META printing identical pattern as the 2022 Bear Cycle.Meta Platforms (META) is on the 5th straight week of sideways price action within the 1W MA50 (blue trend-line) and 1W MA100 (green trend-line). If we exclude the marginal break of December 08, this is the 11th straight week within this range.

Following the mid-August All Time High (ATH), the stock has technically entered a strong downtrend, the strongest since February - March 2025 and its only Support is the 1W MA100.

This looks identical with the start of the previous Bear Cycle. The Bull Cycles that preceded both peaked on the month of August (2021 and 2025 respectively) and right now (January) we are in a similar position as January 2022, with the 1W MA100 supporting, while the 1W RSI is just below 45.00. On top of that, add the fact that the current 1W RSI has been has been under a huge Lower Highs Bearish Divergence since March 04 2024.

With both patterns involving also a Higher Lows support, which after it broke in 2022 led to a Bear Cycle bottom just below the 1.236 Fibonacci extension, we expect META to repeat this if the 1W MA100 breaks and target $360 (Fib 1.236) towards the end of the year. Notice that this would make a perfect contact with the 1M MA100 (black trend-line).

It has to be noted at this stage that the 2022 Bear Cycle was extremely strong due to the dismal fundamentals. It wasn't just the macroeconomic environment (Inflation Crisis, Ukr-Rus war) but also the Metaverse disappointment. It is highly unlikely to get another such strong Bear Cycle, unless a similar bearish catalyst emerges.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Chart Patterns

Solana Still Has Room to Run | Targets AheadHello traders! 🚀

Hope your week is off to a great start!

Today I’d love to share my thoughts on Solana (SOL) 💎

Even though SOL has already made a solid move to the upside, the chart is still sending bullish signals 📈 The structure suggests that the momentum may continue, and the party might not be over yet 😉

From current levels, I’m looking for a move toward 148.

❌ Invalidation level:

Any touch of the 141.6 area will invalidate this bullish scenario.

Let’s break down the targets step by step 👇

🎯 Target 1: 145

🎯 Target 2: 148

🎯 Bold target: (151.4) — a bit optimistic, so I’ll keep it in brackets 😄

If this idea resonates with you, hit the like 👍,

follow for more trading ideas, and

share your thoughts in the comments — where do you see SOL going next? 💬

Trade smart, manage your risk 🧠

Let’s watch the chart together! 🚀📊

ZECBTC / ZECUSDT: Leadership - Best Relative Perf In 2026?

Markets are in do or die. Lots of shakiness & most charts are showing bearish thesis for next 6-8 months. Gold +, Silver +, dollar devaluation. Lots of unknowns in 2026. Lots of political tension. If bitcoin does a pull back ( bear market), I think ZEC might benefit this time around as people are bit nervous parking in dollar/cash. ZEC might benefit a lot in 2026. Charts are lined up, but keep an eye on invalidations. Do you own research.

ZEC is in a relative-strength leadership phase and is likely to outperform BTC during a controlled BTC/ETH pullback in 2026. This is a condition where rotation leaders often continue higher after short-term consolidation. As long as the breakout structure holds, short-term weakness is corrective — not a failure.

ZEC is not “decoupling” from Bitcoin — it’s rotating. Capital is shifting from BTC/ETH/Alts into ZEC as a relative-strength trade, which is why ZEC/BTC has outperformed during recent market weakness. The impulse began after reclaiming the ~0.010–0.011 BTC base, and a short-term pullback over the coming weeks would be normal after such expansion. As long as price holds above ~0.013 BTC and does not lose the breakout zone, the path of least resistance remains higher, with a retest of the ~0.022 BTC level as the next major objective.

This is performance-seeking rotation within crypto, not safe-haven behavior or full decoupling.

Invalidation: A weekly close below ~0.011 BTC negates the relative-strength.

What ZEC is doing:

- Outperforming BTC ✔

- Rallying while BTC/ETH pull back ✔

- Breaking multi-year ZEC/BTC structure ✔

- Attracting rotation from overheated majors ✔

A Short-Term Pullback Is Expected — and Healthy

Reset momentum

Form a continuation base

Preserve the higher-timeframe breakout

A controlled correction ≠ weakness.

It’s what keeps trends alive.

Why 0.022 BTC Is a Logical Target?

It aligns with prior structural resistance

Matches measured-move symmetry from the channel break

Sits at a psychologically important relative-value zone

ZEC does not need Bitcoin to rally to reach this level —

it only needs to outperform BTC, which it is already doing.

Disclaimer: Educational analysis only — not financial advice. Crypto markets are volatile; trade at your own risk.

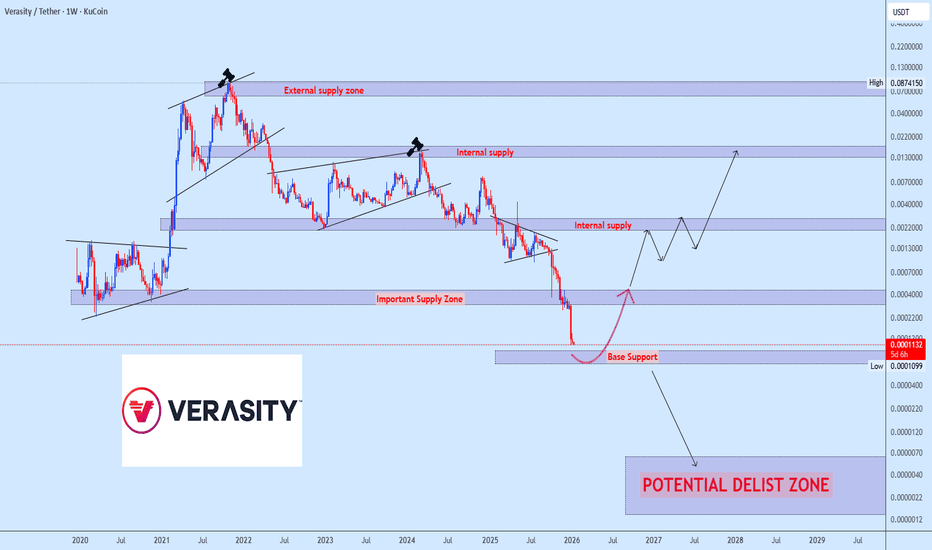

VRAusdt at Risk Key Support Under PressureVRA remains under sustained downside pressure, with price now approaching a critical support base that must hold to preserve the broader structure. This zone represents a key inflection point; failure to defend it would significantly weaken market confidence and could accelerate further downside risk.

If buyers successfully defend this level, a technical rebound is expected, with the bullish recovery path and upside objectives clearly outlined on the chart.

Could we see a reversal from here?GBP/JPY could rise towards the resistance level, which aligns with the 61.8% and the 78.6% Fibonacci projections and could reverse from this level to our take profit.

Entry: 214.60

Why we like it:

There is a resistance level at the 61.8% and the 78.6% Fibonacci projections.

Stop loss: 215.71

Why we like it:

There is a resistance level at the 78.6% Fibonacci projection.

Take profit: 211.99

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

AUDUSD — FRGNT DAILY CHART FORECAST Q1 | D13 | W2 | Y26📅 Q1 | D13 | W2 | Y26

📊 AUDUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

Potential bearish drop for the Kiwi?The price could make a short-term pullback to the resistance level, which is a pullback resistance, and could drop from this level to our take profit.

Entry: 0.5755

Why we like it:

There is a pullback resistance level.

Stop loss: 0.5776

Why we like it:

There is an overlap resistance level

Take profit: 0.5706

Why we like it:

There is a pullback support level that aligns with the 78.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDJPY Intraday Bullish Above 158.63 → Target 159.82Market Bias: Bullish (Intraday)

Trade Idea

USDJPY is continuing its bullish move on the intraday timeframe. Price is holding above the key support level and trading above major moving averages, which keeps the upside scenario active.

As long as price stays above the bullish trigger level, buyers are expected to remain in control.

Trade Plan

Bullish Above: 158.63

Targets:

🎯 159.61

🎯 159.82

🎯 160.03

Bearish Below: 158.28

Technical Reasons

RSI is above 70, showing strong bullish momentum

MACD remains positive above the signal line

Price is above 20 MA and 50 MA

Intraday structure supports higher highs

Buyers are defending the pivot/support area

Use proper risk management

Do not chase price after strong candles

Trade only with confirmation

One setup, one trade only

Invalidation

This bullish view becomes invalid if price sustains below 158.28.

Disclaimer

This analysis is for educational purposes only.

I am not a financial advisor.

Trading involves risk. Trade responsibly and manage your risk properly.

FX:USDJPY CRYPTOCAP:FOREX $INTRADAY AAII:BULLISH $PRICEACTION $TECHNICALANALYSIS

Bearish drop off 50% Fib resistance?GBP/USD has rejected the resistance level, which is an overlap resistance that aligns with the 50% Fibonacci retracement and a cold drop from this level to our take profit.

Entry: 1.3485

Why we like it:

There is an overlap resistance level that aligns with the 50% FIbonacci retracement.

Stop loss: 1.3552

Why we like it:

There is a swing high resistance level.

Take profit: 1.3355

Why we like it:

There is an overlap support level that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDCHF Intraday Bullish Above 0.7984 → Target 0.8046Market Bias: Bullish (Intraday)

Trade Idea

USDCHF is showing strong bullish momentum on the intraday chart. Price is holding above the key support area and trading above major moving averages, which supports further upside continuation.

As long as price remains above the bullish trigger level, buyers are expected to stay in control.

Trade Plan

Bullish Above: 0.7984

Targets:

🎯 0.8036

🎯 0.8046

🎯 0.8055

Bearish Below: 0.7968

Technical Reasons

RSI is above 70, showing strong bullish momentum

MACD is above the signal line and positive

Price is above 20 MA and 50 MA

Intraday structure supports upside continuation

Buyers are defending the pivot/support zone

Use proper risk management

Do not chase price after strong candles

Follow confirmation, not emotions

One setup, one trade only

Invalidation

This bullish view becomes invalid if price sustains below 0.7968.

Disclaimer

This analysis is for educational purposes only.

I am not a financial advisor.

Trading involves risk. Trade responsibly and manage your risk properly.

OANDA:USDCHF CRYPTOCAP:FOREX $INTRADAY AAII:BULLISH $PRICEACTION $TECHNICALANALYSIS

Bearish drop?EUR/USD has rejected off the resistance level, which is an overlap resistance, and could drop from this level to our take profit.

Entry: 1.1678

Why we like it:

There is an overlap resistance level.

Stop loss: 1.1734

Why we like it:

There is an overlap resistance level that aligns with the 61.8% Fibonacci retracement.

Take profit: 1.1569

Why we like it:

There is a pullback support that aligns with the 61.8% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURGBP — FRGNT DAILY CHART FORECAST Q1 | D13 | W2 | Y26📅 Q1 | D13 | W2 | Y26

📊 EURGBP — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURGBP

OGDC PSX 4H Chart Analysis 13-Jan-26Stop Loss: 301 PKR

Sell Stop: 281 PKR

Take Profit 1: 261 PKR

Take Profit 2: 242 PKR

Take Profit 3: 224 PKR

After a sustained bullish trend, a bearish RSI divergence has formed, indicating weakening upward momentum and a potential trend reversal. If the price breaks below the Sell Stop level at 281 PKR, it may confirm a bearish move, with downside targets at 261 PKR, 242 PKR, and 224 PKR.

⚠️ Always remember to protect your capital with a proper stop-loss and disciplined risk management.

GBPUSD Intraday Sell Setup Below 1.3467Market Bias: Bearish (Intraday)

Trade Idea

GBPUSD is showing bearish continuation on the intraday timeframe. Price is trading below the key pivot level and major moving averages, keeping downside pressure active.

As long as 1.3467 acts as resistance, sellers are expected to control the market.

Sell Plan

Sell below: 1.3467

Targets:

TP1: 1.3391

TP2: 1.3374

TP3: 1.3357

Stop Loss: Above 1.3496

Technical Reasons

RSI is below 50, showing weak bullish strength

MACD is below the signal line and in negative territory

Price is below 20 MA and 50 MA

Price is trading below the lower Bollinger Band

Overall intraday structure supports further downside

Always use proper risk management

Wait for confirmation near resistance

Do not chase the price

Avoid overtrading

Invalidation

This bearish setup will be invalid if price breaks and sustains above 1.3467.

Disclaimer

This analysis is for educational purposes only.

I am not a financial advisor.

Forex trading involves risk. Trade at your own responsibility and manage risk properly.

$ FX:GBPUSD FX:GBPUSD CRYPTOCAP:FOREX $Intraday $SellSetup $TechnicalAnalysis $PriceAction

Review and plan for 14th January 2026Nifty future and banknifty future analysis and intraday plan.

Quarterly results- hcltech, tataelxsi, dmart.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Too squeezy to ignoreThe VIX ETF just broke up the falling wedge in the weekly timeframe. I just bought this, it might pull back to test the broken resistant at 34-35. the VIS also is very low and trying to go up. And the SPY is close to ATH. MY SL triggers only if a weekly candle closes below 34.

Good luck

EURUSD Intraday Sell Setup Below 1.1679Market Bias: Bearish (Intraday)

Trade Idea

EURUSD is showing bearish pressure on the intraday chart. Price is trading below the key pivot and major moving averages, which supports further downside movement.

As long as 1.1679 remains strong resistance, sellers are in control.

Sell Plan

Sell below: 1.1679

Targets:

TP1: 1.1597

TP2: 1.1578

TP3: 1.1560

Stop Loss: Above 1.1711

Technical Reasons

RSI is below 50 → bearish momentum

MACD is below signal line and negative

Price is below 20 MA and 50 MA

Price is trading below the lower Bollinger Band

Overall intraday structure favors sellers

Trade only with proper risk management

Wait for confirmation near resistance

Avoid overtrading

Follow your trading plan strictly

Invalidation

If price breaks and holds above 1.1679, this bearish setup will be invalid.

Disclaimer

This analysis is for educational purposes only.

I am not a financial advisor.

Trading involves risk. Always manage your risk and trade at your own responsibility.

FX:EURUSD FX:EURUSD CRYPTOCAP:FOREX $Intraday $SellSetup $PriceAction $TechnicalAnalysis