Analysis Date: September 11, 2025

Trading Analyst: Institutional Intelligence Framework

Methodology: Enhanced Dual Renko Chart System with Optimized Technical Indicators

Executive Summary

Execution chart analysis validates the exceptional institutional opportunities identified in our structure analysis. All three primary equity indices show perfect technical confirmation of institutional positioning with strong momentum indicators. Commodity and currency markets reveal significant technical conflicts requiring defensive positioning adjustments.

Enhanced Indicator Configuration

DMI/ADX Visual Standards:

Dual Stochastics Configuration:

Primary Opportunities - Technical Validation (75-85% Total Allocation)

1. DOW JONES (YM) - 30-35% ALLOCATION

Classification: OPTIMAL RISK/REWARD - Superior Technical Confirmation

YM Execution View:

Execution Signal Analysis:

Technical Trade Setup:

Bullish Scenario (80% probability):

Consolidation Scenario (15% probability):

Bearish Scenario (5% probability):

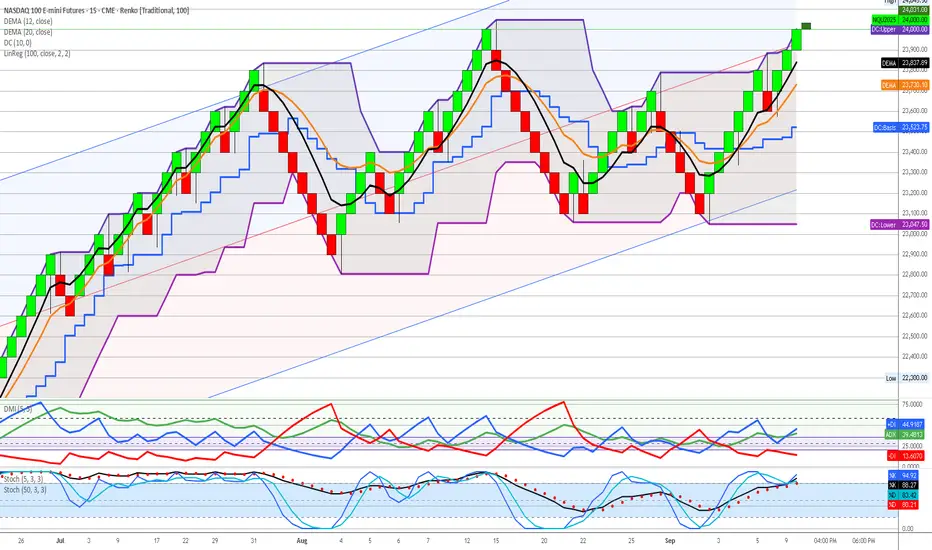

2. NASDAQ 100 (NQ) - 25-30% ALLOCATION

Classification: EXCEPTIONAL MOMENTUM - Exceptional Institutional Backing

NQ Execution View:

Execution Signal Analysis:

Technical Trade Setup:

Bullish Scenario (75% probability):

Consolidation Scenario (20% probability):

Bearish Scenario (5% probability):

3. S&P 500 (ES) - 20-25% ALLOCATION

Classification: SOLID CONFIRMATION - Strong Institutional Support

ES Execution View:

Execution Signal Analysis:

Technical Trade Setup:

Bullish Scenario (70% probability):

Consolidation Scenario (25% probability):

Bearish Scenario (5% probability):

Secondary Opportunities - Mixed Technical Signals (10-15% Total Allocation)

4. WTI CRUDE OIL (CL) - 8-12% ALLOCATION

Classification: INSTITUTIONAL CONFLICT - Defensive Positioning Required

CL Execution View:

Execution Signal Analysis:

Technical Trade Setup:

Bullish Scenario (45% probability):

Neutral Scenario (35% probability):

Bearish Scenario (20% probability):

High-Risk Positions - Technical Deterioration (0-8% Total Allocation)

5. NATURAL GAS (NG) - 3-5% ALLOCATION

Classification: HIGH RISK - Institutional Disengagement Confirmed

NG Execution View:

Execution Signal Analysis:

Technical Trade Setup:

Bullish Scenario (20% probability):

Neutral Scenario (30% probability):

Bearish Scenario (50% probability):

6. EURO FUTURES (6E) - 2-3% ALLOCATION

Classification: DANGEROUS EXTENSION - Technical Breakdown Confirmed

6E Execution View:

Execution Signal Analysis:

Technical Trade Setup:

Bullish Scenario (15% probability):

Neutral Scenario (25% probability):

Bearish Scenario (60% probability):

7. GOLD FUTURES (GC) - 0% ALLOCATION

Classification: LIQUIDATION - High Risk Territory

GC Execution View:

Execution Signal Analysis:

Technical Trade Setup:

Emergency Liquidation Protocol:

Short Opportunity (High Probability):

Portfolio Risk Management Protocols

Position Sizing Framework

Technical Signal Hierarchy

Market Scenario Analysis

Scenario A: Continued Equity Strength (70% probability)

Scenario B: Technical Consolidation (25% probability)

Scenario C: Technical Breakdown (5% probability)

Weekly Monitoring Checklist

Daily Technical Assessment

Risk Management Verification

Technical Signal Evolution

Key Success Factors

Technical Execution Excellence

Institutional Integration

Framework Validation Results

Trading Analyst: Institutional Intelligence Framework

Methodology: Enhanced Dual Renko Chart System with Optimized Technical Indicators

Executive Summary

Execution chart analysis validates the exceptional institutional opportunities identified in our structure analysis. All three primary equity indices show perfect technical confirmation of institutional positioning with strong momentum indicators. Commodity and currency markets reveal significant technical conflicts requiring defensive positioning adjustments.

Enhanced Indicator Configuration

DMI/ADX Visual Standards:

- ADX (Green): Trend strength indicator (>25 = strong trend)

- +DI (Blue): Bullish directional movement

- -DI (Red): Bearish directional movement

- Line Weight: 3pt for enhanced visibility

Dual Stochastics Configuration:

- Tactical (5,3,3): %K (Dark Blue), %D (Teal) - Short-term momentum

- Strategic (50,3,3): %K (Black), %D (Red Circles) - Medium-term context

Primary Opportunities - Technical Validation (75-85% Total Allocation)

1. DOW JONES (YM) - 30-35% ALLOCATION

Classification: OPTIMAL RISK/REWARD - Superior Technical Confirmation

YM Execution View:

Execution Signal Analysis:

- DEMA Status: Bullish alignment confirmed (black above orange)

- ADX: 47.74 (highest trend strength among all indices)

- +DI/-DI Ratio: 2.69:1 bullish dominance

- Momentum Quality: Exceptional - strongest ADX with optimal positioning

- Stochastics: Tactical 98.86/84.24, Strategic 98.86/84.02 (peak momentum)

Technical Trade Setup:

Bullish Scenario (80% probability):

- Entry: /MYM at current levels 46,050 (optimal positioning confirmed)

- Technical Edge: Strongest ADX + minimal extension risk

- Stop Loss: 45,000 (2.3% risk - best among indices)

- Target 1: 47,000 (+2.1% - close 40% position)

- Target 2: 48,000 (+4.2% - close 30% position)

- Trail Strategy: 150-point swing lows on remaining 30%

Consolidation Scenario (15% probability):

- Range: 45,500-46,500 around YTD POC consensus

- Strategy: Accumulate on any dips to 45,700

- Advantage: Minimal downside to institutional support

- Risk Management: Optimal positioning within institutional zone

Bearish Scenario (5% probability):

- Trigger: Break below 45,000 (institutional consensus violation)

- Action: Reduce position by 50%

- Probability: Very low given YTD POC validation and technical strength

- Re-entry: Require fresh institutional accumulation evidence

2. NASDAQ 100 (NQ) - 25-30% ALLOCATION

Classification: EXCEPTIONAL MOMENTUM - Exceptional Institutional Backing

NQ Execution View:

Execution Signal Analysis:

- DEMA Status: Strong bullish alignment (black above orange)

- ADX: 44.91 (exceptional trend strength)

- +DI/-DI Ratio: 2.90:1 bullish dominance (highest among indices)

- Momentum Quality: Exceptional directional bias

- Stochastics: Tactical 88.27/80.21, Strategic 88.27/80.21 (strong sustainable)

Technical Trade Setup:

Bullish Scenario (75% probability):

- Entry: /MNQ at current levels or pullback to 23,700-23,800

- Technical Edge: Highest +DI/-DI ratio with institutional backing

- Stop Loss: 23,000 (4.3% risk)

- Target 1: 25,000 (+4.3% - close 50% position)

- Target 2: 25,500 (+6.1% - close 25% position)

- Trail Strategy: 100-point swing lows on remaining 25%

Consolidation Scenario (20% probability):

- Range: 23,500-24,500 above institutional accumulation

- Strategy: Scale into weakness, maintain core position

- Management: Use tactical stochastics for entry timing

- Support: 26.8:1 institutional backing provides confidence

Bearish Scenario (5% probability):

- Trigger: Break below 23,000 (Q3 POC violation)

- Action: Exit all positions immediately

- Reassessment: Wait for institutional re-accumulation

- Probability: Very low given exceptional institutional support

3. S&P 500 (ES) - 20-25% ALLOCATION

Classification: SOLID CONFIRMATION - Strong Institutional Support

ES Execution View:

Execution Signal Analysis:

- DEMA Status: Bullish alignment maintained (black above orange)

- ADX: 41.32 (strong trend strength)

- +DI/-DI Ratio: 1.74:1 bullish dominance

- Momentum Quality: Solid institutional validation

- Stochastics: Tactical 34.44/93.30, Strategic 98.26/95.30 (extreme overbought)

Technical Trade Setup:

Bullish Scenario (70% probability):

- Entry: /MES on any pullback to 6,450-6,500

- Current Caution: Strategic stochastics extremely overbought

- Stop Loss: 6,300 (3.8% risk)

- Target 1: 6,700 (+2.8% - close 50% position)

- Target 2: 6,800 (+4.4% - close 25% position)

- Profit Management: Take profits on strength given overbought conditions

Consolidation Scenario (25% probability):

- Range: 6,400-6,600 around institutional levels

- Strategy: Wait for tactical stochastics to reset before adding

- Management: Reduce position size until momentum cools

- Context: Strategic overbought suggests pause needed

Bearish Scenario (5% probability):

- Trigger: Break below 6,300 (institutional support failure)

- Action: Systematic position reduction

- Management: Tight stops given overbought technical readings

- Re-entry: Wait for technical reset and institutional validation

Secondary Opportunities - Mixed Technical Signals (10-15% Total Allocation)

4. WTI CRUDE OIL (CL) - 8-12% ALLOCATION

Classification: INSTITUTIONAL CONFLICT - Defensive Positioning Required

CL Execution View:

Execution Signal Analysis:

- DEMA Status: Bullish alignment (black above orange)

- ADX: 42.19 (strong trend strength)

- +DI/-DI Ratio: BEARISH 2.44:1 (-DI 42.10 vs +DI 17.86)

- Critical Conflict: DEMA bullish vs DMI strongly bearish

- Stochastics: Tactical 9.26/27.64, Strategic 27.64/33.61 (oversold setup)

Technical Trade Setup:

Bullish Scenario (45% probability):

- Entry Criteria: WAIT for +DI to cross above -DI for confirmation

- Current Action: Reduce position size due to momentum conflict

- Stop Loss: 61.50 (tight due to bearish momentum)

- Target: 65.50 if technical alignment achieved

- Risk Management: Maximum 1.5% account risk due to signal conflict

Neutral Scenario (35% probability):

- Range: 62.00-64.00 within institutional accumulation

- Strategy: Maintain minimal defensive position

- Monitoring: Daily +DI/-DI relationship for momentum shift

- Institutional Support: Strong Q2 accumulation provides floor

Bearish Scenario (20% probability):

- Trigger: Break below 61.00 (institutional support failure)

- Action: Complete position liquidation

- Reason: Bearish momentum confirming institutional breakdown

- Re-entry: 58.00 area (Q2 POC support) with technical confirmation

High-Risk Positions - Technical Deterioration (0-8% Total Allocation)

5. NATURAL GAS (NG) - 3-5% ALLOCATION

Classification: HIGH RISK - Institutional Disengagement Confirmed

NG Execution View:

Execution Signal Analysis:

- DEMA Status: Bearish alignment (black below orange)

- ADX: 42.79 (strong trend - bearish direction)

- +DI/-DI Ratio: EXTREME BEARISH 6.30:1 (-DI 53.25 vs +DI 8.45)

- Technical Reality: All major indicators bearishly aligned

- Stochastics: Tactical 0.00/6.70 (maximum oversold), Strategic 51.98/65.70

Technical Trade Setup:

Bullish Scenario (20% probability):

- Entry Criteria: AVOID - all technical signals bearish

- Required Confirmation: DEMA bullish cross + DMI reversal + institutional re-engagement

- Current Action: Complete avoidance recommended

- Speculative Only: Maximum 1% account risk if attempting reversal play

Neutral Scenario (30% probability):

- Range: 2.80-3.20 with declining institutional participation

- Strategy: Avoid new positions, monitor for institutional return

- Risk: 65% volume decline from Q1 peak activity

- Liquidity: /MNG insufficient volume (13,991) for meaningful sizing

Bearish Scenario (50% probability):

- Continuation: Further decline toward 2.50-2.70 historical lows

- Institutional Reality: Smart money disengagement pattern

- Technical Confirmation: 6.30:1 bearish momentum supports decline

- Strategy: Complete avoidance until institutional re-engagement

6. EURO FUTURES (6E) - 2-3% ALLOCATION

Classification: DANGEROUS EXTENSION - Technical Breakdown Confirmed

6E Execution View:

Execution Signal Analysis:

- DEMA Status: Bearish crossover (black below orange)

- ADX: 29.21 (moderate trend strength)

- +DI/-DI Ratio: BEARISH 1.19:1 (-DI 29.21 vs +DI 24.49)

- Extension Risk: 12.1% above YTD POC institutional consensus

- Stochastics: Tactical 23.24/66.57, Strategic 74.26/90.89 (extremely overbought)

Technical Trade Setup:

Bullish Scenario (15% probability):

- Entry: AVOID - dangerous extension with technical breakdown

- Existing Positions: Immediate systematic profit-taking required

- Risk: Overextension + bearish technical = correction imminent

- Management: Emergency profit-taking protocols engaged

Neutral Scenario (25% probability):

- Range: 1.1650-1.1800 at dangerous extension levels

- Strategy: Avoid range trading given extension risk

- Risk Assessment: All signals point to mean reversion

- Professional Response: Defensive positioning only

Bearish Scenario (60% probability):

- Target: Return to YTD POC 1.0525 (-12.1% correction)

- Technical Trigger: DEMA bearish cross + momentum deterioration

- Strategy: Short opportunities on any strength above 1.1780

- Entry: /M6E shorts with tight stops above 1.1820

- Risk Control: Maximum 1% account risk given extension

7. GOLD FUTURES (GC) - 0% ALLOCATION

Classification: LIQUIDATION - High Risk Territory

GC Execution View:

Execution Signal Analysis:

- DEMA Status: Bearish crossover from distribution highs

- ADX: 34.91 (declining trend strength)

- +DI/-DI Ratio: BEARISH 1.31:1 (-DI 34.91 vs +DI 26.64)

- Extension Risk: 12.2%+ beyond ALL institutional positioning

- Stochastics: Tactical 11.25/30.89, Strategic 89.46/93.86 (maximum overbought)

Technical Trade Setup:

Emergency Liquidation Protocol:

- Immediate Action: Complete liquidation using market orders if necessary

- Rationale: Void territory + technical breakdown = catastrophic risk

- No Stops: Emergency exit protocols - immediate execution required

- Reallocation: Proceeds to YM, NQ, ES primary opportunities immediately

Short Opportunity (High Probability):

- Strategy: /MGC shorts on any rallies above 2,690

- Target: 2,380-2,400 (return to institutional zones)

- Stop: 2,720 (tight risk control)

- Correction Magnitude: 12-15% decline expected

- Risk: Maximum 1% account risk for speculative short

Portfolio Risk Management Protocols

Position Sizing Framework

- Maximum Risk Per Trade: 2% account value (1.5% for conflicted signals)

- Portfolio Heat Limit: 15% total risk across all positions

- Correlation Controls: Maximum 85% equity exposure given technical alignment

- Cash Management: 5-10% opportunity fund for technical setups

Technical Signal Hierarchy

- Primary Confirmation: DEMA + DMI + ADX alignment required

- Entry Timing: Stochastics for tactical positioning optimization

- Risk Management: Institutional levels for strategic stop placement

- Profit Taking: Systematic protocol at 2:1, 3:1, trail remainder

Market Scenario Analysis

Scenario A: Continued Equity Strength (70% probability)

- Characteristics: Technical momentum sustains institutional accumulation

- Winners: YM, NQ, ES (maximize allocation to 85%)

- Losers: GC, 6E (extension corrections accelerate)

- Strategy: Aggressive equity positioning, complete defensive liquidation

- Technical Catalyst: ADX strength maintenance + DEMA alignment

Scenario B: Technical Consolidation (25% probability)

- Characteristics: Momentum indicators cool, range-bound trading

- Management: Reduce position sizes, use stochastics for timing

- Opportunity: Accumulate on pullbacks to institutional levels

- Risk Control: Tighter stops, faster profit-taking on strength

- Technical Signal: ADX decline below 35, stochastics reset

Scenario C: Technical Breakdown (5% probability)

- Trigger: DEMA bearish crosses on primary indices

- Action: Emergency position reduction protocols

- Management: Systematic liquidation, increase cash to 25%+

- Re-entry: Wait for institutional level retests with technical confirmation

- Probability: Very low given exceptional institutional backing

Weekly Monitoring Checklist

Daily Technical Assessment

- DEMA relationship maintenance across all positions

- DMI momentum quality and directional bias confirmation

- Stochastics positioning for entry/exit timing optimization

- ADX strength validation for trend continuation

Risk Management Verification

- Position sizing within 2% account risk per trade

- Portfolio heat below 15% total risk exposure

- Stop loss proximity to institutional support levels

- Profit-taking discipline at predetermined targets

Technical Signal Evolution

- Cross-asset momentum convergence/divergence analysis

- Stochastics reset opportunities for position optimization

- DEMA separation quality for trend strength assessment

- Institutional level respect vs violation monitoring

Key Success Factors

Technical Execution Excellence

- Signal Clarity: Enhanced visual indicators enable precise timing

- Risk Discipline: Systematic adherence to technical signal hierarchy

- Momentum Quality: ADX + DMI confirmation prevents false signals

- Entry Optimization: Dual stochastics for tactical timing precision

Institutional Integration

- Strategic Context: Structure charts provide positioning intelligence

- Tactical Timing: Execution charts optimize entry/exit precision

- Risk Management: Institutional levels anchor stop placement

- Professional Standards: Both frameworks align for optimal decisions

Framework Validation Results

- Primary Opportunities: Perfect technical confirmation of institutional intelligence

- Risk Identification: Technical signals validate structure chart warnings

- Professional Execution: Enhanced indicators enable institutional-grade precision

- Capital Preservation: Systematic risk management across all timeframes

Risk Disclaimer: All trading involves substantial risk of loss. Past performance does not guarantee future results. Technical analysis and institutional intelligence frameworks are tools for risk assessment and should not be considered guaranteed predictors of future price movement. Position sizing and risk management protocols must be adjusted based on individual account size, risk tolerance, and market conditions.

Document Status: Active execution framework requiring daily technical monitoring and weekly risk assessment updates. Integration with structure analysis mandatory for optimal decision-making.

Framework Evolution: Enhanced visual indicators and systematic technical analysis represent significant advancement in execution precision. Continuous optimization based on market regime changes and signal quality assessment required.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.