Currency Trading ExposedThe Foundation of Currency Trading

At its core, currency trading involves the exchange of one currency for another. Every trade is quoted in pairs, such as EUR/USD, USD/JPY, or GBP/INR. When a trader buys a currency pair, they are buying the base currency and simultaneously selling the quote currency. Exchange rates fluctuate continuously based on supply and demand, reflecting economic strength, capital flows, interest rates, and geopolitical confidence.

Unlike stock markets, forex is decentralized. There is no single exchange. Instead, trading occurs electronically over-the-counter (OTC) through a global network of banks, institutions, brokers, and traders operating 24 hours a day, five days a week. This structure provides unmatched liquidity but also makes regulation and transparency uneven across regions.

Who Really Moves the Currency Market

A common myth is that retail traders drive currency prices. In reality, retail participation represents only a tiny fraction of total volume. The true market movers include:

Central Banks, which influence currencies through interest rates, monetary policy, and direct interventions

Commercial Banks and Financial Institutions, executing large transactions for clients and proprietary desks

Corporations, hedging currency risk arising from international trade

Hedge Funds and Asset Managers, deploying macro and speculative strategies

Governments and Sovereign Funds, managing reserves and capital flows

Retail traders operate on the margins, reacting to price movements rather than creating them. Understanding this power imbalance is crucial for realistic expectations.

What Drives Currency Prices

Currency values are shaped by a combination of fundamental, technical, and sentiment-based factors.

Fundamentally, interest rate differentials are among the most powerful drivers. Capital tends to flow toward countries offering higher real returns, strengthening their currencies. Inflation data, GDP growth, employment numbers, trade balances, and fiscal stability also play major roles.

Technically, forex markets are highly responsive to price levels, trends, support and resistance, and market structure. Because of high liquidity and institutional participation, technical analysis often works effectively—especially on higher time frames.

Sentiment reflects how market participants collectively feel about risk. In times of global uncertainty, traders flock to safe-haven currencies such as the US dollar, Japanese yen, or Swiss franc. During risk-on phases, capital shifts toward emerging market and high-yield currencies.

The Truth About Leverage

One of the most “exposed” realities of currency trading is leverage. Forex brokers offer extremely high leverage, sometimes up to 1:500. While leverage magnifies potential profits, it also magnifies losses—often wiping out accounts faster than traders expect.

Many beginners are attracted by the ability to control large positions with small capital, but this is where the market becomes unforgiving. Without disciplined risk management, leverage turns forex trading into a probability-defying gamble rather than a strategic endeavor. Professional traders focus on capital preservation first, using leverage cautiously and consistently.

Retail Trading vs Institutional Reality

Retail forex education often promotes indicators, signals, and short-term strategies promising quick returns. Institutional traders, however, operate very differently. They focus on:

Macro-economic themes

Interest rate cycles

Order flow and liquidity zones

Risk-adjusted returns over long horizons

This mismatch between retail expectations and institutional reality explains why a majority of retail traders struggle. Currency trading is not about predicting every move—it is about managing uncertainty, probabilities, and drawdowns over time.

Psychology: The Silent Market Force

Currency trading exposes traders not just to markets, but to themselves. Fear, greed, impatience, and overconfidence are amplified in a fast-moving, leveraged environment. Many losses are not due to poor analysis, but poor emotional control.

Successful traders develop routines, predefined risk rules, and the ability to accept losses without emotional reaction. The mental discipline required in forex often exceeds that needed in slower-moving markets.

Opportunities That Still Exist

Despite the challenges, currency trading offers genuine opportunities. High liquidity ensures tight spreads in major pairs. The 24-hour nature allows flexibility across time zones. Strong trends can develop around monetary policy shifts, economic cycles, and geopolitical changes.

For informed traders, currencies also serve as tools for hedging, diversification, and global macro positioning. When approached with realistic expectations, solid education, and patience, forex trading can become a professional skill rather than a speculative trap.

Currency Trading Exposed: The Bottom Line

Currency trading is neither a shortcut to wealth nor an impossible game. It is a highly competitive, institution-driven market where success depends on knowledge, discipline, and risk control. Exposing the reality behind forex removes the illusion of easy money and replaces it with a clearer understanding of how global capital truly moves.

Those who treat currency trading as a serious financial craft—grounded in economics, structure, and psychology—stand a far better chance of long-term survival and growth. In the end, forex does not reward excitement; it rewards consistency, humility, and respect for risk.

Harmonic Patterns

Arbitrage Opportunities Across World ExchangesUnderstanding Global Arbitrage

At its core, arbitrage is the practice of buying an asset in one market where it is undervalued and simultaneously selling it in another market where it is overvalued, locking in a risk-free or low-risk profit. When this activity occurs across different countries or exchanges, it is referred to as global or cross-border arbitrage.

World exchanges differ due to:

Time zone variations

Currency denominations

Regulatory frameworks

Market liquidity and participant behavior

Information dissemination speed

These differences create temporary inefficiencies that arbitrageurs seek to exploit.

Key Types of Arbitrage Across World Exchanges

1. Equity Cross-Listing Arbitrage

Many large corporations are listed on multiple exchanges across the world. Examples include companies listed both in their home market and overseas through American Depositary Receipts (ADRs) or Global Depositary Receipts (GDRs).

Price discrepancies can occur due to:

Exchange rate movements

Different demand-supply dynamics

Local investor sentiment

Arbitrageurs buy shares where they are cheaper and sell where they are more expensive, adjusting for currency conversion and transaction costs.

2. Currency (Forex) Arbitrage

The foreign exchange market is the largest global market and operates 24 hours a day. Arbitrage opportunities arise when exchange rates between three or more currencies are misaligned, commonly known as triangular arbitrage.

For example:

USD → EUR

EUR → JPY

JPY → USD

Even small pricing mismatches can be profitable when executed at large volumes and high speed. However, such opportunities are extremely short-lived due to intense competition and automation.

3. Interest Rate Arbitrage

Interest rates vary across countries due to differing monetary policies, inflation expectations, and economic conditions. Arbitrageurs exploit these differences through covered and uncovered interest rate arbitrage.

Covered interest arbitrage uses forward contracts to hedge currency risk.

Uncovered interest arbitrage takes exposure to currency movements in pursuit of higher yields.

Global bond markets, especially government securities, play a major role in these strategies.

4. Commodity Arbitrage

Commodities such as gold, crude oil, silver, and agricultural products trade on multiple global exchanges. Price differences may arise due to:

Transportation and storage costs

Regional supply-demand imbalances

Taxation and import-export regulations

For instance, gold prices may differ between London, New York, Dubai, and Shanghai markets. Arbitrageurs factor in logistics and financing costs before executing trades.

5. Derivatives and Futures Arbitrage

Futures and options linked to the same underlying asset often trade on multiple international exchanges. Arbitrage opportunities arise when futures prices deviate from their fair value based on spot prices, interest rates, dividends, and time to expiry.

Common strategies include:

Cash-and-carry arbitrage

Reverse cash-and-carry arbitrage

Index futures arbitrage across regions

These trades are popular among institutional players due to their scalability.

6. ETF and Index Arbitrage

Exchange-Traded Funds (ETFs) track indices that may include global securities. When ETF prices diverge from their Net Asset Value (NAV), arbitrageurs step in to profit from the difference.

Global index arbitrage also occurs when the same index futures trade in different time zones, such as Asian, European, and US market hours, leading to temporary mispricing.

7. Cryptocurrency Arbitrage

Digital assets trade on hundreds of exchanges worldwide, often with significant price differences due to:

Capital controls

Liquidity fragmentation

Exchange-specific demand

Regulatory restrictions

Crypto arbitrage can be:

Spatial (between exchanges)

Triangular (within one exchange)

Cross-border (fiat on-ramps and off-ramps)

While highly attractive, these opportunities carry operational, regulatory, and counterparty risks.

Drivers of Arbitrage Opportunities

Several factors contribute to the persistence of arbitrage opportunities across world exchanges:

Market Fragmentation – Different exchanges operate under unique rules and participant structures.

Information Asymmetry – News travels unevenly across regions and time zones.

Currency Volatility – Exchange rate movements distort price parity.

Regulatory Barriers – Capital controls, taxes, and settlement restrictions prevent instant alignment.

Liquidity Differences – Thinly traded markets adjust prices more slowly.

Role of Technology in Global Arbitrage

Modern arbitrage is dominated by technology-driven participants. High-frequency trading (HFT) firms and institutional desks use:

Ultra-low-latency networks

Algorithmic trading systems

Co-location near exchanges

Real-time global data feeds

As a result, simple arbitrage opportunities vanish within milliseconds, leaving retail traders with limited access to pure risk-free arbitrage.

Risks and Constraints

Despite its theoretical risk-free nature, global arbitrage involves several practical risks:

Execution risk due to latency

Currency conversion and hedging costs

Regulatory and compliance issues

Settlement and counterparty risk

Sudden liquidity evaporation

In stressed market conditions, arbitrage can fail, leading to losses instead of profits.

Impact on Global Financial Markets

Arbitrage plays a vital role in:

Enhancing price discovery

Improving market efficiency

Reducing regional price disparities

Integrating global financial systems

Without arbitrage, markets would remain fragmented, inefficient, and prone to persistent mispricing.

Conclusion

Arbitrage opportunities across world exchanges are a natural outcome of global market diversity. While advancements in technology and regulation have reduced the frequency and size of these opportunities, they have not eliminated them. Instead, arbitrage has become more complex, capital-intensive, and speed-dependent.

For institutional players, global arbitrage remains a cornerstone strategy. For individual investors, understanding arbitrage provides valuable insight into how global markets function and why prices converge over time. Ultimately, arbitrage is not just a profit-seeking activity—it is a stabilizing force that keeps the world’s financial markets connected, efficient, and aligned.

Participants’ Market Coverage1. Types of Market Participants and Their Coverage

Financial markets are populated by a wide range of participants, broadly categorized into institutional investors, retail investors, intermediaries, proprietary traders, hedgers, and regulators. Each group covers markets differently.

Institutional investors—such as mutual funds, pension funds, insurance companies, sovereign wealth funds, and endowments—typically provide broad market coverage. They operate across equities, fixed income, commodities, real estate, and increasingly alternative assets like private equity and infrastructure. Their long-term mandates require diversified exposure across sectors and geographies, making them key providers of stable capital. Because of their size, institutional investors influence benchmark indices and play a central role in capital allocation.

Retail investors generally have narrower market coverage. Their participation is often concentrated in domestic equities, exchange-traded funds (ETFs), derivatives for speculation or hedging, and popular thematic investments. While individually small, their collective impact can be significant, especially during periods of heightened sentiment or technological access through online platforms.

Proprietary traders and hedge funds focus on selective but deep market coverage. Rather than covering all markets broadly, they specialize in specific strategies—such as arbitrage, macro trading, statistical strategies, or event-driven trades—across multiple instruments. Their coverage is opportunistic and dynamic, shifting rapidly as risk–reward conditions change.

2. Market Coverage Across Asset Classes

Participants’ market coverage varies significantly by asset class.

In equity markets, coverage is typically broad due to high liquidity, transparency, and accessibility. Large-cap stocks attract coverage from almost all participant types, while mid- and small-cap stocks may have thinner coverage, often dominated by domestic institutions and select funds. This uneven coverage can create pricing inefficiencies in less-followed stocks.

In fixed income markets, coverage is more fragmented. Government bonds enjoy deep participation from central banks, institutions, and foreign investors, while corporate bonds—especially lower-rated or illiquid issues—have limited coverage. This asymmetry affects liquidity and price stability.

Derivatives markets—including futures and options—are heavily covered by hedgers, speculators, and arbitrageurs. Coverage here is driven by leverage, risk management needs, and the ability to express views efficiently. Participants often focus on the most liquid contracts, leaving less popular maturities or underlyings with sparse participation.

In commodity and currency markets, coverage is global but concentrated among professional participants such as exporters, importers, banks, and macro funds. Retail participation exists but is relatively smaller compared to equities.

3. Geographic Market Coverage

Participants’ market coverage also differs by geography. Developed markets generally enjoy extensive coverage due to strong regulation, transparency, and liquidity. Emerging and frontier markets, while offering higher growth potential, often suffer from limited coverage because of political risk, currency volatility, and regulatory uncertainty.

Foreign institutional investors (FIIs) play a crucial role in extending market coverage to emerging economies. Their participation improves liquidity, governance standards, and global integration. However, reliance on foreign capital can also introduce volatility, as global risk-off events may trigger sudden withdrawals.

Domestic institutions help stabilize coverage by providing a local capital base that understands country-specific risks. Balanced participation between domestic and foreign players leads to healthier market development.

4. Time Horizon and Coverage

Market participants differ in their time horizons, which influences how they cover markets.

Long-term investors—such as pension funds and insurance companies—cover markets with a focus on fundamentals, valuation, and sustainability. Their steady participation dampens excessive volatility and supports long-term price discovery.

Short-term traders, including high-frequency traders (HFTs) and day traders, cover markets at a micro level. Their activity is concentrated in highly liquid instruments and contributes to tight bid–ask spreads and rapid price adjustments. However, their coverage is shallow in illiquid or less-followed markets.

The coexistence of multiple time horizons enhances overall market efficiency. When one group withdraws, another often fills the gap, maintaining functional coverage.

5. Role of Intermediaries in Market Coverage

Intermediaries such as stock exchanges, brokers, market makers, and clearing institutions are critical to participants’ market coverage. Market makers, in particular, ensure continuous two-way quotes, enabling participants to transact even during periods of stress. Without them, coverage would become fragmented and liquidity would evaporate quickly.

Technological advancements have expanded coverage by reducing transaction costs and improving access. Electronic trading platforms allow participants to cover multiple markets simultaneously, breaking down geographic and structural barriers.

6. Information, Research, and Coverage Quality

Market coverage is not only about participation volume but also about information depth. Analysts, rating agencies, data providers, and financial media enhance coverage by producing research and disseminating information. Well-covered markets tend to be more efficient, as prices reflect available information more quickly.

Conversely, markets or securities with poor research coverage may experience mispricing. While this increases risk, it also creates opportunities for skilled participants who can conduct independent analysis.

7. Regulatory Influence on Market Coverage

Regulation shapes participants’ market coverage by defining who can participate, how much risk they can take, and which instruments are permissible. Strong regulatory frameworks encourage broader participation by building trust and reducing systemic risk. Overregulation, however, may discourage participation and reduce coverage, particularly in innovative or niche markets.

Balanced regulation promotes inclusive coverage while safeguarding market integrity.

8. Implications of Participants’ Market Coverage

Participants’ market coverage has far-reaching implications. Broad and diversified coverage enhances liquidity, stabilizes prices, and improves capital formation. Narrow or uneven coverage can lead to volatility, liquidity gaps, and systemic vulnerabilities.

For investors, understanding coverage patterns helps in identifying risks and opportunities. Markets with limited coverage may offer higher returns but require careful risk management. For policymakers, fostering balanced participation supports economic growth and financial stability.

Conclusion

Participants’ market coverage is the backbone of financial market functioning. It reflects how different actors engage across assets, regions, and time horizons, shaping liquidity, efficiency, and resilience. A well-covered market benefits from diverse participation, robust information flow, and effective intermediation. As markets evolve through globalization and technology, understanding and adapting to changing coverage dynamics remains essential for all stakeholders in the financial ecosystem.

Comprehensive Financial Market CoverageScope, Importance, and Modern Dynamics

Financial market coverage refers to the systematic analysis, tracking, interpretation, and communication of developments across global and domestic financial markets. It includes equities, bonds, commodities, currencies, derivatives, alternative assets, and emerging financial instruments. In today’s interconnected and fast-moving economic environment, effective financial market coverage plays a critical role in informing investors, policymakers, institutions, and the general public. It bridges the gap between complex market activity and practical decision-making by transforming raw data into actionable insights.

Understanding Financial Market Coverage

At its core, financial market coverage involves monitoring market movements, economic indicators, corporate actions, policy changes, and geopolitical events that influence asset prices. It spans real-time news reporting, in-depth research, technical and fundamental analysis, macroeconomic commentary, and long-term thematic insights. Coverage may be delivered through financial news platforms, brokerage research reports, institutional notes, data terminals, social media channels, and independent analysts.

Financial market coverage is not limited to price reporting. It also explains why markets move, how different assets are interconnected, and what potential future scenarios may unfold. This interpretive layer is what differentiates meaningful coverage from mere information dissemination.

Key Segments of Financial Market Coverage

Equity Markets

Equity market coverage focuses on stock indices, individual companies, sectors, earnings results, valuations, corporate governance, and mergers and acquisitions. Analysts assess both fundamentals (revenues, profits, balance sheets) and technical factors (trends, volume, momentum). Equity coverage is essential for retail investors, portfolio managers, and traders seeking alpha or long-term growth.

Fixed Income and Debt Markets

Bond market coverage tracks government securities, corporate bonds, yield curves, credit spreads, and interest rate expectations. Since debt markets are closely tied to monetary policy, inflation, and fiscal conditions, their coverage is crucial for understanding economic health. Bond market signals often precede equity market trends, making this segment highly influential.

Currency and Forex Markets

Currency market coverage analyzes exchange rate movements driven by interest rate differentials, trade balances, capital flows, and geopolitical risks. Forex markets operate 24/5 and reflect real-time global sentiment. Coverage helps businesses manage currency risk and traders identify macro-driven opportunities.

Commodities and Real Assets

This segment includes energy (oil, gas), metals (gold, copper), agricultural products, and increasingly, carbon and environmental credits. Commodity coverage links supply-demand dynamics, weather patterns, geopolitical tensions, and industrial demand. It is vital for inflation analysis and global growth assessment.

Derivatives and Structured Products

Coverage of futures, options, swaps, and structured instruments focuses on hedging activity, leverage, volatility, and market expectations. Derivatives often reveal institutional positioning and risk appetite, making them an advanced but powerful area of market intelligence.

Role of Macroeconomic and Policy Coverage

A significant pillar of financial market coverage is macroeconomic analysis. This includes tracking GDP growth, inflation, employment data, central bank decisions, fiscal policies, and global economic cycles. Central banks such as the Federal Reserve, ECB, and RBI heavily influence markets through interest rates, liquidity measures, and forward guidance. Accurate coverage of policy signals helps investors anticipate shifts in capital flows and asset valuations.

Geopolitical developments—trade disputes, wars, sanctions, elections—also form a critical part of market coverage. In modern markets, political risk can move prices as strongly as economic fundamentals, making integrated analysis indispensable.

Technology and Data in Modern Coverage

Technology has transformed financial market coverage. High-frequency data, algorithmic analysis, artificial intelligence, and alternative data (satellite data, social media sentiment, supply-chain metrics) are now integral. Market coverage today combines traditional financial statements with real-time analytics and predictive modeling.

Digital platforms enable instant dissemination of insights, while dashboards and visualizations help users interpret complex information quickly. However, this abundance of data also increases noise, making credibility, context, and analytical rigor more important than ever.

Importance for Different Stakeholders

Investors and Traders: Financial market coverage guides asset allocation, risk management, and timing decisions.

Institutions and Corporates: It aids capital raising, hedging strategies, and strategic planning.

Policymakers and Regulators: Market coverage helps assess financial stability and systemic risks.

General Public: It improves financial literacy and awareness of economic trends impacting daily life.

Challenges in Financial Market Coverage

Despite its importance, financial market coverage faces several challenges. Information overload can overwhelm users, while short-termism and sensationalism may distort long-term perspectives. Bias, conflicts of interest, and misinformation—especially in the age of social media—pose risks to credibility. High-quality coverage must balance speed with accuracy, depth with clarity, and opinion with evidence.

The Future of Financial Market Coverage

Looking ahead, financial market coverage is likely to become more personalized, data-driven, and interactive. AI-generated insights, real-time scenario analysis, and cross-asset integration will enhance decision-making. At the same time, human judgment, ethical standards, and contextual understanding will remain irreplaceable.

Conclusion

Comprehensive financial market coverage is the backbone of informed participation in the global financial system. It connects data with insight, markets with the economy, and short-term movements with long-term trends. As markets grow more complex and interconnected, the value of accurate, unbiased, and insightful financial market coverage will only increase—making it an essential tool for navigating uncertainty and opportunity in the modern financial world.

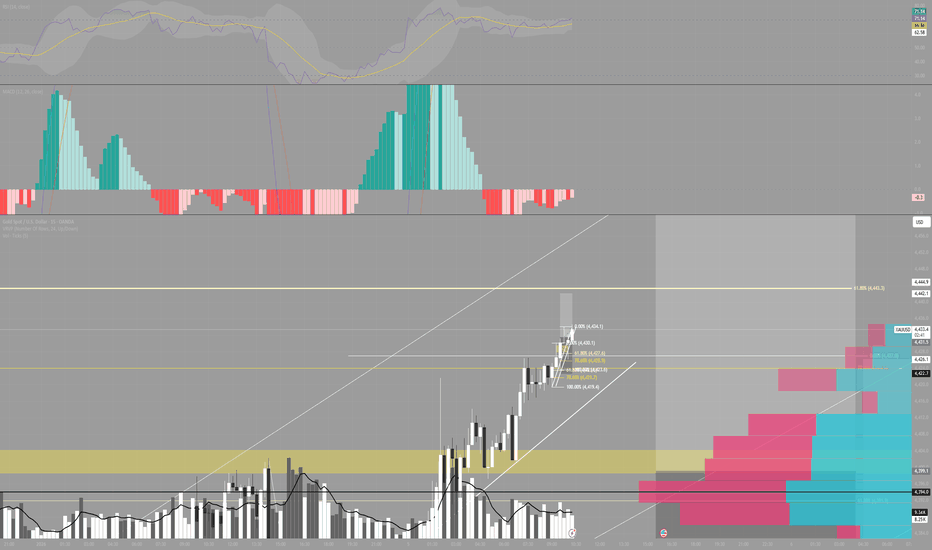

Tikitaka📌 XAUUSD – Intraday Session | Process > Outcome

Today the focus wasn’t on guessing price, but on waiting for the market to confirm and executing only when the context allowed it.

🔎 Broader context

Intraday bullish trend.

Key decision zone between 4420 – 4430.

Market in an acceptance phase after the breakout, with multiple continuation attempts and the risk of false breakouts.

In this kind of environment, patience makes the difference.

🧠 Process followed

No breakout anticipation.

Waited for a close and acceptance on higher timeframes (M15 / M5).

No entries in the noise zone.

While price was inside the box, there was no trade.

Wait for structure.

Breakout + pullback + higher low.

Lower-timeframe confirmation.

Momentum aligned (RSI > 50, MACD turning up after the pullback).

Clean execution.

Fixed risk, moderate RR (~1:1.2), no overtrading.

👉 The trade wasn’t taken because it “looked like it was going up,” but because the market stopped being ambiguous.

✅ Execution

Entry after a confirmed breakout + implicit retest.

SL placed at structural invalidation, not emotional levels.

TP defined from the start.

No moving stops out of anxiety.

No adding positions.

This type of execution protects the account even when the trade fails.

📊 Possible scenarios for the rest of the day

🟢 Scenario 1 – Continuation

As long as price holds above the acceptance zone, and pullbacks remain corrective (low volume),

→ look for continuation on clean pullbacks.

🟡 Scenario 2 – Range / Distribution

If price returns to congestion with no momentum,

→ no trade. Waiting is a valid position.

🔴 Scenario 3 – Structural failure

A clear loss of intraday supports with volume,

→ invalidates longs and opens the door to a deeper rotation.

🎯 Key idea of the day

The one who trades the most doesn’t win — the one who chooses when to trade wins.

Today the value wasn’t in the outcome, but in:

filtering noise,

respecting the plan,

executing without improvisation.

That’s what builds real consistency over the long run.

Good trading and patience.

Gold doesn’t hate you. Gold just loves… your liquidity.If you’ve ever felt like XAUUSD has a personal grudge against you — price spikes the moment you enter, sweeps your SL perfectly, then runs strongly in your predicted direction right after you exit — take a breath. Pause for a second.

The gold market doesn’t move based on emotions.

It moves based on liquidity — the fuel behind every major move .

1. Retail traders trade price. Institutions trade orderflow.

You look at the chart to find a perfect entry.

Institutions look at the chart to find where the most SL and pending orders are stacked.

To them, it’s not a “resistance zone” — it’s a liquidity pool.

When retail SL gets triggered, it turns into market orders.

And those market orders become the free matching engine for big players to enter without excessive slippage.

You think you’re protecting your risk with SL.

The market thinks you’re placing free orders for them to fill their positions.

2. Gold loves clean levels because SL sits at clean levels.

Liquidity sweep zones usually share the same traits:

- Recent highs/lows everyone can see

- Support/resistance that looks clean and easy to draw

- Attractive round numbers like 2,700 – 2,650 – 2,600…

These areas are liquidity magnets, not breakout signals.

3. “Sweep then run” is a process, not an exception.

A major gold move typically has 2 phases:

- Liquidity grab (SL sweep, pending activation)

- Expansion (the real trend begins)

Most traders lose because they confuse phase 1 with phase 2.

Retail sees a spike → fear trend break.

Institutions see a spike → mission accomplished, liquidity collected, positions filled.

4. The market doesn’t need you to be wrong — it only needs you forced out.

Gold doesn’t need to prove your analysis was bad.

It just needs enough volatility to make you:

- Hit SL

- Or close manually out of panic

Either way, the market gets the liquidity you left behind.

5. Trading maturity = not turning yourself into liquidity.

You don’t need to remove SL. You just need to:

- Place SL where the structure is truly invalidated, not where liquidity is obvious

- Enter after liquidity is swept, not before

- Keep margin to reposition during pullbacks

- Understand: being right isn’t enough — you must be right at the right time.

XAUUSD (Gold) Intraday Outlook TodayXAUUSD (Gold) Intraday Outlook Today: Bullish Continuation Toward Supply | Trendline + Fibonacci + EMA + RSI

Gold is rebuilding bullish structure on the 1H chart after a sharp selloff and a clean V-reversal. The current leg shows higher highs and higher lows, suggesting buyers are in control intraday. The main idea for today is simple: buy pullbacks while price holds above the rising trendline, aiming for the major supply zone near 4550–4560.

Market Structure Read (1H)

The recent swing formed a clear reversal and impulsive push up, then price started printing higher lows.

This is typically where the market transitions from “sell rallies” to “buy dips”.

As long as the last higher-low zone holds, the path of least resistance remains up.

Key Resistance Zones (Sell Pressure Areas)

4435–4440: Near-term intraday ceiling. Break and hold above it favors continuation.

4465: Fibonacci extension target (1.272). Often causes the first reaction.

4507–4520: Fibonacci extension target (1.618) + psychological round zone.

4550–4560: Major supply zone (the highlighted green area). Expect heavy reactions here.

Key Support Zones (Buy Response Areas)

4403: Fibonacci 23.6% retracement (first pullback support).

4385: Fibonacci 38.2% retracement (high-probability dip-buy zone).

4371: Fibonacci 50% retracement (deeper pullback level).

4356–4336: Fibonacci 61.8% to 78.6% (last defense for bulls intraday).

4310: Swing low invalidation (bull thesis breaks if reclaimed by sellers).

Fibonacci Map (Measured From 4310 Low to 4432 High)

Retracements:

23.6%: 4403

38.2%: 4385

50%: 4371

61.8%: 4357

78.6%: 4336

Extensions (targets):

1.272: 4465

1.618: 4507

2.0: 4554 (lines up perfectly with the 4550–4560 supply)

This alignment between Fib 2.0 extension and the supply zone is why 4550–4560 is the “magnet target” if bulls stay in control.

Trendline Plan (High-Probability Framework)

Draw a rising trendline connecting the most recent higher lows (from the reversal low).

As long as candles respect the trendline, favor long setups on pullbacks.

A clean break and retest below the trendline shifts the day into correction mode (then we wait for supports to hold before re-entering).

EMA Strategy (Simple Trend Filter)

Use EMA50 and EMA200 on 1H:

Bullish bias: Price above EMA50, and EMA50 above EMA200.

If price returns below EMA50 and fails to reclaim, expect deeper pullback into 4385–4371.

EMA200 is the “line in the sand” for trend health. If price is below EMA200, reduce long bias and focus on quick scalps only.

(If your EMA values differ slightly by broker, prioritize the level reactions and structure over exact numbers.)

RSI Confirmation (Momentum Rules)

Use RSI(14) on 1H:

Bull continuation: RSI holds above 50 on pullbacks and breaks 55–60 on impulses.

Warning sign: Bearish divergence as price approaches 4507 and especially 4550–4560.

If RSI loses 50 and cannot reclaim, expect the market to rotate toward deeper Fibonacci supports.

Trading Setups for Today (Clear Triggers + Invalidation)

Setup A: Buy the Dip (Preferred)

Entry zone: 4403 to 4385

Trigger: bullish rejection candle / engulfing back above the level + RSI recovers above 50

Stop-loss: below 4371 (aggressive) or below 4356 (safer)

Targets: 4465 → 4507 → 4550–4560

Why it works: You’re trading with the trend, using Fibonacci retracement as a structured demand zone.

Setup B: Breakout and Retest (Momentum Play)

Entry: break above 4435–4440, then retest holds as support

Stop-loss: below 4403

Targets: 4465 → 4507

Rule: If breakout happens but retest fails, do not chase. Let it pull back into Setup A zones.

Setup C: Supply Rejection Short (Countertrend, Only With Confirmation)

Entry zone: 4550–4560

Trigger: strong rejection wick / bearish engulfing + RSI divergence

Stop-loss: above 4560–4565

Targets: 4507 → 4465 → 4435

This is a tactical short, not a bias change, unless structure breaks down below key supports.

Invalidation and Risk Notes

If price breaks below 4336 and fails to reclaim, the bullish intraday continuation weakens.

A drop below 4310 invalidates the current bullish swing completely.

Keep risk controlled. Intraday gold can reverse fast around key levels.

XAUUSD SELL SETUP📌 Trade Plan (XAUUSD – Sell Scenario)

🔻 Entry Reason

Price has reached a premium HTF supply zone near prior highs.

Bearish reaction / BOS at the highs suggests buyers are weakening.

Upside move likely completed a buy-side liquidity grab.

Expecting a mean-reversion / bearish continuation move.

🔻 Entry

Sell on rejection inside the 4,420 – 4,440 supply zone

Prefer bearish confirmation (rejection wick / engulfing / LTF CHoCH)

🛑 Stop Loss (SL)

Above supply and recent high:

4,455 – 4,470

🎯 Take Profit (TP)

TP1: 4,365 – 4,350 (internal liquidity)

TP2: 4,325 – 4,300 (HTF demand / sell-side liquidity)

📉 Why This Sell Works

Trading from premium + supply

Buy-side liquidity likely cleared

Structure showing signs of exhaustion

Clear invalidation and strong RR

NIKL: Trend Reversal CONFIRMED — 40% Upside Ahead?📌 Long opened today in the PREMIUM channel

One of the trades we already opened today in the premium channel and which remains relevant for entry at current prices.

📊 FUNDAMENTAL ANALYSIS

Sprott Nickel Miners ETF #NIKL — an ETF focused on nickel-mining companies. Nickel is a key metal for:

the EV sector (next-generation batteries),

the energy transition,

the defense and aerospace industries.

Fundamental drivers:

🟢 Growing demand for nickel from EVs and energy storage

🟢 Limited supply and high capital intensity of new projects

🟢 Strategic importance of nickel for the U.S. and the EU → sector support

🟢 The ETF structure reduces single-issuer risk while preserving sector upside

Risks:

🔴 Commodity price volatility

🔴 Cyclicality of the commodities market

🔴 Dependence on global economic growth

🚀 In the medium term, fundamentals support a continuation of the upside after the accumulation phase.

🛠 TECHNICAL ANALYSIS (W1, based on the chart)

📈 LONG

▪️ Price has broken above the key resistance around ~16.15 and is holding above it

▪️ Reclaim and hold above EMA50 and EMA200 — a shift in the medium-term trend

▪️ Market structure: higher lows + impulsive breakout

▪️ MACD turning up, forming a bullish impulse

▪️ RSI in the 60–65 zone — strong but not overbought

▪️ Breakout from the consolidation range → start of an impulsive phase

▪️ Breakout of the Inverse Head & Shoulders pattern

The current zone represents a retest and confirmation of the breakout — a classic trend-continuation entry.

↗️ TRADE

🎯 T1: 18.93

🎯 T2: 22.46

📊 Upside potential from current levels: ~35–40%

💼 Format: #active_management

Partial profits can be taken at T1, with the remaining position trailed toward T2.

🔥 Conclusion

NIKL shows a rare alignment of:

a strong fundamental narrative,

a trend reversal on the higher timeframe,

a confirmed technical breakout.

This is not a one-off speculation, but a structural idea with continuation potential into 2026.

⚠️ Published ideas are not investment advice and reflect the author’s personal opinion.

GBP/JPY holds within a Wyckoff distribution zone; the 261.8% extGBP/JPY continues to trade close to the multi-year high of 211.60.

There has been little net movement for the last 7 sessions. This can be analysed as a Wyckoff distribution zone. This formation has a bias to break to the upside.

The four-hour chart shows a 261.8% extension level at 212.65.

Support is located at 210.08

Conclusion: I can see no clear indication of a change of trend. The prime target is 212.65

Gold leaves a gap open at $4,332We have witnessed a gap open from the Friday night close of $4,332. This is the result of traders seeking safe-haven after Trump's unprecedented intervention in Venezuelan politics.

We have broken out of a bullish reverse Head-and-Shoulders formation to the upside. This pattern has a measured move target of $4,530.

Intraday support is located at $4,356.

Conclusion: although the Head-and-Shoulders formation offers a mild bullish bias, this pattern is stronger at the base of a medium-term trend. There is ample scope for a move in either direction. The preferred stance would be to buy into dips. (edited)Monday, 5 January 2026 06:40

US Crude Oil (WTI) trades lower within the CD leg; the formationWe have seen overnight volatility as traders assess the impact on crude oil supplies after U.S. forces capture Venezuela's Madura.

From a technical standpoint, we completed a bullish Elliott Wave count (5 waves) at the $58.81 swing high on December 26. That dictates we are now within a corrective AB-CD formation to the downside.

Cypher pattern analysis highlights the commodity moving lower within the CD leg of a Bat formation. This pattern will be completed on a move to $55.32.

Intraday resistance is located at $57.17 (short term point of control) and $57.47.

Conclusion: I can see no clear indication of a change in the bearish trend. I look for rallies to be sold.

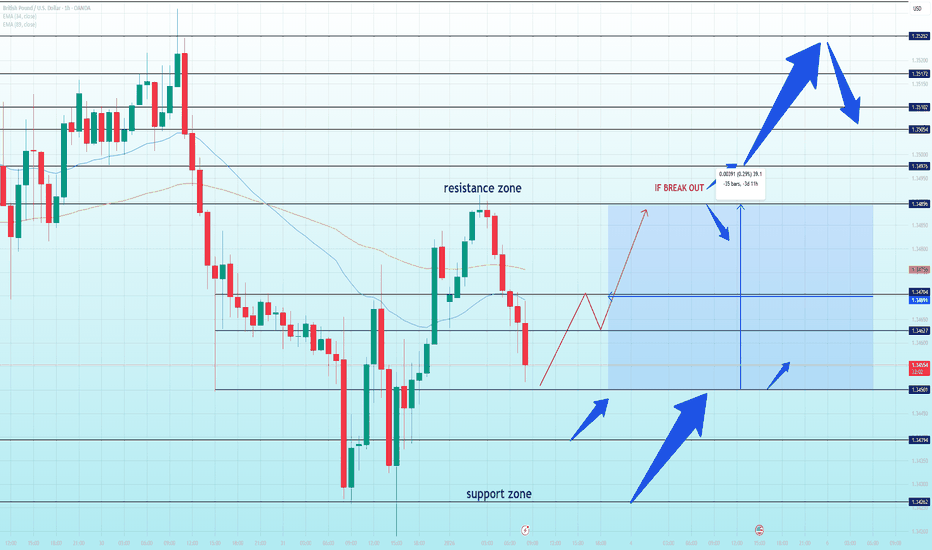

GBP/USD corrects higher within the 4th wave; the 261.8% extensioWe can note spikes in both directions for the last 6 trading sessions. This is common in corrective patterns.

DXY (USD Index) - Although the index is correcting lower, losses should be limited. The focus remains on the sell zone between 98.61 and 98.71 (current price 98.30). Correlation studies would suggest limited upside for GBP/USD.

GBP/USD - Elliott Wave analysis suggests we are correcting higher within the 4th wave. We have a resistance block between 1.3438 and 1.3443. The 261.8% extension level and common exhaustion is seen at 1.3357. The bearish pattern would be broken on a move through the previous swing low of 1.3447.

Conclusion: as long as 1.3447 holds, the bias remains bearish

Elloit wave ETH 1/5/2026Initially, I thought that the wave count from wave(i) to wave(ii) might be wave C, completing the correction in the scinario that wave 4 is not end yet. However, upon reconsideration, the recent downward pressure can also be counted as an impulsive wave i, and it appears too steep to be a corrective move.

Another supporting factor is that the price action following this downward move is clearly corrective, forming a very complex wave structure. The Deep Crab harmonic pattern suggests a reversal zone around 3,180–3,190, which aligns closely with the recent reversal point. This wave count also indicates that wave 4 is nearing completion.

The projected target for wave (v) is around 2,400, supported by butterfly harmonic projections and coinciding with a strong support zone.

The invalidation level for this scenario is a break above 3,330 since wave (ii) should not break above 0.8 retace ment of wae (i).In that case ,ETH wave 4 will not finish yet but the reversal should be soon reaveled

XAUUSD 15mPrice is approaching the back-to-breakeven zone mentioned in our previous analysis.

If bearish reversal candlesticks form within this area, we can look for short opportunities; otherwise, we should be prepared for higher levels and observe where a potential trend change may occur.

Wishing you successful and profitable trades.

GBP/USD at a Decision Point: Breakout Potential or Another RangeGBP/USD is currently trading inside a clearly defined range structure, with price compressing between a well-respected support zone around 1.3450 and a resistance zone near 1.3490–1.3500. Recent price action shows a sharp recovery from the lower boundary, but upside momentum has stalled again as price re-enters the prior resistance area. This behavior suggests the market is not trending, but rotating liquidity within the range.

From a technical perspective, the rejection from the resistance zone is technically clean. Price failed to hold above the short-term equilibrium and slipped back below the mid-range, indicating that buyers lack conviction at higher levels. The moving averages are flattening and overlapping, reinforcing the idea of balance rather than trend. Until a decisive break occurs, upside moves should be treated as corrective, not impulsive.

The bullish scenario only becomes valid if GBP/USD can break and hold above the 1.3490–1.3500 resistance zone, followed by acceptance above that level. In that case, upside expansion could open toward 1.3510 → 1.3525, where higher-timeframe supply is located. Without that confirmation, any push higher remains vulnerable to rejection.

On the bearish / range-continuation scenario, failure to reclaim resistance keeps price rotating back toward the 1.3450 support zone. A clean breakdown below this support would expose deeper downside toward 1.3430 and below, extending the range rather than reversing the broader structure.

From a macro standpoint, GBP remains sensitive to the USD side of the equation. Persistent USD resilience—supported by relatively restrictive financial conditions and cautious Fed messaging—continues to cap upside in GBP/USD. At the same time, the Bank of England’s stance remains restrictive but growth concerns limit aggressive GBP inflows. This macro backdrop favors choppy, range-bound price action, not clean directional trends.

Summary:

GBP/USD is in a neutral-to-range environment. The market is waiting for confirmation. A sustained break above resistance is required to unlock upside continuation; otherwise, the higher-probability outcome remains range rotation back toward support. Patience and confirmation are key at this level.

Gold Trade Plan 04/01/2025Dear Traders,

The price is currently ranging between **4300–4400**. For now, the key support level is around **4300**. Considering the Venezuela-related news, the market may open with a **temporary positive gap**, and I expect another attempt toward **4400**.

For a range breakout, if **4400** is broken and confirmed, after a pullback the price is likely to **continue its bullish trend**.

Regards,

Alireza!

XAGUSD H1 | Bullish Reversal Off Overlap SupportBased on the H1 chart analysis, we could see the price fall to our buy entry level of 74.04, which is an overlap support that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 74.04, which is an overlap support that aligns with the 50% Fibonacci retracement.

Our take profit is set at 77.39, which acts as a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

NZDUSD H4 | Bullish BounceBased on the h4 chart analysis, we can see that the price has bounced off our buy entry level which is an overlap support that aligns with the 38.2% Fibonacci retracement.

Our stop loss is set at 0.5707, which is a pullback support that is slightly below the 50% Fibonacci retracement.

Our take profit is set at 0.5792, which is a pullback resistance that is slightly below the 50% Fibonaci retracement.

High Risk Investment Warning

Stratos Markets Limited (

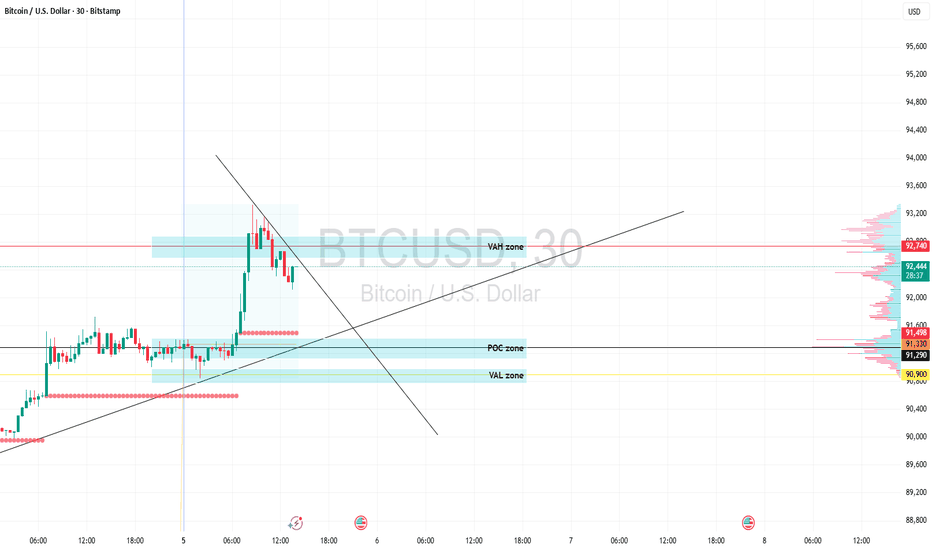

BTC/USD CHART ANALYSIS IN LONDON SESSION I 01/051. Market Structure & Trend

Short-term Trend: The price recently had a strong impulse move from the $90,500 area up to a peak near $93,200. Currently, the market is entering a minor corrective phase or consolidation.

Price Pattern: There are two intersecting trendlines forming a large wedge or triangle pattern. The price is currently sitting near the "apex" of these lines, indicating indecision and a buildup for an upcoming volatile move.

2. Volume Profile Analysis (Key Levels)

The chart displays Value Area zones, which are crucial for identifying institutional interest:

VAH Zone (Value Area High - ~$92,740): The price recently touched this zone and was rejected. This is currently the immediate resistance. If a 30m candle closes above this level, BTC is likely to retest the $94,000 handle.

POC Zone (Point of Control - ~$91,330): This is the level with the highest traded volume. If the price slips further, this will act as a "magnet" support. Prices often gravitate toward the POC before deciding on a new direction.

VAL Zone (Value Area Low - ~$90,900): A strong support floor. If this level breaks, the short-term bullish structure will be invalidated.

3. Technical Indicators

Candlestick Patterns: You can see several consecutive red candles with long upper wicks, suggesting significant selling pressure in the $92,500 - $92,700 range.

Trendline Support: The price is currently hugging the ascending trendline. If it closes below this line (around the $92,200 area), we should expect a pullback toward the POC at $91,330.

## Potential Scenarios:

Bullish Scenario: The price needs to hold the $92,200 level and then break through the VAH ($92,740) with high volume. The next target would be the blue horizontal line at $94,045.

Bearish/Correction Scenario: If the current trendline fails, the price will likely drop to retest the POC ($91,330) and potentially the VAL ($90,900). These zones are where buyers (longs) typically wait for a bounce.

Note: Looking at the red dots (representing historical support floors), there seems to be strong buying interest at lower levels. However, in the immediate 30m timeframe, the VAH is proving to be a tough ceiling.