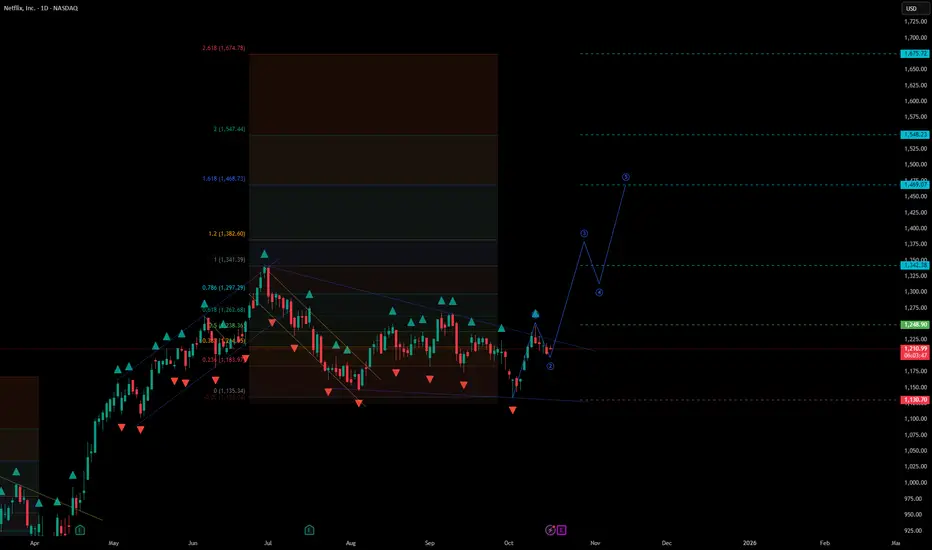

#Netflix – Trend Reversal and Impulsive Setup

Current price: $1,215.6

Netflix is showing early signs of a trend reversal after completing a multi-month corrective phase. The structure suggests a shift toward a new impulsive rally within the broader bullish framework.

🧩 Technical Overview

• After a prolonged pullback from the June highs, price found support near $1,130, forming a local base.

• The descending channel was broken to the upside — a signal of potential momentum change.

• Price is now consolidating above the breakout zone, building the foundation for an upward impulse.

📈 Scenario

• The structure resembles the start of a new impulsive leg following the correction.

• As long as the market holds above $1,130, bullish continuation remains the dominant view.

• Stop-loss: below the recent swing low at $1,130.

• Upside targets:

– $1,250–$1,270 – short-term retest of breakout zone

– $1,340–$1,380 – key resistance and mid-cycle confirmation zone

– $1,470–$1,550 – major Fibonacci target range

– $1,670+ – extended bullish objective if momentum accelerates

⚙️ Market Context

• The broader trend remains constructive as long as price stays above the breakout structure.

• Momentum shift coincides with improving sentiment across large-cap techs.

• A sustained move above $1,340 would confirm renewed strength and open the path toward the $1,500 area.

🧭 Summary

Netflix has likely completed its corrective phase and is preparing for a new upside cycle.

Holding above $1,130 keeps the bullish bias intact, while a breakout above $1,340–$1,380 would confirm trend continuation toward $1,470–$1,550 and beyond.

Current price: $1,215.6

Netflix is showing early signs of a trend reversal after completing a multi-month corrective phase. The structure suggests a shift toward a new impulsive rally within the broader bullish framework.

🧩 Technical Overview

• After a prolonged pullback from the June highs, price found support near $1,130, forming a local base.

• The descending channel was broken to the upside — a signal of potential momentum change.

• Price is now consolidating above the breakout zone, building the foundation for an upward impulse.

📈 Scenario

• The structure resembles the start of a new impulsive leg following the correction.

• As long as the market holds above $1,130, bullish continuation remains the dominant view.

• Stop-loss: below the recent swing low at $1,130.

• Upside targets:

– $1,250–$1,270 – short-term retest of breakout zone

– $1,340–$1,380 – key resistance and mid-cycle confirmation zone

– $1,470–$1,550 – major Fibonacci target range

– $1,670+ – extended bullish objective if momentum accelerates

⚙️ Market Context

• The broader trend remains constructive as long as price stays above the breakout structure.

• Momentum shift coincides with improving sentiment across large-cap techs.

• A sustained move above $1,340 would confirm renewed strength and open the path toward the $1,500 area.

🧭 Summary

Netflix has likely completed its corrective phase and is preparing for a new upside cycle.

Holding above $1,130 keeps the bullish bias intact, while a breakout above $1,340–$1,380 would confirm trend continuation toward $1,470–$1,550 and beyond.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.