Chart Patterns

#ETC/USDT The price is moving within an ascending channel#ETC

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 8.41, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 8.70

First Target: 8.95

Second Target: 9.20

Third Target: 9.50

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

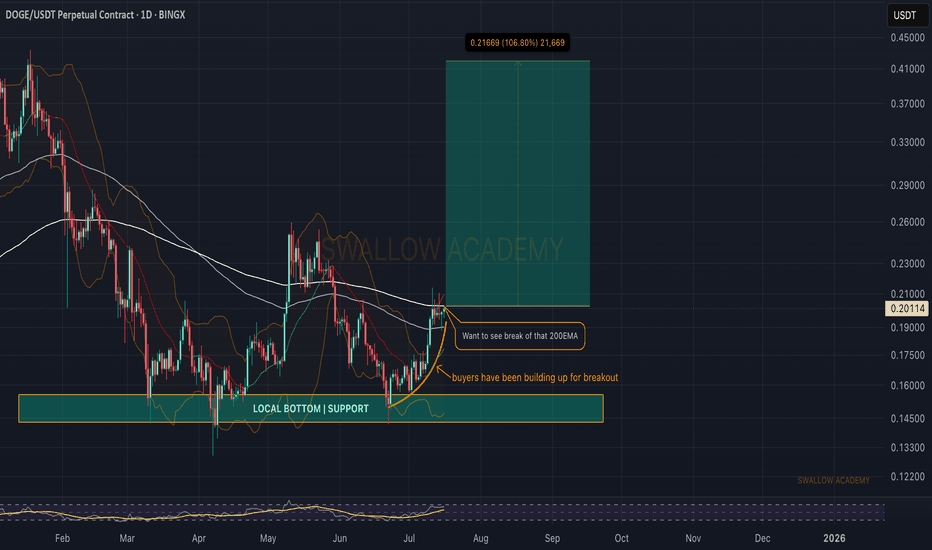

DOGEUSDT at Critical Zone — Reversal Setup or Continuation LowerThe Dogecoin / Tether (DOGEUSDT) pair on the 5-Day timeframe is currently in a macro downtrend phase after failing to maintain a higher-high structure in the upper distribution zone.

Price continues to form:

Lower Highs

Lower Lows

Sustained selling pressure since rejection at the 0.28 area

At the moment, price has returned to a historical demand zone (yellow block) which previously acted as a major accumulation base before the 2024–2025 bullish impulse.

Key zone: 0.099 – 0.084

---

Structure & Pattern Formation

1. Macro Downtrend Structure

Clearly visible:

Distribution at 0.28

Structure breakdown at 0.19

Failed reclaim at 0.153

Continuation lower into demand

This confirms sellers still dominate the higher-timeframe structure.

---

2. Descending Continuation / Bearish Market Structure

Sequence observed:

LH → LL → LH → LL

Every pullback rejected at resistance

As long as there is no Break of Structure (BOS) above 0.153, the trend remains bearish.

---

3. Demand Zone Reaction Area

Yellow block (0.099 – 0.084) represents:

Previous accumulation base

Origin of major bullish impulse

Likely institutional interest zone

An early reaction is visible via a long lower wick (buying response), but no confirmed reversal yet.

---

Key Levels

Resistance

0.116 → Minor supply / recent rejection

0.153 → Structure resistance

0.199 → Mid distribution

0.284 → Macro supply

Support / Demand

0.099 → Upper demand

0.084 → Extreme demand

0.071 → Macro low invalidation

---

Bullish Scenario

Bullish continuation is valid if demand holds.

Confirmation steps:

1. Price holds above 0.099

2. Forms a base / sideways accumulation

3. Break & close above 0.116

4. BOS above 0.153

Upside targets:

0.153 (major resistance)

0.199 (mid-range)

0.284 (macro supply)

Expected structure:

Double Bottom / W pattern

Accumulation range

Formation of Higher Low

If volume enters at demand, mid-term reversal potential increases.

---

Bearish Scenario

Bearish continuation occurs if demand fails.

Main triggers:

Daily / 5D close below 0.084

Lack of significant buyer reaction

Consequences:

Macro structure breakdown

Liquidity sweep of prior accumulation

Downside targets:

0.071 (macro low)

0.060 – 0.055 (next historical support)

If this plays out → it signals distribution is not finished and the market enters a deeper markdown phase.

---

Conclusion

Macro trend: Bearish

Current position: Inside major demand

Decisive zone: 0.099 – 0.084

Most likely current phase:

Re-accumulation or

Continuation distribution before final leg down

Reaction inside this zone will determine whether DOGE prepares for a mid-term reversal or continues printing new lows.

#DOGE #DOGEUSDT #Dogecoin #CryptoAnalysis #TechnicalAnalysis #Altcoin #CryptoTrading #SupportResistance #SupplyDemand #MarketStructure #TradingViewIdeas #CryptoMarket #BullishScenario #BearishScenario #Accumulation #Distribution

EUR/USD Has a Bull Trap_Watch 1.1918 ShoulderHello guys,

I see a bull trap in the EUR/USD currency pair and explained my trading plan for the upcoming week in this video. I hope you like it, and do not hesitate to share your thoughts with me. I am waiting for your comments, so let me know what you think about this bull trap.

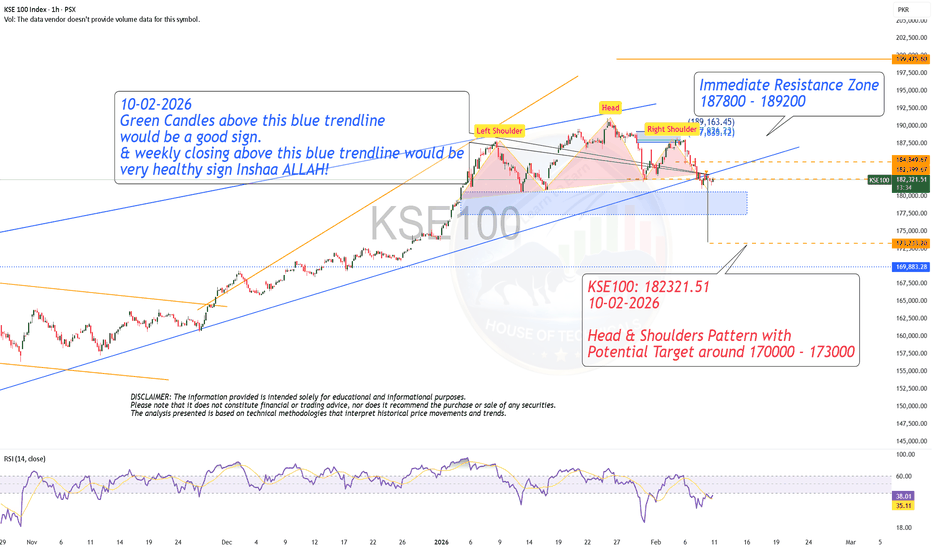

EURJPY:Head and Shoulders Breakdown, Bearish ContinuationEURJPY has formed a Head and Shoulders reversal pattern on the H4 timeframe, with a confirmed neckline break around the 181.0-181.2 area, signaling a shift in short-term structure toward the downside.

Following the breakdown, price moved below key moving averages, and the current bounce appears to be a technical retest of the neckline region.

This zone also aligns with the 0.705-0.79 Fibonacci retracement area, increasing the probability of continued bearish momentum. The main scenario favors further downside toward 178.4, with extended targets near the 176.7-176.5 support zone, which represents a stronger higher-timeframe level. As long as price remains below 182.1-182.3, sellers maintain control.

The alternative scenario would activate if price reclaims and holds above 182.3, invalidating the pattern and reopening the path toward 183.5-185.0.

This is not investment advice. Trading decisions should be based on confirmed structure and price reaction.

Weekly Bias — 16 FebruaryMarkets rarely break cleanly higher from that setup without shaking out late longs first

Trend is still structurally bullish

From a swing trader perspective, risk/reward is cleaner short than long at these highs

Upside continuation from $600 to $650 is +8%

Downside rotation to $545 is -9%

Downside probability is higher near resistance than upside breakout probability

Breadth hasn’t collapsed — so this is not broad panic, it’s selective leadership, or a narrowing tape & that increases odds of fast air pocket pullback before continuation

The tape is leaning toward distribution before continuation

Not full trend reversal, but a liquidity flush to reset positioning

Given resistance, probability favors expansion down first

Now volatility is re-awakening = unstable equilibrium

If momentum expands & price pushes slightly above recent highs, then closes back inside range with larger daily volume, it's bull trap with volatility ignition

You want to be positioned when that happens — not after

If you buy calls here without breakout, you’re paying for expansion that may go the wrong way

This is not a dip-buy environment

This is sell the rips inside a developing corrective structure

Given weekly rejection, distribution signals, short-term edge still favors downside volatility expansion

Short squeezes are possible

That’s short-term bounce energy inside a broader weakening momentum structure

Trend continuation higher unlikely without reset

Fair value likely sits closer to $560–$575

This was prior consolidation + breakout base formed

Markets revert to value before continuation

Markup → distribution → early markdown, not crash, but a 6–10% pullback probability rising

Most traders will look at momentum indicators & think, “oversold, bounce incoming"

That’s lazy analysis & context matters

Oversold inside a range ≠ bullish

In a strong uptrend oversold = buy dip

In a topping/distribution phase oversold = early downside momentum building

We are no longer in a clean upper-band walk

We’re in lower high at $636, rolling daily structure & momentum divergences everywhere

Oversold here is momentum confirmation, not reversal signal

This is still controlled selling, but controlled selling becomes expansion once support breaks

$600 is the pivot

Break $600 with expanding daily range → downside accelerates

Hold $600 & reclaim $615 → you get chop/bounce trap

Ideal entry

Daily close under $600

Range > prior 5 day average

RSI < 45

That’s when momentum synchronizes

Then target $580 → $565

If price reclaims $620

RSI reclaims 55–60

Then this becomes failed breakdown

Until then, oversold is not bullish — it’s pressure building

Momentum is shifting downward under resistance & we're one structural break away from real expansion

Below $592 (S3), the structure opens to $580 fast

Then $565 pocket

Then $550 shelf

Once S3 fails on a daily close, Gamma likely shifts negative

That’s when speed increases

Weekly timeframe bull traps lead to multi-week downside

If weekly momentum shifts, first real magnet isn’t $580 — it’s the mid-$560s/$540s area

If price pops back toward $620–$625

Fails to reclaim $630

Prints another upper wick weekly

That confirms institutional selling into strength

Weekly momentum is rolling over (RSI lower high vs price marginal high)

MACD histogram fading while price stalls near highs

Volume expanded into the recent peak — not what you want for continuation

This appears like a late-cycle wave 5 exhaustion → transition into multi-week corrective structure

Not a crash setup, but definitely corrective risk

On the daily chart

Lower high $636 → failure to expand

Breakdown from $629 → $607 impulse

Bear flag forming between $600–$616

Price riding below short MAs

Daily momentum rolling over

MACD negative cross building

$616–$618 = supply

$621 pivot = major rejection level

$600 = psychological + short-term support

$592 = S3/structure breakdown

$580 = real demand

We are compressing below VWAP/short MAs & that’s bearish positioning, not bullish compression

This looks like a bear flag inside early weekly correction

Clear descending channel

Lower highs stacking ~$617 → $615 → $612 → $608

Momentum making weak bounces

MACD failing to expand on green pushes

RSI cannot hold >50

No hidden bullish divergence worth trading

If $601 fails again, flush to $598 → $595

When tech stalls while defensives hold — correction probability increases

SPY still holding highs, but momentum fading

DIA stronger (defensive rotation)

IWM stalling under prior highs

XLK not expanding

XLF rolling

XLY stalling

This is narrowing leadership

Given structure, dealers likely short Gamma under $600

25Δ puts are are sitting near $590

25Δ calls near $630

OI clustered around $600 & $620

IV > 20d HV → long premium needs directional conviction

Put IV > call IV → skew favoring downside hedge

If $600 breaks → acceleration

Given recent realized vol compression

Rough weekly 1σ likely around ±15–20 points

So upside 1σ $620–$625 & downside 1σ $585–$590

Market is sitting mid-range

That means better risk/reward is shorting failed rallies than buying dips

1. Bull Trap

$616–$621 reclaim without momentum expansion

Especially if volume fades

2. Bear Trap

Hard flush to $590–$592 that immediately reclaims $600

Until one of those triggers — bias is lower highs

The market is leaning

Distribution under $620

Preparing for test of $592

Possible weekly move toward $580 if $600 decisively breaks

Not crash — controlled correction

1. Break $600 → long Puts

Target $592 & $580 in extension

Invalidation on reclaim of $607

This gives clean expansion move

2. Failed bounce into $616–$620 → long puts

Entry on rejection candle + momentum rollover

Target $600 retest & $592 in extension

3. Daily close > $621 with strong breadth → long calls

Target $629 & $636 in extension

This would invalidate bear flag

Until then, calls are countertrend scalps only

Your edge right now is fading weak upside, playing breakdowns & avoiding emotional dip calls

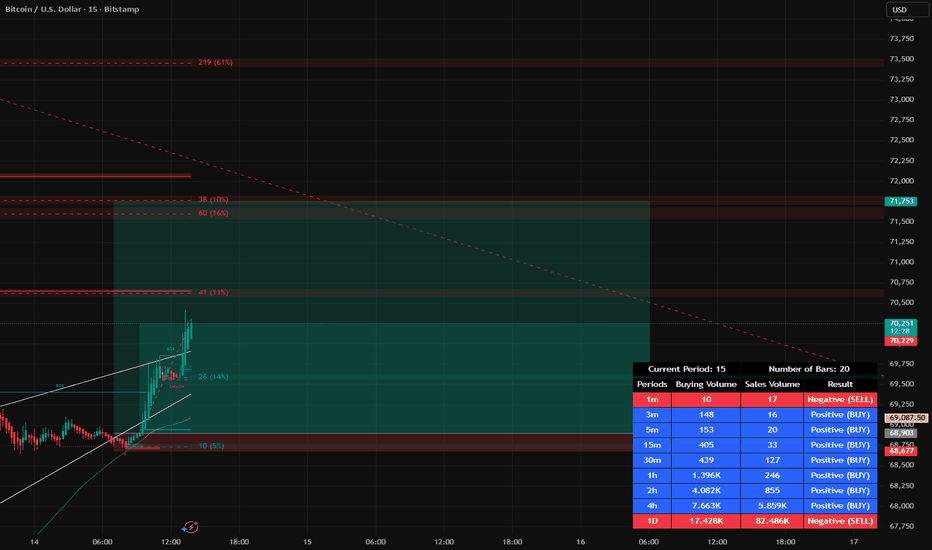

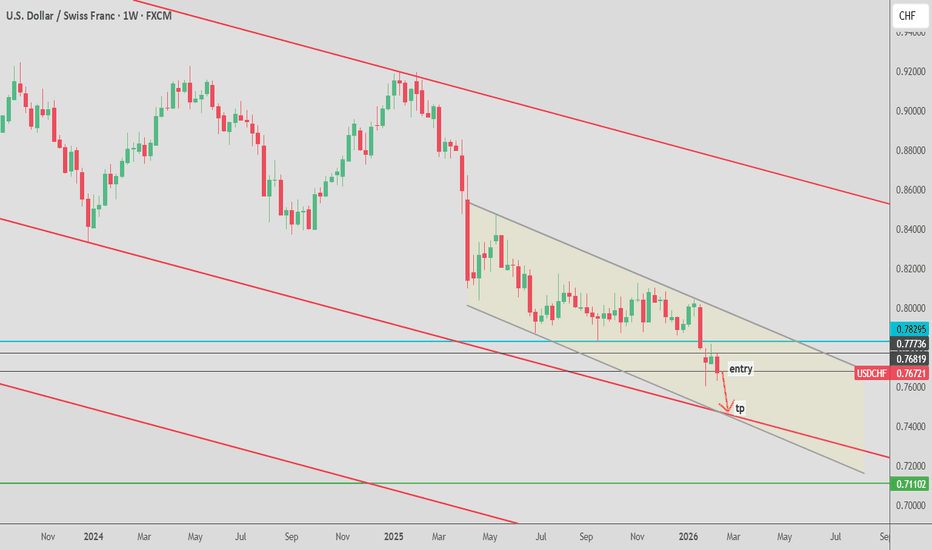

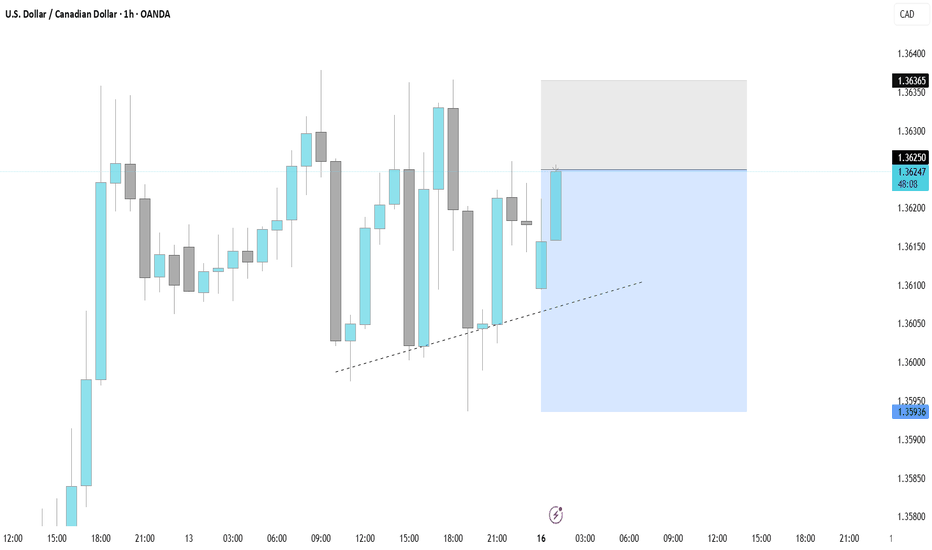

USDCAD — Clean Breakdown Setup Toward 1.35000USDCAD presents a very interesting opportunity this week. It looks like one of those setups where, after a clear break of support, we can enter on the pullback.

In my view, this is not a situation that requires multiple confirmations — the breakdown itself could be sufficient reason to enter a short position.

The potential target for this move could be around 1.35000.

Personally, I’ll be closely monitoring this pair at the start of the week.

#Pouyanfa🔥

$TRIA (1H) price analysis.BYBIT:TRIAUSDT is currently trading in a key decision zone, with price approaching major demand areas that will determine the next directional move. Based on current market structure and liquidity positioning, two clear scenarios are in play.

Scenario 1 – Bullish Continuation:

If price makes a healthy retracement into the Buying Breaker Block at $0.02052–$0.01853 and shows bullish confirmation, buyers are likely to step in. Holding this zone keeps the structure bullish and opens the path for upside continuation toward higher resistance levels, with momentum targeting the $0.025–$0.028 range.

Scenario 2 – Deeper Pullback / Trend Risk:

If price fails to hold the breaker block and takes a sharp retrace into the Last Buying Zone at $0.01449–$0.01347, this area becomes the final support for bulls. A strong reaction here can still lead to a bullish reversal; however, a clean breakdown and acceptance below the last buying zone would officially confirm a bearish trend, signaling a shift in market control to sellers.

Summary:

Holding above demand zones favors bullish continuation, while a loss of the last buying zone confirms bearish market structure. Traders should wait for confirmation at key levels to manage risk effectively.

EURUSD — Watching the Midline for a Breakout SignalThe euro deserves a spot on this week’s watchlist. For nearly a week now, on the 15-minute timeframe, price has been stuck inside a range and has not been able to properly break and hold above the range midline.

We remain buyers on EURUSD, as the higher timeframe trend is still bullish, and we are looking for long signals.

If price can close above the range midline — preferably with a strong 1-hour candle — it could act as a solid trigger for a long position and potentially lead to a breakout from the top of the range.

However, if the range breaks to the downside, we will need to reassess the structure and carefully evaluate the selling momentum before making any decisions.

#Pouyanfa 🔥

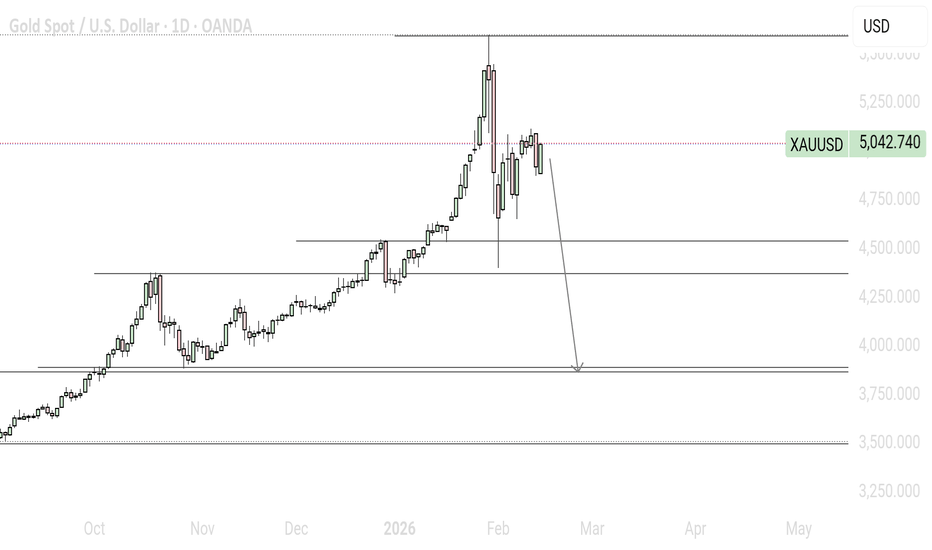

Chart Analysis – Bullish Reversal Toward Resistance

The 1-hour chart of Gold vs US Dollar (XAU/USD) shows a strong bullish recovery after a sharp sell-off. Price has reclaimed a key demand zone and is now pushing toward a major resistance level.

🟢 1. Demand Zone Holding (Bullish Structure Intact)

Price sharply dropped into the 4,880–4,920 support area

Strong rejection from the lows (highlighted reaction zone)

Higher low formed after the bounce

Momentum shifted bullish with consecutive higher highs and higher lows

This confirms buyers stepped in aggressively at discount levels.

🔴 2. Stop Loss Zone

The marked 4,930–4,950 region acts as invalidation.

A break below this zone would:

Disrupt bullish structure

Indicate potential continuation downside

Suggest failed breakout attempt

As long as price remains above this level, bullish bias remains valid.

🟩 3. Current Resistance Zone

Price is now testing 5,020–5,060 supply area

This zone previously acted as consolidation and breakdown area

Reclaiming and holding above it turns it into support

A clean breakout and close above 5,060 increases probability of continuation.

🎯 4. Upside Target

If breakout confirms:

Next major resistance: 5,120–5,150

Strong momentum could extend toward the psychological 5,200 region

📊 Technical Structure Summary

Level Type Price Zone Meaning

Major Support 4,880–4,920 Strong demand reaction

Invalidation 4,930–4,950 Stop loss area

Breakout Level 5,020–5,060 Key resistance flip

Target Zone 5,120–5,150+ Upside objective

📌 Bias: Bullish Above 4,950

Holding above support → continuation likely

Break and close above 5,060 → acceleration expected

Failure below 4,930 → bearish pressure returns

If you'd like, I can also provide:

A short trading plan version

Risk-to-reward breakdown

Intraday scalp vs swing perspective

Or convert this into a caption for social media 🚀

USOIL: Bulls Will Push

The analysis of the USOIL chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

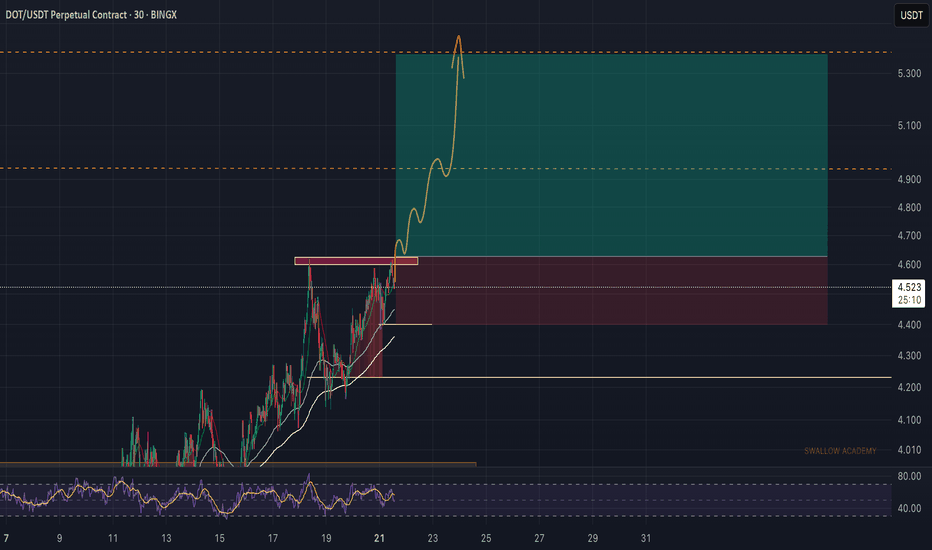

Dogecoin (DOGE): About To Breakout and Start Strong Bullish MoveDogecoin has been on our radars for quite some time, and we had a nice bounce since last time (from the local bottom).

Now we are approaching the breakout point (200 EMA) area, where upon seeing the break we should start a strong upward movement.

Swallow Academy

Shiba Inu (SHIB): Looking For Breakout | Do Not Miss It...Do not miss the breakout that we might see about to happen. We are looking for a breakout on SHIB coin where once we get that breakout from the zone of accumulation (sideways channel), we are going to look for further movement to upper target zones from there!

Swallow Academy

SPY On The Rise! BUY!

My dear subscribers,

SPY looks like it will make a good move, and here are the details:

The market is trading on 681.65 pivot level.

Bias - Bullish

My Stop Loss - 678.64

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 687.62

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK