XAUUSD Bullish Continuation After BOS | M15 StructureChart Analysis (XAUUSD – 15M)

Market Structure

Overall bullish market structure is intact.

Clear Break of Structure (BOS) to the upside after consolidation.

Price respected prior support, formed a Point of Interest (POI), and initiated a strong bullish impulse.

Key Technical Elements

Support Zone: Strong reaction from the POI, confirming institutional demand.

Breakouts:

First breakout confirms bullish intent.

Second breakout validates continuation rather than reversal.

Order Blocks (M15 OB):

Previous OBs acted as accumulation zones.

Current price is reacting near a premium resistance OB, suggesting either a pullback or liquidity grab before continuation.

Trend: Higher highs & higher lows → Upward trend confirmed.

Liquidity (SSL): Minor sell-side liquidity taken before the impulsive move up.

Bias & Expectation

Primary Bias: Bullish continuation

Scenario:

Either a pullback from resistance into intraday demand

Or a break-and-retest before continuation toward higher targets

Forexsignal

Bullish Reversal Structure Toward 5,340 Resistance Market Structure Overview

The 1-hour chart shows gold recovering after a sharp selloff, forming a rounded bottom structure followed by higher lows — a sign of short-term bullish momentum building.

We can break the chart into three phases:

Left Side – Distribution & Breakdown

Price rejected the 5,300–5,340 resistance zone.

A sharp selloff followed, breaking structure and accelerating to the downside.

Capitulation low formed near 4,400 (marked with red circle).

Middle – Accumulation & Base Formation

Rounded bottom structure developed.

Price began forming higher lows.

Buyers defended the 4,950–5,000 support zone multiple times.

Right Side – Compression Under Mid-Range Resistance

Price is consolidating above 5,000 support.

Higher lows suggest accumulation.

Currently pressing against 5,100–5,105 minor resistance.

📌 Key Levels

Major Resistance Zone:

🔵 5,276 – 5,340

This is the primary supply area and projected upside target.

Mid Resistance:

🔵 Around 5,104

Short-term breakout level.

Major Support Zone:

🔴 5,000 – 4,996

Key demand area and potential long entry zone.

📈 Trade Idea Illustrated on Chart

Bias: Bullish

Entry: Near 5,000 support (on pullback)

Target: 5,276 → 5,340 resistance zone

Invalidation: Clean breakdown below 4,990

The projected move suggests a continuation of higher lows leading to a breakout toward the upper supply zone.

🧠 Technical Signals Supporting Bullish Case

Rounded bottom formation

Higher low structure

Strong reaction from demand zone

Consolidation under resistance (bullish compression)

Prior major resistance now acting as magnet

⚠️ Risk Scenario

If price breaks and holds below 4,990:

Structure shifts bearish

Likely retest of 4,900–4,800 zone

Bullish thesis invalidated

🎯 Summary

Gold on the 1H timeframe is showing signs of short-term bullish continuation after a strong recovery from lows. As long as price holds above the 5,000 support zone, the probability favors a move toward the 5,276–5,340 resistance region.

If momentum increases, a breakout above 5,104 could accelerate the move toward target.

EUR/USD - Analysis & Trading Plan (11-Feb-26)Expecting EUR/USD to head towards 1.21000.

Personally, I have opened a position, and if the market hits my stop loss, I will look for another buy opportunity in the highlighted zone.

NB: Risking 1% per trade.

Please like and comment, and I will share another analysis and trading plan with you.

Trade with care and make it simple.

Thank you,

Wave Hub FX

USDJPY Buy Zone ActiveToday, I want to share with you a long position on the USDJPY ( FX:USDJPY ) currency pair. In this idea, I will analyze USDJPY from a fundamental and technical perspective .

Stay with me.

This long isn’t just technical for me — the fundamentals still lean USD-positive vs JPY.

1) Yield/rate gap = the core driver

As long as US yields stay meaningfully above Japan’s, capital flows tend to favor USD, and USDJPY reflects that divergence very cleanly.

2) JPY remains structurally fragile

Japan’s policy stance is still relatively accommodative, while growth/inflation dynamics keep the yen sensitive — so when USD firms up, JPY often underperforms.

3) Key US data week = upside catalyst

With major US releases this week, any upside surprise can revive the “higher-for-longer” narrative — typically supportive for USDJPY longs.

Bottom line:

As long as the US retains a yield advantage and Japan stays cautious, the fundamental backdrop supports a bullish USDJPY bias.

--------------

Now let's take a look at the USDJPY chart on the 4-hour time frame.

USDJPY is currently moving near the support zone(155.100 JPY-154.120 JPY) and the Potential Reversal Zone(PRZ) .

From the Elliott wave theory perspective, USDJPY seems to have completed the corrective Zigzag wave(ABC/5-3-5), and we can expect the next impulse wave.

I expect USDJPY to continue to move up in the coming hours and at least increase to the resistance zone(157.900 JPY-157.400 JPY).

What is your opinion on USDJPY this week?

First Target: resistance zone(157.900 JPY-157.400 JPY)

Second Target: 158.81 JPY.

Stop Loss(SL): 154.51 JPY.

Points may shift as the market evolves

Please respect each other's ideas and express them politely if you agree or disagree.

📌 U.S. Dollar/Japanese Yen Analyze (USDJPY), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

USDJPY H4 | Bullish Bounce Off The price is falling towards our buy entry level at 154.61, which is an overlap support that is slightly below the 50% Fibonacci retracement.

Our stop loss is set at 153.56, which is a pullback support that aligns with the 78.6% Fibonacci retracement.

Our take profit is set at 157.58, which is an overlap resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Bearish reversal off pullback resistance?US Dollar Index (DXY) has rejected off the pivot, which acts as a pullback resistance that aligns with the 61.8% Fibonacci retracement and could drop to the pullback support.

Pivot: 97.85

1st Support: 95.81

1st Resistance: 99.22

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

XAGUSDHello Traders! 👋

What are your thoughts on SILVER?

Silver experienced a sharp decline after a strong rally and printing a local high, correcting nearly 50% from its peak. Upon reaching the highlighted support zone, price showed a bullish reaction, indicating the presence of buyers and the validity of this demand area.

At this stage, we expect price to spend some time moving sideways and ranging within this zone before attempting a bullish corrective move toward the specified upside levels.

As long as price remains below the key resistance areas, any upside move should be considered corrective rather than trend-reversing.

Don’t forget to like and share your thoughts in the comments! ❤️

Falling towards pullback support?AUD/NZD is falling towards the pivot and could bounce to the 1st resistance, which acts as a multi-swing high resistance.

Pivot: 1.15736

1st Support: 1.15262

1st Resistance: 1.16703

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

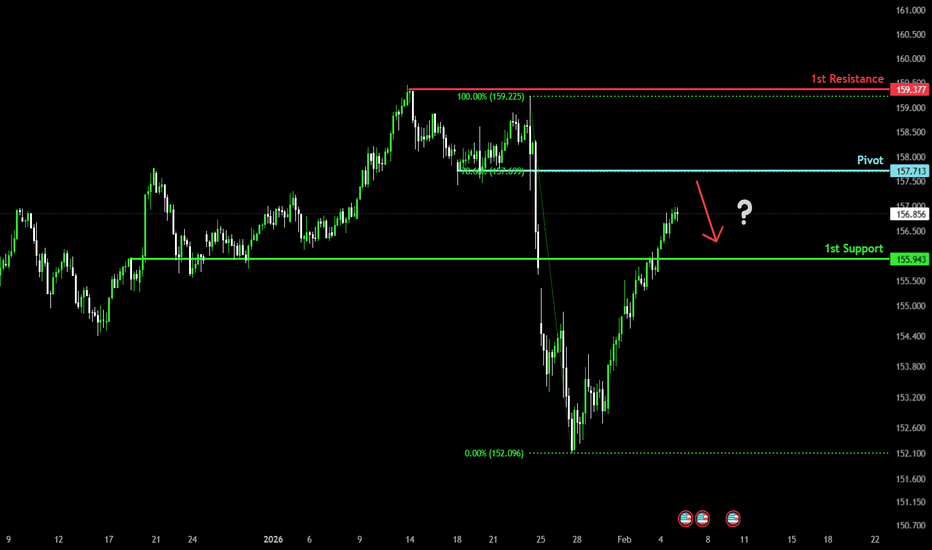

Potential bearish reversal?USD/JPY is rising towards the pivot, which is a pullback resistance and could reverse to the 1st support, which is a pullback support.

Pivot: 157.71

1st Support: 155.94

1st Resistance: 159.37

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish momentum to extend?AUD/JPY is falling towards the pivot point of 108.52, which is a pullback support and could bounce to the 1st resistance.

Pivot: 108.52

1st Support: 108.09

1st Resistance: 109.76

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

XAUUSD 45-Minute Chart — Bearish Rejection From Resistance, Bearish Rejection From Resistance, Short Setup Toward Support

Market Structure:

Gold printed a strong impulsive rally, followed by loss of momentum and a rounded/curving top, signaling distribution. The sharp sell-off confirms a shift from bullish to bearish intraday structure.

Key Resistance Zone (~5060–5070):

This zone acted as previous consolidation and supply. Price retested it from below and failed to reclaim, validating it as resistance.

Entry Logic (Short):

The highlighted entry near resistance aligns with a classic break-and-retest setup. Sellers stepped in aggressively after the retest.

Stop Loss (~5145):

Placed above the recent lower high and rejection wick, protecting against a false breakdown and trend resumption.

Target / Support Area (~4810–4850):

Clear demand zone and prior accumulation area. This is the most logical downside target where buyers previously defended price.

Risk–Reward:

The setup offers a clean R:R, favoring continuation toward support if bearish momentum holds.

Bias:

📉 Bearish below resistance — continuation lower favored unless price reclaims and holds above the resistance zone.

BTCUSD – Very Simple Market Idea (4H)BTCUSD – Very Simple Market Idea (4H)

This is the Bitcoin 4-hour chart.

The market is moving down. Price is making lower highs and lower lows. This means the trend is bearish.

Price fell strong before. Now price moved up a little. This move is only a small pullback.

The grey zone above is resistance. Sellers can enter from this area. Price may go down again.

The blue zone below is support. Price can bounce for a short time. If support breaks, price can fall more.

AUDNZD Setup: Symmetrical Triangle + Bullish FundamentalsToday, I want to share a long idea on AUDNZD ( OANDA:AUDNZD ) with you.

Let’s walk through the fundamental and technical picture step by step.

From a fundamental perspective, AUDNZD maintains a mild bullish bias.

Australia’s monetary policy remains slightly more restrictive compared to New Zealand’s.

Persistent inflation pressures keep the RBA cautious about rate cuts, while recent inflation data in New Zealand has largely been priced in and has not provided a fresh advantage for the NZD.

Additionally, Australia continues to benefit from relatively stronger growth support driven by the commodity sector, which adds to AUD resilience.

Overall, the fundamental balance currently favors AUD over NZD, making a long AUDNZD position reasonable — though, as always, not without risk.

AUDNZD is currently trading near key support lines.

From a classic technical analysis perspective, the pair is consolidating inside a symmetrical triangle, signaling compression and a potential expansion phase ahead.

From an Elliott Wave perspective, AUDNZD appears to have completed the main wave 4, suggesting the market may be preparing for the next impulsive move.

If price breaks above the upper line of the symmetrical triangle, I expect AUDNZD to push at least toward the 1.16370 NZD as an initial upside target.

First Target: 1.16370 NZD

Second Target: 1.1668 NZD

Stop Loss(SL): 1.1547 NZD

Points may shift as the market evolves

Do you think AUDNZD can resume its upward trend?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Australian Dollar/New Zealand Dollar Analysis (AUDNZD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

GBPJPY | Long Idea

GBPJPY showed a big reaction on on the DAILY support zone around 210.4

Looking for this pair to continue up from here.

Best case we see a nice reaction from the small zone around 211.4 with a nice move up.

Yesterday we had a nice move up, and I would like to see that today as well.

Let me know what you think!

Do your own due diligence, this is not investment advise!

EURGBP Long Setup as ECB-Growth Outlook Supports EuroToday, I’d like to share a trading opportunity on the EURGBP pair( OANDA:EURGBP ), so stay with me!

Let’s start with a brief fundamental overview. EUR is likely to rise against GBP as the ECB may keep the rate unchanged, and euro growth may appear stronger compared to GBP, which is likely to decline or depreciate slowly.

Currently, EURGBP is hovering near a support zone(0.8664 GBP-0.8651 GBP).

From an Elliott Wave perspective, it seems that EURGBP has completed a zigzag corrective pattern(ABC/5-3-5), and we can now anticipate the next bullish wave.

I expect EURGBP to soon begin an upward trend and target the resistance zone. If that resistance zone(0.8698 GBP-0.8688 GBP) is broken, we can look for further upward movement toward the resistance lines.

First Target: 0.8697 GBP

Second Target: 0.87105 GBP

Stop Loss(SL): 0.8649 GBP(Worst)

Points may shift as the market evolves

Do you think EURGBP can resume its upward trend?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Euro/British Pound Analysis (EURGBP), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Bullish bounce off pullback support?AUD/NZD is falling towards the pivot, which has been identified as a pullback support and could bounce to the 1st resistance.

Pivot: 1.15978

1st Support: 1.15645

1st Resistance: 1.16583

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Gold Price Breaks $5,000 | XAUUSD Bullish Outlook 2026OANDA:XAUUSD Gold Outlook 2026 Buy or Sell

📅 27 January 2026

📊 MARKET OVERVIEW

Gold posted a historic breakout on January 26, 2026, surging to new all time highs as safe haven demand intensified amid geopolitical risks, policy uncertainty, a weaker dollar, and strong central bank buying. Prices opened above $5,000 for the first time ever, hit an intraday high near $5,111, and closed around $5,080 to $5,090, confirming a decisive break above the $5,000 to $5,100 zone. Momentum stayed strongly bullish with no clear reversal signals, keeping higher targets in focus.

📌 KEY FUNDAMENTALS

📭 There is no major fundamental data scheduled today

📊 CB Consumer Confidence

🏛️ What It Is

CB Consumer Confidence is published by the Conference Board and measures how optimistic or pessimistic U.S. consumers feel about the economy. It is based on a survey covering income expectations, job availability, and future business conditions.

🧠 Why It Matters

Consumer spending makes up nearly 70% of the U.S. economy. When confidence is high, consumers are more likely to spend, supporting economic growth. When confidence weakens, it signals caution, slowing demand, and rising recession risk.

🏭 Richmond Manufacturing Index

🏦 What It Is

Released by the Federal Reserve Bank of Richmond, this index tracks manufacturing activity in the Richmond Fed district, covering new orders, shipments, employment, and capacity utilization.

🧠 Why It Matters

It is an early indicator of U.S. industrial momentum and business sentiment. Manufacturing is highly sensitive to trade policy, tariffs, and global demand.

🌍 GEO POLITICS

🔥 Trump Tariff Threats

President Trump threatened 100% tariffs on Canada over closer China ties and raised tariffs on South Korean imports to 25%. These moves reignited global trade-war fears and drove investors toward gold.

🌐 Trump Wants a deal with Iran

Former U.S. President Donald Trump said Iran is seeking a deal, claiming Tehran has repeatedly reached out for negotiations over its nuclear program. He added that Iran is aware of the strong U.S. military presence in the region and defended U.S.-backed Israeli strikes on Iranian nuclear sites, arguing that without such pressure Iran would already possess nuclear weapons and could have used them.

🛳️ U.S. Aircraft Carrier Raises Pressure on Iran

A U.S. aircraft carrier strike group led by the USS Abraham Lincoln has arrived in the Middle East, strengthening President Trump’s military options against Iran amid rising regional tensions. The deployment follows weeks of unrest in Iran, with ships expected to move closer in coming days. Iran has placed its forces on high alert, warning that any U.S. attack would trigger a severe response.

⚖️ RISK ON RISK OFF ANALYSIS

📉 10 Year US Treasury Yield

4.224% edging slightly higher, showing mild rate pressure but not derailing gold.

📊 Yield Curve Snapshot

30 Year yield near 4.804% slightly softer

5 Year yield around 3.819% pushing higher

3 Month yield near 3.674% also higher

🟡 Gold vs Yields

Despite higher yields, which normally pressure gold, prices remain strong, signaling a clear safe haven override.

💵 Dollar Interaction

US dollar weakness continues, reinforcing gold strength and offsetting yield increases.

🧠 WHAT DO ANALYSTS EXPECT

💪 Gold Strength Today

Gold remains firm near record highs, clearly outperforming risk assets as safe haven demand dominates.

🏛️ Trump Policy Impact

Tariff threats and aggressive trade rhetoric continue injecting uncertainty into global markets, directly supporting gold.

🟠 Gold vs Bitcoin

In the current stress environment, gold is preferred over crypto as investors prioritize liquidity, stability, and capital preservation.

💲 Dollar Pressure

Ongoing policy uncertainty is weighing on the US dollar, reinforcing demand for gold as a fiat alternative.

🏦 Central Bank Demand

Strong and consistent central bank buying reflects long term reserve diversification rather than short term panic.

🌐 Trade War Risks

Escalating tariff threats against major trading partners continue to amplify the geopolitical risk premium embedded in gold prices.

✅ CONCLUSION

Gold’s historic breakout above $5,000 has shifted the market into a firmly bullish regime, with safe haven demand overpowering rising yields and mixed risk signals. Persistent geopolitical uncertainty, trade war rhetoric, and dollar weakness continue to underpin strength, supported by steady central bank buying. With no immediate fundamental headwinds, gold retains a clear upside bias as investors favor stability and capital preservation.

Gold Smashes Past $5,000 – Investors Rush to Safe HavenGold prices have soared to a record high above $5,000 per ounce, as global investors seek safety amid growing political and economic uncertainty.

Gold hit $5,085.50, the highest price ever recorded.

Silver also broke records, reaching $108.60 per ounce.

Analysts believe gold could climb even higher, possibly peaking near $5,500 this year.

Why Gold Is Rising

Gold gained 64% in 2025 and has already risen more than 17% in 2026. Several factors are driving this rally:

Safe-haven demand as investors worry about global stability.

U.S. monetary policy easing, making gold more attractive.

Strong central bank buying, especially from China, which has been purchasing gold for 14 straight months.

Massive inflows into gold ETFs, showing strong investor appetite.

Political Tensions Fuel the Surge

Recent decisions by U.S. President Donald Trump have shaken confidence in U.S. assets:

He backed away from tariff threats against Europe tied to Greenland.

He announced plans for a 100% tariff on Canada if it pursues a trade deal with China.

He threatened 200% tariffs on French wines and champagne to pressure France into joining his “Board of Peace” initiative.

Analysts say these moves have created a “crisis of confidence,” pushing investors toward gold as a safer alternative.

Currency Moves Add Support

The Japanese yen strengthened, pulling the U.S. dollar lower. A weaker dollar makes gold cheaper for buyers using other currencies, further boosting demand.

Other Metals Join the Rally

Silver: up 4.57% to $107.65, after hitting $108.60.

Platinum: up 3.26% to $2,857.41.

Palladium: up 3.2% to $2,074.40.

Silver’s surge is especially notable, as it crossed the $100 mark for the first time ever, following a massive 147% rise in 2025. Tight supply and strong retail investor demand continue to fuel its momentum.

Outlook

Experts expect gold’s rally to continue, with short-term corrections likely but quickly met by strong buying. The safe-haven rush shows no signs of slowing down.

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold has experienced a fast and impulsive rally over the past weeks, reaching the psychological $5,000 level. While this move highlights strong bullish momentum, buying at these levels carries elevated risk.

From a technical perspective, the overall trend remains bullish, with price still trading within a well-defined ascending channel. However, as price approaches the upper boundary of the channel, a corrective move (pullback) is increasingly likely.

Probable Scenario:

After this sharp rally, price is expected to correct toward the key support zone. This area could provide a more favorable low-risk buying opportunity in line with the dominant trend. A bullish reaction from this support may pave the way for new all-time highs.

In the short term, this week’s FOMC meeting could have a significant impact on gold’s price action and may increase volatility.

The bullish trend remains intact, but chasing price at current levels is not recommended. Waiting for a pullback and confirmation around support levels would be the smarter strategy..

Don’t forget to like and share your thoughts in the comments! ❤️

GBPJPY at PRZ – Is a Sharp Reversal About to Start?At the moment, GBPJPY( FX:GBPJPY ) is currently within a Potential Reversal Zone(PRZ) on the 1-hour timeframe, and has formed an Ascending Channel over the past day.

From an Elliott Wave perspective, it seems that GBPJPY is completing microwave 5 of the main wave C. The correction pattern is Zigzag Correction(ABC/5-3-5).

We can also observe a negative Regular Divergence(RD-) between two consecutive valleys.

I anticipate that GBPJPY, after breaking the lower line of the ascending channel, will likely decline to 212.77 JPY. If the support line is broken, we can expect further declines toward the next target.

I’d love to hear your thoughts on GBPJPY. Do you think it will begin a downward trend on the 1-hour timeframe, or will it continue its upward movement?

First Target: 212.77 JPY

Second Target: 212.35 JPY

Stop Loss(SL): 214.31 JPY(Worst)

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 British Pound/Japanese Yen Analysis (GBPJPY), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

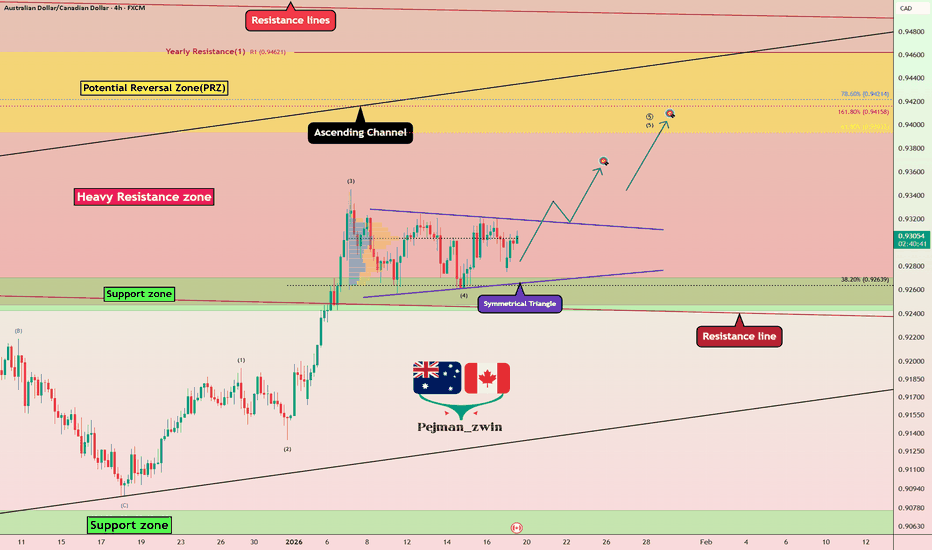

AUDCAD is Breaking Triangle — Bullish Breakout Ahead of CPI?Today, I want to share a long trading opportunity on the AUDCAD pair ( FX:AUDCAD ), so stay tuned!

Currently, AUDCAD has successfully broken through its resistance line and is now situated within a heavy resistance zone(0.9585 CAD-0.9247 CAD).

From a classic technical analysis perspective, if we look at the AUDCAD chart on the 4-hour timeframe, we can see a symmetrical triangle pattern, which suggests a continuation of the recent bullish trend of AUDCAD.

From an Elliott Wave perspective, it appears that AUDCAD has completed microwave 4 of the main wave 5, and we can expect the start of microwave 5 of the main wave 5. The breakout above the upper line of the symmetrical triangle could confirm the end of the microwave 4.

Additionally, today’s Canadian CPI data could act as a key catalyst for AUDCAD.

Based on recent macro trends, I expect inflation pressures in Canada to remain soft.

If CPI comes at or below expectations, it should weaken CAD and support a bullish continuation on AUDCAD.

As long as the structure holds, I remain biased to the long side.

As a result, I expect that after breaking the upper line of the symmetrical triangle, AUDCAD could rise at least to 0.9357 CAD.

First Target: 0.9357 CAD

Second Target: 0.9397 CAD

Stop Loss(SL): 0.9241 CAD

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Australian Dollar/Canadian Dollar Analysis (AUDCAD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.