$ V Retracement$V is Targeting the confirmations levels and the 1.618. $V has ER next Thursday 1/22 and the stock is currently beat down. This seems to be a "B" Wave Retracement, which means a Misleading Retracement like a fake out so to speak so the Run up move that I'm actually looking for is actually a fake run up just to go down further.

I'm entering down here in Hell on the chart lol but the RR is so beautiful that it entices me lol.

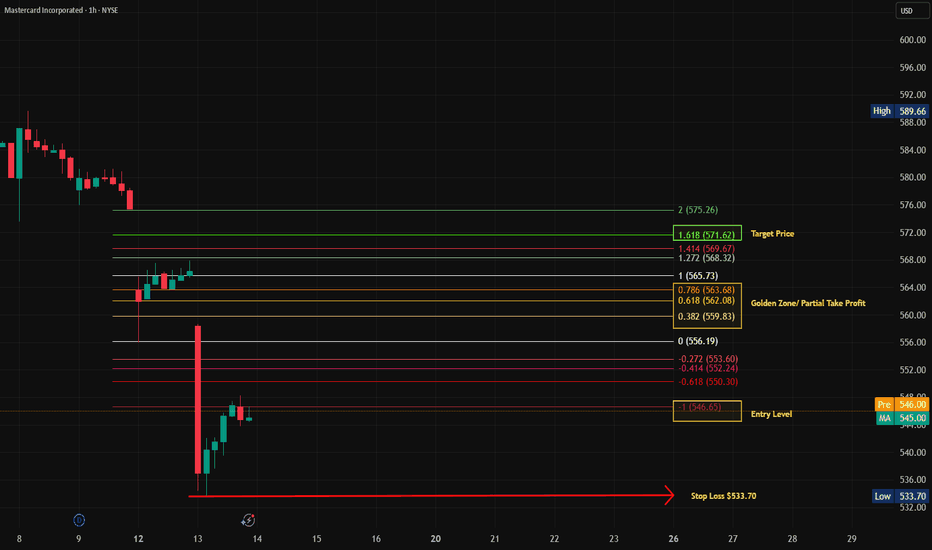

NYSE:MA has the same chart. I posted early this morning. With CPI this week you just never know.

Anyway

Happy Trading, Alerts Set!

Calls

$AVGO Wants More What it dew Yall! Happy New Year! Its Up and Stuck lol. I'm so excited for Life, this will be a wonderful trading year! Let's Kick off the 1st TA for NASDAQ:AVGO on the 1 HR time frame.

(8/14/21 EMA's are used)

-Price has rejected at the 0 level once; however, the anchor is the 0 so it’s kinda like a rejection twice.

-The EMA were stacked for a down bias however they are now flipping indicator buying pressure picking up.

-If price can close above the 0.618 zone before the EOD that’ll look better: buyers gaining control

S/L is at the 0. I look for candles to close below this area not just wick through them. I study these types of entries so I'm always taking a small risk and entering around the .0382 zone (for calls). The R:R is a chef kiss.

This is not financial advice, educational purposes only.

Happy Trading Alerts Set!

Update On $AAPLGreat Entry! Stop Loss never Triggered. 275 Calls did well this week! NASDAQ:AAPL is priming up for a bigger MOVE! Price rejected the 1.272 level HARD and went back to the 1 level and now attempting the 1.272 again. It wouldn't be surprising if price wanted to go to .786 or 0.618 to find liquidity before proceeding, so keep that in mind as well.

P.S. Do not insult what you lack understanding of. Its not a good look. Tradingview dont let you delete hatin' ahh comments. Its a Stain on your name LOL.

Also, there is nothing bad in being wrong, how else will one learn? Stay positive and optimistic!

Happy Trading Alerts Set!

$AAPL On the Move NASDAQ:AAPL Look just like the rest of them with the HARD rejection at -0.414 & -0.272. The Chart Explains it self for the Most Part. The Risk to Reward Ratio is Super Litty!. A whole lot to get and not too much to lose. Stay Discipline and yall will be just FINE.

Alerts Sets, Happy Trading!

TUESDAY is my Favorite day of the Week, Its random as hell.

$Amzn Are You Finished or Are you Done? S/O to Birdmard just because I love that wild ass statement; Lol.

So I've been on NASDAQ:AMZN for a week now and I Learned a Lesson from it last week wicking 1.272 action. So I'm back to perhaps call it from the bottom of where its at currently. But check this is out, I generally only have my fibs to show on the level I chart on, (I dont want to see it on another time frame.) Well, this morning; I guess I hadn't turned my motor all the way on and I read my 1 HR fibs on the 15 mins and got into some 225 Amazon calls only to realize that this is my 1 Hr TF fibs not the 15 mins (Which is what I trade every day). So, this NASDAQ:AMZN Chart Image is Charted on the 1 HR TIME FRAME, but the Image I posted is on the 15 min TF. #Calls

Happy Trading, Alerts Set!

CCL Carnival Corporation Options Ahead of EarningsIf you haven`t bought CCL before the rally:

Now analyzing the options chain and the chart patterns of CCL Carnival Corporation prior to the earnings report this week,

I would consider purchasing the 30usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $1.53.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

QURE uniQure Options Ahead of EarningsAnalyzing the options chain and the chart patterns of QURE uniQure prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $2.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Bullish Thesis for INTC Intel Stock in 2025If you haven`t bought INTC before the previous earnings:

Now Intel INTC is positioned for a potential turnaround and upside by the end of 2025, driven by strategic leadership changes, foundry business expansion, AI innovation, and favorable geopolitical dynamics. Here’s why INTC could head higher this year:

1. Leadership Transformation and Strategic Vision

The appointment of Lip-Bu Tan as CEO in March 2025 has injected new optimism into Intel’s prospects. Tan is a respected semiconductor industry veteran, and his arrival was met with a 10% jump in INTC’s share price, reflecting renewed investor confidence in the company’s direction.

2. Foundry Business Expansion and Government Support

Intel’s pivot toward a foundry-centric model is gaining momentum. The company is leveraging its U.S.-based manufacturing footprint to attract domestic and international clients, especially as geopolitical tensions and trade restrictions make U.S. chip production more attractive.

There is speculation about strategic partnerships, such as TSMC potentially acquiring a stake in Intel’s foundry operations, which could accelerate technology transfers and client wins.

The U.S. government is likely to continue supporting domestic semiconductor manufacturing through incentives and tariffs, directly benefiting Intel’s foundry ambitions.

3. AI and Next-Gen Product Launches

Intel is aggressively targeting the AI and data center markets. The upcoming Jaguar Shores and Panther Lake CPUs, built on the advanced 18A process node, are set for release in the second half of 2025. These chips will be available not only for Intel’s own products but also for external clients like Amazon and Microsoft, expanding the addressable market.

Intel’s renewed focus on AI accelerators and competitive cost structures could help it regain share in high-growth segments.

4. Financial Resilience and Market Position

Despite recent setbacks, Intel remains a dominant player in the PC CPU market and continues to generate substantial revenue, outpacing some key competitors in the latest quarter.

Analysts have revised their short-term price targets upward, with some projecting INTC could reach as high as $62—a potential upside of over 170% from current levels.

Forecasts for 2025 suggest an average price target in the $40–$45 range, with bullish scenarios pointing even higher if execution on foundry and AI strategies meets expectations.

5. Technical and Sentiment Factors

While technical analysis currently signals caution, the $18.50–$20 zone has provided strong support, and any positive news on foundry contracts or AI wins could catalyze a breakout from current consolidation patterns.

Market sentiment has shifted more positively following the CEO change and strategic announcements, suggesting the potential for a sustained rebound if Intel delivers on its promises.

In conclusion:

Intel’s combination of visionary leadership, foundry expansion, AI innovation, and favorable geopolitical trends sets the stage for a potential stock price recovery by the end of 2025. With analyst targets and investor sentiment turning more bullish, INTC presents a compelling case for upside as it executes its turnaround strategy

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ONDS Ondas Holdings Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ONDS Ondas Holdings prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2028-1-21,

for a premium of approximately $3.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DE Deere & Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DE Deere & Company prior to the earnings report this week,

I would consider purchasing the 510usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $8.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

META Platforms Options Ahead of EarningsIf you haven`t bought META before the rally:

Now analyzing the options chain and the chart patterns of META Platforms prior to the earnings report this week,

I would consider purchasing the 720usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $51.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TSLA Tesla Options Ahead of EarningsIf you haven`t bought the dip on TSLA:

Now analyzing the options chain and the chart patterns of TSLA Tesla prior to the earnings report this week,

I would consider purchasing the 800usd strike price Calls with

an expiration date of 2027-1-15,

for a premium of approximately $40.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking for a daytrade on BBAI! OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

USDJPY 4H TRADE IDEA FOR 26TH SEP,2025The USD against the JPY has broken a balanced area it has been in for the previous weeks before, as bulls generally start to take back control of the momentum and trend, but the

The question is, will the move last? As the overall trend is still bearish, this could be signaling a trend reversal based on what we see happening currently, but at this moment price is within a short range as it finds a base to continue long for the rest of the session today.

As usual, my calls or analysis are based on what we see, the current Bias, and from a probability standpoint, meaning that this projection may be or may not be validated, so tread carefully, and as usual, this is not financial advice, trade responsibly

NVDA NVIDIA Corporation Options Ahead of EarningsIf you haven`t bought NVDA before the previous earnings:

Now analyzing the options chain and the chart patterns of NVDA NVIDIA Corporation prior to the earnings report this week,

I would consider purchasing the 150usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $13.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AAPL Apple Options Ahead of EarningsIf you haven`t bought AAPL before the previous rally:

Now analyzing the options chain and the chart patterns of AAPL Apple prior to the earnings report this week,

I would consider purchasing the 255usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

JPM JPMorgan Chase & Co Options Ahead of EarningsIf you haven`t bought JPM befor the rally:

Now analyzing the options chain and the chart patterns of JPM JPMorgan Chase & Co prior to the earnings report this week,

I would consider purchasing the 290usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $20.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOOGL Alphabet Options Ahead of EarningsIf you haven`t bought GOOGL before the rally:

Now analyzing the options chain and the chart patterns of GOOGL Alphabet prior to the earnings report this week,

I would consider purchasing the 215usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $8.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.