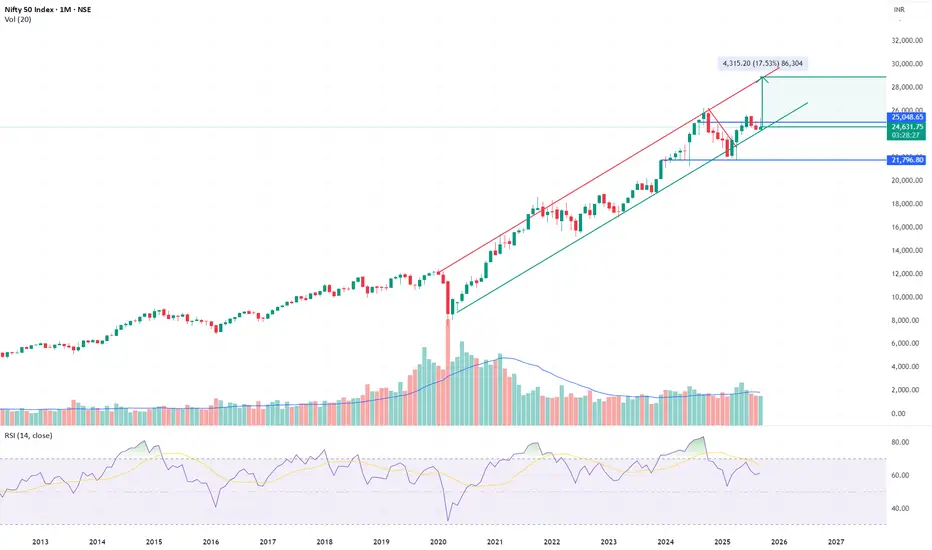

NIFTY is respecting the lower boundary of its long-term upward channel near 24.5–24.6k. This zone remains the key support for the secular uptrend.

Macro Context: Domestic earnings growth remains constructive, but global liquidity, crude oil, and US yields will dictate the timing of the next leg.

Verdict: NIFTY is at the lower channel inflection, not the top. As long as 24k holds, the setup remains bullish, with 26k as the breakout trigger for continuation.

For educational purposes only. This is not investment advice.

- Support: 24,000–24,200 must hold to preserve structure.

- Trigger: A sustained break above 26,000 would mark continuation of the bull leg, with targets at 28,500–29,000.

- Risk: Losing 24k opens room for a deeper slide toward the 21,800 channel base.

Macro Context: Domestic earnings growth remains constructive, but global liquidity, crude oil, and US yields will dictate the timing of the next leg.

Verdict: NIFTY is at the lower channel inflection, not the top. As long as 24k holds, the setup remains bullish, with 26k as the breakout trigger for continuation.

For educational purposes only. This is not investment advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.