DeGRAM | SOLUSD broke the dynamic resistance line📊 Technical Analysis

● SOL/USD continues to respect a medium-term ascending structure after forming higher lows since October. Pullbacks into the rising support zone are being absorbed, indicating accumulation and trend stability.

● Price action shows consolidation below a key resistance band, suggesting a continuation phase. A sustained breakout would open the way toward the next upside leg, in line with the broader impulsive wave structure.

💡 Fundamental Analysis

● Solana benefits from steady network activity growth and improving risk appetite in the crypto market, while expectations of looser global financial conditions support medium-term upside for high-beta assets.

✨ Summary

● Bullish medium-term bias. Key support holds the trend. A breakout above resistance favors continuation toward higher targets, while structure remains constructive as long as ascending support is intact.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Chart Patterns

DeGRAM | ZECUSD is preparing for a correction📊 Technical Analysis

● ZEC/USD rebounded from the long-term support line after completing a falling wedge, but the recovery stalled below a descending resistance, keeping the broader structure corrective. Recent price action forms a rising channel capped by a key resistance trendline, signaling weakening upside momentum.

● Repeated rejections near the upper boundary and a failed triangle breakout suggest distribution, with downside risk toward channel support if sellers regain control.

💡 Fundamental Analysis

● Privacy-focused altcoins like ZEC remain under pressure amid subdued risk appetite and lack of fresh sector-specific catalysts, while capital continues rotating toward higher-liquidity majors.

✨ Summary

● Medium-term bearish bias. Resistance: 550–570. Downside targets: 460–430, with invalidation above descending resistance.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

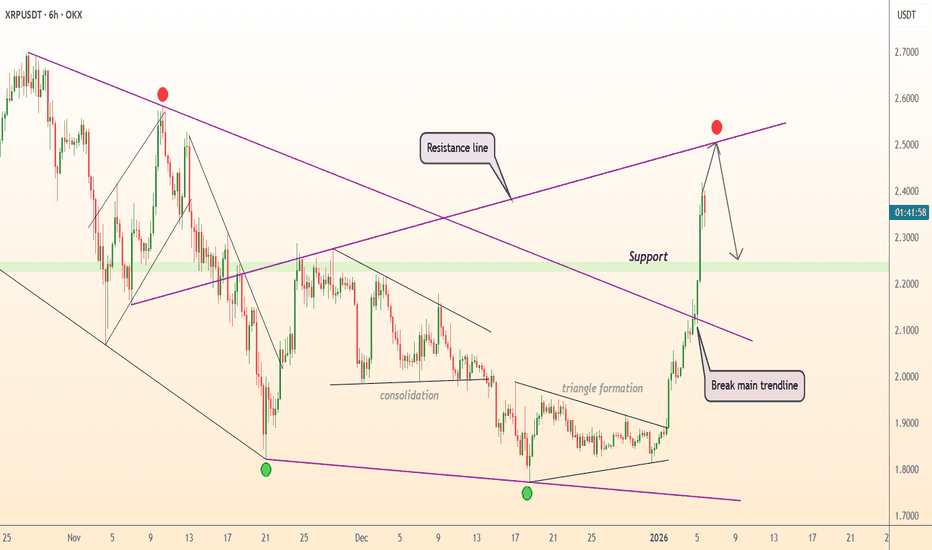

DeGRAM | XRPUSD broke a descending structure📊 Technical Analysis

● XRP/USD made a sharp impulsive rally after breaking the main descending trendline and exiting a long consolidation triangle, but price has now reached a major descending resistance zone near 2.45–2.55, where prior sell reactions formed.

● The vertical advance shows exhaustion characteristics, with price stalling above former support turned resistance, favoring a corrective pullback toward the 2.25–2.20 support area.

💡 Fundamental Analysis

● XRP upside momentum is fading as broader crypto markets consolidate and risk appetite cools, while no new catalysts have emerged to justify continuation after the breakout spike.

✨ Summary

● Medium-term short bias. Resistance: 2.45–2.55. Key support: 2.25–2.20. Expect pullback after breakout exhaustion.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | GBPUSD will retest the $1.35 level📊 Technical Analysis

● GBP/USD rallied into the upper boundary of a medium-term ascending channel and stalled beneath the 1.3560 resistance level, forming a clear lower-high reversal pattern on the 30-min timeframe. Recent price action shows rejection candles and loss of upward momentum.

● After breaking short-term support near 1.3530, price structure favors continuation lower toward the next support at ~1.3505 and beyond if sellers remain in control.

💡 Fundamental Analysis

● The pound is weakening as UK macro momentum slows and USD demand increases amid safe-haven flows and dovish Fed speculation, reinforcing bearish pressure on GBP/USD.

✨ Summary

● Medium-term short bias. Resistance: ~1.3560. Key break: 1.3530. Targets: 1.3505 → lower support. Bias weakens above 1.3560.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Gold Respects EMA 50 — Short-Term Bullish Continuation in FocusGold (XAUUSD) on the 30-minute timeframe is showing early signs of bullish continuation after completing a healthy pullback within a broader recovery structure. Following the prior impulsive leg higher, price corrected in a controlled manner and has now reacted cleanly from the EMA 50, confirming it as dynamic support.

The recent higher low formed along the ascending trendline indicates that buyers are still in control of the short-term structure. This pullback appears corrective rather than impulsive, suggesting the market is reloading for the next expansion phase instead of reversing.

Price is currently trading back above the EMA 50 and holding above the 4,458–4,460 intraday support area, which acts as a key pivot zone. As long as this level holds, bullish continuation remains the preferred scenario.

On the upside, the next liquidity objectives are clearly defined. The 4,495–4,500 zone marks the first resistance and reaction area, followed by the higher-timeframe target near 4,545–4,550, where previous highs and resting liquidity sit.

Trading Plan:

Bullish scenario: Holding above the EMA 50 and the 4,458 support opens the door for continuation toward 4,495, with extension toward 4,545–4,550 if momentum accelerates.

Bearish scenario: A loss of the EMA 50 followed by acceptance below 4,440 would invalidate the short-term bullish setup and expose a deeper pullback toward 4,420–4,400.

Overall, Gold is behaving technically clean on M30. As long as price respects dynamic support, the bias remains buy-the-dip, with confirmation favored over anticipation.

Gold at a Liquidity Crossroads — Expansion or Breakdown IncomingGold (XAUUSD) on H1 is currently trading inside a well defined liquidity price range, following a strong bullish expansion earlier in the week. That impulsive rally confirmed buyer dominance, but recent price action shows momentum has slowed, with the market now entering a distribution and decision phase.

Price is consolidating around the mid range near 4,460, closely aligned with the short-term moving average. This area acts as equilibrium not an ideal zone for aggressive entries as liquidity is building on both sides of the range.

The lower boundary of the structure sits around 4,408, marking a critical support and liquidity sweep zone. A clean break below this level would signal a range failure and open the door for a deeper bearish expansion toward 4,350.

On the upside, the upper boundary and key target remain near 4,545–4,550, where previous highs and resting liquidity are located. Acceptance above this area would confirm bullish continuation and trend resumption.

Bullish scenario: As long as price holds above the 4,408 support, buyers may attempt a push higher. A clean break and acceptance above 4,500, followed by continuation, would open upside targets toward 4,545–4,550.

Bearish scenario: A confirmed breakdown below 4,408, with follow-through and failed pullback, would validate a bearish expansion toward 4,350, signaling that liquidity below the range is being targeted.

For now, Gold is compressing inside a liquidity box. Patience is key the highest-probability trades will come after the range resolves, not while price remains trapped in the middle.

NMLNML has seen a strong impulsive rally, followed by a healthy pullback into the 174–178 demand zone, which aligns with key Fibonacci retracement levels. This zone is acting as a buy-on-dips area within the broader bullish structure.

Momentum remains constructive with RSI cooling off but holding above neutral, suggesting consolidation rather than trend reversal.

Levels to watch:

Buy Zone: 174–178

Upside Targets: 199 → 213 → 226

Invalidation: Daily close below 174

Bullish Reversal in Channel, Eyes on 4600–Gold has found strong support within the 4260–4285 demand zone, which coincides with the lower boundary of a well-established ascending channel. Price action is now showing signs of reversal, with higher lows forming and a break above near-term resistance potentially triggering the next bullish leg.

🔹 Technical Setup:

Price remains within an upward sloping channel since mid-November

Strong demand confirmed around 4260–4285

Bullish scenario resumes upon breakout of local horizontal resistance

Next key Fibonacci extension targets are:

141.4% at 4602.54

161.8% at 4716.19

Horizontal confluence at 4598.76 – 4719.28

📌 Trade Idea:

Bullish bias remains valid above 4260

Breakout above local resistance could accelerate the move toward the upper channel

Ideal target zone: 4600 – 4720

🔻 Invalidation:

A daily close below 4260 would break channel support and invalidate this setup

Gold continues to present a bullish structure supported by strong trend dynamics and favorable technical confluences.

GOLD XAUUSD WE are watching 4500 and 4519-4522-4525 zone level sell zone for a potential reaction.

AT 4500, 4519-4522-4525 supply roof am looking for sell based on 15min confirmation order and extended buy could be the retest of the current all time high.

1300-1400 newyork time defended yesterday and buyers return on bullish sentiment., if the break and close 30min current supply roof ,i will wait and watch 4500 and extended layer is 4519-4522-4525 sell zone,we are close to 4500 .watch that zone and a possible extension into 4519-4522-4525

what is GOLD XAUUSD ??

Gold (Au) is a chemical element and dense, malleable transition metal prized for its lustrous yellow hue, exceptional conductivity, and resistance to corrosion.

History as Store of Value

Gold has served as a store of value for over 6,000 years, from ancient Egyptian tombs (c. 4000 BCE) symbolizing immortality to Lydian coins (600 BCE) enabling standardized trade across empires like Rome (aureus) and Byzantium (solidus, stable 700+ years). The 19th-century gold standard anchored global currencies until 20th-century abandonments, yet gold retains purchasing power

Tier 1 Status Clarification

Gold classifies as a Tier 1 asset under Basel III banking rules , with 0% risk weighting for physical bullion, equivalent to cash for capital reserves, enhancing bank balance sheets amid fiat volatility. This elevates it from prior Tier 3 status, affirming its role as "money again."

#GOLD #XAUUSD

GOODLUCK

Sell-Side Bias Favored at Daily PremiumDAILY

4H

Price is currently trading into daily premium and interacting with buy-side liquidity near the recent highs.

While a 4H CHoCH has formed, the displacement occurred directly into prior supply without clear acceptance. Until the daily closes strong above the highs, upside continuation remains unproven.

Failure to hold above the broken high would increase the probability of this move resolving as a buy-side liquidity sweep, opening the door for downside rotation toward sell-side liquidity near 154.50.

Bias favors the sell scenario unless daily acceptance confirms otherwise.

$FILUSDT Reload Zone Spotted!

BINANCE:FILUSDT (1H) is showing a pullback into demand after a sharp impulsive rally. Price will retrace cleanly into a high-confluence demand area, suggesting accumulation zone, not weakness.

Market Bias: Bullish continuation

Buy Zone: $1.438 – $1.416 (strong demand support)

Risk Line: A decisive break below $1.408 invalidates the setup

Upside Targets:

🎯 Target 1: $1.484 — first reaction and momentum test

🎯 Target 2: $1.558 — liquidity sweep and impulse extension

As long as FIL holds this demand zone, the structure favors dip buys over panic sells. A strong bounce here could ignite the next breakout toward higher liquidity levels.

Gold: The Coiled Spring Gold: The Coiled Spring 🚀

Gold is moving creating beautiful chart patterns right now. Sometimes, the charts don't need a thousand words to tell a story, they just need you to listen. Right now, Gold is whispering "momentum," stacking one bullish pattern on top of another like a masterclass in price action.

The Triangles

We are currently looking at a perfectly compressed triangle.

If we see a clean break above this current structure, we aren't just looking at a move, we’re looking at Gold finding the fuel to launch into brand-new, all-time highs. It’s exciting to watch that energy build up!

The Catch (Watch Your Step! ⚠️)

Context is everything.

There is one thing that keeps me sharp, this breakout is happening right against a massive wall of resistance.

It’s a posible trap. When a small pattern breaks out right into a major ceiling, it’s very common to see a fakeout. The market loves to tease a move before the real one happens. But... if Gold finds the strength to pierce through that level, it will be the definitive "impulse" we've been waiting for to reach those new horizons.

The Long Game

I’ve said it before, and I’ll say it again, zoom out. In the coming years, Gold doesn't just have room to grow—it has the margin to fly. 🦅

Stay patient, watch the price action with intention, and let the market show its hand before you step in.

🎁 Let’s make a simple deal.

I will handle the heavy lifting to find the top 1% of setups like this, and you just HIT the 🚀 Rocket, Follow and Enjoy.

🤝 Deal?

ES finishing a distribution schematic here?Seems to be rolling over on a distribution schematic. Right now the value appears to be in Dividend names like some of which I shared on my profile ( NYSE:NKE for example). Amongst others I'm eying are NYSE:SWK NYSE:NVO and $NESN.

Nasdaq seems to be rolling over, and so do a couple of big tech names like NASDAQ:NVDA and NASDAQ:GOOG hitting a 1.618 extension. Meanwhile small caps are shooting up. And so it looks like we are entering or at least nearing a final phase before a steeper correction.

NATGAS The Target Is UP! BUY!

My dear subscribers,

NATGAS looks like it will make a good move, and here are the details:

The market is trading on 3.141 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3.304

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BITCOIN PERFECT RANGEThis is the only range to keep an eye on with #bitcoin. short from the middle of the channel, or top of the channel. You can also consider a long from the highs if it gets there, then target the middle of the channel.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

BTCUSD READY FOR FLY (READ CAPTION)Hi trader's what do you think about btcusd

BTCUSD is currently maintaining a bullish market structure, with price holding firmly above a strong support zone and showing consistent buyer interest on pullbacks. The overall price action supports further upside continuation toward higher levels.

🔹 Support Zone: 89,000–88,000

This zone represents the primary bullish demand area where buyers have repeatedly stepped in.

As long as BTC holds above 88,000, the bullish bias remains intact.

🔹 Resistance Zone: 95,000

This is the key resistance area where price may face temporary rejection or consolidation.

A strong breakout and close above 95,000 will confirm bullish continuation.

🔹 Supply Zone: 99,000

This is the major upside target and supply area.

If BTC breaks above 95,000, price is likely to extend toward the 99,000 supply zone, where sellers may attempt to slow the move.

A decisive breakout above this zone could signal further upside expansion.

📈 Market Outlook

Holding above 89,000–88,000 → Bullish continuation expected

Break above 95,000 → Opens path toward 99,000 supply zone

Supply zone reaction will determine the next major directional move

Overall, the structure favors a bullish pullback followed by continuation scenario.

please don't forget to like comment and follow

Achr LongACHR 4H — compression into a clean breakout level

* Price is coiling in an ascending triangle: higher lows pressing into the same ceiling.

* Breakout level is clearly defined around 9.0–9.1 (multiple taps = liquidity building above it).

* Pullbacks are getting bought quicker (higher lows), which usually means supply up top is being absorbed.

* Volume has been more supportive on the pushes up vs the fades — what you want to see before a range breaks.

Plan

* Bull trigger: 4H close above ~9.06, then hold/retest that level.

* Invalidation: acceptance back below the level + losing the rising trendline.

Targets (from the marked zones)

* T1 ~10.19

* T2 ~11.47

JOBY is also setting up, Strong sector tailwinds.