GOLD PRICE ACTION ANALYSIS – June 11, 2025 🟡

Technical Breakdown & Bearish Scenario Ahead ⚠️📉

🔍 Overview:

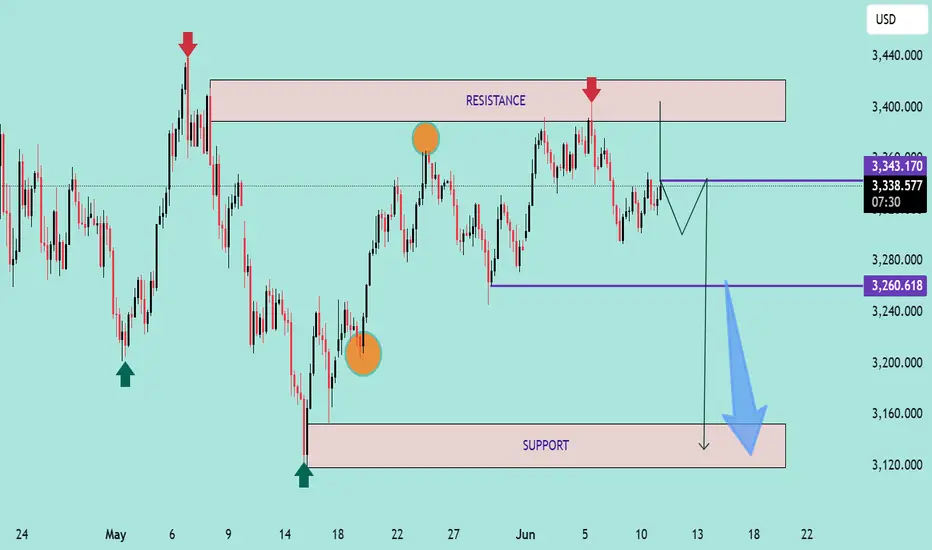

The chart presents a clear range-bound structure with strong horizontal resistance around the $3,400–$3,420 zone and support around the $3,120–$3,160 level. Price is currently trading near the upper range of the consolidation.

📊 Key Technical Levels:

🔴 Resistance Zone: $3,400 – $3,420

➤ Price has been rejected here multiple times (highlighted by red arrows and orange circles), showing strong supply pressure.

🟣 Intermediate Support: $3,260.618

➤ This level acted as a minor support and could be tested again if the current pullback deepens.

🟤 Major Support Zone: $3,120 – $3,160

➤ A key demand area where price previously bounced significantly.

📉 Bearish Setup:

A potential lower high is forming just below the resistance zone.

The projected path suggests a minor pullback to form a bearish retest, followed by a potential breakdown below $3,260.

If the $3,260 support is broken decisively, further downside toward the $3,120–$3,160 support is likely (blue arrow projection).

🔄 Bullish Scenario (Invalidation):

A breakout and strong close above $3,420 could invalidate the bearish structure.

In that case, price might attempt to target higher resistance levels beyond $3,440.

📌 Conclusion:

Gold remains in a range with a bearish bias unless the $3,420 resistance is breached.

🔽 Watch for confirmation below $3,260 for bearish continuation.

✅ For bulls, wait for a strong breakout above resistance with volume.

Technical Breakdown & Bearish Scenario Ahead ⚠️📉

🔍 Overview:

The chart presents a clear range-bound structure with strong horizontal resistance around the $3,400–$3,420 zone and support around the $3,120–$3,160 level. Price is currently trading near the upper range of the consolidation.

📊 Key Technical Levels:

🔴 Resistance Zone: $3,400 – $3,420

➤ Price has been rejected here multiple times (highlighted by red arrows and orange circles), showing strong supply pressure.

🟣 Intermediate Support: $3,260.618

➤ This level acted as a minor support and could be tested again if the current pullback deepens.

🟤 Major Support Zone: $3,120 – $3,160

➤ A key demand area where price previously bounced significantly.

📉 Bearish Setup:

A potential lower high is forming just below the resistance zone.

The projected path suggests a minor pullback to form a bearish retest, followed by a potential breakdown below $3,260.

If the $3,260 support is broken decisively, further downside toward the $3,120–$3,160 support is likely (blue arrow projection).

🔄 Bullish Scenario (Invalidation):

A breakout and strong close above $3,420 could invalidate the bearish structure.

In that case, price might attempt to target higher resistance levels beyond $3,440.

📌 Conclusion:

Gold remains in a range with a bearish bias unless the $3,420 resistance is breached.

🔽 Watch for confirmation below $3,260 for bearish continuation.

✅ For bulls, wait for a strong breakout above resistance with volume.

JOIN MY TELEGRAM CHANNEL

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JOIN MY TELEGRAM CHANNEL

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.