Critical CrossroadsWhat a rodeo it has been for BTC as we enter the new year. Complete opposite of 2019 start which had us at ~3700. Is this a repeat of 2015 & 2016? Time will tell as we progress in this new year.

Over a week ago, we successfully broke through the mid-term downtrend to establish a quite a steep short-term uptrend . That uptrend is now broken and we are in an unconfirmed, steep downtrend which could try to push us further down.

Both the shallower uptrends remain unbroken with the mid-term uptrend being unconfirmed.

There is a good possibility of touching the previous broken downtrend to bounce off it as we approach the critical crossroads where the trend intersect with the LT (long-term) uptrend and the support line @ 7411.

Indicators

We are still in a valid uptrend as seen from the DI+ being above the DI- in the DMI indicator.

RSI (not shown) remains rather bullish still despite the most recent push down. Likely to bounce soon in the ~8250 zone.

Stoch RSI (again, not shown), looks to be leveling out and could turn in the next 2-3 days. This is not indication of an uptrend by itself but shows promise when looking at other indicators.

ATR : Any extreme moves beyond the current average should be taken with great scrutiny. So far, we are within range but an extreme swing down could lead to some ranging as we try to return to mean.

Prediction

My forecast for the upcoming week is mostly bullish due to the fact that we are faced with a steep trend down which are never long lived. It could still trace downwards for a little while long but I can see a swing back up in the next few days based on the indicators currently.

Any crossovers of the indicators to bearish should be taken as a warning foreshadowing that the bears are ready to make a move. Breaking the LT uptrend is also dire warning to the downtrend to come weeks after it crosses and maintains past it.

If we continue up, a shallower uptrend will be beginning to form which could direct us further up. I just don't see a -51°trend as remaining for much longer.

Good luck and happy trading. Remember, the trend is your friend and your enemy if you make it to be.

DMI

basic explanation of how to use a dmi indicator basic tutorial on using a dmi indicator to identify bullish trends , bearish trends and as a general indicator of market strength to be used alonside other tools such as support and resistances, trendlines. i personally use this indicator and have had alot of success with it i hope this video explains the basics to people and helps them with their trades

It's getting HOT in here!Hello Traders!

HOLO is almost ready to take off...

Looking for final confirmations:

DMI - positive cross

AE - positive side green bar

Alligator - ready for eating some candlesticks

Fractal - above the Jaw

Roger out.

S&P 500: Headed lower?Since this "miracle" rally began after Christmas, many investors have wondered when shorting seems like an option. In my opinion that time has pretty much arrived. Of course during this rally there were some small short opportunities but then again trading against the trend can be tricky and costly aka "The trend is your friend".

On the other hand we have of course the full saying "The trend is your friend until the end when it bends". In my opinion that bending has pretty much started.

As seen in the chart after the new ATH it started a decent, making the DMI's cross and tipping the SAR in "reverse". Now the SAR isnt always perfect so generally I wait a few days for confirmation just like the ADX/DMI because technically the ADX needs to be above 20 to be "trending".

After a few days it dipped below the Wilder's MA and staying below that even after a short "bull" move. In the same period the DMI- showed that negative pressure still had the high ground even after a couple green candles.

Now that the ADX line reset itself I think we can see the start of a new trend more clearly.

First of all a break through the 2800-2820 zone would be best since that this area has some history of being a "sup/res" point. After that is completed I expect it to drop about a 100 points tot the 2700-2720 area. That would be more a psychological barrier but has some ground as support. Finish that I think a target at 2600 would be reasonable.

Any questions or comments feel free to do so. Please keep it civil!

Other than that I wish you Happy Trading.

Disclaimer: Use this analyses however you want, but don't come knocking on my door for your losses. Trading this would be your own risk and I'm not obligated to take responsibility for that.

Rising Wedge on XBTUSDCurrently seeing a Rising Wedge on the macro time frames, these patterns are typically bearish, but could see a breakout to the upside about 30-35% of the time.

If we breakout upward your target remains 6200. If we fail downward, there is a support at 5600 which is a daily pivot, there is a also a 4H doji level which will be your failure target at 5455.

If that level is broken you have a significant daily HVN (high volume node) around 5200-5300.

If that is broken, then look to 4800 as a significant support, unlikely to reach this level.

DMI is currently still bullish, but is constricting showing that the trend is weakening.

BTC Daily - Renko, MA (20,50,100,200) & DMIOverall Summary:

Overall I am bearish.

Bitcoin is trading in the $3600 to $4200 range during the last week, 81.5% down from the ATHs, with a market cap of $63 billion. The chart indicates a continuation/consolidation/reversal of the current X trend. The price is closest to the 50 MA with a trend towards the 50 MA. The volume has decreased over the last week, which is supporting the current price action. During the period the ‘dominant’ DMI switched over and it is now the -DMI and a weak trend strength ADX of 19.

Detailed Summary:

This chart uses weekly Renko Candlesticks with 4 MAs (20, 50, 100 & 200) & DMI.

Renko candlesticks are great for trend trading. Renko means ‘brick’ in Japanese because the candlesticks represents only price movements. Although some price action is missed, Renko makes it very easy to identify key trends and support and resistance areas. This chart style is often used along with Heikin Ashi candlestick charts for greater confluence. As you can see, there is very little ‘noise’ in this style of chart, allowing traders to ignore short term trends. I set the security at $50 per block so that every block represents a $50 price move. During the last week the price has ranged by $500, opening at $4100 and closing at $3600. The price has decreased over the period which is a continuation of the long term price trend.

Moving Average are also used on this chart to help identify major areas of S&R and general price trend action. I prefer to use simple Moving Averages on the daily time frame. The 200 MA is red, the 100 MA is orange, the 50 MA is yellow and the 20 MA is green. The choice of colours helps me to read the chart and see if price action is bullish or bearish. For example, if the red is on top and the green is on the bottom, it is clearly bullish. It is also important to note that the longer the Moving Average period, the stronger the support and resistance. During the last week the price is closest to the 50 Moving Average and during this period it has trended towards/around the 50 Moving Average. The 50 Moving Average is currently acting as resistance while there is no MA acting as support. The key Support area is $3300 and key Resistance areas is $4200. I forecast in the next week that price will test the next support area.

Volume is a key indicator that I use to understand past, current and possibly future price action. Unfortunately a majority of the exchange volume is fake ‘wash’ trading so it is important to rely on data from reliable exchanges like Binance and BitFinex. Volume that supports price recent action helps strengthen my belief in a specific trend. During this period volume has decreased in convergence with the recent price action. On a longer term time frame, the volume is in convergence with the long term trends. I forecast in the next week that volume will decrease and this will support a decrease of price.

DMI (Directional Movement Index) is a popular trend trading momentum indicator that measures Moving Averages and is able to identify trends while ignoring ‘noise’. It is used on combination with other trend indicators to build confidence about price actions and trends. Look for divergence and convergence between these three lines: Green is the +DMI or +DI, represents bullish action, Red is the -DMI or -DI, represent bearish action and Yellow is the ADX , is an average of the above two and sums up the MA trend. At the start of the period, the ‘dominant’ DMI was the + DMI, at 41 while the ADX was at 18. During the period the ‘dominant’ DMI switched over and it is now -DMI and the ADX is 18. This indicates a convergence with the long term price trend and a weak trend. I forecast in the next week that the that ‘dominant’ DMI will increase and this will support a decrease of price.

References:

Renko summary - www.investopedia.com

Moving Average summary - www.investopedia.com

Support and Resistance summary - www.investopedia.com

Fake exchange volume summary - www.blockchaintransparency.org

DMI summary - www.investopedia.com

NEUTRAL 1D Renko Chart with CM_Trendbars, EMAs and a custom DMIThis is a 1D BTCUSD (BitFinex) chart using Renko Candlesticks along with a CM_Trendbars (add on), 4 EMAs (9,15,21,55) and a custom DMI - with a focus on the last month of price action.

Renko Candlesticks patterns come from Japan and Renko means ‘brick’. They are a cousin to the Heiken Ashi candlestick patterns, using weighted calculations of the OHLC (Open High Low Close) but without the time. So in simpler terms, they focus on price trend expressed in price blocks ($50 USD for BTC), rather than time and volume. As a result, Renko charts are great at reducing noise and allowing for only the strong trends to be clearly visible on the chart. Trend traders often use this chart style in conjunction with other charts styles and indicators, to clarify the strength and direction of a trend.

BTC hit a 2018 low on the 14th of December, ending a year long bear market that has shredded the market’s confidence (and wallets). The current bottom, which may or may not go lower in 2019, came ironically a week before Xmas. A gift of not, there are two ways to look at it. We then saw a weak bounce of around 3300 with a price trend that grew in strength as it broke through the 3600 S&R level. Two days later on the 20th of December, price had hit the next major S&R area of around 4100 and clearly got rejected. Since then we have seen three tests (rejections) of the same price level, on the 22nd, and 28th and now on the 2nd of January. Three tests in under two weeks demonstrates that there is clear indecision ATM in the market. It is worth noting that Christmas and New Year typically affects the market, as trader's go on holiday and take out money to spend. A clean bullish break could see prices quickly reach around 4450 area and increasing confidence that the market has bottomed out. A weak rejection and further sideways movement would strengthen the case for the bulls, and we could return to ATL of 3300 fairly quickly.

Looking at the CM Trendbars, which is an indicator added on top of the Renko candlesticks that 'colour's the bars depending on the strength of the price action, I read them as slightly bullish in the short term but clearly we need confluence from other indicators.

Moving Average are also used on this chart to help identify major areas of S&R and general price trend action. I prefer to use EMA (Exponential MA), over the non-weighted (Simple MA) because it adds more significance to recent price action over older price action. This provides a more responsive indicator, telling me when a significant trend change is occurring earlier. I have for EMA, 4 based on the Fibonacci numbers; 9 (green), 15 (yellow), 21 (orange) and 55 (red) day time frames. And a 200 day MA (purple). The choice of colours helps me to read the chart and see if price action is bullish or bearish, for example when the green line is at the bottom, followed by the yellow, orange, red (and then purple) it is clearly bearish. Not that the 200 EMA is essentially for identifying long term trends, but I focus on the 9-55 period for trend trading, especially the 21-55 day for multiple week trades.

The last time price crossed the 200 EMA was on the 2nd of September and the 55 EMA on the 18th of October. So the market was expecting a price retrenchment in December. Whether this is just a retracement, before we see the downtrend continue, is not yet clear. What is clear is that we saw a bullish bounce since December 14th with the 9, 15, and 21 crossing over within a week. The 9 day then approached and briefly breached the 55 EMA before dropping below it again since the 25th of December. The MA have since continued to consolidate as we have seen price action tighten around the 4100 S&R levels. This types of MA consolidation is another indicator that the price direction and strength is undecided by the market.

The final indicator is a custom DMI, which is a suitable tool to add alongside the Renko chart and 5 MAs, as it measures the MA of a price change over a given period of time. It is therefore another great tool for identifying trends, and helps to build confidence about price action and trends. We are looking for divergence and convergence between these three lines:

- Green is the +DMI or +DI, represents bullish action

- Red is the -DMI or -DI, represent bearish action

- Yellow is the ADX, is an average of the above two and sums up the MA trend.

The ‘dominate’ DMI has been the -DMI since the start of November, reaching a strength peak of 94 on the 24th of November. Since then we have seen a sharp decline in the strength of the -DMI with a cross over of the ADX on 3rd of December. Although we saw the -DMI ‘dominate’ again a week later it crossed over at 49. In the last month the market’s indecision has been clearly demonstrated by six ‘dominate’ crossovers. At the same time all three lines continue to decline with the ADX now well below 25, at 16. When the market is moving sideways and below 25, it is risky to trend trade. On the flip side, the longer the market continues to consolidate in this range, the larger the price action will be once it breaks out (either up or down).

In combination, the above indicators tell me we have experienced significant bullish price action in December and now the market is consolidating and moving sideways at the 4100 level, below the 55 MA, and with a declining ADX. In the current market, trend trading is unattractive, so I have to wait for a clear breakout either on the up or downside. I am inclined to remain a little bearish ATM and believe we could see price move back down again to the low 3000s range if the bulls are unable to gain more momentum soon.

BTCUSD 1D Renko Chart with CM_Trendbars, EMAs and a custom DMIThis 1D BTCUSD chart is based on Renko Candlesticks, the CM_Trendbars, 4 EMA (9,15,21,55) and a custom DMI.

Renko Chart patterns come from Japan, and they apparently mean 'brick'. They are a cousin of the Heikin Ashi candlestick patterns, using weighted calculations of the OHLC (open, high, low, close) but without the time. Renko candlesticks are now well know but there are sections of the trading community that strongly believe in them. The candlesticks are built using price only, rather than time and volume. This design helps filter out minor price movements to make it easier for traders to focuso on the important trends. Renko charts are not for the day trader, they are really suitable for longer term trend traders that have patience and are waiting for the right types of setups. Each bar represents a set change in price, for example I have set BTC at $50 USD. Renko can be used to add confluence to other indicators and enter into less risky trend trades.

The Renko chart has clearly bearish since the 9th of November, with BTC breaking below the long held resistance line at 6484 and rapidly dropping to 3900 before finally bouncing off 3300's. This has clearly been rejected on the 17th of December when we moved from 3382 to 3938 in two days with a forecasted target of 4416 representing the next area of resistance. I conservative trader would wait for a line of resistance to be broken, and then enter the trade with more confidence, so if 4100 area

Moving Averages, are widely used and one of the most important technical indicators. There are two commonly used MAs, SMA and EMA. SMA (Simple MA) simply takes adds up the closing price over a given period say, 5 days, and divides that number by the number of periods. Eg, 10,12,14,16,18 = 70/5 = 14. The EMA (Exponential) then weights those numbers to place greater significance on the more recent price data points. I use the EMA as it tends to provide a more relevant indicator of recent/current and therefore possible future price actions. I use 5 EMA's on this chart, based on Fibonacci numbers (9,15,21,55,200).

The EMA's have been clearly bullish since the 9th of November, with a good spread between the difference EMA, until the 9,15 and touch the candlestick bodies early in December. They then continued down, although more weakly then the previous move until we hit the 3300 level of resistance. With little price movement and contracting price bands the EMA were gradually leveling off. Then on the 17-19th we have seen the price clearly cross the 9,15 and 21 day EMA with the 55EMA in ear shot. The 200 EMA is at 5200, so we are still 1000+ clear of that target.

THE DMI (Directional Movement Index/Indicator) measures the MA of a price change over a given period of time, 15 days in my case. The DMI is popular with trend traders because it provides clarity on the strength and direction of a trend. There are three lines, the +DMI or +DI in green, the -DMI or -DI which is in the red, and the ADX which is an weighted average of the two that tells up are we trending down/up. Basically when the green crosses over the red, and also the yellow, with conviction we have a strong bullish trend in play. Vice versa. The line on the top, is referred to as the 'dominate DMI'. The long the the MA has remained in a tight price band, the more likely an outbreak will be substantial.

The DMI presented a very clear signal from since the crossover on the 7th of November to it's peak in divergence on the 24th of November. The -DMI and the ADX were clearly trending bearish. What could be interpreted a false bounce/price reversal occurred from the crossover bullish on the 25th of November to the bearish cross over on the 3rd of December. The bearish trend continued until the 7th of November then we started to see some divergence between price (that continued to drop) and the -DMI that weakened in strength. This was a signal that the strength of the bull trend was weakening. Since the 17th of December we have seen both the -DMI and the ADX weaken rapidly, finally crossing the +DMI on the 19th of December. This is set up represents a low risk entry, as the -DMI has managed to go from below the 25 level, confidently cross the -DMI/ADX and also the price has broken a major S&R level.

TRON: SHORTTRON more reasons not to buy...

No trend reversal based on Hull Moving Average analysis.

3 month support is broken.

Due to the young age of the project and exponential MC growth, the coin hasn't yet developed 'strong' support zones.

DMI indicator is not yet topped out;

Therefore expecting more downward price pressure.

Wave trend analysis is still pointing downward.

Being 'bottomed' doesn't signal a price-trend reversal.

Best,

Bavo

BTCUSD 3-6 Months pricetargetHello,

What goes up, needs to come down aswell...

After breaking the 6K level last week Bitcoin is looking for a solid support and new liquidity.

An expected breakdown based on my previous analysis on the BTCUSD daily (see below).

What I expect during the coming weeks to come:

Exponential sell-off(s); This is needed in order to form a bottom (yellow bars)

This will drive down the price heavily and drive up (DMI-)

This idea supports the formation and continuation of the new ADX 'trend'.

Support and price target @ 200weekly MA: 3 000$

Im looking forward to your feedback,

Best,

Bavo

BTC USDT BINANCE Quick UpdateAfter experiencing a good sell off over the last few days BTC is at the bottom region of it's low volatility channel attempting to rally and reclaim 6400.

With several indicators pointing towards an upward momentum coming to the table we are looking to break 6400 and hold above that before going sideways.

There is still massive pressure to keep the price suppressed on BTC, lots of sellers holding orders above our heads keeping us in this channel. That is okay.

We are in a great position for BTC to keep going sideways where it's at.

Lets look towards a push to hold 6400 and watch how the market reacts as the selling orders try to drops us back down.

With the potential breakout on the C.M.F and the D.M.I showing a phase of DMI + increase emerging we are looking ripe for some decent price action.

XRP/USD - WILL WE BE RICH?XRP broke out of the descending wedge pattern, ran up to the .236 Fib level and pulled back to retest previous resistance as support. However it did so on very low volume, so the breakout was extremely unimpressive nor vitally important.

If we maintain this level however, we have still formed a higher low, so I've plotted a potential new ascending trend line. We'll see if this holds and what larger dominant pattern emerges from here.

XRP is one of the most exciting assets to trade right now, more so than Bitcoin or ETH potentially. In my eyes, the dominant narrative is this: Bitcoin is destined to win, so if you're a believer then you're bullish bias is overpowering and you're safe to go long from almost anywhere as long as your time horizon is long enough. Ethereum is doomed to failure, so you're fairly safe to short from any level as long as your time horizon is long enough. However Ripple, with all it's potential banking implications and far-reaching network of influence and potential, is one coin that could make us kings or beggars. There's so much disagreement on it fundamentally, that it makes it a fascinating crypto to speculate on. We'll be watching this one extremely closely.

This chart is still neutral, leaning bearish. I say this because of the following:

DMI is still bearish, with a rise in the strength of the trend. Kumo cloud turning to the downside. Stochastic descending from overbought level, RSI potentially moving down through the 50% level.

There are bullish aspects to this chart. There does seem to be a turn in the DI-, RSI might hold the 50% level, there does appear to be a potential double bottom formation, and recent price action as far as volume is slightly more bullish than bearish. Eyes glued to the charts people, eyes glued.

ETH/USD - NEW PATTERN CONFIRMED!The symmetrical triangle pattern is holding. We've had to readjust it several times over the past week to maintain it's levels, however it hasn't made a break that would cause us to question the current range.

As I've stated above, range-bound assets are difficult to trade. Easy to scalp, difficult to trade if you're time frame is longer then a few hours.

Bullish and bearish momentum are battling much more aggressively here on ETH than on BTC, we can look at DMI to confirm that. They keep swapping positions to the dominant. Unfortunately, ADX keeps trailing lower and lower which confirms our lowered volatility. Low volatility is a good place on an asset to enter, however you have to take your bias into account either bullish or bearish. If you're correct in your assumption, then you got in at the best possible price. If you're wrong then price goes against you and it generally goes fairly quickly from low to high volatility.

Everyone's excitement is growing the longer the charts remain boring, as paradoxical as that may sound. As volatility decreases, experienced traders know what follows, which is often quite violent, ie. profitable.

Neutral chart, however it won't be that way for every long.

BITCOIN/USD - DESCENDING WEDGE HOLDS!The descending wedge pattern is still holding. If you had set buy orders at the bottom trend line, merely extending the trend line from the last support into the future, you would be a very happy turtle right now.

Bullish volume is still struggling to push the price upwards, and at the current moment volume is falling off. This is indicative of a lack of faith in Bitcon's bullish movement at this moment in time. Anything can change, but that is the state of volume at the moment. The overall trend is still bearish, and recent price action confirms this both via candlesticks and volume.

The bearish engulfing candle that we see plotted three bars back is quite important, the amount of volume that candle was able to command relative to recent price action lets us know there are plenty of sellers in the market who are still quite hot to trot to sell and short their positions. The bulls did step in as predicted at the opportune time, however as we've discussed ad nauseum important levels only tell us WHERE the bulls might step in (vica versa with the bears). It doesn't tell us whether or not they will be successful. We need volume to confirm movements. Right now, volume is not confirming this bullish movement.

You can see that the area where price found support was not only the ascending trend line, forming still a pattern of higher lows, but it was also a few satoshis short of the 0.236 Fibonacci retracement on the current descending wedge pattern from true high to true low. These are important levels for you to find on your chart when you're plotting out your plan of action. Numbers matter, and observation is required to see how successful a movement is going to be.

Our smoothed Stochastic is signaling that Bitcoin is oversold, and our RSI shows no divergence at the moment.

DMI is still negative, indicating that bearish momentum is still more powerful than bullish momentum, and volume confirms this.

Price also seems to be stalling out, forming a gravestone doji that reversed at the next Fib level, the .382.

If you're predicting a pullback from here, a Fib measurement puts out .618 entry position at 6473.91. Possible scalping targets to the upside could be 6500 and 6550. However the risk to reward ratio here is not worth it, in my opinion. Don't feel the need to trade, I would like to see more bullish volume to come in, and then you could feel more confident taking a long position all the way to the upside of this descending wedge pattern and then re-evaluating.

I will say that we also completed our TD Countdown, with a perfected 13 count which per TD Strategy gives us a buying option. Something to keep in mind.

Bullish factors - bottom of current trend line, completed 13 countdown, oversold stochastic, reversing RSI.

Bearish factors - dominant trend, DMI bearish w/ weak trend, volume, candlesticks.

STORJ/BTC - 30% PROFIT POTENTIAL!STORJ has formed what could nearly be an ascending triangle, with a series of higher lows and nearly equidistant highs with a slight variation to the downside.

Now is not the time to buy into STORJ, unless volume really cuts loose here and we break to the upside out of this pattern. I don't see that happening now, I feel it's more likely, even with this impressive bullish candle that we pullback from here to gather even more momentum. You can just look at the period of consolidation, which generally measures to the size of the breakout. We can see, the longer the consolidation, the longer and more sustained the bullish movement is. There was very little consolidation for this current move, therefore it's destined to pullback in my eyes.

You can see we've ranged from the .618 to the .236 measuring the true high to the true low on this current pattern. I'm quite excited with this chart, I think this is a good one.

DMI negative momentum continues to fall, positive continues to grow and the trend is strengthening. The range is contracting, which will lead to a volatile spike, our stochastic is nearing oversold levels again. RSI does not confirm this, but it's the only indication we have that's slightly bearish. Recent price action and volume also strengthen the bullish case.

Potential targets upon the breakout are charted as our previous resistance levels, and from current price (which is higher then what our buy in will be) to the final target is 30% potential for profits. Patience, and choose your entrance wisely.

A short term ideaThis is what I see.

The ADX line shows us the BTC is in accumulation phase and also it shows the past 23 days of BTC moves was not a Bull trend the ADX didn't go higher than 25%, Thats very bearish.

Currently price consolidates in a rising wedge which is made between uptrend line and the 25% level line of fan, this is also bearish.

At the end of chart we have 3 Doji, one green and next of it is the yesterday's red Doji candle and today's candle which is not closed yet but if it close as a Doji then it is very bearish too.

They can be a Bearish Tristar pattern or if we don't consider the first one as a Doji (it is a little taller than others) then the 2 other can make 2 Doji in row which is bearish too.

I think today we will know which way BTC will go, up or down.

In my opinion in next 4-5 days BTC will go to 6000-6200 region or it can go lower, then the trend will change to a upward trend.

This is very good for Bitcoin, I really like to see it oversold on daily chart, it can be an excellent rocket fuel for Bitcoin.

Closer look of rising wedge:

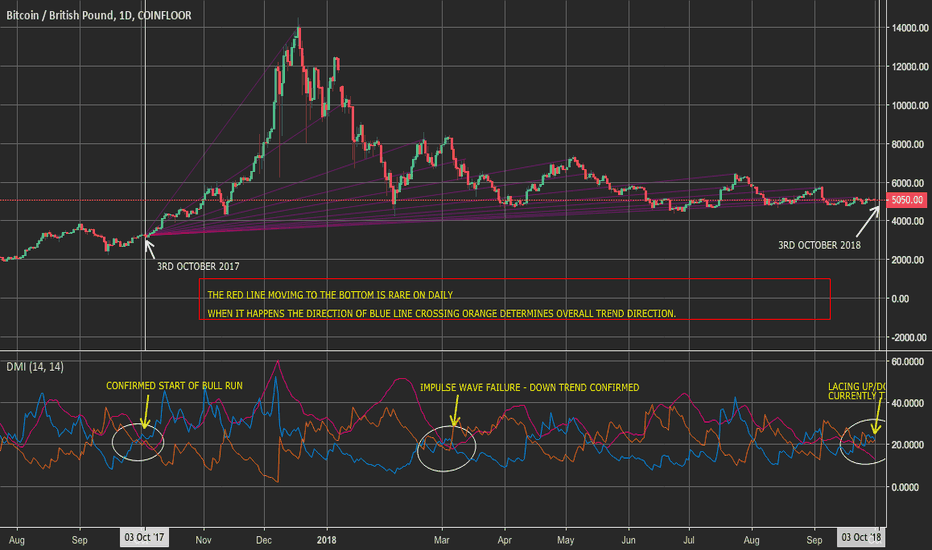

BTC DAILY CHART using DMI indicator- eyes on 3rd October!So, using the DMI indicator on daily .... noticed that the red line is very rarely on the bottom. Every time it goes low it seems to confirm the overall trend direction when the blue line crosses with the orange.....

Watch out for the 3rd of October! Full year from bull run confirmation, coincidence perhaps?

So currently blue line looking down so trend is dipping bearish...... take care.

#FibonacciFriday celebrates with a bearish sentiment in BTCUSDWith price finding early selling interest at a low Fibonacci retracement level ratio and the red negative directional index line not crossing down through the positive directional index line, look for selling interest to remain here with the previous low as a target for a test of support once again.

Despite the latest move up recently, the bears maintain control. Not enough bullish signals for me to go long just yet.

Happy trading!

Looking set for iotaiota has had a nice expected for and has just hit major trend line.

For me, depending on how bitcoin behaves this week I wouldn't be surprised to see iota possibly fall a bit further back to low 16s before surging forward

entry

17500 - 16000

targets

#19000

#21000

#23000

stop loss 15700 if enter in 16s otherwise SL 16750 if you enter in 17s

Wheat, Soybeans, and CornWhy Wheat and why now. What about Soybeans and Corn.

Looking across the Ags, it seems that Wheat is enjoying the most upside. Why is this. In keeping with my focus on the DMI and ADX, I think you’d have start by looking at the monthly chart of the 3. One of the key tenants of DMI/ADX is that best trades seem to originate when the ADX is below 20 for an extended period of time. And, for Wheat, that has been since June of 2013. Since then, it has moved between a couple of lines and for the most part, remaining below the 13 period EMA of the high.

As an aside, in my previous articles, I used EMA’s on the close of price but have moved to a 13EMA on high, 26EMA on low and 20EMA on close with the intent to use them as a channel for pullbacks based of ADX action.

June of last year, the downtrend line was sharply broken but before that, the DMI made a significant move when the +/-DI swapped. Although this had happened several time during the past 4 years, what eventually became important is that the low of this candle was never broken while the high was continually tested and broken with the last time starting the recent uptrend. Also, note that during this time that the +DMI continued to make higher highs will not making lower lows. With the ADX moving above 20 in May of this year, a strong signal was given that the market was ready to move up.

Now, consider the same discussion for ]Soybeans :

Notice the size of the candle that caused the last swap. I’ve included a possible consolidation pattern.

And for Corn :

With Corn the interesting thing on recent action is that the DI’s changed dominance but did so where the swap was to -DI but with a green candle. I don’t see this too often but seems to give mixed signals.