GOLD - Consolidation ahead of the news? Will the trend continue?FX:XAUUSD is attempting to recover to $5,000 after a sharp 3.5% drop on Thursday. There are no clear reasons for this. All market attention is focused on today's US inflation report - CPI.

Yesterday's gold sell-off was caused not only by technical factors, but also by capital flight to the dollar amid renewed fears surrounding AI. There was no news driver, the market was overstretched, and the sharp momentum of the dollar triggered sell-offs (liquidations) in the markets.

Despite strong NFP, the market is still pricing in at least two rate cuts this year.

Ahead is CPI — the main trigger: Forecast — Core CPI slowdown to 2.5% y/y. If inflation turns out to be higher than expected, the market will reassess the Fed's plans, which will strengthen the dollar and hit gold.

High volatility is inevitable today.

Resistance levels: 4990, 5100

Support levels: 4944, 4902

Technically, local and global trends are bullish, and any correction could quickly end in growth, especially from strong levels. A breakout of 4990 and maintaining the price above this level could confirm the bullish nature of the market. On news amid high volatility, the market may test the support of the trend and the range of 4878 - 4812.

Negative scenario: a breakout and close below 4800 could trigger a fall to 4700 - 4600.

Best regards, R. Linda!

Elliott Wave

Gold Short Trigger — PRZ Rejection or One More Push?This Gold( OANDA:XAUUSD ) idea is focused on the 15-minute timeframe and is in line with the previous 1-hour idea I shared, where the first target was reached.

Now, let’s see if on the 15-minute chart we can spot a short trigger for gold—stay with me!

Gold appears to be moving within an ascending channel (possible) over the past few hours and is currently near a Potential Reversal Zone (PRZ) and a Time Reversal Zone (TRZ).

I expect gold, upon entering these reversal areas, to resume its decline and fall at least toward the lower line of the ascending channel, around $4,987. If the lower line of the descending channel breaks, we could anticipate a further drop toward the support zone($4,914-$4,878).

First Target: $4,987

Second Target: Support zone($4,914-$4,878)

Third Target: $4,827

Stop Loss(SL): $5,087

Points may shift as the market evolves

What’s your view for the final trading hours of this week? And what trend do you expect for gold next week? Let me know!

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 15-minute time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

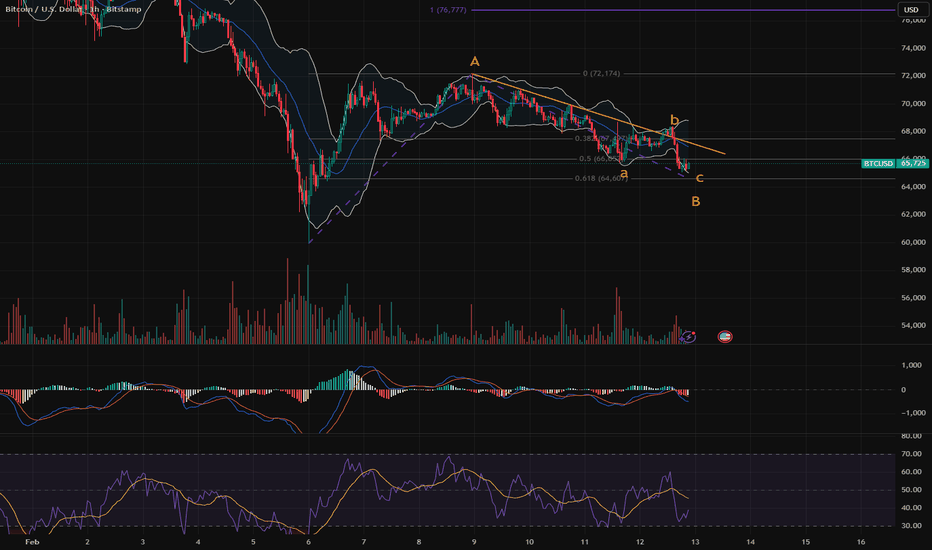

BITCOIN - Correction against the global bearish trend BINANCE:BTCUSDT.P is recovering from an interim low of 65K. The area of interest is 71,500, but it is too early to talk about a bull market, as the influence of buyers may be short-term within the global downtrend.

The main growth factor that emerged on Thursday/Friday was cooling inflation in the US, reducing pressure on the Fed to keep rates high. This brought investors back to risky assets. Will this influence be long-term?

Global and local trends are downward.

Bitcoin is within a neutral range of 71,500 - 65,700. A countertrend movement is forming after a retest of the local low of 65K. Until the structure is broken, a decline to 68,300 - 65,700 should be expected as a primary reaction to the resistance at 71,500. Liquidity capture and the subsequent formation of a false breakout could trigger a local reversal and decline.

Resistance levels: 71,450, 71,850, 73,100

Support levels: 68,370, 65,700

Within the current trading range, it is worth waiting for a retest of the key zone - the area of interest and liquidity 71450 - 71850. The lack of bullish momentum, a false breakout, and consolidation in the selling zone could lead to a sell-off and a decline in price.

Sincerely, R. Linda!

Bitcoin could go up nowHi traders,

Last week Bitcoin made a correction down and started the next impulsive upmove.

So we could see more (corrective) upside again to the Weekly bearish FVG's.

Let's see what the market does and react.

Trade idea: Wait for a correction down on a lower timeframe and a change in orderflow to bullish to trade longs.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

But I react and trade on what I see in the chart, not what I've predicted or expect.

Manage your emotions, trade your edge!

Eduwave

ADAUSDT - Short squeeze before falling to 0.22BINANCE:ADAUSDT , after breaking through the global support zone of 0.275 and updating its lows to 0.22, entered a phase of correction and consolidation below key levels. Another short squeeze could trigger a decline.

Bitcoin is falling after a correction, which generally indicates a weak market and increases bearish pressure on the market. I recently said that Bitcoin would fall even lower, as global targets have not yet been achieved, so against this backdrop, altcoins may react accordingly.

Any corrections and volume spikes can be seen as a hunt for liquidity and quickly sold off.

ADA has been strengthening since the session opened and is showing strength against a weak market (top gainers). There are no fundamental reasons for growth, and technically, the market is heading towards a zone of interest.

Resistance levels: 0.2688, 0.276, 0.284

Support levels: 0.243, 0.2200

From a medium-term perspective, the altcoin has not yet tested the global support level hidden behind 0.22 - 0.2167, formed in 2023. A retest and short squeeze of the resistance zone could trigger a decline towards the target

Best regards, R. Linda!

EU could still go downHi traders,

Last week EU made a move up (finish the B-wave) into the Daily bearish FVG and started a move down.

This could be the (orange) C-wave of (red) wave 4.

Next week we should see more downside for this pair and after that it could go up again.

Let's see what the market does and react.

Trade idea: This pair is still in consolidation. Wait for a clear direction of price.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

But I react and trade on what I see on the chart, not what I've predicted or expect.

Manage your emotions, trade your edge!

Eduwave

Gold could still dropHi traders,

Last week gold made a correction up as I've said in my previous outlook. And after that it started a downmove with a correction up.

So next week we could see another drop for this pair.

Let's see what price does and react.

Trade idea: Wait for a change in orderflow to bearish on a lower timeframe to trade shorts.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

But I react and trade on what I see in the chart, not what I've predicted or expect.

Manage your emotions, trade your edge!

Eduwave

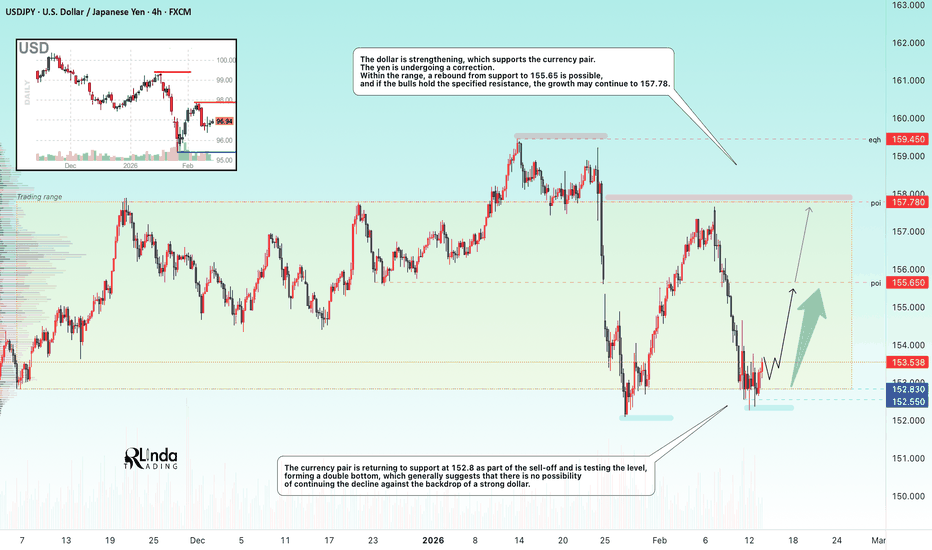

USDJPY - Reversal setup relative to range support FX:USDJPY faces strong support within the correction. The price closed within the trading range of 152.8 - 157.78 and is forming a strong reversal setup relative to the lower boundary.

The dollar is strengthening, which supports the currency pair. The yen is undergoing a correction. Within the range, a rebound from support to 155.65 is possible, and if the bulls hold the specified resistance, the growth may continue to 157.78.

The currency pair is returning to support at 152.8 as part of the sell-off and is testing the level, forming a double bottom, which generally suggests that there is no possibility of continuing the decline against the backdrop of a strong dollar.

Resistance levels: 155.65, 157.78, 159.45

Support levels: 152.83

The false breakout of support indicates that the bulls are trying to maintain their positions and are not letting the price fall, which also confirms the formation of a double bottom. If the bulls keep the price above 153.0, this move could support the price growth.

Best regards, R. Linda!

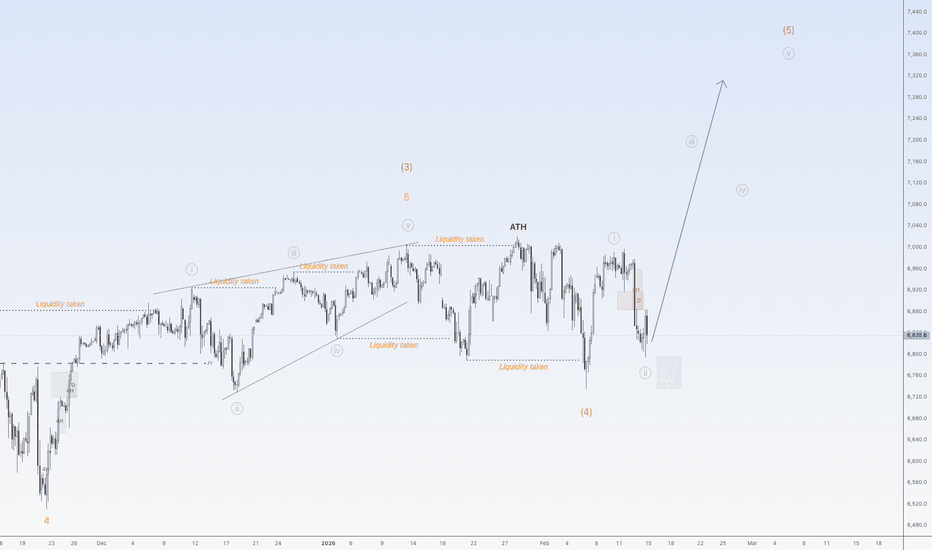

S&P500 should go up nowHi traders,

Last week SPX500USD went up to finish the impulse wave and after that price made a sharp correction (wave 2 of red wave 5?).

So next week we should see the next impulsive wave up or the wavecount is invalidated.

Let's see what the market does and react.

Trade idea: Wait for an impulsive wave up and a correction down. After a change in orderflow to bullish on a lower timeframe you could trade longs.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

But I react and trade on what I see in the chart, not what I've predicted or expect.

Manage your emotions, trade your edge!

Eduwave

The Calm Before the Storm: $16/Gallon Forecast by 2035Greetings to the seekers of signal amidst the noise. To those who prefer the cold clarity of reality over the polished narratives of mainstream forecasts.

While the majority are distracted by Valentine’s Day cards, we are looking at a "valentine" of a completely different scale—one written in crude oil, blood, and gunpowder across the pages of world history.

In the history of "Black Gold," mid-February isn't about romance; it’s about the hard-nosed handshakes that defined the fate of our civilization:

February 14, 1945: Aboard the USS Quincy, FDR and King Ibn Saud signed the blueprint for the modern world. This birthed the "Quincy Pact"—the foundation of the petrodollar system that has underpinned the global financial dominance of the United States for the last 80 years.

February 14, 1971: The Tehran Agreement struck the first blow to this monopoly. It signaled the end of the era where Western oil giants (the "Seven Sisters") dictated prices, shifting the initiative to the exporters of OPEC.

Today, February 14, 2026: We stand at the final decommissioning of these legacy rules. The old paradigm is collapsing; the Quincy Pact has been functionally annulled by history itself. The Strait of Hormuz is becoming the ultimate "bottleneck" through which the global economy must pass—with significant friction and at a heavy cost.

This is not just another market update. It is a Strategic Warning. While "market hype-peddlers" distract the public with fairy tales of a "Green Transition" and "Soft Landings," we will analyze why the world's primary energy source is preparing for a vertical lift-off. This surge will likely reset the savings of millions and force the public onto electric scooters—not out of environmental concern, but out of necessity driven by systemic inflation.

Today, we will break down the current phase using Elliott Wave Theory, identify which energy stocks are still in the "accumulation zone" before they hit the stratosphere, and take a look behind the curtain of global geopolitics where the final pieces are being moved for the endgame.

________________________________________

📈 Technical and Wave Analysis: The Super-Cycle Perspective

Prices are entering the home stretch before a vertical surge, a scenario we have already witnessed in precious metals. While many expected this move sooner, we must remain objective about the asset: the oil market is not just about supply and demand—it is the ultimate expression of global power and strategic monopolies.

To understand the future, we must acknowledge the psychological extremes of the past five years:

⚫️ 2020 (The COVID-19 Shock): A point of total capitulation. Brent TVC:UKOIL crashed to $17, and deliverable WTI futures TVC:USOIL famously committed "historical hara-kiri," dropping into negative territory at -$37 per barrel. The shock of a seller having to pay to get rid of their product was the ultimate "blood in the streets" moment.

⚫️ 2020–2022 (The QE Impulse): Massive monetary expansion and "helicopter money" created a violent inflationary pulse. Prices recovered by +600%, peaking near $135 in the first half of 2022. According to Elliott Wave theory, this entire move from $17 to $135 should be interpreted as Wave 1 of a new global bullish super-cycle.

⚫️ 2022–2026 (The Great Consolidation): For the last four years, the market has been trapped in Wave 2—the phase of disappointment and exhaustion.

Wave A (or W): The sharp correction from $135 down to $70.

Wave B (or X): A grueling two-year sideways grind (range-bound $70–$90) that forced out the last of the retail optimists.

Wave C (or Y): The recent "cleansing" dip toward $60, which served as the final flush before the next major impulse.

________________________________________

📊 The Great American Energy Paradox: Exporting Surplus, Importing Necessity

At first glance, the data seems contradictory: the United States is one of the world’s largest producers and exporters, yet it remains tethered to foreign supply. In 2024, the U.S. exported nearly 4 billion barrels of oil—over half of its total domestic production. This massive outflow of crude and petroleum products underscores America's status as a global energy powerhouse.

The Refinery Mismatch: Why export 55% of your production while continuing to import heavily, particularly from Canada? The answer lies in Quality and Configuration.

The Supply: Most U.S. shale production is "Light, Sweet" Crude (LTO)—low in sulfur and easy to process.

The Infrastructure: However, the massive refinery complexes on the Gulf Coast were engineered decades ago to process "Heavy, Sour" grades—the thick, high-sulfur oil typical of traditional giant fields.

Consequently, the U.S. exports its light surplus to global markets while importing the heavier grades its refineries actually crave. This isn't a failure; it’s a Logistical Optimization.

The Canadian Lifeline: In 2024, 61.7% of U.S. crude imports came from Canada. While South and Central America contribute about 16.3%, the dependency on our northern neighbor is the real story. Since 2013, Canada’s share of U.S. imports has skyrocketed from 33% to over 60%. Despite record domestic production of 13.4 million barrels per day, the U.S. refinery system—and by extension, its economy—is more reliant on Canadian "heavy" barrels than ever before.

________________________________________

⏳ The Current Setup: Accumulation and the "Market Flush" Risk

For the past year, "Black Gold" has been consolidating in a tight, frustrating range between $60 and $70 per barrel. For the retail speculator, this is a "boring" market; for Smart Money, this is a Class-A Accumulation Zone.

🗯 The Core Thesis: "Any price print below $70 should be viewed as an anomalous entry point—a generational 'gift' that will be envied in the years to come."

However, we must address the Tactical Deleveraging Risk. As we look toward a potential 40–50% correction in overextended Tech and Equity indices during 2026, oil will likely be caught in the "Margin Call Crossfire."

When systemic deleveraging begins, large funds sell what is liquid to cover what is losing. We should prepare for a "Flash Flush" toward $50—or lower in a 2020-style panic.

Why the "Flush" is Mathematically Necessary:

Total Capitulation: To wipe out "weak hands" and leveraged bulls who are betting on a bounce too early.

Asset Transfer: To move the final physical barrels from panicked retail hands into institutional vaults and the Strategic Petroleum Reserve (SPR) at bottom-tier prices.

Psychological Warfare: To create a "Death of Oil" narrative in the mainstream media, masking the beginning of the actual vertical impulse.

The Investor’s Playbook: A temporary dip to $50 is not a reason to flee; it is the ultimate opportunity to increase energy exposure. Historically, oil doesn't linger at these forced lows. The moment the Fed reactivates the printing presses to save the collapsing equity indices, and the geopolitical "Hormuz Trigger" is pulled, oil will be the first asset to enter a vertical price discovery phase.

This is where we get into the "Meat and Potatoes" for the Western investor—the actual numbers and the strategic logic that explains why the status quo is a ticking time bomb.

I’ve adapted the tone to be analytical yet urgent, framing the $300 target as a logical outcome of monetary debasement rather than just a "wild guess."

________________________________________

❓ What’s Next? The 2020–2035 Macro Forecast

Once the current "bottoming" structure completes, the market will enter Wave 3. In technical analysis, the third wave is the most powerful, the longest, and the most merciless to short-sellers. It doesn't offer "second chances" on pullbacks; it simply re-prices reality.

Short-term Volatility (2026): If the broader equity markets face a 30-50% deleveraging event, oil could see a sharp -30% "liquidity flush" toward $50. This will be a blink-and-you-miss-it event.

The Near-Term Goal: A return to the triple-digit zone—$100+. This is when the legacy media will start screaming about an "Energy Crisis," but for us, it’s just the beginning.

The Global Target: Long-term projections suggest a range of $300–$500 per barrel by 2030–2033.

While these numbers sound like hyperbole today, remember that Gold at $2,500+ sounded like a hallucination in the early 2000s when it traded at $250. When you factor in the debasement of fiat currencies, the dismantling of global supply chains, and a decade of chronic underinvestment in drilling, these targets aren't just possible—they are a mathematical inevitability.

________________________________________

📊 The "Canadian Shield" and the "Shale Cul-de-Sac"

There is a fundamental misunderstanding of U.S. energy "independence." Let’s look at the hard data:

The Technology Paradox: The U.S. is the #1 producer (21.7 million barrels/day), but it cannot consume its own "menu." American shale is Light Sweet Crude (LTO). However, 70% of the complex refinery capacity in Texas and Louisiana is "hard-wired" to process Heavy Sour (sulfuric) crude.

Canada as the Lifeboat: This is why U.S. imports from Canada have surged to 61.7% (approx. 4 million barrels/day). Canada provides the heavy bitumen that keeps U.S. refineries from seizing up. The U.S. is "addicted" to Canadian heavy barrels.

The Strategic Pivot: OPEC’s share of U.S. imports has cratered to 11.9%. The U.S. is physically separating from the Middle East, but they are still vulnerable to the global price set by OPEC+.

The Venezuelan Logic: Venezuelan crude is the "twin" of Canadian heavy oil and the perfect feed for U.S. refineries. More importantly, it is significantly cheaper to extract than Canadian oil sands.

The "Trump" Realism: Instead of fighting environmental battles over the Keystone XL pipeline from the North, it is strategically more efficient to secure the Venezuelan supply to the South. A short sea route through the Gulf of Mexico is the ultimate insurance policy.

________________________________________

🌡️ The Gasoline Pulse: Breaking the "1–2–4" Paradigm

To gauge where we are going, ignore the tech-heavy Nasdaq and look at the price sign at your local gas station. The FRED:GASREGW (US Regular Gas Price) is the true pulse of the economy, reflecting the real cost of logistics and consumer purchasing power.

The Era of Social Stability (1990–2022): For 35 years, the Western world operated under the "1–2–4 Rule." This range was the "holy grail" of social peace:

The 90s: Post-Cold War dividend. Gas was stable at $1–$1.50.

The 2000s: Emerging market demand shifted the corridor to $2–$4.

The 12-Year Trap (2008–2020): After the 2008 peak ($4), prices spent 12 years in a "Symmetric Triangle." In Wave Theory, this is a compressed spring, coiling energy for a violent release.

In 2020, as the world exited the pandemic shock, the "spring" finally snapped. Price shot through the $4 resistance and hit an all-time high of $5 by the summer of 2022. What the public thinks is a "return to normal" right now is actually a re-test of the breakout. We are sitting on the old $3–$4 ceiling, which has now become the new floor.

________________________________________

🚀 The Transition: Entering the "4–8–16" Reality

What the public mistakes for a "return to normal" is actually a textbook technical move: a prolonged re-test of a broken resistance level. From a macro-technical perspective, the price has simply returned to the midpoint of the old $2–$4 range to establish a massive new support base.

As of early 2026, we’ve seen prices dip toward $2.77/gallon—a nearly 50% retracement from the 2022 all-time highs. To the untrained eye, it looks like the crisis is over. To the analyst, it looks like a spring being coiled.

The 2026–2040 Paradigm: The era of $2.00 gasoline is officially a museum exhibit. We are entering a cycle where price targets are essentially doubling across the board:

The Floor: $4.00 (the old ceiling).

The Median: $8.00.

The Cycle Target: $16.00 per gallon.

This isn't just "price movement"; it is a forced transformation of the American lifestyle. With 80% of U.S. logistics dependent on trucking, $12–$15 gasoline makes traditional internal combustion (ICE) ownership a luxury and turns standard delivery services into "premium" expenses.

This serves as a cynical but effective tool: using an inflationary shock to "reset" the public’s savings and move them toward a digital, electric-based economy—not through incentives, but through the sheer inability to afford the old way of life.

________________________________________

🧮 The Math of the "CP-Lie": Inflation Alchemy

When gasoline prices inevitably surge by +300% toward the $12 mark, it will trigger a chain reaction that no amount of statistical massaging can fully hide:

Direct CPI Contribution: A surge of this magnitude adds an immediate 10–15% to the headline Consumer Price Index.

The Real Number: Combined with baseline inflation, we are looking at CPI prints of +20%—levels associated with war-time economies or hyperinflationary collapses.

The "Statistical Pivot": To prevent a total panic, expect the Bureau of Labor Statistics (BLS) to engage in "methodological adjustments." We will likely see the "weighting" of gasoline in the CPI basket reduced, under the guise that "consumers are driving less," thereby artificially dampening the reported inflation rate.

The objective is clear: create such friction for ICE vehicle owners that the transition to EVs (Tesla and its peers) becomes a survival tactic rather than a choice.

________________________________________

📈 The SPR Trap: Refilling the War Chest

While oil prices are being "marinated" in this lower range, the U.S. administration is executing a classic "buy the dip" strategy. Looking at the US Strategic Petroleum Reserve (SPR) ECONOMICS:USCOSPRE chart, we are seeing the active reconstruction of the nation's energy cushion.

After the previous administration drained the reserves to combat the 2022 price spike, the current leadership has pivoted to aggressive accumulation. Over the last 30 months, reserves have climbed by 70 million barrels (+20%), rising from a critical floor of 354 million to the current 415 million barrels.

The Market Signal: This accumulation creates a massive, artificial floor under the market. As long as "Texas Tea" stays below $80, the U.S. government remains the ultimate "Whale" buyer, preventing a total price collapse. They are racing to restore the strategic buffer before the Semiquincentennial (250th Anniversary of the US) celebrations and the next election cycle are over.

The Warning: The current "discount" at the pump ($2.80/gallon) is a temporary pre-election/pre-celebration gift. Once the SPR tanks are topped off and the political cycle concludes, the accumulated supply deficit will hit the consumer with triple force. The safety valve is being closed—those barrels are now being held for the "Black Swan" of a hot war, leaving the domestic market to face the new $8–$16 paradigm alone.

________________________________________

📊 The Inventory vs. Production Gap: A Glaring Anomaly

When we look at the global energy map, we see a striking contradiction that the mainstream media rarely discusses. It is the contrast between "The Sprint" (U.S. Shale) and "The Marathon" (Conventional Super-Giants).

The Reserves Paradox: Venezuela holds 19.4% of the world’s proven oil reserves (#1 globally), yet its current production is a fraction of its potential due to years of infrastructure decay and sanctions.

The U.S. Mirage: In contrast, the United States—currently the world's #1 producer—controls only 2.9% of global reserves.

This is the definition of a "burn rate" problem. The U.S. is sprinting to maintain its dominance while its underlying "fuel tank" is dangerously low compared to its competitors.

♟️ The Concentration of Power: The New Geopolitical Axis

The "Big Three"—Venezuela, Saudi Arabia, and Iran—collectively control nearly 50% of the planet's oil. This is the ultimate geopolitical fulcrum. If these three nations coordinate their policies (or fall under the influence of a single bloc like BRICS+), they possess the absolute power to dictate global energy prices.

The "Refinery Symbiosis" (The Hidden Detail): Venezuelan oil is primarily Extra-Heavy Crude from the Orinoco Belt (API gravity <15°). It is difficult to extract, but here is the catch: the most sophisticated refineries on the U.S. Gulf Coast were specifically "over-engineered" to process exactly this type of heavy, sulfurous grade.

Venezuela has the raw material.

The U.S. has the specialized "kitchens" to cook it. It is a symbiotic relationship that Washington cannot ignore.

⚠️ The Shale Limit: America’s "Pedal to the Metal" Problem

On paper, the U.S. looks like an untouchable hegemon, pumping 20 million barrels per day (mb/day)—nearly double the output of Saudi Arabia or Russia. However, this record production is not a sign of infinite strength; it is a sign that the U.S. is redlining its engine.

Depletion Rates: The nature of shale (LTO) is that well productivity drops off a cliff very quickly. To maintain 20 mb/day, U.S. operators must drill faster and more aggressively every year just to stand still. This is "production at the limit."

OPEC’s "Wait and See" Strategy: While the U.S. pumps at 100% capacity, Saudi Arabia and Russia are intentionally "idling." They have significant spare capacity but are playing the long game—saving their resources and manipulating the market by tightening supply.

The Strategic Dead End: The U.S. is depleting its scarce 2.9% reserve base at record speed, leaving itself with zero margin for error in the coming decade.

🕵️ The Macro Assessment: Preparing for the "Grand Swap"

When you overlay these two realities—depleting U.S. reserves vs. massive Venezuelan potential—the true picture of the global energy crisis emerges:

The Geopolitical Cul-de-Sac: To maintain superpower status and prevent domestic gas prices from hitting $15/gallon, the U.S. vitally needs access to foreign heavy reserves.

Venezuela as the Only Exit: It is the only country in the Western Hemisphere that can replace the depleting U.S. shale fields. Its 303 billion barrels are the "Holy Grail" for Washington’s long-term survival.

The Iranian Variable: While Iran pumps 5.1 mb/day, it remains a fierce competitor. The strategy is clear: neutralize or bypass Iranian influence while "on-shoring" Venezuelan supply. This is the only way for the U.S. to reformat the market and secure its energy leadership for the next 30 years.

The Bottom Line: We are witnessing a global "castling" move. The U.S. is pumping its own soil dry to bridge the gap until it can secure control over the Venezuelan resource. This isn't just economics; it's a fight for the physical survival of the American system. Without the Venezuelan "backstop," the current U.S. production record will turn into a precipitous decline within years, threatening both the Dollar and the "American Dream."

________________________________________

📊 The Strategic Playbook: Black Gold Through 2035

On a decade-long horizon, the logic is as simple as it is cold: focus on the two sectors that sit at the very beginning of the value chain: E&P (Exploration & Production) and Oilfield Services.

In an environment of global currency debasement and fractured supply lines, these companies act as the ultimate inflation sponges. They own the physical molecules and the proprietary technology required to extract them. This allows them to pass rising costs directly to the end consumer, protecting—and often expanding—their margins while the rest of the economy struggles to breathe.

________________________________________

🏁 Epilogue: On the Ruins of the Old Order

________________________________________

The world we’ve known for decades—the world of cheap logistics, affordable V8 muscle cars, and Petrodollar-induced stability—is evaporating like a drop of gasoline on hot asphalt. While the general public is distracted by currency swings and the latest tech gadgets, the "curtain" has already been raised on the Era of Great Scarcity.

We are at a unique and daunting juncture in history. The 2026–2028 period will be remembered as the moment when financial masks were stripped away and virtual wealth (the "zeros" in bank accounts) lost the battle against physical reality.

The choice today is binary:

You understand the mechanics of this Systemic Wealth Transfer and own the assets physically required for this civilization to function.

Or, you become the "fuel" that pays for the elite's transition into the new technological paradigm.

A Final Warning: When oil moves into the triple digits and stays there, and supply chains finally snap under the weight of geopolitical ambition, it will be too late to seek a "safe haven." Inflationary shocks do not respect borders or political affiliations—they simply reset the wealth of those who lived in the illusion of eternal abundance.

The companies identified in this report are not just "tickers" on a screen; they represent your seat in the First Tier—the group that exits this storm with real capital instead of a pile of devalued paper.

I have converted the chaos of the headlines into a clear strategic roadmap. If this analysis has challenged your perspective or sharpened your focus, hit the "Rocket" 🚀 icon below.

See you at the "refueling stations of the new reality." Fasten your seatbelts; we are entering a zone of maximum turbulence. The ascent will be vertical, and only the prepared will remain on board.

________________________________________

🙏 "Thank you for your attention to this matter." ©

☘️ Good luck, and stay vigilant.

📟 Over and out.

Silver Hits Major Resistance — $78.6/$74.6 Next?Silver ( OANDA:XAGUSD ) is currently moving in the resistance zone($92.76-$82.77).

In terms of Elliott Wave theory, it seems that silver has completed the 5-wave impulse, and we should wait for corrective waves.

Additionally, we’re noticing a Regular bearish Divergence(RD-) between the price peaks, which adds to the bearish sentiment.

I expect silver to fall to at least $78.63. If the support zone($79.00-$77.50) is broken, we can expect silver to fall to $74.63.

First Target: $78.63

Second Target: $74.63

Stop Loss(SL): $90.73(Worst)

Points may shift as the market evolves

Note: For silver to reach the targets, it must break through an important trading level($82.00-$81.20).

Note: If you would like to follow my long-term view on silver, I suggest you follow my long-term silver idea . I hope it is helpful.

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Silver/ U.S. Dollar Analyze (XAGUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

NBIS - Are we gonna get a discount?Top names just started cracking after the SaaS melt down.

If the sell off continues, are we gonna see NBIS at further discount zone?

Not sure, just a hypothetical scenario if we see this around 50 , its gonna be a big BTD.

If we see this on a sale, just grab as much as can.

Apple - Correction on Schedule TodayWe continue to cover corrective moves in Apple stock.

Previously, we discussed Wave A .

Currently, the stock price is in Wave B .

The five -wave impulsive move up is complete and is now being corrected.

Key targets:

265 - local correction

260

256

Potential move from current level: 5-7% .

After that, expect a return to the growth phase,

with possibly one more small upward impulse toward the 290 area, slightly above or below, before Wave C develops.

---

Subscribe and leave a comment.

You’ll get new ideas faster than anyone else.

---

$ZRO ELLIOT WAVE CHART UPDATE

📌 CSE:ZRO Technical Analysis: acroding elliot wave theory 3rd wave already done. now price need down for 4th wave formation after massive rally. currently price is trading near 1.94$ after recently jumping from 1.2$ range.

📌 Major Support Zone:

Green Support Zone: watch the 1.78$ – 1.85$ zone which is a strong support area.

Hold Support: if 4th wave hold green color support zone price can up again for 5th wave formation.

Indicators: RSI is entering overbought territory (~74-80), confirming that a 4th wave pullback is needed for a healthy move.

📌 Bullish Price Targets: if it hold support and 5th wave starts, price can reach:

Target 1: 2.10$ , Target 2: 2.30$ , Target 3: 2.50$

S&P 500: Retest Done — Next Push to New ATH?The S&P 500 index ( SP:SPX ) completed its downward movement as I expected in the previous idea (full target) .

Currently, the S&P 500 index has managed to break the resistance zone($6,956-$6,918) and is completing a pullback to this zone.

In terms of Elliott wave theory, it seems that the S&P 500 index has managed to complete the main wave 4 and is currently completing the main wave 5.

I expect the S&P 500 index to succeed in forming a new All-Time High(ATH) after breaking the resistance lines.

First Target: $7,031

Second Target: Resistance lines

Stop Loss(SL): $6,896

Points may shift as the market evolves

Note: This week, important indexes will be released from the US, which could have a significant impact on the S&P 500 index trend.

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 S&P 500 Index Analyze (SPX500USD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

The GBPJPY Trap | Smart Money’s Next Big Move📉 GBPJPY – Potential Completion of Wave (B), Major Correction Ahead

The long-term bullish cycle on GBPJPY appears to be approaching exhaustion, with technical structure and macro dynamics both signaling a potential Wave (2) corrective phase in motion.

🧩 Elliott Wave Structure

The impulsive advance from the 2020 lows likely represents Wave (1) of a broader cycle, topping near the 208.00 region. Current price action suggests a completed Wave (B) within a larger (A)-(B)-(C) corrective structure, implying downside continuation toward the Wave (2) completion zone between 168.00–158.00 .

📊 Market Structure & Smart Money Context

A Break of Structure (BOS) has emerged beneath 205.00, confirming distribution after prolonged accumulation. Price has also swept liquidity above the prior swing high, aligning with classic Smart Money Concepts — premium pricing before a potential markdown phase.

🔍 Fibonacci & Confluence Zones

The 0.618–0.786 retracement of the Wave (1) impulse coincides with the 168.00–158.00 area, a key Fibonacci confluence that aligns with prior weekly demand and unmitigated imbalance zones . This confluence supports a high-probability reaccumulation area once corrective pressure subsides.

💼 Fundamental Backdrop

From a macro perspective, GBP remains constrained by persistent inflation and stagnating growth, while JPY fundamentals are shifting as the BoJ hints at policy normalization. Any tightening in Japanese yields could amplify downside momentum in GBPJPY.

🎯 Projected Levels

Near-term support: 175.00

Key demand zone: 168.00–158.00

Long-term invalidation: Below 158.00

🕰 Outlook

Until the market confirms a higher-timeframe reversal pattern within the identified demand zone, further downside remains probable. Medium-term traders should monitor liquidity sweeps and BOS confirmations on lower timeframes for re-entry setups.

Stay sharp — Wave C could be fast and decisive! ⚡

What’s your take, traders? 🤔

Do you think Wave C is about to drop hard or will bulls surprise us again? 🐻📉🐂

📈Drop your analysis 👇 — let’s see who nails the next big move! 🚀

⚠️ Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always perform your own due diligence before executing any trades.

#GBPJPY #ElliottWave #SmartMoneyConcepts #MarketStructure #ForexAnalysis #TechnicalAnalysis #Fibonacci #FXTrading #MacroAnalysis #TradingView

BCHUSD (4H) - Zigzag correction into 50–61.8% retracement1) Chart & context

I removed unnecessary indicators to keep the chart focused on structure. I’m tracking waves + Fibonacci and waiting for a high-probability formation.

2) Structure (Elliott Wave read)

• BCHUSD appears to have completed a 5-wave decline from ~687 to ~424.

• Price is now forming a 3-wave corrective move (A-B-C) that resembles an upward Zigzag.

3) Fibonacci confluence

Using Fibonacci retracement from 687 → 424, the correction is moving into the 50%–61.8% zone (optimal retracement area).

This fits EW expectations: after a Zigzag reaches a key fib zone, the correction often ends, opening the door for the next move down.

4) Trade plans (two execution options)

Option A — Early entry (aggressive) ⚡

• Bias: Short

• Entry: Current / near the top of the fib zone (on rejection)

• Stop-loss: Above 687 (invalidation)

Option B — Confirmation entry (conservative) 🛡️

• Trigger: Break below wave B (~493)

• Entry: After the break, wait for a small pullback/retest, then short

• Stop-loss: Above wave C high (tighter risk than Option A)

5) Note on the wave count

Yes - what we label as wave A can always evolve into wave 1 of a larger impulse.

However, current behavior looks more corrective: wave B topped near the 38.2% fib, which is more typical of a zigzag than a clean 1–2 continuation model.

6) Targets 🎯

• Primary target: Below 424

• Optional: scale partials if structure confirms momentum.

7) Invalidation ❌

• A sustained move above 687 invalidates the bearish scenario.

8) Risk note ⚠️

This is a scenario, not a signal. Manage risk per your rules.

⸻

If this idea was useful, please boost/like and follow for more insights and setups.

Nasdaq Crash Incoming: Wave 3 of 3 DownOver in this video, I go through the 5th wave up and identify 2 key things for this top:

1. Wave 5 = Wave 3, since wave 1 is the longest, wave 3 cannot be the shortest wave.

2. 2 Spinning tops marks the peak on 29th and 30th Oct 2025.

The first wave down is a "leading diagonal" because wave 4 overlaps wave 1. The 2nd wave is quite long in terms of duration and forms in an A-B-C. The recent down move is sub-wave 1 of 3 and sub-wave 2 of 3. And we should be expecting a wave 3 of 3 down.

In terms of trading, I recommend being more conservative and setting a higher stop with smaller size but for more aggressive traders, you can place your stop at the recent rebound high but that means you need to be more active in trading.

No matter what, set your size according to your risk management.

Good luck!