Multiply Group (ADX) – Bearish Divergence Ahead, Stay Cautious!Greetings Traders,

A bearish divergence has appeared on the Multiply (ADX) daily chart — time to stay alert!

Key Observations:

RSI shows a bearish divergence, signaling possible short-term weakness.

High volumes recently indicate strong participation — a good sign for future momentum.

Price action may move sideways, consolidate, or even push slightly higher before a decisive move.

The buy zone is above the last higher-high (≈ AED 3.45) with confirmation from strong volume.

Stop Loss: around AED 2.75 (below last low).

Take Profit: near AED 4.15, aligning with the upper target projection.

💡 Strategy: Wait and observe the divergence play out. Enter only on confirmed breakout with volume confirmation. Manage risk with tight stop-loss levels.

Happy Trading & Stay Disciplined!

Divergence

Bullish Divergence

Closed at 26.89 (05-06-2025)

27.50 - 28 is an Immediate Important

Resistance that needs to cross & sustain

for further upside.

There is a Bullish Divergence which may

help this time to break the resistance.

But better approach would be to wait

for the Resistance to cross & then take entry.

If it does, 32 - 33 is easily reachable.

On the flip side, it should not break 23.50

otherwise there would be more selling pressure.

Xmoon Indicator Tutorial – Part 3 – Step Entry (DCA Entry)📘 Xmoon Indicator Tutorial – Part 3

🎯 Step Entry (DCA Entry)

Step-by-step entry, also known as DCA (Dollar Cost Averaging), is one of the key parts of the Xmoon – 3 Push Divergence strategy.

🔹 Why is it important?

After a 3 Push Divergence pattern appears, the market usually doesn’t reverse immediately.

It often moves a bit further in the same direction before turning back.

If we put all our capital in at once, the risk of liquidation increases.

🔹 The solution

We split the capital into several parts and enter the market step by step:

✦ If the market doesn’t reverse from Entry 1 , the chance of reversal at Entry 2 is higher

✦ If it doesn’t reverse from Entry 2, the chance at Entry 3 increases even more

✦ And so on — with each new step, the probability of reversal grows

Benefits of step entries:

✅ Lower overall risk

✅ Higher win rate

✅ Positions reach the Risk Free point faster

📣 If you have any questions or need guidance, feel free to ask us. We’d be happy to help.

Falling Wedge Heading into EarningsAfter previously breaking out of a falling wedge to hit new ATH's, NYSE:GS is holding yet another falling wedge heading into earnings next week. (Previous Chart Below)

Its EMA's are curling upwards, some bullish hidden divergence on the RSI, a MACD golden cross, and a bullish FVG formed as support- Will definitely be watching this one.

USDJPY: CCI divergence and pullback from supply zoneUSDJPY forms a bearish divergence on the CCI indicator (4H chart), signaling a potential loss of momentum. The pair is testing the supply zone 153.70–154.50, where large players previously took profits.

A confirmed reversal could lead to a decline toward 152.00 → 149.70 → 146.65, aligning with Smart Money structure and liquidity zones.

Fundamentally, the yen may strengthen amid possible Bank of Japan interventions and stabilizing U.S. bond yields.

The USD remains fundamentally strong due to rate differentials but is short-term overbought.

Bearish CCI divergence and approach to a key supply zone suggest a potential correction lower.

oct 6: tp hit xDoct 6: tp hit xD

hell yeah brother.

well, I guess the strategy was applied anyway.

and the FRVP helped, maybe?

Sweep + Low Volume Node + OTE + FVG, among the other confluences on my checklist.

What I could have done better on this trade though... was not enter prematurely. in that way, I could have put my 2RR TP above the "TARGET" liquidity. Because as you can see, price swept the target liquidity, and then reversed immediately.

Only by strong orderflow was price able to go lower again. But if it wasn't for this, price would have reversed and hit my SL.

check one of my previous trades, I have this described there in more detail.

everything on this trade is perfect besides my TP point. and maybe my entry, it was kinda rushed ngl.

EURCAD: wedge at the top with bearish divergenceThe EUR/CAD pair has been trading within an ascending channel, but the 4H chart shows a rising wedge pattern, typically a reversal setup. Attempts to sustain above 1.64 have failed so far, while the CCI indicator shows a series of bearish divergences, highlighting weakening bullish momentum.

Technically, the likelihood of a decline after the wedge breakout is high. Initial targets lie at 1.6260, followed by 1.6080, and deeper at 1.5780. A retest of the broken level (re-entry) is possible before the downward move accelerates.

From a fundamental perspective, the euro remains pressured by weak macro data and a cautious ECB, while the Canadian dollar is supported by stable oil prices and a firm Bank of Canada stance. This divergence in fundamentals strengthens the bearish case.

It’s a classic situation where the market tempts traders into expecting a reversal, but confirmation is still required. As always, emotions aside — we wait for clear signals before acting.

DOT is bullish now & many Traders don't see it !!!The price on the daily timeframe is within an ascending triangle, which can be promising. If the price breaks this pattern with bullish candles, it could easily rise by the distance of AB=CD, If my view is correct, DOT will rise to 5$ .

And if this pattern is correct and breaks, higher targets are possible.

UPS : TRADE IDEA 1 NYSE:UPS

Price Action

UPS dropped sharply with a big gap down, followed by heavy selling.

Price is now consolidating near $82–$84, forming a possible falling wedge (bullish) or descending triangle (bearish).

Support & Resistance

Key support: $82

Resistance: $88–$90 (prior consolidation zone)

RSI (Relative Strength Index)

RSI (14) shows bullish divergence: higher lows while price made lower lows

Suggests potential upside momentum or a short-term bounce

MACD (Moving Average Convergence Divergence)

Histogram flattening and trending upward

Signal lines converging, hinting at a possible bullish crossover

Overall Setup

UPS is at a potential reversal zone after an oversold move!

Holding above $82 could trigger a bounce toward $88–$90!

A breakdown below $82 with volume may open downside to $78!

SEPT 25: Price Stopped at Old POISEPT 25: Price Stopped at Old POI

So, I looked for my entry criterias (old sweep check, recent sweep check, divergence check, engulfing candle check, price respecting a fib level check, FVA check), and there it was, so I made my entries.

10pip tp + 5pip sl. let's see how it goes.

Swing Setup: (1D+4H) POI + 5min DIVERGENCE + FVA RESPECT So I did my top down analysis, saw a 1D FVG and price respected it, so I looked for divergences and i found it on the 5min, saw price made an FVA and displaced through it so I decided it was time to enter that because a 4H and 1D FVG is a strong POI, and the fact that price did not burst through it meant it was getting respected.

So I think it was at this time that I saw the FVA has formed and has been respected so I looked for an entry.

For the actual entry, I think there was a small bullish FVG there above the FVA so I took that.

Since price was at a 1D + 4H FVG, I considered it as the Internal Range Liquidity(IRL) and therefore targeted the External Range Liquidity (ERL). I put my SL quite far, at the bottom of this sting into the FVG. It got me 2.8RR I think, and that's good enough.

I made this trade on friday, and it only resolved the next trading day, which was monday.

TL;DR, 4H and above POI(IRL), once you see it getting respected (with an FVA + FVG), take it as a sign, enter without hesitation, and target the ERL.

Gold hits record highs ahead of FOMC! Tech SetupGold reached fresh all-time highs near $3690 ahead of Wednesday's FOMC meeting. Its rally reflects a perfect storm of Fed dovishness and geopolitical tensions, but technical divergences suggest positioning carefully ahead of Powell's decision. The 100% Fib extension and double divergence setup makes any hawkish surprise particularly dangerous for leveraged longs.

CATALYSTS DRIVING THE RALLY:

Fed rate cut fully priced in (25bps expected, some 50bps speculation)

US-China tensions escalate (Nvidia antitrust accusations)

Stephen Miron confirmed to Fed Board of Governors (dovish member)

Dollar weakness supporting precious metals

Surprising correlation: Nasdaq & S&P 500 also hit records alongside gold

TECHNICAL LEVELS:

Resistance :

$3,700 - Key psychological level

$3,750 - Next major target

$3,800 - Extended upside if dovish

Support :

$3,660 - First support for entries

$3,610 - Major support level

Previous swing lows - Stop loss reference

WARNINGS:

Double divergence on 4H & 1H timeframes

100% Fibonacci extension reached

RSI overbought conditions

Momentum diverging from price action

FOMC SCENARIOS:

Bullish Case : Dovish 25bps + accommodative guidance → Target $3,750-$3,800

Risk Case : Hawkish surprise or even neutral tone → Profit-taking toward $3,600-$3,500

KEY RISKS:

Powell emphasising inflation persistence

Resistance to aggressive cutting cycle

Hawkish dot plot projections

Any break below $3,660 signals deeper correction potential

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

From Strength to Weakness: ETH Validates a Key Bearish PatternIntroduction (Market Context)

Ether Futures (ETH) and Micro Ether Futures (MET) have been at the center of market attention since April 2025, when prices staged a remarkable rally of more than +250%. This surge was not just a technical phenomenon—it came in the wake of major macro events such as Liberation Day and the reemergence of U.S. tariff policies under Donald Trump’s administration. Those developments sparked speculative flows into digital assets, with Ether acting as one of the prime beneficiaries of capital rotation.

Yet markets rarely move in one direction forever. After such a sharp rise, technical exhaustion often follows, and signs of that exhaustion are beginning to surface on ETH’s daily chart. Traders who enjoyed the rally now face a critical juncture: whether to protect gains or to consider new opportunities in the opposite direction. The key lies in a pattern that has appeared many times in history, often marking important reversals—the Rising Wedge.

What is a Rising Wedge?

A Rising Wedge is one of the most recognizable bearish reversal formations in technical analysis. It typically develops after a strong uptrend, where price continues to push higher but does so with diminishing momentum. On the chart, the highs and lows still point upward, but the slope of the highs is shallower than the slope of the lows, creating a narrowing upward channel.

The psychology behind the wedge is critical: buyers are still in control, but they are running out of strength with every push higher. Sellers begin to absorb demand more aggressively, and eventually, price breaks through the lower boundary of the wedge. This breakdown often accelerates as trapped buyers unwind positions.

From a measurement perspective, technicians project the maximum width of the wedge at its start, and then apply that distance downward from the point of breakdown. This projection offers a technical target for where price may gravitate in the following weeks. In the case of Ether Futures, that target points toward the 3,200 area, a level of strong technical interest and a logical area for traders to watch closely.

RSI and Bearish Divergence

Alongside the wedge, momentum indicators add further weight to the bearish case. The Relative Strength Index (RSI) is a widely used oscillator that measures momentum on a scale of 0 to 100. Values above 70 are generally interpreted as “overbought,” while values below 30 suggest “oversold.”

The most powerful signals often emerge not when RSI is at an extreme, but when it diverges from price action. A bearish divergence occurs when price sets higher highs while RSI forms lower highs. This is an indication that upward momentum is weakening even as price appears to climb.

Ether Futures have displayed this phenomenon clearly over the past few weeks. The daily chart shows four successive higher highs in price, yet RSI failed to confirm these moves, instead tracing a series of lower peaks. Notably, RSI pierced the overbought zone above 70 twice during this period, but momentum faded quickly after each attempt. This divergence is a classic early warning sign that a bullish run is running out of steam.

Forward-Looking Trade Idea

With the Rising Wedge breakdown and RSI divergence in place, a structured trade plan emerges. Futures traders can express this view through either the standard Ether Futures contract (ETH) or its smaller counterpart, the Micro Ether Futures contract (MET).

Contract Specs & Margins

Ether Futures (ETH): Notional = 50 Ether, Tick size = 0.50, Tick value = $25.00, Initial margin ≈ $68,800 (subject to CME updates).

Micro Ether Futures (MET): Notional = 0.1 Ether, Tick size = 0.50, Tick value = $0.05, Initial margin ≈ $140 (subject to CME updates).

Trade Plan (Bearish Setup)

Direction: Short

Entry: 4,360

Target: 3,200

Stop Loss: 4,702 (coinciding with a minor resistance level)

Reward-to-Risk Ratio: ≈ 3.39 : 1

The projected wedge target around 3,200 is not only a measured move from the pattern but also sits close to a previously established UFO support zone. While anecdotal, this confluence reinforces the credibility of the level as a potential magnet for price.

Risk Management

Regardless of how compelling a technical setup may appear, the most decisive factor in trading remains risk management. Defining risk in advance ensures that losses are limited if the market behaves unexpectedly. In this case, placing the stop at 4,702 not only keeps risk under control but also aligns with a minor resistance level, making the trade plan technically coherent.

Position sizing also plays a crucial role. The availability of Micro Ether Futures (MET) allows traders to participate with significantly reduced capital requirements compared to the full-sized ETH contract. This flexibility makes it easier to fine-tune exposure and manage account risk more precisely.

Equally important is the discipline of adhering to precise entries and exits. Chasing a trade or ignoring pre-defined stop levels can erode the edge provided by technical analysis. Markets often deliver multiple opportunities, but without sound risk management, traders may not survive long enough to benefit from them. Ultimately, capital preservation is the foundation on which consistent performance is built.

Closing

Ether’s spectacular rally since April 2025 is a reminder of the asset’s ability to deliver explosive moves under the right conditions. Yet history shows that parabolic advances rarely continue uninterrupted. The combination of a Rising Wedge breakdown and a confirmed RSI divergence provides strong evidence that the current uptrend is losing momentum, and the market may be entering a corrective phase.

For traders, this is less about predicting the future and more about recognizing when probabilities align in favor of a defined setup. With clear entry, target, and stop levels, the ETH and MET contracts offer a structured opportunity for those willing to take a bearish stance while managing their risk appropriately.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

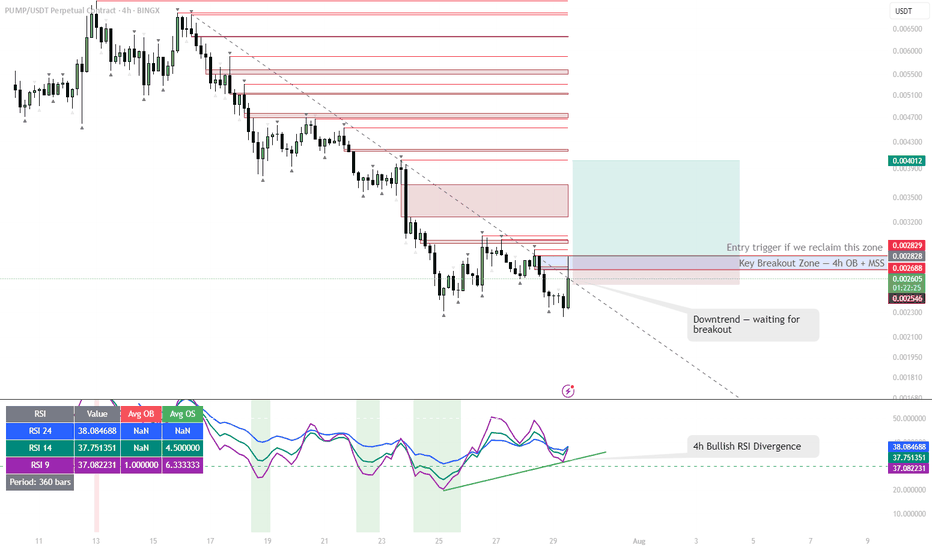

PUMP | #4h #long — Watching for Breakout Confirmation Early signals for a reversal, but not rushing in.

Some clear bullish divergence on the 4h RSI — first positive sign after an extended downtrend. Price can pop from here, but my plan is to wait for a break and hold above the 4h Order Block + MSS zone (red box) before taking any long entry.

Confirmation is key — I only want to get involved if we reclaim this area with momentum.

Scenario:

If we get a strong breakout and close above the red OB + MSS zone, that’s the first entry trigger for a potential trend reversal.

Until then — standing aside, letting the setup prove itself.

Reasoning:

Bullish RSI divergence often marks the beginning of a reversal, but without a structural breakout, the move can easily fail.

Patience pays off in these high-risk, low-liquidity coins.

Divergence and Convergence: How to Read Market SignalsThe cryptocurrency market, like any financial market, is full of paradoxes. Price can rise, yet the strength of the trend is already weakening. Indicators may show that the move is “running on fumes,” but most traders keep buying at the top or selling at the bottom. The result is always the same: emotional trading and chaos instead of system and consistency.

The main problem is that most participants only look at price. But price is just the tip of the iceberg. Beneath it lie volumes, momentum, trader sentiment, and recurring statistical patterns. This is where divergence and convergence come into play — signals that often warn of a trend change long before it becomes obvious.

What are Divergence and Convergence

Divergence occurs when the price makes new highs or lows, but a momentum indicator (such as RSI or MACD) shows the opposite — weakening strength. It’s a signal that the trend is losing energy and the probability of reversal is rising.

Convergence is the opposite. The price updates a low, but the indicator shows higher readings. This suggests sellers are losing steam and buyers may soon regain control.

On the chart, these may look like small details, but for an attentive trader, they mark turning points — the very beginnings of shifts that later become obvious to everyone else.

Why These Signals Matter

Imagine Bitcoin climbing from $105,000 to $118,000. Everyone is euphoric, and newcomers rush to open longs, hoping for more upside. Meanwhile, RSI is already showing divergence: price is up, momentum is down. For a careful trader, that’s a red flag.

Moments like this help avoid buying at the peak and prepare for an incoming correction. More importantly, divergences not only give exit signals but also highlight potential reversal zones — places where traders can plan new entries in the opposite direction.

How to Read Divergence and Convergence

Compare price highs/lows with the indicator. If price rises but the indicator falls — it’s divergence.

Check the context. A single signal on the indicator means little. Support/resistance levels, volumes, and candlestick structure matter.

Be patient. Divergence can form over several candles, and the market often makes one last push before turning.

Combine tools. Use divergence alongside TP/SL zones and trendlines to improve accuracy.

Common Mistakes

Many beginners make the same error: they see divergence and instantly trade against the trend. That’s wrong. Divergence isn’t a “buy/sell button,” it’s a warning. It says: “Be cautious, momentum is fading.” The actual reversal must still be confirmed by price structure and volumes.

Another mistake is ignoring timeframe. Divergence on a 5-minute chart may only play out for a few dollars, but on a 4H or daily chart, the move could be massive.

Building it Into a System

This is the crucial part. An indicator alone won’t make a trader successful. Divergence and convergence need to be part of a system where:

- entry and exit zones are pre-defined,

- profit targets are clearly marked,

- risk is limited by stop-losses,

- and decisions are made without emotions, based on structure.

This is where algorithms and automation prove invaluable. An automated model spots divergence earlier than the eye, flags conditions for a probable trend shift, and guides the trade step by step.

Why It Works

Markets move in cycles, and history repeats. Divergence and convergence are not magic, but a reflection of market physics: momentum fades, energy runs out, and no trend lasts forever. Ignoring these signals means trading blind.

Integrating them into a structured process means having a map of potential scenarios ahead of time. It doesn’t guarantee perfection, but it eliminates guesswork and replaces it with probabilities and discipline.

Conclusion

Divergence and convergence are market warnings for those who pay attention. They help traders exit on time, avoid entering at peaks, and prepare for reversals. Most importantly, they train discipline and patience — the qualities that separate long-term survivors from those who get washed out.

In a world where emotions break strategies, systematic analysis provides the edge. Automation, technical tools, and the ability to read market structure turn chaos into a structured process. For traders seeking to look deeper than just price, divergence and convergence are signals worth learning to read as carefully as a book.

Can Yen Futures Push Higher? Inverted H&S Breakout in Focus1. Introduction

Japanese Yen Futures (6J) and Micro Yen Futures (MJY) are showing a promising technical setup that traders are watching closely. On the daily chart, an inverted Head and Shoulders pattern has formed, suggesting a potential reversal from recent weakness. The neckline lies around 0.006850, and if prices sustain a breakout above this level, the upside projection aligns neatly with a UFO resistance zone near 0.007100.

Adding weight to this bullish case, the MACD histogram is diverging positively, with higher lows forming while price action recorded lower lows. This bullish divergence suggests underlying momentum could support the completion of the pattern and drive Yen Futures higher in the sessions ahead.

2. Understanding the Inverted Head & Shoulders Pattern

The inverted Head & Shoulders (H&S) is a widely recognized reversal formation that often signals the end of a bearish trend. It is composed of three troughs: the left shoulder, the head (the deepest low), and the right shoulder, which is typically shallower. The neckline acts as the key breakout level, and once broken, the projected price target is measured from the head to the neckline, then projected upward.

In the case of Japanese Yen Futures, the neckline sits around 0.006850. A confirmed break above this price would validate the pattern, projecting a target toward 0.007100.

3. The Role of MACD Divergence

Momentum indicators could provide early clues about the strength of a potential breakout. In this case, the MACD histogram is showing bullish divergence—price made lower lows, while the histogram made higher lows. This divergence signals that selling pressure may be weakening, even as price was still falling.

Such conditions could potentially precede significant reversals, and when they align with a clear price pattern like the inverted Head & Shoulders, the probability of follow-through may increase. Traders monitoring this confluence will be looking at the neckline breakout above 0.006850 as the technical trigger that confirms it.

4. Contract Specs: Yen Futures vs. Micro Yen Futures

Understanding contract specifications helps traders size positions correctly and manage risk efficiently.

o Japanese Yen Futures (6J)

Contract Unit: ¥12,500,000

Minimum Tick: 0.0000005 per JPY = $6.25 per contract

Initial Margin (approximate, subject to change): ~$3,100

Popular with institutional traders due to larger notional exposure.

o Micro JPY/USD Futures (MJY)

Contract Unit: ¥1,250,000 (1/10th of standard 6J contract)

Minimum Tick: 0.000001 per JPY = $1.25 per contract

Initial Margin (approximate, subject to change): ~$310

Provides accessibility for retail traders and allows more granular risk management.

Both contracts track the same underlying, but the Micro contract offers flexibility for traders with smaller accounts or those looking to fine-tune position sizes.

5. Trade Plan & Stop Loss Options

With the inverted Head & Shoulders pattern taking shape, the trade bias turns long above the neckline breakout at 0.006850. The upside objective aligns with the resistance around 0.007100, providing a clearly defined target.

Two possible stop-loss placements can be considered:

o Below the Right Shoulder

Provides a valid protection but may offer a weaker Reward-to-Risk (R:R) ratio depending on the right shoulder height.

Useful for conservative traders looking to minimize drawdowns.

o Mathematically Below the Neckline

Positioned far enough to allow for retests of the neckline while aiming for a 3:1 R:R ratio.

Provides a balance between protection and potential profitability.

This approach ensures flexibility, letting traders choose between tighter risk control or a more favorable reward profile.

6. Risk Management Considerations

No pattern or indicator guarantees success, making risk management the cornerstone of any futures strategy. A few key principles stand out:

Always use a stop loss: Prevents small losses from escalating into significant drawdowns.

Avoid undefined risk exposure: Futures are leveraged products; unprotected trades can lead to large, rapid losses.

Precision in entries and exits: Reduces emotional decision-making and improves consistency.

Position sizing matters: Adjusting the number of contracts ensures risk stays proportional to account size.

Diversification and hedging: Yen futures can be used as a hedge against equity or bond market volatility, but should not necessarily replace broader risk controls.

In this context, choosing the stop-loss level carefully and sticking to the pre-defined trade plan is more important than the pattern itself.

7. Conclusion & Forward View

Japanese Yen Futures (6J) and Micro JPY/USD Futures (MJY) are at a critical juncture. The inverted Head & Shoulders on the daily chart, supported by a bullish MACD divergence, highlights a potential reversal in progress. A breakout above the neckline at 0.006850 opens the door for an advance toward the 0.007100 UFO resistance zone.

While the setup looks constructive, it is crucial to recognize that even strong patterns can fail. This is why risk management—through proper stop-loss placement and careful position sizing—remains the most important aspect of any trading plan.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Understanding SMT Divergence In Trading1. Definition and Importance

SMT (Smart Money Technique) Divergence refers to a trading concept that involves identifying discrepancies between the price movement of correlated markets or instruments.

These discrepancies can signal potential market reversals or price manipulation. Specifically, it focuses on the divergence between price movements and indicators (like volume, momentum, or oscillators) in markets that typically move in sync.

In SMT Divergence, traders look for situations where two or more correlated instruments (like

Forex pairs, indices, or bonds) are moving in opposite directions. This "divergence" signals that

there may be a shift in market sentiment, liquidity manipulation, or an opportunity for price

correction.

The importance of SMT Divergence lies in its ability to detect hidden market dynamics that are

often manipulated by institutional players. By understanding these divergences, traders can

gain insights into potential market moves and position themselves accordingly.

2. The Relationship Between Correlated Markets

Understanding these relationships is crucial for identifying SMT Divergence:

Forex Pairs : Many Forex pairs have direct correlations. For example, EUR/USD and USD/JPY are often correlated in the sense that when the USD strengthens, both pairs may exhibit price movement in the same direction (EUR/USD decreases, USD/JPY increases). SMT

Divergence occurs when these pairs move in opposite directions, indicating that something

unusual is happening in the market (e.g., liquidity manipulation or market anticipation).

Indices : Stock market indices (like the S&P 500 or Dow Jones) and related instruments like futures or ETFs can show correlation. A divergence in these indices might indicate potential

trends or reversals, signaling that institutions are positioning themselves for a move in one

direction, and the market is showing resistance.

Bonds : The relationship between bond yields and currency pairs, for instance, can also show correlations. When bond yields move in one direction, certain currency pairs should

generally follow suit. Divergence in this relationship can reveal clues about market

intentions, such as shifts in interest rates or macroeconomic sentiment.

Commodities and Stocks : Commodities like oil and gold can often correlate with indices or specific stocks. For example, if oil prices rise and an energy sector index doesn’t move in the

same direction, this could be a sign of market inefficiencies or institutional positioning.

3. SMT Types

3.1. Bullish SMT Divergence

Bullish SMT (Smart Money Technique) Divergence occurs when one correlated asset forms a

higher low while another makes a lower low. This indicates that one market is showing hidden

strength, suggesting a potential reversal to the upside.

How to Spot Higher Lows in One Asset While the Other Makes Lower Lows:

1. Identify Two Correlated Markets – Choose two assets that typically move together, such as EUR/USD and GBP/USD or NASDAQ and S&P 500.

2. Look for Divergence – Observe when one asset makes a new lower low, while the other fails to do so, instead of forming a higher low.

3. Volume & Price Action Confirmation – Institutions may absorb liquidity in the weaker asset while the stronger one holds its ground.

4. Validate with Market Context – Look at macroeconomic conditions, liquidity pools, and institutional activity to confirm the setup.

3.2. Bearish SMT Divergence

Bearish SMT Divergence occurs when one correlated asset forms a lower high while another

makes a higher high. This signals hidden weakness, indicating that the market may be setting

up for a bearish reversal.

How to Spot Lower Highs in One Asset While the Other Makes Higher Highs:

1. Find Two Correlated Markets – Common pairs include NASDAQ vs. S&P 500 or EUR/USD vs. GBP/USD.

2. Identify the Divergence – One asset makes a higher high, while the other fails to follow and forms a lower high instead.

3. Liquidity & Volume Analysis – Smart money may be using the stronger asset to attract buyers before reversing.

4. Confirm with Institutional Order Flow – Watch for liquidity grabs and imbalance zones.

3.3. Intermarket SMT

Definition : Divergence between assets from different markets, such as Forex vs. Commodities, Stocks vs. Bonds, or Indices vs. the U.S. Dollar.

Examples :

EUR/USD vs. DXY (U.S. Dollar Index) – If EUR/USD forms a higher low while DXY makes a

higher high, this suggests USD weakness and potential EUR/USD strength.

NASDAQ vs. S&P 500 – If NASDAQ makes a higher high but S&P 500 doesn’t, it can indicate

a weakening stock market rally.

Strength & Validity :

High validity because institutions hedge positions across different markets.

3.4. Intramarket SMT

Definition : Divergence within the same market (e.g., multiple Forex pairs or stock indices).

Examples :

EUR/USD vs. GBP/USD – If EUR/USD makes a lower low but GBP/USD doesn’t, it could

indicate bullish strength.

Dow Jones vs. S&P 500 vs. NASDAQ – If NASDAQ is making new highs while the Dow lags, it

may signal weakness in the broader stock market.

Strength & Validity :

Still valid but needs additional confirmation (liquidity sweeps, volume analysis).

4. SMT Divergence vs. RSI Divergence

Why SMT Is Superior to Traditional RSI Divergences

1. RSI Measures Momentum, Not Liquidity – RSI divergence is based on momentum shifts,

which institutions can easily manipulate with fake breakouts or engineered price moves.

2. SMT Focuses on Market Structure & Liquidity – SMT divergence detects institutional

positioning by comparing correlated assets, making it harder to manipulate.

3. RSI Can Remain Overbought/Oversold for Long Periods – Markets can continue trending

despite RSI divergence, while SMT divergence often provides stronger reversal signals.

How Smart Money Manipulates Classic Divergence Traders

Liquidity Sweeps – Institutions use RSI divergence to lure retail traders into premature

reversals before executing stop hunts.

False RSI Signals – In trending markets, RSI divergences often fail, while SMT divergence

provides a more contextual view of smart money positioning.

5. Using TradingView for SMT Analysis

To effectively analyze SMT divergence, traders should monitor at least two correlated assets

simultaneously.

TradingView makes this easy by allowing multiple chart layouts. Steps to Set Up Multiple Charts in TradingView:

a. Open TradingView and click on the “Select Layout” button.

b. Choose a two-chart or four-chart layout to compare correlated assets.

c. Sync timeframes across all charts for consistency.

d. Adjust scaling to ensure price action is easily comparable.

Best Pairs to Compare for SMT Analysis:

Forex : EUR/USD vs. GBP/USD, USD/JPY vs. DXY

Indices : NASDAQ vs. S&P 500, Dow Jones vs. S&P 500

Commodities & FX : Gold (XAU/USD) vs. USD/JPY

Bonds & Equities : 10-Year Treasury Yield vs. S&P 500

6. Key Takeaways

SMT divergence reveals institutional intent by showing liquidity accumulation or

distribution through correlated assets.

Bullish SMT occurs when one asset makes a lower low while the other does not, signaling a

potential reversal up.

Bearish SMT occurs when one asset makes a higher high while the other does not, signaling

a potential reversal down.

Best markets for SMT analysis include Forex pairs, indices, commodities, and bonds, where

correlations are strongest.

SMT is most effective near key liquidity levels, such as session highs/lows, order blocks, and

fair value gaps.

SMT is more reliable during high-impact news events, London & New York sessions, and

quarterly shifts, where institutional activity is highest.

SMT is superior to RSI divergence because it reflects real liquidity dynamics, whereas RSI

can produce false signals.

Combining SMT with market structure shifts like BOS and CHoCH increases trade accuracy

and reliability.

Risk management in SMT trading requires stop-loss placement beyond liquidity grabs and a

minimum 2:1 risk-reward ratio.

Mastering SMT helps traders avoid liquidity traps, improve precision, and align with smart

money moves.

SMT divergence is the footprint of smart money—where one market whispers the truth while the other follows the herd.

Xmoon Indicator Tutorial – Part 2 – Pivots🔻🔻🔻+ Persian translation below 🔻🔻🔻

🔹 What Is a Pivot?

In the Xmoon strategy, every high or low that forms on the chart is considered a pivot.

The number of candles between two highs or two lows defines the size of the pivot.

The more candles there are between them, the larger and more reliable the pivot becomes.

🔸 Types of Pivots in the Xmoon Indicator Settings

In the settings panel, you can choose which types of pivots the patterns should be based on.

There are 4 pivot types :

• Super Minor → the smallest pivot

• Minor

• Mid Major

• Major → the largest pivot

⏫ As you move from Super Minor to Major, the strength of the pivot increases — but the number of signals decreases.

⚖️ Choosing the Right Pivot = Your Trading Style

• Want more signals? → Use smaller pivots like Minor or Super Minor

• Prefer higher accuracy and lower risk? → Use larger pivots like Major or Mid Major

💡 Pro Tip: On higher timeframes, pivots perform better and help reduce risk.

✍️ Summary

If you're looking for frequent signals, trade on lower timeframes, and can handle higher volatility and pressure, then smaller pivots like Super Minor and Minor are a better choice.

But if you prefer quality over quantity, work on higher timeframes, and value clarity, peace of mind, and higher success rates, then larger pivots like Mid Major and Major are the way to go.

📣 If you have any questions or need guidance, feel free to ask us. We’d be happy to help.

🔻🔻🔻 Persian Section – بخش فارسی 🔻🔻🔻

🔹 پیوت چیست؟

در استراتژی ایکسمون، هر قله یا درهای که روی چارت شکل میگیرد، یک پیوت محسوب می شود

فاصله زمانی بین دو قله یا دو دره (یعنی تعداد کندلهایی که بینشان قرار دارد) اندازهی پیوت را مشخص میکند

هرچه تعداد کندل بین دو سقف یا کف بیشتر باشد، آن پیوت بزرگتر و معتبرتر است

🔸 انواع پیوت در تنظیمات اندیکاتور ایکسمون

در بخش تنظیمات، میتوانید مشخص کنید که الگوها بر اساس چه نوع پیوتهایی شناسایی شوند

ما ۴ نوع پیوت داریم

• سوپر مینور ← کوچکترین پیوت

• مینور

• میدماژور

• ماژور ← بزرگترین پیوت

⏫ هرچه از سوپرمینور به سمت ماژور برویم، قدرت پیوت بیشتر میشود، ولی تعداد سیگنالها کمتر می شود

⚖️ انتخاب پیوت مناسب = سبک معاملاتی شما

• به دنبال سیگنال زیاد هستید ← پیوت کوچک تر = مینور و سوپرمینور

• به دنبال دقت بیشتر و ریسک کمتر هستید← پیوت بزرگتر = ماژور و میدماژور

💡 نکته حرفهای: در تایمفریمهای بالا، پیوتها عملکرد بهتری دارند و به کنترل ریسک کمک میکنند

✍️ جمعبندی

اگر دنبال سیگنالهای زیاد هستید، در تایمفریمهای کوچکتر کار میکنید و میتونید نوسانات و فشار روانی بالاتر رو تحمل کنید، پیوتهای کوچکتر مثل سوپرمینور و مینور انتخاب مناسبتری هستند

اما اگر در تایم فریم های بزرگتر کار می کنید و کیفیت سیگنال، آرامش ذهنی و احتمال موفقیت برایتان مهمتر است، پیوتهای بزرگتر مثل میدماژور و ماژور انتخاب بهتری هستند

📣 اگر سوالی دارید یا نیاز به راهنمایی دارید، خوشحال میشویم از ما بپرسید

با کمال میل در خدمتتان هستیم

EUR/CAD: Shorting the Climactic Rally Near 1.6000The strong rally in EUR/CAD has pushed the pair into extreme territory, approaching a major psychological and structural resistance zone. While momentum has been strong, this looks like a potential climactic or "blow-off" top, offering a highly favorable risk/reward opportunity to short the pair in alignment with the weak underlying Euro fundamentals.

The Fundamental Why 📰

The core thesis remains bearish for the Euro. The European Central Bank (ECB) maintains a distinctly dovish tone, signaling a willingness to ease policy further to support a slowing Eurozone economy. This fundamental headwind suggests that extreme rallies in Euro pairs are often exhaustive and present prime shorting opportunities.

The Technical Picture 📊

Major Supply Zone: The price is entering a critical multi-month supply zone between 1.5950 and the key psychological level of 1.6000. This is a major ceiling where significant selling pressure is anticipated.

Fibonacci Extension: This area aligns with a key Fibonacci extension level (1.272) from the last major impulse wave, a common zone where trending moves become exhausted and reversals begin.

Pronounced RSI Divergence: A clear bearish divergence is forming on the daily chart. As price makes this final push to a new high, the Relative Strength Index (RSI) is making a significantly lower high, signaling a deep exhaustion of buying momentum.

The Counter-Trade Rationale 🧠

This is a high-level fade. We are positioning for a reversal at a major, technically significant ceiling. The extreme price extension, combined with clear momentum divergence, indicates that the risk of buying at these highs is substantial. By shorting here, we are betting that the powerful technical resistance and weak fundamentals will trigger a significant correction.

The Setup ✅

📉 Pair: EUR/CAD

👉 Direction: Short

⛔️ Stop Loss: 1.63230

🎯 Entry: 1.59490

✅ Take Profit: 1.52008

⚖️ Risk/Reward: ≈ 2:1