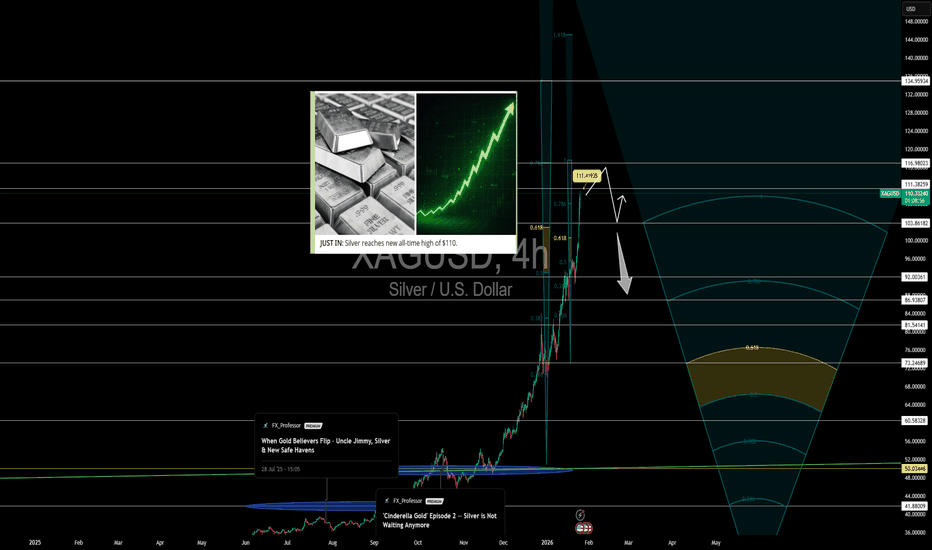

Silver $110, Gold $5K — Bitcoin Pump Next?Silver at $110, Gold at $5K, Bitcoin at Support — The Rotation Has Begun

New all-time highs for silver at $110 mark a historic moment. From $50 in November 2025 to blasting through $70, $80, $90 — and now triple digits — this has been one of the most aggressive moves in precious metals history .

Next resistance? $111.40 , followed by $116 and potentially $134.

Yes, I shorted at $103 and got smashed — life goes on. We adapt. 👊

But this video and analysis isn’t just about silver. It’s about where we are in the macro rotation — across silver, gold, and Bitcoin.

Gold is holding firm above $5,000 , with $5,405 as the next upside target. $5K now acts as psychological support. The metal remains strong — but the key question is: how much longer can gold outperform?

Bitcoin still looks weak — but the BTC/Gold ratio tells a different story . We’re hitting major long-term support from a 2020 ascending channel , backed by positive divergences . From here to the channel midpoint, there’s 73% room for corrective upside . That’s no small move.

The Gold/Silver ratio , using nearly 100 years of history, shows that sharp drops in gold’s relative value happen fast — and reverse just as fast . We’re at 46 now, with 41 as a possible floor. So yes — silver may still squeeze out another 10% outperformance … but exhaustion is near.

BTC/Silver reflects the same dynamic: silver still has the upper hand, but we're nearing major support levels . And when these ratios snap back, they do so hard.

These aren’t trades to chase blindly. They’re rotations to observe, prepare for, and trade with precision. Momentum is shifting — in real time.

Trading Wisdom 📜

When one market peaks, another prepares to rise. Silver's breakout is historic and undeniable — but century-old ratios don’t lie. Bitcoin is approaching key support against both gold and silver simultaneously . If the shift comes, it won’t be slow. It’ll be sharp, fast, and violent. Stay sharp, stay reactive, examine everything.

Disclaimer: What you read here is not financial advice — it’s high-level market philosophy from the FXPROFESSOR himself. Risk is real, and your capital is your responsibility. Learn, adapt, evolve.

One Love,

The FXPROFESSOR 💙

Chart Patterns

BTC/USDT | What's ahead? (READ THE CAPTION)As you can see in the Hourly chart of BTCUSDT, it reached all 4 targets of the previous analysis, reaching 90,600, going above the high of the IFVG, but then again, it returned to the IFVG zone and then went even lower, being traded now at 87,900.

There are relatively equal lows below with liquidity residing below them.

Ideally, I'd like BTCUSDT to sweep the liquidity below there and then make an upwards move.

For the time being, bullish targets: 88,200, 89,200 and 90,200.

Bearish Targets: 87,500, 86,900 and 86,300.

PYPL amazing entryI am looking at PYPL again after amazing run last time (see my previous trade idea here: ). This time I think we are set up for much bigger reversal on this stock with very strong double bottom on multiple timeframes (monthly and then locally daily with double bullish divergence). The fundamentals of this stock are very solid if you do your research, it's clearly undervalued and spend years moving sideways and building a strong base on the chart. A lot of analysts are quiet about PYPL growing their ad business but I think this is a much bigger story than Venmo monetization or branded checkout - the ads is where real money and growth is.

BTC/USD Bearish Flag Breakdown – Downside Targets 82,100 &76,400The BTC/USD daily chart displays a clear bearish trend, highlighted by the formation of a bearish flag pattern after a sharp downward move. Following the strong sell-off, price consolidated within an upward-sloping channel, which acted as a corrective phase before continuation. The recent breakdown below the flag support confirms bearish continuation and signals renewed selling pressure. Price remains below key resistance and moving average levels, indicating weak bullish momentum. The rejection from the resistance zone near 96,000 further strengthens the downside bias. Based on this technical structure, the first downside target is set near 82,100, where temporary support may appear. If bearish momentum persists, the second target is projected around 76,400, aligning with previous demand zones and key historical support levels. Overall, market conditions favor sellers in the short term.

If you found this XAUUSD analysis helpful, don’t forget to LIKE 👍 and COMMENT 💬!

GBP/USD Bearish SetupGBP/USD is showing signs of a potential bearish reversal after failing to hold above a strong resistance zone. Price formed a clear double-top structure near the highs, indicating weakening bullish momentum and increasing selling pressure. The breakdown below the cloud confirms a shift in market bias from bullish to bearish. Sellers are gaining control as price struggles to reclaim resistance, suggesting further downside continuation. If the current structure holds, the first downside target is 1.37594, where short-term support may appear. A sustained move lower could extend toward 1.37219. In case of strong bearish momentum, the final target is 1.36834, aligning with prior support levels. Proper risk management is advised.

If you found this XAUUSD analysis helpful, don’t forget to LIKE 👍 and COMMENT 💬!

GBPUSD bullish breakout supported at 1.3656The GBPUSD remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 1.3656 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.3656 would confirm ongoing upside momentum, with potential targets at:

1.3900 – initial resistance

1.3950 – psychological and structural level

1.4050 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.3656 would weaken the bullish outlook and suggest deeper downside risk toward:

1.3590 – minor support

1.3540 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the GBPUSD holds above 1.3656. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

SELLER INTO MARKET FOR WHILEI can See sellers interest

After the interest rate decision, the seller is inclined to allow additional time so as to reassess the pricing structure, with the intention of lowering the price marginally and introducing further improvements.

Please note that this is not financial advice

US30 Long: Corrective Phase Complete and 4H Bullish EngulfingSimple price action setup on the US30 4H chart.

Correction: We saw a clean 5-wave drop into support.

Rejection: Price tapped the 0.618 Fib level and rejected immediately.

Confirmation: A massive 4H Engulfing Candle has formed, signaling a shift in momentum.

I am Long with stops below the swing low. Looking for a run back to the highs.

Disclaimer: This analysis is for educational purposes only and represents my own view of the market. Trading involves significant risk. Please manage your risk according to your own capital rules.

XAUUSD 4H — Bearish Pullback from Supply ZoneGold has reacted strongly from a key resistance/supply area and is now showing bearish continuation on the 4-hour timeframe. Price broke the rising structure and is moving lower toward the demand zone around 5290–5185. As long as price stays below the supply zone, sellers remain in control. Watch for bearish confirmation or rejection at lower levels before entering trades. Risk management is important.

EURUSD 1H – Demand Zone Rejection Setup EURUSD previously moved in a strong bullish channel, indicating healthy upward momentum. After reaching the channel high, price faced selling pressure and transitioned into a consolidation phase.

The marked demand zone is acting as a key resistance-turned-supply area. Price is currently reacting below this zone, forming a lower high structure, which suggests potential bearish continuation.

A rejection from the demand zone combined with the current structure opens the door for a pullback toward the lower support / target zone, highlighted on the chart.

Key Levels

Demand Zone: Upper red zone (sell pressure area)

Entry Area: Rejection below demand

Target: Lower red support zone

Trade Bias

Bias: Bearish below demand zone

Invalidation: Strong breakout and close above demand

The BTC "Fakeout" Play: My Exact Plan for $94,000The plan remains exactly as discussed. We need to see price reclaim support to confirm a 'fakeout' of the recent lows, which would open the door for an upward continuation toward $94,000 – $95,000.

⚠️ The Bear Case: However, if we see strong red candles on the daily close over the next few days, it’s a warning sign. This potential weakness could drive price further down toward the lower support zones at $84,800 – $83,500.

Long on USD/CAD pairI’m currently very long on the Dollar Index, following its rebound from a four-year historical low. From a technical perspective, the USD is already showing signs of recovery against most major pairs, at least for now.

That said, extra caution is required tonight due to the Fed meeting, which could trigger significant volatility across the markets. Additionally, the Bank of Canada left its policy rate unchanged today, removing an immediate catalyst on the CAD side.

Stay safe tonight.

Will it retest the downtrend line?#BOME

From a structural perspective, we are currently near the resistance zone (S/R), thus facing a risk of pullback.

However, we have broken through the downtrend line, indicating that the downtrend may have ended and the downtrend line will now act as a support line. If the price retests this trend line, it would present a very worthwhile opportunity to go long.

I hope this scenario will happen.

MSFT WARNING!Here is a closer view of the chart I posted back on Oct 5, 2024, for a nice profitable -25% drawdown.

This time will be far more profitable.

Here is a breakdown of the chart.

- Up against a 38-year trendline.

- A rare 5-wave rising wedge.

- A H & S with a head test

- Big Ass Gap Below

- Double top M pattern that CRACKED!

- Rising Bearish Wedge.

This is just getting started!

Bulls, if you didn't make your money in MSFT yet and are trying to squeeze a little bit more profits bc you are too damn greedy. Then you deserve what you get next.

THANK YOU for getting me to 5,000 followers! 🙏🔥

Let’s keep climbing.

If you enjoy the work:

👉 Boost

👉 Follow

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

Czas na BLACKBERRY - 50% potential profit - 5.40 $Based on the current chart structure, the stock appears to be forming a base after a prolonged downtrend, with price stabilizing around the $3.60–$3.70 support zone. This area has acted as a historically significant demand level, where selling pressure is starting to weaken.

Price action shows compression near the lows, which often precedes a volatility expansion. The moving averages are flattening, suggesting that bearish momentum is losing strength, while downside follow-through remains limited. This behavior typically indicates accumulation rather than distribution.

A successful hold above the current support, followed by a reclaim of the $4.20–$4.40 zone, could act as a trigger for momentum buyers. From a technical perspective, this opens the door for a mean reversion move toward the prior resistance region near $5.40, which also aligns with a previous supply zone and represents roughly a 45–50% upside from current levels.

If market sentiment improves or a modest catalyst appears, the stock could move quickly toward the $5.00–$5.40 range in the near term, especially given the relatively light resistance between current price and that level.

Potential TP: 5.40 USD

This analysis is for educational and informational purposes only and does not constitute financial advice or a recommendation to buy or sell securities. All trading involves risk, and you should conduct your own research or consult a licensed financial advisor before making investment decisions.

Bitcoin Down to 60's, 50's in 2026October should be the bottom based on cycles.

ATL 2015 to ATH 2017 = 1064d

ATH 2017 to ATL 2018 = 364d

ATL 2018 to ATH 2021 = 1064d

ATH 2021 to ATL 2022 = 364d

The pattern would print this cycle's ATH on the 6th of October 2025.

We indeed saw the top on October 2025. 364 days takes us to early October low.