GBPJPY-SELL trategy weekly chart GANN FanThis is a pair that has always some difficulty when it comes to apply strategies. There are two items that influences the pair, one being EURGBP cross and the other side is EURJPY movement. Technically, the EURGBP looks a little lethargic, and the EURJPY shows overbought status. This suggest that the move will happen mostly from EURJPY donwward movement.

The GBPJPY pair is very overbought, and am not saying it can't go higher, but overall the pair should correct back towards 207.00 at least is my personal view point. That is the profit area I am looking for.

Chart Patterns

Ondas Holdings' Monumental Capital Raise A Comprehensive Analysis: Ondas Holdings' Monumental Capital Raise and Its Strategic Implications

Significant Dilution Meets Strategic Ambition: Unpacking a $1 Billion Offering

On Monday, shares of Ondas Holdings Inc. (NASDAQ: ONDS) traded lower, a direct reaction to the company's announcement of a monumental and highly complex registered direct offering. This capital raise is not a routine equity event; its sheer size, structure, and implications mark a pivotal moment in Ondas' corporate evolution. The transaction involved selling 19 million shares of common stock and pre-funded warrants for up to 41.79 million additional shares to a single institutional investor, collectively representing 60.79 million common-stock equivalents. Crucially, each of these units was sold with accompanying warrants that grant the right to purchase two additional shares, potentially unleashing another 121.58 million shares into the market if exercised in full. The offering was priced at $16.45 per unit, a premium of approximately 17.5% to the stock's closing price on January 8, 2026, indicating the institutional buyer's strong conviction in the long-term thesis.

The immediate financial impact is substantial. Ondas expects net proceeds of approximately $959.2 million, a war chest that management intends to deploy for "corporate development and strategic growth, including acquisitions, joint ventures, and investments." Looking further ahead, if all the accompanying common stock warrants—which carry a $28.00 exercise price and are valid for seven years—are exercised for cash, the company could raise an additional $3.4 billion. This two-tiered funding mechanism provides immediate capital for aggressive expansion while embedding a massive future funding option.

However, this ambitious move comes at a clear cost to existing shareholders: profound dilution. The market's negative reaction reflects concerns over the massive increase in the share count, both immediate and potential. The sheer scale of the offering, with warrants that could more than triple the current diluted share count, creates a significant overhang on the stock. Investors must weigh this dilution against the transformative potential of the capital being raised.

Strategic Rebranding and Operational Momentum: Building a Defense & Security Platform

This capital infusion is not occurring in a vacuum. It follows a series of strategic initiatives that redefine Ondas as a company. Recently, Ondas announced plans to change its name to Ondas Inc., a move symbolic of its transition from a holding company to a unified, integrated global operating platform. The relocation of its corporate headquarters to West Palm Beach, Florida, further underscores this shift toward a more scalable structure.

Operationally, the company's dual-pronged business model is gaining traction:

Ondas Autonomous Systems (OAS): Focused on autonomous aerial and ground robot intelligence for defense and security. Recent successes include a $10 million order for counter-UAS solutions and robotic platforms from government security agencies, validating its technology in critical infrastructure protection.

Ondas Networks: Provides private wireless solutions via its FullMAX Software Defined Radio technology, serving as a communications backbone for secure, reliable data links.

CEO Eric Brock has articulated a vision of building a "scalable defense and security-related platform" targeting international dual-use markets. The $959 million in new capital is the fuel intended to accelerate this vision through strategic M&A and organic investment.

Technical Analysis: Extraordinary Momentum Meets Overbought Conditions and Key Levels

From a technical perspective, Ondas has been one of the market's most explosive performers, with a 593.61% gain over the past 12 months. The stock exhibits a powerfully bullish trend, trading well above all key moving averages: 32.2% above its 20-day SMA, 57.4% above its 50-day SMA, and a staggering 180.7% above its 200-day SMA.

Key technical indicators, however, signal caution amidst the strength:

The Relative Strength Index (RSI) is at 71.01, solidly in overbought territory, suggesting the rally may be due for a pause or pullback.

The MACD remains above its signal line, confirming the prevailing bullish momentum but warranting vigilance for any bearish crossovers.

Given the stock's parabolic rise and the new dilution overhang, identifying potential support levels is crucial for risk management. Based on Fibonacci retracement analysis of the recent major upward leg, two critical support zones emerge:

Primary Support Zone: $11.81 – This aligns with the 0.236 Fibonacci retracement level. A successful test and hold here would indicate the broader uptrend remains fundamentally intact and that the dilution sell-off was a healthy consolidation.

Secondary & Stronger Support Zone: $9.66 – This corresponds to the 0.382 Fibonacci retracement level. This represents a deeper, but still corrective, pullback that would offer a higher potential reward-to-risk entry for believers in the long-term story, assuming the company's strategic use of capital proves successful.

Investment Thesis: A High-Stakes Inflection Point

In summary, Ondas Holdings stands at a high-stakes inflection point. The company has secured a transformational amount of capital to aggressively execute its vision of becoming a leading integrated platform in the autonomous defense and secure communications sector. The offering's premium pricing and the involvement of a major institutional investor signal strong insider confidence in the roadmap.

The investment decision now boils down to a calculus of dilution versus acceleration. The significant increase in share count is a tangible near-term headwind and the source of the current price pressure. However, if management can deploy this capital effectively to acquire synergistic technologies, secure major contracts, and drive accelerated revenue and profit growth, the dilution could be overcome by a substantially larger equity value.

For investors, the strategy might involve patience. Monitoring the stock's behavior around the key Fibonacci support levels of $11.81 and $9.66 could present strategic entry points. The coming quarters will be critical, as the market will demand clear evidence that the $959 million is being deployed in a manner that justifies the dilution and fulfills the promise of the "Ondas Inc." platform vision. This stock remains a high-volatility, high-potential play on the future of autonomous systems and private wireless networks, but now with dramatically amplified stakes.

Palantir: Air is getting thin NASDAQ:PLTR recently reached our designated red short Target Zone, triggering an active short trade. We have been managing risk proactively, reducing the position by 50% after hitting the initial take-profit level. As a result, our stop-loss is now set at the entry price. As the weekly chart indicates, the stock is primarily in a major corrective phase, identified as wave II in beige. This correction is expected to continue, first pausing in the upper green Target Zone ($117.54–$95.10) before potentially extending down to the lower green Target Zone between $72.58 and $40.66. Alternatively, there is at least a 33% chance that the stock could first post a new high for wave alt.I in beige, above resistance at $207.23.

Tesla Inc. (TSLA) | Bullish Technical Outlook🚗⚡ TSLA Market Profit Playbook – Bullish Swing Strategy

Asset: Tesla, Inc. (TSLA) - NASDAQ Stock Exchange

Current Price: $445.01 (as of Jan 12, 2026)

52-Week Range: $214.25 - $498.83

📊 MARKET SNAPSHOT – REAL-TIME FEED

Live Price Action:

Current trading at $442.83 with intraday range $438.00 - $444.50

All-time high closing price was $489.88 on December 16, 2025

Average daily volume: 60.35M shares

Market cap: $1.48 trillion

Recent Performance:

Stock gained 19.18% over past 4 weeks as of Jan 6, 2026

Year-over-year performance: +13.27%

🎯 TRADING PLAN: BULLISH SETUP

📍 Entry Strategy: Layered Limit Orders (Thief Method)

This strategy uses multiple buy limit orders to scale into positions at favorable levels:

Layer 1: $430.00

Layer 2: $440.00

Layer 3: $450.00

Note: You can add additional layers based on your risk appetite and capital allocation strategy. This scaling approach reduces average entry cost and manages downside risk.

🎯 Take Profit Target:

Primary TP: $490.00 (near recent all-time high resistance zone)

Reasoning: Price approaching the $498.83 52-week high creates a strong resistance zone where profit-taking is expected. The $490 level acts as a police barricade (strong resistance + potential trap zone).

⚠️ Disclaimer: This is MY target level. You have the freedom to set your own profit targets based on your trading style and risk management. Take profits when YOU'RE comfortable – it's your capital, your decision.

🛑 Stop Loss:

Thief SL: $420.00

Risk Management: Positioned below recent support to prevent minor volatility from triggering exits

⚠️ Disclaimer: This is MY stop-loss level. You're encouraged to set your own stop-loss based on your risk tolerance and account size. Protect your capital at YOUR chosen level.

📈 TECHNICAL ANALYSIS

Chart Structure:

Price currently consolidating in mid-channel after pullback from $498.83 high

Stock lies in middle of wide, weak rising trend in short term with further rise signaled

Support from accumulated volume at $429.24 may hold as buying opportunity

Average True Range: 3.35% daily volatility (medium risk profile)

Key Levels:

Support: $429-430 (volume accumulation zone)

Resistance: $490-498 (police barricade resistance cluster)

🌍 FUNDAMENTAL & ECONOMIC FACTORS

Upcoming Catalysts:

Q4 2025 Earnings Release: Wednesday, January 28, 2026 (after market close)

Expected EPS: $0.45 per share

Q4 deliveries of 418,227 vehicles announced (down 15% YoY)

Delivery Performance:

Full year 2025 deliveries: 1.64M units (down 8.6% from 1.79M in 2024)

Energy storage deployments reached record 14.2 GWh in Q4

Industry Headwinds:

Global EV sales growth expected to slow to 12% in 2026 vs 23% in 2025

Federal EV tax credit expired September 2025, impacting affordability

BYD overtook Tesla as world's largest EV seller with 2.26M units sold in 2025

Technical Sentiment:

Analyst consensus: 20 buy, 10 sell ratings (Neutral overall)

Average 12-month price target: $403.32 (High: $600, Low: $120)

🔗 CORRELATED PAIRS TO WATCH

EV Sector Correlation:

NASDAQ:RIVN (Rivian Automotive) - Direct EV competitor

NASDAQ:LCID (Lucid Group) - Luxury EV segment

NYSE:NIO (NIO Inc.) - Chinese EV manufacturer

Tech/AI Correlation:

NASDAQ:NVDA (Nvidia) - AI chip supplier for Tesla's FSD technology

NASDAQ:MSFT (Microsoft) - Cloud/AI infrastructure plays

NASDAQ:META (Meta Platforms) - Nasdaq-100 stocks historically rise in January 70% of time with 2.5% average return

Key Relationship: Tesla's performance increasingly tied to its AI/autonomous driving narrative rather than pure automotive sales. Monitor semiconductor and tech sector momentum as leading indicators.

⚠️ RISK FACTORS

Earnings Volatility: Q4 earnings could create structural shift if margins compress or delivery guidance disappoints

Competition: Intense competition from Chinese manufacturers, particularly BYD's 28% growth rate

Political Risk: Musk's political activities have triggered consumer backlash in Europe and U.S.

Valuation Concerns: Director James Murdoch sold 60,000 shares at $445.40 on January 2, 2026

🎪 TRADING WISDOM: THE THIEF'S PLAYBOOK

This setup represents a swing trade opportunity in a consolidating market leader. The layered entry approach (Thief Strategy) provides:

✅ Cost averaging benefits

✅ Reduced timing risk

✅ Flexibility to scale position size

Remember: Markets reward patience and discipline. The goal isn't to catch the perfect bottom – it's to position yourself in the profit zone and manage risk effectively.

✨ "If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!"

bulls- if we get a deeper reversal and bullish signal, then the flag /channel status is confirmed, and we can surge upside, any good news on NVIDIA this week also helps, looking for a solid 350 points. hurts so much yesterday's buy missed my entry by 20 points (= 2 pips in currency markets) but we charge on. let's get it!!!! 📈

#BTC.W Update📊#BTC.W Update

🧠From a structural perspective, we haven't successfully broken through the blue resistance zone yet, and are still consolidating sideways within it. Only a strong breakout of this area can allow us to maintain a bullish stance.

➡️From a chart perspective, there's a possibility of a bearish flag pattern forming here. We need to closely monitor the support at the lower edge of the flag.

➡️From a time perspective, the consolidation period in this yellow zone is approaching the same duration as the previous yellow zone. We should be wary of potential sharp fluctuations. Whether it will be a strong upward breakout or a downward move to gain liquidity before breaking out, we don't need to speculate; we just need to patiently wait for the market to provide the outcome.

🤜If you like my analysis, please like💖 and share💬

BINANCE:BTCUSDT

Financing a Strategic Pivot Amid the AI Energy RevolutionMarket Analysis: Vistra Corp. (VST) - Financing a Strategic Pivot Amid the AI Energy Revolution

Debt Issuance to Fuel Growth and a Transformative Meta Partnership

On January 12, 2026, Vistra Corp. (NYSE: VST), a Fortune 500 integrated retail electricity and power generation company, announced the successful pricing of a substantial private debt offering. The company secured $2.25 billion in aggregate principal through the issuance of senior secured notes, strategically structured across two tranches to match its long-term capital needs: $1.0 billion in notes due 2031 with a coupon of 4.700%, and $1.25 billion in notes due 2036 with a coupon of 5.350%. Priced at 99.954% and 99.745% of face value respectively, these notes were offered to qualified institutional buyers, reflecting strong institutional demand for Vistra's credit.

The structure of this offering is noteworthy for its alignment with the company's existing capital framework. The notes will be issued by Vistra Operations Company LLC, a key operating subsidiary, and will be senior, secured obligations backed by first-priority liens on a substantial portion of the company's assets—the same collateral pool that supports its primary credit facility. This structure provides lenders with a high degree of security. A notable covenant allows for the release of this collateral should Vistra achieve an investment-grade rating on its senior unsecured debt from two major agencies, a provision that aligns lender and shareholder interests in the company's credit improvement.

Management has explicitly earmarked the proceeds to serve three strategic purposes:

To fund a portion of the consideration for the pending acquisition of Cogentrix Energy (approximately 5.5 GW of generation assets).

For general corporate purposes, including the repayment of existing, likely higher-cost, indebtedness.

To cover associated fees and expenses.

This capital raise is not merely a refinancing exercise; it is a deliberate move to strengthen the balance sheet and provide dry powder for Vistra's ambitious growth strategy, squarely focused on the seismic shift in electricity demand.

The Core Investment Thesis: Vistra as a Critical "Picks and Shovels" Play for the AI Boom

While semiconductor companies have been the clear early beneficiaries of the artificial intelligence revolution, a compelling secondary thesis is rapidly gaining prominence: the indispensable and massive energy infrastructure required to power it. The International Energy Agency (IEA) forecasts that global data center electricity consumption could double by 2030 to nearly 1,000 TWh. This creates an unprecedented, long-duration demand driver for reliable, scalable, and increasingly carbon-free power.

Vistra's recent landmark partnership with Meta Platforms (META) to support its "Prometheus" AI supercomputing cluster exemplifies this shift. Unlike partnerships with developmental nuclear firms, Vistra brings immediate, operational scale. The agreement involves two 20-year Power Purchase Agreements (PPAs) for 2,609 MW of carbon-free generation from Vistra's existing nuclear fleet in the PJM market. This deal is transformative: it significantly extends the economic life of key assets, provides unparalleled revenue visibility for decades, and validates nuclear power as a cornerstone for high-density, 24/7 computing needs.

Navigating Near-Term Financial Headwinds with a Long-Term Growth Blueprint

A superficial glance at Vistra's recent quarterly financials reveals the volatility inherent in the merchant power business. Q3 2025 results showed a year-over-year decline, with revenues of $4.97B (down 21%) and EPS of $1.75 (missing estimates). This earnings pressure, attributed largely to fuel cost volatility and regional pricing dynamics, explains the stock's subdued performance over the past year, currently trading well below its 52-week high.

However, focusing solely on trailing earnings misses the strategic buildout underway. Vistra is executing a multi-faceted strategy to capitalize on the AI-driven demand surge:

Nuclear Expansion: Beyond the Meta deal, the company has secured other long-term PPAs for its nuclear output, including a major agreement that more than triples the output of its Comanche Peak facility starting in 2027.

Balanced Fleet Development: Recognizing the need for both carbon-free and dispatchable power, Vistra is aggressively expanding its solar and battery storage portfolio while also acquiring modern, efficient natural gas assets (like the Lotus Infrastructure and Cogentrix deals). Gas generation serves as the critical, flexible backbone to support intermittent renewables and meet immediate data center interconnect requests.

Strong Balance Sheet: Despite earnings volatility, the company maintains a robust financial position with healthy liquidity ($602M in cash versus $231M in short-term debt as of Q3 2025) and significant adjusted EBITDA growth (up 9.9% YOY in Q3), underscoring core operational strength.

Valuation, Analyst Sentiment, and Technical Perspective

Vistra's forward-looking growth narrative is reflected in its valuation metrics, which trade at a premium to sector medians (e.g., forward P/E of ~26x). This premium is underpinned by its unique positioning as a merchant generator with leveraged exposure to soaring wholesale power prices and secured long-term contracts, unlike traditional regulated utilities.

Wall Street analysts largely endorse this view, with a consensus rating of "Strong Buy." The mean price target of approximately $242 suggests a potential upside of nearly 39% from current levels, with the majority of covering analysts (16 out of 19) in the "Strong Buy" camp.

From a technical analysis standpoint, for investors considering entry, key support is identified at the $141.76 level, which aligns with the 0.382 Fibonacci retracement of a prior significant upward move. This zone may offer a level of stability or a potential rebound point during broader market pullbacks.

Conclusion: A Strategic Inflection Point

In summary, Vistra Corp. is at a strategic inflection point. The recent $2.25 billion debt offering provides the capital to accelerate its transformation into a premier power supplier for the digital age. While near-term earnings are susceptible to commodity swings, the long-term thesis is powerful and concrete: Vistra's diversified, modernizing fleet—anchored by its invaluable nuclear assets and bolstered by strategic gas acquisitions—is being proactively contracted to meet the generational demand wave from AI and electrification. For investors with a long-term horizon who can tolerate cyclical volatility, Vistra represents a compelling infrastructure play on the AI revolution, offering a rare combination of visible growth, dividend income, and exposure to the fundamental re-rating of power assets.

GBP/USD building a Bat formation; support a 1.3452We witnessed continued upward pressure from the 1.3391 swing low. We have seen a correction to the downside close to the projected AB barrier of a Bat formation.

Currently holding within a bullish Flag. Support is located at 1.3452.

The Bat will be completed on a move to 1.3548

Conclusion: although there is ample scope for a corrective move to the downside, I look for dips to find buyers

USDJPY Wait For The Beak!The Bank of Japan just hiked interest rates by 25 bps to 0.75%, the highest level in ~30 years. FED lowering while BOJ raising rates is bad juju for the carry trade.

Why carry risk is rising

BOJ hikes = funding cost up. Yen is no longer “free money.”

Fed cuts = yield advantage shrinking. The whole carry equation weakens.

Compression kills carry. You don’t need parity — you just need the gap to narrow.

What actually breaks carry trades

Not the BOJ hike

Not the Fed cut

The moment markets believe the trend is durable

Carry trades die on expectations, not announcements.

Keep an eye out for the breakout.

If carry breaks, bad juju for Crypto & AI trade,

Buy This BEFORE the AI Energy Crisis: 100% Gains on Natural Gas?Natural Gas is quietly setting up for the biggest trade of 2026. While everyone is watching tech stocks, a massive Falling Wedge pattern on the daily chart suggests NATGAS is bottoming out and preparing for a +100% rally.

I break down why the era of "cheap gas" is ending and how AI Data Centers and new LNG export terminals are about to trigger a massive supply squeeze.

I cover: 📉 The Technicals: The multi-year "Falling Wedge" breakout that targets $7.00. 🌍 The Macro: Why 2026 is the year of the "Supply Deficit" (AI Power + LNG Expansion). 🎯 The Trade Plan: My exact entry triggers, stop-loss at $2.65, and why I’m targeting a 100%+ gain. ⚠️ Risk Analysis: What could invalidate this bullish thesis?

This isn't just a swing trade; this is a potential supercycle bottom. If you are looking for an asymmetric opportunity with a 1:7 Risk/Reward ratio, you need to watch this analysis.

#NaturalGas #NatGas #Commodities #Trading #TheGoldenTrader #Investing #EnergySector #XNGUSD

Stop!Loss|Market View: EURUSD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the EURUSD currency pair☝️

Potential trade setup:

🔔Entry level: 1.16106

💰TP: 1.15142

⛔️SL: 1.16509

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Despite the euro's strengthening at the very beginning of the week from the previously identified support area, the pair is still viewed favorably by sellers, with targets at 1.15500 and 1.15000. This scenario requires waiting for the price to approach the support at 1.16160, a retest of which will likely be followed by a downward breakout. Accumulation during the retest of this support will be a particularly strong selling context.

Thanks for your support 🚀

Profits for all ✅

Gold — potential pullback Gold & Silver — potential pullback before the next leg higher 📈

Both markets are in strong uptrends, but after this recent push, price is starting to look a bit stretched.

I’m not chasing highs here — I’m patiently waiting for a healthy pullback into key support zones.

Gold: watching the 4550–4580 area for a potential reaction.

Strong trends don’t move in a straight line. Pullbacks are where the best opportunities usually form.

What levels are you watching?

XAUUSD BULLISH SETUP(READ CAPTION)Hi trader's what do you think about gold

Gold (XAUUSD) is currently showing a bullish market structure, with price holding above a key support zone and buyers actively defending pullbacks. The overall price action supports a continuation toward higher levels.

🔹 Support Zone: 4455–4430

This zone represents the primary bullish demand area where buyers have previously stepped in strongly.

As long as Gold holds above 4430, the bullish bias remains valid.

🔹 Resistance: 4518

This is the key near-term resistance level.

A confirmed breakout and close above 4518 will strengthen bullish momentum and signal continuation.

🔹 Supply Zone: 4550

This is the main upside target and supply area.

If Gold breaks above 4518, price is likely to move toward the 4550 supply zone, where sellers may attempt to slow or reject the move.

A strong breakout above 4550 could open the door for further bullish expansion.

📈 Market Outlook

Holding above 4455–4430 → Bullish continuation expected

Break above 4518 → Targets 4550 supply zone

Supply zone reaction will define the next directional move

Overall, the structure supports a bullish pullback followed by continuation setup.

please don't forget to like comment and follow thank you

The chart is a 1‑hour EUR/USD The chart is a 1‑hour EUR/USD

1. Seller Zone: A yellow shaded area marking a resistance region where selling pressure is expected, indicating a potential bearish zone.

2. Range: A yellow box highlighting a consolidation or trading range where price has been moving sideways before a breakout.

3. Support Level: Marked at 1.16776, with additional levels shown nearby (1.16849, 1.16674, etc.), indicating where buyers may step in.

4. Target Point: A projected downside move is shown with a purple arrow pointing to a lower price zone (around 1.16428 / 1.16394), suggesting a bearish target if the price breaks below the range.

5. Price Action: The chart shows a descending trendline cutting through the seller zone, indicating a bearish bias. The recent candles are breaking out of the range toward the downside, suggesting potential further decline to the target.

6.

Key takeaway: The setup expects a continuation of selling pressure after the breakout from the range, aiming for the target near 1.16394, with the next support around that level. Resistance remains in the seller zone above.

#EDU/USDT Forming Bullish Momentum

#EDU

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.1486. The price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.1506

First Target: 0.1523

Second Target: 0.1545

Third Target: 0.1568

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For inquiries, please leave a comment.

Thank you.

#CVX/USDT : Long-Term Breakout Signals Massive Upside Potentia

#CVX

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1.95. The price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 1.98

First Target: 2.02

Second Target: 2.06

Third Target: 2.12

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For inquiries, please leave a comment.

Thank you.

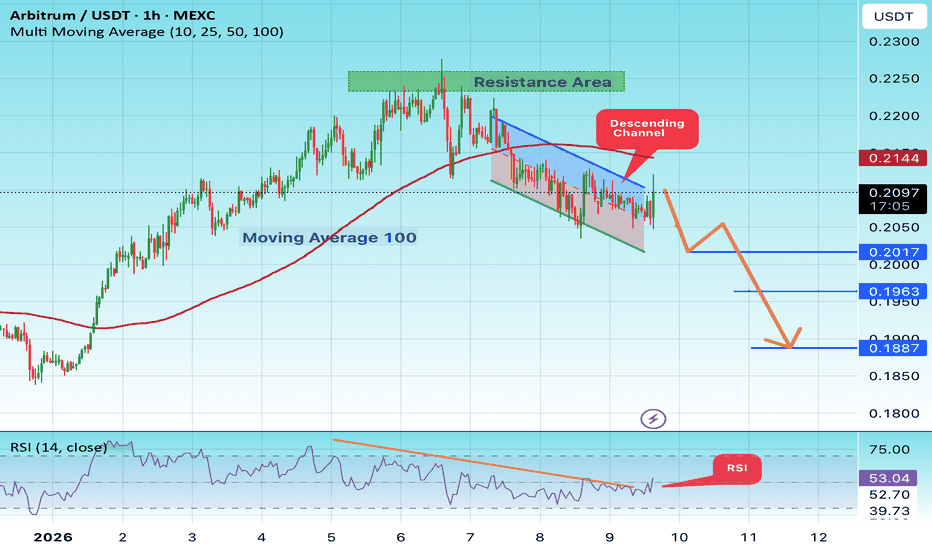

#ARB/USDT#ARB

The price is moving within a descending channel on the hourly timeframe. It has reached the upper boundary and is trending downwards, with a retest of this boundary expected.

The Relative Strength Index (RSI) is showing an upward trend, approaching the upper boundary, and a downward reversal is anticipated.

There is a key resistance zone (in green) at 0.2250, and the price has bounced from this zone several times. Another bounce is expected.

The price is showing a consolidation pattern above the 100-period moving average, which we are approaching, supporting the possibility of a downward move towards it.

Entry Price: 0.2120

Target 1: 0.2017

Target 2: 0.1963

Target 3: 0.1887

Stop Loss: Above the green resistance zone.

Don't forget one simple thing: Money Management.

For inquiries, please leave a comment.

Thank you.

#DOGS/USDT is currently strongly bullish#DOGS

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.0000418. The price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.0000439

First Target: 0.0000447

Second Target: 0.0000458

Third Target: 0.0000472

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For inquiries, please leave a comment.

Thank you all.