ADAUSDT - Short squeeze before falling to 0.22BINANCE:ADAUSDT , after breaking through the global support zone of 0.275 and updating its lows to 0.22, entered a phase of correction and consolidation below key levels. Another short squeeze could trigger a decline.

Bitcoin is falling after a correction, which generally indicates a weak market and increases bearish pressure on the market. I recently said that Bitcoin would fall even lower, as global targets have not yet been achieved, so against this backdrop, altcoins may react accordingly.

Any corrections and volume spikes can be seen as a hunt for liquidity and quickly sold off.

ADA has been strengthening since the session opened and is showing strength against a weak market (top gainers). There are no fundamental reasons for growth, and technically, the market is heading towards a zone of interest.

Resistance levels: 0.2688, 0.276, 0.284

Support levels: 0.243, 0.2200

From a medium-term perspective, the altcoin has not yet tested the global support level hidden behind 0.22 - 0.2167, formed in 2023. A retest and short squeeze of the resistance zone could trigger a decline towards the target

Best regards, R. Linda!

Descending Channel

Bitcoin Bored Range… Big Bounce Loading? (66K Zone)Over the past four or five days, Bitcoin ( BINANCE:BTCUSDT ) has been moving within a range, which might have made some traders a bit bored.

Right now, BTC is moving inside a heavy support zone($78,260-$64,850) and, in the past couple of days, seems to be inside a small descending channel.

From an Elliott Wave perspective, it looks like Bitcoin is completing the corrective wave C of the main wave Y, in a Double Three Correction structure(WXY).

I expect that Bitcoin will rise from the Cumulative Long Liquidation Leverage($66,120-$64,420) and climb at least to $68,971. If it breaks the upper line of the descending channel with strong momentum, we could even anticipate a move up to $71,311. Let me know your thoughts!

First Target: $68,971

Second Target: $71,311

Stop Loss(SL): $63,821

Points may shift as the market evolves

Cumulative Long Liquidation Leverage: $60,000-$58,000

Cumulative Short Liquidation Leverage: $73,100-$71,620

CME Gap: $84,560-$79,660

CME Gap: $54,545-$52,980

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

XRPUSDT - Hunting for liquidity before the fallBINANCE:XRPUSDT looks very weak, losing 69% from its high. As part of the downtrend, the coin may experience sharp local spikes in search of liquidity before falling.

Bitcoin is consolidating below 70K without the ability to break through the key level. The market is stagnating after a sharp decline, which may continue.

After the pullback phase, an intermediate consolidation has formed with a liquidity zone of 1.4625 - 1.4886. Within the downtrend, the market may form a short squeeze in the specified zone, followed by a decline to 1.2845.

The market has confirmed two key levels, 1.4625 and 1.3850, with support tested and a weak reaction. If the market begins to contract towards support, this will only increase the chances of a further decline.

Resistance levels: 1.4625, 1.4885, 1.5300

Support levels: 1.412, 1.385, 1.2845

I do not rule out the possibility of an attempt to break the downward structure and grow, but in the current conditions, any bullish momentum can be quickly sold off. Technically, I have identified an area of interest between 1.4625 and 1.4885. There may be a false breakout, a retest of 1.3850, and a further decline

Best regards, R. Linda!

This Is Not a Reversal: #XMR’s Structure Signals downside

Yello Paradisers! Are you aware that #XMRUSDT is currently in one of the most deceptive Elliott Wave phases, where the price looks stable, but the structure strongly suggests another sharp downside move is still ahead?

💎#XMR after the sharp decline from the all-time high, has been unfolding a textbook structure inside a dominant descending channel. From a higher-timeframe Elliott Wave perspective, the market is clearly positioned within wave 4 of the larger impulsive decline. This is a critical phase, as wave 4 corrections are designed to exhaust late participants before the final continuation leg unfolds.

💎The current price action is forming an ascending corrective channel, but it is important to understand that this move is not impulsive. Structurally, this advance fits perfectly as an ABC/WXYXZ complex correction, developing entirely within the boundaries of the broader bearish descending channel. This tells us that the market is correcting in time and structure, not reversing the trend. In professional Elliott Wave terms, this is a classic setup before wave 5 continuation to the downside.

💎Market participation further validates this count. Volume has been consistently decreasing throughout the ascending channel, indicating a lack of real buying interest. This contrasts sharply with the previous sell-offs, which were accompanied by expanding volume, confirming that sellers remain in control of the primary trend. Corrective advances with declining volume are a strong hallmark of wave 4 behavior.

💎Momentum also aligns perfectly with this interpretation. RSI is showing a hidden bearish divergence between the last two swing highs, a signal that momentum is resetting in favor of the prevailing downtrend rather than building strength for a reversal. Hidden divergence in wave 4 environments typically precedes strong trend continuation moves.

💎From a structural level perspective, $420 remains the key resistance zone and aligns with the upper boundary of the corrective formation. On the downside, $277 acts as an important interim support, while $230 is the major support area and a logical downside objective once wave 5 begins. A decisive breakdown of the ascending corrective channel would confirm the completion of wave 4 and activate a high-probability wave 5 continuation scenario.

If you want to be consistently profitable, you need to be extremely patient and always wait only for the best, highest-probability trading opportunities. Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. This is the only way you can get inside the winner circle of Paradisers.

MyCryptoParadise

iFeel the success🌴

Weekly Down-Channel: Support Rebound Play ?ENA/USDT is trading at the lower boundary of a well-respected weekly descending channel. This area acts as dynamic support, so the primary idea is a controlled rebound toward the channel midline first, and potentially the upper boundary if momentum follows. Confirmation comes from strong rejection wicks and a weekly close holding the channel support (plus a break of minor bearish structure on lower TFs). A clean weekly close below the lower band invalidates the bounce and favors bearish continuation.

Target (TGT) Could be attempting to Reverse Bear TrendThis is an analysis of the 1 Week or Macro timeframe. We zoom out to get a feel for the big picture moves.

Where Target's current price action has reached, it warrants attention and to me is a critical area to watch.

Why critical? Well, we have reached the Upper bounds of Targets Bearish Channel so we either attempt for a break of the resistance holding us down or we continue the Bearish trend downwards.

Why Bearish channel or trend? Because technical analysis 101 says that the observation of Lower Highs and Lower Lows are indicative of a bearish trend.

It can't be any clearer. With this established, its always important to remember:

The Trend Is Your Friend. Probabilities dictate that price action will continue to move in the direction of the established trend. Until ofcourse it doesn't by printing reversal signs/ signals, etc.

Notice the Green rectangle highlighting the Price action of the last 10 months-ish.

In April 2025, we reached a price of around $86.00, bounced from here to around $105.00 and again fell back down to around $86.00 in the Fall of 2025.

Reaching $86.00 twice, is a Double bottom formation. A potential sign of an attempt to reverse trend.

Now in recent Price Action we are currently around $112.00. This is our first Higher high since we began our Bearish trend in October 2021.

The Green Zone can also potentially becoming a multi year consolidation range.

Which is why again i would say is a critical area and warrants attention.

What i'm looking to see is how price action interacts with this current price zone highlighted in Orange, titled "Confluence of Resistance". Its not going to be easy as people will look to unload stock, as many have held stock since the highs of $231.00.

A clear sign that Bullish Trend is getting stronger is if we break above the Red Resistance Trend line and Confirm Support and show clear signs of moving above the Orange zone as well.

Another sign would be a clear HIgher Low Print.

But do keep in mind, probabilities point to Current Trend Continuing unless something big happens.

So its exciting to see what plays out in the coming weeks to months as Target attempts big things or the big things fizzle out.

Follow for more updates.

BITCOIN - Correction to 81K - 82K before the fallBINANCE:BTCUSDT.P is forming a correction after a decline. The market is testing 79,200 (the consolidation boundary), which could trigger a breakout and momentum for a retest of the liquidity zone.

The fundamental background remains weak, there is still no support for the market in this direction, and the crypto winter phase may continue for some time. Statistically, after a sharp fall or a strong trend, the market should move into a sideways range/flat, where accumulation for a trend reversal may form.

Bitcoin is in local consolidation after strong sell-offs. The market is storming 79,200 and, as part of the correction, may break through resistance and head towards the zone of interest 81,000-82,000 before falling.

The cryptocurrency market, like Bitcoin, is in a downtrend. The coin tested support at 75K, but the area of interest (74,500) was not reached. Accordingly, due to the relevance of the liquidity zone, the market may form a short squeeze and return to the target.

Resistance levels: 79,200, 81K, 82,000

Support levels: 77,850, 74,500

I expect two movements from the market. As part of the current correction, Bitcoin may form a breakout of 79200 and an impulse to 81-82K, but bears are likely to keep the market in this zone and provoke a further decline to 77900 - 74500.

Best regards, R. Linda!

GOLD - Correction within the local downtrend FX:XAUUSD stabilizes after correction, returning above $4750 after testing the $4400 area earlier in the week. However, the overall trend remains under pressure.

Key factors: DXY remains strong, limiting gold's growth. Tensions between the US and Iran have eased slightly, reducing demand for gold as a safe-haven asset. The appointment of Kevin Warsh, who is considered a proponent of tighter fiscal policy, has supported the dollar.

The market is awaiting the release of the US ISM Manufacturing PMI, which will set the tone ahead of employment data. This data will adjust expectations for future Fed rate cuts.

Despite a short-term recovery, gold remains in a downward correction amid a strong dollar and reduced geopolitical risks. The latest economic data from the US will determine the dynamics.

Resistance levels: 4470 - 4475, 4885

Support levels: 4696, 4583, 4432

Technically, I expect a retest of the nearest resistance; the market may react with a pullback/decline to support.

Best regards, R. Linda!

HYPEUSDT - Dump after pumpBINANCE:HYPEUSDT.P ended its rally in the 35.0 zone, smoothly changing the market phase from pump to dump. The cryptocurrency market is weak, but after a sharp decline, there may be a local correction

Bitcoin fell again to 81K during the Asian session. A strong rebound or uptrend should not be expected at this time. There is no fundamental support for the crypto market. Any attempts at growth may be perceived as a hunt for liquidity before the fall.

Within the framework of the downward trend and the weak state of cryptocurrencies, HYPEUSDT formed a pump phase and tested the local resistance zone of 35.0. The market was unable to reach the liquidity zone of 36.4. Before continuing its decline, against the backdrop of a general market correction, the coin may test 31.38 - 32.90

Resistance levels: 31.38, 32.9

Support levels: 29.98, 28.4, 25.84

If the market rebounds after the fall, the coin may test the resistance zone of 31.38 - 32.9. Another short squeeze and a close below 29.98 could trigger a continuation of the dump down to the interim bottom...

Best regards, R. Linda!

SOLUSDT - Bears increased pressure after retesting resistance BINANCE:SOLUSDT bounces off trend resistance and updates its local minimum to 122.4. A bearish phase is developing in the market, and a small correction is possible before the fall.

The daily timeframe indicates a crypto winter, a downtrend, and weak buying power due to capital outflows and a weak fundamental background.

Bitcoin is testing 90K and has once again been rejected by the resistance zone. Liquidation and a fall to the intermediate support zone have formed. Altcoins reacted aggressively to this impulse.

Resistance levels: 126.6, 130.5

Support levels: 123.0

SOLANA has two key levels: 123.0, closing below which could trigger a sell-off and a drop to 116.7. And resistance at 126.6, which acts as a zone of interest. It is possible that altcoins may test resistance in search of liquidity.

Best regards, R. Linda!

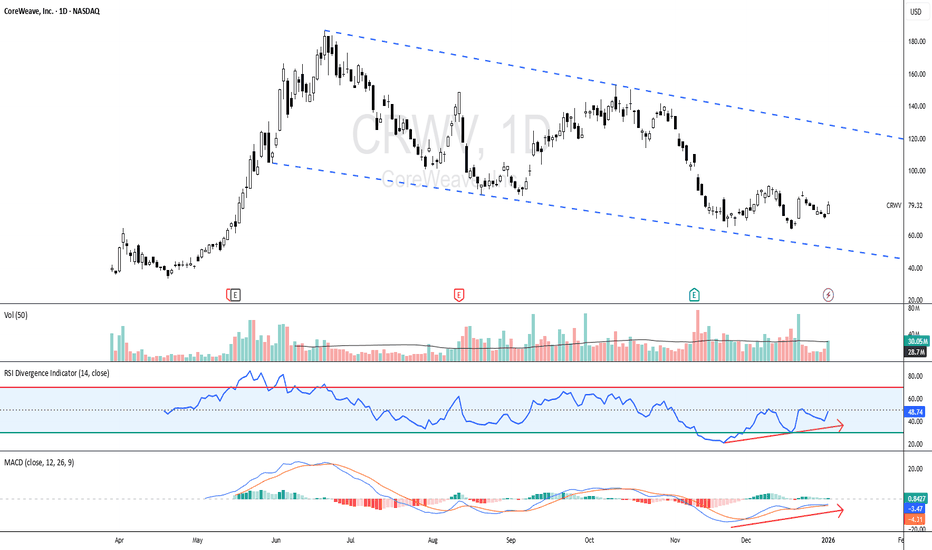

CRWV - Risk is clearly defined, making this a structured setup!CRWV - CURRENT PRICE : 79.32

CRWV is currently trading within a descending channel, indicating a medium-term corrective move after a prior uptrend. Importantly, price is now basing near the lower boundary of the channel, a zone where buyers previously showed interest.

Rather than breaking down aggressively, price action is stabilizing, suggesting selling pressure is starting to fade.

📈 Momentum Is Improving (Key Clue)

While price remains subdued, momentum indicators are telling a different story:

~ RSI (14):

RSI is recovering from lower levels and moving higher while price is still near the channel bottom. This signals improving momentum and early bullish divergence characteristics.

~ MACD:

MACD histogram is contracting, and the lines are starting to curl upward. This typically reflects weakening bearish momentum and the potential for a trend shift.

👉 When momentum improves while price holds support, it often precedes a technical rebound.

📌 This is a technical rebound setup — confirmation comes with continued momentum improvement and price holding support.

ENTRY PRICE : 77.00 - 79.32

FIRST TARGET : 96.00

SECOND TARGET : 110.00

SUPPORT : 63.80 (the low of BULLISH HARAMI pattern - 17 and 18 DECEMBER 2025 candle)

USDJPY - Interventions strengthen the JPY (price decline)FX:USDJPY is in a negative rally phase, passing through the entire trading range, breaking through the daily timeframe support at 154.450 and closing below the level, hinting at a possible continuation of the decline.

The dollar is falling, the yen is strengthening. The Bank of Japan intervened, which contributed to the strengthening of the national currency. The current movement may continue...

The currency pair breaks through the fairly important support level of 154.500 (154.45) as part of the rally and closes below the level. Consolidation is forming on the local timeframe, which may be aimed at a further decline. A short squeeze in the 154.45 zone could trigger a decline to 153 - 151.8

Resistance levels: 154.45, 155.65

Support levels: 152.96, 151.85

A breakdown from the local consolidation could trigger a continuation of the decline, as could a retest of the nearest resistance (liquidity hunt).

The market still has the potential to continue falling to 151.85 and to the intermediate bottom of 149.5.

Best regards, R. Linda!

BITCOIN - Consolidation below 90K. Weak marketBINANCE:BTCUSDT failed to break through the 90K area, and the market is forming a cascade of resistance, indicating the dominant position of sellers in the current circumstances.

The market still looks quite weak, and any attempts at growth are a hunt for liquidity. Global and local trends are bearish, with sales dominating (outflow of funds).

There is no fundamental support, the transfer of assets to crypto exchanges and the outflow of funds from ETF funds continues, which in general indicates weak market sentiment during the crypto winter. The current cycle is downward, and there is a possibility of a retest of the 80,000-75,000 zone.

Technically, Bitcoin is facing strong resistance at 89K and, unable to continue its growth, is rebounding and heading downwards. A short squeeze may form before the fall.

Resistance levels: 88,950, 89,590, 90,350

Support levels: 86970, 86100

If the bears keep the price below 89000, the market may fall to an intermediate bottom of 86000, however, closing below 86K could signal a further decline to 80K.

Best regards, R. Linda!

LTCUSDT - Hunting for liquidity before the fallBINANCE:LTCUSDT is consolidating below 70.0 before a possible continuation of the decline. The global trend is downward, liquidity is low...

After a sharp decline, the coin entered a consolidation phase, during which a cascade of support is observed, which may falsely indicate the presence of a buyer. The goal of such a maneuver may be to capture liquidity at 69.70 before falling to 65.0

Within the context of a downtrend and low liquidity, MM may form a retest of the 69.3-69.7 zone (liquidity area) to continue consolidation and further decline to 67-65.

Resistance levels: 69.30, 69.70

Support levels: 67.0, 65.3

A retest of the resistance and liquidity zone and the absence of bullish momentum may form a false breakout of the upper boundary of consolidation, which in turn may provoke a continuation of the decline towards both local targets and the global bottom...

Best regards, R. Linda!

BTCUSDT - The battle for 90K may end in a decline BINANCE:BTCUSDT , against the backdrop of Trump's speech and various comments, caused a shake-up within the range of 87,800-90,300, but the price is consolidating below key resistance within the current downtrend...

The downtrend may continue if Bitcoin consolidates below 90K. There is a chance of this happening as there is still no fundamental support for the market. Everyone is talking about the "CLARITY Act" on cryptocurrencies, but there is no date for its signing, and there are rumors that the process may be postponed until late winter or mid-spring, leaving the market without a bullish driver.

The market is experiencing a phase of struggle for the 90K resistance zone. Bears are stubbornly resisting, forming a false breakout and consolidation below resistance. The structure could be broken if there is an impulsive breakout of the 90,500 zone and the bulls are able to keep the price above this zone, but the bears have formed a fairly strong resistance zone.

Resistance levels: 90,400, 91,400

Support levels: 87800, 85000

I do not rule out another attempt to retest the 90350 zone, but if the bears keep the price below 90K, the market will have no chance for growth. In this case, a pullback to 89K - 88K can be considered.

Best regards, R. Linda!

AAVEUSDT - Bear market. Breakdown of support at 162.0BINANCE:AAVEUSDT is testing the support of the range amid a market decline. Bulls are reversing their positions due to weakening fundamentals. Focus on support at 162.0

Bitcoin is falling due to the deterioration of the fundamental background. The altcoin market is reacting aggressively and entering a short zone. AAVE is breaking out of the range, and if it closes below 162.0, the decline may intensify

A pre-breakout base is forming relative to 162.0. Before the fall, a retest of the local liquidity zone at 165.9 is possible. However, closing below the support at 162.0 will be a signal for a further decline to 157.0 - 148.0.

Support levels: 162.0, 157.23, 148.06

Resistance levels: 165.9, 169.1

The price breaking out of the range suggests readiness for further movement. A breakout of support indicates that the movement will be downward. Closing below 162.0 could trigger a sell-off to 157 - 148 - 145.

Best regards, R. Linda!

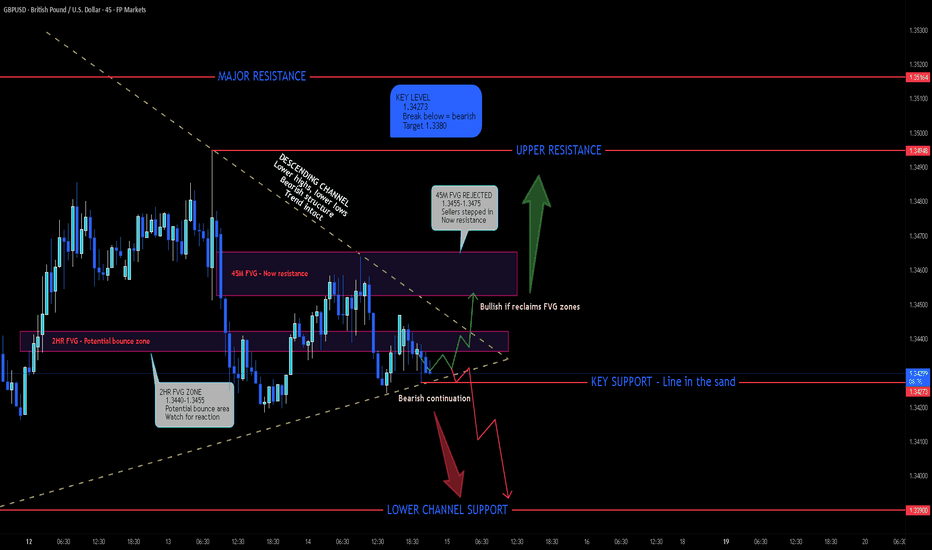

GBPUSD - Descending Channel with Stacked FVG Zones

Alright traders, let's talk GBPISD!

GBPUSD is showing some interesting price action right now. We've got a descending channel playing out on the 45-minute timeframe with two stacked FVG zones creating a decision area. Price just retested the 45M FVG and sellers stepped in - now it's acting as resistance.

Here's the key: 1.34273 is the line in the sand. Break below = bearish continuation. Hold above = potential bounce into the FVG zones.

The Structure

Price has been making lower highs and lower lows inside this descending channel. We saw a push up into the 45M FVG zone (1.3455-1.3475) but sellers rejected it hard. Now that zone has flipped from support to resistance.

Below that, we have the 2HR FVG zone (1.3440-1.3455) which could act as a retest area if we get a bounce. But if 1.34273 breaks, we're heading to the lower support at 1.3380.

Why This Setup Matters

Descending channel intact - trend is bearish until breakout

45M FVG rejected - sellers in control at that level

2HR FVG below - potential bounce zone if bulls step in

1.34273 is critical support - break = acceleration lower

BoE expected to cut rates - bearish for GBP

Dollar strength persisting despite Fed drama

Fundamental Picture

Mixed signals but leaning bearish for GBP:

UK GDP data due Thursday - expected to show 0.2% contraction

BoE's Taylor: "Interest rates should continue on a downward path"

UK inflation cooling faster than expected

Speculators cut bearish GBP positions by most in 5 months

Dollar holding near 1-month highs despite Powell drama

Fed expected to hold rates - supports USD

Japan yen drama pulling focus but USD still firm

Key Levels

Resistance:

1.3455-1.3475 - 45M FVG zone (now resistance)

1.3510 - Upper resistance

1.3575 - Major resistance / channel top

Support:

1.3440-1.3455 - 2HR FVG zone (potential bounce)

1.34273 - KEY SUPPORT (line in the sand)

1.3380 - Lower channel support

The Scenarios

Bearish (favored): Price stays below the 45M FVG zone, retests the 2HR FVG but fails to hold, breaks below 1.34273, and continues down the channel toward 1.3380. The descending channel structure supports this move, and weak UK data could accelerate it.

Bullish: Price bounces from the 2HR FVG zone, reclaims the 45M FVG (1.3455-1.3475), and breaks above the descending channel. Target would be 1.3510, then 1.3575. This needs strong UK GDP data or significant dollar weakness.

Chop scenario: Price oscillates between the FVG zones and 1.34273 support. Wait for a clear break before committing.

My Lean

I'm BEARISH here. The descending channel is intact, the 45M FVG got rejected, and the fundamentals favor USD strength (Fed holding, BoE cutting). The 1.34273 level is the trigger - break below that and we're targeting 1.3380.

If you're looking for shorts, wait for a retest of the 2HR FVG zone that fails, or a clean break below 1.34273.

What's your read on GBPUSD? Bulls or bears winning this one? 👇

Approaching a Major Inflection Point After 2.5‑Year DowntrendNHC is shaping up for a meaningful breakout after a ~2.5‑year downtrend.

We’ve still got a few days left in the monthly candle, but a close above $4.71 would strengthen the probability of a sustained trend reversal.

Why the setup is interesting

- Price has reacted cleanly from a macro 50% retracement (ATL → ATH).

- It’s also sitting right on the major 50% level from the COVID low to ATH.

- Price is currently resting on the old ATH region, turning prior resistance into support.

- We’re seeing a potential first test and impulsive break of the yearly pivot (need to see spike of volume relative by end of month with larger candle spread)

- Volume has been declining for ~2 years, hinting at seller exhaustion rather than active distribution.

Where caution is still warranted

- The monthly candle hasn’t closed, and price is pressing into the yearly pivot for the first time.

- Coming in sideways increases the chance of a rejection wick before any true breakout.

- A sharp pullback into S1 wouldn’t be unusual, especially if the pivot acts as initial resistance before a stronger rally and eventual breakout attempt.

Overall, the structure is improving, the higher‑timeframe levels are doing their job, and the pivot interaction will likely dictate whether we break now or after a cleaner retest.

Tron continuing to climb the measured move lineUsually when you see a measured move line treated like a staircase by price action and by this many consecutive daily candles probability is good that the breakout will be validated. If so, the target for this one is around 43-44 cents. *not financial advice*