BAIDU: Bullish Breakout With 40% Upside PotentialHey Realistic Traders!

Baidu, one of China’s leading technology stocks, is starting to flash signals that point to significant upside potential. Rather than relying on hype, let’s turn to the chart and see whether the technical analysis support this bullish narrative.

Technical Analysis

On the daily timeframe, NASDAQ:BIDU has been trading consistently above the EMA200, indicating a well-established bullish trend. Within Wave 4 of this broader uptrend, Baidu formed a bullish flag pattern, a corrective structure that typically appears before trend continuation. A breakout from this pattern signals renewed bullish pressure and often marks the beginning of Wave 5 in Elliott Wave theory.

Notably, the most recent swing low has held above the upper trendline, reinforcing the bullish Wave 5 scenario. This move was further supported by a MACD bullish crossover, adding momentum confirmation. Based on this setup, we anticipate a move toward the first target at 149.50, with potential extension toward the Fibonacci projection near 181.25 , completing the bullish Wave 5. Minor pullbacks may occur along the way as part of a healthy trend progression.

This bullish wave count remains valid as long as price stays above 107.24. A move below this level would invalidate the Wave 5 structure and shift the outlook back to neutral.

Support the channel by engaging with the content, using the rocket button, and sharing your thoughts in the comments below.

Disclaimer: This analysis is for educational purposes only and should not be considered a recommendation to take a long or short position on Baidu.

Chinesestocks

BIDU – Weekly Structure BreakoutContext

- Weekly timeframe

- Long corrective phase since 2021

- Recent transition from downtrend to base and breakout

What I see

- Clean breakout from the long-term descending channel

- Successful retest of the channel and rising support

- Price holding above the 200-week moving average

- Consolidation formed directly on long-term support

- Recent advance from a higher low confirms support acceptance

What matters now

- Holding above the 200-week MA keeps the reversal structure intact

- Continuation requires sustained trade above former resistance

Buy / Accumulation zone

- Pullbacks toward the 200-week MA and former channel resistance acting as support

Targets

- Primary upside reference at the 1.618 Fibonacci extension ($211 area)

- Higher extensions remain possible toward prior cycle projections if trend continues

Risk / Invalidation

- Sustained weekly loss of the 200-week MA would invalidate the support confirmation

JD – Weekly Descending Wedge (Late-Stage Compression)Thesis

JD remains in a late-stage descending wedge, with volatility compression increasing the probability of a range resolution. Peers already broke out in 2025 a similar setup (BABA, BIDU). 2026 can be the time for JD to catch up.

Context

- Weekly timeframe

- Multi-year downtrend transitioning into a base

- Support zone acting as the wedge “floor”

What I see

- 12+ months of narrowing range

- Repeated rejection at descending resistance

- Demand holding the same support region

- Compression suggests a decision point approaching

What matters now

- A weekly close above wedge resistance is the confirmation trigger

- Until then, this remains a compression structure, not a breakout

Buy / Accumulation zone

- Support zone at the wedge floor (risk defined by a breakdown).

Targets

- First: $70s

- Next: higher extensions into Wave 5, once pull back held

Risk / Invalidation

Weekly breakdown below the support floor invalidates the wedge thesis.

BIDU mid-term TABaidu remains among the strongest in Chinese market in selected area, yes it's somewhat weakened on daily but the indicators are far more stronger comparing to Alibaba for example. And If we take weekly frame Baidu is significantly better in cash flow than many Chinese stocks in similar area.

There's no completed mid-term setup for an uptrend continuation yet but it's improving towards an uptrend. The current area between $115-125 remains to be a consolidation area. BIDU is among the stocks to keep an eye on for the potential uptrend.

BABA – Weekly Structure UpdateThesis

BABA, after multi year base, is completing an intermediate corrective phase within a broader bullish reversal structure.

Context

- Weekly timeframe

- Multi-year base completed

- Price trading above key long-term levels

What I see

- Impulsive advance followed by a controlled pullback

- Structure suggests intermediate wave (4) nearing completion

- Pullback is respecting prior breakout area

- Pullback is holding rising moving-average support

- Consolidation is forming above former resistance

What matters now

- Structure remains constructive while the recent higher low holds

- Resolution of consolidation should define the next directional leg

Buy / Accumulation zone

- Current pullback range aligned with wave (4) retracement

Targets

- Intermediate upside reference near the $230 area

BABA: when China allows growth againAlibaba remains one of the most undervalued mega-cap tech companies globally. After years of regulatory pressure and weak macro conditions in China, the company is entering a stabilization phase. Regulatory risks have eased, and Chinese authorities are signaling support for the technology sector and domestic consumption. Alibaba continues to generate strong cash flow, operates a massive ecosystem across e-commerce, cloud, and logistics, and actively executes share buybacks, reducing float. At current levels, the market is pricing in excessive pessimism, creating asymmetric upside if macro conditions improve.

From a technical perspective, price is trading inside a rising channel. After a strong impulse, the market moved into a corrective phase, forming a swing zone. Price remains above key EMA levels, confirming a valid medium-term uptrend. The current area represents a buyer interest zone aligned with structural support and Fibonacci levels. Declining volume during the pullback supports the idea of a healthy correction rather than trend reversal.

Trading plan: as long as price holds above the current support zone and confirmation appears, long positions become attractive. The first target is a return to previous highs, followed by Fibonacci extensions. Medium-term targets align with the upper boundary of the channel. A breakdown below the swing zone would invalidate the bullish scenario and signal deeper correction.

The best opportunities often appear when fear fades but confidence hasn’t returned yet.

VIPS | This Chinese Retailer Will Rise High | LONGVipshop Holdings Ltd. is a holding company, which engages in the provision of online product sales and distributions services. It operates through the following segments: Vip.com, Shan Shan Outlets, and Others. The Others segment includes internet finance, offline shop, and city outlets. The company was founded by Ya Shen and Xiao Bo Hong on August 22, 2008 and is headquartered in Guangzhou, China.

JD.com large cap value worth buying nowJD.com just beat earnings showing an ability to adapt to the current environment in China.

Simultaneously we see calls for Chinese policy makers to continue stimulating the consumer to ward off a very dangerous deflationary death spiral.

I'm reaching a bit here, but it we may be setting up a large inverted head & shoulders pattern on the charts.

JD.com

* is profitable

* pays a dividend

* has lots of cash

* proved it can adapt to tough environment

* beaten earnings forecasts as far as the eye can see

* tremendously depressed share price

Bullish here -- one of my top two holdings.

CHINA A50 Bullish inside Channel Up aiming at 16650.China A50 index (CN50) has been trading within a 7-month Channel Up and is currently holding the 1D MA50 (blue trend-line), while being on the 3rd Bullish Leg of this pattern.

The previous two both rose by around +16.50%, so given the similarities, we remain bullish on the index, targeting 16650.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Can Strong Fundamentals Survive Geopolitical Storms?JD.com presents a compelling paradox in modern investing: a company demonstrating robust operational performance while its stock remains volatile due to factors entirely beyond its control. Despite market speculation about decline, JD.com has shown impressive financial resilience with consistent revenue growth—15.8% in Q1 2025 and 22.4% in Q2 2025 - alongside improving operating margins that reached 4.5% for JD Retail in Q2 2025. The company has strategically invested over RMB 75 billion in R&D since 2017, building a sophisticated logistics network spanning over 3,600 warehouses and developing cutting-edge technologies that have reduced fulfillment costs to a world-leading 6.5%.

However, JD.com's strong fundamentals exist within a challenging ecosystem of domestic and international pressures. China's deflationary environment, with CPI rising only 0.2% in 2024, has created subdued consumer demand, while intensifying competition from disruptors like Pinduoduo has reshaped the e-commerce landscape. Rather than engaging in destructive price wars, JD.com has pivoted toward sustainable profitability, leveraging its premium brand reputation and proprietary logistics network as key differentiators in an increasingly crowded market.

The most significant risk facing JD.com - and all US-listed Chinese companies- is geopolitical uncertainty rather than operational weakness. US-China trade tensions, regulatory crackdowns in both countries, and the specter of potential Taiwan conflict scenarios create unprecedented risks for investors. A hypothetical Taiwan invasion could trigger catastrophic sanctions, including SWIFT banking exclusions and forced delistings, potentially rendering these stocks worthless regardless of their underlying business strength. This analysis reveals that Bloomberg Economics estimates such a conflict would cost the global economy $10 trillion, with Chinese companies facing existential threats to their international operations.

The JD.com case study ultimately illustrates a new reality in global investing: traditional financial analysis focusing on revenue growth and operational efficiency may be insufficient when evaluating companies operating across geopolitical fault lines. While JD.com remains operationally strong with clear competitive advantages, investors must recognize they are essentially placing bets on US-China diplomatic stability rather than just corporate performance. This political risk premium fundamentally changes the investment equation.

$CNIRYY -China CPI Data Beats Forecasts (July/2025)ECONOMICS:CNIRYY

July/2025

source: National Bureau of Statistics of China

- China’s consumer prices were flat yoy in July 2025,

surpassing expectations for a 0.1% decline and following a 0.1% rise in June.

Non-food prices picked up, supported by Beijing’s consumer goods subsidies. Meanwhile, producer prices fell 3.6%, extending declines for the 34th month and holding at the steepest drop since July 2023.

HUYA | HUYA | Long at $2.61HUYA NYSE:HUYA operates game live streaming platforms in China. This stock got my attention based on the reported fundamentals and price position, but moderate "Chinese delisting" risks exist given the US's new political administration.

Book Value = $3.23 (Undervalued)

Forward P/E = 4.1x (Growth)

Debt-to-equity = 0x (Healthy)

Quick Ratio = 1.56x (Healthy)

Altman's Z Score = <1.8 (Bankruptcy risk is relatively high)

From a technical analysis perspective, the stock price momentum has shifted upward based on the historical simple moving average. The price often consolidates within and slightly outside of this simple moving average band before progressing higher (after a long period of selling). While near term-declines are a risk, a longer-term hold (if the fundamentals do not change and delisting doesn't occur) may pay off given the value, growth, and overall health of the company.

Thus, at $2.61, NYSE:HUYA is in a personal buy zone.

Targets into 2028:

$3.45 (+32.2%)

$5.80 (+122.2%)

JD.cm | JD | Long at $33.16Like Amazon NASDAQ:AMZN and Alibaba NYSE:BABA , I suspect AI and robotics will enhance JD.com's NASDAQ:JD automation in warehousing, delivery, and retail. There is some risk here, like other Chinese stocks, that they could be delisted from the US market if trade/war tensions rise. But I just don't think that is likely (no matter the threats) due to the importance of worldwide trade and investment. I could be way wrong, though...

NASDAQ:JD has a current P/E of 8.1x and a forward P/E of 1.2x, which indicates strong earnings growth ahead. The company is healthy, with a debt-to-equity of 0.4x, Altmans Z Score of 2.6, and a Quick Ratio of .9 (could be better).

From a technical analysis perspective, the historical simple moving average (SMA) band is still in an overall downtrend but starting to level out (accumulation of share area). It is possible, however, that the price may drop into the $20s to close out the existing price gaps on the daily chart as tariff threats arise. But that area is another personal entry zone if fundamentals hold.

Thus, while it could be a bumpy ride and the risk is there for delisting, NASDAQ:JD is in a personal buy zone at $33.16 (with known risk of drop to the $20s in the near-term).

Targets into 2028:

$44.00 (+32.7%)

$52.00 (+56.8%)

Beginning of the Uptrend for Stock #01Beginning of the Uptrend for Stock #01: 9988 (BABA)

The price has broken out of a consolidation range that lasted approximately two years, supported by a normal volume distribution.

The stock has risen to meet the Fibonacci Extension resistance level of 161.8 at a price of 144 HKD. Currently, it is forming a sideways consolidation pattern on the smaller timeframe, establishing a base structure viewed as re-accumulation.

The 6-month target is set at the Fibonacci Extension level of 261.8, which corresponds to a price of 189 HKD. This target aligns with a price cluster based on the valuation from sensitivity analysis, using the forward EPS estimates for 2025-2026 as a key variable for calculations, along with the standard deviation of the price-to-earnings ratio.

Wait for the Right Moment to Accumulate Shares within the Consolidation Range

Purchase near the support level of the range when the price pulls back. Look for a candlestick reversal pattern as a signal to add to your position.

However, should the price break down to the lower consolidation range, the stock would lose its upward momentum, potentially leading to a prolonged period of consolidation or a deeper pullback to around 90 HKD.

Always have a plan and prioritize risk management.

CHINA A50 Rebound expected.China A50 index (CN50) has been trading within a Channel Down since the October 18 2024 Low and is currently attempting to hold its 1D MA50 (blue trend-line) as Support. If successful, we expect this Bullish Leg to approach the top of the pattern.

The shortest Bullish Leg rise has been +10.94% so a 13900 Target would be well within the risk limits.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BILI Projects to $100Bilibili Inc. is a leading provider of online entertainment tailored for the youth of the People's Republic of China. The company boasts a diverse array of digital offerings, including professionally produced user-generated videos, mobile gaming experiences, and enhanced services like live streaming, occupationally created videos, audio dramas on Maoer, and comics available through Bilibili Comic. Additionally, Bilibili offers advertising solutions, IP derivatives, and various other services. The company is also involved in business and technology development, e-commerce, and the distribution of videos, comics, and games. Established in 2009, Bilibili Inc. is based in Shanghai, China.

Bilibili is currently priced at $20.81, indicating it may be undervalued according to discounted cash flow analysis, which suggests a fair value of $28.84. Although there has been notable insider selling recently, the stock remains 28% below its estimated fair value and is projected to achieve profitability within the next three years, surpassing average market growth rates. While the anticipated revenue growth of 10.2% per year is not as robust as one might hope, it still outpaces the overall US market's growth rate of 8.9%.

$BEKE Inverse head and shouldersKE Holdings Inc. is a publicly traded Chinese real estate holding firm that offers a comprehensive online and offline platform for housing transactions and related services through its subsidiaries. It stands as the largest online real estate transaction platform in China.

Investors commonly refer to the entire operation as "Beike."

The company has garnered financial support from major players like Tencent, SoftBank Group, and Hillhouse Investment.

In August 2020, KE made its debut on the New York Stock Exchange (NYSE), successfully raising $2.12 billion during its initial public offering. On its first trading day, the stock soared by 87%, bringing the company's valuation to nearly $40 billion.

By May 2022, KE expanded its reach by becoming a dual-listed entity, adding its shares to the Hong Kong Stock Exchange.

KE operates two primary businesses: Lianjia and Beike. Lianjia functions as a real estate agency, while Beike serves as an online platform that connects customers with estate agents, including Lianjia. Lianjia is often likened to Redfin, whereas Beike is compared to Zillow.

The company is divided into four key business segments:

1. Existing home transaction services

2. New home transaction services

3. Home renovation and furnishing

4. Emerging and other services

$NTES NETEASE to benefit from Chinese stimulus.NetEase, Inc. is a prominent Chinese internet technology firm established by Ding Lei in June 1997. The company offers a diverse range of online services encompassing content, community engagement, communication, and commerce. It specializes in the development and operation of online games for both PC and mobile platforms, alongside advertising, email services, and e-commerce solutions within China. As one of the largest players in the global internet and video game industry, NetEase also manages several pig farms. Additionally, it features an on-demand music streaming service. Notable video game titles from NetEase include Fantasy Westward Journey, Tianxia III, Heroes of Tang Dynasty Zero, and Ghost II. From 2008 to 2023, the company was responsible for the Chinese versions of popular Blizzard Entertainment games, including World of Warcraft, StarCraft II, and Overwatch. In August 2023, NetEase unveiled a new American studio, spearheaded by veterans from Bethesda and BioWare.

Chinese Internet Stocks on the Edge: KWEB vs. FXI Introduction:

The Chinese internet sector AMEX:KWEB is at a critical juncture when compared to large-cap Chinese stocks AMEX:FXI . The ratio between these two reflects sector leadership—if KWEB outperforms, it signals renewed strength in internet stocks and suggests the sector is leading.

Current Market Context:

Potential Breakdown: The KWEB-to-FXI ratio is teetering near key support. A breakdown here would be a bearish signal for Chinese internet stocks.

Bullish Outlook: However, bulls are closely watching for signs of outperformance from KWEB, which could indicate the start of a new bullish trend.

Higher-Low Formation: If the ratio forms a higher low relative to its long-term trend, it would be a sign of potential strength in the internet sector.

Key Levels to Watch:

Support: Monitor the ratio’s current support level closely. A breakdown below this could lead to increased selling pressure on KWEB.

Resistance: A breakout above recent highs would indicate renewed outperformance and signal a bullish rotation into internet stocks.

Conclusion:

KWEB is at a make-or-break point, and the coming days could determine its fate. If the sector can establish a higher low and break above resistance, it could signal a bullish shift for Chinese internet stocks. Will KWEB lead, or will large-cap Chinese stocks maintain their dominance? Let me know your thoughts in the comments!

Charts:

(Include a chart showing the KWEB-to-FXI ratio, marking key support, resistance, and any signs of higher-low formations.)

Tags: #KWEB #FXI #ChineseStocks #InternetSector #SectorLeadership #TechnicalAnalysis #MarketTrends #China

$BABA Falling wedge breakout on dailyNYSE:BABA falling wedge breakout confirmed with MACD signalling bullish trend.

There's volume gap just above 90 to 94 where price can move very fast.

All sentiment indicator has been very bearish lately which makes me come to conclusion that this was the bottom.

Market was positioning for TRUMP to possibly put on 60% tarrifs on china which doesn't seem to be happening now as Trump has suggested negotiations with President XI

my PT is $99 for BABA in next 3 months

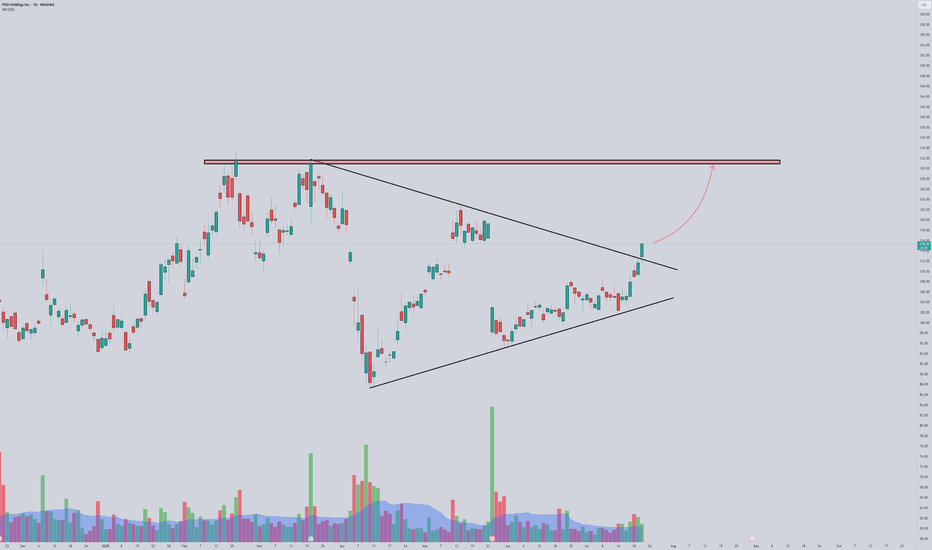

$PDD reversal finally coming for China stocks?PDD set to make a bullish move. Price at trendline going back to May and also at the demand zone from September before October’s parabolic move. RSI, MACD, and STOCH are all curling up and oversold. A break above 102.50 and this will explode higher. Initial PT at 110 and followed by gapfill PT at 114. SL at break and close of bottom trendline.

Xiamen Changelight Soars 108% in Just 16 Days!Xiamen Changelight Analysis:

Xiamen Changelight has seen a phenomenal rally, achieving a stunning 108% gain over the past 16 days. The recent bullish momentum has allowed the stock to achieve all target levels, with each level surpassed in quick succession.

Trade Setup:

Entry Point: $8.11

Stop Loss: $7.86

Target Levels:

TP 1: $8.41

TP 2: $8.90

TP 3: $9.38

TP 4: $9.69

Technical Indicators:

The stock has trended strongly above the Risological dotted trend line, showing a clear uptrend and sustained buying pressure. The price action’s alignment with this trend suggests confidence among buyers and the potential for continuation if volume remains supportive.

Market Sentiment:

The sharp rise in share price reflects strong interest in Xiamen Changelight, potentially driven by fundamental catalysts or broader market trends in its industry. With robust volume supporting the upward movement, the momentum appears sustainable, although some consolidation might occur after such a large gain.

Outlook:

With all targets reached, traders should monitor for any pullback or consolidation phase as new support levels are established. The strong trend could attract further interest, especially if broader sentiment remains positive. Keep an eye on volume and price stability to assess if another leg up is likely in the coming sessions.