Ethereum Near Major Resistance: Structure StrengtheningEthereum is currently trading just below a strong resistance zone around 3,050–3,070, where multiple prior rejections have occurred. Price is advancing within a clearly defined ascending price channel, indicating controlled bullish pressure rather than impulsive expansion. The recent sequence of higher lows suggests buyers are active, but the lack of strong follow-through near resistance highlights hesitation.

From a technical structure perspective, ETH is transitioning from a recovery phase into a potential range environment. The upper boundary of the rising channel aligns closely with horizontal resistance near 3,030–3,050, creating a confluence zone where profit-taking is likely. Momentum candles are slowing, and price is beginning to overlap, which typically precedes either consolidation or a corrective pullback rather than an immediate breakout.

If ETH fails to reclaim and hold above 3,050 on a clean H1/H4 close, the higher-probability scenario is a rotation back toward the mid-range, with downside targets around 3,000 → 2,970, and potentially deeper into the 2,950–2,930 support cluster. This would keep Ethereum locked in a sideways range, rather than confirming a trend continuation.

From a macro perspective, the environment remains mixed. While expectations of future rate cuts in 2026 provide medium-term support for risk assets, near-term USD stability and restrictive financial conditions continue to cap aggressive upside moves. Additionally, flows into crypto remain selective, favoring short-term rotations rather than sustained breakouts. Without a clear macro catalyst (such as dovish Fed signaling or a strong risk-on impulse), upside attempts near resistance are vulnerable to rejection.

Summary:

Ethereum is technically constructive but not in breakout conditions yet. As long as price remains below the strong resistance zone, the market should be treated as range-bound, with upside capped and pullbacks toward support remaining a valid and healthy scenario. Patience is required until either structure breaks decisively higher—or the range resolves with confirmation.

ETH

$ETH 4H FractalsCRYPTOCAP:ETH 2022 4H fractals are still lining up well here.

We’ve just seen a secondary test of the trendline, which usually points to some consolidation or chop in this zone rather than an immediate breakout. Price looks like it needs a bit of time to build acceptance here.

As long as $2800 continues to hold as support, the structure stays constructive, and that keeps the higher-timeframe upside intact. If this base holds and momentum gradually rebuilds, there’s a decent chance we see a push toward the $3700 area later this quarter.

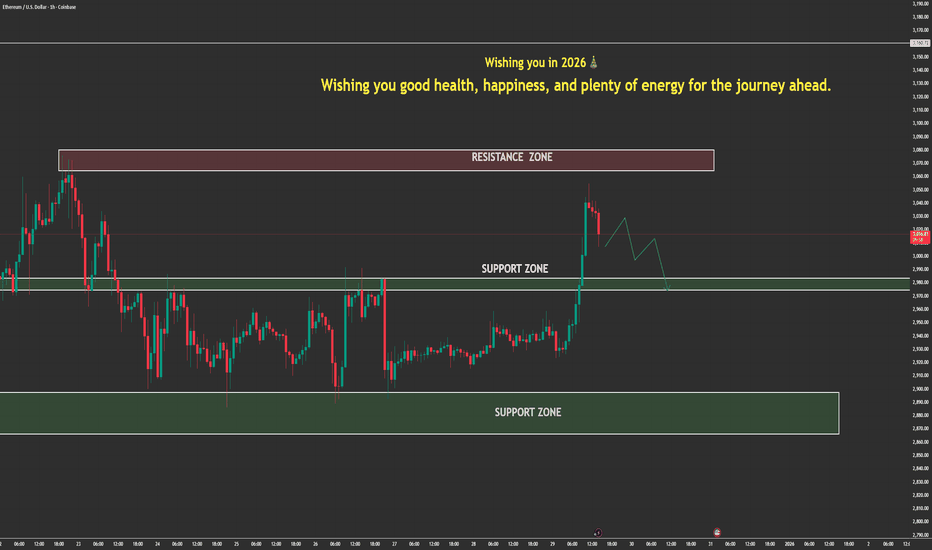

Ethereum Is Not Ready to Rally — This Is a DistributionHello everyone,

On the H1 timeframe, the key focus right now is not upside continuation, but the fact that Ethereum is stalling below a well-defined resistance zone after a completed impulsive move. The current price action suggests distribution and rebalancing, rather than the start of a new bullish leg.

After the strong impulsive rally that pushed ETH sharply above 3,000, price was rejected from the upper resistance near 3,030, triggering a fast corrective sell-off. That initial drop was aggressive and directional, signaling that buyers who entered late were forced to exit. Since then, ETH has recovered partially but has failed to regain acceptance inside the resistance zone around 2,980–3,000.

From a structural perspective, the market is now printing lower highs beneath resistance, with price compressing in the middle of the range. This behavior indicates that upside momentum has weakened and that buyers are no longer in control. The consolidation here is not constructive it is occurring below resistance, which favors another leg lower rather than a breakout.

Technically, the current structure aligns with a bearish corrective sequence. The sideways-to-lower drift suggests that ETH is building a base for continuation down toward the 2,900–2,880 support zone, which has acted as a demand area previously. The projected path on the chart reflects this logic clearly: a shallow bounce, followed by renewed selling pressure into support.

Resistance zone: 2,980–3,000 — repeated rejection, sellers active.

Major resistance: ~3,030 — prior impulse high and supply.

Support zone: 2,880–2,900 — next area where buyers may step in.

Only a clean breakout and sustained acceptance above the 3,000–3,030 resistance would invalidate this pullback scenario and reopen bullish continuation. Until that happens, ETH remains in a post-impulse correction phase, where downside tests are more likely than upside expansion.

Wishing you all effective and disciplined trading.

ETH Compresses Between Supply and Demand On the 1H timeframe, Ethereum is trading inside a clearly defined range, capped by a strong resistance zone around 3,040–3,080 and supported by a demand zone near 2,880–2,920. Price is currently rotating around the mid-range near 2,970, showing hesitation rather than directional conviction. This positioning signals balance between buyers and sellers, not trend expansion.

From a structure perspective, the market has failed multiple times to sustain acceptance above the resistance zone. Each push into supply has been followed by sharp rejections, indicating that sell-side liquidity remains active at higher levels. The recent rebound is corrective in nature and has not yet invalidated the broader ranging structure.

On the downside, the support zone has held repeatedly, but reactions from this area are becoming increasingly overlapping and less impulsive. This behavior typically reflects absorption rather than aggressive accumulation. As long as price holds above this support, downside risk is contained, but the lack of strong follow-through limits bullish continuation.

In the near-term outlook, ETH is likely to continue range oscillation unless a clear catalyst drives expansion. A rejection from the 2,980–3,000 area would favor a move back toward the lower boundary of the range, while a clean breakout and acceptance above 3,080 would be required to confirm a structural shift toward higher prices.

From a macro context, crypto remains sensitive to broader risk conditions, including USD stability and liquidity expectations. Without a decisive risk-on impulse or volume expansion, moves into resistance should be treated with caution.

In summary, Ethereum remains range-bound and compressed. Until price decisively breaks and holds outside the 2,880–3,080 range, the market favors patience, reaction-based trading, and respect for key zones rather than directional bias.

Ethereum Compresses Below Major Supply On the 1H timeframe, Ethereum is trading within a well-defined sideways range, capped by a strong resistance zone around 3,050–3,080 and supported by a demand area near 2,900–2,920. Price has repeatedly failed to establish acceptance above the upper boundary, confirming that this zone remains a dominant supply area rather than a breakout level.

The sharp impulsive rally into resistance earlier in the session was followed by an immediate rejection, forming a classic stop-run and distribution reaction. This behavior indicates that liquidity above prior highs was absorbed by sellers, not followed by continuation. Since then, price has rotated back into the range, reinforcing the market’s balance condition rather than trend expansion.

From a structural perspective, Ethereum is currently printing overlapping candles and shallow pullbacks, characteristic of range-bound price action. The 34 EMA and 89 EMA are flattening and converging, which further supports the view that momentum is neutral and that the market is waiting for a catalyst to resolve the range.

On the downside, the support zone around 2,900–2,920 has been respected multiple times. Each test has produced a reaction, suggesting the presence of responsive buyers. However, these bounces lack strong follow-through, highlighting that demand is defensive rather than aggressive at this stage.

From a macro and sentiment standpoint, Ethereum remains highly correlated with broader crypto risk appetite and liquidity conditions. With no immediate macro shock or strong risk-on impulse, price action favors mean reversion within the range rather than a sustained directional move.

In summary, Ethereum is in a clear consolidation phase between major supply and demand. A clean breakout above 3,080 with acceptance and volume would be required to shift the structure bullish. Until that occurs, rallies into resistance and dips into support should be viewed as range rotations, not trend signals.

Still Ranging — The Breakout Isn’t Here YetCOINBASE:ETHUSD continues to trade in a range-reaccumulation structure on H2. Price is holding above the 2,880–2,920 support zone, while upside attempts remain capped below the 3,060–3,100 resistance area. This behavior reflects rotation and liquidity rebalancing rather than a decisive trend move.

The EMA cluster is flattening, reinforcing the idea of consolidation. As long as support holds, the structure favors a gradual build-up for another upside attempt.

Resistance: 3,060 – 3,100

Support: 2,880 – 2,920

Range focus: 2,900 – 3,100

➡️ Primary: support holds → higher lows → rotation back toward 3,060–3,100 resistance.

⚠️ Risk: clean break below 2,880 opens a deeper pullback into the lower demand zone.

ETH — Price Slice. Capital Sector. 1872.78 BPC 22© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 01.01.2026

🏷 1872.78 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 22

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

Imagine price on a chart moving in a “zigzag”—up, then down, in an apparently chaotic sequence.

To this dynamic we introduce Magnitude 1.0 —a mathematical construct whose purpose is to trace a single, smooth, continuous line that best captures the overall direction of what initially appears to be disorderly motion.

This is analogous to the tire mark left on wet asphalt after a sharp maneuver: the track is jagged, yet you can still discern an “average” line indicating the vehicle’s general trajectory.

Magnitude 1.0 filters noise —minor fluctuations, emotional impulses, short-term liquidity spikes. It reveals not randomness, but structure .

Unlike linear models, Magnitude 1.0 permits this “average line” to be nonlinear , which is critical in markets where trends are rarely straight—especially in crypto assets.

Now we introduce Magnitude 1.1 —the logical forward extension of Magnitude 1.0.

If Magnitude 1.0 is a smooth curve fitted through historical data, then Magnitude 1.1 is its extrapolation beyond the observable time horizon .

This is not a forecast, but a hypothesis :

“If the market continues behaving as it has over the past N periods, price will most likely reside somewhere here.”

Magnitude 1.0 is a tool of anticipation, not action. It answers the question:

“What level could reasonably serve as a target, assuming the current market geometry holds?”

Yet the market is a living system. A new announcement, a liquidity shift, a macro impulse—any of these can instantly invalidate the hypothesis. Thus, the value of Magnitude 1.1 emerges only in context :

- current volume,

- position relative to key structural levels,

- the state of the external information environment.

Consider a river.

Magnitude 1.0 defines its general channel, despite waves, eddies, and local turbulence.

Magnitude 1.1 speculates where the river might flow next— if the terrain remains unchanged .

But if rain begins or a dam appears, the hypothesis collapses.

You do not build your house based on Magnitude 1.1. You merely prepare for one of several plausible scenarios.

Why does this matter?

Within the framework of Capital Geometry , where price is not merely a number but a projection of hidden structure:

- Magnitude 1.0 extracts implicit architecture from the chaos of price data,

- Magnitude 1.1 tests the temporal resilience of that structure— without conflating the model with reality .

This aligns with a foundational principle:

Analysis is not prediction—it is preparation for a sequence of events.

To whom is this addressed?

— Not to retail traders leveraging 100x.

— Not to those who “draw” arbitrarily on charts, then complain that price “goes the wrong way,” oblivious to timeframe hierarchy.

— Not to those who operate without defining price ranges or structural context.

This material is intended for institutional players, quantitative analysts, and those capable of decoding the embedded information .

It is a gesture of respect to those who think in terms of capital geometry , not short-term speculation.

The retail sector operates via mechanics : trading from levels within near-term ranges, only after confirmation and closure on timeframes of 1D and higher.

But if your analysis relies solely on indicators supplied by vested corporate entities for the purpose of disinformation—it is no surprise you fear the future.

Some are deceived by randomness, others lack patience, and a third group has merely been favored by capital—to make the crowd believe in illusion.

Volume. Time. Price.

These categories belong to a fading era.

Each is governed by deeper mathematical magnitudes.

Some participants provide liquidity, others are professional traders, and others still are analysts.

And then there are those who remain in the shadows—yet whose work forms the bedrock of market order.

I extend to you a sign of respect.

Because between the lines, you understand .

I assist those who think .

And I conceal pathways—not out of fear, but out of respect for the capital that engineered this system.

It is logical. Designed. And projected years ahead.

Thank you.

— The Architect

BPC — The Bolzen Price Covenant

thereum Is Not Trending — It’s Being NegotiatedCOINBASE:ETHUSD is currently trading inside a well-defined sideways range, with price repeatedly oscillating between a strong resistance zone near 3,050–3,080 and a support zone around 2,900–2,920. The chart clearly shows that neither buyers nor sellers have been able to establish sustained control, resulting in rotational price behavior rather than a directional trend.

From a price action standpoint, the recent impulsive rally into the upper resistance zone was met with immediate and aggressive selling pressure. The sharp rejection from this area confirms that supply remains dominant at higher prices, and the market has not yet accepted value above this resistance. Importantly, the rejection was followed by a fast retracement back into the range, a classic sign of failed continuation rather than a healthy breakout.

Structurally, COINBASE:ETHUSD continues to form overlapping highs and lows, which is characteristic of consolidation. There is no clear sequence of higher highs or lower lows on the 1H timeframe. Instead, price is rotating around the mid-range equilibrium near 2,940–2,960, where liquidity is actively exchanged. This reinforces the idea that the market is in a balance phase, not a trend phase.

The moving averages (EMA 34 and EMA 89) further support this neutral bias. Both averages are flattening and converging, with price frequently crossing above and below them. This behavior typically reflects compression and indecision, not momentum. Until price can hold decisively above the EMAs with expansion, or break below them with follow-through, directional conviction remains weak.

On the macro side, COINBASE:ETHUSD is currently lacking a strong catalyst. BITSTAMP:BTCUSD is consolidating, U.S. yields are relatively stable, and there is no immediate Fed driven volatility pushing risk assets decisively in one direction. As a result, COINBASE:ETHUSD is trading more on technical liquidity levels than on macro narrative, which explains the repeated range-bound reactions.

In summary, COINBASE:ETHUSD remains neutral and range-bound, capped by strong resistance overhead and supported by a well-defended demand zone below. The market is waiting for acceptance outside the range, not reacting to anticipation. Until a clean breakout or breakdown occurs with volume and follow-through, COINBASE:ETHUSD should be approached as a mean-reverting market, where patience and level-based execution matter more than directional bias.

ETH — Price Slice. Capital Sector. 2488.80 BPC 18© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 30.12.2025

🏷 2488.80 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 18

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2271.53 BPC 31© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 30.12.2025

🏷 2271.53 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 31

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2503.16 BPC 15© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 30.12.2025

🏷 2503.16 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 15

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH 1W Update: Chopping, but looking good for Q1 2026 ETH Update: Ethereum is continuing to work through a higher timeframe consolidation after the strong move into the upper range earlier this year. The rejection from the ~$4.7k resistance zone was sharp, but importantly, price has since stabilized and is now holding above the key ~$2.7k–$3k support region. That area has acted as a major pivot multiple times in the past, and holding it keeps the broader structure constructive.

From a market structure perspective, this still looks like a reset within a larger range rather than a full trend failure. The selloff from the highs has transitioned into sideways-to-overlapping price action, which is typical during digestion phases on the weekly. ETH is effectively building a base between higher timeframe support and prior resistance, allowing momentum and positioning to cool off.

The ~$3.4k level remains an important inflection zone. Acceptance back above it would be an early signal that ETH is ready to rotate higher again and challenge the upper range. Until then, some chop and volatility should be expected as the market works through this consolidation. The projected path suggests a period of basing followed by a renewed push higher once participation and liquidity return.

Zooming out, the bigger picture remains intact. ETH continues to hold above major cycle support, and as long as that remains the case, the odds favor continuation rather than a deeper corrective phase. This looks less like distribution and more like consolidation ahead of the next leg.

For now, patience is key. As long as ETH holds this support zone and avoids a decisive breakdown, the structure supports higher prices over time, with the upper range near ~$4.7k remaining the key target once momentum rebuilds.

Ethereum Isn’t Breaking Out — It’s Building Pressure Inside Hello everyone,

On the H1 timeframe, the key focus right now is not the recent rebound, but the fact that Ethereum remains structurally range-bound after a failed breakout attempt. The market has not transitioned into a new trend yet; instead, it is continuing to rotate between clearly defined supply and demand zones.

After pushing aggressively into the upper resistance zone around 3,040–3,070, ETH was rejected sharply, producing a fast sell-off back into the middle of the range. Importantly, this drop did not trigger a broader breakdown. Price stabilized and began to trade sideways again, which tells us that sellers were able to defend resistance, but buyers are still active at lower levels.

From a structural perspective , COINBASE:ETHUSD is printing overlapping candles and compressed swings, a classic sign of balance rather than trend. There is no sequence of higher highs to confirm bullish continuation, and no lower-low expansion to suggest bearish control. This is a market in rebalancing mode, not directional movement.

Technically , the 2,880–2,910 support zone continues to act as a firm demand base. Each approach into this area has been absorbed quickly, preventing further downside expansion. On the upside, the 2,980–3,000 resistance zone is the first ceiling to clear, followed by the major supply zone near 3,050–3,070, where sellers have previously stepped in aggressively.

The projected price path on the chart reflects this logic well: short-term oscillation inside the range, followed by a potential liquidity sweep before any meaningful expansion. Only clear acceptance above the upper resistance zone would confirm a bullish breakout and open the door for continuation higher. Conversely, a decisive breakdown below the support zone would invalidate the accumulation narrative and shift the bias lower.

Until one of those conditions is met, Ethereum is not trending. It is building pressure inside a range, and patience remains the highest-probability strategy.

Wishing you all effective and disciplined trading.

ETH Is at a Make-or-Break ZoneEthereum is currently trading inside a clearly defined range, capped by major resistance around 3,160 and supported by a key demand zone near 2,980, with a deeper structural support around 2,780. The recent impulsive rally was decisively rejected at resistance, confirming that sellers are still defending the upper boundary of this range.

From a technical perspective, price action shows classic range behavior. After the rejection, ETH rotated back toward the mid-range and is now hovering just above support (~2,980). As long as this level holds on a closing basis, the market structure remains neutral-to-bullish within the range. A successful defense here would likely lead to a rebound toward 3,060 and a retest of the 3,160 resistance zone.

However, a clean breakdown below 2,980, especially with strong volume and a 1H/4H close, would invalidate the range floor and open downside continuation toward 2,900, followed by the major liquidity pocket around 2,780.

On the macro side, year-end conditions are playing a critical role. Holiday liquidity is thin, which statistically increases the probability of false breakouts and liquidity sweeps rather than clean trend continuations. At the same time, recent Federal Reserve adjustments to liquidity conditions and easing expectations around monetary policy have kept risk assets supported, but without enough conviction to force a decisive breakout. Crypto markets are therefore reacting more to positioning and short-term flows than to long-term macro repricing.

For Ethereum specifically, the broader narrative around institutional adoption, staking yield, and ETF-related expectations continues to provide medium-term support. That said, these factors are not yet strong enough to override the current technical range in the short term.

Bottom line: ETH remains a range-bound market. As long as 2,980 holds, upside rotations toward 3,060–3,160 remain the higher-probability scenario. A confirmed break below support would shift control back to sellers and expose 2,900 → 2,780. Until a decisive breakout occurs, traders should expect sideways price action with sharp intraday swings, typical of the Christmas trading period.

This Resistance Test Will Decide the Next 10% MoveETH/USD – 1H Market Analysis

Ethereum is currently locked in a clear range structure, trading between a major support zone around 2,880–2,920 and a well-defined resistance zone near 3,060–3,120. Price has already tested both extremes multiple times, confirming that this is not a trending environment yet, but a controlled consolidation where liquidity is being built.

From a structural perspective, ETH is forming repeated higher lows inside the range, while sellers continue to defend the resistance zone aggressively. This behavior reflects compression, not weakness. The market is balancing orders, shaking out impatience, and preparing for expansion rather than reversing impulsively.

Forward Scenarios to Watch:

Primary scenario (Higher probability): Another pullback toward the mid-range or support zone, followed by a rotation higher and a renewed test of resistance.

Bullish continuation: A clean hourly close above 3,120 with acceptance opens upside toward 3,200–3,280.

Bearish invalidation: A decisive breakdown below 2,880 would shift the structure bearish and target the lower demand zone.

Bottom line:

Ethereum is not breaking out yet it’s compressing. This is the phase where smart money positions quietly, while reactive traders get chopped. The breakout will come, but only after liquidity has been fully harvested. Patience remains the edge.

ETH — Price Slice. Capital Sector. 2539.72 BPC 13© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 30.12.2025

🏷 2539.72 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 13

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2480.68 BPC 16© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 30.12.2025

🏷 2480.68 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 16

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH/USDT 4H Chart Review🧭 Current Market Structure

Medium-term trend: up, but at risk

The price has broken below the uptrend line (black diagonal).

After a strong upward impulse, a sharp downward candlestick (distribution) appeared → no continuation of the uptrend.

This is a classic signal of bullish weakness, not a full trend reversal, but a warning.

🔑 Key Levels

🟢 Resistance

3059–3070 – very strong resistance (multiple reactions)

3126 – higher timeframe resistance (if it reaches this level → euphoria)

🟡 Decision Zone (now)

2938–2960 – current consolidation

This is where the market decides whether to return above the trend or move lower.

🔴 Supports

2911 – local support (very important)

2868 – strong structural support

2755 – critical support (reversal of the uptrend)

📉 RSI Stochastic

A pullback from the upper levels (80+) to ~20

Downward momentum has not yet expired

No bullish divergence → no signal for an aggressive long

📌 Scenarios

🔵 Scenario A – bullish (less likely)

Conditions:

Defense 2911

Return above 2960 + 4-hour candle close

Trend line reclaim

Targets:

3059

3126

👉 This would be a fake breakdown

🔴 Scenario B – bearish (more likely)

Conditions:

4-hour close below 2911

No quick rebound

Targets:

2868

then 2755

👉 Healthy correction in the trend or a change in structure to sideways/bearish

ETH — Price Slice. Capital Sector. 2545.00 BPC 17© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 29.12.2025

🏷 2545.00 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 17

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2541.33 BPC 10© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 29.12.2025

🏷 2541.33 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 10

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

📎 Architect’s Note:

I thank TradingView moderation for their constructive collaboration and for enabling the display of analytical artifacts in their evolutionary state. Publishing maps in prefactum mode is not merely a technique—it is a method of future verification through structure. This is BPC quantum analytics—The Bolzen Price Covenant.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

🏷 PC-compatible international interactive link:

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2365.10 BPC 11© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 29.12.2025

🏷 2365.10 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 11

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

🏷 PC-compatible international interactive link:

— The Architect

BPC — The Bolzen Price Covenant