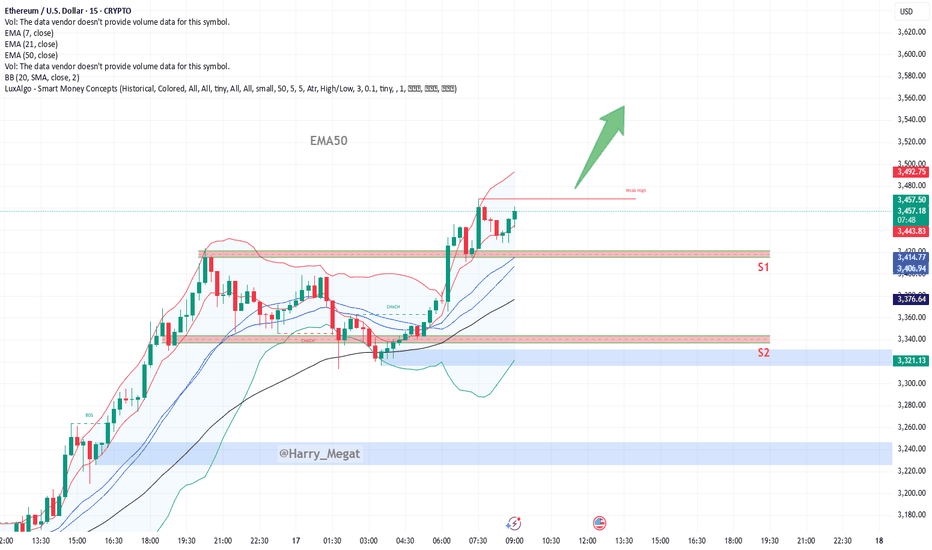

Technical **chart analysis** for ETH/USDTechnical **chart analysis** for **ETH/USD** based on (15-min timeframe) :

Bullish Outlook**

* **Price Action**: Ethereum is consolidating just above previous resistance (\~\$3,440) after a breakout from the range.

* **Current Price**: \~\$3,446

* **EMA Support**:

* EMA 7: \$3,441 (price holding above)

* EMA 21: \$3,413

* EMA 50: \$3,376 (strong dynamic support)

Key Levels**

* **Resistance Broken**: Former resistance zone (\~\$3,415–\$3,440) now acting as support.

* **S1 Support Zone**: \$3,415–\$3,440 (ideal retest zone for long entries)

* **S2 Support Zone**: \$3,335–\$3,350 (next demand zone if S1 fails)

Analysis Summary**

* **Trend**: Bullish momentum is intact above EMA cluster.

* **Setup**: Retest of breakout zone successful → price stabilizing above EMA7.

* **Target Area**: If momentum continues, next target zone could be \$3,500–\$3,560 (as shown by green arrow).

* **Invalidation**: Drop below \$3,413 (EMA21) and especially \$3,376 (EMA50) would weaken the bullish structure.

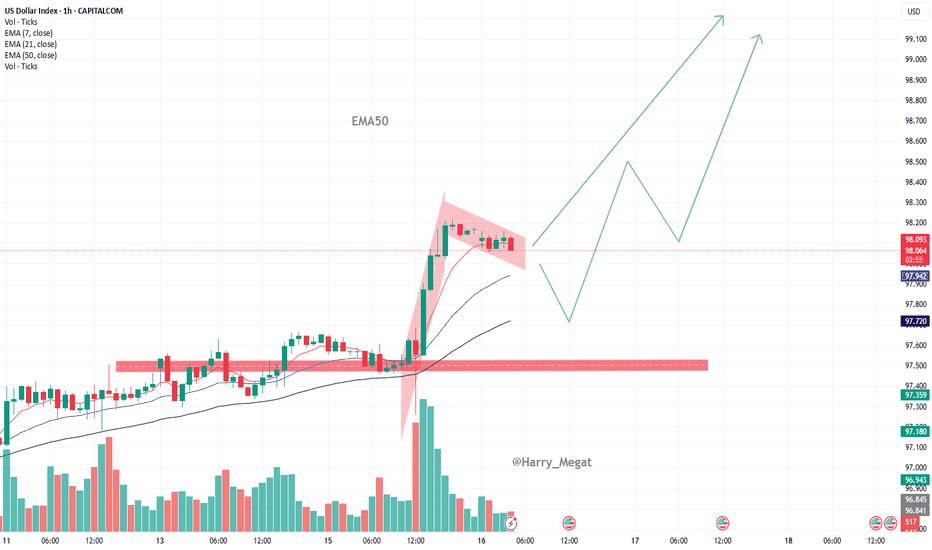

Chartanalysis

Gold (XAU/USD) Setup based on 30-minute chartGold (XAU/USD) Setup based on 30-minute chart

**Bullish Scenario**

* **Support Held**: Price is currently testing a key horizontal support zone (\~\$3,320–\$3,327), which has held multiple times in the past.

* **Potential Reversal**: If price forms a bullish candlestick pattern here (e.g., bullish engulfing, hammer), we may see a rebound.

* **Upside Target**:

* **First Resistance**: \$3,345–\$3,350 (green zone)

* **Further Target**: \$3,380–\$3,400 if momentum continues

**Confirmation Triggers**:

* Bullish price action from support zone

* Break above EMA 7 / EMA 21 (\~\$3,330–\$3,336)

* Increasing volume on green candles

**Bearish Scenario**

* **Breakdown Threat**: Price is hovering near support; if it breaks below \$3,320 with volume, downside pressure may intensify.

* **Next Support Levels**:

* \$3,310 (minor)

* \$3,285–\$3,275 (major support)

**Bearish Triggers**:

* Clear break and close below \$3,320

* EMA crossover (short-term below long-term)

* Rising red volume bars

Summary

| Direction | Conditions | Targets |

| ---------- | --------------------------------------------------- | ------------------------- |

| Bullish | Hold above \$3,320 + breakout above \$3,336 (EMA50) | \$3,350 → \$3,380–\$3,400 |

| Bearish | Break below \$3,320 support | \$3,310 → \$3,285 |

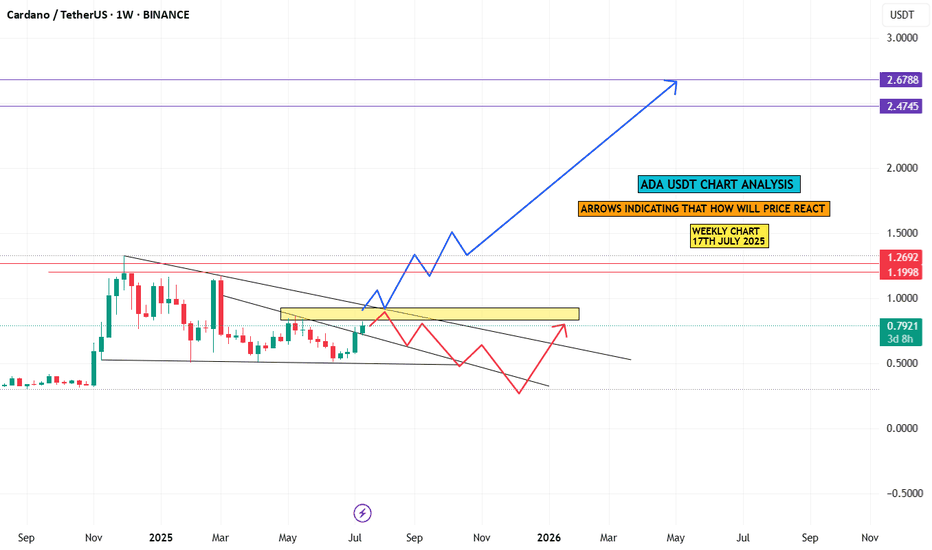

EUR/USD Technical Outlook Daily chart frame**EUR/USD has bounced from the S1 zone (\~1.1595–1.1575)**, chart analysis

**EUR/USD Technical Outlook**

**Current Price:** \~1.1618

**Recent Action:** Rejection from S1 zone, forming a potential base.

**Bullish Scenario (Active)**

The pair has bounced from key **S1 support** (1.1595 area), suggesting demand is present.

**If momentum holds:**

* **Immediate Target 1:** 1.1645 (Fibonacci + 21 EMA)

* **Target 2:** 1.1665–1.1685 zone (7 EMA + minor resistance)

* **Target 3:** 1.1725 (R1 zone and mid-July resistance)

* Breakout above R1 would shift momentum firmly bullish.

*Watch for bullish continuation candles and rising volume.*

**Bearish Risk (Still Possible)**

* If the bounce stalls near **1.1645–1.1665**, and the pair reverses:

* A drop back toward **1.1595–1.1575** support could occur again.

* Break below that zone would expose:

* **S2 support at 1.1510**

* Possibly extend to **1.1475** in case of stronger USD demand

Summary:

* **Bounce from S1** shows initial bullish strength.

* **Key resistance to break:** 1.1645–1.1685 for bullish continuation.

* **Key support to hold:** 1.1595–1.1575 to avoid deeper correction.

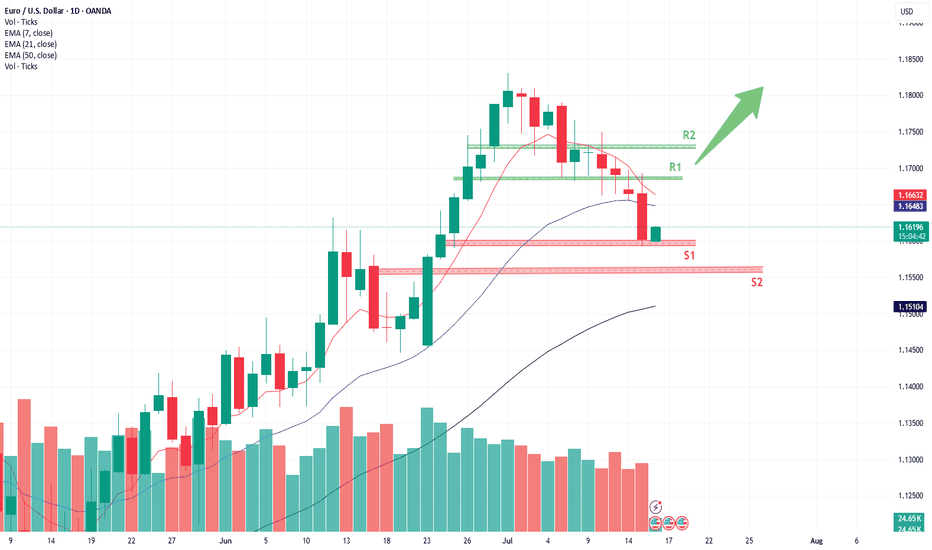

DXY Bullish Pennant (awaiting breakout)**1-hour timeframe** of the **US Dollar Index (DXY)** with technical analysis applied. Here's the breakdown:

**Technical Analysis Summary:**

**Current Price:**

* Around **98.08**, trading just under the **7 EMA (98.09)**.

**Bullish Structure:**

* A strong **bullish impulse leg** is visible (sharp green candle rally).

* Followed by a **bullish flag/pennant** pattern (marked in red), which is typically a **continuation pattern** in an uptrend.

* The flag is forming after a steep upward move — suggesting **consolidation before potential breakout continuation**.

**EMA Trend Support:**

* **EMA 7, 21, and 50** are aligned bullishly:

* EMA 7 > EMA 21 > EMA 50

* This supports the **short-term uptrend** structure.

**Support Zones:**

* A strong **demand zone** is marked between **97.50–97.70** (highlighted in red), where price previously consolidated before the breakout.

* EMA 50 also sits around **97.72**, reinforcing this as a strong **pullback support level**.

**Possible Scenarios:**

1. **Bullish Continuation:**

* If the price breaks above the flag resistance, it may **rally towards 98.70 → 99.00 → 99.10**.

2. **Bullish Pullback:**

* If price dips to retest the support near **97.80–97.90** or EMA 21, and holds, it may bounce and continue upward.

**Conclusion:**

* **Trend:** Bullish

* **Pattern:** Bullish Pennant (awaiting breakout)

* **Support:** 97.72–97.90

* **Upside Targets:** 98.70 → 99.00+

* **Outlook:** Positive bias continues **as long as price holds above the support zone** and EMAs.

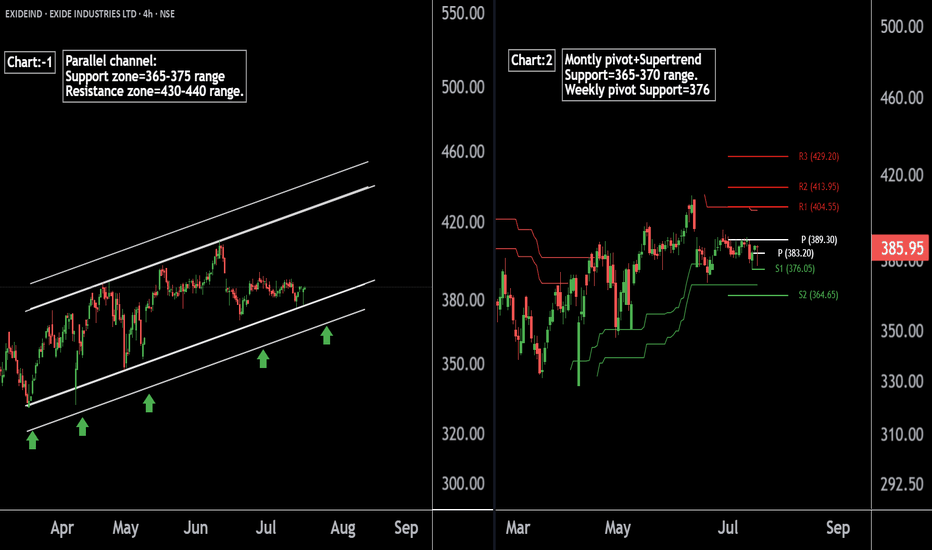

Exide Industries Ready for the Next Bull Run !! Powering Up !!there are two chart of Exide Industries.

In a first chart: EXIDEIND is moving in a well defined parallel channel and currently trading near at support 365-375 range

In the second chart,EXIDEIND is respecting support at both the monthly pivot and the supertrend indicator, with the support zone positioned between ₹365-₹370.

EXIDEIND is currently sustaining below both the monthly and weekly pivot levels at ₹290. As long as the stock does not break above this pivot zone, the momentum is expected to remain weak.

If this level is suatin then ,we may see higher prices in EXIDEIND.

Thank you !!

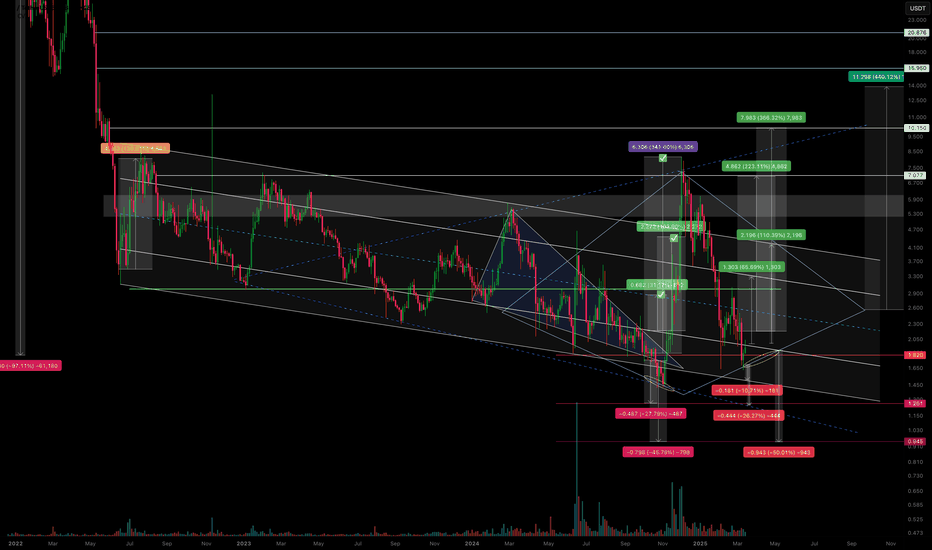

CVX/USDT – Is the scenario repeating? Continuing to work.The previous trading idea has played out with 3 out of 4 marked zones reached.

We saw a false breakout from the descending channel, followed by a pullback in line with the overall market—returning to the channel’s support zone.

I’ve noticed a potential formation of either a diamond pattern or an expanding triangle, but we’ll see how it plays out further.

Regarding declines and support zones:

-10.71% drop to the support of the descending channel.

-26.27% drop to the anticipated support of the expanding triangle.

-50% drop, likely as a squeeze under extremely negative news.

Regarding growth and resistance zones:

+65% rise to the resistance of the internal channel.

+110% rise to the resistance of the external channel (and if a diamond pattern forms, then its boundary).

+246% rise as a second attempt to break out of the descending channel.

+440% rise as a potential realization of diamond pattern pricing (if it forms).

All of this should be factored into your trading strategy, even the less likely scenarios.

I'll share the execution of the previous trading idea in my TG. I've also marked it on the chart.

Gold (XAU/USD) 4-hour chart4-hour chart of Gold (XAU/USD)** showing a key technical setup near the \$3,344 level. Price action is testing a significant **resistance zone** highlighted in grey, with two possible scenarios unfolding from this level.

**Chart Analysis Overview:**

* Gold has been in a **bullish short-term trend**, forming higher lows and pushing above the **EMA 7, 21, and 50**, all converging near the \$3,324–\$3,331 area (acting as dynamic support).

* Price is now approaching a **multi-tested resistance zone** near \$3,360–\$3,390, where it has previously faced selling pressure.

* Volume is rising, supporting the current bullish momentum.

**Scenario 1: Bullish Breakout (Green Path)**

**Conditions:**

* Price breaks and holds above the \$3,360–\$3,390 resistance zone.

* Continued bullish momentum supported by trade tensions, safe-haven demand, and Fed uncertainty.

**Target:**

* First target: \$3,400

* Extension: \$3,420–\$3,440 zone if momentum strengthens.

**Invalidation:**

* Failure to hold above \$3,360–\$3,390 range could limit upside potential.

**Scenario 2: Bearish Rejection (Red Path)**

**Conditions:**

* Price gets rejected from the resistance zone (\$3,360–\$3,390).

* Fails to establish support above the breakout level and drops back below \$3,330.

**Target:**

* Immediate support at \$3,310–\$3,290

* Deeper correction towards \$3,260–\$3,220 if bearish pressure increases.

**Confirmation:**

* Look for bearish candlestick patterns near resistance (e.g., shooting star, bearish engulfing).

* Drop below EMA cluster (\$3,324–\$3,331) to confirm weakness.

**Conclusion:**

Gold is at a decision point near major resistance. A breakout above \$3,390 could extend the bullish rally, while failure to break this level may invite sellers and trigger a correction. Watch price action around this resistance for confirmation of the next move.

Bullish Outlook for Ethereum (ETH/USD)The chart shows a **bullish outlook for Ethereum (ETH/USD)** on the 1-hour timeframe, suggesting a potential continuation of the uptrend after a recent breakout.

Chart Breakdown:

* **Current Price:** \~\$3,038

* **Key Levels:**

* **S1 (Support 1):** Around \$2,996 — a key breakout and retest level.

* **S2 (Support 2):** Around \$2,945 — secondary support and accumulation zone.

* **EMAs:**

* EMA 7: \$3,023

* EMA 21: \$2,996

* EMA 50: \$2,970

The price is currently above all three EMAs, signaling **short-term bullish momentum**.

Bullish Scenario:

* The price recently **broke out above a strong resistance zone (\~\$2,996)**.

* If ETH successfully **retests and holds S1 as support**, we could see a continuation move toward:

* **\$3,080 → \$3,120 → \$3,160** as short-term targets.

* The green path suggests a **healthy pullback and continuation pattern**, which aligns with bullish market structure.

Invalidation/Bearish Scenario:

* A **break below S1 (\$2,996)** may shift bias toward S2 (\~\$2,945).

* Loss of S2 support could open the door for deeper correction..”

GOLD - CUT n REVERSE area, what's next??#GOLD ... perfect move as per our video analysis and now market just reached at his today most expensive area, that is 3340-41

Keep close that area and only holding of that area can lead us towards further bounce otherwise not.

So keep in mind we should didn't holda our longs below 3340-41

And obviously we will go for cut n reverse below 3340-41 in confirmation.

Good luck

Trade wisely

BTC/USD Technical Analysis — Educational BreakdownBTC/USD Technical Analysis — Educational Breakdown (July 13, 2025)

🔍 Market Context

Bitcoin (BTC/USD) is currently trading around $117,913, exhibiting a clear reaction from a well-defined resistance zone between $118,439 and $119,000. This resistance aligns with a previously unfilled 4H Bullish Fair Value Gap (FVG) — a price inefficiency left behind during a strong bullish move — which has now been filled, triggering a pause and reaction in bullish momentum.

🧠 Key Concepts Explained

📘 1. Fair Value Gap (FVG)

In Institutional Price Delivery models (often used in Smart Money Concepts), a Fair Value Gap represents an imbalance in price action — usually between the wicks of candles where price moved too quickly, leaving inefficient trading zones. Price often retraces to these areas before resuming its direction. Here, BTC has filled the 4H Bullish FVG, which acts as a magnet for price and a potential reversal point once filled.

📘 2. Liquidity Sweep

The chart highlights a Sell-Side Liquidity Sweep — this occurs when price dips below a key short-term low or consolidation range to trigger stop-losses and collect liquidity before making its next move. This move is typically engineered by larger market participants to capture orders before deciding on true directional intent.

📘 3. Resistance and Support

Resistance ($118,439 – $119,000): This area is acting as a supply zone where sellers are stepping in after price filled the FVG.

Support ($115,580): This level has previously provided demand and also holds liquidity (stop-losses from long positions), making it a probable target if bearish pressure follows through.

📈 Potential Trade Insight (Educational)

⚠️ This is not financial advice but an educational scenario based on the current technical setup.

Bearish Setup: If price rejects from resistance and forms a lower high, a short entry targeting the support zone at $115,580 could be considered, using a stop above $119,000.

Bullish Invalidator: A break and hold above $119,000 would suggest bullish continuation, potentially targeting higher time frame imbalances or resistance.

📚 Summary & Takeaway for Learners

This chart presents an excellent case study in understanding how institutional concepts like FVGs, liquidity sweeps, and key supply/demand zones interact in real price action. Traders can learn the following from this setup:

Price doesn’t move randomly — it often targets liquidity and imbalances.

Patience is key — waiting for confirmation at known reaction zones can improve trade accuracy.

Market context matters — a filled FVG at resistance combined with a liquidity sweep gives confluence to a bearish outlook.

BTCUSD Analysis : Bitcoin Trend Shifted/Bullish Pattern + Target🧭 Overview:

Bitcoin’s recent price action has delivered a textbook sequence of institutional liquidity play, volume-driven breakout, and supply zone rejection. After rallying on increasing volume, BTC tapped into a significant 3x Supply Zone—which also served as a previous reversal point—and was swiftly rejected. The market is now trading around a key decision zone where traders must stay alert for a confirmed bullish reversal, or risk getting caught in further downside.

🔍 Step-by-Step Technical Breakdown:

🔸 Liquidity Grab + Volume Expansion

The move began with a liquidity sweep, as BTC pushed above recent highs, hunting stop-losses and inducing breakout traders. This kind of price manipulation is typical of smart money accumulation/distribution zones.

Immediately following that, we observed a volume expansion—a strong signal that institutional players had stepped in, propelling BTC upward with conviction. This expansion pushed price sharply into the 3x Supply Zone, a critical zone of interest from a previous bearish reversal.

🔸 3x Supply Zone – The Turning Point

Once price entered the 3x Supply Zone, bearish pressure resumed. No bullish continuation pattern appeared on the second attempt into this zone—confirming that sellers were defending it aggressively. This area has now been validated as a strong supply barrier, capable of initiating trend reversals.

🔸 Major BOS – Structural Shift Confirmed

Price broke below key support around $120,500, which marked a Major Break of Structure (BOS). This BOS is crucial—it represents a shift from a bullish to bearish market structure and is often the signal that retail longs are trapped.

This BOS was followed by a mini reversal zone, but again, no bullish confirmation appeared there—highlighting market weakness.

🔸 Minor BOS & Trendline Breakdown

Further downside action led to a Minor BOS near $117,800, reinforcing the bearish sentiment. Additionally, the ascending trendline—which had supported BTC’s rally—was decisively broken and retested from below. This confirms a shift in momentum, now favoring sellers.

📍 Current Price Action – Critical Decision Zone

BTC is currently hovering around $117,000, right at a potential demand zone. While there was a brief bullish reaction, the market hasn’t formed a valid bullish reversal pattern yet.

There’s a clear message from the chart:

“We want a bullish pattern here—otherwise, support will break and supply will double.”

In simple terms, unless bulls step in with structure (higher low, engulfing candle, etc.), sellers will likely take over, and price may test deeper support levels.

🎯 What to Watch Next:

✅ Bullish Case:

If BTC forms a strong reversal pattern (e.g., double bottom, bullish engulfing, or inverse head & shoulders), we can expect a short-term recovery back to:

Target 1: $118,500

Target 2: $120,000–$120,500

❌ Bearish Case:

Failure to hold this zone and no clear bullish pattern = likely continuation to the downside, potentially targeting:

$116,000

Even $114,500 in extended moves

🧠 Trading Insights (Educational):

Volume + Structure = Edge

Don’t rely solely on candlestick signals—combine them with structural breaks and volume to get confluence.

Supply Zones Aren’t Just Rectangles

The 3x Supply Zone was powerful because it had historical context, volume convergence, and psychological resistance. These layered factors make zones more reliable.

BOS Isn’t a Trendline Break

BOS means real structural shift. In this case, lower highs and lower lows confirmed the change.

💡 Final Thoughts:

BTC is at a make-or-break level. The recent rejection at the 3x supply zone has shifted the momentum, and buyers must prove their strength now—or risk watching the price unravel further.

Stay patient, wait for structure, and never fight momentum.

Gold’s Chart Update Next Move: Bullish or Bearish?Gold has shown strong bullish momentum 💪 as it breaks through the descending trendline 📉, positioning itself to target the upper liquidity zone 💰. Right now, we have two key scenarios to watch:

1️⃣ Bullish Scenario: If Gold breaks above the 3345 level and closes a solid candle above it 🔝, we could see a move towards 3360 🚀, signaling further upward potential.

2️⃣ Bearish Scenario: However, if Gold sweeps the 3345 zone and fails to maintain the bullish momentum 🔻, we may see a pullback that could push prices lower 📉.

Stay vigilant 👀 and keep an eye on price action for the next big move! 🔍📊

₿itcoin: Pushing Higher—But Watch for a Reversal AheadAfter taking a brief pause over the weekend, Bitcoin resumed its upward momentum early this morning, trading within the blue Target Zone between $117,553 and $130,891. This marks the first time the cryptocurrency giant has traded above the key $120,000 level. Within this zone, and in line with our primary scenario, we continue to anticipate the peak of the corrective wave B rally, followed by a trend reversal to the downside. We expect a significant wave C decline, targeting the lower blue zone between $62,395 and $51,323. As such, prices in the upper blue Target Zone may present an opportunity to take (partial) profits on existing long positions and, where appropriate, to initiate potential short positions as a hedge. These shorts could be protected with a stop 1% above the upper boundary of the zone, given there remains a 35% probability that Bitcoin could break directly above the $130,891 resistance and set a new high as blue wave alt.(i).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

BTCUSD Weekly Analysis : Testing $130K Resistance + Next Target📌 1. Big Picture – Bitcoin is in a Parabolic Uptrend

This chart clearly shows that Bitcoin has shifted from a consolidation phase into a full-blown parabolic rally. That’s not just random growth — it’s an aggressive, momentum-driven market move that usually only happens during major bull cycles.

The curve shown in black — labeled “Black Mind Curve Support” — is your guide here. It's not a simple trendline. It shows how Bitcoin is accelerating upward, and this curve acts as a dynamic support. Every time price dips to it, buyers jump in fast — which shows strong bullish pressure and market confidence.

🔍 2. Blue Ray Broken = Trend Change Confirmed

Earlier, BTC was stuck under the Blue Ray, a long-term resistance trendline. As marked:

“Blue Ray Always Continue Trend”

That means, as long as price stays under it, the market is bearish. But guess what?

BTC broke above it — strongly.

That break confirmed a reversal in long-term structure, and it triggered this massive upward move. This breakout also aligned with a pattern of higher highs and higher lows, further confirming that bulls are now in full control.

🧠 3. Current Situation – Heading Into Mini Reversal Zone

Now BTC is trading around $117,820, and it's approaching the green box labeled Mini Reversal Zone — between $125,000 and $135,000.

Why is this area important?

It’s a psychological zone (big round numbers).

It lines up with historical resistance and previous supply zones.

It’s where smart money might take some profit, so we could see rejection or a short-term pullback here.

🎯 4. Two Scenarios to Watch

✅ Scenario A: Mini Pullback & Retest

BTC hits the Mini Reversal Zone → stalls → pulls back → retests the Black Mind Curve → bounces again.

That’s bullish and normal in a healthy uptrend. If you missed earlier entries, this pullback could be your golden opportunity.

🚀 Scenario B: Breakout of Reversal Zone

If Bitcoin breaks above $135K with strong momentum and closes the weekly candle high, we may see another parabolic rally toward $140K+.

This would mean even stronger buyer interest, possibly driven by FOMO, ETFs, or macro news.

📉 What Could Invalidate the Bullish Move?

Only if BTC:

Breaks below the Black Mind Curve, and

Starts closing weekly candles under $105K–$100K

That would mean the curve is broken, momentum is lost, and we might go into a consolidation or deeper correction.

But for now? No signs of weakness. Trend is strong, volume is rising, and price action is clean.

🧩 Summary of Key Levels

Type Level Notes

Curve Support Dynamic ($105K–$110K) Critical for trend continuation

Mini Reversal Zone $125K – $135K Watch for rejection or breakout

Bullish Target $140K+ If breakout holds above reversal zone

Trend Indicator Black Mind Curve As long as price rides this, bulls are in control

📌 Final Thoughts

This BTC chart isn’t just a random uptrend — it’s a well-structured parabola, powered by strong technical support and clean breakouts. Everything is lining up for a potential monster move, but don’t chase price blindly.

Watch the Mini Reversal Zone closely. If we see rejection, be ready to buy the dip. If we break through with volume — it’s 🚀 time again.

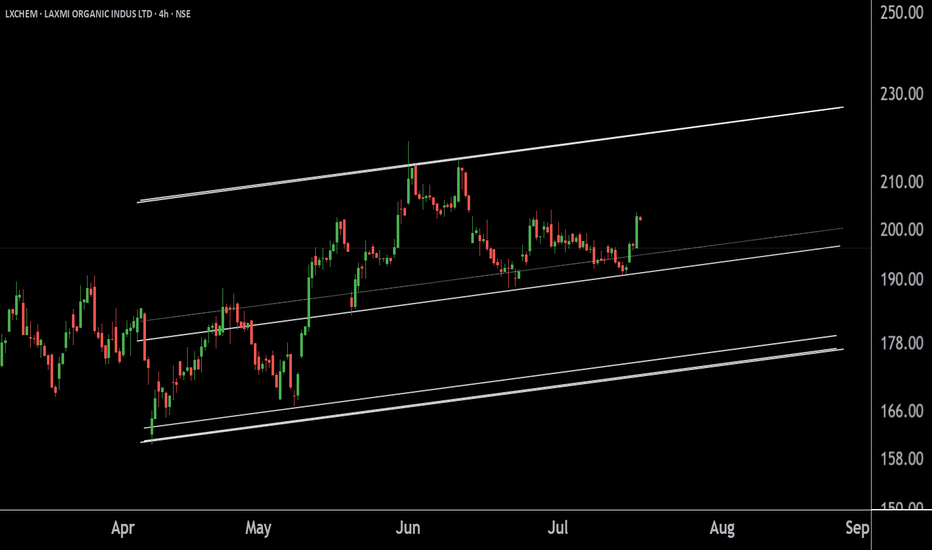

BF UTILITIES LTD 'S KEY LEVEL || BREAKDOWN OR BREAKOUT ??These are two charts of BF Utilities – one on the daily timeframe and the other on the weekly timeframe.

In the first chart : BF Utilities is sustaining near its Law of Polarity (LOP), which is acting as a resistance zone around the 880–890 range.

In the second chart : BF Utilities is forming a Rising Wedge pattern, with the resistance also lying in the 870–880 zone.

If this level is sustain ,then we may see lower price in BF Utilities.If this level is broken, the stock may move towards the upper boundary of the channel.

Thank you !!

RENDER: Is the Correction Over?RENDER has surged nearly 20% at its peak recently. This prompts the question of whether the wave 2 correction low may already be in place. We continue to consider this scenario as our alternative outlook, in which we would anticipate direct gains above the resistance levels at $6.08 and $11.82 (probability: 40%). However, our primary expectation remains that a new low will be set within our magenta Target Zone (coordinates: $5.43–$1.81) before the projected upward moves unfold.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Update on: "XAU USD a little & nice BUY set up" 11-07-2025Quick update : I did "collect" a bit earlier (Unlucky I haven't got possibility to monitor trade all the way down today ), TP @ 3365.405.... Like I said earlier, a little & nice trade!

Also, did hit TP around - 3367.188 as promised ! AAA+ trade !

All analysis is based on technical analysis only...

Short & clear without any "BS"...

I do not believe in fundamental analysis (& if you are desperate for it, then... gold is never going to get cheaper in a very long term & it is a good investment for the next 50-100+ years, if you are happy with "preserving" your wealth, but if you are looking get paid this or next week, then...trading is a way. )

All of you have a lovely weekend ( with a nice profit in the pocket ! )