US30 (Dow Jones) – 1-Hour Timeframe Tradertilki AnalysisMy friends, greetings,

I have prepared a US30 analysis for you.

My friends, if the US30-Dow Jones index manages to close a candle above the levels of 48392.3-48151.0, I will open a buy position and target the 48,900 level.

At the moment, the most important levels are 48392.3-48151.0. Expecting an upward move without breaking above these levels does not seem logical right now.

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏✨

Thank you to all my friends who support me with their likes.❤️

Elliotwaveanalysis

SPY – ATH into Heavy Macro Week | Trend Still IntactThesis

AMEX:SPY continues to trade in a mature but intact bullish cycle, pushing to new all-time highs despite a heavy macro and event-driven calendar.

Context

- Weekly timeframe

- CPI, PPI, Jobless Claims ahead

- Start of key earnings season

- Supreme Court ruling delayed into next week, adding uncertainty

What I see

- Market printed another ATH and closed the week at the highs

- Price remains well above rising trend support

- No visible distribution or topping structure yet

- Momentum remains strong despite known macro risks

What matters now

- As long as price holds above the rising channel, the trend remains bullish

- Last CPI print came in much cooler than expected

- A second consecutive soft CPI would confirm a disinflation trend and likely fuel further upside

- Market is clearly not pricing near-term stress

Buy / Accumulation zone

- This is not an area for aggressive new buying

- Focus shifts from adding risk to managing and cleaning the portfolio

- Selectively trimming positions that fully rode the last 5–6 years of the cycle

Targets

- Trend-following extension remains open toward higher Fib projections

- No confirmed cycle top yet

Risk / Invalidation

- A sustained loss of the rising channel would signal the need to reduce exposure

- Until then, price action favors holding, not anticipating a top

XAUUSD – Structure Holding at the Blue BoxHi fellow traders,

On the 1H XAUUSD chart, I am applying Elliott Wave principles to outline a potential continuation scenario. After a sharp corrective move, price is reacting from the blue box and holding above the key structural level, suggesting the correction may be complete and continuation to the upside remains possible.

I am entering at the current price, with a Stop Loss at 4270.00. My Take Profit is set at 4574.60, targeting continuation within the larger impulsive structure.

If price breaks below the stop level, this trade is no longer valid.

Structure first. Noise second.

Good luck and trade safe!

BABA: Multi-Year Rounding Bottom Breakout — Wave 4 Support CheckThis chart for Alibaba (BABA) showcases a massive multi-year accumulation pattern, specifically a "Rounding Bottom" or "Cup" formation that began in late 2022. From an Elliott Wave perspective, the stock appears to have completed a primary Wave 3 impulse peak near the $190 level in late 2025 and is currently in the late stages of a Wave 4 corrective pullback.

The long-term outlook for BABA remains highly bullish as it successfully transitions from a multi-year basing phase into a structural uptrend. The recent pullback from the October 2025 highs represents a textbook Wave 4 correction, which has found precision support at the 0.382 Fibonacci retracement level ($143.58). This level aligns perfectly with the breakout point of the major rounding base, transforming old resistance into new support.

Key Technical Levels:

* Support Zone: The $143 - $150 area is critical; as long as the pivot at point 4 holds, the impulsive structure remains intact.

* Wave 5 Target 1: A 1.0 Fibonacci extension projects an initial target of $205.42, which would reclaim the 52-week highs.

* Wave 5 Target 2: The primary 1.618 extension sits at $242.59, aligning with major historical supply zones from early 2021.

* Invalidation: A sustained daily close below the Wave 2 low (approx. $70-$80) would invalidate this specific count, though the $143 level is the immediate "line in the sand" for bulls.

Projected Outlook:

The current price action at $150.96 is forming what looks like a bullish consolidation (handle) following the massive cup breakout. With cloud and AI demand accelerating revenue growth into 2026, the fundamental narrative supports a re-rating toward the $200+ consensus analyst targets. Traders should watch for a breakout above the Wave 3 peak to confirm the start of the final fifth-wave leg higher.

ELF - Completion of 5-Wave Impulse Down - Bullish ABC Underway?This daily chart highlights a potential trend reversal following the significant 1-2-3-4-5 impulse decline observed throughout late 2024 and 2025. The completion of this 5-wave sequence at the $49.40 low appears to have set the stage for a major corrective recovery or the start of a new bullish cycle. We are currently tracking an ABC zig-zag structure, with Wave 'b' recently finding support near the $80 level, aligning with the bottom of the descending parallel channel.

Key Technical Levels:

* Wave 'C' Target: The immediate focus is the 1.0 Fibonacci extension at $168.82, which represents an equal-leg move (a=c).

* Long-Term Extensions: If the recovery develops into a larger impulsive move, the 1.618 extensions at $202.67 and $231.52 serve as secondary targets.

* Invalidation: A breakdown below the recent pivot at point 'b' (approx. $75-$80) would delay the bullish outlook and suggest further consolidation within the channel.

Projected Outlook:

The price action is currently reacting to the median line of the descending channel. A sustained breakout above the $100-$110 resistance zone would confirm the Wave 'c' trajectory toward the May 2026 target window. This setup offers a favorable risk/reward ratio for those looking to play the recovery of a quality growth stock that was heavily oversold in 2025.

ETH/USD: A global bearish zigzag on Ethereum1. The main idea is a global zigzag {a}-{b}-{c} to the downside.

2. Wave {a} can be counted as a double zigzag WXY, but I don’t want to do that.

3. However, I still want to break this move down into a leading diagonal triangle (LDT), which is what I’m showing on the chart.

4. Locally, there is no clear strength, and the price action looks corrective.

5. So it’s crucial to know whether wave {b} is complete, as this move may develop into a more complex correction.

6. If wave {b} is complete, we may already be seeing the development of wave (iii) of {c} on the local scale.

7. The downside move could extend for a minimum of two more months toward the lower channel boundary.

8. If wave {b} becomes more complex, we may still see its full development into another corrective pattern, followed by the advance of wave {c}.

9. The basic targets of the decline are the 0.618 and 1 Fibonacci levels. For now, I don’t want to include the 1.618 Fibonacci level on the chart.

10. There’s a strong chance that in the future the price could reach the range between $2,033 and $1,141.

Silver Pulls Back After Double Top TestSilver futures bounced off resistance at $82.67 on Tuesday. According to our primary scenario, the next key move will be for price to break through this level, which would open the way toward the red Target Zone between $92.25 and $111.28. In that area, we expect the prominent top of the green-labeled wave to form, followed by a larger corrective move. Based on this outlook, traders could consider entering short positions within the $92.25 to $111.28 range, using a stop set 1% above the upper boundary of the zone. Alternatively, it’s possible that the green wave alt. already peaked at $82.67 and price is now correcting directly below support at $69.26. If this scenario plays out—which we assign a 35% probability—a direct pullback into the alternative green long Target Zone between $53.26 and $47.16 would be expected.

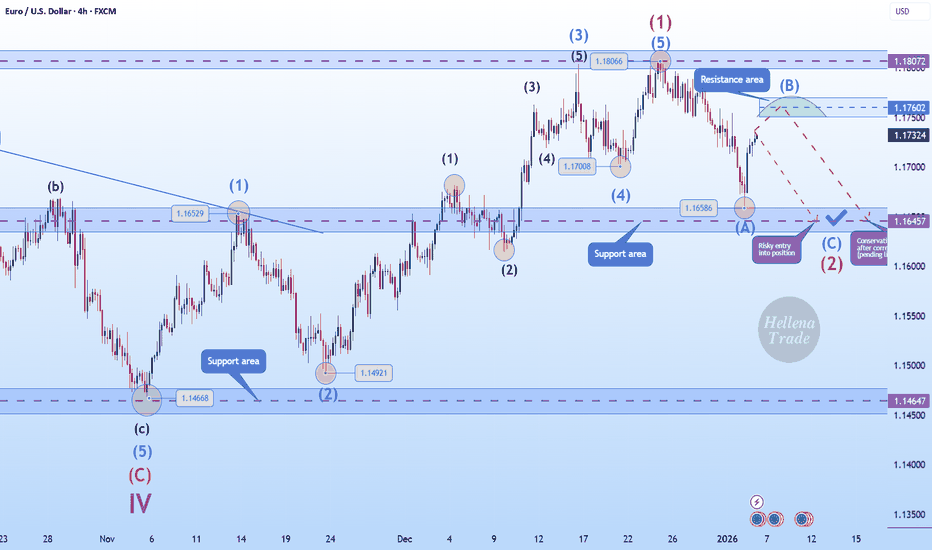

Hellena | EUR/USD (4H): SHORT to support area 1.16457 (ABC).Colleagues, judging by the nature of wave “2” movement, I assume that the correction is not yet complete. This movement is slightly stretched, and we can clearly see waves “A” and ‘B’, which means we can expect an update of wave “A” minimum and reaching at least the support level of 1.16457.

Somewhere below, I expect the completion of wave “C” and wave “2”, but that will be a slightly different forecast.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

BIDU – Breakout Confirmed | Watching Wave 3Thesis

BIDU has completed a multi-year corrective phase and is now advancing within a developing Wave 3 structure following a confirmed breakout.

Context

- Weekly timeframe

- Prolonged correction since 2021

- Structural transition from downtrend → base → breakout

What I see

- Clean breakout confirmed at the end of December

- Prior support found on the 50-day moving average before expansion

- Successful acceptance above former resistance

- Price holding above long-term trend support

- Structure now showing impulsive characteristics

What matters now

- Wave 3 remains intact while price holds above post-breakout support

- After Wave 3 completes, attention shifts to a controlled Wave 4 pullback

- Confirmed support during Wave 4 would define the next add opportunity

Buy / Accumulation zone

- Initial breakout already played

- Next accumulation opportunity expected on confirmed Wave 4 support

Targets

- Primary upside reference at the 1.618 Fibonacci extension ($225 area)

- Higher extensions remain possible if momentum persists

Risk / Invalidation

- Loss of key breakout support would delay the bullish structure

ZETA – Breakout Confirmed | Primary Wave 3Thesis

NYSE:ZETA is transitioning from long-term accumulation into the early phase of Primary Wave 3 following a confirmed breakout.

Context

- Daily / weekly structure

- Primary Wave 2 completed near $10 (April 2025)

- Wave 1 advanced to ~$22

- Recent phase was a controlled Wave 2 consolidation

What I see

- Price has broken out of the accumulation structure

- Higher highs and higher lows now in place

- Price holding above rising moving-average support

- Former resistance has turned into support

What matters now

- Holding above the breakout level keeps the Wave 3 structure intact

- Pullbacks toward former resistance should be viewed as constructive

- Momentum confirms a shift from accumulation to expansion

Buy / Accumulation zone

- Initial accumulation was completed in the $14–$15 area

- Post-breakout pullbacks into support remain add zones

Targets

- $38 area (structural resistance)

- $65 area (1.618 Fib – Primary Wave 3)

- $100 area (Primary Wave 5 extension)

Risk / Invalidation

- Loss of post-breakout support would delay the Wave 3 scenario

BABA – Weekly / Daily Structure | Wave (4) Update

Thesis

NYSE:BABA remains in a broader bullish reversal, with the current pullback continuing to resolve as an intermediate corrective phase.

Context

- Weekly and daily timeframes

- Multi-year base already completed

- Prior impulsive advance followed by a controlled retracement

What I see

- Pullback continues to respect the prior breakout structure

- Price is consolidating inside a descending corrective channel

- Rising longer-term moving-average support remains intact

- Structure remains consistent with an intermediate Wave (4) correction

What matters now

- The 50-day moving average is aligned with the 0.382 Fibonacci retracement near the $159 area

- A break and hold above this confluence would signal completion of Wave (4)

- Failure to reclaim this level likely extends consolidation

Buy / Accumulation zone

- Current consolidation range within the Wave (4) retracement zone

- Risk remains defined against the recent higher low

Targets

- A confirmed flip of the $159 confluence opens the path toward the $230 area

- That level aligns with the next intermediate upside reference

Risk / Invalidation

- Loss of rising support would weaken the bullish reversal structure

Rolls-Royce Holdings: Wave Count AdjustedAfter Rolls-Royce shares recently surged and broke through resistance at €14.10, we have revisited our wave count and made some adjustments. We now primarily believe that the low of wave (4) in magenta was likely set at the end of November, forming a turquoise A-B-C three-wave move. In any case, the ongoing wave (5) in magenta should still have some upside potential before completing the larger cyclical wave I in beige.

XAU/USD | Bearish When $4,425 Confluence Support Is Breached⚡Critical Confluence Level ($4,425)

⚡Key Support: The $4,425 level is currently a key focus as it represents the confluence point between the 100-hour SMA and the 38.2% Fibonacci Retracement of the recent price rally.

⚡Breakout Scenario: If the price closes decisively below this level, it is expected to trigger further technical selling, which could drag Gold down towards the psychological level of $4,400.

⚡Stability: Holding the price above the 38.2% level is crucial to stabilize the faltering market sentiment.

Hellena | Oil (4H): SHORT to support area of 54.53 (Wave 5).Colleagues, the price is still forming a downward impulse of five waves, and given the geopolitical situation and rather loud news, we need to be cautious.

Therefore, I believe that wave “5” will update the minimum of wave ‘3’, but I will not set a distant goal - I want to see the price in the support area of 54.53. This will be enough to confirm the structure of the momentum and think about the continuation of the large “ABC” correction.

It is quite possible that we may see a small correction to the 57.00 area before the start of the downward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

BITCOIN: Slips LowerBitcoin has experienced another bout of selling in recent hours but remains above the $92,000 level. Our primary outlook still calls for a significant move lower as part of green wave C—specifically, into the green Target Zone between $62,250 and $51,212, where we expect the low of the larger orange wave a to form. After that, we anticipate an extended (though corrective) b-wave rally, which could potentially push back toward the $100,000 mark. Only after this move do we foresee the final leg down in the ongoing wave-(ii) correction.

XAU/USD | Consolidation Towards Bullish Structure⚡Consolidation Zone (4436 - 4458): The price is currently "squeezed" in this area. This is a no-trade zone for conservative traders.

⚡Bearish Scenario (Healthy Correction): According to your plan, confirmation of a 1H Close below 4436 is crucial. The 4420 - 4407 area is a strong demand zone. If the price breaks through this level, we may see a liquidity grab towards 4378 - 4360 before the medium-term bullish trend resumes.

⚡Bullish Scenario (Trend Continuation): Stability above 4458 indicates that buyers are still dominant. However, the real confirmation is a 1H Close above 4475, which would pave the way towards the psychological level of 4500 and beyond.

USDCHF: when the safe haven loses its edgeUSDCHF remains attractive as global expectations around monetary policy shift. Markets are increasingly pricing a softer tone from the Fed later in the year, while demand for safe-haven assets like the Swiss franc continues to fade. Switzerland’s low inflation and limited growth outlook reduce CHF appeal, opening room for USD recovery, especially against low-yield currencies.

From a technical perspective, price has formed a base after a sharp decline. Higher lows indicate a developing bullish structure. Price is holding above short-term EMAs, and the former resistance zone has turned into support. The current area represents a retest aligned with structure and Fibonacci levels. Rising volume on advances versus pullbacks supports the bullish continuation scenario.

Trading plan: as long as price holds above the retest zone and confirmation appears, long positions are favored. The first target is a move toward recent highs, followed by Fibonacci extensions. A breakdown below support would invalidate the bullish setup and return price to consolidation.

When fear-driven currencies lose momentum, moves tend to accelerate.

TSLA- Want to buy? Be aware of deeper correction, wait on 370/80Tesla has made a very nice recovery from the April 2025 lows and even reached new highs near the 500 area, but we are now seeing an interesting retracement at the start of 2026. This pullback can still be corrective, but it should be deeper then, as we are still missing the three subwaves within wave four, before the market can complete this correction.

A very interesting support zone for those looking to rejoin the trend comes in around the 380 -370 area. This zone aligns with the previous fourth wave area and the former swing high from May 2025. The Elliott Wave Oscillator also points room to more downside, as momentum could likely reach levels similar to those seen around the July and November 2025 as shown on the daily chart, withi hilighted arrows on the indicator.

Highlights

• Key support zone to watch is 380–370

• Current pullback likely part of wave four, still missing three subwaves

• Elliott Wave Oscillator suggests deeper pullback is due

• Broader bullish structure remains valid above the 275–277 invalidation zone

USD/JPY | Medium-Term Uptrend PotentialThe price is currently trading at 156.47, attempting to break through the upper boundary of your zone at 156.71.

However, the recent weak US service sector (ISM) and job openings (JOLTS) data released tonight is putting pressure on the dollar, supporting your bearish scenario.

⚡ Execution Scenario

Bearish Confirmation (Primary Entry): As per your plan, wait for the 4-Hour (4H) candle to close below 155.74. This will confirm that sellers have taken full control.

- TP 1: 154.34

- TP 2: 153.18

⚡Final Target: 152.40 (strong liquidity area).

Correction Scenario (Caution): If the price rebounds and stabilizes above 156.71, this short-term bearish structure will be invalidated, and USD/JPY could retest the 158.00 level.

Hellena | Oil (4H): SHORT to support area of 55.74 (Wave 5).Colleagues, wave “4” of the minor order is ending or has already ended. As part of a major downward movement in wave ‘5’ of the major movement, I expect a downward movement in wave “5” of the minor order.

This wave should update the low of wave “3”, but I believe it is worth looking at the nearest target in the support area of 55.746.

I also allow for the possibility of reaching the 59.00 area before the price begins a downward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

ASML Keeps Progressing HigherASML has been bullish for most of the second half of 2025, and with the current strong push to new highs it looks like we are dealing with a new motive wave structure, now unfolding as wave five. But keep in mind that this is a final leg, and this wave could complete the higher degree structure. But for now, the trend still needs to complete five subwaves within wave five, which could allow price to extend higher, potentially toward the 1300 area, after a blue subwave four retracement as shown on the daily chart. The key level to watch is around 1110, which was also the high from July 2024. As long as price stays above that level, the uptrend remains intact. A push back below it would likely signal a temporary slowdown rather than a trend reversal.

Highlights

– ASML remains in a strong uptrend and is unfolding wave five

– Potential extension higher after a blue subwave four pullback

– Key support to watch is 1110

– A break below 1110 would signal temporary slowing, and enw correction ahead.