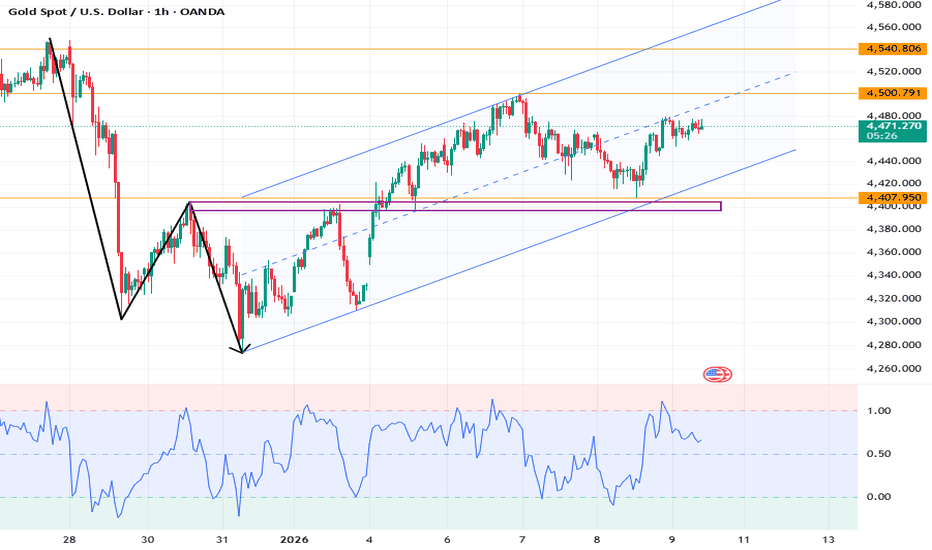

Elise | XAUUSD – 30M | Range Reaction After DistributionAfter rejection from the distribution zone, XAUUSD moved into a corrective bearish phase. Sellers failed to extend below the range lows, resulting in a strong rejection candle from support. This reaction suggests liquidity collection below the range and a potential mean reversion toward upper levels, provided price holds above support.

Key Scenarios

✅ Bullish Reaction Scenario 🚀

If price continues to hold above the range low and builds structure:

🎯 4,430

🎯 4,465

🎯 4,490 (range high retest)

❌ Bearish Continuation Scenario 📉

Failure to hold above 4,396 with acceptance below support opens downside continuation toward deeper liquidity.

Current Levels to Watch

Resistance 🔴: 4,465 – 4,490 (Mid-range & Distribution Base)

Support 🟢: 4,396 – 4,405 (Range Low / Reaction Zone)

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

Gann

just atetrade hit tp for a 1:3

gotta start being more discipline posting my trades but I get lazy with it lolol. IDK why I even post, probably because trading is lonely AF and I have no one to talk to about this

almost complete with my stage 1 funded account challenge with funding pip

after getting funded, going to risk 0.5% per trade so I get 20 tries. think about it, if you have 20 tries that means you always have a buddy with you. you have 10 fingers and your buddy has 10 fingers. 2 sticks are always stronger than 1. which is risking 1% per trade because the max loss limit is 10%

piece out everyone! I wish everyone love and abundance (:

Jesus is King 👑

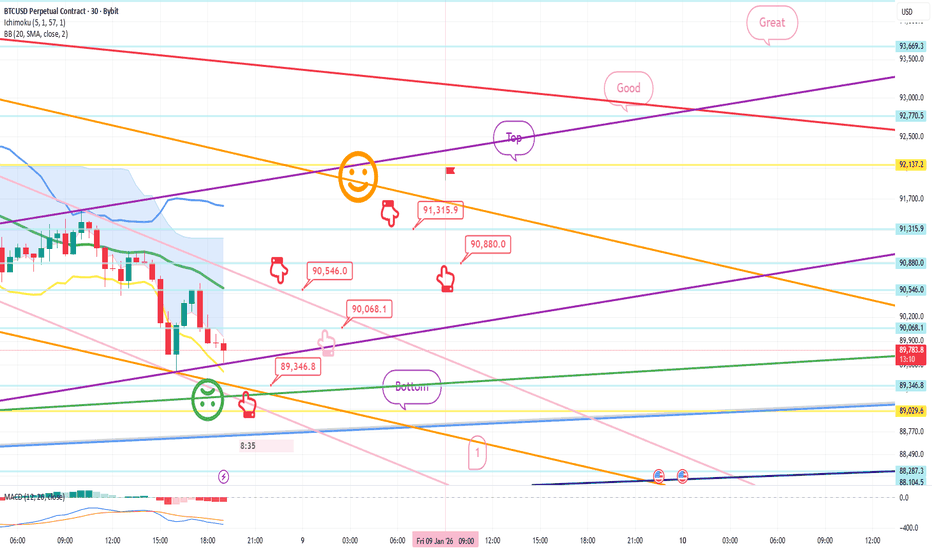

Elise | BTCUSD – 30M | HTF Demand Reaction SetupBITSTAMP:BTCUSD

After a sustained sell-off, price tapped into HTF demand and produced a strong impulsive reaction followed by consolidation. The market is currently compressing above demand, suggesting sellers are losing momentum. A higher low above the demand zone would signal a potential corrective bullish move.

Key Scenarios

✅ Bullish Case 🚀

If price holds above the HTF demand zone and breaks minor intraday structure:

🎯 Target 1: 91,200

🎯 Target 2: 92,000

🎯 Target 3: 92,800

❌ Bearish Case 📉

A clean breakdown and close below 88,900 would invalidate the bullish idea and expose lower liquidity levels.

Current Levels to Watch

Resistance 🔴: 91,200 – 92,000 – 92,800

Support 🟢: 89,600 – 88,900

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

AUDUSD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST📅 Q1 | D9 | W1 | Y26

📊 AUDUSD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

DXY — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST📅 Q1 | D9 | W1 | Y26

📊 DXY — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

XAUUSD: Market Trends and News Analysis on January 9thRegarding tonight's US NFP employment report, the market generally expects an increase of approximately 60,000 jobs, a slight decrease in the unemployment rate to 4.5%, and a 0.3% month-over-month increase in hourly wages. This is the first NFP employment report released entirely on schedule since the US government shutdown last October disrupted the data release schedule. While current inflation is above the 2% target level, the Fed's next decision will still depend on whether the weakness in the labor market continues to justify easing policies, highlighting the importance of this data.

A weak labor market is generally positive for gold prices: If job growth slows and the unemployment rate rises, indicating weakening economic activity, it could strengthen market expectations for a Fed rate cut. Rate cuts typically reduce the opportunity cost of holding gold, driving up gold prices.

Short-term volatility is possible: If the actual data is lower than expected (e.g., non-farm payrolls significantly lower than 60,000 or the unemployment rate higher than 4.6%), gold prices may rise due to increased safe-haven demand and expectations of a rate cut. Conversely, if the data exceeds expectations, gold prices may face short-term pressure.

In summary, regardless of the data results, the interest rate cut and geopolitical uncertainty are expected to continue supporting gold prices. In the short term, gold prices are likely to remain on an upward trend, maintaining a high level (above 4400) and fluctuating within a narrow range.

Technically, the daily chart showed a bullish hammer candlestick pattern yesterday. Although prices slightly retraced during the Asian session, they still found support, indicating that short-term market expectations for further gains remain strong. However, cautious trading was observed during the Asian and European sessions. Traders are awaiting the data release, and technical analysis will be less relevant during the NY session, so further analysis will be omitted.

Considering the risks associated with the NFP data, a conservative strategy is to remain on the sidelines and avoid the uncertainty brought about by the shift in market focus. Support levels to watch in the NY market are around 4420/4395. Avoid trying to predict the top during an uptrend; be aware that new highs may be reached at any time.

More analysis →

USDCAD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST📅 Q1 | D9 | W1 | Y26

📊 USDCAD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:USDCAD

EURUSD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST📅 Q1 | D9 | W1 | Y26

📊 EURUSD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURUSD

GBPUSD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST📅 Q1 | D9 | W1 | Y26

📊 GBPUSD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPUSD

EURGBP — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST📅 Q1 | D9 | W1 | Y26

📊 EURGBP — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURGBP

Elise | BTCUSD – 30M | Bearish Structure ContinuationBITSTAMP:BTCUSD

After tapping into the HTF supply region, Bitcoin showed strong bearish displacement followed by a series of weak corrective pullbacks. Each pullback has failed below prior resistance, indicating continuation rather than reversal. The current price action suggests distribution and trend continuation toward lower liquidity levels.

Key Scenarios

❌ Bearish Continuation 📉

As long as price remains below the bearish structure trendline and HTF supply, continuation targets remain active:

🎯 88,800

🎯 87,600

🎯 86,000 (extended liquidity sweep)

✅ Bullish Invalidation 🚫

A strong break and close above the bearish trendline with acceptance would invalidate the short bias and shift structure.

Current Levels to Watch

Resistance 🔴: 90,800 – 92,000 (Structure Resistance)

Support 🟢: 88,800 – 87,600 (Liquidity Target Zone)

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

AUDCAD Intraday Rebound Above 0.9269 – Targets 0.9301 & 0.9309Market: AUD/CAD (Australian Dollar vs Canadian Dollar)

Timeframe: Intraday (M15–M30)

Bias: Rebound / Short-term recovery

🔍 Analysis

AUD/CAD is trading near a strong pivot support at 0.9269 after a recent pullback.

Price is showing signs of stabilization, and this area may act as a base for a technical rebound.

As long as price holds above 0.9269, a move toward higher resistance levels remains possible.

🎯 Key Levels

Support / Pivot: 0.9269

Resistance 1: 0.9301

Resistance 2: 0.9309

Upper Resistance: 0.9317

📈 Trading View (Educational)

Rebound bias only above 0.9269

Watch for bullish reaction near support

A clear break below 0.9269 may invalidate this rebound idea

This setup is based on intraday price action and key technical levels.

⚠️ Risk Management

Always use proper risk management and stop-loss.

Avoid over-trading in low-momentum sessions.

📝 Disclaimer

This analysis is for educational purposes only and not financial advice.

Forex trading involves risk, and market conditions can change quickly.

You are fully responsible for your own trading decisions.

OANDA:AUDCAD GETTEX:AUD LSE:CAD CRYPTOCAP:FOREX $INTRADAY $PRICEACTION $SUPPORTRESISTANCE $TRADINGVIEW

ETHUSD: Ethereum Wave Structure Awaits ImpulseETHUSD: Ethereum Wave Structure Awaits Impulse

ETHUSD Wave Overview (D1 and H4)

As a trader who has been practicing wave analysis for over ten years, I note that the current picture for Ethereum shows the completion of an extended corrective formation and the potential for a new move.

Chart D1: The global structure indicates that the market is gradually breaking out of its sideways range. The wave formation looks like the end of a correction, which is laying the foundation for the next impulse.

Chart H4: Local dynamics confirm the first signs of an impulse. Key entry points are forming here, which could mark the beginning of a larger wave.

Main Scenario

After the completion of the corrective phase, a downward impulse sequence is expected to develop. This movement may be accompanied by increased seller activity and a shift in focus to the downside.

Alternative Scenario

If the price holds above local peaks and forms a stable upward impulse structure, the focus will shift to continued growth. In this case, the correction will be considered incomplete, and Ethereum may experience an additional rebound.

Trading Idea

Conservative approach: wait for confirmation of a breakout of key levels and enter with the trend.

Aggressive approach: use local impulses on H4 for earlier entries, but with short stops.

In both cases, it is important to maintain strict risk management and adjust the plan as new impulses emerge.

Results

ETHUSD is at a crossroads between the end of the correction and the beginning of a new impulse. The wave structure on D1 and H4 provides clear guidelines for action: watch for confirmation of the scenario and act with discipline.

XAUUSD: Market Analysis and Strategy for January 8thGold Technical Analysis:

Daily Resistance: 4540, Support: 4350

4-Hour Resistance: 4500, Support: 4400

1-Hour Resistance: 4440, Support: 4415

The daily gold chart shows a pullback, but the overall magnitude is not large. The short-term structure still maintains a bullish outlook. Although there is a technical pullback, it cannot be ruled out that this is due to the anticipated negative impact of the non-farm payroll data. The deviation correction of the moving average indicators has basically ended. The price is repeatedly testing the support level of 4420. The price is trading above the upward trend line support. On the daily chart, the gold price is still in an upward channel. Pay attention to the upward rebound energy after the technical indicators stabilize. The short-term resistance level is around 4500. Once 4500 is recovered, the historical high could be broken at any time.

The 1-hour chart shows a downward trend with oscillations. It is in a downward channel, with the moving averages crossing downwards. The resistance level is moving down in a step-like manner. The Bollinger Bands are widening and have a continued downward trend. Pay attention to the short-term resistance level around 4440 and the support level around 4400.

Trading Strategy:

BUY: 4408~4400

More Analysis →

JENUARY 8 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

The Nasdaq indicator will be released shortly at 10:30 AM.

*When the red finger moves,

this is a one-way long position strategy.

1. $89,346.8 is the entry point for a long position.

Stop-loss price is set when the green support line is broken.

(It must be touched before 9 PM,

to complete the 6+12 pattern and trigger an uptrend.)

2. I've marked the wave path with the finger in the middle.

The short-term target price is $90,546 -> $91,516.9.

After re-entering the long position at $90,880,

the target price is in order from Top -> Good -> Great.

If it touches the bottom today,

the mid-term pattern will be broken again,

creating the possibility of further declines. Please be careful.

The bottom section is connected to the uptrend line, so it's best to maintain a long position.

The bottom section is open up to section 1.

Please note that my analysis up to this point is for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

How Investors Earn from Interest Rate Differentials in MarketCarry Trade Profits:

Carry trade profits arise from one of the oldest and most widely used strategies in global financial markets: borrowing money in a low-interest-rate currency and investing it in a higher-interest-rate currency or asset. The core idea is simple, but the execution, risks, and macroeconomic implications are complex. Over decades, carry trades have shaped capital flows, influenced exchange rates, and occasionally amplified financial crises. Understanding how carry trade profits are generated, sustained, and lost is essential for traders, investors, policymakers, and students of international finance.

Concept and Basic Mechanics of Carry Trade

At its foundation, a carry trade exploits interest rate differentials between two countries. An investor borrows funds in a country where interest rates are low—historically currencies like the Japanese yen or Swiss franc—and converts those funds into a currency where interest rates are higher, such as the Australian dollar, New Zealand dollar, or emerging market currencies. The borrowed funds are then invested in higher-yielding assets such as government bonds, money market instruments, or even equities.

Carry trade profits come from two main sources. The first is the interest rate spread, which is the difference between the low borrowing cost and the higher investment yield. The second potential source is exchange rate movement. If the high-yielding currency appreciates or remains stable against the funding currency, profits increase. Even if the exchange rate remains unchanged, investors can still earn steady income purely from the interest differential.

Why Carry Trades Become Attractive

Carry trades tend to flourish in periods of global economic stability, low volatility, and predictable monetary policy. When central banks signal prolonged low interest rates, investors gain confidence that funding costs will remain cheap. At the same time, higher-yielding economies attract capital, reinforcing the attractiveness of the trade.

Low global inflation, ample liquidity, and accommodative central bank policies also support carry trade profits. When risk appetite is strong, investors are more willing to take exposure to currencies and markets perceived as riskier but rewarding. In such environments, carry trades can generate consistent returns that outperform traditional low-yield investments.

Role of Monetary Policy and Interest Rate Cycles

Central bank policies are the backbone of carry trade profitability. Interest rate decisions by major central banks like the US Federal Reserve, European Central Bank, Bank of Japan, and Reserve Bank of Australia directly shape funding costs and yield opportunities. A prolonged low-rate policy in one economy effectively turns its currency into a funding currency.

When interest rate cycles diverge—some economies tightening while others remain accommodative—carry trade opportunities expand. However, when central banks shift unexpectedly or signal rapid tightening, carry trade positions can unwind abruptly. Thus, carry trade profits are highly sensitive to changes in forward guidance, inflation expectations, and economic data.

Exchange Rate Risk and Its Impact on Profits

While interest differentials generate steady income, exchange rate movements can magnify or erase carry trade profits. A sudden depreciation of the high-yielding currency against the funding currency can wipe out months or even years of interest gains in a short period. This is why carry trades are often described as strategies that deliver small, consistent profits punctuated by occasional large losses.

Currency volatility increases during periods of geopolitical stress, financial crises, or global risk aversion. In such moments, investors rush to unwind carry trades, buying back funding currencies and selling high-yield currencies. This mass exit leads to sharp exchange rate reversals, intensifying losses.

Carry Trade Profits Across Asset Classes

Although traditionally associated with currency markets, carry trade principles apply across asset classes. In bond markets, investors borrow at short-term rates and invest in longer-term or higher-yield bonds. In equity markets, leveraged investments funded by low-cost borrowing can resemble carry trades. Even in commodity and crypto markets, investors use similar logic by borrowing cheaply to invest in assets with higher expected returns.

In emerging markets, carry trade profits often come from investing in high-yield government bonds. These trades can provide attractive returns but expose investors to political risk, inflation shocks, and capital control measures. As a result, carry trade profits in emerging markets tend to be higher but far more volatile.

Systemic Effects and Global Capital Flows

Carry trades influence global capital flows and exchange rate dynamics. Large inflows into high-yielding economies can lead to currency appreciation, asset price inflation, and credit expansion. While this can support growth, it may also create vulnerabilities, such as asset bubbles and excessive foreign debt.

When carry trades unwind, the reverse happens. Capital flows out rapidly, currencies depreciate, and financial conditions tighten. This pro-cyclical behavior has been observed during major global events, where carry trade reversals intensified market stress and volatility.

Risk Management and Hedging Strategies

To protect carry trade profits, investors often use risk management tools such as stop-loss orders, currency options, and diversification across multiple currency pairs. Some investors partially hedge exchange rate risk, sacrificing a portion of yield to reduce downside exposure.

Successful carry traders closely monitor macroeconomic indicators, central bank communications, inflation trends, and geopolitical developments. They understand that carry trade profits depend not only on yield but also on stability. Timing exits is as important as entering the trade.

Carry Trade Profits in the Long Term

Historically, carry trades have delivered positive average returns over long periods, particularly during stable economic phases. However, returns are unevenly distributed. Most profits accumulate gradually, while losses occur suddenly during crises. This asymmetric payoff profile requires discipline, patience, and robust risk controls.

Institutional investors such as hedge funds, banks, and asset managers are better positioned to manage these risks due to access to leverage, hedging instruments, and real-time data. Retail investors can participate but must be cautious, as leverage amplifies both gains and losses.

Conclusion

Carry trade profits represent a powerful but double-edged strategy in global finance. By exploiting interest rate differentials, investors can generate steady income and enhance portfolio returns during periods of stability. However, these profits come with significant exposure to exchange rate risk, monetary policy shifts, and sudden changes in market sentiment.

Understanding the macroeconomic environment, managing risk carefully, and respecting the cyclical nature of global markets are essential for sustaining carry trade profits. When used wisely, carry trades can be a valuable component of a diversified investment strategy, but when ignored or over-leveraged, they can become a source of severe financial loss.

ETH/USDC: A Gentle Unfolding of Harmonious Flow (3H Timeframe)In the serene cadence of the market, ETH/USDC presently dwells within a balanced range of 2685–3065 on the 3-hour chart.

From the perspective of the Harmonious Flow of Energy, this consolidation is not mere hesitation, but a quiet accumulation — a space where forces align in subtle proportion, neither overpowering the other, yet preparing for natural resolution.

The structure speaks of restraint: proportional waves, measured volumes, and a context that favours continuity over disruption. The energy here feels contained, yet directed — pointing toward an upward release when the balance tips with clarity.

A breakout above the range carries a calm probability of extension toward 3800–4000, a zone where past resistance may gently invite reflection. There, the flow could pause, allowing a harmonious correction — not a reversal, but a respectful return to test the conviction of buyers who entered within 2685–3065.

Such a retracement would serve the deeper rhythm: affirming strength without excess, protecting positions with poise rather than force.

This reading requires no urgency. When the elements — flow, harmony, proportion, and context — converge without pressure, the path reveals itself simply. Until then, we observe with lightness.

Wishing you clarity in the flow.

Predictions on NQ Plays for Shorts or Longs! Basing my analysis on volume profile, trend based fib extension, and imbalances of price action. My thoughts are we drop during Sunday open and sweep lows before a rally up to ATHs. I love seeing multiple POCs (black lines) inline with each other and if shorts are the play we can sweep some of those or possibly retrace back and reject from the Gann box fibs inside the 4hr imbalance. I love that a previous sessions POC is inline with 50% gann box fib of the 4hr imbalance. We can tap that level or possibly sweep and tap the low volume node below it and then reverse up to higher fib retracement or to ATHs.

If longs are the play and we gap up at Sunday open. we could repeat same pattern as of last week and tap back to the 50% fib and then shoot up to 61.8 and reverse down to the 4hr imbalance, a previous POC from Friday session, previous POC that is inline with the 50% fib that’s inside the 4hr imbalance which of course also inlines with a key resistance level that I circled and labeled on my chart and then we sweep those levels or retest those levels and rally up to 78.6% or to ATHs. We can retrace to 61.8 and then back down to 50% and then up to 78.6 or ATHs. A lot of possibilities!!! Will be interesting to see what the market has in store for us!!! Always remember have a plan before you trade! Don’t overthink, Over-trade-, Over-leverage, and have good risk management!!! Patience is the key to trading success!!! Have a great week and weekend everyone and let’s make money not only this week but this year!!! 2026 is our year traders!!!

BNB/USD Consolidation Beneath Resistance After Trend ExpansionBinance Coin recently completed a sustained upside expansion, confirmed by multiple upside target interactions and a steady advance above the short-term mean. After reaching the upper portion of the projected range, price has shifted into a consolidation phase, with recent daily candles rotating below the short-term average.

This behavior reflects a pause in momentum rather than a decisive structural breakdown, particularly given that higher-timeframe support remains intact.

Momentum & Regime Behavior

Momentum has begun to roll over from elevated levels following the prior advance. The projected momentum cross visible ahead highlights a potential decision window where price may stabilize and resume the broader trend or continue retracing into deeper support.

Despite short-term softness, the weekly context remains constructive, suggesting the current move is corrective unless confirmed otherwise by structure.

Key Levels to Monitor

Near-Term Support Zone: The lower daily target region represents the first area where buyers may attempt to defend structure. Holding this zone keeps the broader bullish framework intact.

Upside Reclaim Zone: A sustained move back above the short-term mean would improve the probability of rotation toward higher daily and weekly targets.

Invalidation Level: A decisive breakdown below daily structural support would weaken the current trend and increase the likelihood of a deeper pullback toward lower weekly levels.

Forward-Looking Outlook

As long as price remains supported above higher-timeframe structure, the prevailing bias remains neutral-to-bullish, with the current action best interpreted as consolidation following expansion rather than trend failure. Directional clarity is expected as price resolves around the highlighted support and momentum aligns.

Summary

Trend: Higher-timeframe bullish, short-term corrective

State: Consolidation beneath resistance

Bias: Neutral-to-bullish while daily support holds

Confirmation: Reclaim of short-term resistance

Invalidation: Loss of daily structural support

This forecast is forward-looking and based solely on current price behavior and indicator structure. Always apply confirmation and risk management appropriate to your strategy.