💰 GOLD BOUNCES FROM $4,000 - FOMC MINUTES TODAY! 📈

Current Price: $4,085 - $4,090 🟢

Opening Price: $4,079

Yesterday's Close: $4,066 (+0.56%)

Today's Performance: +0.56% ✅

Status: 🟢 RECOVERY MODE - CRITICAL DAY

🚨 MAJOR EVENT TODAY - FOMC MINUTES! ⚡

THE $4,000 SUPPORT HELD! Gold successfully defended the critical psychological level and is now bouncing. But TODAY is the most important day this week!

What's Happening:

✅ $4,000 Support HELD - Bulls defended successfully!

✅ Morning Star Pattern Formed - Bullish reversal signal at support

✅ FOMC Minutes TODAY - Will determine next major move

✅ NFP Data Thursday - First post-shutdown jobs report

✅ Risk-Off Sentiment - Safe-haven flows supporting gold

✅ Expected to RISE - Analysts forecast upward movement

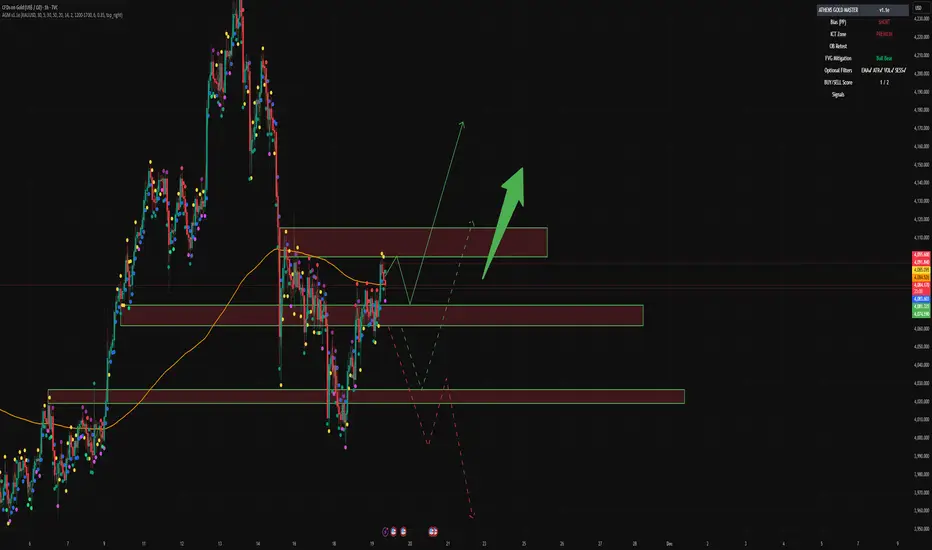

📊 TECHNICAL ANALYSIS

Market Structure: BULLISH RECOVERY 🟢🟢

Gold has bounced off the ascending trendline AND the $4,000 psychological level - a DOUBLE support confluence! Bulls are back in control short-term.

Key Development: Bulls managed to hold psychological level of $4,005 and formed Morning Star pattern indicating renewed buying activity

Critical Support Levels (Defended!) 🔵

Support 1: $4,050 - $4,060 (Current base - Strong)

Support 2: $4,000 - $4,005 (HELD! Psychological + Trendline)

Support 3: $3,987 - $4,002 (November open)

Support 4: $3,965 (November 6 low)

Support 5: $3,930 (Major support)

Key Resistance Levels (Recovery targets) 🔴

Resistance 1: $4,096 - $4,100 (KEY - 50-day MA + Descending trendline)

Resistance 2: $4,112 - $4,120 (20-day SMA - Strong)

Resistance 3: $4,140 - $4,150 (Major barrier)

Resistance 4: $4,170 - $4,212 (Previous descending trendline)

📈 TECHNICAL INDICATORS

RSI (14): 49 (Neutral - Can move either direction) ⚪

MACD: Rising sharply, approaching zero line (Bullish momentum!) 🟢

MFI: Growing - Liquidity inflow into asset ✅

4H RSI: Bounced up but below 50 (Recovery attempt) ⚡

Moving Averages:

Price broke above 100-day MA ✅

Testing 50-day MA at $4,096 🔴

20-day SMA at $4,112 (Resistance) 🔴

Above ascending trendline ✅

VWAP & SMA20: Aligned with market price - Equilibrium between buyers/sellers

🎯 TODAY'S TRADING STRATEGIES

SCENARIO 1: BULLISH BREAKOUT 🟢 (60% Probability)

On November 20, 2025, price of XAU/USD expected to RISE

IF Gold Breaks Above $4,100:

Break of descending trendline and 50-day MA around $4,096 could open rally toward $4,212

LONG Setup:

Entry: Break and close above $4,100-$4,112

Targets:

TP1: $4,140 📍 (+40 pips)

TP2: $4,170 📍 (+70 pips)

TP3: $4,212 📍 (+112 pips - Previous trendline touch)

Stop Loss: $4,065 (Below support)

Risk/Reward: Excellent 1:3+ ratio ✅

SCENARIO 2: FALSE BREAKOUT / REJECTION 🔴 (30% Probability)

IF Gold Gets Rejected at $4,096-$4,112:

Bulls tried but failed - retest of support coming

SHORT Setup (Scalp):

Entry: Rejection at $4,100-$4,112 (confirmed with bearish candle)

Targets:

TP1: $4,065 📍

TP2: $4,050 📍

TP3: $4,000 📍 (Retest)

Stop Loss: $4,125 (Tight!)

⚠️ WARNING: This is counter-trend - use small positions!

SCENARIO 3: FOMC VOLATILITY 📊 (10% Probability)

IF FOMC Minutes Cause Whipsaw:

Strategy: WAIT for Clear Direction

Let the dust settle after FOMC release

Trade the REACTION, not the news

Entry: After 30-60 minutes of FOMC release

Follow the momentum with trend

💎 BEST TRADE SETUPS FOR TODAY

CONSERVATIVE APPROACH (Highly Recommended!) 🎯

WAIT FOR FOMC MINUTES! Don't trade BEFORE the release.

Setup A - Breakout Play (Preferred):

WAIT for FOMC minutes (Today, US session)

IF gold breaks $4,100-$4,112 with volume

Entry: $4,105-$4,112 (after confirmation)

Target: $4,140 → $4,170 → $4,212

SL: $4,080

Why: Riding institutional momentum

Setup B - Dip Buy:

IF gold pulls back to $4,050-$4,060

Entry: $4,052-$4,060 (on bounce)

Target: $4,100 → $4,120

SL: $4,035

⚠️ DO NOT TRADE during first 30 min after FOMC release! Wait for clarity!

🌍 FUNDAMENTAL ANALYSIS

TODAY'S MAJOR EVENTS 📅

🔥 FOMC MINUTES (US Session - CRITICAL!)

This is THE event today. Will show:

Fed's thinking on December rate cut

Concerns about economy post-shutdown

Inflation outlook

Market waiting for FOMC Minutes release and speech by Fed member John Williams

Thursday: NFP Data (First post-shutdown report)

September NFP expected: +50,000 jobs

Unemployment Rate: 4.3% (forecast)

This could be market-moving!

BULLISH FACTORS ⬆️⬆️

✅ $4,000 Support Held - Technical strength confirmed

✅ Morning Star Pattern - Bullish reversal at support

✅ Risk-Off Sentiment - Stocks falling, gold rising

✅ Softer Treasury Yields - Making gold more attractive

✅ Shutdown Concerns - Economic weakness = gold support

✅ Analysts predict gold may reach $4,456-$4,509 by end November

✅ Central banks targeting 750-900 tonnes purchases for 2025

BEARISH RISKS ⬇️

⚠️ Hawkish FOMC - If minutes show Fed reluctant to cut rates

⚠️ Strong NFP Thursday - Would reduce rate cut odds

⚠️ Resistance at $4,100-$4,112 - Strong technical barrier

⚠️ December Rate Cut Odds - Only 43% (down from 63%)

⚠️ DXY Still Above 99.50 - Dollar maintaining strength

🔥 MARKET SENTIMENT: CAUTIOUSLY BULLISH

What's Different Today:

The $4,000 level held perfectly - this is VERY bullish technically. But FOMC minutes could change everything in minutes!

Analyst Views:

Short-term (Today/Tomorrow):

$4,000 held, bulls need acceptance above $4,100 for rally to gather steam. FOMC minutes will determine direction.

This Week:

Critical - FOMC + NFP data will set tone for rest of November

Month End:

IF recovery continues → $4,200-$4,300 possible

IF rejected at $4,100 → Chop between $4,000-$4,100

💡 PROFESSIONAL GAME PLAN

For DAY TRADERS:

⚡ Wait for FOMC!

Do NOT trade 1 hour before release

Do NOT trade first 30 min after release

After dust settles, trade the direction

Use tight stops (whipsaws common)

For SWING TRADERS:

📊 This is Your Setup!

IF $4,100 breaks with FOMC → GO LONG (hold 3-5 days to $4,170+)

IF rejected at $4,100 → WAIT for next dip to $4,000

Target: $4,212 (1-2 week hold)

For LONG-TERM INVESTORS:

💎 Accumulation Zone

$4,000-$4,080 range is BUYING opportunity

Long-term targets: $4,500-$5,000 (2026)

Strategy: Build position gradually

Vision: Multi-month hold

📅 TODAY'S TIMELINE

Asian Session (Done): Gold bounced to $4,085-$4,090 ✅

European Session (Now): Consolidation before FOMC

US Session: FOMC MINUTES RELEASE 🔥🔥🔥

After FOMC: Big volatility expected - direction determined

Tomorrow (Thursday):

NFP Data (September) - First post-shutdown

This will confirm or reverse today's move

🎬 BOTTOM LINE (TL;DR)

Price: $4,085 (Bouncing)

Bias: 🟢 BULLISH (IF breaks $4,100)

Key Level: $4,100 (Break = Rally | Reject = Chop)

Today's Event: FOMC MINUTES (Trade-defining!)

Best Action: WAIT for FOMC, then trade the breakout

Risk Level: HIGH (Event volatility!)

🔔 THE $4,100 LEVEL - TODAY'S BATTLEGROUND!

IF GOLD BREAKS ABOVE $4,100-$4,112:

✅ Bulls win!

✅ Target $4,140 → $4,170 → $4,212

✅ Possible rally to $4,250+

✅ GO LONG after confirmation

IF GOLD REJECTS AT $4,100:

⚠️ Bulls stall

⚠️ Range between $4,000-$4,100 continues

⚠️ Wait for next setup

⚠️ Don't force trades

FOMC DECIDES EVERYTHING!

📊 Dovish = GOLD UP 🚀

📊 Hawkish = GOLD DOWN/SIDEWAYS 📉

📊 TECHNICAL OUTLOOK

Trend: 🟢 BULLISH (Short-term recovery active)

Momentum: IMPROVING - MACD rising 📈

Support: HOLDING at $4,050-$4,060 ✅

Resistance: TESTING at $4,096-$4,112 🎯

Pattern: Morning Star reversal + Trendline bounce

Next Move: Break $4,112 = UP | Reject = CHOP

Key Technical:

Having bounced off ascending trendline and $4,000, gold broke above 100-day MA and now testing descending trendline/50-day MA confluence

⚠️ RISK MANAGEMENT - FOMC DAY!

✅ Wait for FOMC - Don't guess the news!

✅ Small Positions - Risk MAX 1% (High volatility!)

✅ Wide Stops - Give trades room (40-50 pips)

✅ Quick Profits - Lock gains on FOMC spikes

✅ No Revenge - If wrong, accept and move on

🎯 SWING TRADE SETUPS

Setup A - FOMC Breakout (Recommended):

WAIT for FOMC minutes release

Entry: IF breaks $4,112 (after FOMC)

Target 1: $4,170 (Hold 2-3 days)

Target 2: $4,212 (Hold 5-7 days)

Target 3: $4,250 (Hold 1-2 weeks)

Stop Loss: $4,070

Setup B - Rejection Trade:

Entry: IF rejected at $4,100 (after FOMC)

Target 1: $4,050 (Hold 1-2 days)

Target 2: $4,000 (Hold 2-3 days)

Stop Loss: $4,125

🏆 PROFESSIONAL ANALYSIS SUMMARY

Gold has executed a PERFECT TECHNICAL BOUNCE from the $4,000 psychological level. The formation of a Morning Star candlestick pattern at support is a classic bullish reversal signal.

The Setup:

Price trading at $4,085.62 as of 19.11.2025

Held $4,000 support perfectly (double bottom with trendline)

Now testing critical $4,096-$4,112 resistance zone

FOMC minutes today will determine next major move

Most Likely Scenarios:

Scenario 1 (60%):

FOMC shows Fed concerned about economy → Gold breaks $4,112 → Rally to $4,170-$4,212

Scenario 2 (30%):

FOMC shows Fed staying hawkish → Gold rejected at $4,100 → Range $4,000-$4,100 continues

Scenario 3 (10%):

FOMC very dovish → Gold explodes through $4,212 → $4,250+

The Big Picture:

$4,000 holding is VERY bullish. This was the make-or-break level and bulls defended it perfectly. If FOMC is dovish or neutral, gold has clear path to $4,200+

💪 TRADING PSYCHOLOGY TIP

THE BOUNCE IS HERE!

Yesterday we were at $4,000 and scared. Today we're at $4,085 and hopeful. This is why you MUST have a plan and stick to it. Those who bought at $4,000 yesterday are now profitable. Discipline wins! 🎯

🎓 LESSON: THE MORNING STAR PATTERN

What happened at $4,000:

Day 1: Long bearish candle (fear)

Day 2: Small candle (indecision)

Day 3: Long bullish candle (bulls return)

This is a Morning Star - one of the most reliable bullish reversal patterns! It shows bears exhausted and bulls taking control.

Trading Strategy:

When you see this at major support (like $4,000), it's a HIGH probability long setup!

🔮 FORECAST

Today: FOMC minutes → Breakout $4,112 OR rejection

Tomorrow: NFP data → Confirm today's direction

End of Week: $4,140-$4,170 OR back to $4,000

Next Week: Recovery continues to $4,200+ if $4,100 breaks

Month End: $4,250-$4,300 (IF bullish scenario plays out)

🚨 FOMC MINUTES - WHAT TO WATCH FOR

Dovish Signals (Gold UP 🟢):

Concerns about economic weakness

Mentions of shutdown impact

Opens door to December cut

Worries about labor market

Hawkish Signals (Gold DOWN/FLAT 🔴):

Confidence in economy

Inflation still concerning

No urgency to cut rates

Strong labor market comments

Neutral (Gold CHOP ⚪):

Data-dependent language

Wait-and-see approach

No clear direction

📊 SUPPORT/RESISTANCE SUMMARY

Strong Support: $4,050, $4,000 (CRITICAL)

Weak Support: $4,065, $4,040

Weak Resistance: $4,096, $4,100

Strong Resistance: $4,112, $4,140, $4,170, $4,212

Breakout Level: $4,112 (Game changer!)

Breakdown Level: $4,000 (Would be very bearish)

⚠️ FINAL DISCLAIMER

Today is a high-impact event day. FOMC minutes can cause extreme volatility and rapid price swings. This analysis is for educational purposes only. Never trade the news blindly - wait for confirmation. Use stop losses religiously. Position sizes should be smaller than normal on event days. False breakouts are common immediately after news. The first move after FOMC is often NOT the real move. Past performance does not guarantee future results. Consult a licensed financial advisor before trading.

📱 CRITICAL DAY AHEAD!

💬 FOMC minutes in few hours!

🔔 HIGH volatility expected

⚡ Trade the reaction, not the prediction!

🙏 Be patient, be disciplined!

#Gold #XAUUSD #FOMC #ForexTrading #TechnicalAnalysis #NFP #MorningStar #BullishReversal #EventTrading #RiskManagement #FOMCMinutes #MarketAnalysis #DayTrading #SwingTrading

Current Price: $4,085 - $4,090 🟢

Opening Price: $4,079

Yesterday's Close: $4,066 (+0.56%)

Today's Performance: +0.56% ✅

Status: 🟢 RECOVERY MODE - CRITICAL DAY

🚨 MAJOR EVENT TODAY - FOMC MINUTES! ⚡

THE $4,000 SUPPORT HELD! Gold successfully defended the critical psychological level and is now bouncing. But TODAY is the most important day this week!

What's Happening:

✅ $4,000 Support HELD - Bulls defended successfully!

✅ Morning Star Pattern Formed - Bullish reversal signal at support

✅ FOMC Minutes TODAY - Will determine next major move

✅ NFP Data Thursday - First post-shutdown jobs report

✅ Risk-Off Sentiment - Safe-haven flows supporting gold

✅ Expected to RISE - Analysts forecast upward movement

📊 TECHNICAL ANALYSIS

Market Structure: BULLISH RECOVERY 🟢🟢

Gold has bounced off the ascending trendline AND the $4,000 psychological level - a DOUBLE support confluence! Bulls are back in control short-term.

Key Development: Bulls managed to hold psychological level of $4,005 and formed Morning Star pattern indicating renewed buying activity

Critical Support Levels (Defended!) 🔵

Support 1: $4,050 - $4,060 (Current base - Strong)

Support 2: $4,000 - $4,005 (HELD! Psychological + Trendline)

Support 3: $3,987 - $4,002 (November open)

Support 4: $3,965 (November 6 low)

Support 5: $3,930 (Major support)

Key Resistance Levels (Recovery targets) 🔴

Resistance 1: $4,096 - $4,100 (KEY - 50-day MA + Descending trendline)

Resistance 2: $4,112 - $4,120 (20-day SMA - Strong)

Resistance 3: $4,140 - $4,150 (Major barrier)

Resistance 4: $4,170 - $4,212 (Previous descending trendline)

📈 TECHNICAL INDICATORS

RSI (14): 49 (Neutral - Can move either direction) ⚪

MACD: Rising sharply, approaching zero line (Bullish momentum!) 🟢

MFI: Growing - Liquidity inflow into asset ✅

4H RSI: Bounced up but below 50 (Recovery attempt) ⚡

Moving Averages:

Price broke above 100-day MA ✅

Testing 50-day MA at $4,096 🔴

20-day SMA at $4,112 (Resistance) 🔴

Above ascending trendline ✅

VWAP & SMA20: Aligned with market price - Equilibrium between buyers/sellers

🎯 TODAY'S TRADING STRATEGIES

SCENARIO 1: BULLISH BREAKOUT 🟢 (60% Probability)

On November 20, 2025, price of XAU/USD expected to RISE

IF Gold Breaks Above $4,100:

Break of descending trendline and 50-day MA around $4,096 could open rally toward $4,212

LONG Setup:

Entry: Break and close above $4,100-$4,112

Targets:

TP1: $4,140 📍 (+40 pips)

TP2: $4,170 📍 (+70 pips)

TP3: $4,212 📍 (+112 pips - Previous trendline touch)

Stop Loss: $4,065 (Below support)

Risk/Reward: Excellent 1:3+ ratio ✅

SCENARIO 2: FALSE BREAKOUT / REJECTION 🔴 (30% Probability)

IF Gold Gets Rejected at $4,096-$4,112:

Bulls tried but failed - retest of support coming

SHORT Setup (Scalp):

Entry: Rejection at $4,100-$4,112 (confirmed with bearish candle)

Targets:

TP1: $4,065 📍

TP2: $4,050 📍

TP3: $4,000 📍 (Retest)

Stop Loss: $4,125 (Tight!)

⚠️ WARNING: This is counter-trend - use small positions!

SCENARIO 3: FOMC VOLATILITY 📊 (10% Probability)

IF FOMC Minutes Cause Whipsaw:

Strategy: WAIT for Clear Direction

Let the dust settle after FOMC release

Trade the REACTION, not the news

Entry: After 30-60 minutes of FOMC release

Follow the momentum with trend

💎 BEST TRADE SETUPS FOR TODAY

CONSERVATIVE APPROACH (Highly Recommended!) 🎯

WAIT FOR FOMC MINUTES! Don't trade BEFORE the release.

Setup A - Breakout Play (Preferred):

WAIT for FOMC minutes (Today, US session)

IF gold breaks $4,100-$4,112 with volume

Entry: $4,105-$4,112 (after confirmation)

Target: $4,140 → $4,170 → $4,212

SL: $4,080

Why: Riding institutional momentum

Setup B - Dip Buy:

IF gold pulls back to $4,050-$4,060

Entry: $4,052-$4,060 (on bounce)

Target: $4,100 → $4,120

SL: $4,035

⚠️ DO NOT TRADE during first 30 min after FOMC release! Wait for clarity!

🌍 FUNDAMENTAL ANALYSIS

TODAY'S MAJOR EVENTS 📅

🔥 FOMC MINUTES (US Session - CRITICAL!)

This is THE event today. Will show:

Fed's thinking on December rate cut

Concerns about economy post-shutdown

Inflation outlook

Market waiting for FOMC Minutes release and speech by Fed member John Williams

Thursday: NFP Data (First post-shutdown report)

September NFP expected: +50,000 jobs

Unemployment Rate: 4.3% (forecast)

This could be market-moving!

BULLISH FACTORS ⬆️⬆️

✅ $4,000 Support Held - Technical strength confirmed

✅ Morning Star Pattern - Bullish reversal at support

✅ Risk-Off Sentiment - Stocks falling, gold rising

✅ Softer Treasury Yields - Making gold more attractive

✅ Shutdown Concerns - Economic weakness = gold support

✅ Analysts predict gold may reach $4,456-$4,509 by end November

✅ Central banks targeting 750-900 tonnes purchases for 2025

BEARISH RISKS ⬇️

⚠️ Hawkish FOMC - If minutes show Fed reluctant to cut rates

⚠️ Strong NFP Thursday - Would reduce rate cut odds

⚠️ Resistance at $4,100-$4,112 - Strong technical barrier

⚠️ December Rate Cut Odds - Only 43% (down from 63%)

⚠️ DXY Still Above 99.50 - Dollar maintaining strength

🔥 MARKET SENTIMENT: CAUTIOUSLY BULLISH

What's Different Today:

The $4,000 level held perfectly - this is VERY bullish technically. But FOMC minutes could change everything in minutes!

Analyst Views:

Short-term (Today/Tomorrow):

$4,000 held, bulls need acceptance above $4,100 for rally to gather steam. FOMC minutes will determine direction.

This Week:

Critical - FOMC + NFP data will set tone for rest of November

Month End:

IF recovery continues → $4,200-$4,300 possible

IF rejected at $4,100 → Chop between $4,000-$4,100

💡 PROFESSIONAL GAME PLAN

For DAY TRADERS:

⚡ Wait for FOMC!

Do NOT trade 1 hour before release

Do NOT trade first 30 min after release

After dust settles, trade the direction

Use tight stops (whipsaws common)

For SWING TRADERS:

📊 This is Your Setup!

IF $4,100 breaks with FOMC → GO LONG (hold 3-5 days to $4,170+)

IF rejected at $4,100 → WAIT for next dip to $4,000

Target: $4,212 (1-2 week hold)

For LONG-TERM INVESTORS:

💎 Accumulation Zone

$4,000-$4,080 range is BUYING opportunity

Long-term targets: $4,500-$5,000 (2026)

Strategy: Build position gradually

Vision: Multi-month hold

📅 TODAY'S TIMELINE

Asian Session (Done): Gold bounced to $4,085-$4,090 ✅

European Session (Now): Consolidation before FOMC

US Session: FOMC MINUTES RELEASE 🔥🔥🔥

After FOMC: Big volatility expected - direction determined

Tomorrow (Thursday):

NFP Data (September) - First post-shutdown

This will confirm or reverse today's move

🎬 BOTTOM LINE (TL;DR)

Price: $4,085 (Bouncing)

Bias: 🟢 BULLISH (IF breaks $4,100)

Key Level: $4,100 (Break = Rally | Reject = Chop)

Today's Event: FOMC MINUTES (Trade-defining!)

Best Action: WAIT for FOMC, then trade the breakout

Risk Level: HIGH (Event volatility!)

🔔 THE $4,100 LEVEL - TODAY'S BATTLEGROUND!

IF GOLD BREAKS ABOVE $4,100-$4,112:

✅ Bulls win!

✅ Target $4,140 → $4,170 → $4,212

✅ Possible rally to $4,250+

✅ GO LONG after confirmation

IF GOLD REJECTS AT $4,100:

⚠️ Bulls stall

⚠️ Range between $4,000-$4,100 continues

⚠️ Wait for next setup

⚠️ Don't force trades

FOMC DECIDES EVERYTHING!

📊 Dovish = GOLD UP 🚀

📊 Hawkish = GOLD DOWN/SIDEWAYS 📉

📊 TECHNICAL OUTLOOK

Trend: 🟢 BULLISH (Short-term recovery active)

Momentum: IMPROVING - MACD rising 📈

Support: HOLDING at $4,050-$4,060 ✅

Resistance: TESTING at $4,096-$4,112 🎯

Pattern: Morning Star reversal + Trendline bounce

Next Move: Break $4,112 = UP | Reject = CHOP

Key Technical:

Having bounced off ascending trendline and $4,000, gold broke above 100-day MA and now testing descending trendline/50-day MA confluence

⚠️ RISK MANAGEMENT - FOMC DAY!

✅ Wait for FOMC - Don't guess the news!

✅ Small Positions - Risk MAX 1% (High volatility!)

✅ Wide Stops - Give trades room (40-50 pips)

✅ Quick Profits - Lock gains on FOMC spikes

✅ No Revenge - If wrong, accept and move on

🎯 SWING TRADE SETUPS

Setup A - FOMC Breakout (Recommended):

WAIT for FOMC minutes release

Entry: IF breaks $4,112 (after FOMC)

Target 1: $4,170 (Hold 2-3 days)

Target 2: $4,212 (Hold 5-7 days)

Target 3: $4,250 (Hold 1-2 weeks)

Stop Loss: $4,070

Setup B - Rejection Trade:

Entry: IF rejected at $4,100 (after FOMC)

Target 1: $4,050 (Hold 1-2 days)

Target 2: $4,000 (Hold 2-3 days)

Stop Loss: $4,125

🏆 PROFESSIONAL ANALYSIS SUMMARY

Gold has executed a PERFECT TECHNICAL BOUNCE from the $4,000 psychological level. The formation of a Morning Star candlestick pattern at support is a classic bullish reversal signal.

The Setup:

Price trading at $4,085.62 as of 19.11.2025

Held $4,000 support perfectly (double bottom with trendline)

Now testing critical $4,096-$4,112 resistance zone

FOMC minutes today will determine next major move

Most Likely Scenarios:

Scenario 1 (60%):

FOMC shows Fed concerned about economy → Gold breaks $4,112 → Rally to $4,170-$4,212

Scenario 2 (30%):

FOMC shows Fed staying hawkish → Gold rejected at $4,100 → Range $4,000-$4,100 continues

Scenario 3 (10%):

FOMC very dovish → Gold explodes through $4,212 → $4,250+

The Big Picture:

$4,000 holding is VERY bullish. This was the make-or-break level and bulls defended it perfectly. If FOMC is dovish or neutral, gold has clear path to $4,200+

💪 TRADING PSYCHOLOGY TIP

THE BOUNCE IS HERE!

Yesterday we were at $4,000 and scared. Today we're at $4,085 and hopeful. This is why you MUST have a plan and stick to it. Those who bought at $4,000 yesterday are now profitable. Discipline wins! 🎯

🎓 LESSON: THE MORNING STAR PATTERN

What happened at $4,000:

Day 1: Long bearish candle (fear)

Day 2: Small candle (indecision)

Day 3: Long bullish candle (bulls return)

This is a Morning Star - one of the most reliable bullish reversal patterns! It shows bears exhausted and bulls taking control.

Trading Strategy:

When you see this at major support (like $4,000), it's a HIGH probability long setup!

🔮 FORECAST

Today: FOMC minutes → Breakout $4,112 OR rejection

Tomorrow: NFP data → Confirm today's direction

End of Week: $4,140-$4,170 OR back to $4,000

Next Week: Recovery continues to $4,200+ if $4,100 breaks

Month End: $4,250-$4,300 (IF bullish scenario plays out)

🚨 FOMC MINUTES - WHAT TO WATCH FOR

Dovish Signals (Gold UP 🟢):

Concerns about economic weakness

Mentions of shutdown impact

Opens door to December cut

Worries about labor market

Hawkish Signals (Gold DOWN/FLAT 🔴):

Confidence in economy

Inflation still concerning

No urgency to cut rates

Strong labor market comments

Neutral (Gold CHOP ⚪):

Data-dependent language

Wait-and-see approach

No clear direction

📊 SUPPORT/RESISTANCE SUMMARY

Strong Support: $4,050, $4,000 (CRITICAL)

Weak Support: $4,065, $4,040

Weak Resistance: $4,096, $4,100

Strong Resistance: $4,112, $4,140, $4,170, $4,212

Breakout Level: $4,112 (Game changer!)

Breakdown Level: $4,000 (Would be very bearish)

⚠️ FINAL DISCLAIMER

Today is a high-impact event day. FOMC minutes can cause extreme volatility and rapid price swings. This analysis is for educational purposes only. Never trade the news blindly - wait for confirmation. Use stop losses religiously. Position sizes should be smaller than normal on event days. False breakouts are common immediately after news. The first move after FOMC is often NOT the real move. Past performance does not guarantee future results. Consult a licensed financial advisor before trading.

📱 CRITICAL DAY AHEAD!

💬 FOMC minutes in few hours!

🔔 HIGH volatility expected

⚡ Trade the reaction, not the prediction!

🙏 Be patient, be disciplined!

#Gold #XAUUSD #FOMC #ForexTrading #TechnicalAnalysis #NFP #MorningStar #BullishReversal #EventTrading #RiskManagement #FOMCMinutes #MarketAnalysis #DayTrading #SwingTrading

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.