Overview:

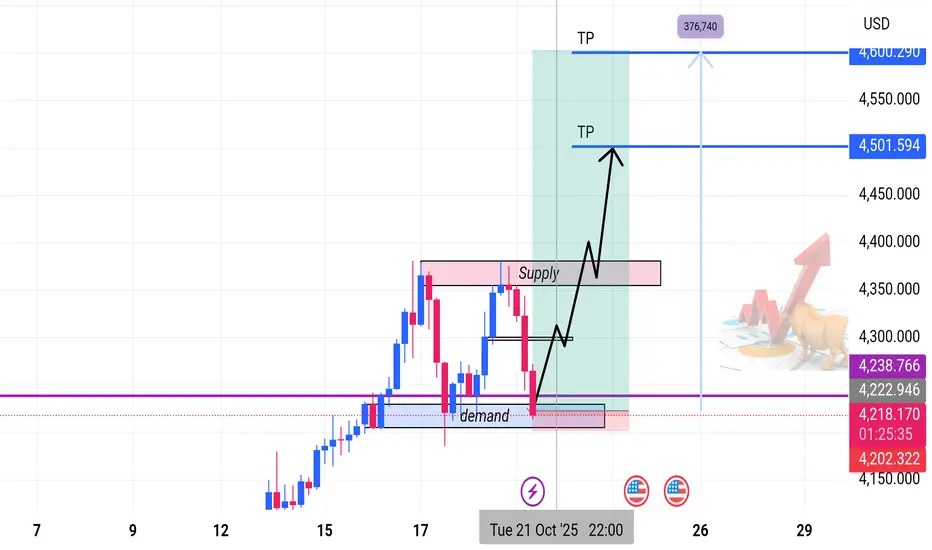

Gold is maintaining a strong bullish structure on the 4-hour timeframe, forming consistent higher highs and higher lows.

Recently, price tapped into a key Demand Zone, showing a clear rejection and early signs of buyer re-entry — signaling a potential continuation of the uptrend.

Technical Outlook

• Trend: Bullish market structure intact.

• Current Price: ~4,230.34

• Demand Zone (Buy Zone): Price has bounced from a major demand area — indicating renewed buying pressure.

• Reversal Confirmation: Rejection wicks and bullish candles confirm demand reaction.

• Supply Zone (Resistance): Overhead supply remains the key obstacle. A break and close above it could trigger a strong rally toward the next resistance.

Trade Setup

Parameter Level (Approx.) Description

Entry (Buy Zone) 4,230.34 Reaction from demand zone

Take Profit 1 (TP1) 4,501.59 Conservative target

Take Profit 2 (TP2) 4,576.74 Extended target

Stop Loss (SL) ~4,200.00 Below demand zone

Market Outlook

As long as the demand zone holds, the bullish structure remains valid.

A confirmed break above the supply zone could invite strong momentum toward higher targets.

Failure to hold the demand base may trigger a corrective move lower — hence, risk management remains crucial.

Bias: 🟢 Bullish

Timeframe: 4H

Strategy: Supply & Demand | Market Structure | Price Action

Gold is maintaining a strong bullish structure on the 4-hour timeframe, forming consistent higher highs and higher lows.

Recently, price tapped into a key Demand Zone, showing a clear rejection and early signs of buyer re-entry — signaling a potential continuation of the uptrend.

Technical Outlook

• Trend: Bullish market structure intact.

• Current Price: ~4,230.34

• Demand Zone (Buy Zone): Price has bounced from a major demand area — indicating renewed buying pressure.

• Reversal Confirmation: Rejection wicks and bullish candles confirm demand reaction.

• Supply Zone (Resistance): Overhead supply remains the key obstacle. A break and close above it could trigger a strong rally toward the next resistance.

Trade Setup

Parameter Level (Approx.) Description

Entry (Buy Zone) 4,230.34 Reaction from demand zone

Take Profit 1 (TP1) 4,501.59 Conservative target

Take Profit 2 (TP2) 4,576.74 Extended target

Stop Loss (SL) ~4,200.00 Below demand zone

Market Outlook

As long as the demand zone holds, the bullish structure remains valid.

A confirmed break above the supply zone could invite strong momentum toward higher targets.

Failure to hold the demand base may trigger a corrective move lower — hence, risk management remains crucial.

Bias: 🟢 Bullish

Timeframe: 4H

Strategy: Supply & Demand | Market Structure | Price Action

Champ_of_Gold

ICT • PA • SMC

I don’t predict. I synchronize with the market’s rhythm.

Signals here 👉t.me/+TDFp_Ervho80YzU0

ICT • PA • SMC

I don’t predict. I synchronize with the market’s rhythm.

Signals here 👉t.me/+TDFp_Ervho80YzU0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Champ_of_Gold

ICT • PA • SMC

I don’t predict. I synchronize with the market’s rhythm.

Signals here 👉t.me/+TDFp_Ervho80YzU0

ICT • PA • SMC

I don’t predict. I synchronize with the market’s rhythm.

Signals here 👉t.me/+TDFp_Ervho80YzU0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.