Bitcoin's good performance will continue in September?!Bitcoin is located between EMA50 and EMA200 in the 4H time frame and is trading above the $60,000 level

Risk on sentiment in the US stock market or investing in Bitcoin ETF funds has led to its continued upward movement, and you can look for Bitcoin sales positions within the specified supply range

Capital withdrawals from Bitcoin ETFs or risk off sentiment in the US stock market will pave the way down for Bitcoin. The target of this downward movement will be the level of 63 thousand dollars

It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market, and compliance with capital management in the cryptocurrency market will be more important

Etf-bitcoin

Bitcoin - Heavy Capital Exit from Bitcoin ETF After labour dayBitcoin is lower than the EMA50 and EMA200 in the 4H timeframe and is trading in its descending channel

The risk on sentiment in the US stock market or the entry of capital into bitcoin ETFs has resulted in the start of the upward movement, and after bitcoin in the specified supply zone, it can be entered into bitcoin sell

It should be noted that heavy fluctuations and shadows are possible due to the movement of whales in the market, and the capital management of capital in the cryptocurrency market will be more important

Less is more...If you don't know me, I have been a trader a very long time. Nearly 25 years to be exact.

Over the years, I have spent a lot of time studying a wide array of techniques, tools, patterns and market sentiment. Lucky enough, the markets have also been very kind to me.

I've been fortunate enough to have two trading books published by large traditional publishing companies. So it's safe to say, I live and breathe trading.

I am going to do a series of posts here covering a couple of key educational topics - starting with Elliott Wave theory.

When it comes to Elliott Wave theory, there seems to be a love hate relationship for many people. Some get it, some see it as not relevant. To be honest, both are correct.

Now before you jump on the high horse "it doesn't work for crypto" - let me start by saying, this is not a lesson on how to use Elliott Theory. I covered that in these posts below;

And step two;

In terms of using Elliott, it's not as simple as trying to figure out each and every move. (this is often why, it does not work.) Instead the benefit of Elliott, is to accept it as a bias tool that aids in understanding the current market sentiment.

We often see posts online about things like the Wall Street cheat sheet. I also covered this in another post here on @TradingView

Where the theory has any real value, is simply to obtain a bias. The market is always searching for liquidity. In order to obtain liquidity, the market needs to attract players for the game.

Now, you have probably entered a trade and felt almost immediately that the market has pushed against you, it's out to get you and the brokers are playing 1 vs 1 against you.

This is where sentiment really comes in.

As a retail trader you have likely been exposed to tools such as RSI, MACD or even dabbled with Elliott and Wyckoff. But the reason the market does, what the market does, is not to get you as an individual, instead it's there to collect liquidity from a crowd.

Elliott wave theory isn't a technical tool, it's a sentiment tool.

So instead of trying to guess every internal and nested swing, you can make an awful lot of money by simply giving a directional bias.

I wrote an article in 2021 here -

About the emotions, I used the Simpsons to get the point across. The general idea is to understand where liquidity is likely to be and use that to make informed trading decisions.

If you have any specific questions, even topics you would like covered, leave a comment below. I'll add to this in another post as part of this series.

Stay safe and wish you all the best.

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Bitcoin Whales Aren't Buying the Dip (yet)The large holder netflow indicators helps you to keep an eye on when the largest Bitcoin wallets (those holding >0.1% of the supply) accumulate or sell $BTC. Not only can these wallets seriously impact the markets, they often pick the best moments to accumulate or sell, meaning we can learn a lot from their behavior.

Bitcoin has retraced quite significantly since the turmoil in the middle east. The big question on everyone's mind is this: Is the dip over?

While it is hard to say, we can see that the largest whales haven't started accumulating CRYPTOCAP:BTC yet. They did do this during previous dips. This could indicate that large holders are expecting prices to decrease further.

Keep your eyes on this indicator today, as ETF wallets can strongly impact this metric. Will ETF investors sell out of fear, or respond strongly and buy the dip?

The Large Holder Netflow indicator provides crucial insights into the activities of Bitcoin's largest wallets, those holding more than 0.1% of the supply. These wallets not only have the potential to significantly influence the market but also tend to time their buying and selling strategically, offering valuable lessons from their trading behaviors.

Recent events in the Middle East have triggered a significant retracement in CRYPTOCAP:BTC price. The big question on everyone's mind is this: Is the dip over?

Determining the end of the dip is challenging, but it's worth pointing out that the largest whales have not yet begun accumulating CRYPTOCAP:BTC , something they did do in recent downturns. This pattern suggests that these significant holders might anticipate further declines in price.

Today, keep a close watch on this indicator. ETF wallets play a substantial role in influencing this metric. The behavior of ETF investors, whether they sell out of fear or buy into the dip aggressively, will be key to predicting the market's direction.

Bitcoin Flat( is the ETF gonna be positive or ?)Bitcoin ETF is either gonna bring Positive news to the space or it is gonna bring negative news.

So, if Negative, from the current price we might see a drop as detailed on the Chart, else if the news are positive, as already detailed on the chart, a move from 39k is needed for a Bullish run continuation.

Bitcoin Near-Term Price TargetFuelled by its imminent ETF approval, Bitcoin broke past resistance at $28,000 and has seemingly begun a new bull market. For those of you who got in on this move, myself included, I have identified what I think will be a temporary top and a good place to take profit within the next 1-2 months.

On the 1W timeframe we can see the cloud edge to edge trade is in progress and typically price will reach the flat line at the top of the cloud, which is at about $42,000. This level is the 50% fibonacci retracement of the previous bull market high in November 2021, and the bear market low in November 2022.

Additionally the level roughly coincides with the top of the monthly bollinger bands which will act as resistance. Of note is that the bollinger bands are in the process of squeezing together, which occurs prior to a high volatility move.

Once we hit the $42,000 area and the ETF approval is officially announced, I expect that there may be a sell the news event as we have already been pumping on the rumour. Then there will be sideways for a few months until the halving. New chart patterns will likely form during this period, which will provide an opportunity for re-entry and a continuation of the bull market.

BlackRock's Big MoveIn a week marked by substantial financial developments, none have captivated the attention of investors quite like the unfolding saga of BlackRock's Bitcoin ETF. The focus began to shift back onto the ETF topic after the iShares Bitcoin Trust was officially listed on the Depository Trust & Clearing Corporation (DTCC), a crucial component of the U.S. market infrastructure. Adding to this momentum, BlackRock has made amendments to its ETF filing to indicate the possibility of seeding the ETF this month.

While these steps do not guarantee approval, they are widely seen as bolstering confidence in an eventual SEC endorsement. In a sense, they mark a continuation of the approval process. However, it's crucial to temper expectations, as it's unlikely that the SEC will make a quick decision. Following its historical approach during the approval process for BTC/ETH Futures ETFs, the SEC is expected to grant approval to multiple fund managers simultaneously. Given this context, a decision might be deferred until early next year, as the SEC awaits other applications to meet the criteria reportedly satisfied by BlackRock. Despite this uncertainty, BlackRock's proactive steps seem designed to assert its 'first-mover' advantage in the market, regardless of whether the SEC eventually confers it.

In a separate yet related development, the DC Circuit Court of Appeals has formally closed the Grayscale case, requiring the SEC to re-evaluate Grayscale's application to convert GBTC to a spot ETF. Depending on the SEC's decision, this could either pave the way for more accessible cryptocurrency investment products or introduce additional regulatory hurdles. To underscore the market sentiment, Bitcoin's recent surge past the 35k mark indicates that the market is increasingly factoring in the likelihood of an ETF approval, with the timing of such an event being the only remaining question.

In conclusion, the approval of a Bitcoin ETF could not only be a financial game-changer but also a pivotal moment for the asset class as a whole. By offering a straightforward and regulated path for investors, it promises to attract a surge of capital particularly from the institutional sector that could catalyze the next bull market. As cryptocurrencies gain further legitimacy, the SEC's eventual endorsement would catapult cryptocurrencies from the periphery right into the core of the financial world.

$BLOK #Blockchain ETF. Why u should Buy$BLOK #Blockchain ETF 🚀

3-Day Chart Setup (for Positional trading/longer timeframe investing).

In Accumulation phase b4 the next leg UP.

For long term investors who like exposure to growth in this sector without picking #Winning #Stocks, #BLOK ETF provides the easy option!

BITCOIN ($BTC): IMPORTANT FUNDAMENTAL (Futures/ETF) MILESTONESHi Crypto Friends,

Check out my latest BTC's analysis.

I do not use any technical indicators, I only drew a few important milestones concerning BTC Futures and ETF.

I will update this TA regularly.

If I missed any important event, leave me your comment. I will add it into the chart.

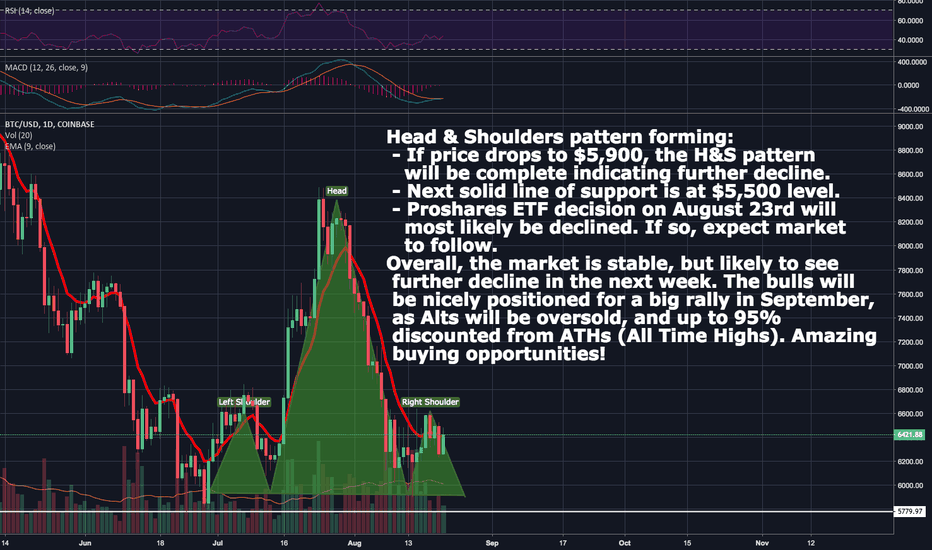

BTC Head & Shoulders Formation Head & Shoulders pattern forming:

- If price drops to $5,900, the H&S pattern

will be complete indicating further decline.

- Next solid line of support is at $5,500 level.

- Proshares ETF decision on August 23rd will

most likely be declined. If so, expect market

to follow.

Overall, the market is stable, but likely to see

further decline in the next week. The bulls will

be nicely positioned for a big rally in September,

as Alts will be oversold, and up to 95%

discounted from ATHs (All Time Highs). Amazing

buying opportunities!

Downtrend will continue until November - $5,000 per bitcoinShort points for the next months

Downtrend will continue until November

Security Tokens will get into the game

The price at which most miners would really start shutting down their operations is around $3,000 to $4,000 per bitcoin

More institutional investors will get into bitcoin (end of September ETF)

The sell-off currently from investors, who last year piled into initial coin offerings (ICOs) and now getting out by empty promises / weak MVP.

Learn more about Security Tokens

chainsulting.de

What is Chainsulting ?

Chainsulting is a consulting and development company, on the subject of Distributed-Ledger-Technologie (DLT).

We show ways, opportunities and risks and offer comprehensive solutions.

Get in touch with us

chainsulting.de