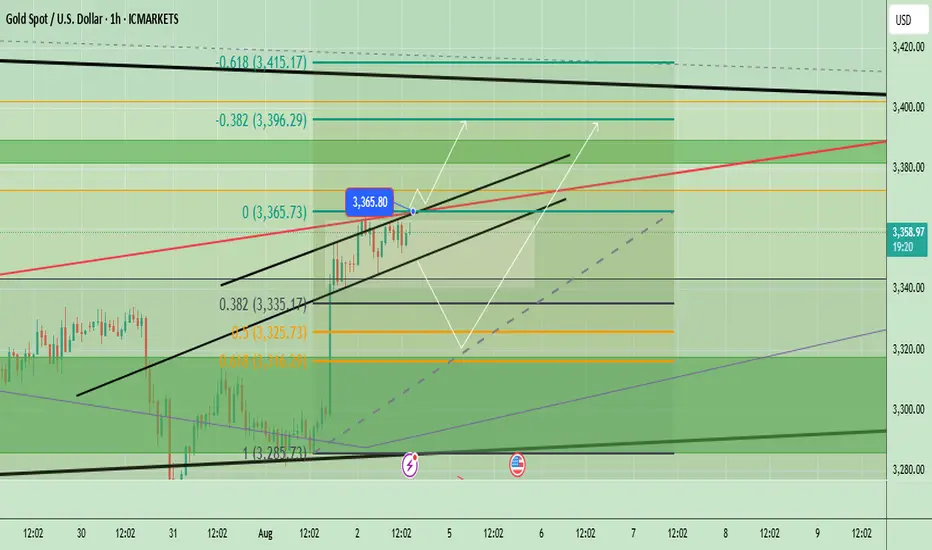

Gold has been showing a short-term bullish momentum after bouncing from the 3285 support zone, forming an ascending channel visible on the chart. The price is currently trading near 3361, close to the upper boundary of the channel and a key horizontal resistance level at 3365–3370. If the bullish momentum continues and price breaks above 3365–3370, we could see further upside toward 3396 and potentially 3400+. However, a failure to hold above this level could trigger a short-term retracement toward 3335–3325 support.

📈 Potential Scenarios:

- Bullish: If price sustains above $3,365, we could see an upside push toward $3,396 and possibly higher to $3,410 resistance.

- Bearish: A rejection near the channel top or $3,365 may lead to a pullback toward $3,325 (Fib 0.5) and then $3,285 support.

🔑 Key levels to watch:

- Upside: $3,365 → $3,396 → $3,410

- Downside: $3,335 → $3,325 → $3,285

- Trend Bias: Short-term bullish as long as price stays above 3325

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

📈 Potential Scenarios:

- Bullish: If price sustains above $3,365, we could see an upside push toward $3,396 and possibly higher to $3,410 resistance.

- Bearish: A rejection near the channel top or $3,365 may lead to a pullback toward $3,325 (Fib 0.5) and then $3,285 support.

🔑 Key levels to watch:

- Upside: $3,365 → $3,396 → $3,410

- Downside: $3,335 → $3,325 → $3,285

- Trend Bias: Short-term bullish as long as price stays above 3325

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Trade active

Gold is trading around 3,368, holding above the key 3,365 support within a rising channel. A breakout above 3,372–3,378 may trigger bullish momentum toward 3,390–3,396, while failure to hold 3,365 could lead to a pullback toward 3,348–3,335. The short-term bias remains neutral-to-bullish as long as price stays above 3,348, but a drop below 3,325 would shift momentum bearish.

🔑 Key Levels

- Immediate Resistance: 3,372 – 3,378

- Major Resistance: 3,390 – 3,396 (0.382 Fib extension zone)

- Immediate Support: 3,355 – 3,348 (mid-channel & Fib support)

- Strong Support: 3,335 – 3,325 (0.382 and 0.5 Fib retracement levels)

Trade closed: target reached

Target achieved successfully$27=270 Pips Booked ($3368-$3395 Target)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.