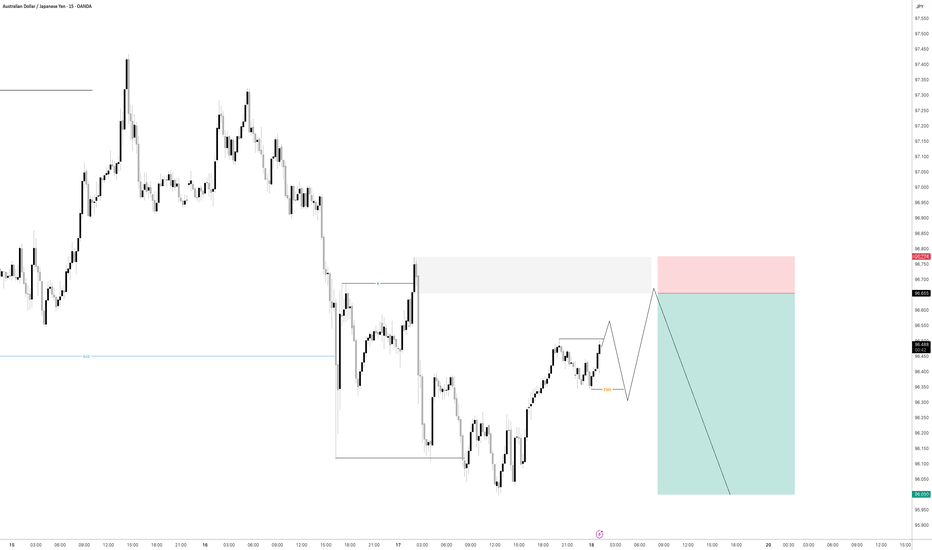

AUDJPY - POTENTIAL?USDJPY is getting super interesting.

If we can get some bearish intent to try and induce the early sellers to the downside creating some buyside liquidity then i will be all over this for a trade.

Lets see how price has moved by the morning as it does need a bit more development before we can consider entering for a short position

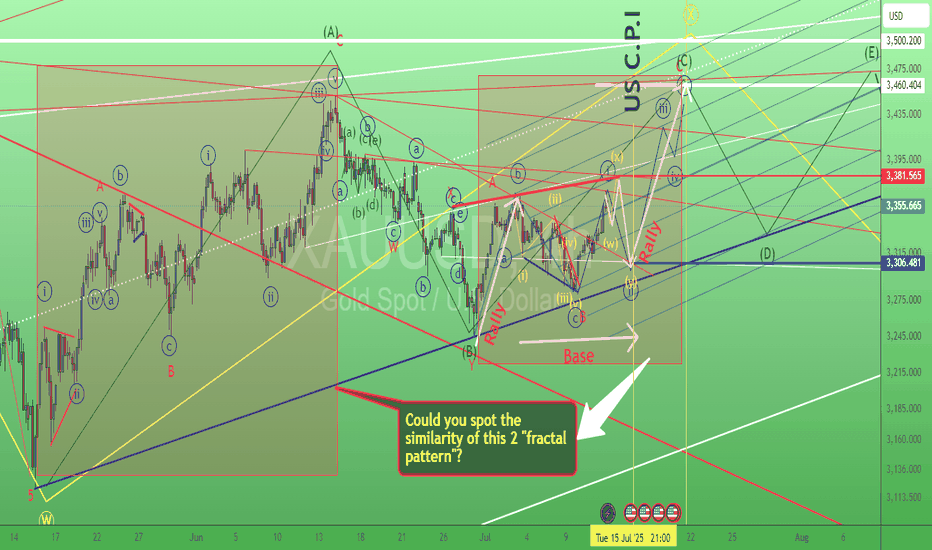

Fractal

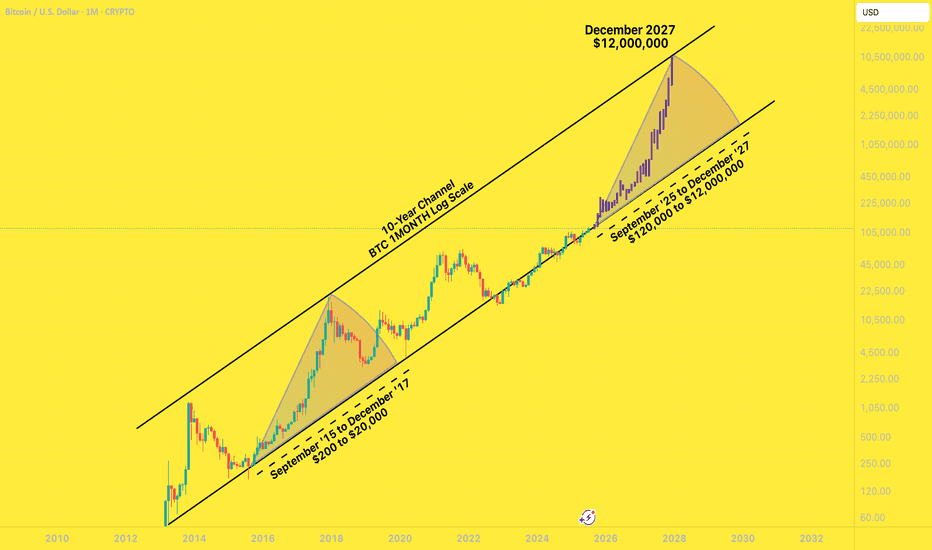

BTC to $12,000,000 December '27I had a years-old bookmarked chart from @MillionaireEconomics that I wanted to update and pick a random, extremely bullish candle pattern from the last time BTC came off the bottom channel to slap on it.

Riddle me this:

Why shouldn't Bitcoin go to $12,000,000 by December 2027?

Saylor continues to lead the way for global companies to scramble to build their own BTC warchests. These early adopters are having investor money dumped into them by the truckload.

Countries are stacking BTC

The BTC ETFs are a smash hit

Trump is all for making his own multi-billy family bitty stack

Mid-curvers will sell far too early, for far too little.

In the next two years, you'll be bombarded with countless, seemingly good reasons to sell your Bitcoins for hundreds of thousands of dollars - and then millions of dollars.

A shocking number of people will be far too early to sell. They will wake up in a cold sweat, night after night, haunted by their "could-have-been" stack, the number that updates in their head ten times a day, going up by six or seven figures a day .

... until they FOMO right back in at $11,999,999.

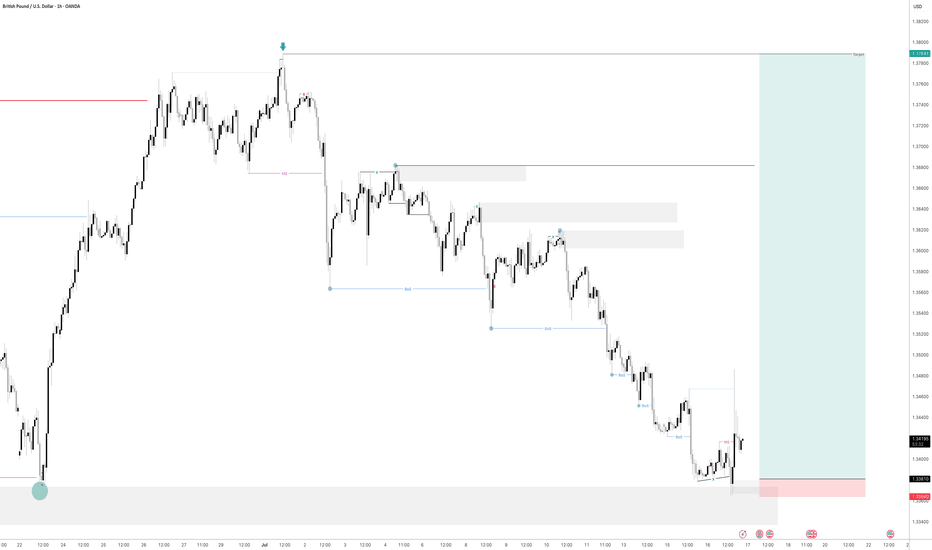

GBPUSD - Is it Ready? Looking at GBPUSD

We have had a Market shift to the upside from a HTF Point of Interest. I am now waiting for price to come back into a 15min demand area and hopefully price will take off to the upside from here.

We have also swept liquidity before a drastic move to the upside.

Lets see how this one plays out

Ethereum's Road to $7500 – Strategic Entries & Profit Optimizati🔵 Entry Zone: My first position is placed at $2225.5, aligning with a strong support level, while a secondary entry at $1857.5 serves as an additional safeguard against unexpected market swings—lowering my average purchase price and protecting capital.

💰 Profit-Taking Strategy: For low-risk traders, securing a 40% profit from the first entry is a prudent move to lock in gains early. However, my long-term target remains ambitious.

🚀 Main Target: Based on valuation models and fundamental news, Ethereum’s upside potential points toward $7500. However, I personally plan to secure 90% of my holdings at $6000, ensuring strong profit realization while leaving room for further upside.

This setup balances risk management, smart positioning, and strategic profit optimization. Let’s see how ETH’s trajectory unfolds!

Entry1: 2225.5

Entry 2: 1857.5

If your second entry is successful, you are required to withdraw 50 to 70 percent of your capital to maintain your capital. I will definitely update this setup.

$SPY: Composite Sub-Cycles (Recursive)Research Notes Documenting Commonality

I’ve identified several bar patterns that formed following significant historical declines. They share notable similarities, as if suggesting that the magnitude of past major moves sets the structure of subsequent groups of sub-cycles (which I call "building blocks" sometimes).

I placed them in respect to current scaling laws so the method of exclusion can be applied in order to familiarize with typical "terrain" of price dynamics at such phase. Documenting them because a direct study is the most effective approach to uncovering the essence of recursive patterns.

Some of the bar patterns are lowered to highlight temporal aspect which matters more than price scale.

We start ALT Season now with 3 targets!Hello guys,

As you can see we have 3 targets🎯 green, blue, red,

which target we will reach?

It depends on the Fractal scenario on the right, So we will wait 2 clear trends,

each one has 3 tops and Clear correction between the up trends,,

Don't lose your positions and don't jump between currencies!

Also Don't burn your wallet with Future!

Spot is Enough!

Bitcoin Fractal, increase to $116k Hi Everyone☕👋

BINANCE:BTCUSDT

Been such a long time since I posted. Today I'm looking at BTCUSDT, and I'm looking at the previous all time high cycle and what we were seeing (the pattern aka fractal).

Here's why we're likely going a little higher.

First correction of -32%

Followed by first peak, ATH

Correction, then the second peak and the REAL ath. Which is where we likely are:

Interesting to note that the previous time, the second ath was NOT THAT MUCH HIGHER. This should be considered to manage expectations in terms of how high we can go. Anything above +6% is a bonus.

Learning#02 : Fractals⛰️ Learning#02 : Fractals

The Cleanest Clue on a Cluttered Chart

If you like clean charts and smart price behaviour, Fractals are one of those tools that give subtle but powerful signals. They’re not magic. They simply reflect what price is telling you—if you’re willing to listen.

Let’s unpack the concept and learn how to use Fractals like a pro.

🔍 What Is a Fractal in Trading?

In technical analysis, a Fractal is a five-candle pattern that marks a local top or bottom in price. It’s a pure price-action signal that doesn’t rely on lagging indicators.

There are two types of Fractals:

Bearish Fractal (Top): The 3rd candle has the highest high, surrounded by two lower highs on each side.

Bullish Fractal (Bottom): The 3rd candle has the lowest low, flanked by two higher lows on each side.

These formations are Price's way of saying: *"I tried to go further, but couldn't."

📊 What Do Fractals Indicate?

A shift in short-term control (bulls vs. bears)

Minor support or resistance zones

Useful markers for entries, exits, or trailing stop levels

They don't guarantee reversals but are excellent at highlighting where price momentum may pause, reverse, or build structure.

📈 How to Use Fractals – A Practical Guide

Let’s be clear: Fractals are not trade signals by themselves.

Instead, they work best when used in confluence with your strategy. Think of them as tools that:

Help confirm breakout levels

Refine pullback entries

Guide you in drawing cleaner trendlines, fib zones, and support/resistance levels

Assist in identifying swing highs and lows for Dow Theory-style trend analysis

🔗 Fractals + Strategy = Smart Trading

Whether you trade breakouts or mean reversion, Fractals help clarify:

Which highs or lows matter

Where to place stop losses with structure-based logic

How to trail SL as the trade progresses

They quietly organize your chart into readable, tradeable levels.

🚀 Practical Uses of Fractals

Fractals are the first tool I add to any chart—they instantly reveal structure and guide every step of my analysis.

1. Breakout Confirmation

Wait for a candle to close above a bullish fractal high or below a bearish fractal low.

Useful when the market is trending or forming structures like double bottoms/tops.

2. Pullback with Confirmation

Use the fractal zone as a short-term S/R level. If price returns and shows signs of rejection (like an inside bar, wick rejections, or low volume), consider entries based on confirmation.

Great in sideways or swing environments.

3. Trend Structure Validation

Fractals reveal clear pivot highs/lows, helping:

Confirm higher highs/higher lows

Mark structure for trendline drawing

Validate Fib levels or S/R zones

4. Trailing Stop Loss

Update your SL to trail behind the most recent opposite-side fractals.

In longs: SL below new bullish fractals

In shorts: SL above new bearish fractals

This lets you stay in the move while managing risk like a pro.

How it’s Look Like on Chart

snapshot

⚠️ Common Mistakes to Avoid

Trading every fractal blindly

Ignoring price context or trend

Relying on fractals in low-volume, choppy markets

📝 Final Thoughts

Fractals are like breadcrumbs left by price action. They quietly point to areas where the market faced resistance or found support. Alone, they’re not enough. But in the hands of a price-action trader, they’re incredibly useful.

Used alongside market structure, confirmation signals, and clean charting habits, Fractals become:

Trend identifiers

Entry enhancers

Stop loss trail markers

⭐ Bonus Tip

Next time you mark a level, Fibonacci or draw a trendline, check if a Fractal confirms it. You’ll be surprised how often it does.

Trade simple. Trade clean.

— Kiran Zatakia

GBPUSD - Also continued downside continuationLooking at GU. This is a little bit ahead of its time in comparison to EU.

And what i mean by that is EU is a lot further away from its 4H demand zone compared to GBP so it will be super interesting to see how we react at the level we are fast approaching on GU.

I am in a short position as of Friday. I will be posting a video tomorrow showing exactly how and why i got short on GU so stay tuned for that one.

As always if there is anything else i can be of assistance with give me a message and i will be happy to answer any questions you may have

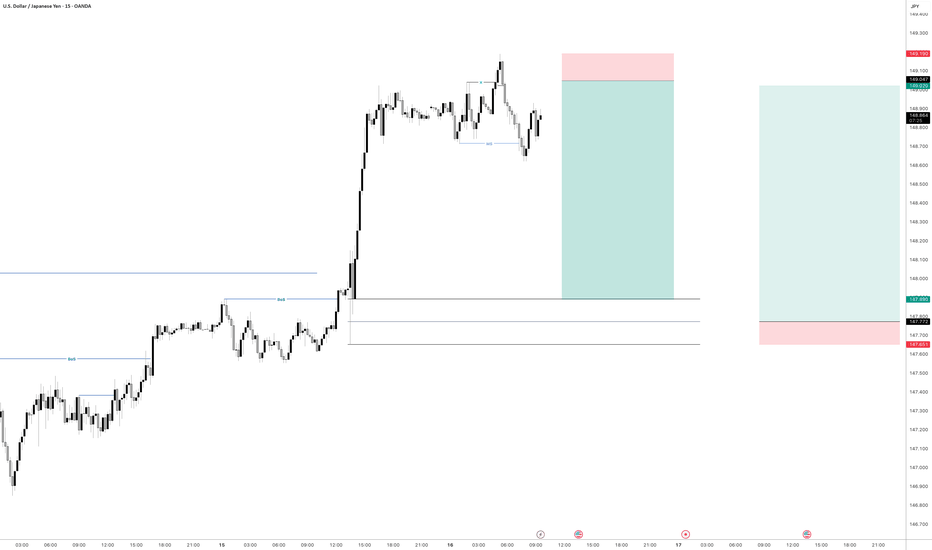

EURUSD - Still Orderflow remains bearishLooking at EU. The 1H Orderflow is still maintaining that bearish intent. My area is set now for where i want to take a potential sell to the downside seeing as everything else is pretty much mitigated.

The only issue with this potential sell of is that we never really had a sweep of liquidity before we rolled over and moved to the downside.

We do have a level of inducement before our POI but i think in an ideal world i would love to see us build up a bit more liquidity before the POI just to induce the early sellers before making that move to the downside.

For now. On the lower TF's i will be looking to take short term long positions back up to our POI before looking for the longer terms short. to our 4H POI in which i will be looking to get long once again.

Any questions feel free to give me a message

XRP/USDT Monthly Chart: History Repeating Itself?Hey traders! Let’s dive into this monthly XRP/USDT chart. I’ll be honest — I’m skeptical about this outcome, but let’s break it down because it could actually happen!

The chart screams déjà vu, with XRP’s price action mirroring the 2014-2018 period. Back then, XRP broke out from its 2014 ATH in 2017, leading to a massive rally. Fast forward to now, and we’re seeing a similar setup, but with a twist. XRP is struggling to break through the 2018 ATH resistance zone around $3.31, which reminds me of the Breakout Consolidation phase we saw in 2017. Historically, this consolidation led to a breakout, and the chart hints at a potential repeat!

If XRP breaks out soon, we could see a parabolic move, potentially targeting much higher levels. However, the current resistance is a tough hurdle, and if it fails, we might see a pullback to lower supports.

Key Levels to Watch:

Resistance: $3.31 (2018 ATH)

Support: $1.643 (previous consolidation low)

Breakout Target: To be determined (potentially parabolic)

Breakdown Risk: $0.650

I’m not fully convinced, but the setup is intriguing — could this be XRP’s moment to shine? What do you think? Let’s discuss below!

BTC Long / Buy SetupBTC is strongly Bullish towards 120k liquidity level, I'm not seeing any healthy correction before hitting the 120k level. If BTC strongly breaks and closes below 106.9k then chances are high that it will touch the weekly level and again come to 107k level, but this time it will struggle to break the 107k level because it will become bearish fvg, if it holds the 107k level and give any strong reaction from the zone then the next level is 120k. even a wick towards 105k or below doesn't matter, any body closing below the 106.9k (at least 4hrs) will lead short term weakness to the trend.