Technical Analysis

How to Apply Quarter’s Theory on Cardano (ADA) | Crypto TAHow to Apply Quarter’s Theory on Cardano (ADA) | Crypto Technical Analysis

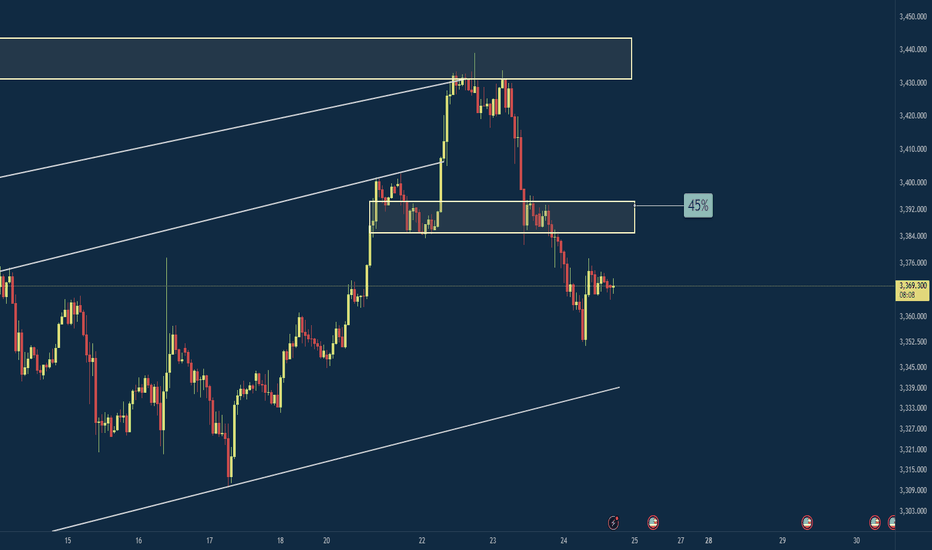

In this video, we break down how to draw and use Quarter’s Theory on Cardano (ADA) to understand market structure and price rotation in crypto.

You’ll learn how institutional traders use quarter levels to identify key turning points and why this method can help you see precision entries long before retail traders react.

Whether you’re trading spot or futures, this breakdown gives you a practical framework to read crypto price movement like a professional.

What You’ll Learn:

How to draw Quarter’s Theory levels on a crypto chart

Why market makers respect these levels across all timeframes

How to use quarter zones for entries, exits, and managing bias

Real example using ADA/USD

If you’re ready to stop guessing and start reading the market’s geometry, this is where to begin.

Tags: quarters theory, cardano analysis, crypto trading strategy, institutional trading concepts, market structure crypto

Introduction to a Trading System 1: Setting timeframes + bonusIntroduction to a Trading System: Setting Timeframes & Logarithmic Scaling

This educational video is the first in the "Signal and Structure" series, where an experienced crypto trader with 5+ years in cryptocurrency and additional forex background shares their systematic approach to chart analysis and trading.

Key Topics Covered:

Logarithmic Scale Fundamentals

- Why log scale is essential for cryptocurrency trading

- How it provides better perspective on price movements across different time periods

- Demonstrates using Bitcoin's price history how log scale reveals the true magnitude of moves and shows market maturation

Strategic Timeframe Selection System

- Introduces a unique 5-timeframe system based on dividing by 4:

- Monthly (30 days) - the base unit

- Weekly (≈30÷4 days)

- 2-Day (≈week÷4)

- 12-Hour (48 hours÷4)

- 3-Hour (12÷4)

Trading Philosophy

- Emphasizes simplification over complexity in trading

- Explains why using non-standard timeframes (2-day instead of daily) provides an edge

- Discusses how higher timeframes show cleaner structure while lower timeframes display more chaos

- Advocates for making trading easier by reducing noise and confusion

Practical Insights

- Higher timeframes (monthly/weekly) show more reliable patterns and are watched by institutional traders

- Lower timeframes become increasingly chaotic but still contain tradeable patterns

- The importance of stepping back to see the bigger picture in markets

The instructor brings a unique perspective influenced by classic traders like Gann and Wyckoff, and has developed over 140 custom indicators for their trading system. The video sets the foundation for understanding market structure before diving into signals and trading strategies in future episodes.

FX Professor 101: How I Start My Charts with Trendlines & FibFX Professor 101: How I Start My Charts with Trendlines & Fib Levels 🧠📈

Some of you asked me to show my charting process again — so here it is, strictly educational, using Pepper as the example (because a few of you believe in it and asked about it). Let’s build this chart together from scratch. 🛠️

Step 1: Get Full Historical Context 📜

I always start by selecting a chart with the most data available. More history = more structure to work with. No shortcuts here.

Step 2: Anchor with Horizontal Trendlines 📏

I look for a clear support → resistance → support pattern with no manipulation. That becomes my anchor level.

Then I scan for secondary levels – if they’re too close or manipulated, I keep them dotted and as references.

Zooming in helps. Don't hesitate to get granular when needed. 🔍

Step 3: Respect the Manipulation 🤨

If a chart feels overly manipulated (wicks, fakeouts, no clear rejections), I lose trust in it. But sometimes even within manipulation, valid levels emerge — and I mark them clearly.

Step 4: Fibonacci Confirmation 🔢✨

Once I place the trendlines, I overlay Fibonacci retracements to see if they align. In this case, one of my levels landed exactly on 0.618 – no cap! 😂 That’s when experience meets structure.

Final Notes 🧘♂️

• Only two levels made the final cut

• Secondary levels marked with dotted lines

• 0.618 Fib validated the primary structure

• Support at 929 is looking strong as of now

This is my process. It’s how I start every serious chart. Nothing fancy — just history, structure, and experience. If it helps even one of you out there, I’m happy. 💙

One Love,

The FXPROFESSOR 💙

Food for Trading Thought:

From my experience as an AI developer, I’ve come to one firm conclusion — AI will never replace us. It can assist, but it can’t see what you see or feel what you feel. The real edge in trading is your human intuition, patience, and discipline.

Trading is a game — a risky game. Play it right if you're going to play it at all.

Stay human and remember: the best Blockchain is YOU, the best Altcoins are your loved ones and your work/creation/purpose in life. 🎯

Welcome Back! Gold Trading Strategy & Key Zones to WatchIn this week’s welcome back video, I’m breaking down my updated approach to XAU/USD and how I plan to tackle the Gold markets in the coming days. After taking a short break, I’m back with fresh eyes and refined focus.

We’ll review current market structure, identify key liquidity zones, and outline the scenarios I’m watching for potential entries. Whether you’re day trading or swing trading gold, this breakdown will help you frame your week with clarity and confidence.

📌 Covered in this video:

My refreshed trading mindset after a break

Key support/resistance and liquidity zones

Market structure insights and setup conditions

What I’ll personally avoid this week

The “trap zones” that might catch retail traders off guard

🧠 Let’s focus on process over profits — welcome back, and let’s get to work.

Multi-Time Frame Analysis (MTF) — Explained SimplyWant to level up your trading decisions? Mastering Multi-Time Frame Analysis helps you see the market more clearly and align your trades with the bigger picture.

Here’s how to break it down:

🔹 What is MTF Analysis?

It’s the process of analyzing a chart using different time frames to understand market direction and behavior more clearly.

👉 Example: You spot a trade setup on the 15m chart, but you confirm trend and structure using the 1H and Daily charts.

🔹 Why Use It?

✅ Avoids tunnel vision

✅ Aligns your trades with the larger trend

✅ Confirms or filters out weak setups

✅ Helps you find strong support/resistance zones across time frames

🔹 The 3-Level MTF Framework

Use this to structure your chart analysis effectively:

Higher Time Frame (HTF) → Trend Direction & Key Levels

📅 (e.g., Daily or Weekly)

Mid Time Frame (MTF) → Structure & Confirmation

🕐 (e.g., 4H or 1H)

Lower Time Frame (LTF) → Entry Timing

⏱ (e.g., 15m or 5m)

🚀 If you’re not using MTF analysis, you might be missing critical market signals. Start implementing it into your strategy and notice the clarity it brings.

💬 Drop a comment if you want to see live trade examples using this method!

How to Use Renko Charts for Drawing Support and ResistanceHow to Use Renko Charts for Drawing Support and Resistance Like a Pro

Most traders rely on candlestick charts to identify support and resistance zones—but if you’re still sleeping on Renko charts, you’re missing out on one of the cleanest ways to map market structure.

Renko charts filter out noise and only plot price movement, not time, giving you a stripped-down view of market momentum. That’s exactly what makes them powerful for spotting true support and resistance zones—without all the clutter.

Why Renko Charts Work for Support & Resistance

Support and resistance are areas where price historically reacts—either bouncing or reversing. On traditional candlestick charts, these zones can be hard to identify clearly because of wicks, time-based noise, and volatility.

Renko charts simplify that.

Because Renko bricks are only formed after a specific price move (like 20 pips or using ATR), the chart naturally filters out sideways chop and lets key levels stand out like neon signs.

How to Draw Support and Resistance with Renko

Here’s a quick step-by-step process:

Set Your Brick Size

Use an ATR-based Renko setting (ATR 14 is common), or set a fixed brick size that fits your trading style. For swing trading, slightly larger bricks will work best.

Look for Flat Zones

Identify areas where price stalls or flips direction multiple times. These flat “shelves” on the Renko chart often line up with strong historical support or resistance.

Mark the Bricks, & Sometimes The Wicks

With Renko, you’re not dealing with traditional candlestick wicks. So your levels are based on the tops and bottoms of the bricks, not erratic spikes.

Check for Confirmation

If a level held as resistance and later flips into support (or vice versa), that’s a key zone to mark. These “flip zones” are often hotbeds of institutional activity.

Bonus Tip: Combine with Price Action

Renko charts tell you where price is likely to react—but combining them with price action techniques (like engulfing candles, pin bars, or M/W formations on traditional charts) will give you a lethal edge.

Use Renko to mark the zone, then switch to candlesticks to fine-tune the entry. Best of both worlds.

If you’ve been struggling to draw clean support and resistance levels—or find yourself second-guessing your zones—Renko might be your solution. It’s not about fancy indicators or chart tricks; it’s about removing the noise so you can trade what really matters: structure and momentum.

Are you using Renko in your strategy? Drop a comment or shoot me a message—I want to hear how it’s working for you.

How I Stopped Missing The Best Trade Entries!!I’ll be honest—when I started trading, I had no idea what I was doing. I’d open a 15-minute chart, see what looked like a good setup, and jump in. Sometimes I got lucky, but more often than not, the market turned against me.

I remember one trade in particular that still stings when I think about it. I was trading EUR/USD on the 15-minute chart, and I spotted what I thought was the perfect breakout. Without hesitating, I entered.

An hour later, the market completely reversed, and I was stopped out. Frustrated, I zoomed out to the daily chart, and there it was: I’d entered a buy trade right into a major resistance zone during a long-term downtrend.

That trade taught me a hard truth: if you don’t look at the bigger picture, you’re setting yourself up for failure.

How I Changed My Approach

After that trade, I knew I had to change how I looked at the market. I started using multiple timeframes, and it made all the difference. Here’s how I do it:

1️⃣ Start Big (Monthly and Weekly Charts):

I always start with the monthly or weekly chart to get the big picture. Is the market trending up, down, or just moving sideways? Are we approaching any major levels that could cause a reversal?

For example, if the monthly chart shows a strong downtrend, I know I’ll only be looking for sell setups. That keeps me from fighting the overall momentum.

2️⃣ Zoom In (Daily and 4-Hour Charts):

Once I’ve got the big picture, I move to the daily or 4-hour chart. This is where I refine my plan. I look for key levels like support and resistance or patterns like consolidations and pullbacks.

These timeframes help me figure out where the market is likely to go next, and they’re where I start building my trade idea.

3️⃣ Precision Entries (30-Minute and 5-Minute Charts):

Finally, I drop to the lower timeframes—30-minute and 5-minute charts—to time my entry. This is where I wait for confirmation. Maybe it’s a candlestick pattern, a breakout with volume, or a pullback to a key level I spotted earlier.

This part takes patience. There have been so many times I’ve almost jumped the gun, but waiting for that confirmation has saved me more times than I can count.

My Secret Sauce

Here’s the approach I stick to every single time:

1. Align with the bigger picture. If the monthly and weekly charts are trending down, I only look for sell setups. I don’t care what the smaller timeframes say—sticking to the big picture keeps me disciplined.

2.Identify key levels. On the daily and 4-hour charts, I mark the major support and resistance zones where the market is likely to react.

3.Wait for confirmation. When the price reaches one of my levels, I don’t jump in right away. I wait for the 30-minute or 5-minute chart to give me a clear entry signal.

Here’s the real kicker: I’ve learned to walk away if nothing aligns. No trade is better than a bad trade, and patience has become my best tool.

Switching to multiple timeframes has completely changed the way I trade. It taught me to be patient, to respect the market, and to stop forcing trades that don’t make sense.

If you’ve been struggling with timing your entries or feel like you’re always one step behind, I get it—I’ve been there. Try this approach. Start with the bigger picture, work your way down, and let the market come to you.

And if you’ve got questions or want to know more about how I trade, send me a DM or check out my profile. I’m happy to help—you don’t have to figure it all out alone.

Kris/Mindbloome Exchange

Trade What You See

Watch Me Make $600,642 Backtesting in 20 MinutesMastering Backtesting with TradingView's Replay Feature: Your Target Practice for Trading Success

In the world of trading, practice makes perfect, and one of the best ways to hone your skills is through backtesting. TradingView’s replay feature serves as an invaluable tool for traders looking to test strategies, refine their skills, and improve their overall performance. Think of it as target practice—a way to simulate real market conditions without the pressure of live trading. This article will delve into how to effectively use the replay feature, challenge yourself, and why practice is essential for every trader.

The Power of Backtesting

Backtesting is the process of testing a trading strategy on historical data to determine its viability. It’s like a dress rehearsal for traders, allowing you to assess how a strategy would have performed in different market conditions. With TradingView’s replay feature, you can step back in time and play out the price movements of any market you choose.

Using TradingView's Replay Feature

Setting Up the Replay Feature:

Open TradingView and select the asset you want to backtest.

On the chart, locate the “Replay” button in the toolbar (usually represented by a play icon).

Click the button and select the date from which you want to start your replay. You can drag the slider to move through the historical data at your own pace.

Simulating Live Trading Conditions:

As the replay plays out, you can apply your trading strategy just as you would in real-time. Take note of price action, support and resistance levels, and your entry and exit points.

Use this opportunity to test different indicators and strategies, adjusting parameters as you see fit.

Documenting Your Trades:

Keep a journal of your trades during the replay. Note what worked, what didn’t, and any adjustments you made. This reflection is crucial for developing your trading skills.

Target Practice: Challenging Yourself

To truly benefit from backtesting with the replay feature, consider implementing challenges that simulate the pressure of live trading. Here are some ways to push yourself:

1. Risk Management Challenges:

Decide on a specific risk amount for each trade—say $1,000. After reaching a target profit, like $15,000, challenge yourself to avoid losing a predetermined amount, such as $2,500.

This mimics real-life scenarios where maintaining profits can be just as challenging as making them. It forces you to practice discipline and stick to your risk management rules.

2. Trade Frequency Goals:

Set a target for the number of trades you want to execute during the replay. For example, aim to make 10 trades in a single session. This encourages you to be decisive and consistent with your strategy.

3. Time Constraints:

Limit yourself to a specific time frame when executing trades. For instance, challenge yourself to make all trades within a 30-minute window during the replay. This helps you practice decision-making under pressure, enhancing your ability to react quickly in real-market situations.

The Importance of Practice for Traders

As traders, we must remember that consistent practice is key to mastery. The replay feature allows you to simulate different scenarios without the risk of real money, giving you the freedom to learn from your mistakes. Here’s why practice is crucial:

Building Confidence:

The more you practice your strategy in a controlled environment, the more confident you’ll become in your abilities. This confidence translates into more decisive actions when trading live.

Identifying Strengths and Weaknesses:

Regularly backtesting enables you to pinpoint areas where your strategy excels and where it falters. This awareness allows you to adapt and evolve your approach over time.

Understanding Market Dynamics:

Each market behaves differently. By practicing across various assets and timeframes, you’ll develop a deeper understanding of market dynamics, helping you make better-informed decisions.

TradingView’s replay feature is a powerful tool for backtesting and honing your trading strategies. By treating this process as target practice, you can simulate real trading scenarios, test your strategies, and build the skills necessary for successful trading. Don’t shy away from challenging yourself with risk management goals, trade frequency targets, and time constraints. Remember, consistent practice is the pathway to mastery, and with the right tools and mindset, you can elevate your trading game to new heights. So dive into that replay feature, test your strategies, and watch your trading skills flourish!

Quarter Theory: Intraday Trading Mastery - Part 1 IntroGreetings Traders!

In today’s video, we’ll be introducing Quarter Theory Intraday Trading Mastery, a model grounded in the algorithmic nature of price delivery within the markets. We’ll explore candle anatomy and learn how to predict candle behavior on lower timeframes to capitalize on intraday trading opportunities. This model will also help us identify the optimal trading sessions and execute trades with high probability, all while effectively acting on market bias.

This video will focus primarily on the foundational content, with practical examples to follow in the next video. In the meantime, I encourage you to practice these concepts on your own to deepen your understanding.

This video is part of our ongoing High Probability Trading Zones playlist on YouTube. If you haven’t watched the previous videos in the series, I highly recommend checking them out. They provide crucial insights into identifying market bias, which Quarter Theory will help you act on effectively.

I’ll attach the links to those videos in the description below.

Premium Discount Price Delivery in Institutional Trading:

Mastering Institutional Order-Flow Price Delivery:

Quarter Theory Mastering Algorithmic Price Movements:

Mastering High Probability Trading Across All Assets:

Best Regards,

The_Architect

Mastering Risk: Stop Loss in TradingTypes of Stop Loss

Money Stop

Definition: A trader sets a fixed amount they are willing to lose on a trade, for example, £20.

Issue: This approach often leads to larger losses because it doesn’t align with market movements.

Advice: Avoid using the money stop.

Time Stop

Definition: Used mainly by scalpers, this involves closing a trade if it doesn't move in the expected direction within a set time frame (e.g., 4-8 bars).

Key Point: It requires discipline to adhere to the set time limit.

Advice: Suitable for scalpers.

Technical Stop Loss

Definition: Based on price movements and market structure, this is the most effective stop loss for technical traders.

Types:

Initial Stop Loss: Set at the entry of a new position, usually at a momentum high or low. The trade remains valid as long as the price doesn't reach this point.

Technical Trailing Stop: Used to protect gains on a winning trade. As the price moves in your favor, adjust the stop to a new structure point that, if reached, invalidates the trade.

The 3-Step Method For High-Quality AnalysisIn this video I give you the 3-step method I use to do my analysis.

By incorporating these steps, it is also how I do my top-down analysis. You can think of it as a checklist as well.

First, I have my Bias, which determines where I believe price is drawn to. For example in the case of SMC/ICT Concepts, we observe where the liquidity is in the market and use that to frame where price is likely going to go to sooner or later.

Secondly, I have my Narrative, which is on a lower timeframe, and paints the picture of HOW price is going to form in order to initiate the move to that price target. This usually includes more engineered liquidity on lower timeframes, and manipulation to happen.

Thirdly, I have my Confirmation, which is where I want to enter a trade. This is the lowest of the three timeframes, and is the final point in which I will frame a trade setup. Usually I will look for the exact same things I look for in my Bias and Narrative, but on this timeframe. I also tend to include the factor of time, such as Killzones, Seasonality, and News Drivers.

Note that the timeframes can be anything you want them to be, and you are not restricted from moving from timeframe to timeframe. But, the important thing is to be consistent with WHERE you believe price is going, HOW you think it may get there (this can change as price forms), and again WHERE you are going to enter a trade.

- R2F

Top-Down Analysis (The CORRECT Approach!)In this video I go through how to effectively do a top-down analysis, and avoid common mistakes.

This can apply to any type of trading methodology, but here the focus will be on ICT’s liquidity and inefficiency concepts.

This topic is important to traders who are keen on improving their win-rate and catching those higher RR trades. Whilst those things don’t define a successful trader, only consistent profitability and sound risk management do, I believe an effective top-down approach to framing trades is a worthwhile endeavor. Better trade setups give you less stress, more profits, and more freedom of time.

What is a "top-down analysis"?

It is basically doing your analysis on a higher timeframe to get in line with where you or your strategy is showing price is likely moving to, then on a lower timeframe to wait for your trade setup to form, and then either entering on that timeframe or going to an even lower timeframe for an entry signal. For example, if the weekly chart is bearish, and you see a bullish candle on the hourly chart, you may be fooled into trading in the wrong direction. For the highest probability, you need to be in sync with the higher timeframe.

My approach is split into 3 parts:

1. I have my BIAS which is built on the monthly, weekly, and daily timeframe. This helps me determine the direction I want to trade in. If my analysis is bullish, I want to look for longs, and vice versa for shorts.

2. Then I have my NARRATIVE, aka my ‘story’ of how my setup may form on a lower timeframe, usually the 1-4h timeframe. For example, I may be looking for a specific pool of liquidity to be swept at a certain time of the day.

3. Thirdly, I have my CONFIRMATION, which is usually based on the 5-15m timeframe.

I hope you found this video insightful and that it helps enhance your trading.

If you need clarification about the content, or you are still struggling with finding your groove as a trader and need personal guidance or mentorship, feel free to reach out to me via TradingView’s private message or on X (formerly known as Twitter).

Til next time, happy trading.

- R2F

The Trader's Toolkit: Building a Dynamic Trading JournalJoin us in this comprehensive tutorial as we walk through the essential process of building a personalized trading journal. Whether you're new to trading or aiming to elevate your strategies, this educational video empowers you with the knowledge of why building a trading journal is a critical step in your trading journey. Learn with us, and discover why a trading journal is a crucial addition to your trading toolkit.

Navigating Markets with Gann Fans: A Step-by-Step GuideWelcome to our comprehensive tutorial on placing and utilizing Gann Fans. In this step-by-step guide, we'll dive into the practical aspects of Gann Fans, a powerful tool for assessing non-horizontal support in resistance for technical analysis. We will thoroughly explain how Gann Fans are placed and what pitfalls to avoid when placing them. Whether you're new to Gann Fans or looking to enhance your trading strategy, this video provides actionable insights and a real-world example to help you harness the potential of Gann Fans with confidence. Join us as we demystify Gann Fans and empower you to navigate market swings with precision and skill.

Chainlink Educational Post - Finding Support And ResistanceMany of you have been asking me how I timed my NASDAQ:LINK trade so well. Purchasing at $7.63 on October 20th and now seeing it up to $16.20, I will say it was slightly lucky, but it was not random.

In this video I go over a few of my basic strategies for getting major price points out of an asset in less than 15 minutes.

Follow for more trading content. Exclusive videos will be released weekly.

Sorry about the AUDIO quality - Dont have a mic with me right now.

- Joshua

Helios Capital Investment

How To Analyze Any Chart 📚 Gold Example 📹Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Today we are going to go over a practical example on #GOLD , but you can apply the same logic / strategy on any instrument.

Feel free to ask questions or request any instrument for the next episode.

📚 Always remember to follow your trading plan when it comes to entry, risk management, and trade management.

Good luck!

Remember, all strategies are good if managed properly!

~Rich

Channel tradingHow to trade channels after sharp moves, where there is a valid money flow in the market.

During this short video I just described one of very common and useful techniques that is applied for channel trading, which is for this video scalping, but it applies to all time frames.

Here you need to get confirmation and be patient for pull back, it is important to put your stop loss precisely and of course be loyal to it (please do not move it)

Put the stop loss under that shadow but with enough space for breathing

Best Exit and Profit Taking using Only Support and ResistanceHey Traders so today I wanted to share what I believe to be 2 of the best exit strategies using only Support and Resistance on your Daily Charts. Also another way of staying 3 days behind the market and using a trailing stop. The nice thing about these strategies is they don't require any indicators just drawing a few lines on your chart.

Enjoy!

Trade Well,

Clifford

How To Add Drawings To Your ChartIn this Tradingview basics video I'm going to show you how to add drawings to your chart using the options available on the left-side rail.

We'll look at not only what the options are, but the benefits of using "stay in drawing mode" as well as how labeling specific tools as "favorites" can save you time when marking up the charts.

If you have any question, comments, or subjects for future "Tradingview Basics" videos please leave them below.

Until next time, "Plan Your Trade, Trade Your Plan"

Akil