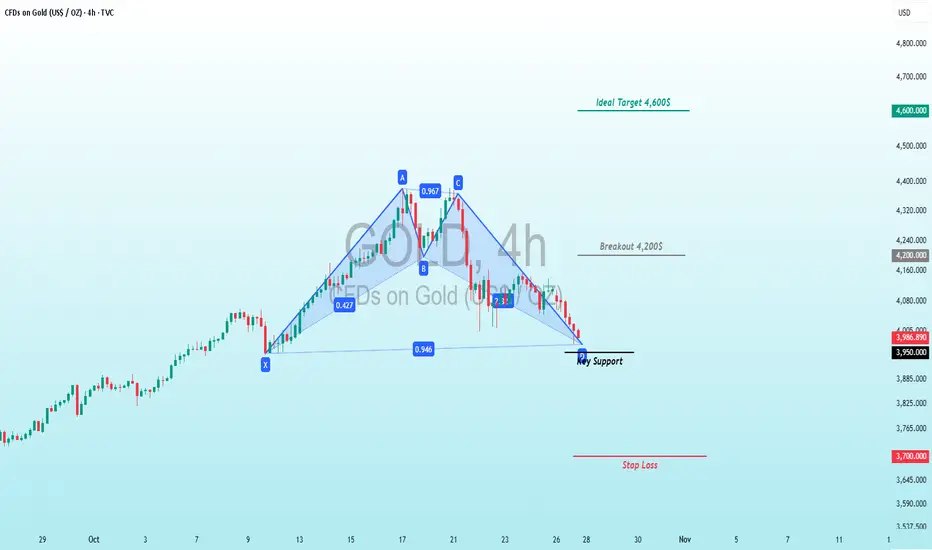

🟡 CFDs on Gold (USD/OZ) Symmetrical Triangle Squeeze Setup! 📊

Fast-forward to Oct 27: Price's testing the apex near $3,989 (up +3.989% short-term) ⚖️, hovering at the 0.47 Fib retracement level from the A-B swing 🕸️ (key support at $3,950, resistance at $4,070). Breakout north? Bulls could rocket to $4,200 (5.5% quick gain) or full measured move to $4,600 retest for +15.5% profit 💰 from here – ideal for longs with stops below $3,900. Bear breach? Down to $3,700 (-7%) for shorts. Geopolitics + Fed whispers = high octane – watch volume explosion! ⚠️

#GoldTrading #CFDs #CommodityBreakout

✅MY Free Signals Telegram

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅MY Free Signals Telegram

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.