When Your Chip Business Out Chips the Market

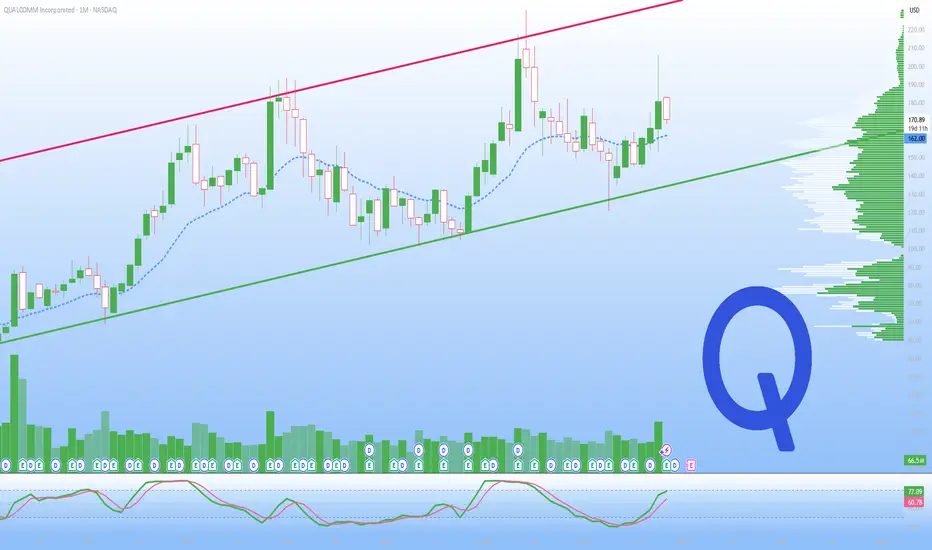

Its time to check Qualcomm’s latest numbers, and it’s pretty clear the handset business is back in a big way. Let’s break it down..

fiscal Q4 revenue came in at $11.3 billion, up 10% from last year and half a billion above what analysts expected. Earnings per share hit $3.00 on a non GAAP basis 13 cents better than forecast. The heavy lifting came from the chip business, QCT, which grew 13% to $9.8 billion.

Handsets were the star. That segment jumped 14% to $7 billion, and it’s not hard to see why Samsung’s premium Android phones are flying off the shelves, and Qualcomm’s Snapdragon chips are right in the middle of that.

Automotive also set a record at $1.1 billion, up 17%, which shows the car tech push is paying off. IoT grew a respectable 7% to just over a billion. The one soft spot was licensing QTL dropped 7% to $1.4 billion, but that’s a smaller piece of the pie these days.

Cash flow was insane! $12.8 billion in free cash for the full year, a record. They returned $3.4 billion to shareholders in the quarter alone, even after eating a $5.7 billion non cash hit from a U.S tax bill

Looking ahead, management’s guidance for Q1 FY26 is aggressive $11.8 to $12.6 billion in revenue and $3.30 to $3.50 in EPS, both crushing consensus.

They’re calling for record handset revenue again, thanks to new flagship Snapdragon launches. CEO Cristiano Amon sounded pumped on the conference call, talking up over 150 AI PC designs in the works, real traction in automated driving, and a faster than expected move into AI data centers, with meaningful volume now slated for fiscal ’27

Qualcomm’s riding a strong rebound in premium smartphones, diversifying smartly into auto and PCs, and sitting on a mountain of cash

The guidance suggests the momentum’s not slowing down anytime soon. If the Android flagship cycle stays hot and AI keeps infiltrating everything, this could be a solid setup into next year

Are you bullish or bearish on QCOM from here?

Its time to check Qualcomm’s latest numbers, and it’s pretty clear the handset business is back in a big way. Let’s break it down..

fiscal Q4 revenue came in at $11.3 billion, up 10% from last year and half a billion above what analysts expected. Earnings per share hit $3.00 on a non GAAP basis 13 cents better than forecast. The heavy lifting came from the chip business, QCT, which grew 13% to $9.8 billion.

Handsets were the star. That segment jumped 14% to $7 billion, and it’s not hard to see why Samsung’s premium Android phones are flying off the shelves, and Qualcomm’s Snapdragon chips are right in the middle of that.

Automotive also set a record at $1.1 billion, up 17%, which shows the car tech push is paying off. IoT grew a respectable 7% to just over a billion. The one soft spot was licensing QTL dropped 7% to $1.4 billion, but that’s a smaller piece of the pie these days.

Cash flow was insane! $12.8 billion in free cash for the full year, a record. They returned $3.4 billion to shareholders in the quarter alone, even after eating a $5.7 billion non cash hit from a U.S tax bill

Looking ahead, management’s guidance for Q1 FY26 is aggressive $11.8 to $12.6 billion in revenue and $3.30 to $3.50 in EPS, both crushing consensus.

They’re calling for record handset revenue again, thanks to new flagship Snapdragon launches. CEO Cristiano Amon sounded pumped on the conference call, talking up over 150 AI PC designs in the works, real traction in automated driving, and a faster than expected move into AI data centers, with meaningful volume now slated for fiscal ’27

Qualcomm’s riding a strong rebound in premium smartphones, diversifying smartly into auto and PCs, and sitting on a mountain of cash

The guidance suggests the momentum’s not slowing down anytime soon. If the Android flagship cycle stays hot and AI keeps infiltrating everything, this could be a solid setup into next year

Are you bullish or bearish on QCOM from here?

🟣MasterClass moonypto.com/masterclass

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🟣MasterClass moonypto.com/masterclass

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

🟢Signal moonypto.com/signal

🔵News t.me/moonypto

⚪ t.me/moonyptofarsi

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.