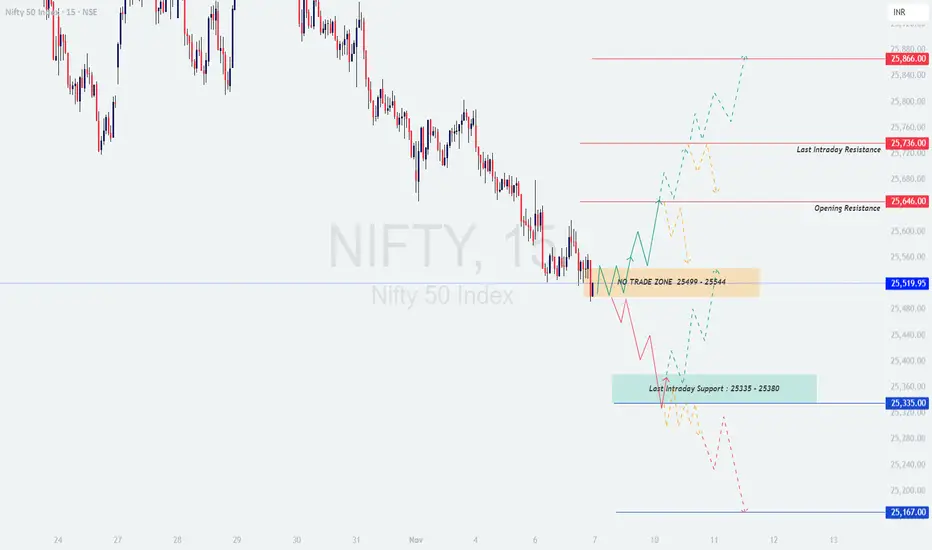

📊 NIFTY TRADING PLAN — 07 NOV 2025

(Timeframe Reference: 15-Min Chart)

Chart Summary:

Nifty is currently trading near the 25,520 zone, which lies just below the identified Opening Resistance (25,646) and slightly above the No-Trade Zone (25,449 – 25,544). The index remains range-bound, but volatility is expected to pick up as it approaches key breakout zones. A decisive move beyond these levels could trigger strong directional momentum — either continuation or reversal.

The broader trend bias remains neutral-to-bullish unless Nifty slips below 25,380, which marks the last intraday support area.

🟢 Scenario 1: GAP-UP Opening (100+ Points)

If Nifty opens around or above 25,620 – 25,650, it will open directly near the Opening Resistance zone. A strong gap-up needs immediate follow-through to sustain bullish momentum.

💡 Educational Note: Gap-ups often lure traders into impulsive entries. The key is confirmation — a sustained break above the resistance with rising volume confirms institutional participation. Always avoid long positions if the first candle forms a wick-type rejection near resistance.

🟧 Scenario 2: FLAT Opening (Within 25,449 – 25,544)

This range represents the No-Trade Zone. Flat openings within this area typically cause early volatility and indecision. Traders should avoid taking trades immediately as price may oscillate rapidly before choosing direction.

🧠 Educational Tip: During flat openings, avoid predicting direction. Let the breakout confirm. Early trades inside such zones are mostly hit by stop-loss whipsaws. The best trades emerge after clarity, not anticipation.

🔴 Scenario 3: GAP-DOWN Opening (100+ Points)

If Nifty opens below 25,420, sentiment will likely turn weak, and price may test the Last Intraday Support (25,335 – 25,380).

📘 Educational Insight: Gap-downs often lead to panic selling in the opening moments. Patience and confirmation are crucial. If volume starts drying near support zones, it usually indicates seller fatigue and potential reversal setups.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

📈 SUMMARY:

📚 CONCLUSION:

Nifty stands at a critical juncture between consolidation and breakout. The 25,544 level acts as a trigger for directional clarity — a sustained move above can revive bullish sentiment, while a fall below 25,449 may bring further weakness.

Be patient during opening volatility, focus on level confirmations, and let price action guide you rather than emotions.

📊 Trading is not about catching every move — it’s about catching the right move at the right time.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. The analysis shared above is purely for educational purposes and market understanding. Please consult a certified financial advisor before taking any trading or investment decisions.

(Timeframe Reference: 15-Min Chart)

Chart Summary:

Nifty is currently trading near the 25,520 zone, which lies just below the identified Opening Resistance (25,646) and slightly above the No-Trade Zone (25,449 – 25,544). The index remains range-bound, but volatility is expected to pick up as it approaches key breakout zones. A decisive move beyond these levels could trigger strong directional momentum — either continuation or reversal.

The broader trend bias remains neutral-to-bullish unless Nifty slips below 25,380, which marks the last intraday support area.

🟢 Scenario 1: GAP-UP Opening (100+ Points)

If Nifty opens around or above 25,620 – 25,650, it will open directly near the Opening Resistance zone. A strong gap-up needs immediate follow-through to sustain bullish momentum.

- []If price sustains above 25,646 with strong bullish candles and volume confirmation, traders can look for long entries targeting 25,736 and 25,866.

[]However, failure to hold above 25,646 may indicate exhaustion. Rejection candles near resistance could invite short-term profit booking and a retracement toward 25,544 – 25,490. - Ideal strategy: Wait for the first 15–30 minutes to confirm momentum. Enter on pullbacks rather than chasing the initial move.

💡 Educational Note: Gap-ups often lure traders into impulsive entries. The key is confirmation — a sustained break above the resistance with rising volume confirms institutional participation. Always avoid long positions if the first candle forms a wick-type rejection near resistance.

🟧 Scenario 2: FLAT Opening (Within 25,449 – 25,544)

This range represents the No-Trade Zone. Flat openings within this area typically cause early volatility and indecision. Traders should avoid taking trades immediately as price may oscillate rapidly before choosing direction.

- []Avoid entering trades within the 25,449 – 25,544 band.

[]If price breaks above 25,544 decisively with strong green candles, upside targets remain 25,646 → 25,736. - If price breaks below 25,449, it could drift lower toward 25,380 – 25,335 (the last intraday support zone). Sustained selling may extend weakness toward 25,167.

🧠 Educational Tip: During flat openings, avoid predicting direction. Let the breakout confirm. Early trades inside such zones are mostly hit by stop-loss whipsaws. The best trades emerge after clarity, not anticipation.

🔴 Scenario 3: GAP-DOWN Opening (100+ Points)

If Nifty opens below 25,420, sentiment will likely turn weak, and price may test the Last Intraday Support (25,335 – 25,380).

- []If a reversal candle (hammer or bullish engulfing) forms within the 25,335 – 25,380 support area, it can offer a short-covering opportunity toward 25,490 – 25,544.

[]However, if Nifty breaks and sustains below 25,335, further downside may open toward 25,167. - Avoid shorting directly on deep gap-downs — wait for a pullback near 25,490 – 25,544 to get a better entry with favorable risk-reward.

📘 Educational Insight: Gap-downs often lead to panic selling in the opening moments. Patience and confirmation are crucial. If volume starts drying near support zones, it usually indicates seller fatigue and potential reversal setups.

💼 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS:

- []Avoid buying options in the first 15 minutes of volatile openings — IV (Implied Volatility) spikes can cause inflated premiums.

[]Always define your stop-loss before entering a trade; risk no more than 1–2% of your total capital per setup.

[]Use ITM options for directional conviction and avoid OTM strikes in a range-bound market.

[]Trail your stop-loss once your position gains 30–40 points in favor. - Remember: Capital protection is your first priority; missing a trade is better than a forced loss.

📈 SUMMARY:

- []🟧 No-Trade Zone: 25,449 – 25,544[]🟥 Resistance Zones: 25,646 / 25,736 / 25,866[]🟩 Support Zones: 25,380 – 25,335 / 25,167[]⚖️ Bias: Neutral-to-Bullish above 25,544 | Weakness below 25,449

📚 CONCLUSION:

Nifty stands at a critical juncture between consolidation and breakout. The 25,544 level acts as a trigger for directional clarity — a sustained move above can revive bullish sentiment, while a fall below 25,449 may bring further weakness.

Be patient during opening volatility, focus on level confirmations, and let price action guide you rather than emotions.

📊 Trading is not about catching every move — it’s about catching the right move at the right time.

⚠️ DISCLAIMER:

I am not a SEBI-registered analyst. The analysis shared above is purely for educational purposes and market understanding. Please consult a certified financial advisor before taking any trading or investment decisions.

Trade closed: target reached

Prices reversed well from the highlighted ( Last intraday support) zone, showing a smart recovery from the lower levels and achieving the intraday upside targets.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.