Dollar is strengthening against euro Hello! This is your finance professional speaking. Today we will look at one of the most important currency pairs in the global economy - EUR/USD.

Let’s start with fundamental analysis.

The EUR/USD pair reflects the ratio of the euro to the US dollar and reacts sensitively to central bank decisions, macroeconomic statistics, and overall risk appetite in global markets. Two institutions play a key role here - the European Central Bank (ECB) and the U.S. Federal Reserve (Fed).

Now let’s break down the key indicators and see how they influence the EUR/USD exchange rate.

1. Interest rates of the ECB and the Fed

This is the main driver of the pair’s movement. When rates in the U.S. are higher, the dollar becomes more attractive to investors and EUR/USD usually declines. If ECB policy is tighter or rates in the eurozone are relatively higher, the euro receives support.

2. Inflation

Rising inflation forces central banks to tighten monetary policy.

High inflation in the U.S. increases the likelihood of Fed rate hikes and supports the dollar.

Rising inflation in the eurozone strengthens expectations of tightening from the ECB and supports the euro.

3. Labor market

Strong U.S. employment data (NFP, unemployment) strengthens the dollar and raises expectations of higher interest rates. A weakening labor market, on the other hand, puts pressure on the dollar. The same logic applies to the eurozone.

4. Economic growth (GDP)

Higher growth makes a country’s assets more attractive.

Strong U.S. economic growth supports the dollar; strong eurozone growth supports the euro.

5. Market risk sentiment

In periods of uncertainty, investors move into safe-haven assets. The dollar traditionally plays the role of a "safe haven", so when global risks increase, the EUR/USD pair often declines.

Now let's move on to technical analysis.

1)EUR/USD has formed 5 Elliott waves up, indicating a potential trend completion.

2)At the end of the trend, a Wyckoff distribution structure has formed, signaling selling activity.

3)The reverse USDEUR chart shows that the dollar is being bought.

DXY is also an important indicator. In the attached screenshot, you can see that the dollar index is currently strengthening, and if it continues to rise, all dollar-denominated assets may undergo a correction.

Overall, that’s the situation!

Write in the comments what you think

Fxtrading

EURJPY smart money is here!Hi! A financier is at the screens - today I’ll show you the trade I entered.

In front of us is the EURJPY chart.

First, it’s worth noting that the inverse chart JPYEUR looks very weak. This tells us that the euro is indeed stronger now, and we may see growth.

Second, in mid-December we had a similar structure. I’ve highlighted these structures with a blue rectangle.

Inside these rectangles, an accumulation schematic based on Wyckoff formed. This suggests that we have potential for a reversal and solid upside. It’s also worth noting that the structures are similar to each other and exhibit fractality.

So overall, I opened a long position, aiming to trade it up to the high where we have a liquidity shelf.

USDJPY Wait For The Beak!The Bank of Japan just hiked interest rates by 25 bps to 0.75%, the highest level in ~30 years. FED lowering while BOJ raising rates is bad juju for the carry trade.

Why carry risk is rising

BOJ hikes = funding cost up. Yen is no longer “free money.”

Fed cuts = yield advantage shrinking. The whole carry equation weakens.

Compression kills carry. You don’t need parity — you just need the gap to narrow.

What actually breaks carry trades

Not the BOJ hike

Not the Fed cut

The moment markets believe the trend is durable

Carry trades die on expectations, not announcements.

Keep an eye out for the breakout.

If carry breaks, bad juju for Crypto & AI trade,

XAUUSD (Gold) – Bullish Exhaustion → Short OpportunityGold is currently trading near a strong resistance zone after a sharp impulsive move, showing signs of bullish exhaustion. Price is respecting the rising trendline, but rejection from the upper zone suggests a potential pullback / correction.

🔹 Key Observations:

Strong bullish push followed by consolidation

Price reacting near a premium resistance area

Possible lower high formation

Trendline break or rejection could trigger downside momentum

🎯 Bearish Scenario:

If price fails to hold above resistance, we may see a corrective move toward the demand zone highlighted on the chart.

📌 Targets:

First support near 4536 area, followed by deeper continuation if momentum increases.

🛑 Invalidation:

A strong close and hold above the resistance zone will invalidate the short setup.

⚠️ Risk Management:

Always wait for confirmation and manage risk properly. This is not financial advice.

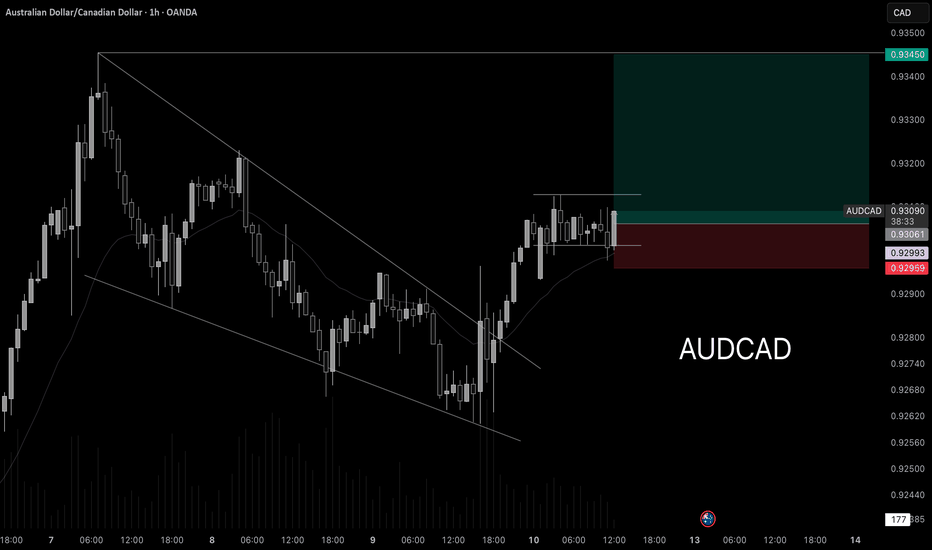

AUDCAD going long!Hello! This is your finance professional, and here is a new high-quality analysis.

Today we will review the AUDCAD currency pair.

On the chart, we can see that after a strong impulse the price went into a correction. The decline did not follow a usual structure but formed a wedge pattern.

A wedge pattern is a reversal structure. That is exactly what happened — the price reversed and we saw the continuation of the uptrend.

Right now, I have taken a long position according to my trend-following strategy and set the target at the asset’s high.

BTCUSD 1H – Trendline Resistance + Supply Zone RejectionBitcoin is trading under a strong descending trendline, showing clear bearish pressure on the 1H timeframe. Price has revisited a key supply/resistance zone (green area) and failed to break above it, indicating seller dominance.

The recent pullback looks corrective, and price is expected to reject from the supply zone and continue the downside move. A bearish continuation is likely as long as BTC remains below the trendline resistance.

Target:

➡️ Previous demand/support zone around 89,700 – 89,800

Invalidation:

❌ Sustained candle close above the supply zone & trendline

Risk Management:

Use proper position sizing and wait for confirmation before entry.

⚠️ This is not financial advice. Trade with discipline.

FX TRADINGI just closed a position in CADGBP

Track record

+ 36% since April 17, 2025

Win Rate = 100%

Technique

Reflexivity : (return to the mean, ) At one point of the wave, there is a reverse undertow

The goal is to take advantage of this phenomena

I use only PF charts. The challenge is assessing the right size of the box. It is calculated with a simple algorithm. The larger the box, the longer it takes time to close the trade.

The trend is your friendHello everyone. I’m a financier and this is educational post that might help you get closer to consistent profitability (if you actually get the point).

Today I want to talk about trend trading. Yes - that very “best friend of a trader” that every book and every course keeps repeating. And after years in the market I can say: it’s not just a cliché - it really works.

I’ve been through plenty of strategies: classic TA, Elliott Waves, Smart Money Concepts, Williams’ trading chaos - you name it. I’ve traded with the trend, against it, and inside ranges.

Honestly, the results were average. My monthly win rate was about 30–40%. Not terrible, but I wanted fewer mistakes and more stability.

Eventually I set one hard rule for myself:

👉 I only trade in the direction of the trend.

And statistically, that mostly means trading the uptrend.

Here’s the logic. Any asset can drop around 99.99% - the downside is capped. But to the upside there is no limit. An asset can grow 2x, 5x, 10x and more. So statistically, longs are more favorable. I still take shorts when the market structure is bearish, but lately most assets are trending up.

So what’s the real advantage of trading with the trend?

The market has its own momentum. It’s simply easier to move with that flow than to fight it. I stopped trying to outsmart the market or predict every reversal. I don’t obsess over overbought/oversold signals. I just wait for my setup - the same repeatable scenario - and I trade it in the direction of the trend.

I’m a boring trader - and that’s exactly why I’m a profitable trader.

On social platforms my job is to share analysis and possible scenarios. But trading itself is different: the goal is not to predict, the goal is to execute. If the setup plays out - great. If not -no problem, I wait for the next one. I’m no longer a hostage to my own forecasts, which only kill objectivity.

Trend filters out a huge number of bad trades. It instantly removes about half of all random entries. After I really internalized that, my win rate improved, my psychology inside trades got much cleaner, less FOMO, less second-guessing. I stopped guessing - and started systematically executing.

So my takeaway for today:

👉 Trend really is your friend.

Try focusing only on trend trading and then tell me in the comments how it changed your results and mindset.

FX 2025 RecapThe price action in FX futures throughout 2025 was defined by a historic retreat of the U.S. dollar, which saw its "grip slip" as the U.S. Dollar Index fell by approximately 9% over the year. The primary driver was a dramatic shift in Federal Reserve policy; after holding rates steady for much of the year, the Fed Pivot in September, triggered by a softening labor market and the "One Big Beautiful Bill," resulted in a series of rate cuts that brought the fed funds rate down to 4.25% by December. This dollar weakness provided a massive tailwind for major G10 futures, with the Swedish Krona emerging as the top performer with a 20% gain, while the Euro and Swiss Franc both surged roughly 14% against the greenback in the first half of the year alone.

Volatility reached "monstrous" levels in the second quarter due to the "Liberation Day" tariffs announced on April 2. This event triggered a massive risk-off stampede, causing the Cboe

Volatility Index to witness its largest-ever one-day spike and sending daily global FX turnover to a record $9.6 trillion. While the dollar initially spiked on safe-haven demand, the subsequent "Trump trade" exhaustion and concerns over fiscal sustainability during the longest U.S. government shutdown in history cemented the bearish trend. In contrast, the Japanese Yen futures experienced significant whipsaws as the Bank of Japan diverged from its peers by raising rates to 0.5%, creating a complex environment where traders had to balance narrowing interest rate differentials against the threat of 24% tariffs on Japanese auto exports.

If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

*CME Group futures are not suitable for all investors and involve the risk of loss. Copyright © 2023 CME Group Inc.

**All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

GBPUSD BUY SETUP | Bullish Continuation | High-Probability TradeGBPUSD on the 1H timeframe shows strong bullish momentum after a clean breakout above the key resistance zone. Price is now forming a bullish flag / falling channel, indicating a healthy pullback before the next impulsive move.

📈 Trade Idea

Bias: Buy (Bullish Continuation)

Entry: Break & hold above the flag resistance

Target: 1.3600 – 1.3610 🎯

Invalidation: Below 1.3468

🔍 Why this works

Strong impulsive move = smart money participation

Flag structure = continuation pattern

Previous resistance flipped into support

Clear risk-to-reward setup (RR 💪)

⚠️ Risk Management

Always wait for confirmation and manage risk properly. No FOMO trades.

GBPUSD - Ascending Channel at $1.35

Executive Summary

FX:GBPUSD is trading at $1.3498 on December 28, 2025, consolidating near 3-month highs within a well-defined ascending channel on the 2H timeframe. The British Pound is having its best year since 2017 (+8% YTD) while the US Dollar is on track for its worst year since 2003 (-9.9% YTD). Price is testing critical resistance at $1.3520-1.3560 after breaking above $1.35 for the first time in three months. The Bank of England's cautious stance on rate cuts versus the Fed's expected easing creates a favorable backdrop for sterling, but thin holiday volumes and overbought conditions warrant caution.

BIAS: NEUTRAL - Watching for Breakout at Resistance

The trend is clearly bullish with +8% YTD. The ascending channel is intact. However, price is testing critical resistance near multi-month highs. Wait for breakout confirmation or pullback to support before entering.

Current Market Context - December 28, 2025

GBP/USD is in a strong uptrend:

Current Price: $1.3498 (-0.04% on the day)

Day's Range: $1.3477 - $1.3527

52-Week Range: $1.2099 - $1.3789

52-Week High: $1.3789 (approaching)

Technical Rating: BUY

Performance Metrics - ALL GREEN (except 6M):

1 Week: Positive

1 Month: +2%

3 Months: Positive

6 Months: -1.49%

YTD: +7.88%

1 Year: +7.57%

Sterling is having its best year against the Dollar since 2017. The pound broke above $1.35 for the first time in three months.

THE BULL CASE - Dollar Weakness Driving Sterling Higher

1. Dollar's Worst Year Since 2003

The US Dollar has been under severe pressure:

Dollar Index (DXY) on track to lose 9.9% for the year

Steepest annual drop since 2003

Whipsawed by tariff chaos and Fed independence concerns

"The USD risk premium widened in December" - HSBC

"USD weakness may reflect growing concerns around Fed independence" - HSBC

2. Fed Rate Cut Expectations

Fed funds futures pricing in 2-3 rate cuts in 2026

First cut expected as early as March/April

Goldman Sachs expects "two more 25bp cuts to 3-3.25%"

Fed balancing weakening labor market against inflation concerns

Lower rates = weaker Dollar = stronger Sterling

3. Bank of England Cautious on Cuts

BoE cut rates by 25bps to 3.75% in December

Narrow 5-4 vote reflecting ongoing inflation concerns

Governor Bailey: rates will trend lower "but not as quickly as markets might hope"

UK inflation at 3.2% - still above BoE's 2% target

Hawkish BoE vs Dovish Fed = Sterling strength

4. Improving UK Economic Sentiment

"Sterling-wise looks to be some improving sentiment towards the outlook" - Neil Wilson, Saxo Markets

Revised GDP figures showed substantial upward revision to business investment

UK GDP grew 0.1% in Q3, in line with expectations

Budget delivered extra fiscal headroom, triggering relief rally

Positioning was negative going into Budget - relief rally since

5. Sterling's Best Year Since 2017

GBP/USD up over 8% YTD

Best annual performance since 2017

Broke above $1.35 for first time in 3 months

Up over 2% in December alone

Outperforming most G10 currencies

THE BEAR CASE - Short-Term Caution

1. Near Multi-Month Highs

Price at 3-month highs

Testing critical resistance zone $1.3520-1.3560

Natural resistance after strong rally

Profit-taking risk elevated

52-week high at $1.3789 still ~300 pips away

2. Thin Holiday Volumes

Year-end trading conditions

Many market participants off

Thin liquidity can cause erratic moves

"Thin turn of year markets provide opportunity" for sharp reversals

Reduced participation until January

3. Overbought Conditions

+8% YTD rally

+2% in December alone

Extended from moving averages

Mean reversion possible

Consolidation healthy after strong move

4. UK Fiscal Concerns

Budget watchdog to publish forecasts on March 3

Any negative assessment could pressure sterling

Fiscal headroom remains tight

BoE forecasts flat growth in Q4

5. Potential Dollar Bounce

Dollar oversold after -9.9% YTD decline

Risk-off events could boost Dollar safe-haven appeal

Fed could turn hawkish if inflation persists

Yen intervention could trigger broader FX volatility

Expert Analysis

MUFG Strategists:

"The drop for the dollar this year is unlikely to be a one-off with scope for further gains ahead."

HSBC Analysts:

"The USD risk premium widened in December which suggests USD weakness may reflect growing concerns around Fed independence, not just the monetary policy outlook."

"With many other G10 central banks on hold, we think Fed liquidity operations and a slight dovish Fed bias leaves the USD outlook tilted to the downside."

Neil Wilson, Saxo Markets:

"Sterling-wise looks to be some improving sentiment towards the outlook for the economy even if it looks a bit miserable in the trenches right now."

"Positioning was kind of negative going into the Budget so as that delivered extra fiscal headroom we have seen some relief rally since."

Goldman Sachs (David Mericle):

"We expect the FOMC to compromise on two more 25bp cuts to 3-3.25% but see the risks as tilted lower."

Technical Structure Analysis

Price Action Overview - 2 Hour Timeframe

The chart shows a textbook bullish structure:

Ascending Channel Characteristics:

Clear ascending channel established

Lower trendline: Rising support (yellow dashed)

Upper trendline: Rising resistance (yellow dashed)

Higher highs and higher lows throughout

Price respecting channel boundaries well

Currently trading near upper channel boundary

Key Zones Identified (Purple Shaded):

Upper resistance zone: $1.3520-$1.3560

Lower support zone: $1.3220-$1.3280

Major resistance lines: Red horizontals at key levels

Channel width: ~300 pips

Current Position:

Price at $1.3498 - testing upper resistance zone

Consolidating after push to 3-month highs

52-week high at $1.3789 within reach

Technical rating: BUY

Key Support and Resistance Levels

Resistance Levels:

$1.3527 - Day's high / immediate resistance

$1.3520 - Resistance zone lower boundary

$1.3535 - Recent 3-month high

$1.3560 - Resistance zone upper boundary

$1.3600 - Psychological resistance

$1.3650 - Secondary resistance

$1.3700 - Psychological level

$1.3789 - 52-WEEK HIGH (major target)

Support Levels:

$1.3477 - Day's low / immediate support

$1.3450 - Secondary support

$1.3400 - Psychological support

$1.3350 - Tertiary support

$1.3320 - Support zone upper boundary

$1.3280 - Support zone lower boundary

$1.3220 - CHANNEL FLOOR (major support)

$1.2099 - 52-Week low

Channel Analysis

Channel established from October lows

Strong upward slope - bullish momentum

Price respecting both boundaries

Channel width: approximately 300 pips

Upper boundary: ~$1.3520-$1.3560

Lower boundary: ~$1.3220-$1.3280

Breakout above channel would accelerate rally

Moving Average Analysis

Price trading above all major moving averages

MAs sloping upward - bullish alignment

Short-term MAs above long-term MAs

MAs providing dynamic support on pullbacks

Trend structure bullish on all timeframes

SCENARIO ANALYSIS

BULLISH SCENARIO - Breakout to 52-Week High (60% Probability)

Trigger Conditions:

2H close above $1.3560 resistance zone

Volume confirmation on breakout

Dollar Index breaks below 97.50

Fed signals more rate cuts

Risk-on sentiment continues

Price Targets if Bullish:

Target 1: $1.3600 - Psychological level

Target 2: $1.3650 - Secondary resistance

Target 3: $1.3700 - Psychological level

Target 4: $1.3789 - 52-week high

Extended: $1.3850+ (new highs)

Bullish Catalysts:

+8% YTD momentum

Ascending channel intact

Fed rate cut expectations (2-3 cuts in 2026)

Dollar's worst year since 2003

BoE cautious on cuts vs Fed dovish

Sterling at 3-month highs

Best year since 2017

BEARISH SCENARIO - Pullback to Channel Support (40% Probability)

Trigger Conditions:

Rejection at $1.3520-$1.3560 resistance

Break below $1.3400 support

Dollar bounce on strong US data

Risk-off sentiment

BoE turns more dovish

Price Targets if Bearish:

Target 1: $1.3400 - Psychological support

Target 2: $1.3320 - Support zone upper boundary

Target 3: $1.3280 - Support zone lower boundary

Target 4: $1.3220 - Channel floor

Bearish Risks:

Near 3-month highs - natural resistance

Thin holiday volumes

Overbought after +8% YTD

Profit-taking risk elevated

Potential Dollar bounce

UK fiscal concerns (March 3 forecasts)

NEUTRAL SCENARIO - Consolidation in Range

Most likely short-term outcome:

Price consolidates between $1.3400-$1.3560

Thin holiday trading

Wait for January for directional clarity

Healthy consolidation before next leg

Channel support provides floor

MY ASSESSMENT - NEUTRAL with Bullish Bias

The weight of evidence favors bulls, but caution warranted at resistance:

Bullish Factors (Dominant):

+8% YTD - Best year since 2017

Ascending channel intact

Dollar's worst year since 2003 (-9.9%)

Fed rate cuts expected (2-3 in 2026)

BoE cautious vs Fed dovish

52-week high within reach

Technical rating: BUY

Higher highs and higher lows

Bearish Factors (Minor):

Near 3-month high resistance

Thin holiday volumes

Overbought short-term

Profit-taking risk

My Stance: NEUTRAL - Wait for Confirmation

The trend is clearly bullish with +8% YTD. The ascending channel is intact. Fed rate cut expectations continue to pressure the Dollar. However, price is testing critical resistance after a strong rally. Wait for breakout confirmation or pullback to support.

Strategy:

Wait for breakout above $1.3560 OR

Buy dips to $1.3280-$1.3320 support zone

Target $1.3650, $1.3700, $1.3789 (52-week high)

Stops below channel support

Don't chase at current levels

Respect the ascending channel

Trade Framework

Scenario 1: Breakout Trade Above $1.3560

Entry Conditions:

2H close above $1.3560

Volume confirmation

Dollar Index weakness

Trade Parameters:

Entry: $1.3565-$1.3580 on confirmed breakout

Stop Loss: $1.3480 below recent support

Target 1: $1.3650 (Risk-Reward ~1:1)

Target 2: $1.3700 (Risk-Reward ~1:1.4)

Target 3: $1.3789 (52-week high, Risk-Reward ~1:2.5)

Scenario 2: Buy the Dip at Support Zone

Entry Conditions:

Price pulls back to $1.3280-$1.3320 zone

Bullish rejection candle

Channel support holds

Trade Parameters:

Entry: $1.3280-$1.3320 at support zone

Stop Loss: $1.3200 below channel floor

Target 1: $1.3400 (Risk-Reward ~1:1)

Target 2: $1.3520 (Risk-Reward ~1:2.5)

Target 3: $1.3650 (Risk-Reward ~1:4)

Scenario 3: Channel Bottom Buy

Entry Conditions:

Price tests $1.3220 channel floor

Strong bounce with volume

Channel support holds

Trade Parameters:

Entry: $1.3220-$1.3250 at channel bottom

Stop Loss: $1.3180 below channel

Target 1: $1.3400 (Risk-Reward ~1:3)

Target 2: $1.3520 (Risk-Reward ~1:5)

Target 3: $1.3650 (Risk-Reward ~1:8)

Scenario 4: Rejection Short (Counter-Trend)

Entry Conditions:

Clear rejection at $1.3520-$1.3560

Bearish engulfing or pin bar

Dollar strength returns

Trade Parameters:

Entry: $1.3520-$1.3540 on rejection

Stop Loss: $1.3590 above resistance

Target 1: $1.3400 (Risk-Reward ~1:2.4)

Target 2: $1.3320 (Risk-Reward ~1:4)

Note: Counter-trend - smaller position size

Risk Management Guidelines

Position sizing: 1-2% max risk per trade

Respect the ascending channel

Buy dips, don't chase highs

Thin holiday volumes = wider stops

Scale out at targets

Move stop to breakeven after first target

Watch Dollar Index for confirmation

Monitor BoE and Fed commentary

Invalidation Levels

Bullish thesis invalidated if:

Price closes below $1.3220 (channel floor)

Ascending channel breaks down

Dollar Index surges above 100

BoE signals aggressive rate cuts

Bearish thesis invalidated if:

Price closes above $1.3789 (new 52-week high)

Channel breaks to upside

Dollar Index breaks below 96

Fed signals aggressive rate cuts

Conclusion

FX:GBPUSD is in a strong bullish trend, trading at $1.3498 within a well-defined ascending channel. Sterling has gained +8% YTD (best since 2017) as the Dollar weakens (-9.9% YTD, worst since 2003). The 52-week high at $1.3789 is within reach.

The Numbers:

Current Price: $1.3498

YTD Performance: +7.88%

1-Year Performance: +7.57%

52-Week High: $1.3789

52-Week Low: $1.2099

Dollar YTD: -9.9% (worst since 2003)

Key Levels:

$1.3789 - 52-WEEK HIGH (bullish target)

$1.3520-$1.3560 - Upper resistance zone

$1.3498 - Current price

$1.3400 - Psychological support

$1.3280-$1.3320 - Lower support zone

$1.3220 - Channel floor

The Setup:

Ascending channel intact. Fed rate cuts pressuring Dollar. BoE cautious on cuts. Sterling outperforming. All signs point higher, but respect resistance.

Strategy:

NEUTRAL stance - wait for confirmation

Buy breakout above $1.3560

Buy dips to $1.3280-$1.3320 support zone

Target $1.3650, $1.3700, $1.3789 (52-week high)

Stops below channel support

Respect the trend

The trend is your friend. Don't fight Sterling's momentum, but don't chase at resistance.

EURUSD - Ascending Channel at 1.1770 | Dollar Weakness + Fed Executive Summary

FX:EURUSD is trading at 1.17705 on December 26, 2025, consolidating near the top of a well-defined ascending channel on the 4H timeframe. The Euro has had an impressive year with +13.67% YTD gains as the US Dollar weakens on Fed rate cut expectations. The pair is approaching the 52-week high of 1.19187, with the ascending channel structure suggesting continued bullish momentum. However, short-term technicals show slight bearish divergence, and thin holiday trading could bring volatility.

BIAS: BULLISH - Ascending Channel Intact

The trend is clearly bullish with +13.67% YTD. The ascending channel is well-defined and intact. Buy dips to channel support, target the 52-week high.

Current Market Context - December 27, 2025

EUR/USD is in a strong uptrend:

Current Price: 1.17705 (-0.07% on the day)

Day's Range: 1.17615 - 1.17966

52-Week Range: 1.01766 - 1.19187

52-Week High: 1.19187 (approaching)

Technical Rating: Slightly bearish short-term

Performance Metrics - ALL GREEN:

1 Week: +0.41%

1 Month: +1.52%

3 Months: +0.90%

6 Months: +0.37%

YTD: +13.67%

1 Year: +12.96%

Every timeframe is positive. The Euro is having its best year against the Dollar in recent memory.

THE BULL CASE - Dollar Weakness Driving Euro Higher

1. Fed Rate Cut Expectations

The US Dollar has been under pressure as investors price in further Federal Reserve rate cuts:

Fed funds futures pricing in 2-3 rate cuts in 2026

First cut expected as early as March/April

Fed balancing weakening labor market against inflation concerns

Divided Fed has left investors on edge about policy outlook

Lower rates = weaker Dollar = stronger Euro

2. Dollar Index Weakness

Dollar Index (DXY) at 97.96

Poised for 0.8% weekly drop - weakest since July

Euro, Sterling, Swiss Franc all pushing to recent highs

Dollar has fallen throughout 2025 as Fed cuts rates

Other central banks expected to hold rates steady

3. Fed Chair Succession Uncertainty

Jerome Powell's term ends in May

Trump to nominate replacement

Any inkling of Trump's decision could sway markets

Uncertainty adding to Dollar weakness

4. US-EU Tensions (Potential Euro Catalyst)

US sanctioned former EU officials including Thierry Breton

Tensions over digital regulation and Big Tech

France's Macron condemned the sanctions

Could lead to Euro strength as EU asserts sovereignty

Transatlantic tech rift deepening

5. Seasonal Strength

2025 significantly outperforming 2024 and 2023 seasonally

Euro typically strong in year-end trading

Thin holiday volumes can amplify moves

THE BEAR CASE - Short-Term Caution

1. Technical Rating Shows Slight Bearish

TradingView technicals gauge pointing toward "Sell"

Short-term overbought conditions possible

Near 52-week high - natural resistance

Consolidation after strong rally

2. Thin Holiday Trading

Many markets closed or light volumes

Thin liquidity can cause erratic moves

Year-end positioning adding volatility

Reduced participation until January

3. US Economic Data Still Solid

Jobless claims unexpectedly fell last week

US businesses see year-ahead employment growth at 4.32%

Revenue growth expectations at 3.83%

Strong data could limit Dollar weakness

4. Potential Dollar Bounce

Dollar oversold after recent decline

Mean reversion possible

Fed could turn hawkish if inflation persists

Risk-off events could boost Dollar safe-haven appeal

Technical Structure Analysis

Price Action Overview - 4 Hour Timeframe

The chart shows a textbook bullish structure:

Ascending Channel Characteristics:

Clear ascending channel established

Lower trendline: Rising support (cyan dashed)

Upper trendline: Rising resistance (cyan dashed)

Higher highs and higher lows throughout

Price respecting channel boundaries well

Currently trading in upper half of channel

Key Zones Identified (Purple Shaded):

Upper resistance zone: 1.1800-1.1820

Middle support zone: 1.1700-1.1740

Lower support zone: 1.1480-1.1520

Major resistance line: ~1.1820 (red horizontal)

Major support line: ~1.1480 (red horizontal)

Current Position:

Price at 1.1770 - near upper channel

Consolidating after recent push higher

Testing middle of recent range

52-week high at 1.19187 within reach

Key Support and Resistance Levels

Resistance Levels:

1.1797 - Day's high / immediate resistance

1.1800-1.1820 - Upper resistance zone (purple)

1.1850 - Secondary resistance

1.1900 - Psychological resistance

1.1919 - 52-WEEK HIGH (major target)

1.2000 - Extended target / psychological

Support Levels:

1.1761 - Day's low / immediate support

1.1740 - Secondary support

1.1700-1.1740 - Middle support zone (purple)

1.1650 - Channel midline area

1.1600 - Psychological support

1.1480-1.1520 - Lower support zone (purple)

1.1480 - MAJOR SUPPORT (red line)

Channel Analysis

Channel established from late November lows

Strong upward slope - bullish momentum

Price respecting both boundaries

Channel width: approximately 300-350 pips

Midline providing dynamic support/resistance

Breakout above channel would accelerate rally

Moving Average Analysis

Price trading above all major moving averages

MAs sloping upward - bullish alignment

Short-term MAs above long-term MAs

MAs providing dynamic support on pullbacks

Trend structure bullish on all timeframes

SCENARIO ANALYSIS

BULLISH SCENARIO - Breakout to 52-Week High

Trigger Conditions:

4H close above 1.1820 resistance zone

Volume confirmation on breakout

Dollar Index breaks below 97.50

Fed signals more rate cuts

Risk-on sentiment continues

Price Targets if Bullish:

Target 1: 1.1850 - Secondary resistance

Target 2: 1.1900 - Psychological level

Target 3: 1.1919 - 52-week high

Extended: 1.2000+ (new highs)

Bullish Catalysts:

+13.67% YTD momentum

Ascending channel intact

Fed rate cut expectations (2-3 cuts in 2026)

Dollar weakness continuing

Euro outperforming seasonally

52-week high within reach

All performance metrics green

BEARISH SCENARIO - Pullback to Channel Support

Trigger Conditions:

Rejection at 1.1800-1.1820 resistance

Break below 1.1700 support zone

Dollar bounce on strong US data

Risk-off sentiment

Fed turns hawkish

Price Targets if Bearish:

Target 1: 1.1700-1.1740 - Middle support zone

Target 2: 1.1650 - Channel midline

Target 3: 1.1600 - Psychological support

Extended: 1.1480-1.1520 - Lower support zone

Bearish Risks:

Technical rating showing slight bearish

Near 52-week high - natural resistance

Thin holiday volumes

Potential Dollar bounce

US economic data still solid

Overbought short-term

NEUTRAL SCENARIO - Consolidation in Range

Most likely short-term outcome:

Price consolidates between 1.1700-1.1820

Thin holiday trading

Wait for January for directional clarity

Healthy consolidation before next leg higher

Channel support provides floor

MY ASSESSMENT - BULLISH with Short-Term Caution

The weight of evidence favors bulls:

Bullish Factors (Dominant):

+13.67% YTD - Strong trend

Ascending channel intact

All performance metrics green

Fed rate cuts expected

Dollar weakness continuing

52-week high within reach

Seasonal strength

Higher highs and higher lows

Bearish Factors (Minor):

Technical rating slightly bearish

Near 52-week high resistance

Thin holiday volumes

Short-term overbought possible

My Stance: BULLISH - Buy Dips

The trend is clearly bullish with +13.67% YTD. The ascending channel is intact and well-defined. Fed rate cut expectations continue to pressure the Dollar. The 52-week high at 1.1919 is the obvious target.

Strategy:

Buy dips to 1.1700-1.1740 support zone

Target 1.1850, 1.1900, 1.1919 (52-week high)

Stops below channel support

Don't chase at current levels

Respect the ascending channel

Trade Framework

Scenario 1: Breakout Trade Above 1.1820

Entry Conditions:

4H close above 1.1820

Volume confirmation

Dollar Index weakness

Trade Parameters:

Entry: 1.1825-1.1840 on confirmed breakout

Stop Loss: 1.1750 below recent support

Target 1: 1.1900 (Risk-Reward ~1:1)

Target 2: 1.1919 (52-week high)

Target 3: 1.2000 (Extended)

Scenario 2: Buy the Dip at Support Zone

Entry Conditions:

Price pulls back to 1.1700-1.1740 zone

Bullish rejection candle

Channel support holds

Trade Parameters:

Entry: 1.1700-1.1740 at support zone

Stop Loss: 1.1650 below channel midline

Target 1: 1.1800 (Risk-Reward ~1:1.2)

Target 2: 1.1850-1.1900 (Risk-Reward ~1:2)

Target 3: 1.1919 (52-week high)

Scenario 3: Channel Bottom Buy

Entry Conditions:

Price tests 1.1480-1.1520 major support

Strong bounce with volume

Channel support holds

Trade Parameters:

Entry: 1.1500-1.1550 at channel bottom

Stop Loss: 1.1430 below major support

Target 1: 1.1700 (Risk-Reward ~1:2)

Target 2: 1.1800 (Risk-Reward ~1:3.5)

Target 3: 1.1900+ (Extended)

Risk Management Guidelines

Position sizing: 1-2% max risk per trade

Respect the ascending channel

Buy dips, don't chase highs

Thin holiday volumes = wider stops

Scale out at targets

Move stop to breakeven after first target

Watch Dollar Index for confirmation

Monitor Fed commentary

Invalidation Levels

Bullish thesis invalidated if:

Price closes below 1.1480 (major support)

Ascending channel breaks down

Dollar Index surges above 100

Fed signals no more rate cuts

Bearish thesis invalidated if:

Price closes above 1.1919 (new 52-week high)

Channel breaks to upside

Dollar Index breaks below 96

Fed signals aggressive rate cuts

Conclusion

FX:EURUSD is in a strong bullish trend, trading at 1.17705 within a well-defined ascending channel. The Euro has gained +13.67% YTD as the Dollar weakens on Fed rate cut expectations. The 52-week high at 1.1919 is within reach.

The Numbers:

Current Price: 1.17705

YTD Performance: +13.67%

1-Year Performance: +12.96%

52-Week High: 1.19187

52-Week Low: 1.01766

Key Levels:

1.1919 - 52-WEEK HIGH (bullish target)

1.1800-1.1820 - Upper resistance zone

1.1770 - Current price

1.1700-1.1740 - Middle support zone

1.1480-1.1520 - Lower support zone

The Setup:

Ascending channel intact. Fed rate cuts pressuring Dollar. Euro outperforming seasonally. All performance metrics green. The path of least resistance is higher.

Strategy:

BULLISH stance - buy dips

Buy 1.1700-1.1740 support zone

Target 1.1850, 1.1900, 1.1919 (52-week high)

Stops below channel support

Respect the trend

The trend is your friend. Don't fight the Euro's momentum.

ETH Base Formation Under Bearish PressureCRYPTOCAP:ETH is forming a solid base near the bottom, which is a positive sign for a potential short-term bounce.

However, the overall trend remains bearish, with price still capped below the descending trendline and resistance zone.

Any upside from here is likely corrective unless ETH breaks and holds above key resistance.

DYOR, NFA

Please hit the like button if you like it, and share your views in the comments section.

AVNT Testing Key Resistance After Trendline BreakNYSE:AVNT is testing a key resistance zone after breaking above the descending trendline. While this bounce looks promising, price needs to hold above this level for any sustained upside.

A rejection here could lead to another pullback, so confirmation is key.

DYOR, NFA

EURUSD at Key Supply Zone – Shorts AheadEURUSD is reacting from a strong supply zone after taking buy-side liquidity. Price shows rejection and potential lower-high formation, suggesting a bearish continuation toward demand zones. Waiting for confirmation before entry. Trade with proper risk management.

Gold Is Pressing the Old ATH — The Final Break Looks ImminentMARKET BRIEFING – XAU/USD (4H)

Market State:

– Gold is in a strong bullish continuation structure, forming higher lows along an ascending support while compressing directly beneath the old ATH at 4,380.

– This is bullish stair-step price action, not exhaustion buyers are accepting higher prices on every pullback.

Key Levels:

– Old ATH / Decision Zone: 4,360 – 4,380

– Structure Support: ~4,260 – 4,270

– Trend Support (Ascending): intact

– Upside Objective: 4,450 → 4,500 (New ATH)

Price Action:

– Repeated rejections below ATH are getting shallower, signaling supply absorption.

– Each pullback is met with faster buying, confirming strong demand control.

– Compression against resistance = breakout pressure, not distribution.

MACRO CONFIRMATION – WHY THIS BREAK HAS BACKING

1. Fed Policy Caps the Downside

– The Fed remains on hold, with markets pricing future easing rather than further tightening.

– Real yields struggle to move higher → historically bullish for gold.

2. USD Lacks Follow-Through

– The Dollar fails to trend despite elevated rates a late-cycle signal.

– This reduces headwinds for gold near key resistance.

3. Persistent Safe-Haven & Central Bank Demand

– Geopolitical risk and fiscal uncertainty remain unresolved.

– Central banks continue to accumulate gold, reinforcing structural demand beneath price.

4. Liquidity Inflection Favors Hard Assets

– As global liquidity stabilizes, gold tends to lead upside expansions before other assets react.

Next Move:

– Holding above 4,260 keeps the bullish structure intact.

– Acceptance above 4,380 opens clean price discovery toward 4,450–4,500.

– Any dip into ascending support is a continuation setup, not a reversal signal.

Altcoin Market Cap Building Energy Before Next ExpansionThe total crypto market cap excluding the top 10 continues to follow a familiar cycle of accumulation, breakout, expansion, and consolidation. After strong moves, the market typically ranges for a period before the next leg.

Currently, it is consolidating within a wide range, similar to past phases before major expansions. This suggests the market is building energy, not distributing.

A breakout above the range could trigger the next expansion phase for altcoins, while patience is needed until that happens.

NFA

Please hit the like button if you like it, and share your views in the comments section.

Gold Bulls in Control | XAUUSD Trade IdeaXAUUSD remains bullish 📈 Price is consolidating above key support after a strong impulsive move. A healthy pullback into demand could offer buy opportunities, targeting previous highs and the upper supply zone. Bias stays bullish unless support breaks. Trade with proper risk management.