GOLD Massive Long! BUY!

My dear friends,

My technical analysis for GOLD is below:

The market is trading on 4708.4 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 4829.8

Recommended Stop Loss - 4622.8

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Forex

XAUUSD Long: Defends Trend Support, Targeting $5,190 SupplyHello traders! Here’s a clear technical breakdown of XAUUSD (2H) based on the current chart structure. Gold remains in a broader bullish environment after a strong impulsive move that developed from a well-defined accumulation range. Following this consolidation phase, price broke to the upside and began respecting a rising trend line, confirming sustained buyer control and healthy trend conditions. During the advance, multiple bullish breakouts occurred above prior resistance levels, each followed by continuation, reinforcing the strength of the underlying trend. This bullish leg ultimately pushed price into a major Supply Zone around 5,190, where upside momentum began to stall.

Currently, at the supply area, Gold faced strong selling pressure, leading to a sharp pullback and the formation of a descending supply line, signaling short-term corrective pressure within the broader uptrend. Price then dropped toward a key Demand Zone near 4,940, which aligns closely with the rising trend line and a previous breakout structure. This confluence of horizontal demand and dynamic trend support makes the zone technically significant. The recent decline appears corrective rather than impulsive, suggesting profit-taking and short-term distribution instead of a full trend reversal.

My scenario: as long as XAUUSD holds above the 4,940 Demand Zone and continues to respect the rising trend line, the broader bullish structure remains intact. A sustained reaction from this demand area could lead to a recovery move back toward the 5,190 Supply Level (TP1). A clean breakout and acceptance above this supply would confirm bullish continuation and open the door for further upside expansion. However, a decisive breakdown below the demand zone and trend line would invalidate the bullish bias and signal a deeper corrective phase. For now, Gold is at a key decision area, with buyers attempting to defend structure and resume the broader uptrend. Manage your risk!

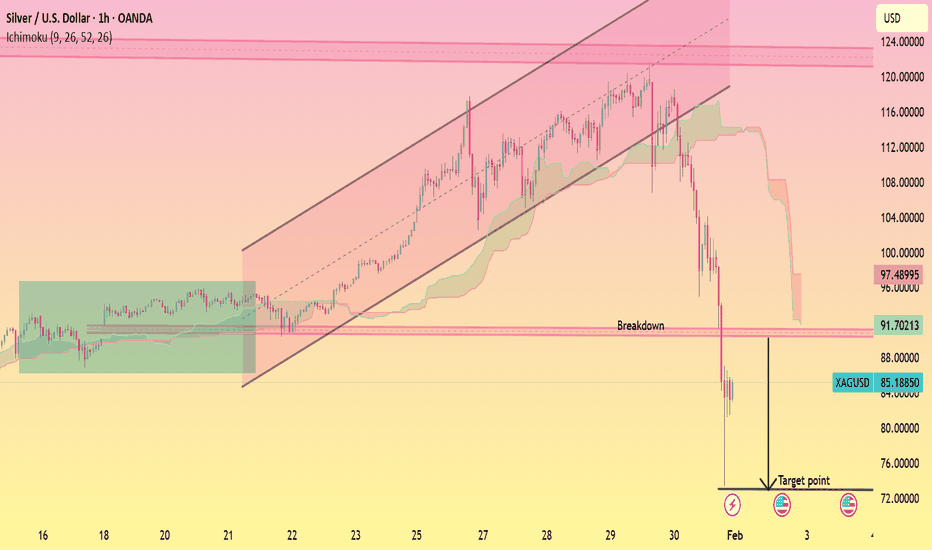

Chart Analysis & Trade Idea (Micro Silver – 1H)Price was moving inside a consolidation / range (blue box).

A strong bearish breakout occurred from the range, showing seller dominance.

After a sharp drop, price has reached a demand zone (green box).

Demand Zone Insight:

Buyer interest is visible inside the demand zone.

Strong rejection from the lows indicates selling pressure is weakening.

A possible liquidity sweep (SL hunt) below the lows followed by stabilization suggests reversal potential.

Trade Idea (Bullish Reversal Setup):

Entry: Buy from the demand zone or after bullish confirmation

Stop Loss: Below the demand zone / recent low

Targets:

TP1: 90.00

TP2: 95.00

TP3: 100.00 (next supply / resistance area)

Confirmation Signals:

Bullish engulfing or strong bullish close on 1H / 15M

Break of minor structure (higher high) for confirmation.

SOL Breakdown in Bearish ChannelThis 2-hour SOL/USD chart with Ichimoku Cloud shows a sustained downtrend inside a descending channel. After topping near the upper resistance, price rolled over, lost cloud support, and formed a bearish consolidation before breaking lower. SOL continues to trade below key resistance around 128–130, with the cloud acting as overhead pressure. The projected downside target sits near 104, signaling bearish continuation unless price reclaims the channel and cloud.

XAUUSD Trend Reversal (CHOCH)

This is a 1-hour XAUUSD (Gold/USD) chart. Price was moving inside a rising channel supported by the Ichimoku cloud. After making a high, the market showed a Change of Character (CHOCH), broke below key support and the cloud, and shifted from bullish to bearish structure. Strong selling pressure followed, with price heading toward the lower marked target zone, signaling downside continuation.

Entry at 4895

Target point 4580

XAGUSD Channel Breakdown

This is a 1-hour XAGUSD (Silver/USD) chart. Price was moving in a clear ascending channel with Ichimoku support, then broke down below the channel and key support zone. After the breakdown, strong bearish momentum appeared, indicating a trend reversal from bullish to bearish, with downside continuation toward the marked lower target area.

GBPJPY Is Going Up! Long!

Take a look at our analysis for GBPJPY.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 210.351.

The above observations make me that the market will inevitably achieve 212.357 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

Gold Reclaims Support After Sharp Drop - 5,100 Resistance as TP1Hello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure. Gold initially traded within a clearly defined range, where price moved sideways, signaling a period of consolidation and market balance before the next impulsive move. From this range, XAUUSD broke to the upside and transitioned into a well-structured ascending channel, confirming strong buyer control with a consistent sequence of higher highs and higher lows. Price respected both the rising support line and the channel resistance, highlighting healthy bullish conditions throughout this phase. As the uptrend developed, gold eventually approached the key Resistance / Seller Zone around 5,100, where selling pressure became evident. Although price briefly broke above this level, the move lacked acceptance and resulted in a sharp rejection, forming a fake breakout and trapping late buyers. Following this rejection, XAUUSD dropped aggressively toward the Buyer Zone around 4,890–4,810, which aligns with previous resistance turned support and a key horizontal support level. The reaction from this area was strong, indicating active demand and buyer interest returning to the market. Currently, price is stabilizing above the Buyer Zone and attempting to recover after the fake breakdown. This behavior suggests a corrective rebound rather than a full trend reversal at this stage. Structurally, as long as gold holds above the Buyer Zone and maintains acceptance above support, a recovery move toward the 5,100 Resistance Level (TP1) remains possible. This area also overlaps with the Seller Zone, where selling pressure is likely to reappear. My scenario: holding above the Buyer Zone keeps the corrective bullish recovery intact, with 5,100 as the primary upside target. A strong rejection from resistance could resume downside pressure, while a decisive breakdown below the Buyer Zone would invalidate the recovery scenario and signal continuation of the broader corrective move. For now, XAUUSD is at a key decision area, with buyers attempting to defend support and build upside momentum. Please share this idea with your friends and click Boost 🚀

EUR/USD – 1H | Range Breakdown & Bearish Continuation SetupEUR/USD previously traded in a clear accumulation range (green box), which acted as a base for a strong bullish impulsive move. After the breakout, price entered a distribution / consolidation zone (blue box), where upside momentum weakened and sellers gradually gained control.

Price has now broken below the range support, confirming a bearish range breakdown. The current structure shows:

Lower highs forming inside the range before the breakdown

Strong rejection from the upper boundary of the blue zone

Acceptance below the range, indicating bearish continuation potential

Bias: Bearish

Key Level: Former range support acting as resistance

Expectation: A corrective pullback toward the broken support, followed by continuation to the downside.

Trade Idea (Conceptual):

Look for sell opportunities on retracements into the broken range

Bearish continuation favored while price remains below the range low

Downside targets lie toward the next demand zone / liquidity below

Market Logic:

This is a classic range expansion → distribution → breakdown scenario. Once price fails to reclaim the range, continuation moves often follow as trapped buyers exit positions.

Why the Same Strategy Performs Differently in Crypto and ForexMany traders experience the same frustration. A strategy shows consistency in one market and breaks down in another. The instinctive reaction is to question the rules, indicators, or entries. In most cases, the strategy is not the problem. The environment is.

Crypto and Forex operate under very different structural conditions. Crypto trends tend to expand faster, with sharper volatility and deeper intraday swings. Liquidity is thinner, order books change rapidly, and price frequently overshoots levels before stabilizing. Forex moves more slowly, with deeper liquidity and more controlled reactions, especially during active sessions.

These differences change how a strategy behaves in practice. Stop placement that works well in Forex can be too tight for Crypto, where routine volatility regularly exceeds technical boundaries. Profit targets that feel conservative in Crypto may be unrealistic in Forex, where expansion unfolds more gradually. The logic of the setup remains sound, but the execution parameters no longer match the market.

Time also plays a role. Crypto trades continuously, meaning trends can develop at any hour and extend without the pauses created by session boundaries. Forex activity is concentrated around specific windows, and strategies often perform best when aligned with those periods. Running the same rules outside their optimal timing reduces effectiveness.

Risk sequencing further amplifies these differences. In Crypto, clusters of volatility can create rapid drawdowns even when the strategy remains statistically valid. In Forex, losses are often more evenly distributed, allowing smoother equity curves. Traders who do not adjust position sizing or expectations misinterpret this as inconsistency.

Successful traders adapt execution while preserving logic. Entry criteria, risk models, and trade management evolve to fit the market’s structure. The strategy stays the same. The application changes. Understanding this distinction is what allows traders to remain consistent across asset classes rather than constantly searching for something new.

Trading Gold Without a Stop Loss: A Slow Suicide1️⃣ No Stop Loss Is Not Courage

Many traders believe that trading gold without a Stop Loss shows confidence, toughness, or the ability to withstand volatility.

In reality, it often means the opposite.

Not using a Stop Loss usually comes from one simple reason: an unwillingness to admit being wrong. When price moves against the position, instead of accepting a controlled loss, traders choose to hold and convince themselves that gold will eventually come back.

The problem is that the market does not operate on personal belief.

Not having a Stop Loss does not make you stronger.

It only makes your mistakes harder to fix.

2️⃣ In Gold Trading, No Stop Loss Means No Brakes

XAUUSD is a high-volatility market that reacts aggressively to news and capital flows.

Price can move far and fast — sometimes within minutes.

Trading gold without a Stop Loss is like driving downhill without brakes.

At first, it may feel manageable.

But once momentum accelerates, you no longer have a choice.

Gold does not care where you entered.

And it will not stop just because your account is in pain.

3️⃣ A Trade Without a Stop Loss Rarely Kills You Instantly

The real danger is that it kills you slowly.

It starts with a small drawdown.

Then a deeper one.

Until you no longer have the emotional clarity to exit.

What began as a trade becomes:

- A holding position

- A hope trade

- A prayer trade

At that point, it is not just your account at risk — your discipline and mental control are already gone.

And once emotions take over decision-making, the outcome is usually inevitable.

4️⃣ Long-Term Traders Are Not the Ones Who Win the Most

They are the ones who lose with limits.

A Stop Loss is not there to be hit.

It exists so you always know:

- Where you are wrong

- How much you are willing to lose

- And whether you can come back tomorrow

In gold trading, a Stop Loss is not a personal preference.

It is the price of staying in the game.

Without it, sooner or later, the market will teach you this lesson — with real money.

GBP/AUD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

GBP/AUD pair is trading in a local downtrend which we know by looking at the previous 1W candle which is red. On the 4H timeframe the pair is going down too. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 1.970 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Market Analysis: EUR/GBP Enters Holding PatternMarket Analysis: EUR/GBP Enters Holding Pattern

EUR/GBP declined and is now consolidating losses below 0.8700.

Important Takeaways for EUR/GBP Analysis Today

- EUR/GBP is trading in a bearish zone below the 0.8690 pivot level.

- There is a key expanding triangle forming with resistance near 0.8680 on the hourly chart.

EUR/GBP Technical Analysis

On the hourly chart of EUR/GBP, the pair started a steady decline from well above 0.8725. The Euro traded below 0.8690 against the British Pound.

The EUR/GBP chart suggests that the pair even declined below 0.8660 and the 50-hour simple moving average. A low was formed at 0.8641, and the pair is now consolidating losses. There was a move above 0.8650 and the 23.6% Fib retracement level of the downward move from the 0.8716 swing high to the 0.8641 low.

The pair is now facing resistance near a key expanding triangle at 0.8680 and the 50% Fib retracement. The next major barrier for the bulls could be 0.8690.

A close above 0.8690 might accelerate gains. In the stated case, the bulls may perhaps aim for a test of 0.8715. Any more gains might send the pair toward the 0.8725 pivot.

Immediate support sits near 0.8650. The first key zone sits at 0.8640. A downside break below 0.8640 might call for more downsides. In the stated case, the pair could drop toward 0.8600.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Analysis: GBP/USD Retreats From HighsMarket Analysis: GBP/USD Retreats From Highs

GBP/USD is showing positive signs above 1.3580 and 1.3620.

Important Takeaways for GBP/USD Analysis Today

- The British Pound rallied above 1.3700 and 1.3800 before there was a pullback.

- There is a connecting bearish trend line forming with resistance at 1.3760 on the hourly chart of GBP/USD.

GBP/USD Technical Analysis

On the hourly chart of GBP/USD, the pair remained well-bid above 1.3500. The British Pound started a decent increase above 1.3650 against the US Dollar.

The bulls were able to push the pair above the 50-hour simple moving average and 1.3750. The pair even climbed above 1.3800 and traded as high as 1.3869. Recently, there was a pullback below 1.3760 and the 23.6% Fib retracement level of the upward move from the 1.3401 swing low to the 1.3869 high.

The pair is now consolidating below 1.3750. There is also a connecting bearish trend line forming with resistance at 1.3760. On the upside, the GBP/USD chart indicates that the pair is facing resistance near 1.3725.

The next hurdle for the bulls could be 1.3760. A close above 1.3760 could open the doors for a move toward 1.3870. Any more gains might send GBP/USD toward 1.4000.

On the downside, the bulls might remain active near the 50% Fib retracement at 1.3635. If there is a downside break below 1.3635, the pair could accelerate lower. The first major support is at 1.3510, below which the pair could test 1.3480.

The next key area for the bulls could be 1.3400, below which the pair could test 1.3320. Any more losses could lead the pair toward 1.3250.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GBP/JPY BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

GBP/JPY pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 4H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 210.973 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSDHello Traders! 👋

What are your thoughts on Gold?

After a strong and uninterrupted rally, Gold reached the upper boundary of the ascending channel and faced a sharp rejection, triggering a deep corrective move. Considering the extended bullish move over recent weeks without any meaningful pullback, such a correction was technically expected.

Price is currently undergoing a corrective phase. We expect the market to continue its decline after a pullback to the broken level and the highlighted resistance zone. The minimum downside target remains the lower boundary of the ascending channel.

As long as price remains below the broken resistance, corrective pressure is likely to persist.

A move toward the channel support is the primary scenario.

In case of a decisive breakdown below the channel floor, the next marked support zone will become the following downside target.

The broader trend is still bullish, but in the short to medium term, deeper correction phases should be expected.

Don’t forget to like and share your thoughts in the comments! ❤️

RegimeWorks Trade Idea — AUDUSD (Context-First Scenario Map)1) Regime Context (Higher-Timeframe)

AUDUSD is currently interacting with a key decision band on the daily structure, where price has recently pushed into a zone that matters for directional follow-through. The area marked POI aligns with a 61.8% Fibonacci retracement level, making it a high-relevance area for reaction if price rotates lower.

RegimeWorks framing: this is a context zone — not a signal. Directional permission comes from how price behaves at the decision levels.

2) Execution Context (1H Structure)

On the 1H timeframe, a Head & Shoulders structure has formed, and price has broken below the neckline at:

Neckline / decision level: 0.69798

Price is now drifting back toward that neckline, which sets up a clean “retest decision” situation.

3) Primary Scenario (Bearish Continuation — If Retest Rejects)

If price retests 0.69798 and fails to reclaim it (i.e., rejection / inability to hold above on 1H closes), then the breakdown remains structurally valid and a continuation move becomes plausible.

Path of least resistance (scenario):

Retest neckline → rejection → rotation lower

Downside interest shifts toward the POI zone, which also matches the 61.8 daily Fib retracement area

RegimeWorks interpretation: neckline rejection = “permission” for further downside within this scenario map.

4) Alternate Scenario (Breakdown Failure — If Neckline Reclaims)

If price reclaims 0.69798 and begins holding above it on closes, the breakdown thesis weakens and the move below the neckline may have been a false break / sweep.

Implication (scenario):

Reclaim + acceptance above neckline can open the door to mean-reversion back into the prior range/structure.

RegimeWorks interpretation: reclaim = “permission removed” for the bearish continuation thesis.

5) Key Levels

Decision / neckline: 0.69798

Downside objective zone (if rejection holds): POI (61.8 Fib confluence on daily mapping)

RegimeWorks Disclaimer

This is a RegimeWorks scenario map — not an instruction, not advice, and not a prediction. It outlines possible paths based on structure + confluence. Price can invalidate either scenario quickly; always wait for your own confirmation criteria before acting.

EURUSD Is Compressing at Demand — This Range Will Decide After a strong impulsive rally, EURUSD has transitioned into a corrective compression phase. Price is currently coiling between a descending resistance trendline and a clearly defined demand zone around 1.1900–1.1920, creating a tightening range. This is not random consolidation. It’s a classic post-impulse rebalancing structure, where liquidity is being absorbed before the next directional move.

From a technical perspective, buyers continue to defend the demand zone aggressively, with multiple higher lows forming inside the base. The EMA is flattening and running through the range, confirming balance rather than trend in the short term. Each rejection from resistance has weaker follow-through, suggesting sellers are distributing less effectively as price holds above demand.

Market logic:

Bullish scenario: As long as demand holds, a clean breakout and acceptance above the descending resistance would likely trigger a continuation toward 1.2000–1.2080, aligning with the next liquidity pool above prior highs.

Bearish invalidation: A decisive breakdown and close below the demand zone would shift control back to sellers, opening the door for a deeper retracement into the prior value area.

Summary:

EURUSD is not trending it’s compressing between supply and demand. The next impulsive leg will come from who wins this zone, not from prediction. Let price confirm.

Bitcoin Is Basing at Key Support Bitcoin has just completed a sharp impulsive sell-off from the $89,000–$90,000 region, breaking below the EMA 98 and accelerating lower with strong bearish momentum. This move flushed liquidity and forced price into a high-interest support zone between approximately $81,700 and $82,200. Since tagging this zone, price action has shifted character. Instead of continued expansion to the downside, Bitcoin is now consolidating with shorter candles, overlapping ranges, and failed follow-through by sellers. This behavior suggests selling pressure is being absorbed, not extended. From a structural standpoint, the current range is a post-impulse base, not a confirmed reversal yet. The market is transitioning from expansion into potential stabilization, and this is where direction is decided.

Key Technical Observations

Major impulsive breakdown completed below $85,900 (EMA 98)

Strong reaction and stabilization inside $81,700–$82,200 support zone

No new lower lows since the initial sell-off

Internal structure shows early higher-low attempts on lower timeframes

Primary Scenario (Relief Rally)

If Bitcoin holds above $81,700 and continues building acceptance:

A corrective push toward $83,800–$84,500 becomes likely

A sustained reclaim above $85,900 would confirm short-term trend relief and open upside rotation toward $87,500–$88,500

This would still be a corrective rally, not a full trend reversal, unless higher time-frame structure is reclaimed.

Alternative Scenario (Continuation Down)

If price fails to hold $81,700 with acceptance below:

Downside opens toward $80,000, then $78,500–$79,000

That would confirm the current consolidation as bearish continuation, not accumulation

Bitcoin is no longer selling aggressively it is testing whether buyers are willing to defend value.

This is a decision zone, not a prediction zone.

Let price confirm whether this base becomes a launchpad or a pause before continuation.

Support reaction here will define the next leg.

Gold Compresses Inside a Symmetrical TriangleGold is currently trading around five thousand one hundred forty-six after a strong impulsive rally from below four thousand nine hundred to above five thousand five hundred. Following that markup leg, price has transitioned into a symmetrical triangle, defined by lower highs and higher lows, while holding above the rising support trendline and the EMA ninety-eight near five thousand two hundred thirty-three. This behavior signals consolidation, not weakness. Sellers are present, but they lack momentum, and every pullback toward the five thousand one hundred to five thousand one hundred fifty area continues to be absorbed rather than sold aggressively.

From a liquidity and psychology perspective, this structure reflects position rebalancing, not distribution. Buy-side liquidity remains stacked above five thousand four hundred and five thousand five hundred, while sell-side liquidity sits below five thousand one hundred. The market is compressing to build liquidity, forcing both late buyers and early shorts into poor positioning. As long as price does not accept below five thousand one hundred, the higher probability outcome remains an upside expansion, with a breakout targeting the five thousand five hundred to five thousand six hundred zone once volatility is released.

Ethereum Lost Structure — Bearish Continuation Favored Ethereum has clearly shifted into bearish control on the 4H timeframe after a clean rejection from the $3,040–$3,080 resistance zone. That rejection was followed by a strong impulsive sell-off, confirming that the prior upside move was corrective rather than trend-reversing.

From a structural perspective, ETH is no longer rotating it is expanding to the downside.

Technical Breakdown

- Price failed decisively at the $3,040–$3,080 resistance zone

- ETH broke below the $2,935 key mid-range level

- Price is now trading below the declining EMA, confirming bearish trend alignment

- The recent bounce attempts are overlapping and weak, characteristic of bearish pullbacks, not accumulation

This sequence confirms a lower high → breakdown → continuation structure.

Primary Scenario (Bearish Continuation)

As long as Ethereum remains below $2,935, downside pressure dominates.

Key downside objectives:

First support test near $2,660

If that level fails to hold, price may extend toward $2,520–$2,550

Any short-term bounce into $2,760–$2,800 should be treated as corrective, not bullish, unless structure is reclaimed.

Invalidation / Reassessment

The bearish bias would only be questioned if ETH:

Reclaims $2,935 with strong acceptance

And follows through above $3,000

Without that, rallies are selling opportunities, not trend changes.

Ethereum is no longer in balance it has transitioned into markdown.

Until proven otherwise, the market is:

Below resistance

Below trend structure

Below momentum control

Let price confirm strength before calling a bottom. Structure comes first.

Gold Is Testing Demand Inside a Descending ChannelHello traders, Gold is currently trading near $5,160, continuing its short-term corrective phase after the rejection from the all-time high region around $5,580–$5,600. Following that rejection, price has developed a clean descending channel, confirming that the market is in a controlled pullback rather than a disorderly sell-off.

From a structural perspective, the most important area right now is the demand zone between approximately $5,080 and $5,130. This zone previously acted as a base before the impulsive breakout and now represents a key decision point. The recent sell-off has slowed as price approaches this area, indicating that selling pressure is losing momentum rather than accelerating. Technically, this pullback remains corrective. Price is retracing within the channel without breaking the broader bullish structure formed during the prior markup phase. As long as gold holds above the $5,000–$5,020 support region, the larger uptrend remains intact, and this move should be viewed as a reset in momentum rather than a trend reversal.

Two scenarios stand out clearly:

Primary scenario:

If price holds within the $5,080–$5,130 demand zone and begins to form higher lows, a corrective bounce toward the descending channel resistance near $5,300–$5,350 becomes likely. A sustained reclaim above $5,350 would strongly suggest that the correction is complete and that price may rotate back toward the prior highs.

Alternative scenario:

If price fails to hold the demand zone and accepts below $5,080, downside risk increases toward the $4,990–$5,000 region, where stronger structural support and liquidity sit. A clean break below $5,000 would signal that the correction is expanding rather than stabilizing.

Key takeaway:

Gold is not breaking its trend it is testing demand within a corrective channel.

Demand reaction here matters more than prediction. Let price confirm whether buyers defend this zone or step aside.