Chart Patterns

NQ UpdateSo weird, I figured they'd pump NQ along with the other indices ahead of the Supreme Court decision, but it wound up being a tech dump and sector rotation. I thought it'd go and fill the gap above, but it looks like it wants to complete the pennant formation first.

What's also weird is that foreign markets don't seem to care.

We'll see what happens when the market opens. Supreme Court conference usually starts at 10am eastern. They may not even make a decision yet.

No updates before the market opens, it's all about if the Supreme Court has made a decision, and if they decide to nullify the tariffs.

BEATUSDT – Approaching the Most Critical Support Zone🛡️ BEATUSDT – Approaching the Most Critical Support Zone

After a prolonged downtrend from the all-time high above $4.50, BEATUSDT is now testing its most significant support zone around $0.47–$0.50.

🔍 Technical Overview:

Price has dropped over 10% today, reaching a historically strong support level.

Volume is picking up near this zone, suggesting increased market attention.

RSI (14) is deep in oversold territory, with two prior bearish signals now potentially exhausted.

📈 Possible Scenarios:

Bullish case: If this support holds, we could see a rebound toward the $0.75 resistance.

Bearish case: A breakdown below $0.47 may open the path toward $0.35 or lower.

🎯 Trade Setup:

This zone offers a high-risk/high-reward opportunity. Traders may look for bullish confirmation (e.g., reversal candlestick or RSI divergence) before entering. Risk management is key—consider tight stop-losses below the support.

Bitcoin Daily update - support retest failed but all not lost

PA came back down to retest the previous resistance and it failed as support.

Bulls have caught the fall for now and we wait to see what happens today.

PA currently sitting on a line of Support on the VRVP

That is a shorter term 4 hour chart showing more details for the near term

The Orange dash line is the Value Area High. Hopefully this wil hold.

Below that, we have the POC, Point of Control at 87500 area.

The 4 hour MACD

We can see the MACD has fallen below neutral and the histogram shows that fall not enfing soon. Lets see what happens when IF the Red signal line hits neutral.

The Daily MACD

We can also see the daily MACD turning over a little as the Histogram has turned white for 2 days

A lot points towards PA maybe dropping back to the High to Mid 80K mark but I think we may see that reversed a little today.

We Just have to wait and See.....

Time always Tells

POLUSDT Relief Bounce vs Bearish ContinuationPOLUSDT remains in a well-defined falling channel, with overall structure still favoring downside continuation. Price is currently staging a relief rally, pushing into a crucial supply zone that will act as a major decision area. A clear rejection from this zone would align with the prevailing bearish structure and favor continuation toward the highlighted downside targets. Conversely, a successful break and acceptance above supply could invalidate the bearish channel and trigger a stronger upside rally.

Reaction at this level will be key in determining the next directional move.

NIFTY • 1D - 5th Wave & EDTNIFTY appears to be forming an Ending Diagonal Top (EDT) structure within Wave-5.

The current price is respecting the upper wedge boundary and showing rejection signals.

If the price breaks below the rising trendline, a short opportunity opens with a clear risk-defined setup.

Disclaimer

This analysis is for educational and informational purposes only.

It is not investment advice, and I am not a SEBI-registered advisor.

Trading in financial markets involves risk.

Please do your own research or consult a certified financial advisor before taking any trades.

You are solely responsible for your trading decisions.

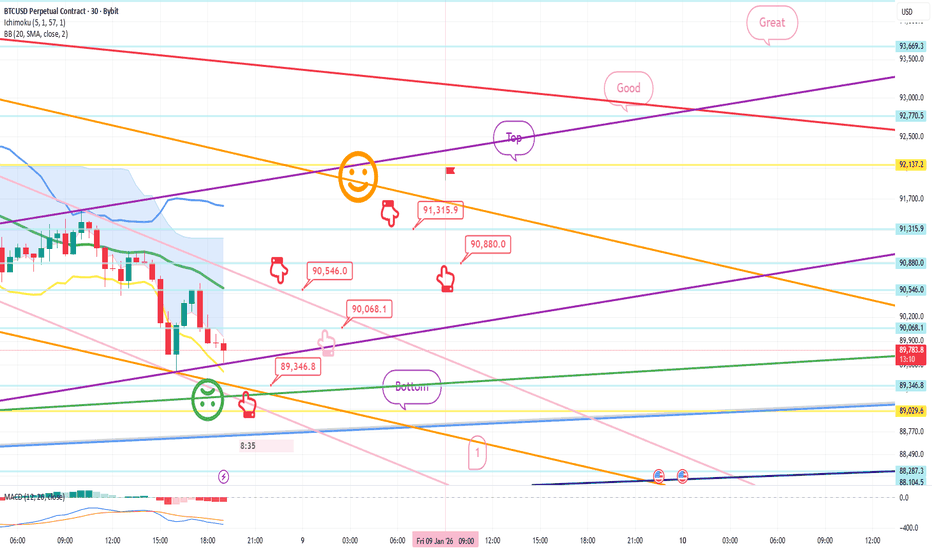

JENUARY 8 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

The Nasdaq indicator will be released shortly at 10:30 AM.

*When the red finger moves,

this is a one-way long position strategy.

1. $89,346.8 is the entry point for a long position.

Stop-loss price is set when the green support line is broken.

(It must be touched before 9 PM,

to complete the 6+12 pattern and trigger an uptrend.)

2. I've marked the wave path with the finger in the middle.

The short-term target price is $90,546 -> $91,516.9.

After re-entering the long position at $90,880,

the target price is in order from Top -> Good -> Great.

If it touches the bottom today,

the mid-term pattern will be broken again,

creating the possibility of further declines. Please be careful.

The bottom section is connected to the uptrend line, so it's best to maintain a long position.

The bottom section is open up to section 1.

Please note that my analysis up to this point is for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

[LONG] XAUUSDT - Shinning GOLD?Hello traders!

Gold is expected to move higher if it successfully breaks out above the resistance area.

Make sure the candle closes above the resistance before entering a LONG position.

Targets are already set — and don’t forget to place your Stop Loss accordingly!

Happy hunting! 🚀✨

From Balance to Expansion | Reading Bullish Market PressureMarket Context (2H – EURCAD)

This chart highlights a clear transition from balance into expansion , driven by strong bullish market pressure .

Price initially developed within a horizontal channel , forming repeated same highs and same lows , reflecting equilibrium between buyers and sellers.

That balance was eventually resolved to the upside, followed by the development of an ascending channel , where price continues to form higher highs and higher lows — a typical structural outcome when buy-side pressure takes control.

Price is now reacting within the ascending structure, making this area important to observe from a pressure perspective.

This is not a prediction, but an observation of how market pressure interacts with evolving structure .

📈 Scenario 1 – Continuation Within Ascending Structure

A continuation higher from the current reaction would remain consistent with:

• Acceptance within the ascending channel

• Higher low structure holding

• Bullish pressure remaining dominant

📈 Scenario 2 – Deeper Pullback

Price may retrace further toward the lower ascending trendline before attempting continuation.

As long as this trendline holds, the broader bullish context remains intact.

⚠️ Pressure Reassessment

If price breaks and sustains below the ascending trendline and begins forming lower lows , bullish pressure becomes less evident and a potential shift toward bearish pressure would require reassessment.

🧠 Key Observation

Patterns describe structure, but market pressure explains why expansions occur after balance .

Learning to recognize these pressure shifts helps frame market behavior without relying on indicators or predictions.

(Those studying market pressure concepts will recognize this transition.)

⚠️ Educational & Analytical Use Only

This analysis is shared strictly for educational and analytical purposes.

No financial advice, trade signals, or guarantees are provided.

All decisions remain the sole responsibility of the reader and should align with their own ethical, legal, and religious principles.

Silver (XAGUSD) New All Time Highs?Silver has staged an impressive rally, pushing back toward the $80 region before seeing a low-timeframe correction, with price now retesting the value area high, which previously flipped into support.

As long as price continues to hold this level on a closing basis, it keeps the bullish structure intact and opens the probability for continued upside.

From a technical and market-structure perspective, Silver remains bullish and positioned for continuation.

A sustained hold above this key support could fuel a further rotational move higher, keeping new highs and extended upside potential firmly in play as momentum remains in buyers’ favour

Bitcoin Is Holding Demand — Bulls May Be Setting Up the Next Price is reacting positively from a well-defined demand zone around 89,700–90,000, where selling pressure has been absorbed after the recent pullback. Despite the prior correction, the broader structure remains constructive as buyers defend this key area.

A sustained hold above the demand zone opens the door for a bullish recovery toward 91,400–92,300, where price may pause near the EMA and prior intraday resistance.

If bullish momentum strengthens and price breaks and closes above 92,300, the upside continuation scenario comes into play, targeting 93,200–93,700 as the next expansion zone. As long as price holds above 89,700, the upside scenario remains the primary focus.

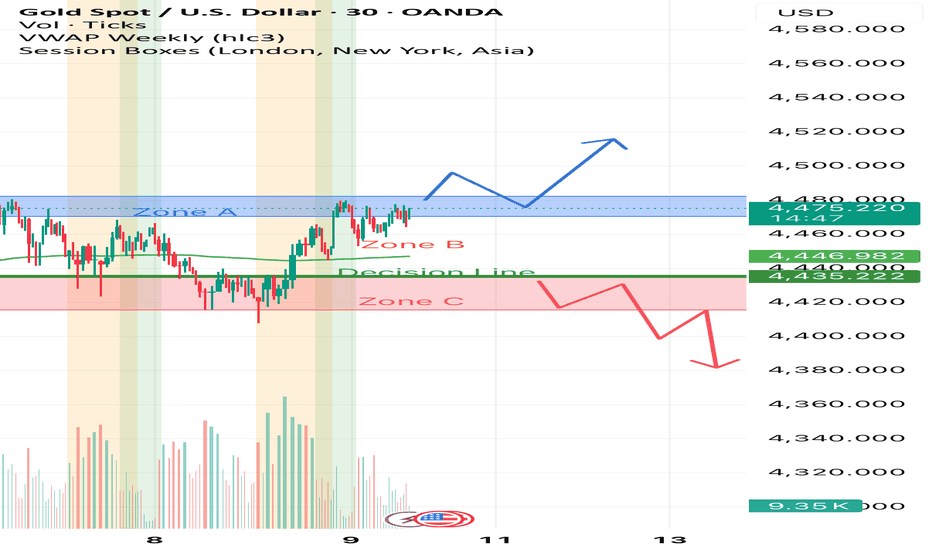

Gold Decision Map – Today (09/01/2026)Gold Decision Map – Today (XAUUSD)

🧩 Market Context

Current price action reflects a re-pricing phase following a failed upside breakout.

Momentum has not confirmed continuation, and no clear directional impulse is present.

📌 Conclusion:

The market is in a decision phase within defined price ranges, not in a confirmed trend.

⸻

🗺️ Key Price Zones

🔵 Zone A — Upper Rejection Zone

4465 → 4485

• Represents the current ceiling of price action

• Any move into this zone is considered corrective, not trend-driven

📌 Bullish continuation requires a clean break and acceptance above 4485.

⸻

🟡 Zone B — Balance / Rotation Zone

4435 → 4465

• Area of balance and position rotation

• No directional edge

• Behavior-driven, not predictive

📌 This is not a no-trade zone,

but it is not a directional decision zone.

⸻

🔴 Zone C — Lower Decision Zone

Below 4435

• Holding below this level keeps downside pressure active

• Acceptance below 4410 signals a transition into a weaker structure

🎯 Downside references:

• 4390

• then 4360

⸻

🔍 What Are We Waiting For?

🟢 Bullish Scenario

• Break above 4485

• Followed by:

• Successful retest, or

• Clear price acceptance above the level

➡️ Targets:

• 4515

• then 4545

📌 Without acceptance, upside remains corrective only.

⸻

🔴 Bearish Scenario

• Break below 4435

• Followed by:

• Failure to reclaim the level

• Price acceptance below it

➡️ Targets:

• 4410

• 4390

• 4360

⸻

🟡 Between 4485 ↔ 4435

• Rotational / range-bound market

• Directional bias is postponed

📌 Range trading is possible only for short-term traders,

with reduced size and strict risk control.

⸻

🧭 Final Takeaway

• Above 4485 → bullish only with acceptance

• Below 4435 → bearish only with acceptance

• Between → decision delayed

Direction is not predicted.

Direction is confirmed through price behavior.

Bullish bounce setup?NZD/CAD is falling towards the pivot, which is slightly above the 61.8% Fibonacci retracement, and could bounce to the 1st resistance.

Pivot: 0.79333

1st Support: 0.78954

1st Resistance: 0.79992

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

S&P500 policy uncertainty from TrumpMarket reaction drivers

Trump’s housing policy post triggered a risk sell-off, particularly in real-estate and related stocks. His plan to ban large institutional investors from buying single-family homes spooked the sector and weighed on broader sentiment. Blackstone and other home-related names slid sharply on the announcement.

Defence stocks were also hit after Trump said he would block dividends and stock buybacks for defence contractors unless they increase production and maintenance — dragging names like Northrop Grumman, Lockheed Martin and RTX lower. (From your text)

Later, a Trump request to boost the 2027 US defence budget from $1 trn to $1.5 trn offered a potential positive catalyst for defence firms after the close, partially counterbalancing earlier negativity. (From your text)

Index performance

The S&P 500 closed lower as the renewed policy risk pressured markets. The headline index fell modestly, but the decline would have been worse without gains in mega-cap tech (the Magnificent 7 outperformed), while the equal-weight S&P underperformed, showing broader sector weakness. (From your text)

Sector and style effects

Real estate and private equity names underperformed due to the housing policy news.

Capital goods and defence stocks lagged on policy risk and restrictions on payouts.

Tech leaders provided relative support, helping to limit the overall S&P drawdown.

Oil & energy sectors may see positioning around access to Venezuelan crude — with US refiners potentially benefiting if imports are expanded — adding a nuanced catalyst for energy stocks.

(Bloomberg)

Overall tone for S&P 500 trading

Risk-off bias: policy uncertainty from Trump’s housing and defence remarks pressured cyclical and value sectors.

Selective strength in growth/tech: large cap tech helped cap losses.

Cross-market complexity: commodity and energy setups (Venezuelan crude access talks) add nuance to sector rotation.

Key Support and Resistance Levels

Resistance Level 1: 6942

Resistance Level 2: 6965

Resistance Level 3: 6986

Support Level 1: 6873

Support Level 2: 6847

Support Level 3: 6826

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

The Yield Curve: A Forex Trader’s Early Warning SystemTradingView added the Yield Curves tab (found at the bottom right of your chart) to their UI last Year and constantly improved upon it. At first glance, it looks like a tool just for bond traders. But even though I am not a bond trader (yet), I started wondering: Can we use this as an early indicator for Forex trading?

The short answer is YES . While Forex traders usually watch price action and news, bond yields often move before the news hits the screen. In this write-up, I will show you how to use this "hidden" signal to stay one step ahead of the market.

First things first: How to Recreate My Charts

If you want to track this yourself on TradingView, search for these two symbols:

- US10Y - US02Y: This shows the "Spread" the gap between long and short rates.

- FRED:DFF: This shows the actual daily interest rate set by the Federal Reserve.

By overlaying these, you can see exactly when the bond market (the Spread) moved before the Fed (the Rate).

The Basics: What is a Bond Yield? (The Seesaw Rule)

To understand the chart, you only need to know Bond prices and yields move like a seesaw.

- When traders buy bonds: The price goes up, and the yield goes down.

- When traders sell bonds: The price goes down, and the yield goes up.

Why do we care? Yields represent the "market's opinion" on interest rates. If yields are falling, the market is betting that the Fed will cut interest rates soon. If yields are rising, the market expects rates to stay high. Because interest rates drive currency value, the yield curve is the ultimate indicator of what "Smart Money" is doing before the news goes public.

The Simple Math (The "Seesaw")

Bond yields and bond prices move on a seesaw. When one goes up, the other must go down because the interest payment (the "coupon") is fixed.

Think of a bond as a fixed contract that never changes. If you own a bond that pays exactly $50 a year, that $50 is locked in.

- Scenario A: You buy a bond for $1,000 that pays $50 interest. Your yield is 5% ($50 / 1,000).

- Scenario B: (Low CPI): Suddenly, a low inflation (CPI) report comes out. Investors get excited because they think the Fed will cut interest rates soon. They rush to buy your bond. Because everyone wants it, the price of your bond rises to $1,100.

The Result: The bond still only pays that fixed $50. But because the new buyer paid $1,100 for it, their yield is now only 4.5% ($50 / 1,100).

Simple English: You are paying more money (higher price) to get the same fixed reward. Therefore, your percentage of profit (yield) goes down.

Summary so far:

Low CPI: The market anticipates lower interest rates in the future.

The Action: Traders rush to lock in today's higher rates by buying bonds.

The Result: Bond prices go up.

The Math: Higher price for the same interest = Lower Yield.

This is why you will see the US10Y yield drop on your TradingView chart the second a "cool" inflation report hits the news.

Setting the Scene: The "Early Indicator" Theory

In a healthy economy, a 10-year bond should pay more than a 2-year bond. Why? Because lending money for 10 years is riskier than lending it for 2 years. This is a "Normal" curve.

An Inverted Curve happens when the 2-year yield is higher than the 10-year yield. This is the market’s way of saying: "We think the Fed has pushed rates too high for the 'Now,' and they will be forced to cut them in the 'Future' to save the economy."

The Timeline: 2019 to Today (Context to the Chart Above)

1. Aug. 2019: Pre-Covid Jitters The spread touches 0. The US-China trade war was slowing global growth. The bond market warned of a slowdown months before the pandemic.

2. Mar. 2020: Pandemic Shock The Fed cuts rates to 0.1%. The spread spikes as the market expects a massive recovery.

3. Mar. 2021: The "Transitory" Trap Inflation starts rising. The Fed says it’s temporary and keeps rates at 0.1%, but the spread starts falling. The bond market knew the Fed was wrong and that rate hikes were coming.

4. Mar. 2022: The Pivot The Fed finally hikes rates. The "Cheap Money" era ends. The 2-year yield spikes to keep up with the Fed.

5. Jun. 2022: Inflation Spike (KEY EVENT) (9.1%) Inflation hits a 40-year high. This is the "Panic Point." Investors realize the Fed must hike aggressively to break inflation.

6. Jul. 2022: The Great Inversion The spread falls below 0. The market signals a recession is coming. For the first time since 2008, the market decided that the "Now" was more risky than the "Future.”

7. Jul. 2023: The Bottom (KEY EVENT) (Soft Landing Bet) The spread hits its lowest point (-1.08%). Inflation drops to 3%, but jobs stay strong. The market starts betting that we might avoid a crash. The spread begins to rise.

8. 2022–2024: The Long Wait The longest inversion in history (26 months). The economy was "immune" to high rates because of 3% mortgages and corporate cash.

9. Sep. 6, 2024: The Un-Inversion (KEY EVENT) (Soft Landing Confirmed) The Golden Signal. The curve turns positive. This wasn't because of a crash, but because inflation was defeated. The bond market confirmed the Soft Landing 12 days before the Fed’s first 0.50% cut.

10. Jan. 2026: Normalization We are here today. The spread is stable at +0.68%. The Fed rate is 3.50%. The curve is healthy again.

The Takeaway

The Rule: The bond market represents "Smart Money."

The Signal: A rising spread usually means the market expects rate cuts or economic strength.

For Forex: If the spread rises before the Fed cuts, it’s an early signal to look for Dollar weakness.

The next time you see the US10Y - US02Y line making a big move on your chart, don't wait for the Fed meeting. The bond market has already made its decision. If the spread is rising, the market is "pricing in" a weaker dollar or a rate cut. As Forex traders, that is our cue to look for setups.

Think of it this way: The spread is a "Confidence Meter."

Falling Spread: "We are worried the Fed is hiking too much."

Rising Spread: "We are excited the Fed is finally cutting rates to help the economy."

*** Congratulations for making it this far! Let me know in the comments if you use or plan to use these early indicators.

GOLD XAUUSD WE are watching 4500 and 4519-4522-4525 zone level sell zone for a potential reaction.

AT 4500, 4519-4522-4525 supply roof am looking for sell based on 15min confirmation order and extended buy could be the retest of the current all time high.

1300-1400 newyork time defended yesterday and buyers return on bullish sentiment., if the break and close 30min current supply roof ,i will wait and watch 4500 and extended layer is 4519-4522-4525 sell zone,we are close to 4500 .watch that zone and a possible extension into 4519-4522-4525

what is GOLD XAUUSD ??

Gold (Au) is a chemical element and dense, malleable transition metal prized for its lustrous yellow hue, exceptional conductivity, and resistance to corrosion.

History as Store of Value

Gold has served as a store of value for over 6,000 years, from ancient Egyptian tombs (c. 4000 BCE) symbolizing immortality to Lydian coins (600 BCE) enabling standardized trade across empires like Rome (aureus) and Byzantium (solidus, stable 700+ years). The 19th-century gold standard anchored global currencies until 20th-century abandonments, yet gold retains purchasing power

Tier 1 Status Clarification

Gold classifies as a Tier 1 asset under Basel III banking rules , with 0% risk weighting for physical bullion, equivalent to cash for capital reserves, enhancing bank balance sheets amid fiat volatility. This elevates it from prior Tier 3 status, affirming its role as "money again."

#GOLD #XAUUSD

GOODLUCK

just atetrade hit tp for a 1:3

gotta start being more discipline posting my trades but I get lazy with it lolol. IDK why I even post, probably because trading is lonely AF and I have no one to talk to about this

almost complete with my stage 1 funded account challenge with funding pip

after getting funded, going to risk 0.5% per trade so I get 20 tries. think about it, if you have 20 tries that means you always have a buddy with you. you have 10 fingers and your buddy has 10 fingers. 2 sticks are always stronger than 1. which is risking 1% per trade because the max loss limit is 10%

piece out everyone! I wish everyone love and abundance (:

Jesus is King 👑

Bullish set up SilverI'm currently shorting silver with TP's between 73 and 72.

I can see a few things possibly happen with XAGUSD.

Price could drop and tap into the OB or bounce back from the lower edge of the blue bar following the yellow arrow. Or price could retract first and follow the path of the red arrow.

Either way, my bias on silver is super bullish (like all the precious metals rn).

There is a high demand for silver in the world for all kinds of applications. On top of that are the uncertainties in America and China's policy towards silver supporting the bull run.

Multi-Pattern Transition | Reading Selling Pressure in StructureMarket Context (30M – EURJPY)

This chart highlights a multi-pattern confluence where selling pressure dominates the broader structure .

Price initially developed within a descending channel , reflecting sustained bearish pressure.

That phase was followed by a combination of an imperfect Head & Shoulders structure and an ascending triangle , both forming within the same price region.

The subsequent breakdown to the downside and current pullback suggest that sell-side pressure remains active in this area.

This is not a prediction, but an observation of how pressure behaves when multiple structures overlap.

📉 Scenario 1 – Pullback Continuation

A continuation lower from the current pullback would remain consistent with:

• Previous descending channel context

• Failed bullish structure resolution

• Persistent selling pressure

📉 Scenario 2 – Deeper Pullback

Price may retrace higher toward the upper horizontal resistance before resuming lower.

As long as price remains below this level, the bearish pressure context remains intact.

⚠️ Pressure Reassessment

If price breaks and sustains above the upper horizontal level, bearish pressure becomes less evident and the market bias would require reassessment, with bullish pressure potentially taking precedence.

🧠 Key Observation

Patterns provide visual structure, but market pressure explains follow-through .

When several patterns fail or overlap in the same zone, pressure often becomes the more reliable context than pattern labels.

⚠️ Educational & Analytical Use Only

This analysis is shared strictly for educational and analytical purposes.

No financial advice, trade signals, or guarantees are provided.

All decisions remain the sole responsibility of the reader and should align with their own ethical, legal, and religious principles.