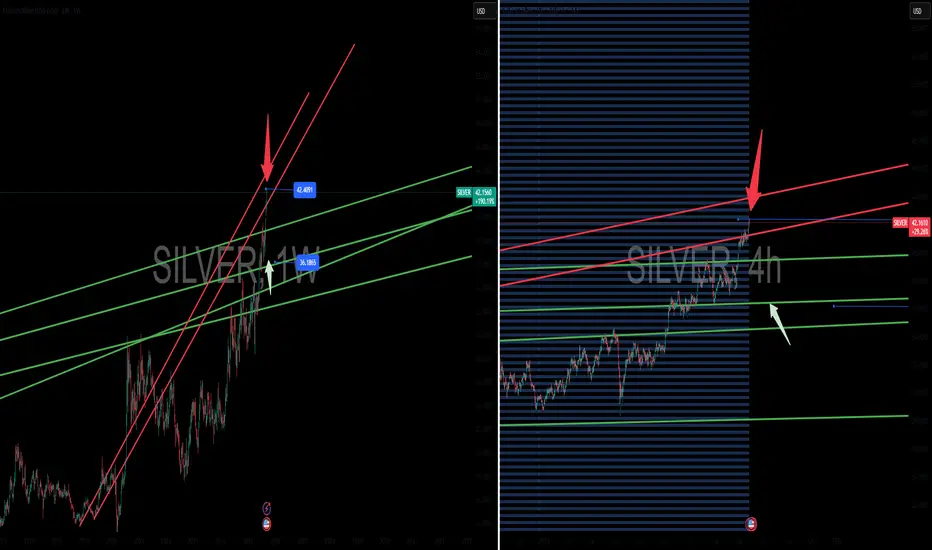

Based on a technical analysis of the silver market from a weekly and 4-hour perspective, here is a trade idea to short silver on a potential correction, mirroring the gold thesis.

Short Trade Thesis: Weekly Chart Analysis

The weekly chart for silver (XAG/USD) reveals an extended and overbought price action. The current rally, driven by a combination of safe-haven demand and robust industrial use, has been steep and rapid, pushing the price to new multi-year highs.

Extended Price Action: The weekly chart's Relative Strength Index (RSI) is signaling extremely overbought conditions, a classic indication that the upward momentum is likely unsustainable in the short term. The price has moved far from its key moving averages, creating a significant "extension" that often precedes a period of consolidation or a corrective pullback.

"Skipped" Support: During this powerful ascent, the price "shot through" a previous major resistance level around $41.00. According to classic technical analysis principles, a significant resistance level, once broken with conviction, becomes a new support level. The price has not yet retested this crucial level. A healthy correction would involve a retracement back to this zone to confirm its new role as support before any potential further move up.

Trade Idea: Short Silver

This trade idea is a counter-trend position, targeting a short-term correction within the broader bullish trend. The goal is to capitalize on the likely mean-reversion move back to the closest, most significant support level.

Entry: Short silver at the 4-hour chart resistance line at or near the recent multi-year high of $42.50. (Shown by Red arrow)

Take-Profit (Exit): The logical exit is at the immediate 4-hour support line and psychological level of $41.00. (Shown by Green arrow)

Short Trade Thesis: Weekly Chart Analysis

The weekly chart for silver (XAG/USD) reveals an extended and overbought price action. The current rally, driven by a combination of safe-haven demand and robust industrial use, has been steep and rapid, pushing the price to new multi-year highs.

Extended Price Action: The weekly chart's Relative Strength Index (RSI) is signaling extremely overbought conditions, a classic indication that the upward momentum is likely unsustainable in the short term. The price has moved far from its key moving averages, creating a significant "extension" that often precedes a period of consolidation or a corrective pullback.

"Skipped" Support: During this powerful ascent, the price "shot through" a previous major resistance level around $41.00. According to classic technical analysis principles, a significant resistance level, once broken with conviction, becomes a new support level. The price has not yet retested this crucial level. A healthy correction would involve a retracement back to this zone to confirm its new role as support before any potential further move up.

Trade Idea: Short Silver

This trade idea is a counter-trend position, targeting a short-term correction within the broader bullish trend. The goal is to capitalize on the likely mean-reversion move back to the closest, most significant support level.

Entry: Short silver at the 4-hour chart resistance line at or near the recent multi-year high of $42.50. (Shown by Red arrow)

Take-Profit (Exit): The logical exit is at the immediate 4-hour support line and psychological level of $41.00. (Shown by Green arrow)

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.