DAX Index

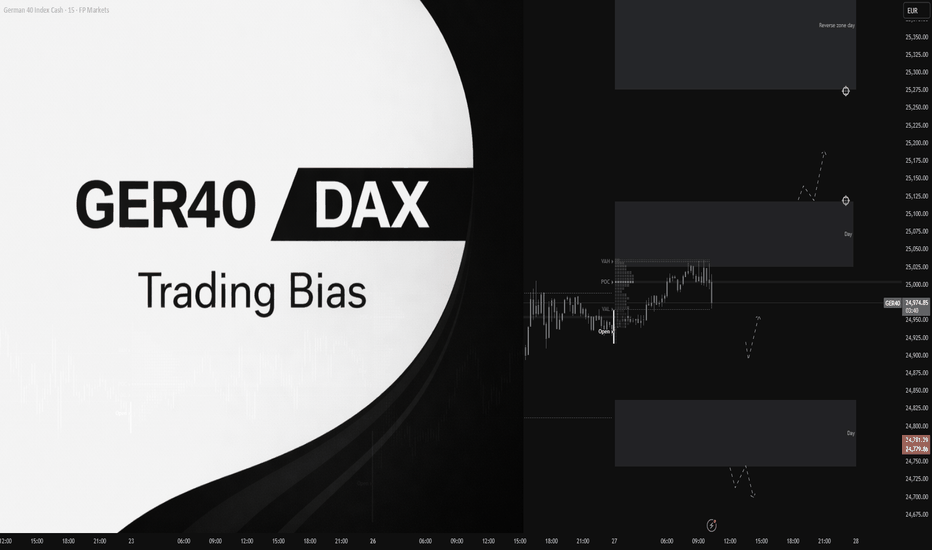

GER40 (DAX) – Trading Plan for Today | Jan 28🔥GER40 (DAX) – Trading Plan for Today | Jan 28

The session opened with a bearish bias:

price opened below the key level, while the key level itself is positioned

below the Point of Control, confirming a short intraday context.

Price acceptance below key levels keeps downside pressure active.

Main plan (short)

The priority remains short.

Downside target:

– lower daily zone: 24,825 – 24,860

This area may bring:

– slowing momentum,

– profit-taking,

– a potential buyer reaction.

Alternative option

It’s important to note that the previous period showed buyer interest.

If price:

– reclaims above the key daily level,

– and accepts above it,

the short bias weakens,

and a long option becomes valid

with a target toward the long reverse zone: 25,065 – 25,090.

If this idea was helpful, support it 🚀 and follow.

This is not financial advice. Proper risk management is required.

Primium Price DetectedThe market is currently at the 0.75 dealing range level which is the premium price, sells could be taken instantly, but we ought to be wary of the fair value gap that has not been filled above. The ultimate anticipation is for price to hike a bit, grab the liquidity and simultaneously fill the gap above. This shall give us the opportunity to take action in this potential bearish market.

Germany 40 :: Trend-Aligned Bullish Trade Setup📈 GERMANY 40 (DAX 40) INDEX - BULLISH PULLBACK CONTINUATION 🚀

Day/Swing Trade Strategic Entry Guide | CFD Market Opportunity

🎯 TRADING SETUP OVERVIEW

Asset: DAX 40 Index (German Blue-Chip Equities) 🇩🇪

Current Market Level: ≈ 24,896 - 24,950 EUR (As of Jan 27, 2026)

52-Week Range: 18,489.91 - 25,507.79 EUR

YTD Performance: +16.13% | Month Trend: +2.48% | Weekly: -1.72%

Market Trend: Bullish with Pullback Consolidation Phase ✅

📊 TECHNICAL ANALYSIS - PRICE ACTION SETUP

Bullish Thesis: SMA Pullback + Reversal Confirmation

✨ Strategy Structure:

Primary Trend: Uptrend Intact (ATH: 25,507.79 on Jan 13, 2026) 📈

Current Correction: Healthy consolidation zone between 24,400 - 24,950

Technical Signal: Simple Moving Average (SMA) pullback with support validation

Market Cycle: Transitioning from retracement phase → acceleration phase

🎪 ENTRY STRATEGY - TIERED LIMIT LAYER APPROACH

"Smart money enters at strength, not at desperation!" 💡

TIER 1 - AGGRESSIVE ENTRY (First Confirmation Signal)

Price Level: 24,700 EUR ✅

Rationale: Tests 61.8% Fibonacci retracement + Daily support zone

Risk Profile: Medium - Immediate technical resistance above

TIER 2 - OPTIMAL ENTRY (Recommended Sweet Spot)

Price Level: 24,800 EUR 🎯

Rationale: Key consolidation support + Previous PoC (Point of Control)

Risk Profile: Best Risk/Reward Ratio

Volume Profile Strength: High liquidity, support bounce evidence

TIER 3 - CONSERVATIVE ENTRY (Maximum Confirmation)

Price Level: 24,900 EUR 📍

Rationale: Final retest of recent swing high + SMA convergence zone

Risk Profile: Lower volatility entry, higher probability confirmation

Entry Execution: Use LIMIT ORDERS ONLY for superior execution

Avoid MARKET ORDERS (slippage risk in index trading)

Set entries 5-10 minutes before Frankfurt Open (8:00-9:00 CET)

Stack 3 positions across all tiers to maximize edge

🎲 TARGET LEVELS - PROFIT TAKING STRATEGY

PRIMARY TARGET: 25,500 EUR 🚀

Distance from Entry: +600 to +800 points

Technical Reason:

📌 Fibonacci Resistance Cluster (78.6% projection)

📌 Previous ATH breakout zone (25,507.79)

📌 Overbought RSI signals exit at this junction

📌 Institutional resistance + Order clustering

Risk Factor: Strong resistance confluences - expect rejection/consolidation

SECONDARY TARGET: 25,200 EUR ⭐

Conservative Exit: Take partial profits here (50% position)

Reason: Second resistance tier, risk management checkpoint

TRAILING PROFIT STRATEGY:

Lock gains at +400 points minimum

Trail stop-loss above recent swing lows

DISCLAIMER: Risk management is YOUR responsibility ⚠️

🛑 STOP LOSS MANAGEMENT - CAPITAL PRESERVATION

Recommended SL Placement: 24,600 EUR 💪

Distance from Optimal Entry (24,800): -200 points loss maximum

Technical Justification:

📍 Sits below key daily support pivot (24,412.21)

📍 Below 61.8% Fibonacci support zone

📍 If this breaks = trend reversal confirmed

Risk per Trade: 2-3% portfolio allocation recommended

AGGRESSIVE SL (For Strong Risk Appetite): 24,650 EUR

Tighter, reduces loss magnitude

Increases stop hunts/whipsaws probability

CONSERVATIVE SL (For Capital Preservation): 24,400 EUR

Allows more room for consolidation noise

Slightly wider but higher survival rate

⚠️ CRITICAL DISCLAIMER: Your stop-loss placement is YOUR decision based on risk tolerance. Don't copy blindly. Adjust to YOUR account size and risk parameters!

🔗 CORRELATED PAIRS TO WATCH - CONFLUENCE TRADING

POSITIVE CORRELATIONS (Move Together ↔️)

1. EUR/USD 💱 - EUROPEAN CURRENCY STRENGTH

Ticker: EURUSD / FX:EURUSD

Why It Matters: DAX composed of Eurozone exporters; EUR strength = DAX benefits

Current Level: ~1.1700 (Monitor resistance/support)

Watch Signal: Break above 1.1700 = additional bullish catalyst for DAX

Impact: 0.70+ correlation coefficient

2. EUROSTOXX 50 📊 - BROADER EUROPEAN EQUITIES

Ticker: ^STOXX50 / TVC:ESTX50

Why It Matters: DAX is largest component; often leads EStoxx movement

Setup Advantage: Confirm DAX strength via European sector index

Divergence Risk: If DAX rallies but EuroStoxx lags = weakness warning

3. S&P 500 / SPX 🇺🇸 - GLOBAL RISK SENTIMENT BAROMETER

Ticker: ^GSPC / TVC:SPX500

Why It Matters: Risk-on/risk-off appetite flows across Atlantic

Current Level: ~6,915 (Monitor Fed decision impact)

Correlation Context: 0.65+ during bull markets; weakens in crisis

Trade Signal: SPX strength > DAX often precedes 24-48hr DAX surge

4. FTSE 100 📍 - UK EQUITY BENCHMARK

Ticker: ^FTSE / TVC:UK100

Why It Matters: Close correlation to DAX; financials + commodities exposure

Monitor: If FTSE breaks key support = risk-off signal for DAX

INVERSE CORRELATIONS (Opposite Moves) ⚡

1. USD/INDEX 💪 - US DOLLAR STRENGTH

Ticker: DXY / USDINDEX

Why It Matters: Strong USD = headwind for DAX exporters

Watch: If DXY rallies above 109 = potential DAX pressure

Setup: Weakness in USD = tailwind for continental Europe stocks

2. VIX / VOLATILITY INDEX 😰

Ticker: ^VIX / CVIX

Why It Matters: Rising fear = risk-off = DAX weakness

Safe Zone: VIX below 18 = bullish backdrop for DAX

Warning Signal: VIX spike above 25 = trend reversal risk

📰 FUNDAMENTAL & ECONOMIC FACTORS - MACRO DRIVERS FOR 2026

🇩🇪 GERMAN ECONOMIC STRENGTH NARRATIVE ✅

1. FISCAL STIMULUS BOOST 💰 (Major Positive)

€127 Billion Defense + Infrastructure Spending (2026):

Government approved new €500B special fund for infrastructure

Defense spending exempted from debt brake (1%+ of GDP)

Multiplier effect expected Q2-Q4 2026

Impact on DAX: Infrastructure/defense contractors (Rheinmetall, Airbus) → Upside

Status: Already approved, beginning implementation phase

2. ECONOMIC RECOVERY TRAJECTORY 📈

Bundesbank Forecast: GDP stagnation 2025 → +1.2% growth 2026-2027

Growth Driver: Export resurgence starting Q2 2026

Manufacturing Momentum: German Composite PMI = 52.5 (3-month high, Jan 2026)

Implication: Peak pessimism already priced in; upside surprise likely

3. INFLATION NORMALIZATION ✨ (Supportive for Equities)

German HICP Inflation: 2.0% (Dec 2025) - At ECB 2% target!

Forecast Path: 2.1% (2026) → 1.9% (2027) → 2.0% (2028)

Real Wage Growth: +8.5% minimum wage increases announced

Equity Impact: Lower inflation removes rate hike fears; supports valuations

4. ECB POLICY STANCE 🏦 (Supportive Hold)

ECB Rate Decision: HOLD at 2.0% deposit rate through 2026

Rationale: Inflation at target (2%), growth resilient at 1.4%

Next Hike Expected: Mid-2027 only (if inflation accelerates)

Market Impact: Monetary accommodation extended; liquidity supportive

⚠️ HEADWIND FACTORS TO MONITOR 🚨

1. US TARIFF UNCERTAINTY 🎯

Trump Administration Risk: 200% threats on French goods, potential EU tariffs

DAX Impact: Export-dependent companies (SAP, Siemens, Allianz) face pressure

Mitigation: German fiscal spending partially offsets export weakness

2. GEOPOLITICAL TENSIONS 🌍

Recent De-escalation: Greenland concern subsided (net positive for risk sentiment)

Ongoing Risks: Russia/Ukraine, Middle East remain volatile

Market Effect: Drives intermittent VIX spikes; creates trading noise

3. CHINA COMPETITIVE PRESSURE 🐉

EV Transition Challenge: German auto industry facing Chinese EV competition

DAX Exposures: BMW, Mercedes, Volkswagen at risk long-term

Silver Lining: German tech (SAP, Infineon) + defense spending counters

📅 UPCOMING ECONOMIC CALENDAR - KEY DATES TO WATCH

Jan 28-29, 2026 🇺🇸 US Fed Decision (HIGH IMPACT) - Watch for rate hold + forward guidance signals that could shift risk sentiment

Jan 30, 2026 🏦 ECB Policy Decision (MEDIUM IMPACT) - Expected rate hold at 2.0%; confirmation keeps monetary accommodation supportive

Late Jan 2026 💻 SAP Q4 Earnings (HIGH IMPACT) - Tech sector bellwether; strong results = DAX upside catalyst

Feb 2026 🏭 German Factory Orders (MEDIUM IMPACT) - Measures economic momentum; growth above forecast = bullish for exporters

Q1 2026 📊 German GDP Data (HIGH IMPACT) - Recovery confirmation; expected +1.2% growth validates our bullish thesis

Feb/Mar 2026 📈 ECB Inflation Data (MEDIUM IMPACT) - Maintains 2% target check; any spike above = potential rate hike concerns

💡 TRADER'S EDGE - THIEF TRADER PHILOSOPHY

"The market rewards patience, position sizing, and profit-taking discipline more than perfect timing."

TRADING COMMANDMENTS 📜

✅ DO THIS:

Plan your trade → Trade your plan (No emotion)

Use limit entries at calculated levels (Avoid chase buying)

Take profits incrementally (50% at target 2, trail the rest)

Respect stops (Losses are learning fees)

Scale position size to risk tolerance (2-3% loss = survival mode)

❌ AVOID THIS:

FOMO entries at market price (Slippage killer)

Holding through TP target (Greed loses gains)

Moving stops against you (Stop-hunt protection lost)

Averaging down in downtrends (Pyramid to danger)

Ignoring correlation signals (Confluence > single indicator)

🎯 RISK DISCLOSURE & IMPORTANT WARNINGS ⚠️

THIS IS NOT FINANCIAL ADVICE!

💼 Trader's Acknowledgment:

Index CFD trading carries EXTREME RISK - 80%+ of retail traders lose capital

You can lose MORE than your initial deposit (leverage = double-edged sword)

Past performance (DAX +16.13% YTD) ≠ Future results

Geopolitical/economic shocks can gap markets against your stops

ONLY risk capital you can afford to lose completely

🔐 Your Responsibility:

This analysis is educational framework, not a trading signal

Entry price selection (24,700 / 24,800 / 24,900) is YOUR choice

Stop-loss placement must match YOUR risk tolerance

Take-profit levels are suggestions—adjust to YOUR psychology

Consult a licensed financial advisor before trading

Use demo account first to validate edge

🚀 FINAL WISDOM - TRADER'S MANTRA

"In trading, capital preservation beats capital accumulation. A small, consistent edge + compound returns = wealth."

The Setup is Clear. Entry signals are prepared. Confluence is established. Now it's YOUR move.

Will you wait for confirmation? Will you scale entries? Will you honor your stops?

The market doesn't care about your opinion. It only respects price action and risk management.

Trade with purpose. Trade with discipline. Trade to survive another day.

🎲 May your entries be precise, your exits be profitable, and your psychology be unshakeable. 💪

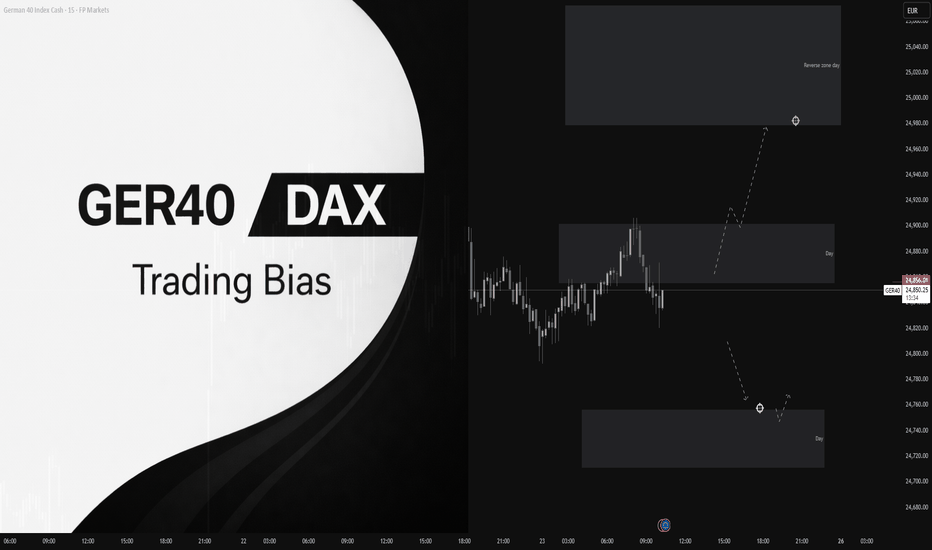

GER40 (DAX) – Trading Plan for Today | Jan 27🔥 GER40 (DAX) – Trading Plan for Today | Jan 27

From a broader perspective, the market remains in a bullish context.

The week opened below the key level, but buyers reacted almost immediately.

Liquidity was taken without facing meaningful selling pressure,

highlighting strong buyer interest.

Today’s session opened above the key level,

although the level itself is still below the Point of Control.

This structure suggests either a range-bound session

or a continuation of the bullish move.

Primary scenario (long)

If price holds above the key level,

the bias shifts toward a bullish continuation.

Primary upside target:

– 25,118

This area may trigger:

– a slowdown,

– partial profit-taking,

– or a short-term reaction.

Alternative scenario

Failure to extend higher may result in

a balanced / sideways session

without directional follow-through.

If the idea was useful, support it 🚀 and follow.

This is not financial advice. Risk management is required.

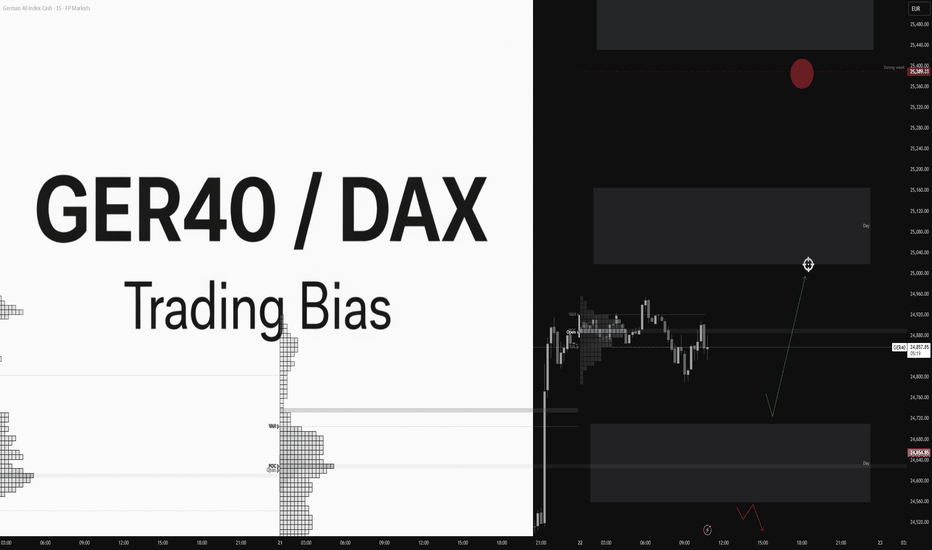

GER40 / DAX – Trading Plan for Today | Jan 26🔥 GER40 / DAX – Trading Plan for Today | Jan 26

The session opened below the key daily level and inside the reverse zone.

The key area is also located below the Point of Control,

which initially sets a bearish intraday bias.

Primary scenario (short)

As long as price remains below the key daily level,

short positions are favored.

Downside targets (marked on the chart):

– daily zone: 24,772 – 24,814

– lower reverse zone: 24,704 – 24,624

These areas may trigger a slowdown

or a technical reaction.

Alternative scenario (long)

A bullish reaction has already appeared inside the reverse zone,

so a shift toward a long scenario is possible today.

Longs are considered only if:

– price accepts above the upper daily zone ~24,939

In that case, the upside target becomes:

– upper reverse zone: 25,009 – 25,089

If the idea was useful, support it 🚀 and follow.

This is not financial advice. Risk management is required.

GER40 (DAX) – Intraday Trading Plan | Jan 23🔥 GER40 (DAX) – Intraday Trading Plan | Jan 23

After an impulsive move, the previous session was spent in consolidation,

indicating balance and position building.

Today’s opening occurred below the key daily level

and below the previous day’s Point of Control,

which sets a bearish intraday context.

Primary scenario (short)

As long as price remains below the key daily area:

– 24,856

the short scenario remains in priority.

Primary downside target for today:

– lower daily zone (Day)

This area may cause a slowdown

and a potential buyer reaction.

Alternative scenario (long)

The long scenario will be considered

only after acceptance above the upper daily zone:

– 24,901

In this case, rotation toward the daily reverse zone

becomes likely.

If the idea was useful, support it 🚀 and follow.

This is not financial advice. Risk management is required.

GER40 / DAX – Trading Plan for Today | Jan 22 GER40 / DAX – Trading Plan for Today | Jan 22

Price opened and remains above the key daily level at 24,654.85,

with the level holding above the previous period’s Point of Control,

confirming buyer strength and a bullish intraday bias.

However, it is important to note that the key weekly level is located higher,

making the upper area a natural price magnet.

Primary scenario (long)

As long as price holds above 24,654.85,

the bullish scenario remains valid.

Daily target zone:

– 25,016.38 – 25,169.00

This area aligns with the daily range

and a test of the weekly resistance,

where a reaction or slowdown is expected.

Alternative scenario (narrative shift)

The bullish scenario is invalidated

only if price accepts below the daily short area:

– 24,558.50

In that case, downside continuation may develop

toward the daily reverse zone:

– 24,297.29

If the idea was useful, support it 🚀 and follow.

This is not financial advice. Risk management is required.

GER40 (DAX) – Trading Plan for Today | Jan 20GER40 (DAX) – Trading Plan for Today | Jan 20

The market opened and accepted below the key daily level at 25,004.88,

which is also located below the previous day’s Point of Control.

This structure defines a bearish day context.

At the same time, an impulsive reaction from the daily reverse zone is currently in play,

opening the door for a potential counter-trend move.

Local scenario: LONG from the reverse zone

Primary scenario:

– waiting for buyer reaction from the daily reverse zone

– upside rotation back toward the daily zone (Day) marked on the chart

Alternative scenario (bearish continuation)

If price accepts and holds below the daily reverse zone,

the bearish context remains valid with continuation to the downside.

All decisions are based strictly on price reaction and confirmation.

No guessing the market defines direction.

If you found this idea useful, support it with a 🚀 and follow.

Not financial advice. Always manage risk.

#202603 - priceactiontds - weekly update - dax futuresGood Evening and I hope you are well.

comment: Neutral. 1605 points up and we pulled back for 242 last week. Disgustingly overbought and overdone but that fact does not make you money in this profession. Opex is behind us and we could see a decent pullback before more upside. My target is still around 25000 for W4 before we will likely do another leg up if no news-bomb hits.

current market cycle: bull trend

key levels for next week: 24900 - 26000

bull case: 8th consecutive green. Bulls still not taking bigger profits and we barely move down. Can only expect more upside. Can the orange face tariff-scare round #24 scare the markets? Just stop. It would need a much more serious escalation before markets begin to care again. Too much TACO in 2025. 26000 is the obvious target but I doubt we will get there without touching 25000 again first.

Invalidation is below 24600

bear case: Bears are barely making money. We should pull-back to 25000 but the chart gives the bears absolutely nothing. Even if we get to 25000 I doubt many bears will hold and I expect bulls to heavily buy it for another strong leg up.

Invalidation is above 26200

short term: Slightly bearish for 25000ish but ultimately expecting 26000 to get hit before the trend line breaks.

medium-long term - update 2026-01-10: 26000 is likely. This is as overdone and overbought as a market can be.

DAX Is this the end of its 3-year Bull Cycle?DAX (DE40) has been practically on a wide range consolidation since June 2025, with a slight slopped Higher Highs acting as Resistance where it got rejected 2 days ago. This may signal the end of the market's massive 3-year Bull Cycle as the pattern resembles a lot the April 2015 market Top, which led to a strong, nearly 1-year correction back to the 1W MA200 (orange trend-line).

This is not the first time we bring to you this chart. We first posted it 3 months ago warning of a potential multi-year Top on the market's 16-year Channel Up and this time the warning may be translating into action. Exactly two months ago, the index hit its 1W MA50 (blue trend-line) for the first time since the April low and rebounded, which is the last actions that the market did both in September 2021, August 2017 and March 2011 before a Phase Top two months after.

We won't be going over the pattern cyclical specifics again, as we've done so in detail on the previous analysis, but Phase 3 seems to be topping now due as not only has it exceeded the 2.236 Fibonacci extension from the Phase 2 Low but just did on the 1.618 Fib ext of the Phase 1 High. For reference, the April 2015 High, which was the Phase 3 Top, was priced only 1 month after breaking it.

In addition, the 1M RSI has been massively overbought, trading just under and hitting its 80.00 Resistance, a level that was last tested in April 2007, which is exactly when that Phase 3 peaked! All the above are the strongest technical conditions that a typical Cycle Top on this pattern exhibits.

As a result, we expect 2026 to be a Bear Cycle. Phase 4 historically has corrected to at least the 0.382 Fibonacci retracement level, while also hitting the 1W MA200. Based on its trajectory, we move our long-term Target to 19000, which fills both conditions. Notice also that the 1M RSI has a 14-year Support trend-line as well at 39.00. If this gets hit, it is historically the most optimal signal to buy for the long-term regardless of the price the market will be at the moment. Use it to your advantage.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DAX Remains Bullish as Wave (3) AdvancesWe discussed the DAX back on December 19, when we identified a bullish setup based on waves (1) and (2), suggesting the start of a five-wave impulsive advance and the potential extension of the rally within wave (3).

As of today, January 15, the DAX is unfolding nicely to the upside and remains firmly within wave (3). There is still room for further gains, with the 26,000 area acting as a key upside target. At this stage, we are continuing to track wave (3), where subwave 5 may still be missing, indicating that additional upside is possible before a higher-degree wave (4) corrective phase develops.

From a risk-management perspective, the 25,000–24,800 zone represents an ideal support area. As long as price holds above this region, we should remain alert for a bullish resumption and the continuation of the broader uptrend toward wave (5).

DAX is bullish as long as the price is above 24500 invalidation area.

Germany40 (GER40) – 30-Minute Timeframe Tradertilki AnalysisMy friends, greetings,

I have prepared a Germany40-GER40 analysis for you.

If GER40 reaches the levels of 25374.95-25339.21 on the 30-minute timeframe, I will open a buy position.

My target will be the 25513.48 level.

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏✨

Thank you to all my friends who support me with their likes.❤️

Dax - Short Term Buy IdeaH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------

DAX - Up for nowCounting waves and assessing technical potential. Here’s what we see:

October 2020 - Completed the correction and started forming the 5th wave of the uptrend.

November 2025 - Making the final push, forming the last sub-wave 5 within the larger wave.

Key reversal level sits near 28,300 .

Note: this level coincides with the Fibonacci levels where the first wave ended in March 2000 .

Key targets:

Trend reversal expected at 28,300

Local correction at 26,900

Additional reversal points at 29,300 / 31,200

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

DAX entered its 7-month Resistance Zone. Will it decline again?DAX (DE40) just entered its 7-month Higher Highs Zone, which has been the technical Resistance of a long-term Ascending Triangle that started on the May 27 2025 High.

With the 1D RSI overbought (above 70.00), the conditions for a new medium-term sell opportunity have emerged. All previous five Bearish Legs of this Triangle have been fairly symmetrical, with the lowest being -5.07%.

We expect at least a repeat of that, which gives us a 24100 Target that may coincide with a 1D MA200 (orange trend-line) and 1W MA50 (red trend-line) test. The latter is the market's long-term Support and will decide the trend for 2026.

If the 1D RSI hits 40.00 though before the price hits 24100, we will take profit on the sell regardless, as that has been the RSI's Symmetrical Support for the entirety of the Ascending Triangle.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GE40 (DAX): Structural Breakout — Bulls Targeting 25,000

Macro Environment: Investors are currently digesting a "Santa Rally" while eyeing the upcoming Fed Minutes for clues on 2026 monetary policy. Despite thin year-end liquidity, the technical structure remains exceptionally bullish as fiscal reform optimism offsets manufacturing weakness.

Technical Analysis

The H4 chart reveals a decisive shift in market regime:

The Breakout: Price has cleared a multi-month descending trendline and a major horizontal ceiling at 24,400.

Base Formation: A clean accumulation zone (grey box) acted as a launchpad, confirming strong institutional demand at lower levels.

Momentum: The successful flip of previous resistance into support suggests a "Buy the Dip" environment.

Order Swing Set-up: LONG

Entry: 24,476 (Ideally on a retest of the breakout level)

Take Profit: 25,006 (Key psychological level & measured move target)

Stop Loss: 24,195 (Protected below the recent consolidation base)

Risk/Reward Ratio: ~ 1:1.8

⚠️ DISCLAIMER: This post is for educational purposes and personal opinion only; it is not financial advice. Trading indices involves significant risk, especially during low-liquidity holiday periods. Please Do Your Own Research (DYOR) and manage your risk strictly.

DAX 3-Drives Pattern - Monster Short SignalOK, I admit, it’s very early to call this a three-drives pattern.

But as a trader, I always think, “What if?”

This is my way of preparing early in the process. It allows me to make educated decisions, rather than FOMO trades.

What I am waiting for now is a break of the yellow CIB line. Typically, after such a break, price pulls back to retest it. This behavior is similar to what we see when the median line of a fork is broken.

If this setup triggers, it would clearly be a long-term play. Or it could be over vevry quick via a very sharp, violent move to the south.

Let’s watch it and prepare for this thesis.

DAX BULLISH BREAKOUT|LONG|

✅DAX Price has delivered a clean bullish displacement above a key ICT level, confirming breakout strength. Previous resistance flips into support, with momentum aligned toward higher buy-side liquidity and continuation higher. Time Frame 9H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅

DAX Free Signal! Buy!

Hello,Traders!

DAX breaks and holds above a key horizontal demand, confirming bullish market structure. Smart money displacement and clean BOS suggest continuation toward higher liquidity, with pullbacks likely to be shallow before expansion resumes.

--------------------

Entry: 24,493

Stop Loss: 24,361

Take Profit: 24,684

Time Frame: 4H

--------------------

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DAX WILL KEEP GROWING|LONG|

✅DAX breaks above a key supply zone, confirming bullish ICT market structure. Acceptance above prior highs signals smart money continuation, with upside expansion likely toward premium liquidity after a brief consolidation. Time Frame 8H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅