A trip to $60,000 and back before coffee.Bitcoin

BTCUSD

spent the end of last week doing what it does best: reminding traders that fire-breathing dragons aren’t in fairytales only.

After a sharp drop to $60,033 on Thursday torched thousands of long positions, the world’s largest cryptocurrency bounced hard. By Friday, it had clawed its way back above $70,000. Still, that dip was the orange coin’s lowest level since October 2024 and roughly 52% below last year’s record of $126,000.

By Monday morning, Bitcoin looked almost calm. It hovered around $70,700, barely changed on the day. The contrast with last week’s price action felt dramatic. Bitcoin rarely travels in straight lines, and this was another reminder.

🤔 Buy the Dip or Declare It Gone?

As always, opinions split fast. Some traders rushed to declare Bitcoin’s demise (for the 463th time – there’s a website for that). Others quietly loaded up, calling the move a classic paper-hands shakeout.

Markets, by nature, lean optimistic. The real question is whether optimism has enough fuel to pull Bitcoin out of its recent slump and into a renewed upside phase. The bounce has been impressive, an 18% upswing, but conviction remains fragile.

🌪️ Volatility Is a Feature, Not a Bug

Extreme volatility comes with the territory. Bitcoin’s slide from a $126,000 peak in October arrived despite a crypto-friendly White House and accelerating institutional adoption.

For some investors, that raised uncomfortable questions about Bitcoin’s role during periods of geopolitical stress.

Digital gold? Perhaps. Perfect hedge? That debate remains open.

🧊 The Market Finds Its Feet, Carefully

The broader crypto market has stabilized, though nerves remain close to the surface and Bitcoin still commands the lion’s share, according to the dominance chart. Traders describe the tone as cautious rather than confident. Or every analyst’s favorite expression: cautious optimism.

One level stands out on everyone’s chart. The $60,000 threshold has emerged as the primary near-term support. It marked the floor of last week’s selloff and remains the line bulls prefer not to revisit anytime soon.

On the upside, $75,000 carries symbolic weight. A sustained break above that zone would strengthen the case that the worst of the bear phase has passed and that buyers are regaining control.

📈 Institutions Quietly Step Back In

While price action grabbed headlines, flows told a quieter story. US Bitcoin exchange-traded funds recorded $221 million in inflows on February 6, suggesting that some investors viewed the selloff as an opportunity rather than a warning sign.

Institutional participation tends to move slowly and deliberately. These flows do not guarantee higher prices, but they add some confidence during moments of stress. For a market built on confidence, that matters.

🧮 The Levels That Matter Now

If Bitcoin is serious about $70,000, attention turns to a handful of technical levels that traders are watching closely.

But before that, let’s talk about the 200-week moving average near $58,000, a level Bitcoin respected during the recent dip. Holding above it keeps the longer-term structure intact.

Next sits the $73,000 to $75,000 zone, an area packed with prior support and resistance. Clearing it convincingly would signal momentum shifting back toward the bulls.

Beyond that, the path opens toward $81,000, a level that could act as the next magnet if sentiment continues to improve.

Again, that is if the OG coin manages to reel itself out of the sub-$70,000 area. The bounce from $60,000 reminded traders that sharp selloffs often attract bargain hunters and dip scoopers.

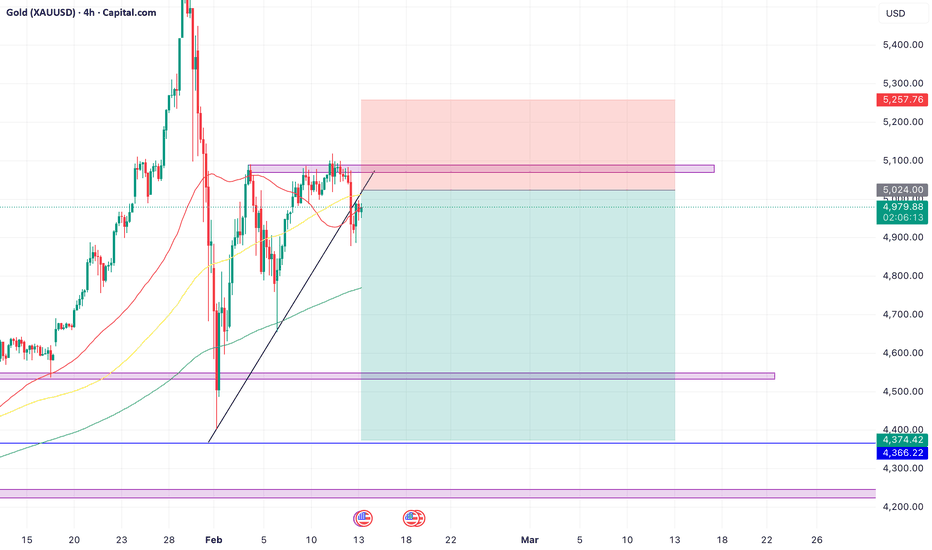

Chart Patterns

SPX/BTCUSD Warnings??To the "Dollar is Dead" crowd... This chart may be of interest. It's SPX/BTCUSD with DXY overlayed in Blue. During periods where SPX outperforms BTC, Dollar tends to run hard.

How this "corrects" remains to be seen. Will DXY Rip and SPX continue to outperform? Or does BTC wake up?

$ETH - LTF Weekend OutlookBINANCE:ETHUSDT | 2h

Kinda dependent on Bitcoin here — if we get a push into 70–71k, Ethereum could squeeze into 2150-2190 for that triple tap. But it can also just reject around 2100 if momentum stalls.

We are pumping into the weekend, so if this rolls over after, I’d want to see 2000–1950 hold on a pullback to keep structure intact.

#SLP/USDT Ready to go higher#SLP

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.000600. The price has bounced from this level several times and is expected to bounce again.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.000634

Target 1: 0.000655

Target 2: 0.000676

Target 3: 0.000700

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Visa ($V) just broke down from a one-year range. Further downsidVisa ($V) just broke down from a one-year range.

Further downside looks likely. Why? 👇

• Range break = expansion.

A year-long consolidation builds pressure. The longer the range, the more significant the eventual move tends to be. Breaks from extended ranges often lead to strong follow-through.

• Extended long-term run.

Since the 2009 financial crisis, Visa has appreciated more than 30x without a major structural correction. Moves of that magnitude rarely go uninterrupted forever. Over a 100 years of history you can see that these very extended trends always have an end.

Trade plan:

Stop: $335

Target: $280 zone

Thanks to an attentive member who brought this to my attention, I was able to initiate this short yesterday.

#ARB/USDT | Testing Wedge Breakout Amid Key Support#ARB

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.1066, and the price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.1099

First Target: 0.1139

Second Target: 0.1188

Third Target: 0.1238

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

PLTR long-term TAPalantir is a massive beast, this stock has a very strong uptrend on weekly time frame and it's far from done yet, currently there's a countertrend correction in the process and the distribution on mid-term but as for the long-term it has lots of resources left to continue the uptrend rally after the correction. Watch for the blue line and SMA50 to hold the support.

#DOT/USDT Ready to go higher#DOT

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1.20, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1.30

Target 1: 1.33

Target 2: 1.38

Target 3: 1.43

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

PLTR: Confirmed 3.2x Breakout Holding PLTR: Confirmed 3.2x Breakout Holding — But the Multi-Timeframe Bias Says the Trend is Against It.

Overview

PLTR at 131.72 presents a clean tension between price action and directional structure. On one hand, there's a confirmed 3.2x breakout with a 4.3% bounce off demand and only -1.4% retrace — the buyers are holding ground. On the other hand, the multi-timeframe bias reads Moderate BEAR at 41.3/58.7% with EMA bearish (2:5), Ichimoku bearish (5:9), C>T flipped bearish (6:8), and a bearish engulfing pattern. The breakout is real. The trend behind it is working against it. One of these signals is wrong — and the resolution will determine PLTR's next significant move.

Price Structure

PLTR trades at 131.72 with a confirmed breakout: 4.3% bounce at 3.2x magnitude, classified as Strong Breakout. The retrace is -1.4%, which is shallow relative to the bounce — buyers are defending the level with conviction.

Price sits in a demand zone with 1 demand below and 8 supply zones overhead. The S/D imbalance is significant: 8:1 supply-over-demand means the breakout faces heavy layered resistance above. Each supply zone represents a prior selling level that will need to be absorbed for continuation.

The breakout classification is important context. A confirmed 3.2x breakout means the bounce exceeds the retrace by more than 3x — this isn't a marginal recovery or a dead cat bounce. The price structure has validated the demand zone. The question is whether that validation can overcome the trend-level headwinds.

Multi-Timeframe Directional Bias

The bias reads Moderate BEAR (7.41% on the summary, 41.3/58.7% on the detailed breakdown). Total signal count: 26 bull : 37 bear out of 121 evaluated. The spread is 17.5%, classified as Moderate. Clarity at 48%.

Close vs Tenkan: 6:8 bearish. This is a critical reading. On 8 of 14 active timeframes, price is closing below the Tenkan-sen. When C>T flips bearish, it means the short-term momentum across the majority of timeframes has turned against buyers. The Tenkan-sen is the most responsive Ichimoku component — when price loses it across multiple timeframes, directional momentum has shifted.

EMA alignment: 2:5 bearish. The moving average structure decisively favors sellers. Only 2 timeframes show bullish EMA positioning against 5 bearish. The trend, as defined by moving average calculations, points down.

Ichimoku TK crosses: 5:9 bearish. This is the strongest bearish component in the setup. Nine timeframes show bearish TK crosses versus only five bullish. The cloud structure has tilted materially toward sellers — not just on a few timeframes but across the broad spectrum.

Candlestick patterns: 10:4 bullish. Here's the divergence. Despite everything above pointing bearish, the candle structure favors bulls 10:4. The pattern detail adds nuance:

Stars: 2:0 bullish — two bullish reversal stars with no bearish counterpart.

Three-Soldiers: 0:1 — one bearish three-soldier pattern with no bullish equivalent.

Harami: 0:1 — one bearish harami, suggesting indecision resolving bearish on at least one timeframe.

Engulfing: 0:1 bearish — one bearish engulfing pattern.

Pattern total: 2:2 — evenly split when counting only resolved patterns.

The raw candle score (10:4) looks bullish, but the resolved pattern detail tells a more nuanced story. The bullish signals are coming from individual candle formations (stars, general candle shape), while the bearish signals are coming from multi-bar continuation and reversal patterns (three-soldiers, engulfing, harami). Multi-bar patterns generally carry more weight than single-bar signals because they represent sustained directional behavior rather than a single session's price action.

Momentum: Bull ↓ (bullish but declining). Bandwidth at 5.38% is moderate. No squeeze is active. The declining momentum during a confirmed breakout is a cautionary signal — the directional energy that produced the breakout is fading rather than building.

The Breakout vs Trend Conflict

This is the central analytical question and it applies broadly beyond just this PLTR setup.

The breakout case: Price has bounced 4.3% off demand with a 3.2x confirmation. The retrace is shallow (-1.4%). The demand zone is validated. Candlestick patterns favor bulls 10:4 with 2 bullish stars. The breakout is a real, confirmed, structural event.

The trend case: The multi-timeframe bias is Moderate BEAR. EMA is bearish (2:5). Ichimoku is bearish (5:9). C>T has flipped bearish (6:8). There's a bearish three-soldier, a bearish engulfing, and a bearish harami — three separate bearish multi-bar patterns forming across the timeframe spectrum. The trend across moving averages and cloud structure doesn't support the breakout.

The resolution comes down to timeframe hierarchy. Breakouts are typically short-to-medium timeframe events. Trends operate on medium-to-long timeframes. When a short-term breakout occurs against a longer-term bearish trend, there are two outcomes:

Outcome A: The breakout is the beginning of a trend reversal. The short-term bullish price action (the 3.2x breakout) gradually converts the longer-term indicators. EMAs start flipping from 2:5 toward 3:4. Ichimoku TK crosses shift from 5:9 toward 6:8. The breakout was the first signal; the trend change follows.

Outcome B: The breakout is a counter-trend bounce within a dominant bearish structure. The longer-term bearish indicators (EMA 2:5, Ichimoku 5:9) reassert themselves. The breakout stalls against supply, momentum continues declining (Bull ↓ → Neutral → Bear), and price resumes the prevailing downtrend.

Volume Intelligence

Volume Z-score: -0.73 (Quiet). 6.68K shares on $880.28K dollar volume. Volume momentum is decelerating at -0.68. Bull:Bear volume Z-scores: -0.42 : -0.48 — both sides equally suppressed.

Volume direction is Neutral with a Direct relationship. The VolZ across timeframes reads -0.73 on the short lookback and -0.04 on the longer lookback — short-term volume is Quiet while the longer-term base is essentially neutral (right at the historical average).

No volume squeeze is active, but squeeze momentum on volume is contracting sharply at 548.6%. Volume compression is accelerating — participation is draining from the near-term structure at an increasing rate.

No whale activity detected.

The volume profile offers no directional edge. Both sides are equally absent. The breakout occurred and is holding without volume confirmation — which means it hasn't been validated by institutional participation, but also hasn't been rejected by volume-driven selling.

A breakout without volume confirmation is not necessarily invalid — it's incomplete. The verdict is still pending. What happens to volume in the next few sessions will either validate or invalidate the breakout thesis.

Scenarios

Scenario 1 — Breakout Leads Trend Reversal (~30% probability):

The confirmed 3.2x breakout proves to be the early signal of a larger reversal. The 2 bullish stars and 10:4 candle score are the leading indicators. Volume enters on continuation (Z climbing from -0.73 toward 0+). The EMA structure begins flipping — even one signal moving from 2:5 to 3:4 changes the thesis. Momentum stabilizes from Bull ↓ and turns back to Bull ↑. The demand zone holds as a structural base, and price begins working through the first supply zones overhead. The C>T ratio improves from 6:8 toward 8:6 as lower timeframes realign bullishly.

Key confirmation: EMA shifting to 3:4 or better. Volume Z above -0.3 on a continuation bar. Momentum flipping from Bull ↓ to Bull ↑. C>T improving to at least 7:7.

Scenario 2 — Trend Reasserts, Breakout Fades (~45% probability, primary):

The Moderate BEAR bias, bearish EMA (2:5), bearish Ichimoku (5:9), bearish C>T (6:8), and the cluster of bearish multi-bar patterns (three-soldier, engulfing, harami) prove to be the dominant signals. The breakout was a counter-trend bounce that lacks the volume and momentum to overcome the prevailing downtrend. Declining momentum (Bull ↓) continues its trajectory toward Neutral and then Bear. The 8 supply zones overhead absorb any breakout energy. Price retraces from the -1.4% level deeper toward -3% to -5%, testing and eventually breaking the demand zone beneath.

Key confirmation: Momentum completing the transition from Bull ↓ to Bear. C>T worsening from 6:8 to 5:9 or worse. Candle score declining from 10:4 toward 8:6. Volume entering on a red candle (bearish volume validation). The bearish three-soldier pattern producing follow-through.

Scenario 3 — Stalemate and Compression (~25% probability):

The breakout prevents a sell-off, but the bearish trend prevents continuation. Price enters a tight range at the current level. Bandwidth contracts from 5.38% toward 3-4%, potentially building toward a new squeeze. Volume remains Quiet as neither side commits. The EMA (2:5) and candle (10:4) conflict persists unresolved for multiple sessions. This scenario eventually resolves into Scenario 1 or 2, but on a delayed timeline — often catalyzed by earnings, macro data, or sector rotation.

Key indicator: Bandwidth declining below 4% without directional resolution. Price holding demand but not advancing into supply. Volume Z remaining between -1.0 and -0.5.

What to Watch

EMA trajectory (2:5). This is the most important tracking metric. The EMA is the most objective trend measure. Any movement toward 3:4 materially strengthens the bull case. If it worsens to 1:6, the bear case becomes overwhelming.

C>T ratio (6:8 bearish). The C>T is the most responsive directional reading. Its current bearish tilt contradicts the breakout. If it shifts back to 7:7 or better, the breakout is gaining timeframe support. If it worsens to 5:9, the breakout momentum is dying.

The bearish pattern cluster. Three separate bearish multi-bar patterns (three-soldier, engulfing, harami) across different timeframes is meaningful. These are not single-bar noise — they represent sustained bearish sequences. If additional bearish patterns form, the trend case strengthens. If they age out without replacement, the bear case loses its pattern foundation.

Volume on the next directional candle. The -0.73 Z with -0.68 decelerating momentum means the market hasn't voted yet. Whichever direction the next meaningful volume bar appears (Z above -0.3) is a strong directional signal — volume breaks the tie that price structure and trend indicators have created.

Momentum trajectory. Bull ↓ is the current state. The next transition determines the breakout's fate: Bull ↑ = breakout alive, Neutral = breakout dying, Bear = breakout failed.

Risk Note

A confirmed 3.2x breakout against a Moderate BEAR bias creates a binary-outcome setup — the breakout either reverses the trend or gets absorbed by it. The 2:5 EMA, 5:9 Ichimoku, and 6:8 C>T create formidable trend headwinds, while the 10:4 candle score and validated demand zone provide legitimate bullish support. Volume is Quiet and non-committal (-0.73 Z), offering no tiebreaker. The 8:1 supply/demand imbalance overhead tilts structural risk to the downside. PLTR carries additional factor risk from AI sector sentiment and government contract news flow, which can override technical structure. Position sizing should reflect the breakout-vs-trend conflict and the absence of volume confirmation. Educational analysis only — not financial advice.

TAGS

PLTR Palantir Technical Analysis Supply and Demand Multi-Timeframe Analysis Volume Analysis Stocks Breakout

BITCOIN Will Go Lower From Resistance! Sell!

Take a look at our analysis for BITCOIN.

Time Frame: 6h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 68,813.79.

Taking into consideration the structure & trend analysis, I believe that the market will reach 62,426.84 level soon.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

SOLUSD Bullish Reversal from Demand Zone.....

This 1H **SOLANA (SOLUSD)** chart shows a shift in market structure after a **CHOCH (Change of Character)**, followed by a controlled pullback within a descending channel. Price tapped into a well-defined **demand zone** and respected the Ichimoku cloud support, triggering a strong bullish impulse. The recent breakout signals renewed upside momentum, with the **first upside target around the 90–91 zone**. As long as price holds above the demand area, the bias remains bullish and dips can be seen as potential continuation entries.

ORAS- LOW RISK / good opportunity / great fundamentalORAS- Timeframe 1 day

Format a Gartley bullish pattern as follows:

- Entry: 405.00(current price: 405)

- Stop loss: 380.00(potential loss: +6%)

- First target: 446.00(potential profit: 10%)

- Second target: 471.00(potential profit: +16%)

- Third target: 500.00(potential profit: +23%)

This is not investment advice, only my analysis based on chart data.

Consult your account manager before investing.

Thanks and good luck.

ETH/USD BEARS ARE GAINING STRENGTH|SHORT

ETHUSD SIGNAL

Trade Direction: short

Entry Level: 2,043.16

Target Level: 1,807.32

Stop Loss: 2,199.76

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 6h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BITCOIN BTCUSDT WEEKLY DIRECTIONAL STRUCTURE TRADING.Bitcoin current price=69,790.51

technical analysis of bitcoin.

the break of 108,648.54 opens retest and a sell confirmation evidently seen on the chart.

the break of 98,289.94 opens retest and sell confirmation

the break of weekly support at 78,407.53 ,the retest sell confirmation ,if we break above and hold, it will be a buy confirmation.

the current ascending trendline provided the demand floor for current price action ,its a psychological trendline on weekly time frame to me .if will breakout from the trendline ,selling could retest 48,793 demand floor .

if the sentiment turns full scale bearish then the option is retesting 43,537.6 demand floor .the break and close of 43,537.6 will lead us into 30,989.17.this will be a critical zone and a litmus test zone

the strategy is based on break and close followed by successful hold of a broken level, if a break out does not hold at your zone ,you look to a higher layer, this is what i mean that trading is 100% probability allegedly

Bitcoin fundamental information allegedly.

the anticipation of BOJ (Bank of Japan Rate Hike to 1% in April 2026 Could Crash Bitcoin Price allegedly ,the march/April MPC outlook will be on lookout.

The crypto market is under intense bearish pressure with bears holding the price to ransom as expectations grow that the Bank of Japan could likely raise interest rates to 1%,thats a 25% basis point hike in April 2026. its a big warning sign if we get a tighter policy monetary policy in Japan, A tighter monetary policy by BOJ will reduce global liquidity and trigger another sharp Bitcoin sell-off which will attract a stronger bearish bias and liquidation in the market.

the bank of japan (BOJ) and swiss national bank (SNB) are known for keeping near to zero rate over the years ,for BOJ a known safe-haven currency and global liquidity provider to shift the sentiment ,bitcoin will face a selling pressure on sentiment.

BOJ( bank of japan) has always been the primary force behind the yen carry trade because it maintains interest rates between zero and near-zero for multiple years now.

the last MPC ( monetary policy committee ) raised rates to 0.75% in January 2026, amidst rising inflation, stronger wage growth, and pressure on the weak yen continues to push policymakers toward further tightening of the yen.

Why Japan’s Monetary Policy Matters for Bitcoin Price action in 2026 trade directional bias .

Japan is holding the title of the largest creditor nation worldwide and china is second .japan possesses approximately $1.2 trillion worth of U.S. Treasuries. Japanese banks and institutions also invest heavily in global bonds, stocks, and other risk assets, making Japan a key source of global liquidity.

If the Bank of Japan proceeds with another rate hike in march /April meeting allegedly, that risk appetite could weaken USDJPY .On technical a stronger yen and falling USD/JPY would signal reduced global leverage, which often pressures Bitcoin and other small altcoins.but there is a clause to the the downside of USD JPY,keep an eye on the dollar index and US10Y price action as the rise under any fundamental outlook will balance BOJ rate hike effect.

However the economic docket's of BOJ will be watched as further rake hike will be depending on future economic data as they unfold.

The Bitcoin price action after BOJ( bank of japan )rate hike in January 2026 reflected on the chart, the price of Bitcoin fell after the Bank of Japan raised rates to 0.75%.

generally the crypto markets reacts when global liquidity conditions changes especially if its coming from a stronger liquidity provider

Every crypto traders should know that When interest rates increases, borrowing becomes more expensive, which reduces the flow of capital into risk assets like Bitcoin and other altcoins whose value is based on sentiment and public validation with little to no ecosystem application..

should BOJ ( Bank of Japan ) raises rates again toward 1% as alleged, then Bitcoin could face more downside pressure and many people will be liquidated and many position closed out of stoploss on trade position.

Why does a Bank of Japan rate hike impact global crypto markets?

Japan is a major source of global liquidity due to its large holdings of foreign assets. When the BOJ raises rates, it strengthens the yen and unwinds yen carry trades, reducing the flow of capital into risk assets like Bitcoin and causing market pressure, its not crypto market alone ,pairs like USD,EURO,AUD and GBP will experience a sharp change in the price action.

How does Japan’s interest rate policy affect the yen carry trade?

Japan has kept rates near zero for years, making it the primary source of the yen carry trade. When the BOJ hikes rates, the yen strengthens, making these trades more expensive to maintain and forcing investors to sell off risk assets like crypto..

pls like and share if you find this chart useful.

wish you Goodluck.

#btcusdt #bitcoin #crypto.

MUBAREAK BULL RUN LOADING🔥 Fortune AI Radar — CRYPTOCAP:MUBARAK

Fresh activity detected on CRYPTOCAP:MUBARAK today.

Data suggests increasing market interest & buyers stepping in.

Technicals currently lean bullish, with momentum trending upward.

Whales showing hints of accumulation and hype rising among traders.

This coin is flashing strong signals on short-term charts — worth keeping an eye on 👀

Not financial advice — always research before taking decisions

QNT: breakout alert! key levels and targets for the upcoming dayQNT. Who else was waiting for this thing to finally wake up? Interoperability and tokenization are back in the spotlight according to market sources, and today QNT answered with a clean breakout right as headlines talked about renewed interest in institutional blockchain rails.

On the 4H chart price has ripped out of the 68-70 box and is now pushing into the green supply zone around 73-75. Volume picked up on the breakout and RSI is hovering above 70, so momentum is bullish but a bit overheated. My base case is a shallow pullback or sideways pause above 70, then a push toward the next resistance cluster near 76 and possibly 79-80.

My plan: I prefer longs on a retest of 70-71 or a tight consolidation just under 74, with 🎯 focus on 76 first, then 79-80 if the trend stays clean. ✅ As long as 70 holds on 4H closes, bulls keep the ball. ⚠️ If price dives back under 69 and closes below 68.5, I’ll treat it as a fakeout and look for 64 and lower liquidity. I might be wrong, but right now QNT finally looks ready to stretch its legs.

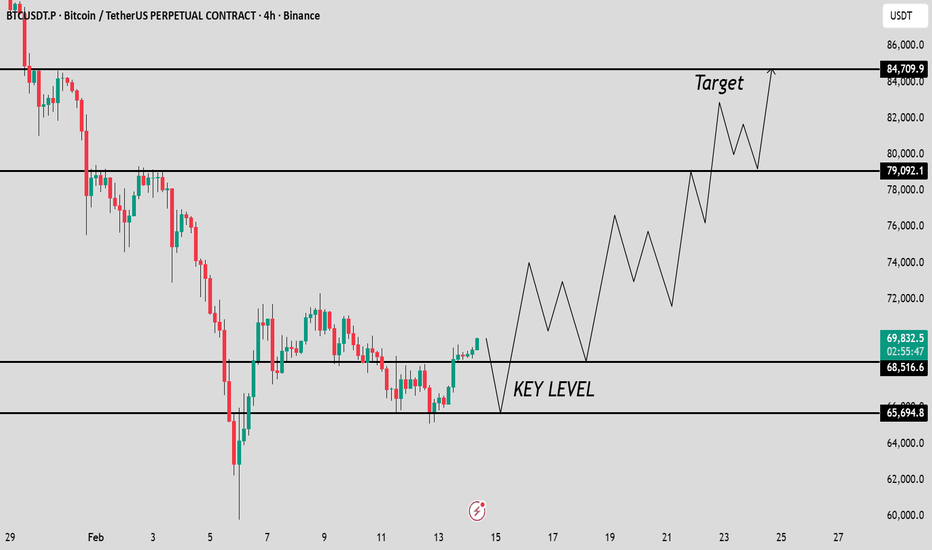

BTC/USDT Eyes Short-Term Rally Toward $84K While Holding SupportBTC/USDT continues to show solid structural strength on the higher timeframes, indicating a potential short-term bullish continuation. As long as price sustains above the critical support zone of $68K – $65K, the overall momentum remains in favor of buyers.

If this support holds firmly, BTC is likely to build bullish pressure and gradually move toward the $84K region in the coming sessions. However, traders should remain cautious, as volatility and liquidity sweeps can still occur on lower timeframes.

Proper risk management is essential — avoid rushing into trades, wait for clear confirmations, and always plan entries based on strong risk-to-reward setups. As always, do your own research before making any trading decisions.

ZKCUSDT Forming Bullish MomentumZKCUSDT is forming a clear bullish momentum pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 90% to 100% once the price breaks above the wedge resistance.

This bullish momentum pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching ZKCUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal.

Investors’ growing interest in ZKCUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

IONQ MOVING IN ASCENDING CHANNELAscending channel can be seen clearly. Currently price is at the channel bottom with very good support at 45.

it also made a high at , and pulled back to low of 45

Either buy at CMP 48 and average at 45. I expect it to stay above 45, and hit 55 again, next 65 and 75 would the targets.