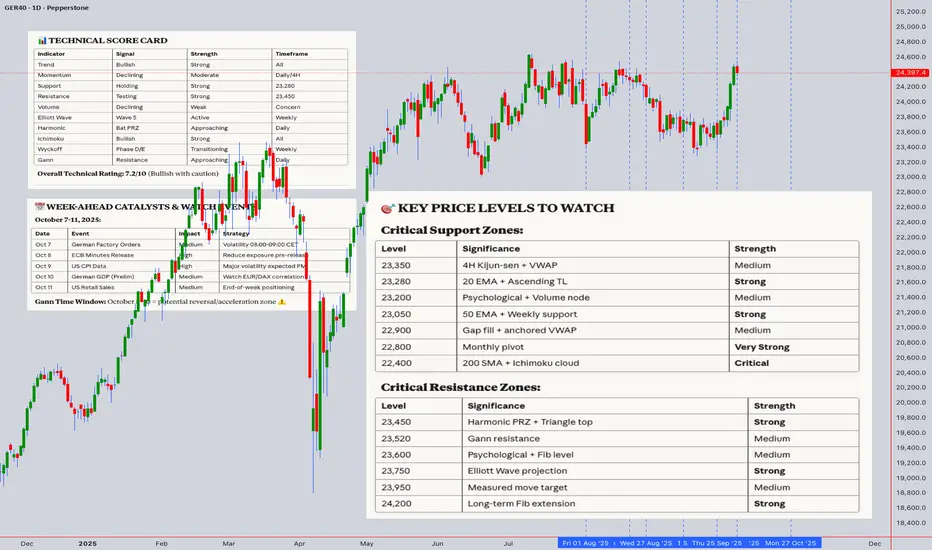

Current Price: 23,397.40 | 4th October 2025, 12:54 AM UTC+4

📊 MARKET OVERVIEW & STRUCTURAL ANALYSIS

The DAX40 is trading near all-time highs, displaying robust bullish momentum following the breakout above 23,000. The index is currently in a consolidation phase after an extended rally, suggesting potential for either continuation or a corrective pullback.

Key Market Context:

Trend Structure: Primary uptrend intact across all major timeframes

Market Phase: Late-stage expansion with decreasing momentum divergence

Volatility: Moderate; Bollinger Bands showing compression on 4H/Daily charts

Volume Profile: Declining volume on recent highs suggests potential exhaustion

🎯 MULTI-TIMEFRAME ANALYSIS

MONTHLY CHART - Long-term Perspective

Elliott Wave Count: Currently in Wave 5 of a larger impulse structure from 2022 lows

Gann Analysis: Price approaching the 1x2 Gann angle from the 2022 pivot; resistance expected at 23,450-23,500

Ichimoku Cloud: Trading well above the Kumo; Tenkan-sen/Kijun-sen bullish crossover sustained

Key Support: 22,800 (monthly pivot) | 22,400 (cloud base)

Key Resistance: 23,500 (Gann resistance) | 23,850 (Wave 5 projection target)

WEEKLY CHART - Swing Trading Perspective

Pattern Recognition: Potential Bull Flag formation developing (consolidation after strong rally)

Wyckoff Analysis: Phase D (markup) transitioning to possible Phase E (redistribution)

RSI: 67.2 - approaching overbought territory but not yet extreme

VWAP (Anchored from Jan 2025): 22,950 - price trading above, bullish bias confirmed

Volume Analysis: Decreasing volume on upswings suggests weakening buying pressure

DAILY CHART - Swing & Position Trading

Harmonic Pattern: Potential Bat Pattern completion zone: 23,450-23,550 (PRZ)

Head & Shoulders Watch: No clear reversal pattern yet, but right shoulder formation risk if rejection occurs above 23,500

Bollinger Bands: Price at upper band (23,420); squeeze pattern suggests breakout/breakdown imminent

Moving Averages:

20 EMA: 23,280 (immediate support)

50 EMA: 23,050 (critical support)

200 SMA: 22,400 (long-term trend support)

RSI: 64.8 - neutral to slightly overbought

MACD: Bullish but histogram showing declining momentum

4-HOUR CHART - Intraday/Swing Bridge

Trend: Short-term consolidation within ascending channel

Ichimoku: Price above cloud; flat Kijun-sen at 23,350 = pivot zone

VWAP: 23,365 - current price trading slightly above, marginally bullish

Support Levels: 23,350 | 23,280 | 23,200

Resistance Levels: 23,450 | 23,520 | 23,600

Pattern: Ascending Triangle forming between 23,280 support and 23,450 resistance

1-HOUR CHART - Intraday Focus

Candlestick Pattern: Indecision candles (doji/spinning tops) suggesting hesitation

RSI: 58.4 - neutral zone

Bollinger Bands: Mid-band at 23,370; price oscillating around mean

Volume: Below average - lack of conviction

Gann Square of 9: Next resistance at 23,445 (45° from current pivot)

15-MINUTE & 5-MINUTE CHARTS - Scalping

Micro Structure: Range-bound between 23,370-23,420

VWAP: Acting as dynamic support/resistance at 23,385

Volume Spikes: Watch for breakout confirmation with volume >120% of 20-period average

RSI (15M): Oscillating between 45-60 (neutral range)

🔍 CRITICAL TECHNICAL SIGNALS

Bullish Indicators:

✅ Price above all major moving averages (20/50/200 EMA)

✅ Ichimoku Cloud bullish alignment across all timeframes

✅ Higher lows pattern maintained since September

✅ Golden Cross intact (50 EMA > 200 EMA)

✅ Volume-weighted averages showing institutional support

Bearish Warning Signs:

⚠️ Declining volume on rallies (distribution concern)

⚠️ RSI bearish divergence forming on 4H/Daily charts

⚠️ Approaching Gann resistance and harmonic PRZ

⚠️ MACD histogram declining (momentum weakening)

⚠️ Potential Bull Trap risk if rejection occurs above 23,450

Neutral/Watch Factors:

🔶 Bollinger Band squeeze on daily chart (breakout pending)

🔶 Wyckoff redistribution signs require confirmation

🔶 No clear Head & Shoulders pattern yet (monitoring right shoulder)

📈 INTRADAY TRADING STRATEGY (Next 5 Trading Days)

SCENARIO A: BULLISH BREAKOUT (Probability: 45%)

Trigger: Break and hold above 23,450 with volume confirmation

Entry Points:

Aggressive: 23,455 (immediate breakout)

Conservative: 23,470 (retest of breakout level)

Targets:

T1: 23,520 (short-term resistance)

T2: 23,600 (Gann 1x1 angle)

T3: 23,750 (measured move from triangle)

Stop Loss:

Below 23,350 (4H Kijun-sen)

Time Frames: 5M, 15M, 1H entries | Hold 4H-Daily for swing

Risk:Reward: Minimum 1:2.5

SCENARIO B: RANGE-BOUND CONSOLIDATION (Probability: 35%)

Range: 23,280 - 23,450

Long Entries:

23,280-23,300 (lower range support + 20 EMA)

23,350-23,365 (4H pivot + VWAP)

Short Entries:

23,430-23,450 (upper range resistance)

23,520-23,535 (false breakout rejection)

Targets:

Range midpoint: 23,365

Opposite range boundary

Stop Loss:

Longs: Below 23,250 (range invalidation)

Shorts: Above 23,480 (breakout confirmed)

Strategy: Mean reversion scalping on 15M/1H charts

SCENARIO C: BEARISH CORRECTION (Probability: 20%)

Trigger: Break and close below 23,280 (20 EMA + ascending trendline)

Short Entry Points:

Aggressive: 23,275 (break confirmation)

Conservative: 23,300 (retest as resistance)

Targets:

T1: 23,200 (minor support)

T2: 23,050 (50 EMA + psychological level)

T3: 22,900 (weekly VWAP + gap fill)

Stop Loss:

Above 23,370 (failed breakdown)

Confirmation Signals:

RSI breaking below 50

MACD bearish crossover on 1H/4H

Volume surge on breakdown

📊 SWING TRADING STRATEGY (1-4 Weeks Outlook)

BULLISH SWING SCENARIO

Entry Zone: 23,200-23,280 (pullback to 20 EMA support)

Position Sizing: Build in 3 tranches

40% at 23,280

30% at 23,200

30% at 23,050 (if deeper correction)

Targets:

T1: 23,750 (Elliott Wave 5 target - partial profit 40%)

T2: 23,950 (Measured move + Gann extension - 30%)

T3: 24,200 (Fibonacci 1.618 extension - runner 30%)

Stop Loss: Below 22,950 (daily close basis)

Hold Duration: 2-4 weeks

Ideal Setup:

Bullish engulfing candle on daily chart at support

RSI bounce from 40-45 zone

Volume increase on bounce

BEARISH SWING SCENARIO (Hedge/Counter-trend)

Entry Zone: 23,480-23,550 (harmonic PRZ + Gann resistance)

Confirmation Required:

Bearish reversal candlestick (shooting star, evening star)

RSI bearish divergence

MACD bearish crossover on daily chart

Break below 23,350 on closing basis

Targets:

T1: 23,050 (50 EMA - 40% cover)

T2: 22,800 (monthly pivot - 35% cover)

T3: 22,400 (200 SMA + cloud base - final 25%)

Stop Loss: Above 23,650 (daily close)

Risk Management: Tight stops; favor bullish bias unless clear reversal

⚡ ELLIOTT WAVE ANALYSIS

Current Count:

Primary Wave: Wave 5 of larger impulse from 2022 lows

Intermediate Wave: Subwave 5 of Wave 5 (terminal phase)

Minor Wave: Possible wave (iv) consolidation completing

Wave Projections:

Wave 5 Target (Equal legs): 23,750-23,800

Wave 5 Target (1.618 extension): 24,150-24,250

Corrective Wave A Target (if reversal): 22,800-22,900

Wave C Target (full correction): 22,200-22,400

Key Insights:

Wave structure suggests uptrend continuation likely

Terminal wave characteristics: decreasing momentum, longer time

Watch for five-wave completion signals near 23,750-24,000 zone

🔮 GANN ANALYSIS

Square of 9 (from 23,000 pivot):

45° Resistance: 23,445 ⚠️ (approaching)

90° Resistance: 23,667

180° Major Resistance: 24,000 (psychological confluence)

45° Support: 23,111

90° Support: 22,889

Gann Angles (from September 2024 low):

1x1 Angle: Currently at 23,580 (equilibrium)

1x2 Angle: 23,450 (major resistance) ⚠️

2x1 Angle: 23,100 (support)

Time Cycles:

Next significant Gann time window: October 8-10, 2025 (21 trading days from last pivot)

Potential reversal/acceleration zone

Price & Time Squaring:

Price at 23,400 squares with October 7th time projection

Suggests potential turning point early next week

🌊 ICHIMOKU KINKO HYO ANALYSIS

Current Status (Daily Chart):

Tenkan-sen (Conversion): 23,350 (flat = consolidation)

Kijun-sen (Base): 23,280 (critical support)

Senkou Span A: 23,100

Senkou Span B: 22,850

Chikou Span: Above price (bullish confirmation)

Cloud Analysis:

Price well above cloud = Strong Bull Trend

Cloud thickness = robust support structure

Future cloud (26 periods ahead) shows slight thinning = potential volatility increase

Key Signals:

TK Cross: Tenkan approaching Kijun from above (watch for bearish cross)

Price vs Kijun: Trading above = bullish, but proximity suggests correction risk

Chikou Span: Clear of price = trend continuation likely

Ichimoku Trading Signals:

Buy Signal: Pullback to 23,280-23,300 (Kijun support) with bullish rejection

Sell Signal: Daily close below Kijun (23,280) with bearish TK cross

Strongest Support: Cloud base at 22,850-23,100

📉 WYCKOFF MARKET CYCLE ANALYSIS

Current Phase Assessment: Late Phase D (Markup) / Early Phase E Watch

Characteristics Observed:

Accumulation (Complete): Built solid base 22,000-22,500 (July-August)

Markup Phase D: Strong advance from 22,500 to 23,400 (September-October)

Distribution Signs (Emerging):

Declining volume on rallies

Buying Climax (BC) potential near 23,500

Automatic Reaction (AR) risk if sharp rejection occurs

Secondary Test (ST) of supply likely

Wyckoff Price Levels:

Creek: 22,900-23,000 (major demand zone)

Spring Potential: 23,480-23,550 (if false breakout occurs)

Sign of Weakness (SOW): Break below 23,200 would signal distribution

Trading Implications:

If Markup Continues: Target 23,750-24,000 (Phase E)

If Distribution Begins: First support 23,000-23,050, major 22,800

Volume Confirmation Critical: Breakouts require 30%+ above average volume

Composite Operator Behavior:

Likely testing supply at current levels

Watch for shake-out below 23,280 to trap weak longs

Absorption of supply above 23,450 needed for continuation

🎪 HARMONIC PATTERN ANALYSIS

Active Pattern: Potential Bat Pattern Completion

Pattern Structure:

X: 22,450 (September low)

A: 23,150 (interim high)

B: 22,850 (retracement)

C: 23,350 (rally)

D (PRZ): 23,450-23,550 (reversal zone) ⚠️

Fibonacci Ratios:

AB: 0.382-0.500 retracement of XA ✓

BC: 0.382-0.886 retracement of AB ✓

CD: 1.618-2.618 extension of BC (target: 23,480-23,550)

XD: 0.886 retracement of XA (23,520) ⚠️

Trading Strategy:

Bearish Reversal Zone: 23,450-23,550

Entry: Short on bearish reversal confirmation in PRZ

Targets (if pattern activates):

38.2% CD: 23,200

61.8% CD: 22,950

100% CD: 22,650

Stop Loss: Above 23,600 (pattern invalidation)

Alternative Patterns:

Bullish Butterfly target at 23,750 if breakout sustains above 23,550

Gartley Pattern support at 23,050 on any correction

📊 INDICATOR SYNTHESIS

RSI (Relative Strength Index):

Daily: 64.8 (neutral/slightly overbought)

4H: 61.2 (neutral)

1H: 58.4 (neutral)

Divergence: Bearish divergence forming on 4H/Daily (price higher highs, RSI lower highs) ⚠️

Key Levels:

Overbought: >70 (not yet extreme)

Oversold: <30 (correction target)

Support: 50 level = trend strength gauge

Bollinger Bands:

Daily: Squeeze pattern (low volatility = breakout imminent)

4H: Price at upper band (23,420) = short-term extended

Bandwidth: Narrowing significantly = explosive move coming (direction TBD)

Strategy: Wait for band break + close outside, then enter in direction of break

VWAP Analysis:

Session VWAP: 23,385 (dynamic pivot)

Weekly VWAP: 23,290 (critical support)

Anchored VWAP (Jan 2025): 22,950 (major support)

Volume Profile: Highest volume node at 23,300-23,350 (strong support/resistance flip zone)

Moving Average Confluence:

20 EMA: 23,280 (immediate support)

50 EMA: 23,050 (medium-term support)

200 SMA: 22,400 (long-term trend)

Alignment: Bullish across all timeframes

Golden Cross: Active since August 2024 (50>200) = long-term bullish

MACD (Moving Average Convergence Divergence):

Daily: Bullish, but histogram declining (momentum loss)

4H: Approaching zero line (neutral)

Signal: Watch for bearish crossover on 4H as early reversal warning

Divergence: Confirming RSI bearish divergence on daily chart

🚨 TRAP IDENTIFICATION & AVOIDANCE

BULL TRAP Risk (HIGH ALERT): ⚠️⚠️⚠️

Scenario: False breakout above 23,450-23,500 followed by sharp reversal

Warning Signs:

Breakout with declining volume (no conviction)

Quick spike to 23,500-23,550 with long upper wicks

Inability to hold above 23,450 for more than 2 hours (1H chart)

RSI divergence + MACD histogram declining

Break below 23,350 after failed breakout

Protection Strategy:

Wait for retest of breakout level before entering longs

Require volume confirmation (>120% of 20-period average)

Set tight stops below 23,380 if entering on breakout

Reduce position size by 50% if entering in potential trap zone

Bull Trap Target (if triggered): 23,000-23,050 (trap participants' stops)

BEAR TRAP Risk (LOW-MODERATE):

Scenario: False breakdown below 23,280 followed by sharp recovery

Warning Signs:

Break on low volume

Quick recovery above 23,280 within 1-2 candles

Strong bullish reversal candlestick at support

RSI showing bullish divergence at lower levels

Protection Strategy:

Wait for daily close below 23,250 before aggressive shorts

Watch for volume confirmation on breakdown

Be ready to cover shorts if price reclaims 23,300 quickly

Don't short against major support zones without confirmation

🌍 MARKET CONTEXT & EXTERNAL FACTORS

Macroeconomic Considerations:

ECB Policy: Dovish stance supporting equity markets

German Economy: Manufacturing PMI showing signs of stabilization

EUR/USD: Correlation with DAX; watch 1.08-1.10 zone

US Markets: S&P 500 correlation strong; US data impacts DAX sentiment

Geopolitical: Middle East tensions = safe-haven flows (moderate risk)

Earnings Season:

German corporate earnings (October) = potential volatility catalyst

DAX constituent reporting: watch for sector rotation

Seasonal Patterns:

October historically volatile for European indices

End-of-month portfolio rebalancing (October 31st) = potential volatility

Volatility Indicators:

VDAX (DAX volatility): Currently moderate ~15-16

Complacency risk if volatility spikes above 18

🎯 COMPREHENSIVE TRADING PLAN

INTRADAY TRADERS (5M - 1H Charts):

Monday-Wednesday Outlook:

Primary Strategy: Range trading between 23,280-23,450

Scalp Zones:

Buy: 23,300-23,320 | Target: 23,380-23,400 | Stop: 23,275

Sell: 23,430-23,450 | Target: 23,370-23,350 | Stop: 23,475

Thursday-Friday Outlook:

Breakout Watch: Decision time for triangle pattern

If Bullish: Long 23,460+ | Target: 23,550 | Trail stop

If Bearish: Short <23,270 | Target: 23,150 | Stop: 23,320

Risk Management:

Maximum 1% risk per trade

2:1 minimum risk:reward

No more than 3 active positions simultaneously

Daily loss limit: 2% of account

SWING TRADERS (4H - Daily Charts):

PRIMARY SETUP: Buy the Dip

Entry Zone: 23,200-23,280 (expect pullback next week)

Confirmation: Bullish engulfing or hammer on daily chart

Position Size: 2-3% risk per trade

Targets: 23,750 (T1) | 24,000 (T2) | 24,250 (T3)

Stop Loss: 22,950 (daily close basis)

Time Horizon: 2-4 weeks

SECONDARY SETUP: Breakout Long

Entry: Break and hold above 23,480 (daily close)

Confirmation: Volume >1.5x average + consecutive closes above

Targets: 23,750 | 24,000 | 24,300

Stop Loss: 23,350

Hold: Trail stop to 20 EMA on daily chart

HEDGE SETUP: Short from Resistance

Entry: 23,500-23,550 with reversal confirmation

Confirmation: Shooting star + RSI divergence + MACD cross

Targets: 23,200 | 23,050 | 22,800

Stop Loss: 23,650 (strict)

Position Size: 50% of normal (counter-trend)

POSITION TRADERS (Weekly - Monthly Charts):

Long-Term Bullish Thesis:

Entry Strategy: Accumulate on corrections to 23,000-23,200

Core Position: Build over 2-3 weeks

Targets:

24,000 (3-month target)

24,500 (6-month target)

25,000 (12-month psychological)

Stop Loss: Weekly close below 22,600

Rationale: Elliott Wave 5 completion + breakout from multi-year consolidation

Portfolio Allocation:

60% long exposure at current levels

20% cash for pullback buying

20% hedges if approaching 23,800-24,000 zone

🔔 ALERT LEVELS & NOTIFICATIONS

Critical Price Alerts to Set:

✅ 23,480 (Breakout level - LONG signal)

✅ 23,450 (Harmonic PRZ - Watch for reversal)

✅ 23,350 (4H support - Breakdown warning)

✅ 23,280 (Daily 20 EMA - CRITICAL support)

✅ 23,200 (Buy zone activation)

✅ 23,050 (50 EMA - Major support test)

✅ 22,950 (Stop loss trigger for swings)

Indicator Alerts:

RSI crossing 70 (overbought) or 50 (weakness)

MACD bearish crossover on 4H/Daily

Bollinger Band break (either direction)

Volume spike >150% of average

📌 CONCLUSION & BIAS

Overall Bias: CAUTIOUSLY BULLISH 🟢 (60% probability)

Bullish Case (60%):

The primary trend remains intact with price above all major moving averages and strong cloud support. The consolidation near highs is healthy, and a resolution to the upside targeting 23,750-24,000 is the path of least resistance. Elliott Wave structure suggests one more push higher to complete Wave 5.

Bearish Case (20%):

Declining volume, RSI divergence, and approach of major resistance (Gann, harmonic PRZ) suggest caution. A failed breakout above 23,500 could trigger a correction to 23,000-22,800. Wyckoff distribution signs require monitoring.

Neutral/Range Case (20%):

Continued consolidation between 23,200-23,500 for 1-2 weeks is possible as the market digests recent gains and awaits economic catalysts.

Best Trading Approach:

Intraday: Range trade 23,280-23,450 until breakout

Swing: Wait for pullback to 23,200-23,280 for optimal risk:reward longs

Position: Maintain core long exposure with stops below 22,800

Key Success Factors:

Patience: Wait for high-probability setups at defined levels

Discipline: Honor stop losses without exception

Flexibility: Adapt to price action; market is always right

Confirmation: Require volume and indicator alignment before major trades

🎓 FINAL RECOMMENDATIONS

For Aggressive Traders:

Trade both sides of the range

Quick profits (50-100 points)

Tight stops (50-80 points)

High frequency (5-10 trades/week)

For Conservative Traders:

Wait for 23,200-23,280 pullback

Larger position size with better risk:reward

Wider stops (150-200 points)

Target 23,750+ for 1:3+ reward

Low frequency (1-2 trades/month)

For Long-Term Investors:

Accumulate on any dip toward 23,000

Hold through minor volatility

Target 24,500+ over 3-6 months

Stop only on weekly close <22,600

Disclaimer: This analysis is for educational purposes only and should not be construed as financial advice. Trading involves substantial risk of loss. Always conduct your own research and consult with a licensed financial advisor before making investment decisions. Past performance does not guarantee future results.

📊 MARKET OVERVIEW & STRUCTURAL ANALYSIS

The DAX40 is trading near all-time highs, displaying robust bullish momentum following the breakout above 23,000. The index is currently in a consolidation phase after an extended rally, suggesting potential for either continuation or a corrective pullback.

Key Market Context:

Trend Structure: Primary uptrend intact across all major timeframes

Market Phase: Late-stage expansion with decreasing momentum divergence

Volatility: Moderate; Bollinger Bands showing compression on 4H/Daily charts

Volume Profile: Declining volume on recent highs suggests potential exhaustion

🎯 MULTI-TIMEFRAME ANALYSIS

MONTHLY CHART - Long-term Perspective

Elliott Wave Count: Currently in Wave 5 of a larger impulse structure from 2022 lows

Gann Analysis: Price approaching the 1x2 Gann angle from the 2022 pivot; resistance expected at 23,450-23,500

Ichimoku Cloud: Trading well above the Kumo; Tenkan-sen/Kijun-sen bullish crossover sustained

Key Support: 22,800 (monthly pivot) | 22,400 (cloud base)

Key Resistance: 23,500 (Gann resistance) | 23,850 (Wave 5 projection target)

WEEKLY CHART - Swing Trading Perspective

Pattern Recognition: Potential Bull Flag formation developing (consolidation after strong rally)

Wyckoff Analysis: Phase D (markup) transitioning to possible Phase E (redistribution)

RSI: 67.2 - approaching overbought territory but not yet extreme

VWAP (Anchored from Jan 2025): 22,950 - price trading above, bullish bias confirmed

Volume Analysis: Decreasing volume on upswings suggests weakening buying pressure

DAILY CHART - Swing & Position Trading

Harmonic Pattern: Potential Bat Pattern completion zone: 23,450-23,550 (PRZ)

Head & Shoulders Watch: No clear reversal pattern yet, but right shoulder formation risk if rejection occurs above 23,500

Bollinger Bands: Price at upper band (23,420); squeeze pattern suggests breakout/breakdown imminent

Moving Averages:

20 EMA: 23,280 (immediate support)

50 EMA: 23,050 (critical support)

200 SMA: 22,400 (long-term trend support)

RSI: 64.8 - neutral to slightly overbought

MACD: Bullish but histogram showing declining momentum

4-HOUR CHART - Intraday/Swing Bridge

Trend: Short-term consolidation within ascending channel

Ichimoku: Price above cloud; flat Kijun-sen at 23,350 = pivot zone

VWAP: 23,365 - current price trading slightly above, marginally bullish

Support Levels: 23,350 | 23,280 | 23,200

Resistance Levels: 23,450 | 23,520 | 23,600

Pattern: Ascending Triangle forming between 23,280 support and 23,450 resistance

1-HOUR CHART - Intraday Focus

Candlestick Pattern: Indecision candles (doji/spinning tops) suggesting hesitation

RSI: 58.4 - neutral zone

Bollinger Bands: Mid-band at 23,370; price oscillating around mean

Volume: Below average - lack of conviction

Gann Square of 9: Next resistance at 23,445 (45° from current pivot)

15-MINUTE & 5-MINUTE CHARTS - Scalping

Micro Structure: Range-bound between 23,370-23,420

VWAP: Acting as dynamic support/resistance at 23,385

Volume Spikes: Watch for breakout confirmation with volume >120% of 20-period average

RSI (15M): Oscillating between 45-60 (neutral range)

🔍 CRITICAL TECHNICAL SIGNALS

Bullish Indicators:

✅ Price above all major moving averages (20/50/200 EMA)

✅ Ichimoku Cloud bullish alignment across all timeframes

✅ Higher lows pattern maintained since September

✅ Golden Cross intact (50 EMA > 200 EMA)

✅ Volume-weighted averages showing institutional support

Bearish Warning Signs:

⚠️ Declining volume on rallies (distribution concern)

⚠️ RSI bearish divergence forming on 4H/Daily charts

⚠️ Approaching Gann resistance and harmonic PRZ

⚠️ MACD histogram declining (momentum weakening)

⚠️ Potential Bull Trap risk if rejection occurs above 23,450

Neutral/Watch Factors:

🔶 Bollinger Band squeeze on daily chart (breakout pending)

🔶 Wyckoff redistribution signs require confirmation

🔶 No clear Head & Shoulders pattern yet (monitoring right shoulder)

📈 INTRADAY TRADING STRATEGY (Next 5 Trading Days)

SCENARIO A: BULLISH BREAKOUT (Probability: 45%)

Trigger: Break and hold above 23,450 with volume confirmation

Entry Points:

Aggressive: 23,455 (immediate breakout)

Conservative: 23,470 (retest of breakout level)

Targets:

T1: 23,520 (short-term resistance)

T2: 23,600 (Gann 1x1 angle)

T3: 23,750 (measured move from triangle)

Stop Loss:

Below 23,350 (4H Kijun-sen)

Time Frames: 5M, 15M, 1H entries | Hold 4H-Daily for swing

Risk:Reward: Minimum 1:2.5

SCENARIO B: RANGE-BOUND CONSOLIDATION (Probability: 35%)

Range: 23,280 - 23,450

Long Entries:

23,280-23,300 (lower range support + 20 EMA)

23,350-23,365 (4H pivot + VWAP)

Short Entries:

23,430-23,450 (upper range resistance)

23,520-23,535 (false breakout rejection)

Targets:

Range midpoint: 23,365

Opposite range boundary

Stop Loss:

Longs: Below 23,250 (range invalidation)

Shorts: Above 23,480 (breakout confirmed)

Strategy: Mean reversion scalping on 15M/1H charts

SCENARIO C: BEARISH CORRECTION (Probability: 20%)

Trigger: Break and close below 23,280 (20 EMA + ascending trendline)

Short Entry Points:

Aggressive: 23,275 (break confirmation)

Conservative: 23,300 (retest as resistance)

Targets:

T1: 23,200 (minor support)

T2: 23,050 (50 EMA + psychological level)

T3: 22,900 (weekly VWAP + gap fill)

Stop Loss:

Above 23,370 (failed breakdown)

Confirmation Signals:

RSI breaking below 50

MACD bearish crossover on 1H/4H

Volume surge on breakdown

📊 SWING TRADING STRATEGY (1-4 Weeks Outlook)

BULLISH SWING SCENARIO

Entry Zone: 23,200-23,280 (pullback to 20 EMA support)

Position Sizing: Build in 3 tranches

40% at 23,280

30% at 23,200

30% at 23,050 (if deeper correction)

Targets:

T1: 23,750 (Elliott Wave 5 target - partial profit 40%)

T2: 23,950 (Measured move + Gann extension - 30%)

T3: 24,200 (Fibonacci 1.618 extension - runner 30%)

Stop Loss: Below 22,950 (daily close basis)

Hold Duration: 2-4 weeks

Ideal Setup:

Bullish engulfing candle on daily chart at support

RSI bounce from 40-45 zone

Volume increase on bounce

BEARISH SWING SCENARIO (Hedge/Counter-trend)

Entry Zone: 23,480-23,550 (harmonic PRZ + Gann resistance)

Confirmation Required:

Bearish reversal candlestick (shooting star, evening star)

RSI bearish divergence

MACD bearish crossover on daily chart

Break below 23,350 on closing basis

Targets:

T1: 23,050 (50 EMA - 40% cover)

T2: 22,800 (monthly pivot - 35% cover)

T3: 22,400 (200 SMA + cloud base - final 25%)

Stop Loss: Above 23,650 (daily close)

Risk Management: Tight stops; favor bullish bias unless clear reversal

⚡ ELLIOTT WAVE ANALYSIS

Current Count:

Primary Wave: Wave 5 of larger impulse from 2022 lows

Intermediate Wave: Subwave 5 of Wave 5 (terminal phase)

Minor Wave: Possible wave (iv) consolidation completing

Wave Projections:

Wave 5 Target (Equal legs): 23,750-23,800

Wave 5 Target (1.618 extension): 24,150-24,250

Corrective Wave A Target (if reversal): 22,800-22,900

Wave C Target (full correction): 22,200-22,400

Key Insights:

Wave structure suggests uptrend continuation likely

Terminal wave characteristics: decreasing momentum, longer time

Watch for five-wave completion signals near 23,750-24,000 zone

🔮 GANN ANALYSIS

Square of 9 (from 23,000 pivot):

45° Resistance: 23,445 ⚠️ (approaching)

90° Resistance: 23,667

180° Major Resistance: 24,000 (psychological confluence)

45° Support: 23,111

90° Support: 22,889

Gann Angles (from September 2024 low):

1x1 Angle: Currently at 23,580 (equilibrium)

1x2 Angle: 23,450 (major resistance) ⚠️

2x1 Angle: 23,100 (support)

Time Cycles:

Next significant Gann time window: October 8-10, 2025 (21 trading days from last pivot)

Potential reversal/acceleration zone

Price & Time Squaring:

Price at 23,400 squares with October 7th time projection

Suggests potential turning point early next week

🌊 ICHIMOKU KINKO HYO ANALYSIS

Current Status (Daily Chart):

Tenkan-sen (Conversion): 23,350 (flat = consolidation)

Kijun-sen (Base): 23,280 (critical support)

Senkou Span A: 23,100

Senkou Span B: 22,850

Chikou Span: Above price (bullish confirmation)

Cloud Analysis:

Price well above cloud = Strong Bull Trend

Cloud thickness = robust support structure

Future cloud (26 periods ahead) shows slight thinning = potential volatility increase

Key Signals:

TK Cross: Tenkan approaching Kijun from above (watch for bearish cross)

Price vs Kijun: Trading above = bullish, but proximity suggests correction risk

Chikou Span: Clear of price = trend continuation likely

Ichimoku Trading Signals:

Buy Signal: Pullback to 23,280-23,300 (Kijun support) with bullish rejection

Sell Signal: Daily close below Kijun (23,280) with bearish TK cross

Strongest Support: Cloud base at 22,850-23,100

📉 WYCKOFF MARKET CYCLE ANALYSIS

Current Phase Assessment: Late Phase D (Markup) / Early Phase E Watch

Characteristics Observed:

Accumulation (Complete): Built solid base 22,000-22,500 (July-August)

Markup Phase D: Strong advance from 22,500 to 23,400 (September-October)

Distribution Signs (Emerging):

Declining volume on rallies

Buying Climax (BC) potential near 23,500

Automatic Reaction (AR) risk if sharp rejection occurs

Secondary Test (ST) of supply likely

Wyckoff Price Levels:

Creek: 22,900-23,000 (major demand zone)

Spring Potential: 23,480-23,550 (if false breakout occurs)

Sign of Weakness (SOW): Break below 23,200 would signal distribution

Trading Implications:

If Markup Continues: Target 23,750-24,000 (Phase E)

If Distribution Begins: First support 23,000-23,050, major 22,800

Volume Confirmation Critical: Breakouts require 30%+ above average volume

Composite Operator Behavior:

Likely testing supply at current levels

Watch for shake-out below 23,280 to trap weak longs

Absorption of supply above 23,450 needed for continuation

🎪 HARMONIC PATTERN ANALYSIS

Active Pattern: Potential Bat Pattern Completion

Pattern Structure:

X: 22,450 (September low)

A: 23,150 (interim high)

B: 22,850 (retracement)

C: 23,350 (rally)

D (PRZ): 23,450-23,550 (reversal zone) ⚠️

Fibonacci Ratios:

AB: 0.382-0.500 retracement of XA ✓

BC: 0.382-0.886 retracement of AB ✓

CD: 1.618-2.618 extension of BC (target: 23,480-23,550)

XD: 0.886 retracement of XA (23,520) ⚠️

Trading Strategy:

Bearish Reversal Zone: 23,450-23,550

Entry: Short on bearish reversal confirmation in PRZ

Targets (if pattern activates):

38.2% CD: 23,200

61.8% CD: 22,950

100% CD: 22,650

Stop Loss: Above 23,600 (pattern invalidation)

Alternative Patterns:

Bullish Butterfly target at 23,750 if breakout sustains above 23,550

Gartley Pattern support at 23,050 on any correction

📊 INDICATOR SYNTHESIS

RSI (Relative Strength Index):

Daily: 64.8 (neutral/slightly overbought)

4H: 61.2 (neutral)

1H: 58.4 (neutral)

Divergence: Bearish divergence forming on 4H/Daily (price higher highs, RSI lower highs) ⚠️

Key Levels:

Overbought: >70 (not yet extreme)

Oversold: <30 (correction target)

Support: 50 level = trend strength gauge

Bollinger Bands:

Daily: Squeeze pattern (low volatility = breakout imminent)

4H: Price at upper band (23,420) = short-term extended

Bandwidth: Narrowing significantly = explosive move coming (direction TBD)

Strategy: Wait for band break + close outside, then enter in direction of break

VWAP Analysis:

Session VWAP: 23,385 (dynamic pivot)

Weekly VWAP: 23,290 (critical support)

Anchored VWAP (Jan 2025): 22,950 (major support)

Volume Profile: Highest volume node at 23,300-23,350 (strong support/resistance flip zone)

Moving Average Confluence:

20 EMA: 23,280 (immediate support)

50 EMA: 23,050 (medium-term support)

200 SMA: 22,400 (long-term trend)

Alignment: Bullish across all timeframes

Golden Cross: Active since August 2024 (50>200) = long-term bullish

MACD (Moving Average Convergence Divergence):

Daily: Bullish, but histogram declining (momentum loss)

4H: Approaching zero line (neutral)

Signal: Watch for bearish crossover on 4H as early reversal warning

Divergence: Confirming RSI bearish divergence on daily chart

🚨 TRAP IDENTIFICATION & AVOIDANCE

BULL TRAP Risk (HIGH ALERT): ⚠️⚠️⚠️

Scenario: False breakout above 23,450-23,500 followed by sharp reversal

Warning Signs:

Breakout with declining volume (no conviction)

Quick spike to 23,500-23,550 with long upper wicks

Inability to hold above 23,450 for more than 2 hours (1H chart)

RSI divergence + MACD histogram declining

Break below 23,350 after failed breakout

Protection Strategy:

Wait for retest of breakout level before entering longs

Require volume confirmation (>120% of 20-period average)

Set tight stops below 23,380 if entering on breakout

Reduce position size by 50% if entering in potential trap zone

Bull Trap Target (if triggered): 23,000-23,050 (trap participants' stops)

BEAR TRAP Risk (LOW-MODERATE):

Scenario: False breakdown below 23,280 followed by sharp recovery

Warning Signs:

Break on low volume

Quick recovery above 23,280 within 1-2 candles

Strong bullish reversal candlestick at support

RSI showing bullish divergence at lower levels

Protection Strategy:

Wait for daily close below 23,250 before aggressive shorts

Watch for volume confirmation on breakdown

Be ready to cover shorts if price reclaims 23,300 quickly

Don't short against major support zones without confirmation

🌍 MARKET CONTEXT & EXTERNAL FACTORS

Macroeconomic Considerations:

ECB Policy: Dovish stance supporting equity markets

German Economy: Manufacturing PMI showing signs of stabilization

EUR/USD: Correlation with DAX; watch 1.08-1.10 zone

US Markets: S&P 500 correlation strong; US data impacts DAX sentiment

Geopolitical: Middle East tensions = safe-haven flows (moderate risk)

Earnings Season:

German corporate earnings (October) = potential volatility catalyst

DAX constituent reporting: watch for sector rotation

Seasonal Patterns:

October historically volatile for European indices

End-of-month portfolio rebalancing (October 31st) = potential volatility

Volatility Indicators:

VDAX (DAX volatility): Currently moderate ~15-16

Complacency risk if volatility spikes above 18

🎯 COMPREHENSIVE TRADING PLAN

INTRADAY TRADERS (5M - 1H Charts):

Monday-Wednesday Outlook:

Primary Strategy: Range trading between 23,280-23,450

Scalp Zones:

Buy: 23,300-23,320 | Target: 23,380-23,400 | Stop: 23,275

Sell: 23,430-23,450 | Target: 23,370-23,350 | Stop: 23,475

Thursday-Friday Outlook:

Breakout Watch: Decision time for triangle pattern

If Bullish: Long 23,460+ | Target: 23,550 | Trail stop

If Bearish: Short <23,270 | Target: 23,150 | Stop: 23,320

Risk Management:

Maximum 1% risk per trade

2:1 minimum risk:reward

No more than 3 active positions simultaneously

Daily loss limit: 2% of account

SWING TRADERS (4H - Daily Charts):

PRIMARY SETUP: Buy the Dip

Entry Zone: 23,200-23,280 (expect pullback next week)

Confirmation: Bullish engulfing or hammer on daily chart

Position Size: 2-3% risk per trade

Targets: 23,750 (T1) | 24,000 (T2) | 24,250 (T3)

Stop Loss: 22,950 (daily close basis)

Time Horizon: 2-4 weeks

SECONDARY SETUP: Breakout Long

Entry: Break and hold above 23,480 (daily close)

Confirmation: Volume >1.5x average + consecutive closes above

Targets: 23,750 | 24,000 | 24,300

Stop Loss: 23,350

Hold: Trail stop to 20 EMA on daily chart

HEDGE SETUP: Short from Resistance

Entry: 23,500-23,550 with reversal confirmation

Confirmation: Shooting star + RSI divergence + MACD cross

Targets: 23,200 | 23,050 | 22,800

Stop Loss: 23,650 (strict)

Position Size: 50% of normal (counter-trend)

POSITION TRADERS (Weekly - Monthly Charts):

Long-Term Bullish Thesis:

Entry Strategy: Accumulate on corrections to 23,000-23,200

Core Position: Build over 2-3 weeks

Targets:

24,000 (3-month target)

24,500 (6-month target)

25,000 (12-month psychological)

Stop Loss: Weekly close below 22,600

Rationale: Elliott Wave 5 completion + breakout from multi-year consolidation

Portfolio Allocation:

60% long exposure at current levels

20% cash for pullback buying

20% hedges if approaching 23,800-24,000 zone

🔔 ALERT LEVELS & NOTIFICATIONS

Critical Price Alerts to Set:

✅ 23,480 (Breakout level - LONG signal)

✅ 23,450 (Harmonic PRZ - Watch for reversal)

✅ 23,350 (4H support - Breakdown warning)

✅ 23,280 (Daily 20 EMA - CRITICAL support)

✅ 23,200 (Buy zone activation)

✅ 23,050 (50 EMA - Major support test)

✅ 22,950 (Stop loss trigger for swings)

Indicator Alerts:

RSI crossing 70 (overbought) or 50 (weakness)

MACD bearish crossover on 4H/Daily

Bollinger Band break (either direction)

Volume spike >150% of average

📌 CONCLUSION & BIAS

Overall Bias: CAUTIOUSLY BULLISH 🟢 (60% probability)

Bullish Case (60%):

The primary trend remains intact with price above all major moving averages and strong cloud support. The consolidation near highs is healthy, and a resolution to the upside targeting 23,750-24,000 is the path of least resistance. Elliott Wave structure suggests one more push higher to complete Wave 5.

Bearish Case (20%):

Declining volume, RSI divergence, and approach of major resistance (Gann, harmonic PRZ) suggest caution. A failed breakout above 23,500 could trigger a correction to 23,000-22,800. Wyckoff distribution signs require monitoring.

Neutral/Range Case (20%):

Continued consolidation between 23,200-23,500 for 1-2 weeks is possible as the market digests recent gains and awaits economic catalysts.

Best Trading Approach:

Intraday: Range trade 23,280-23,450 until breakout

Swing: Wait for pullback to 23,200-23,280 for optimal risk:reward longs

Position: Maintain core long exposure with stops below 22,800

Key Success Factors:

Patience: Wait for high-probability setups at defined levels

Discipline: Honor stop losses without exception

Flexibility: Adapt to price action; market is always right

Confirmation: Require volume and indicator alignment before major trades

🎓 FINAL RECOMMENDATIONS

For Aggressive Traders:

Trade both sides of the range

Quick profits (50-100 points)

Tight stops (50-80 points)

High frequency (5-10 trades/week)

For Conservative Traders:

Wait for 23,200-23,280 pullback

Larger position size with better risk:reward

Wider stops (150-200 points)

Target 23,750+ for 1:3+ reward

Low frequency (1-2 trades/month)

For Long-Term Investors:

Accumulate on any dip toward 23,000

Hold through minor volatility

Target 24,500+ over 3-6 months

Stop only on weekly close <22,600

Disclaimer: This analysis is for educational purposes only and should not be construed as financial advice. Trading involves substantial risk of loss. Always conduct your own research and consult with a licensed financial advisor before making investment decisions. Past performance does not guarantee future results.

I am nothing @shunya.trade

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I am nothing @shunya.trade

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.