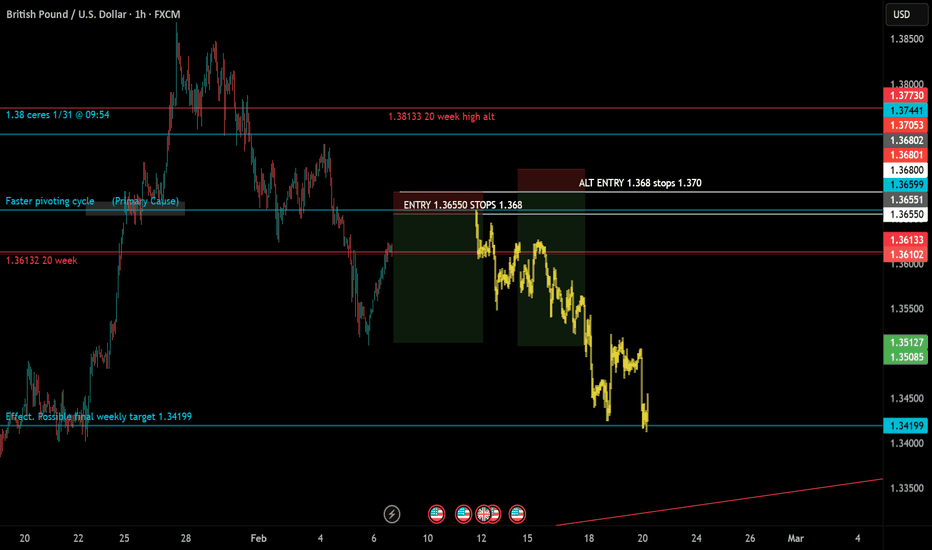

Gu trend flipping short?Gu currently dropping below my important 2 line (red) 20 week zone here which is indicating a bearish sign at least for the next coming week. The blue lines on my chart indicate another cycle at play that moves faster than the red one that also indicates the nearest line as resistance at 1.36599 with a mirrored angle at 1.34199. Although I do not need the full move to finish my phase 1 challenge, there is a likelihood that 1.34199 will be touched this week but I will only be aiming for the break of the previous week low. Finally we have the white lines that we can find at least 1- 2 entries a day that show up everyday but when you have 2 white lines such as these that are moving this close together it usually indicates a larger reversal is underway. Often times the chart may find confluence between the white support and resistance lines and the larger ones that line up either perfectly or within pips of each other. I am a seller at 1.36550 with a stop at 1.368 targeting last weeks low. If it does move higher than that for some reason then my alt short will be at 1.368 stops at 1.370 still targeting last weeks low at least! Good luck and happy trading!

Gann Square

$ONDS Gann square analysisThe 45 degree pivot line on the weekly chart has historically been the zone of greatest resistance for $ONDS. With the recent breakout NASDAQ:ONDS is ascending toward this zone once again. I'll be looking for momentum to carry us above this line in order to carve out support.

DO YOUR OWN RESEARCH; THIS IS NOT INVESTMENT ADVICE.

Gann time and price HBR The swing high is at 333.8. Price then fell to the swing low at 144 in 332 days. You can see the symmetry in price and time.

I have marked the square up on the chart back at 333.8 in 335 days.

Price has a lot of work to do in next 90/100 days. This falls in line with ganns idea of price acceleration in the last phase of swing.

The company has recently been on a purchasing spree to expand its reach into the gulf of America.

They have also been buying back shares.

XAUUSD 1h chart levels for the coming week 24 to 28 November

FOREXCOM:XAUUSD

Hey Everyone,

Please see My updated 1h chart levels and targets for the coming week 24 to 28 November

The price closed on 4065 so If the price BREAKOUT UP this area for will open 4093.

The 4061 & 4067 reversal zone and key decision points; if breached, it becomes the path to 4125.

Weekly close at a 90-degree angle from the peak of 4036

If it breaks through with momentum, it will head towards 4004-3998 as it shown on the chart

The week should move like this

Monday should move to 135° degrees (down to 4036 or up to 4093)

Tuesday 150° degrees (if it moved down we will see 4006 & if up will see 4102) First move 150° and We will see rejection of a Strong price when the (moon & sun & Mercury meet I call it = Test Price Day)

Wednesday 160° degrees ((if it moved down we will see 4004 & if up will see 4125 and then 4157) If the price touches the 180-degree angle, it is heading towards a volatile day followed by a strong rise or fall.

Thursday 170° degrees (the price will move between 4125-4157) and if the price moved down wee will move 225° degrees between 4036-4006) A day approaching the peak or undermost, not a reversal day.

Yousif

H-k-O-r-E

The secret to winning in gold trading! About your mindset!This article does not cover strategies. For trading, please refer to the previous article.

Gold Trading Mindset: Gold trading mindset is a key factor in determining trading success or failure. Here are some key points and tips about gold trading mindset to help you better navigate market fluctuations:

Overcoming Greed and Fear

Greed: Avoid chasing rising prices and selling falling. Don't blindly increase your position or delay taking profits due to short-term gold price increases. Set reasonable take-profit targets and lock in profits promptly.

Fear: Avoid panic selling during market declines. If a trade fits your strategy, calmly assess the risks to avoid missing out on rebound opportunities due to short-term fluctuations.

Accepting losses is normal. The gold market is highly volatile and losses are part of the cost of trading. Don't let a single loss get you emotionally upset. Instead, focus on the long-term effectiveness of your overall trading strategy. Strictly implement stop-loss rules and control the scope of losses.

Maintain patience and discipline. The gold market is often in a volatile or trendless state, so you need to wait patiently for clear trading signals. Avoid frequent trading to minimize emotional interference. Develop and strictly adhere to a trading plan, and don't change it arbitrarily due to short-term market fluctuations.

Avoid blindly following the crowd. Don't trade impulsively based on the actions of others or market sentiment. Gold prices are influenced by multiple factors, requiring independent analysis of fundamentals and technicals to form your own judgment.

View market fluctuations rationally. Short-term fluctuations in gold prices may be influenced by geopolitical factors, economic data, and other factors, but long-term trends are determined by supply and demand and macroeconomic trends. Don't be misled by short-term fluctuations and maintain a long-term investment perspective.

Manage your funds effectively to control the risk of individual trades. It is recommended that losses on individual trades should not exceed 1%-2% of your total capital. Operating with a small position can reduce psychological stress and promote a more stable mindset.

Continuously study and review your trading experiences regularly, analyzing the reasons for success and failure. Improve your understanding of the market by studying macroeconomics and technical analysis methods.

Gold trading is not just a battle with the market; it's also a battle with your own emotions. Maintaining a calm and rational mindset, and combining trading strategies with mindset management, is the key to achieving stable profits in long-term trading.

If you find it helpful after reading this article, please like and support it, or share it with other friends. We will update trading strategies and trading skills every day!

BIT500: Prediction Markets — From Polymarket to InfoFiIn the dynamic crypto landscape of September 2025, prediction markets are evolving into powerful tools for aggregating information and speculation. Polymarket is experiencing explosive growth, with trading volume up 50% month-over-month, reaching $1.16 billion in June and $7.5 billion for the year. This reflects a shift from simple betting to InfoFi—"information finance," where markets not only forecast events but also generate valuable analytics. From BIT500, a leading analytics platform focused on AI-driven signals and on-chain metrics, we analyze Polymarket’s rise, InfoFi signals, and trading opportunities. Our tools track volumes, RSI, and MACD for related assets (USDC, POLY-like tokens, DeFi tokens). Data as of September 16, 2025—perfect timing for positioning ahead of Q4 rallies.

BIT500 equips traders with real-time dashboards; sign up for demo access to seize the advantage.

Polymarket’s Growth: +50% Volume and Leadership in Predictions

Polymarket, a decentralized platform on Polygon, is recording record growth: trading volume up 50% in August-September, with $1.16 billion in June and a total of $7.5 billion in 2025. This is a 300% increase from 2024, driven by bets on elections, recessions, and crypto trends (e.g., “US recession in 2025” at 40% probability). The platform uses USDC for betting, capturing 75% of the prediction market share, surpassing Kalshi (a CEX alternative).

Growth drivers: Web3 integration (NFT betting, DAO voting), institutional inflows ($2 billion), and AI analytics for precise forecasts. On-chain: Transactions up 25%, holder count exceeds 1M, with TVL at $150 million. BIT500’s AI detects a 71% bullish sentiment: Polymarket correlates with BTC (0.6), boosting DeFi liquidity.

From Polymarket to InfoFi: The Evolution of Information Markets

InfoFi is the next frontier, where predictions become “information finance”: markets cover not only events (elections, sports) but also data (AI trends, social signals). Polymarket leads, but InfoFi extends to Kaito (tokenized insights), Cookie3 (social-fi predictions), and Galxe (quest-based markets). The InfoFi market grew 150% YTD, with TVL at $500 million, aggregating “crowd wisdom” for forecasts 20% more accurate than polls.

InfoFi signals: Polymarket/Kaito RSI at 55–60 (neutral-bullish), MACD divergence points to growth. On-chain: Inflows to InfoFi protocols up 30%, with whale activity in USDC (betting collateral). BIT500 forecasts $10 billion TVL by 2026, with a 0.7 correlation to ETH for DeFi integrations.

Trading Opportunities: MACD, RSI, and BIT500 Signals

BIT500 leverages AI for signals on related assets (USDC for betting, ETH/Polygon for platforms). Levels based on the April 2025 trend.

USDC (Polymarket betting): Support at $0.999–$1.000 (50% Fibonacci). Resistance at $1.001–$1.002. RSI at 58 (bullish momentum). MACD: Crossover above zero—signal for 0.2–0.5% arbitrage (Binance premium). On-chain: Inflows $2.5 billion, TVL +15% in InfoFi.

MATIC (Polygon, Polymarket’s base): Support at $0.45–$0.48 (38.2% Fibonacci). Resistance at $0.52–$0.55. RSI at 62 (healthy trend). MACD: Histogram +0.12—10% growth to $0.55. On-chain: Transactions up 20%, InfoFi integration +25% volume.

InfoFi Aggregate (Kaito/COOKIE tokens, ~$0.85 equivalent): Support at $0.75–$0.80 (61.8% Fibonacci). Resistance at $0.90–$0.95. RSI at 55 (bullish divergence). MACD: Bollinger squeeze—8–12% breakout. On-chain: Holder growth +10%, DeFi TVL $100 million.

Overall trend: RSI 56–60, MACD bullish—enter at supports for 10–20% upside in Q4. Risks: Regulation (CFTC scrutiny), hedge with USDC.

Conclusion: Trade Predictions with BIT500

Prediction markets, from Polymarket (+50% volume) to InfoFi, are a breakthrough, with $7.5 billion in trading and $500 million TVL. MACD and RSI signal a bullish trend for USDC/MATIC. BIT500’s AI is your guide for signals and on-chain insights.

Ready to bet? Join BIT500 for alerts. Which prediction market interests you? Comment below!

#PredictionMarkets #Polymarket #InfoFi #MACD #BIT500

ChatGPT Claims $ADA Is Waking Up – Could $3 Be Back on the TableWith Cardano (ADA) showing renewed momentum, speculation is resurfacing about whether it can approach its $3 all-time high. While ChatGPT-powered analysis highlights early signs of revival, measured expectations and strategic planning are essential.

ADA’s Technical Setup: Signs of Uptick

Whale accumulation: Large wallets are steadily acquiring ADA, hinting at long-term confidence.

EMA crossover: ADA’s 50-day MA recently crossed above the 200-day MA—a bullish omen.

Volume confirmation: Price increases are backed by rising trade volume, strengthening the signal.

This alignment suggests ADA may be entering a steady upward phase.

Ecosystem Growth Driving Optimism

Vasil upgrade legacy: Network throughput improvements and reduced fees remain strengths.

DeFi & NFT traction: Over 30 smart contracts launched recently, signaling healthy usage.

Strategic partnerships: Engagements in green finance and digital identity add real use-case value.

Together, these factors strengthen ADA’s fundamentals and investor sentiment.

Sizing Up the $3 Benchmark

Market cap scale: To reach $3, Cardano’s market cap needs to expand by approximately $90 billion—a significant leap.

Past performance context: ADA flirted with $3 in late 2021 but lacked supporting network activity to sustain it.

Trigger dependency: Institutional adoption, DeFi hubs, or major fiat tie-ins are likely prerequisites for a breakout.

A controlled climb toward $2 seems more realistic, with a push beyond requiring major catalysts.

Investor Considerations

Staggered entry (DCA): Consider accumulating between $1.20–$1.40.

Profit-taking strategy: Partial exits at $2 and $2.50+ help lock in gains while maintaining exposure.

News monitoring: Watch new dApp launches, development updates, and community announcements.

Portfolio balance: ADA is best held alongside BTC, ETH, and select altcoins to mitigate risk.

Final Take

On-chain momentum and ecosystem signals suggest Cardano is moving off the sidelines. However, an overnight surge to $3 is unlikely without significant developments. By combining thoughtful accumulation with active monitoring and disciplined risk management, investors can position themselves to benefit if ADA continues its upward trajectory in 2025.

MEV Bot Exploit by MIT-Educated Brothers Leads to $25M CryptoIn the dynamic world of crypto trading, where cutting-edge innovation meets finance, abuses are inevitable. One of the most prominent cases of the year involves brothers Anton and James Peraire-Bueno, MIT graduates accused of exploiting Maximal Extractable Value (MEV) strategies to siphon off $25 million from the Ethereum ecosystem within seconds. The case may set a precedent for how automated behavior in decentralized systems is judged under traditional legal frameworks.

What Happened?

According to the prosecution, the brothers deployed several Ethereum validators and used specialized algorithms to reorder transactions within blocks. This allowed them to front-run other MEV bots and redirect transaction flows in their favor—a textbook mempool attack. In just 12 seconds, they allegedly drained $25 million in ETH and other digital assets.

Why Is This Case Unique?

First major MEV case involving such significant financial losses

Criminal charges despite actions operating within protocol rules

Academic background of the defendants adds to the public intrigue

This case raises a key legal question: Can actions that are technically “legal” under protocol rules still constitute fraud if they are knowingly harmful to other participants?

Implications for the Crypto Industry

The trial could redefine ethical and legal standards in the DeFi and automated trading sectors. If convicted, this could trigger a broader review of front-running bots, sandwich attacks, and other MEV strategies that, until now, have existed in a legal gray area.

As the regulatory landscape evolves, this trial may become a cornerstone in shaping how future MEV tactics are governed—and how automated trading fits into the legal definition of financial manipulation.

E

Forex Market: Myth or Strategy? — Analysis by Valtrix GroupEvery year in June, forex traders pay close attention to historical price movements, hoping to identify recurring seasonal patterns. But does June really offer a strategic edge, or is it a marketing myth and an overrated idea?

At Valtrix Group, we view seasonality as a secondary but useful filter — especially during periods of low volatility and a lack of macroeconomic catalysts.

What Does History Tell Us?

Historical data on major currency pairs (EUR/USD, USD/JPY, GBP/USD) shows that June often exhibits:

A rise in volatility in the first half of the month — driven by inflation data releases (U.S., EU);

Moderate strengthening of the U.S. dollar, particularly between the FOMC meeting and the quarterly earnings season;

In some years — flat movements caused by low liquidity ahead of the summer holiday season.

However, long-term statistics are mixed. For example, from 2013 to 2023, EUR/USD rose in June in 6 out of 10 years and declined in 4, showing no strong directional bias.

Why Seasonality Doesn’t Always Work

The forex market is driven not only by technicals and statistics but also by macroeconomics, geopolitics, and monetary policy. When major events occur in June (Fed meetings, crises, elections), seasonal patterns can easily be disrupted.

Moreover, algorithmic trading and arbitrage strategies reduce the likelihood of consistent price movements repeating year after year.

Gold (XAUUSD) Trading Setup – Mid-June 2025 Analysis🔰 Gold (XAUUSD) Trading Setup – Mid-June 2025 Analysis

This chart represents a strategic price action-based setup on Gold (CFDs on Gold – US$/Oz) using a 15-minute timeframe. It includes clearly defined entry zone, support/resistance levels, and profit-taking targets (TP1, TP2) for both bullish and bearish scenarios.

🔍 Current Market Context

Current Price: ~$3431.77

Structure: The price has been in an upward trend with a consolidation phase forming near the key mid-zone.

Highlighted Zone: A decision zone is marked in red (between ~$3422 and ~$3418), acting as the key liquidity zone or breakout area.

📈 Bullish Bias

If price breaks and holds above the red zone:

✅ TP1: $3480

✅ TP2: $3580

These levels act as short- to mid-term bullish targets based on projected extensions of recent upward momentum.

📉 Bearish Bias

If price breaks and holds below the red zone:

✅ TP1: $3320

✅ TP2: $3260

This indicates a possible reversal or correction phase, with targets derived from recent swing lows and support areas.

📌 Trading Notes

The blue shaded areas represent target zones for partial or full exits.

Red zone is the critical breakout decision point.

Ideal for breakout or pullback traders.

Can be combined with volume/confirmation indicators (e.g., RSI, MACD, or price action candles) for entry timing.

DXY – Key Level Broken, More Downside Ahead?Hello Folks , Long time no see .

The US Dollar Index (DXY) just broke below 106.5, and things are getting interesting. The trend has been weakening, and price is now sitting at a crucial zone.

📌 Here’s what I’m watching:

107.66 is the big resistance. If price can reclaim it, bulls might have a chance.

105.48 & 104.46 are the next major support levels.

👀 My Take:

If we stay below 106.5, I expect more downside towards 105.4 and maybe 103.3. If price bounces and reclaims 107, I’ll reconsider.

What’s your view? More downside or a bounce coming? Drop your thoughts below! 🚀🔥

🚨 Disclaimer:

Just sharing ideas here—this isn’t a trade advice . Everyone sees the market differently, and the goal is to improve our analysis, not tell anyone what to do. At the end of the day, your trades are your call, your responsibility. Trade smart! 🚀📊

The Four Fears of Trading and the Law of HarmonyTrading is not just about charts, strategies, and numbers. It’s a psychological battlefield, where fear dominates — but there’s also an often-overlooked factor: harmony. WD Gann’s Law of Harmony teaches that markets, like people, have unique vibrations. When you trade in sync with stocks or currency pairs that ‘resonate’ with you, your confidence and performance improve. Let’s explore how combining Gann’s insights with an understanding of the Four Fears of Trading can create a balanced, more successful trading mindset.

What Is the Law of Harmony?

The Law of Harmony is one of WD Gann’s foundational principles. Gann believed that everything in the universe moves according to natural laws, and markets are no different. Each stock, commodity, or currency pair has its own ‘vibration’ or rhythm — a unique frequency that determines how it behaves. When a trader finds a market whose vibration aligns with their own psychological makeup and trading style, they experience greater clarity, confidence, and success. This is trading in harmony.

Gann used this principle to select markets that matched his analysis style, making it easier to forecast price movements. He believed that recognizing harmony between the trader and the market was just as important as the technical setup itself. He meticulously studied time cycles, price patterns, and astrological influences to find markets that moved in predictable, harmonic ways — and traded only those that felt “right.”

In essence, Gann’s Law of Harmony is about working with the market’s natural flow, not against it. When you’re in sync, trades feel clearer, decisions become easier, and success feels almost effortless.

The Four Fears of Trading

In a recent Twitter poll I conducted, 45% of traders admitted that fear was their toughest emotional challenge — more than greed, hope, or overconfidence. Fear in trading can be broken down into four key categories: the fear of losing money, fear of missing out (FOMO), fear of being wrong, and fear of leaving money on the table. Let’s explore each one — and how the Law of Harmony can help conquer them.

1. Fear of Losing Money

This is the most common fear among traders — nobody wants to lose money. The reality, however, is that losses are an inevitable part of trading. Trading is a game of probabilities, with each trade having around a 50% chance of success.

Many traders react to losses with irrational decisions like closing trades too early or holding onto losing trades in the hope they’ll bounce back. This behavior stems from loss aversion — the natural human tendency to avoid losses more than we seek equivalent gains.

How the Law of Harmony helps:

Trade assets that ‘vibe’ with you. Some stocks or forex pairs will naturally feel clearer and easier to predict — that’s harmony.

Stop forcing bad trades. If you consistently lose on a specific pair, stop forcing it. It might not align with your psychology.

Backtest your system. Develop and backtest a trading system over multiple market conditions (trending, sideways, volatile). When you find one that feels ‘right,’ stick with it.

2. Fear of Missing Out (FOMO)

FOMO drives traders to jump into unplanned trades, often near market tops, for fear they’ll miss a big move. This leads to poor entries, increased risk, and reduced potential rewards. The irony? These impulsive trades often result in losses.

How the Law of Harmony helps:

Shift your mindset from “making money” to “following a process.” Money is a byproduct of trading in harmony with the right instruments.

Accept that the market is endless. Opportunities are like waves — there’s always another one coming. When you trade in sync with a market’s natural rhythm, better setups come to you.

3. Fear of Being Wrong

From childhood, we’re conditioned to avoid mistakes. In trading, however, losses are not failures — they’re feedback. The fear of being wrong can cause traders to hold onto losing trades, cut winners short, or avoid taking trades altogether.

How the Law of Harmony helps:

Focus on pairs or stocks that feel intuitive. When you feel more connected to an asset’s behavior, the fear of being wrong diminishes.

Accept that not every market resonates with you — and that’s okay.

Embrace losing trades as a natural part of the business. Even in harmony, some trades won’t work — that’s part of the rhythm.

4. Fear of Leaving Money on the Table

This fear emerges when a trader exits a trade too soon, only to watch the market continue in their favor. It’s frustrating, but trying to capture every last pip is a recipe for disaster. Markets are unpredictable, and no one catches the exact top or bottom consistently.

How the Law of Harmony helps:

Trust the market’s rhythm. If you’re aligned with the right instrument, more opportunities will come.

Define your exit strategy before entering a trade.

Let go of perfection. Accept that partial profits are better than no profits. In a harmonious market relationship, consistency matters more than squeezing every move.

Final Thoughts: Finding Harmony in Trading

Fear is a natural part of trading — it’s part of being human. The goal isn’t to eliminate fear but to manage it. By identifying which type of fear affects you the most and combining it with Gann’s Law of Harmony, you’ll make more rational decisions and improve your long-term performance.

Imagine you’re at a party. A mutual friend introduces you to a new group of people. You might vibe with some, while others give you an uncomfortable feeling. Stocks and forex pairs work the same way. You naturally gel with some, understanding their behavior and making profitable trades, while others consistently lead to losses.

The secret to long-term trading success is not forcing trades or chasing markets — it’s about finding what resonates with you. Focus on the process, trade in harmony, and the profits will follow.

Remember: The market doesn’t reward those who fight it. It rewards those who flow with it.

Happy trading!

Relax guys! Technical Analysis predicted this a month ago. It's okay traders, markets are allowed to go Down too. In fact it's responsible of them to, as that is what makes a healthy market cycle

I called this downtrend a month ago, using a step by step process I use for all markets.

Give it another week or two, and the uptrend will return