EURUSD 1H INSIDE CANDLE METHOD BREAKOUTINSIDE CANDLE STRATEGY

What is an Inside Candle

1. Previous candle engulfs next candle.

2. 2nd candle high is lower that 1st candle.

3. 2nd candle low is higher than 1st candle.

INSIDE CANDLE METHOD

1. Incoming Trend

2. Inside Candle – Opposite Color

3. Enter Break of Engulfing Larger Candle

Inside Candle method is a great short term consolidation indicator.

If your trade plan contains breakouts and consolidation then this method is for you.

This is a great way to find smaller consolidations quicker which will give you more trades on whatever time frame you want to look.

On a daily chart it may take weeks for a consolidation pattern to form.

Inside candle represents a pause, consolidation or compression in the market after a big move.

Often you will also see reduced volume on the inside candle.

Inside Candle method is a pause or a reversal of the trend . So it is more effective if there is an incoming trend.

Enter a break of the larger engulfing candle in the direction of the break.

Enter with a Stop Order a few pips above or below breakout level.

Which trades you take is a matter of preference.

Some like reversal trades or trend following trades.

Scalping in doesn't matter what direction you may go.

Trend following you will want to see this in context of a larger trend.

Take all the trade setups and just shut down the ones that don't preform.

Trade Management: Enter 2 trades

Stop Loss is 1.5 x ATR for both trades

First Take Profit is 1 x ATR for 1st trade

2nd trade there is no take profit.

When 1st TP is hit move 2nd trades SL to breakeven.

Let profit run on 2nd trade by following/trailing SL.

If a candle closes back inside the larger engulfing candle close down trade.

Watch for a setup for the next breakout.

Candlestick Analysis

How To Follow A Analysis Correctly & Benefit from thisHi Traders, here is the full Educational Video on " How to follow A Analysis Correctly"

This is a Very Important Concept In Forex trading when following " Mine Or Someone Else Analysis " On Tradingview

Conditions To Follow "Global Fx Education Analysis"

1. Wait For Confirmation From the Market ( Daily Close )

2. Have Patience ( wait For the "Retest or Pullback")

3.Always Use Risk Management

4. Never enter! If the market doesn't Respect the area ( Support / Resistance ).

Dont forget to drop me a like , Comment and a follow.

We appreciate the support and it will encourage us to make more free analysis like this for you all :)

Have a great week.

See You in the next Video!

THE TREND IS YOUR FRIEND... but don't trend trade!!As you have probably heard do not trade against the trend. I'm going to assume you know what this means but if you don't read the bottom paragraph first.

Trading with the trend is obviously much more beneficial to us, and its clear why we shouldn't go against it. But have you tried being a trend trader? Aka a person who tries to identify trends and rides these huge moves out and scales in along the way?

For starters markets range 90% of the time, so only in 10% of market conditions are you going to succeed. Assuming you don't miss the big move because of all the previous losers and break evens you had in ranging conditions which filled you full of self doubt.

There are people who successfully trend trade, and I ask myself why bother??? It is such a struggle, you have to go through so many loosing streaks and keep calm and collected until that big move comes and you're in on it. For me that is too much stress and too much of a strain on my brain.

Trade with the trend when there is one of course. Only buy if there is a clear uptrend and sell if there is a downtrend. But in my advice I would steer clear of trying to follow the trend orcatch these big moves; you'll get chopped up hard in between!

I like it simple. See where people just got wiped out by the banks and follow the big boys.

Do you want to join our gang Haha?

You stay classy San Diego.

***** Trading with the trend is only buying in an uptrend, and only selling in a downtrend, if you do not know what a trend is, message me or google "How to identify a trend in trading" *****

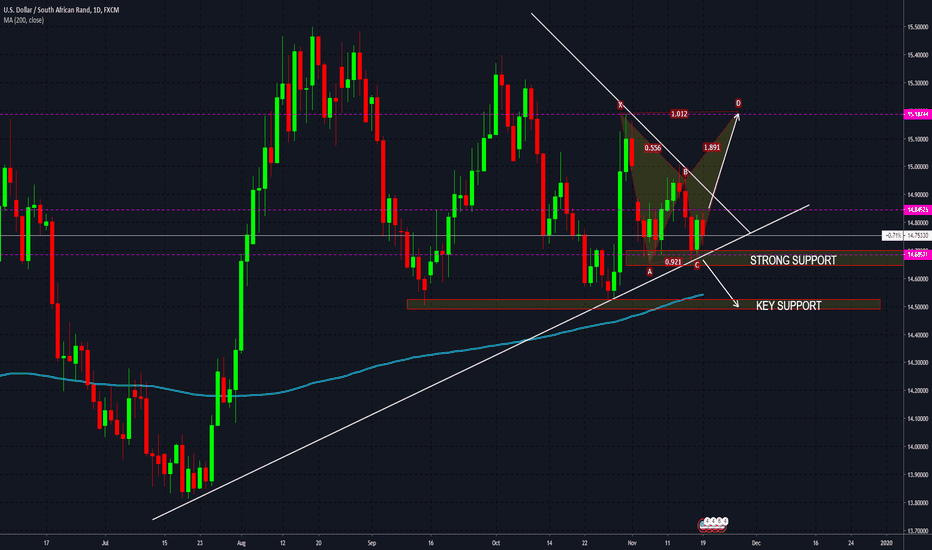

USD/ZAR - Anticipation of a Breakout But Which Direction?USD/ZAR is experiencing what I would call a choppy market at the present time. In times of choppy markets my suggestion is always to look at other opportunities in the market. Why? In choppy markets, we see a lot of indecision. Its actually likely that you will LOSE money or try to chase the market to no avail. What we want to trade is a trending market..A trending market is where we can see clear buy and sell opportunities and we see CLEAR continuous higher highs (buy opportunity) or lower lows (sell opportunity)

As a backdrop in terms of fundamentals there is a lot of uncertainty in the markets as it relates to emerging market currencies. The China trade war is playing heavily into this uncertainty. In light of the fundamentals, we know that we keep the fundamentals in mind as we trade the technicals. The technicals are what make up make up the market structure. It gives a picture of the forex pair over the course of time, which includes the fundamentals (news). This is why I always say to keep the fundamentals in mind. However, we should give a lot of credence to the technicals more than the fundamentals. Given this lets look at the technicals and what do we see?

- We see price is sitting on a very strong level of support, and is currently trading within a range On a lower timeframe you will see the choppiness to which I refer..

- We see price is still sitting above the 200 MA and the 200 MA which tells us that for now price is holding ground above the very next key level of support.

- We see price is trading and consolidating on a higher timeframe within a pennant (note trendlines)

- We know that the longer the consolidation within a pennant on a higher timeframe especially, we can expect there to be a massive breakout. In which direction though? Only time will tell.

- As we continue to study this pair, we could possibly have two scenarios:

1. If price breaks out to the upside, given the previous consolidation, I would expect a massive breakout to the upside to higher highs as noted (remember the massive breakout a couple of weeks ago? Perhaps just like that..not definite but perhaps).

2. If price pushes beyond support to the downside, given the previous consolidation, I would expect a breakout to the downside towards the next key support as noted.

For now I say, watch, study and be ready to take advantage of the breakout when it happens, as it breaks out of the pennant or for conservative, you can watch for the break and re-test.

Please refer to my previous studies on price action, key zones, and how to study the markets using price action study.

I now offer one-on-one mentoring sessions where we will together study the markets and you will learn how to trade price action and understand market structure. If interested please inbox me for information. Spaces are limited; For individual sessions, I have space just for a few more students, as I like to take the on-on-one time to spend with each individual. Group sessions are also available, if you would like to get a small group of students (3 to 5), and you can take advantage of lesser group rate. I really enjoy studying the market and sharing with others. As we study I will share certain e-books and educational material that I have as we learn this market together.

Thanks for studying along! Always use proper risk management, use your confluences, and wait for confirmation before entering any trade. Conserving capital is very key.