Market Re-cap and structure of the dayMarket Type: Breakout → Trend Day Up

Bias: Bullish once PDH reclaimed

Result: + $128 | 4W / 1L

Key Levels I respected

PDH: 25,844.75

NY AM High: ~25,880

POI ladder acted as clean targets + reaction zones (POI4/5/6 area)

What price did today (simple)

Early AM was choppy / ORB filters blocked some entries (good… no forced trades).

Once price reclaimed PDH, it confirmed buyers.

Breakout pushed into NY AM High, then we got continuation candles = the edge window.

Later in the day, entries started showing “too late / low volume” → that’s the sign momentum is extended and risk increases.

My best trades / why they worked

✅ Took longs after PDH reclaim + strength candles

✅ Used POIs as targets, not hope

✅ Stayed with the trend during the best time window

The mistake (and the lesson)

❌ One late trade = reduced edge (post push / extension / “too late” conditions)

Rule reminder: If the system is warning “too late,” either size down or shut it down.

What I’m focused on next session

Wait for PDH reclaim + pullback continuation

Don’t chase after big candles

Trade the clean window, protect the green

Emacrossover

All Cylinders Firing: VWAP → Valid Entry → ORB → Expansion (MNQ/Today was one of those “all cylinder's firing” sessions — clean structure and clean execution.

✅ The Blueprint (A+ Sequence)

Retest to VWAP (white line)

Context Indicator prints “Valid Entry” (confirmation)

ORB breakout (market chooses direction)

ORB retest / pullback hold (best risk entry)

Expansion to the upside into targets/POIs

📌 MNQ Read (Structure)

Price respected VWAP/structure and gave a controlled move.

Once momentum started slowing near highs / volume cooled, it wasn’t “press for more” time — it was protecting profit time.

🎯 QQQ Execution (0DTE Scalps)

Took calls only when the sequence lined up with MNQ context.

No chasing. No forcing. Focused on retest entries and profit-taking into strength.

🎓 Teaching Moment

Breakouts are optional — the retest is the paycheck.

If we break ORB but can’t hold the retest, we wait.

If we break ORB and hold the retest with VWAP + Context aligned, we execute with confidence.

Not financial advice — educational purposes only.

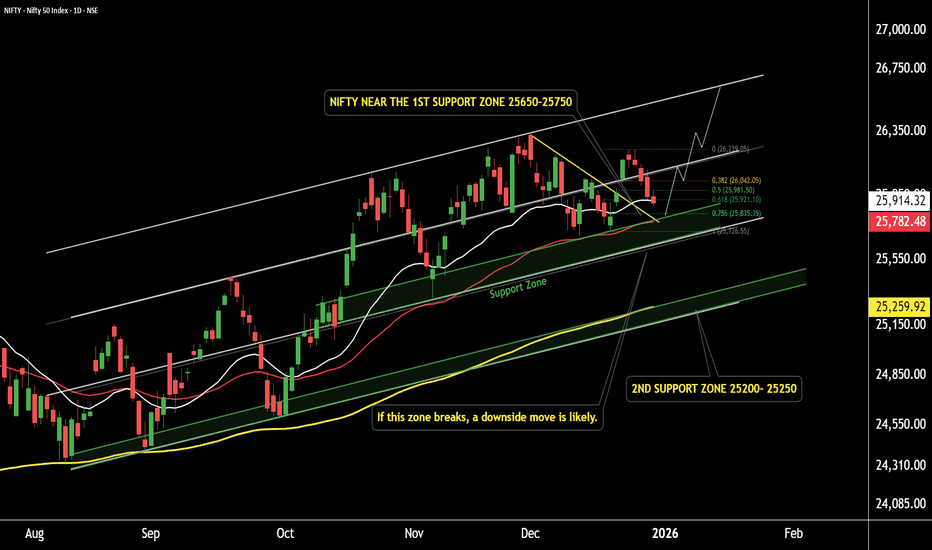

NIFTY Holding Key Support — Reversal in FocusNIFTY 50 – Daily Timeframe Support & Outlook

On the daily timeframe, NIFTY 50 is currently placed near an important short-term support zone.

Short-Term Support Zone: 25,740 – 25,770

If this support zone breaks decisively, NIFTY may extend its decline toward the major support area at 25,200 – 25,300

Reversal & Upside Scenario

If NIFTY sustains above the short-term support range of 25,550 – 25,700, a technical reversal is possible.

In such a case, the index may witness an upside move toward 26,300 followed by 26,600.

Thank You...

Momentum Talking in PAYTM !!This is the daily timeframe chart of Paytm.

The stock is showing a bullish move after a positive EMA crossover.

The key EMA support zone lies between ₹1,250–₹1,290.

If this support zone sustains, the stock may move higher, offering a potential upside of around 24–25% from current levels 1530 and 1600.

Trend remains positive as long as EMA support holds

Thank You !!

Sequent Scientific Ready for Bounce| Key Levels in Play . This is the daily timeframe chart of Sequent Scientific.

The stock is moving within a well-defined structure, showing strength despite a volatile market environment.

Key support levels: 200 and 170

EMA support: Near the 190 level

Resistance zone: Around 270

If these support levels sustain, the stock may witness a further upside move in the coming sessions.

Thank you.

MAHLIFE Poised for a Powerful Bull RallyThis is the daily timeframe chart of MAHLIFE.

The stock is moving within a well-defined structure with a positive EMA crossover, and key support lies near the 380–390 zone.

MAHLIFE has formed a Cup & Handle pattern on the higher timeframe and is currently trading around 404 after giving a pattern breakout.

If the support zone holds, we may see higher levels in the coming sessions.

Thank you.

Bulls Take Charge Critical Nifty Level for Uptrend ContinuationNifty Approaches Key Support Zone as Bulls Prepare for the Next Upswing

📈 Refined Analysis (4 hour Timeframe)

Nifty 50 is currently forming a Higher High – Higher Low (HH–HL) structure on the daily chart, indicating a continued bullish trend. The index is now trading near a crucial support zone between 26,000 and 25,700.

Both EMAs are also providing strong support:

First EMA support: around 26,025

Second EMA support: around 25,700

These two levels are extremely important for Nifty, as holding this zone could trigger the next leg of the bull run. If the support holds, the bullish move may extend toward the 26,700–26,800 zone, which acts as a natural resistance based on Nifty’s typical price behavior.

Thank you.

JSL Entering Bull Mode – Potential Upside Loading!JSL – Daily Timeframe Analysis

JSL is moving within a well-defined parallel channel and is currently sustaining above the Lop and key support zone near ₹700–710.

The EMA’s positive crossover further confirms the bullish trend and supports the ongoing momentum in this range.

On the shorter timeframe, the stock is forming a broadening wedge pattern with a support base around ₹700–710.

If this zone continues to hold, we may witness higher price levels in JSL in the coming sessions.

Thank you!

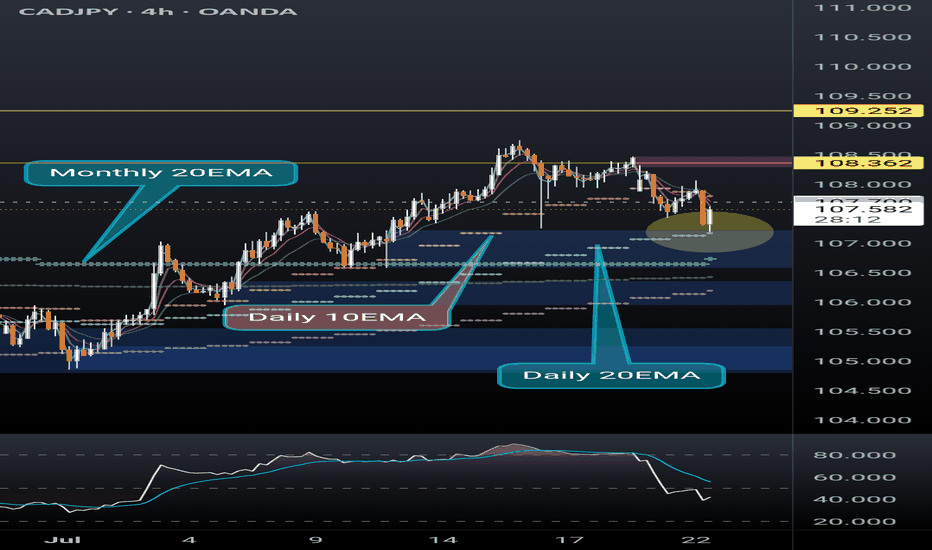

AUDCAD potential long setupLooking at AUDCAD this morning and noticed the 3 bounces off the Monthly 50EMA (overlayed on this 4H chart). The pair is stuck in a wide range after a strong September rally linked to the gold (commodities) strength and above forecast AUD economic data. The pair is also sitting at a critical trend line support while RSI is positioned well for a move upward.

Fundamentally, precious metals are erasing Friday's losses while a meeting between President Trump and Australian PM Albanese is set to take place Monday morning to discuss a critical minerals deal (among other topics), which could boost the AUD significantly. In the meantime the Canadian government continues to follow Brussel's lead in economic obliteration and CAD insignificance.

I could be wrong, I'm a nobody.

BITCOIN - New ATH is ahead!Over the past year — exactly 363 days — Bitcoin has only formed the Golden Cross pattern 3 times.

If you look at the chart, you’ll notice that each time this pattern appeared, it triggered a strong bullish rally leading to a new ATH (all-time high), as clearly shown.

And right now, Bitcoin is forming this exact pattern again on the daily timeframe.

For clarity:

- The Golden Cross happens when a smaller EMA (like the EMA 25) crosses above a larger EMA (like the EMA 50) .

This crossover is a classic bullish signal often marking the start of major upward moves.

based the fibonacci The next expected ATH for BTC is projected around 140K

Best Regards :

Ceciliones

JK Tyre gripping the market! Potential wealth creator in market.JK Tyre is currently showing strong technical strength on the weekly timeframe:

The stock is sustaining above its 9-year law of polarity, with a major support zone around ₹250–260, which has already been respected.

It is trading within a well-defined ascending parallel channel, with channel support near ₹300–320.

Multiple moving averages are also acting as strong support – EMA at ₹270, EMA at ₹290, and SMA at ₹320.

Conclusion:

JK Tyre is technically well-supported at lower levels and is respecting long-term support zones. The stock is showing positive momentum within its channel structure, making it an attractive candidate for medium to long-term investors Best Accumulation Zone: ₹300–320 (near channel + SMA support).

Secondary Entry (deep support): ₹270–290 if the stock dips.

$BTC bounce setup at EMA crossover with eyes on $116.5k BTCUSDT is currently bouncing back after the recent Nvidia earnings boosted sentiment. Historically, whenever the 21 EMA and 50 EMA near a bearish crossover, the market tends to bounce before deciding direction. This pattern is aligning again as selling volume pressure has decreased significantly, indicating that downside momentum is weakening.

If Bitcoin can retest the $116,500 level and hold above it, short-term bulls may regain confidence. However, the real test lies at the $118,000 zone. A sustained breakout and close above this key resistance could open the path for another push toward $125,000. Until then, traders should keep a close eye on EMA reactions and volume confirmations before positioning.

BNBUSDT — Golden cross with a target at 804- 850BNB has broken the descending trendline and formed a clear reversal structure.

A golden cross (EMA 50 crossing EMA 200 from below) confirms bullish intentions. The price is now holding above 783 -a key level that aligns with the 0.618 Fibonacci retracement. A retest of the 778–768 area is expected, followed by a potential rally to 808–810.

If momentum continues, the 860 zone (Fib 3.618) becomes the next target. The uptrend remains intact. RSI supports the move, MACD is in positive territory, and volume remains stable.

On the fundamental side, BNB remains a central token in the Binance ecosystem. With no regulatory pressure in the short term and ongoing development of the platform, institutional and retail interest remains strong. General optimism across the altcoin space also provides momentum.

Holding the 768–778 area is key for further growth. A drop below could test 760 support, but the bullish structure remains valid.

Master MACD Histogram + EMA Filter To Filter Out NoiseThe MACD histogram isn’t just noise — it’s a leading signal for momentum shifts when interpreted correctly. On this AAVE 1H chart, a textbook transition plays out:

– Rising histogram fades → crosses below 0

– EMA filter confirms trend shift

– Strategy flips short at the peak, locks in a +10.76% move

The recent long trigger occurs only after the histogram begins rising, crosses above zero, and price breaks back above the 50/9/3 EMA filter.

💡 Histogram Tips:

– Rising bars = bullish momentum building

– Shrinking bars = momentum weakening

– Crossing the zero line = potential trend reversal

– Best results come when histogram + EMAs align

⚙️ Settings Used:

MACD: 25 / 60 / 220

EMA Filter: 50 / 9 / 3

Entry Mode: Both (Histogram + Crossover Confluence)

📈 Use histogram transitions as an early signal — but always confirm with trend filters to avoid fakeouts.

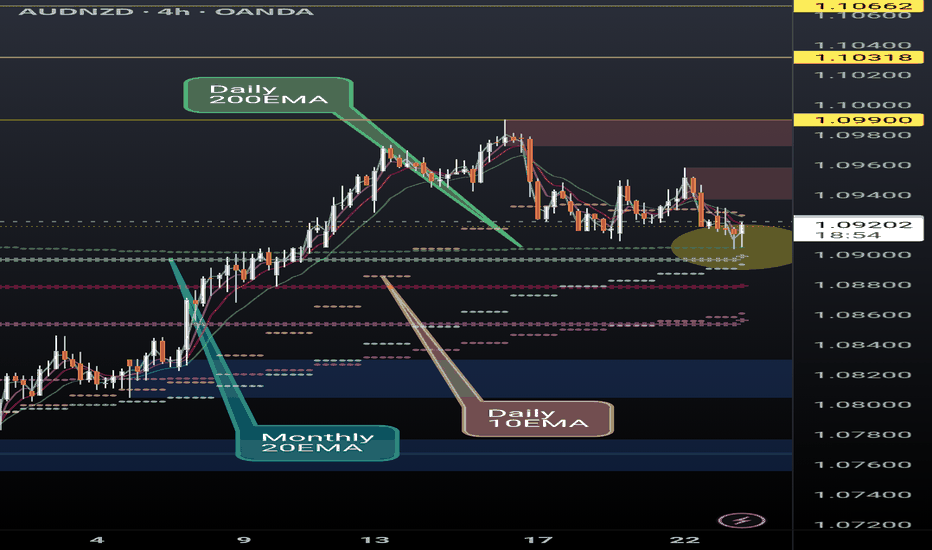

AUDNZD finding support on critical EMAsAUDNZD is finding support at the daily 200EMA (overlayed on 4H chart) and, more significantly, above the monthly 20EMA (overlayed). Break and hold the daily 10EMA (overlayed) will be key.

If the momentum continues we could see a continuation of the ongoing rally however recent AUD monetary policy meeting minutes seemed to lean dovish.

I'm a cat not a financial advisor.

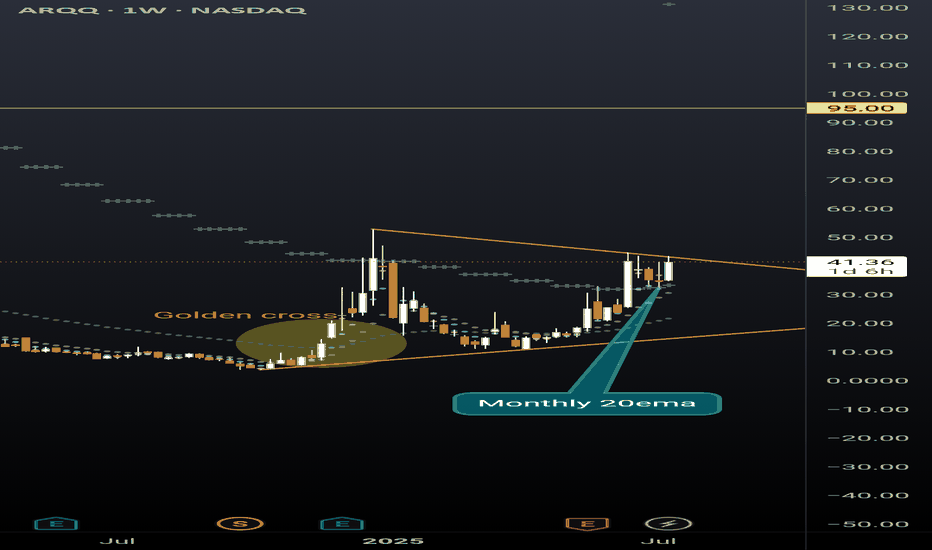

ARQQ weekly pennantBeautiful weekly pennant on ARQQ weekly timeframe. This chart is coiling nicely for a continuation. Still early in the process of reaching breakout but given the recent momentum in this sector a premature break to the upside can happen at any moment.

The ticker is currently sitting above the monthly 20ema (overlayed on this weekly chart), and just had a strong bounce off the daily 20ema (overlayed on this weekly chart). Golden cross is also highlighted that occurred in December 2024 with the daily 50ema retracing back to the daily 200ema and then continuing the uptrend earlier this spring.

TATA MOTORS LTD at BEST SUPPORT !!This is the Daily chart of TATA MOTORS LTD.

TATA MOTORS having good law of polarity at 660 range.

TATAMOTORS has given a positive EMA crossover, with its support range lying around 660-680.

If this level is sustain , then We may see higher price in TATAMOTORS.

Thank you !!

XAU/USD Bounces Off Strong Support Zone – Bullish MomentumGold (XAU/USD) has shown a strong bounce from the clearly defined support zone around the 3280–3290 level on the 1-hour timeframe. This zone has held multiple times in the past, confirming its significance. Additionally, the 200 EMA (red) is aligned with this horizontal support, creating a strong confluence area. Price action has respected this level, forming a bullish reversal candle setup, indicating potential for upside movement.

Based on this structure, a long (buy) trade can be considered around the 3300–3305 range, ideally after a bullish confirmation candle or price holding above the EMAs. This entry provides an opportunity to ride the next wave upward while maintaining a favorable risk-to-reward ratio.

The stop loss for this trade should be placed just below the support zone—around 3275 USD. Placing the stop slightly below this area protects against fakeouts while still maintaining good risk control. This is a logical level where the setup would be invalidated if breached.

For targets, the first potential resistance and partial profit booking zone is near 3335–3340 USD. This zone acted as resistance during previous price swings. If momentum sustains, the second target zone is around 3360–3370 USD, which marks a previous swing high and a likely destination for bullish continuation. For extended upside potential, traders can aim for 3385+ USD, especially if the price action is supported by volume and broader market sentiment.

This setup offers a clean technical play with a risk-reward ratio of approximately 1:2.5 or higher. Traders can also trail their stop-loss once the price crosses above the first target to protect gains while riding further upside.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Is There the Best Moving Average For Swing Trading?Is There the Best Moving Average For Swing Trading?

In swing trading, moving averages are widely used to analyse market trends and identify potential turning points. In this article, we’ll dive into the most commonly used MAs, their unique characteristics, and how they can be applied in swing trading strategies.

What Are Moving Averages?

You definitely know what moving averages are. However, we need to start our article with a brief introduction to this market analysis tool.

A moving average (MA) is a fundamental tool in technical analysis that helps traders understand the direction of a market trend by smoothing out price fluctuations, often touted among the best indicators for swing trading. Instead of focusing on the volatile ups and downs, MAs calculate an average of prices over a specific period, such as 20, 50, or 200 periods. This gives traders a clearer picture of the overall trend by filtering out short-term volatility.

There are different types of moving averages, but they all work on the same principle: tracking the average price over time to highlight the market's trajectory. For example, a 20-period MA shows the average (usually closing price but a trader can choose highs, lows, and opens) over the past 20 periods, updating as new prices come in. This rolling calculation creates a line on the chart, making it easy to identify whether the market is trending upwards, downwards, or moving sideways.

Types of Moving Averages

Moving averages come in various forms, each with unique characteristics that cater to different trading styles and strategies.

Simple Moving Average (SMA)

The simple moving average (SMA) is the most straightforward type, calculated by averaging the closing prices (but a trader can choose any price type) over a set number of periods. For example, a 20-period SMA adds up the last 20 closing prices and divides by 20. It’s popular among traders who want a broader view of price trends without overreacting to short-term fluctuations, making it a contender for one of the best moving averages for swing trading. However, SMAs can lag behind price action, as they give equal weight to all prices in the calculation.

Hull Moving Average (HMA)

The hull moving average (HMA) is designed to reduce lag while maintaining a smooth line. By combining weighted averages with additional smoothing techniques, the HMA offers a balance of speed and clarity, making it an underrated moving average for swing trading.

Exponential Moving Average (EMA)

The exponential moving average (EMA) prioritises recent prices, giving them more weight in the calculation. This makes it more responsive to price changes compared to the SMA. Swing traders often use EMAs in faster-moving markets, where quick adjustments to trend shifts are crucial, with 8- and 21-period EMAs considered by some traders as two of the best EMAs for swing trading. For instance, a 20-period EMA reacts faster to sudden price movements than a 20-period SMA, helping traders spot potential reversals sooner.

Weighted Moving Average (WMA)

Similar to the EMA, the weighted moving average (WMA) also gives more importance to recent prices but does so with a linear weighting system. This means the most recent price has the greatest impact, gradually decreasing with older data. WMAs are less common but useful when traders want a more precise reflection of recent price action.

How to Use Moving Averages in Swing Analysis and Trading

Moving averages are versatile tools that can provide valuable insights for swing traders. Beyond highlighting trends, they can help identify potential turning points and dynamic support or resistance levels. Here’s how they’re commonly used in swing trading:

1. Identifying Trends

MAs are widely used to assess the direction of a trend. For instance, if the price consistently stays above a rising moving average, it suggests an upward trend. Conversely, when prices remain below a declining moving average, the market could be trending downward. Swing traders often rely on shorter moving averages, like the 20-period, for identifying trends that align with their trading horizon.

2. Spotting Reversals with Crossovers

Crossovers happen when two MAs intersect. A common example is a shorter MA crossing above a longer one, which may indicate a shift towards bullish momentum and vice versa.

3. Dynamic Support and Resistance

MAs act as floating support and resistance levels. MAs serve as a support level in an uptrend, with the price bouncing off it repeatedly. In a downtrend, the same moving average might act as resistance, limiting upward moves.

4. Filtering Market Noise

In choppy markets, MAs can smooth out minor fluctuations, making it easier to focus on the bigger picture. Swing traders often use longer MAs, such as the 50-day or 200-day, to filter out irrelevant short-term movements.

5. Timing Entry and Exit Zones

Many traders use crossovers to time their entries and exits, though it’s worth noting their lagging nature means they can result in untimely trades. They can also provide context. For example, if the price approaches a key moving average after a strong move, it might indicate a consolidation phase or a potential reversal, allowing traders to adapt their analysis.

Common Moving Averages for Swing Trading: The 20, 50, and 200 MAs

Swing traders often turn to the 20-, 50-, and 200-period moving averages as their go-to tools for analysing market trends. Each serves a specific purpose, helping traders gauge short-, medium-, and long-term price movements. These moving averages are often used together.

20-Period Moving Average

The 20-period MA is a favourite for short-term trend analysis. It reacts quickly to price changes; therefore, traders use it to identify recent momentum or potential trend shifts. Traders frequently watch for price “bounces” off the 20-period MA as potential indications of continuation in the current trend.

50-Period Moving Average

The 50-period MA provides a medium-term perspective, offering a smoother look at price trends. It’s slower to react than the 20-period MA but avoids being overly lagging. This balance makes it useful for identifying sustained trends while filtering out minor price noise. When prices interact with the 50-period MA, it often acts as a dynamic support or resistance level.

200-Period Moving Average

The 200-period MA is the benchmark for long-term trend analysis. It’s often used to determine the overall market direction. This MA is also a widely followed indicator for institutional traders, adding weight to its significance. Interactions with the 200-period MA often mark key turning points or areas of consolidation.

Traders also monitor crossovers between the 50- and 200-period MAs, recognised by some as the best moving average crossover for swing trading. For instance:

- Golden Cross: When the 50-period MA crosses above the 200-period MA, it suggests potential bullish momentum.

- Death Cross: When the 50-period MA drops below the 200-period MA, it signals a possible bearish shift.

Using Them Together

Using the 20-, 50-, and 200-period MAs together offers a comprehensive approach to identifying the best moving average crossover setups, allowing traders to see the bigger picture while still tracking short-term shifts. For instance, when the price breaks above the 200-period MA while the 20-period MA crosses above the 50-period MA, it may signal the beginning of a broader bullish trend. Meanwhile, a price drop below all three MAs could suggest broader bearish momentum.

Other Moving Average Combinations for Swing Trading

While the 20, 50, and 200-period MAs are staples in swing trading, exploring other combinations can offer nuanced insights tailored to specific trading strategies. Some alternative moving average setups that traders often employ include:

8-Period and 21-Period Exponential Moving Averages (EMAs)

This pairing is favoured by traders seeking to capture short-term price movements with greater sensitivity. They call this the best EMA crossover strategy. The 8-period EMA responds swiftly to recent price changes, while the 21-period EMA provides a slightly broader perspective.

10-Period and 50-Period Simple Moving Averages (SMAs)

Combining the 10- and 50-period SMAs offers a balance between short-term agility and medium-term trend identification. This combination helps traders filter out minor price fluctuations and focus on more sustained movements.

28-Period and 50-Period HMAs

For traders focused on short-to-medium-term trends, the 28- and 50-period HMAs offer a balanced approach. The 28-period HMA reacts quickly to price changes, while the 50-period HMA provides a steadier view of the broader trend. Crossovers between the two can signal potential bullish or bearish momentum shifts, benefiting from the HMA’s reduced lag.

13-Period and 34-Period WMAs

Rooted in Fibonacci sequences, the 13- and 34-period WMAs are employed by traders who believe in the natural rhythm of the markets. A 55-period WMA can also be included for a longer-term perspective. Crossovers between these WMAs can highlight potential trend reversals or continuations, with the WMA adapting more quickly than other MAs due to its weighted calculation.

Implementing These Combinations

When applying these moving average combinations, it's crucial to consider the following:

- Market Conditions: These combinations often perform better in trending markets versus ranging markets. Moreover, shorter MAs might be more effective in capturing quick price movements during high volatility.

- Timeframes: Traders align MAs with their trading horizon. Shorter periods like the 5-period or 8-period MAs are usually used by traders focusing on brief swings, while longer periods like the 50-period MA cater to those looking at extended trends.

- Confirmation with Other Indicators: Relying solely on moving averages can lead to false signals. Traders corroborate these signals with other technical indicators, such as Bollinger Bands or the Relative Strength Index (RSI).

What Moving Averages Should You Use for Swing Trading?

There is no best moving average for swing trading. The choice of MAs ultimately depends on a trader's strategy and preferences. The combinations discussed provide a framework, but experimenting with different setups can help identify what aligns with individual trading styles and objectives.

The Bottom Line

Moving averages are powerful tools for swing trading, offering insights into trends and potential market turning points. Whatever your unique preference for different types and lengths, understanding their application can refine your strategy.

FAQ

Which Moving Average Is Good for Swing Trading?

The 20-period, 50-period, and 200-period moving averages are widely used in swing trading. However, different combinations, like the 8- and 21-period or 13- and 34-period MAs can offer equally valuable insights; it ultimately comes down to the trader’s preference.

What Is the Most Popular Moving Average to Use?

The most popular moving average depends on a trader’s trading style and goals. Shorter MAs, like the 20-day MA, are popular for quick trend identification, while longer ones, such as the 200-day MA, provide a bigger picture. Many traders combine MAs to cover different timeframes.

Is 200 EMA Good for Swing Trading?

The 200-period EMA is useful for swing traders seeking to understand long-term trends. It reacts faster than the 200-period SMA, making it suitable for traders looking to incorporate a responsive indicator in their analysis.

Which Indicator Is Most Popular for Swing Trading?

There isn’t a single best indicator for swing trading. Moving averages, RSI, MACD, and volume indicators are commonly used. Combining these can provide a more comprehensive analysis.

Which Volume Indicator Is Popular for Swing Trading?

The On-Balance Volume (OBV) and Volume Weighted Average Price (VWAP) are popular volume indicators for swing traders, helping assess market momentum.

Which RSI Indicator Is Popular for Swing Trading?

The standard 14-period RSI is widely used. Swing traders often adjust it to shorter periods (e.g., 7) for faster signals or longer periods (e.g., 21) for smoother trends.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.