POLYGON/ex MATIC - Horse pattern, very bullish ?¿*2nd attempt, making it more thrustworthy*

beautiful animal, much power, once the head of the horse is completly finished, we run the green valleys with very yummy grass

orange line is SL, need to close below on daily

target is 0.75

ALT

APE Main trend. Channel. Wedge. Reversal zones 05 05 2025Logarithm. Time frame 1 week.

1️⃣ Decline from the maximum by -98% , which is acceptable for assets of such liquidity and capitalization, after that either a trend reversal (main), or a complete scam.

2️⃣X (twitter) of this crypto project has 473 thousand subscribers . This army will be sent to pump this cryptocurrency at the right time in the so-called 3rd alt season of this cycle.

🟣And now work with a breakout of the descending wedge, and the price movement to the resistance of the descending channel. The percentage locally - medium-term showed for clarity from two zones - scenarios.

3️⃣The third plus is that this cryptocurrency is traded on 4 liquid exchanges: binance, bybit, okx, and most importantly Coinbase.

Line chart (trend direction and liquidity).

W Secondary. Reversed Head and Shoulders Key Area. 18 09 25Logarithm. 3 days.

Main trend 23 03 2025

A breakout of the previously mentioned key resistance (pair to USD) occurs on huge buying volume and an exit from the sideways trend (inverse head and shoulders).

Local targets, in case the inverse head and shoulders pattern is realized and a bowl forms at the next resistance level (previous consolidation).

NYM Main Trend. 09/18/2025Logarithm. 1 week. -97% decline from the liquid zone, and more than -99% on all exchanges.

🔵 Main trend — descending channel (price at resistance, exit potential)

🟡 Secondary trend — sideways consolidation in the channel (upper part — reset zones)

🟣 Local trend — cup with handle (implementation in case of a breakout).

🔈 Previously (for publicity purposes), the project allegedly raised $300 million (verification via online links, for the less-than-savvy). The next step is a simple one. Listing on XXX. With a current decline of -99%, the first "investors" (partially redistributed from the wallets of small, unmonitored investors) have a notional profit of +400%. Consider the profit at the listing. The upper part of the channel and the middle (descending) are the reset waves, and in each local altseason, there's a small rise (creating interest and hope).

Fantik has been trading since 2022 and is listed on the buybit , along with several moderately liquid ones. It's losing liquidity and interest. Twitter's 160,000 is very low (this reflects the creators' reluctance to burn money on advertising and awareness of this "special" cryptocurrency, one of thousands.

⚠️ Later, there will be delistings, which is logical. But, before that, it's entirely possible to make money locally. In my opinion, it's a scam in the long term, even if they temporarily reset the chart and legend, meaning rebranding, swaps, and other tricks to continue selling at any price.

📊 It operates using a pump/dump strategy, with pre-distributed risk and a designated amount, without being tied to a project or ticker. It's all the same. It's one of dozens of "non-special" cryptocurrencies in this strategy. That is, it's important to diversify such assets. I've explained everything in the comments and shown examples and situations dozens of times on other charts.

📊 Spot only and no stops (low liquidity). All targets are relatively "down-to-earth." Price slippage may occur due to low liquidity. This can be exploited or ignored.

DYDX -98% Secondary trend Holders reset. Inverse H&S 09 15 2025Logarithm 3 days. In the capitulation zone on the super negative, a reversal pattern of an inverted head and shoulders is formed. Its implementation of goals is to enter when the price overcomes the resistance of the pattern.

Main trend. -98%.

DYDX Main trend. 30 08 2024

15 09 2025

Manipulations from the project developers. Most recently in June (trend minimum, negative) - the developments froze (turned to zero) the tokens of about 40,000 DYDX holders. They blocked the token migration bridge from the ETH network to the DYDX network. In other projects, such migration is always open (for example, from the fact that I have EWT (EWTB), because many holders, after purchasing an asset and withdrawing it to a wallet, do not particularly follow the events of the projects. But, with DYDX, this did not work. Balances on wallets, and already a super depreciated token (from the peak of pumping, a natural -98% depreciation in liquidity), literally turned into zero. Probably, it is more offensive not to the hamsters who bought on the listing, news and hype, but to those people who gained from supporting a long-term downward channel.

There are rumors that for 10% of the cost, developers make an exchange of network tokens. If this is true, then from the standpoint of the morality of the developers, this is the moral bottom.

LUMIA Main trend -91% Low/high zones 01/18/2025Logarithm. Time frame 3 days. Fresh cryptocurrency. This main trend of this cryptocurrency itself (the entire history of trades) acts as a secondary trend in meaning.

The legend of the utility-imitation of this cryptocurrency is the tokenization of assets. A very good idea for the future hype of this kind, especially if they will continue to hype the "American" HBAR.

The chart shows the zones (support/resistance horizontal and dynamic) of maximums and minimums for work.

Now, after breaking the logic of the descending wedge (all the price drop), the price went into sideways consolidation. The channel step and local levels are shown. If they draw an inverted head and shoulders with the price in the channel canvas (part is already there), then there will be an exit to % of its base up, just to one of the following designated resistance zones. If the market as a whole is negative, then from this consolidation there may be another wave of decline. The zones are shown in the idea.

The asset itself was dumped after a local listing pump by -91%, these are not the minimum values for assets of such liquidity. But, sometimes if the market as a whole looks bullish, then the trend of the wrapper is reversed, this is an acceptable decline, but not minimal. Consider this in your money management and work tactics.

TIA (Celestia) XXL Main Trend Channel. Now +10X 13 09 25The price entered the 10X profit zone of crypto funds on 09 2025.

🟣 Locally , a symmetrical triangle formed under the downward trend.

🟢 Breakthrough — a trend break and movement to the resistance of the downward channel.

🔴Not a breakthrough — further immersion, after all, now the price is in the 10X zone , but already at least not 574 X ) When working with such hype, remember what a crazy profit the asset is at the "bottoms".

On the one hand, the asset will move with the market as a whole , and not by itself. In order to continue selling the hyped crypto wrapper, large market participants (swindlers and exchanges) will have to create hype again and redirect the traffic of "inexperienced" market participants. That is, make "dump waves ". You can use this, but with due regard to money management, and do not climb into margin and futures on such assets (inadequate profit on the other side). Work with local, down-to-earth goals (channel logic, in case of its breakthrough - the bowl), and not with maximum hypothetical ones.

WLD Main trend. Super pump +1118 and decline -95. 09 05 2025Logarithm. Main trend. Time frame 3 days.

Super pump +1118.42% and decline -95.16%.

Smart and stupid money. The legend of the project is quite interesting, it is quite possible that there will be attempts to implement it, but always in the first place in such projects is: "money from nothing". The chart confirms this. After the pump +1118.42%, a huge distribution zone, which formed the upper part of the pattern of one of the varieties of "head and shoulders" at an angle. Which makes it clear that the profit is huge. Even now, with a price decrease below the listing prices, from the peak of the pump by -95.16%, which is normal for assets of such liquidity, the profit of some "investors" is +25 X !! Think about what profit was when pumping +1118% (it is impossible to implement, the pump is done just for the chart, to raise the price, for "false goals" and hype, so that on rollbacks "cheap", in the distribution zone they were not afraid to buy on the conditional hype "whales bought". Although now it is unlikely that they will pour. In order to constantly sell at excess profit "at any prices", you need to make interest, both for traders and for investors, that is, volatility waves. They will pump under the market.

Local trend . Local impulse from the minimum prices. Locally, the price rested against the median, in case of its breakthrough - the implementation of the ascending pennant.

XTZ Secondary Trend. Channel. Wedge. Capitulation Zone. 07 05 20Logarithm. Time frame 1 week (less is not necessary).

The secondary trend has formed a horizontal channel for several years, with repeating wedge-shaped formations, the third time we entered under the support of this channel not by squeezes to collect long stop-loss, but by full candles and the structure of a descending wedge. It looks more vertical. The corrective movement to this semi-vertical wedge, quite possibly, will similarly have an aggressive character. The wedge is almost in the final phase of its formation. I showed percentages for clarity to the key reversal zones, for orientation for your money management and setting the first medium-term, and possibly local targets.

The main trend of this previously hyped cryptocurrency since 2017

XTZ/USD Main Trend. Descending Channel 01 2023

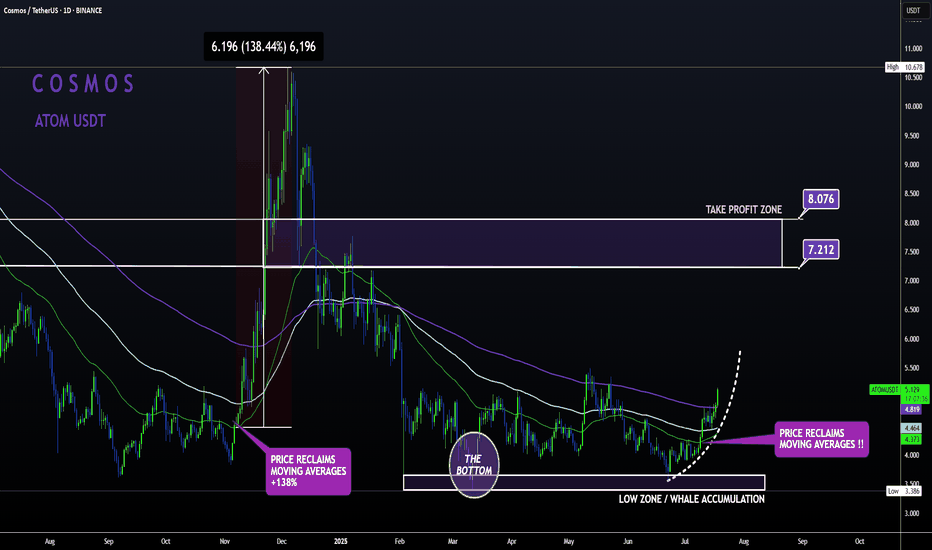

ATOM Sleeping GIANT ALT | Moving Averages BULLISH like NOV24'ATOM is slowly but surely making a turn up towards the first Take Profit point.

From the bottom, Cosmos has already increased a whopping 52% , with even more room to grow:

In my previous update, the 4 was still bearish when looking at trend lines and moving averages.

However, this has flipped to bullish from the 4h upward, with the price trading high above the moving averages in the 4h and in the daily timeframe:

4H:

Daily:

Note how previously, the big increases started as soon as the price regained the moving averages as support.

SUI Wave (4) Still Underway?Its unclear weather CRYPTOCAP:SUI wave 4 is complete or still underway as a larger triangle of flat correction, in a ending diagonal wave 4 (defined by wave 4 falling to wave 1 at the 0.5 Fib).

Price terminated 3 waves up at the High Volume Node resistance and is now finding support at the weekly pivot, 0.236 Fibonacci retracement. Further decline brings up the the 0.382 High Volume Node support.

Weekly RSI is at the EQ.

Safe trading

$ETH Did The Poke Above All Time High!As I said in my last update it would be unusual to complete the Elliot wave motif wave without a poke above all time high first and we got that this week adding confluence to an expected retracement ahead in wave 2. Poke above all time high shows long term strength.

Weekly RSI has bearish divergence from the wave 3 top in overbought territory.

Initial target is the (4) bottom and weekly pivot point at $3200 followed by $2800 High Volume Node and then the weekly 200EMA, S1 pivot and High Volume Node support at $2250. I will look out for longs in these areas.

Analysis is invalidated if proceed into price discovery.

Safe trading

BNB Retracement Ahead?CRYPTOCAP:BNB wave 5 looks complete at the weekly R1 pivot. RSI continues to print weekly bearish divergence from the wave 3 high.

Wave IV was a difficult count but appears to be a triangle which is a final pattern before the terminal move. Wave 2 retracement target usually ends at the bottom of wave 4 so $90 in this case which also finds confluence with 0.382 Fibonacci retracement and a swing below the weekly pivot, a good long signal.

Analysis is invalidated if we continue into price discovery.

Safe trading

CATI Memcoin. Main (essentially secondary) trend. Channel. 25 05Logarithm. Time frame 3 days (less is not necessary). Decline from the maximum -94%. As a rule, altcoins (ticker name, legend, imitation of usefulness does not matter) of such liquidity decline in their secondary trend until its reversal by -95-98%.

But, at the moment, there is a significant increase in volume, this is a good sign, if the price goes beyond the resistance of the descending channel, then a trend expanding triangle will form, or as it is also called the Livermore cylinder (dynamic zones of support / resistance of the "participation" phase).

In order not to miss the reversal, if you are afraid to gain a position now, then work with orders for a breakthrough, that is, a trend break.

🟣For 2 months now, a sideways trend with a 100% step, the price is being pulled to the resistance of the descending channel.

Breakthrough of it — trend reversal.

Not a breakthrough , decline to the next "shelf".

Everything is quite simple and logical. All levels and zones of potential minimums and maximums are shown. Remember, the average price of the set and reset is important. The key resistance zone after the reversal, where you will need to dump most of the position, or everything, is highlighted in gray.

Dogecoin (DOGE) Market Update & Catalysts: Ready for 50 cents?🚀 Dogecoin (DOGE) Market Update & Catalysts

🐋 Whale Accumulation & Trading Activity

Large players (“whales”) have been steadily absorbing DOGE, fueling upward momentum. Recent market structure shows that bulls defended the $0.22 zone, while primary support and reload range sits at $0.15–$0.16 — the bottom of the accumulation range. A breakout above $0.25 could spark a run toward $0.40, especially if short positions get squeezed.

🏦 ETF Prospects & Institutional Tailwinds

Optimism is building around a potential Dogecoin Spot ETF, with growing speculation that approval could arrive in the next cycle. An ETF would open the doors for institutional capital, mirroring what happened with Bitcoin’s rally.

🔗 Expanding Utility (DogeOS & DeFi)

The development of DogeOS, which allows DOGE to interact with Ethereum DeFi ecosystems, could give the coin a major utility boost beyond its meme status. This evolution may help sustain higher valuations long-term.

📈 Technical Signals & Price Forecasts

Chart patterns are turning favorable:

Golden cross (50-day MA crossing the 200-day) shows momentum strength.

Oversold RSI signals suggest a potential reversal upward.

If support at $0.15–$0.16 holds and bulls reclaim $0.25, upside targets expand to $0.34–$0.40.

🔮 Bullish Scenarios & Analyst Sentiment

Mid-term projections highlight possible price zones:

Conservative path: $0.30–$0.33 into 2025.

Aggressive path: Retesting all-time highs near $1 if institutional demand + ETF + DeFi traction align.

🌟 Key Positive Catalysts

🔑 Catalyst 🚀 Impact

🐋 Whale absorption & accumulation Strengthens base; short squeezes possible.

🏦 Spot ETF approval potential Brings institutional demand.

📊 Technical bullish patterns Golden cross + RSI suggest uptrend.

🔗 DogeOS & DeFi integration Expands DOGE’s real-world use cases.

💬 Strong community + hype Keeps DOGE in the spotlight.

✅ Summary

Dogecoin is holding its accumulation base at $0.15–$0.16, with strong whale support and growing catalysts like ETFs and DeFi integration. If bulls can reclaim the $0.25–$0.26 zone, momentum could build toward $0.40 in the mid-term — with long-term upside scenarios eyeing $1+ if institutional and utility drivers align.

SOL Elliot Wave Count ChangedCRYPTOCAP:SOL Solana appears to have completed an Elliot wave diagonal pattern with a series of ABCs.

Falling below the trend line and 200EMA would confirm this and bring up a first target of $140 at the High Volume Node and 0.5 Fibonacci retracement.

Daily RSI has had bearish divergence for a while. The 'alt-coin golden pocket' 0.786 sits at the wave 2 bottom around $119 which would be a buy for me if price gets down that far.

Safe trading.

FET Wave 2 Underway, Triangle InvalidatedWave C of 2 appears to be underway for $FET. With the 1:1 extension target from wave A lines up with the golden pocket retracement and S2 daily pivot so is definitely an area to watch.

RSI has room to fall into oversold.

Price failed 2 tests of the descending daily 200EMA, we expect price to break through on the 4th.

Safe trading

AAVE Ending Diagonal?We have some more clarity with the local AAVE pattern and it does appear to be an Elliot wave ending diagonal. After a strong wave 3 ending diagonals form as a terminal pattern with a thrust above the trend line threshold and drop back down to complete a higher degree motif wave 1.

The following retracement has a high probability of terminating at the wave 4 bottom which in this case is at the High Volume Node support and 0.5 Fibonacci retracement at $210.

RSI has printed a series of bearish divergence from overbought but this took a long time to play out!

Analysis is invalidated if price breaks above $400.

Safe trading

$SOL Ready for Price Discovery?CRYPTOCAP:SOL wave 3 of (5) appears to be underway but has to get through the major resistance High Volume Node at $216 and previous high first for an impulsive move.

Weekly pivot point was tested successfully as support and RSI has plenty of room to continue upwards.

Analysis is invalidated below $130.

Safe trading

$HBAR Macro Chart - Ready for wave 5 of (1) of 3 up?CRYPTOCAP:HBAR appears to be printing a wave 4 triangle above the weekly pivot point. This implies the next move would be a terminal wave (5) of 1 of (3) likely completing with a poke above all time high to trap FOMO novice investor / traders. Classic Elliot Wave.

Wave 2 of (3) has a high probability of ending at the wave 4 triangle base which is the weekly pivot and 0.236 Fibonacci retracement adding confluence. This fib level support would indicating continued trend strength.

If it is a wave 1 of (3) is completing then we can expect the long term target to overextend the weekly R5 pivot point of $1.16, possibly reaching $3.

Weekly RSI remains at the EQ so plenty of room to grow.

Analysis is invalidated below the weekly pivot.

Safe trading