NVA Long: Breakout From Descending Wedge With 80%+ Upside📌 Nova Minerals (#NVA) — Long Idea | Premium Channel

This long position was opened today in our premium channel, and the setup is still attractive for entry.

📊 FUNDAMENTAL ANALYSIS

🟢 Nova Minerals is a gold exploration and development company with key assets in Alaska (the Estelle Gold Project), one of the most prospective and geopolitically safe regions for gold mining.

🟢 The company continues to actively expand its resource base, increasing confirmed reserves, which enhances its investment appeal amid expectations of higher gold prices.

🟢 Gold traditionally benefits from macroeconomic uncertainty, inflation risks, and weakening confidence in fiat currencies — creating a supportive backdrop for the junior mining sector.

🔴 The main risks remain the lack of stable profitability at this stage and high volatility typical of early-stage development companies.

🛠 TECHNICAL ANALYSIS

📈 LONG

▪️ Price has broken out of a descending wedge and is holding above the upper trendline.

▪️ Price is confidently trading above the 50 EMA, with attempts to consolidate above a key resistance level.

▪️ The 200 EMA acts as a strong long-term support, keeping the broader structure bullish.

▪️ RSI is trending higher, remains in bullish territory, and is not overbought.

▪️ MACD has turned upward and shows strengthening bullish momentum.

▪️ Volume confirms renewed buying interest after consolidation.

↗️ TRADE SETUP

🎯 T1: $14.37

🎯 T2: $18.53

📊 Upside potential: approximately 80%+ if momentum continues toward the upper range and a breakout to new local highs.

💼 Portfolio

#active_management

⚠️ This idea is not investment advice and reflects the author’s personal opinion. Each investor is responsible for their own trading decisions.

Harmonic Patterns

GOLD XAUUSD GOLD 5096-5100 was a complete reaction as predicted on friday.

KEY DEMAND FLOOR 4965-4960

KEY DEMAND FLOOR 4847-4840.

OR FOLLOW THE STRUCTURE.

STRUCTURE NEVER LIES.

am watching 4500-4496 zone a strong demand floor

Geopolitical Tensions

US President Donald Trump's insistence on acquiring Greenland, including threats of force and tariffs on opposing European nations, has sparked US-Europe friction. French President Macron's rebukes and potential suspension of US-EU trade deals have weakened the dollar, boosting gold's appeal to foreign buyers.

Economic Factors

A softer US dollar makes gold cheaper globally, while expectations of steady Federal Reserve rates—despite labor improvements—favor non-yielding assets like gold. Central banks in China and India continue aggressive gold buying, adding structural support.

Future Outlook

Prices may climb toward $5,000-5024k AND extend into 5070k zone if tensions persist and the dollar stays weak, though stronger US data could cap gains.

the dollar index is holding daily support at 97.935$ and during newyork today buy candle kept yesterday demand floor and we are seeing GOLD price into systematic correction from 4890-4880 zone .if they insist on daily buy floor then we will be watching 4900 which is a pathway to 5000-524k and more advanced buying based on the trendangle strategy.

WHAT IS GOLD ???

Gold (Au) is a chemical element and dense, malleable transition metal prized for its lustrous yellow hue, exceptional conductivity, and resistance to corrosion.

History as Store of Value

Gold has served as a store of value for over 6,000 years, from ancient Egyptian tombs (c. 4000 BCE) symbolizing immortality to Lydian coins (600 BCE) enabling standardized trade across empires like Rome (aureus) and Byzantium (solidus, stable 700+ years). The 19th-century gold standard anchored global currencies until 20th-century abandonments, yet gold retains purchasing power

Tier 1 Status Clarification

Gold classifies as a Tier 1 asset under Basel III banking rules , with 0% risk weighting for physical bullion, equivalent to cash for capital reserves, enhancing bank balance sheets amid fiat volatility. This elevates it from prior Tier 3 status, affirming its role as "money again.

HOW DOES THE DOLLAR INDEX AFFECT THE PRICE ACTION AND DIRECTIONAL BIAS ??

The US Dollar Index (DXY) exhibits a strong inverse relationship with global gold prices, where a stronger dollar typically depresses gold values and a weaker dollar boosts them.

Core Mechanism

Gold trades in US dollars worldwide, so dollar strength raises gold's cost for non-US buyers, curbing demand and lowering prices. A weaker dollar reduces this barrier, making gold cheaper and spurring purchases from international investors.

Correlation Strength

Historical data shows a negative correlation coefficient of -0.40 to -0.80, meaning 40-80% of gold's movements often align inversely with DXY changes. Interest rate differentials amplify this: Fed hikes strengthen the dollar and hurt non-yielding gold, while cuts weaken it and favor gold.

Influencing Factors

Geopolitical risks or inflation can override the link temporarily, but dollar dynamics remain the primary driver in most cycles. For instance, recent dollar weakness from de-dollarization trends has fueled gold rallies.

the brics nation are busing buying GOLD.this is the year of GOLD as the new money backed by physical GOLD ,this is why all BRICS CENTRAL BANKS are stocking the yellow bullion.

#GOLD #XAUUSD

I am now Long PUTS IN SLV and Silver 2027 lateThe wave structure is now complete as into the cycle high and fib relationship The US$ is about to Bottom in wave B low we should then see a huge rally in DXY and a sharp decline in all metals and the sp 500 is in wave c up in wave 5 of the diagonal 5th wave all coming into the 5 spirals due 2/9 event best of trades WAVETIMER

CRDO in BUY ZONEMy trading plan is very simple.

I buy or sell when at either of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow volume spikes beyond it's Bollinger Bands

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at bottom top of channels

Money flow momentum is spiked negative and at bottom of Bollinger Band

Entry at $136.25

Target is upper channel around $164, but may close at moving averages around $150

Set your own stop. Mine is set at $133.

[LOI] - BTR - BTR

Key Points

Purpose : Bitlayer is a Layer 2 network built on Bitcoin, designed to enable scalable DeFi applications while maintaining Bitcoin's security through BitVM technology. It aims to unlock Bitcoin's capital for broader use in smart contracts and decentralized finance.

Problem Solved: Bitcoin's native limitations in scalability, programmability, and transaction throughput hinder complex DeFi; Bitlayer addresses this by providing Turing-complete contracts via an optimistic validation scheme, allowing high-throughput execution without compromising Bitcoin's consensus.

Bullish Case for Demand : With Bitcoin's ecosystem gaining traction in 2026 amid BTCFi narratives, Bitlayer's EVM compatibility, yield-generating assets like YBTC, and upcoming enhancements could drive adoption; its low market cap (~$30M) suggests high growth potential but also volatility, making it risky to short as pumps (e.g., recent 46%+ daily gains) indicate strong speculative interest.

Partnerships : Key collaborations include mining pools (Antpool, F2Pool, SpiderPool) controlling ~40% of Bitcoin hashrate, DeFi platforms like Kamino Finance and Orca for YBTC integration on Solana, infrastructure ties with AWS and Chainlink, and ecosystem links with Sui, Base, Arbitrum, and Cardano.

Current Market Cap : Approximately $30.6 million, with a circulating supply of 261.6 million BTR out of 1 billion total; this low cap amplifies upside potential in a bullish BTC L2 market but heightens risk.

Recent Announcements : January 2026 funding surge of $29 million to enhance BTC and multi-chain integrations; anticipated mainnet upgrade in February 2026; USDC token contract update; outlook for further growth including Bitcoin event participation.

Notes on how I personally use my charts/NFA:

Each level L1-L3 and TP1-TP3 (Or S1-S3) has a deployment percentage. The idea is to flag these levels so I can buy 11% at L1 , 28% at L2 and if L3 deploy 61% of assigned dry powder. The same in reverse goes for TP. TP1: 61%, TP2:28% and TP3:11%. If chart pivots between TP's, in-between or in Between Sell levels these percentages are still respected. I like to use the trading range to accumulate by using this tactic.

Just my personal way of using this. This is not intended or made to constitute any financial advice.

This is not intended or made to constitute any financial advice.

NOT INVESTMENT ADVICE

I am not a financial advisor.

The Content in this TradingView Idea is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained within this idea constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this idea post is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the idea/post constitutes professional and/or financial advice, nor does any information on the idea/post constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the idea/post before making any decisions based on such information.

Sir. Galahad - QUANT

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by.

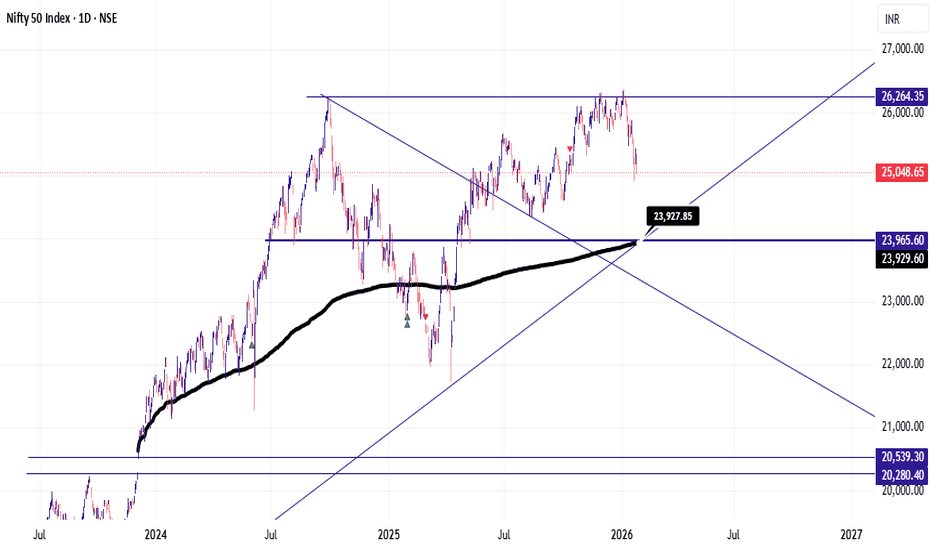

Nifty 50 Analysis Target For Bearish Momentum Stop Here Sure 👍

Here is the **Nifty 50 Components list (in English only):**

---

## ✅ Nifty 50 Companies List

### **Banking & Financial Services**

* HDFC Bank

* ICICI Bank

* State Bank of India

* Axis Bank

* Kotak Mahindra Bank

* Bajaj Finance

* Bajaj Finserv

* Shriram Finance

### **Information Technology (IT)**

* Tata Consultancy Services (TCS)

* Infosys

* HCL Technologies

* Wipro

* Tech Mahindra

### **Oil, Gas & Power**

* Reliance Industries

* ONGC

* NTPC

* Power Grid Corporation of India

### **FMCG (Fast Moving Consumer Goods)**

* Hindustan Unilever (HUL)

* ITC

* Nestlé India

* Britannia Industries

### **Automobile**

* Maruti Suzuki India

* Tata Motors

* Mahindra & Mahindra

* Hero MotoCorp

* Bajaj Auto

* Eicher Motors

### **Metals & Mining**

* Tata Steel

* JSW Steel

* Hindalco Industries

* Coal India

### **Pharmaceuticals & Healthcare**

* Sun Pharmaceutical Industries

* Dr. Reddy’s Laboratories

* Cipla

* Divi’s Laboratories

* Apollo Hospitals

### **Cement & Infrastructure**

* UltraTech Cement

* Grasim Industries

* Larsen & Toubro (L&T)

### **Telecom**

* Bharti Airtel

### **Others**

* Adani Enterprises

* Adani Ports & SEZ

* Asian Paints

* UPL

---

⚠️ *Note:*

Nifty 50 constituents are reviewed **twice a year (March & September)** by NSE, so the list may change slightly over time.

If you want, I can also provide:

* Nifty 50 sector weightage

* Latest updated list in table format

* Nifty 50 historical returns

* Best stocks for long-term investment

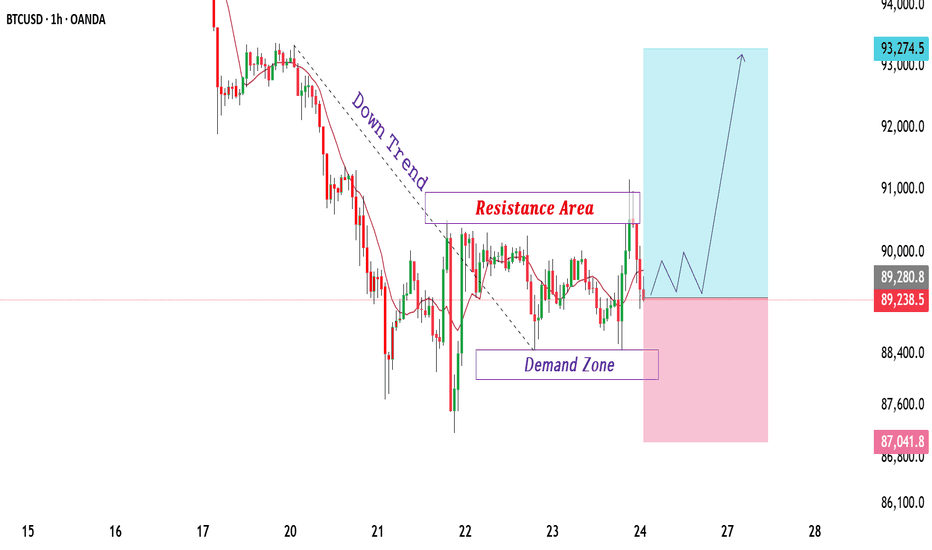

BTCUSD Consolidates Between Demand and Resistance Price Zones.BTCUSD is trading within a corrective phase after a strong bearish impulse, clearly showing a short-term downward structure. Price action continues to respect the descending trend, with lower highs and controlled pullbacks, indicating that selling pressure is still active. The marked resistance area around the recent highs represents a key supply region where price previously reacted and faced rejection. This zone remains important, as repeated failures above it suggest sellers are defending this level and limiting upside momentum.

On the lower side, a well-defined demand zone is visible near the recent swing lows. This area is supported by multiple price reactions and a short period of consolidation, highlighting the presence of buyers absorbing selling pressure. The demand zone acts as a critical support region and a potential buy interest area if price shows stability and positive reaction within this range. As long as price holds above this demand, a temporary recovery or sideways movement remains possible.

Current market behaviour suggests consolidation between demand and resistance, reflecting a balance between buyers and sellers after the sharp decline. Volatility is expected near both zones, where price may react strongly. Acceptance above resistance would weaken the bearish structure and shift focus toward higher levels, while a sustained move below demand would confirm continuation of downside momentum. Overall, the market remains cautious, with a bearish bias in the short term while price stays below resistance, and key reactions expected around the highlighted demand and resistance areas.

Disclaimer: This analysis is for educational purposes only. It is not financial advice. Trading involves risk and uncertainty.

EURUSD LONG 4 HOURSİn the position entered based on the bat pattern , i believe the long position should be maintained , and the target is the potential D point of the newly forming crab pattern .

Entry Level = 1.15130

Stop Level = 1.1450

(To protect against the possibility of the pattern failing , we can move the stop level to point a of the first pattern)

Tp = 1.18617

"Not financial or trading advice -simply sharing my perspective"

Gold's safe-haven properties have been activated to the extreme.Bullish Core Support: Four-Fold Logic Resonance, Maximum Momentum

1.Massive Capital Inflows, ETF and Central Bank Support: The world's largest gold ETF (SPDR) significantly increased its holdings by 6.87 tons from the previous day, reaching 1086.53 tons, a new high in over two years. It also recorded a net inflow of over $500 million during the day, setting a new record for single-day capital inflow, indicating strong institutional bullish sentiment. Central bank gold purchases continue to increase, with the People's Bank of China increasing its holdings for 16 consecutive months, adding 35 tons in January. The average monthly gold purchase by central banks globally remains at a high level of 60-70 tons, creating rigid support and absorbing marginal supply from the market.

2.Escalating US-Europe Geopolitical Conflicts, Extreme Risk Aversion: Trump officially announced a 10% tariff on goods from eight countries, including Denmark, Germany, and France, starting February 1st. The EU is preparing retaliatory countermeasures. Pension funds in Denmark and other countries are accelerating the sale of US bonds and shifting to gold. Geopolitical risks have evolved from a temporary event to a constant support factor. The VIX index surged to 20.09, maximizing the safe-haven attribute of gold.

3.US Dollar Index Hits Three-Month Low, Valuation Pressure Completely Removed: The US dollar index continued to weaken during the day, falling to a low of 97.48, a new three-month low. It is currently trading at 97.207, down 0.45% for the day and a cumulative decline of 1.5% since the beginning of the year, establishing a weak trend. The negative correlation between the dollar and gold is evident; dollar depreciation significantly reduces the cost of holding gold, opening up ample room for a surge in gold prices.

4.Strong Institutional Bullish Consensus, Strong Trend Momentum: Goldman Sachs raised its gold price target to $5400 by the end of 2026, and UBS suggested that it could reach $5400 in extreme scenarios. The market has a high degree of consensus on the upward shift of the gold price center. Gold prices surged by $38.94 in just one hour today, a 0.77% increase. Both domestic and international markets showed strong upward momentum, with London gold and COMEX gold futures rising simultaneously. The daily and hourly charts show a complete bullish pattern, indicating that the trend is likely to continue.

Gold trading strategies

buy:5060-5070

tp:5080-5090-5120

BTC/USDT – Short-Term Relief Rally (Weekly Timeframe)hi traders

Don't get too excited but...

This technical analysis evaluates the weekly price action of Bitcoin (BTC), identifying a high-probability reversal setup based on momentum exhaustion at a key structural support level.

1. Technical Setup: Bullish RSI Divergence

The primary catalyst for this trading idea is the Bullish Divergence between the price action and the Relative Strength Index (RSI) on the weekly timeframe.

Price Action: Bitcoin has recently undergone a healthy correction, pulling back to a significant horizontal support zone between $84,000 and $88,000. While the price made a series of lower lows (or equal lows) in this range, the bearish pressure appears to be waning.

RSI Indicator: During this same period, the RSI (14) has formed a clear higher low.

Significance: A bullish divergence on a high timeframe like the weekly chart is a powerful indicator of "selling exhaustion." It suggests that while the price is testing lows, the underlying momentum is actually shifting to the upside, often preceding a trend reversal or a significant relief rally.

2. Chart Structure: Support & Resistance

Support Validation: The level near $87,937 is acting as a strong psychological and technical floor. The presence of several weekly wicks in this area confirms that buyers are stepping in to defend this zone.

Immediate Resistance: The first major hurdle for the bulls is the recent consolidation peak near $96,000 - $98,000. This area served as local resistance throughout late 2025.

3. Trading Execution Plan

Based on the "short-term rally" thesis indicated on the chart:

Entry Zone: $87,500 - $89,000 (Current market price/support retest).

Target (Short-Term): ~$98,000. This aligns with the flag marked on the chart and represents a return to the upper boundary of the current range.

Stop-Loss: A weekly close below the major support at $84,000 would invalidate the bullish divergence thesis.

4. Market Context

Bitcoin is currently in a phase of high-level consolidation. This weekly bullish divergence suggests that the most aggressive portion of the recent sell-off is over. A successful bounce from this $88k floor would validate the broader macro bull trend and potentially set the stage for an attempt at the six-figure mark ($100,000+) later in the quarter.

Conclusion

The Weekly Bullish Divergence on BTC/USDT provides a high-conviction setup for a short-term rally. With the price successfully defending the $88k support and momentum shifting upward, the path of least resistance points toward a retest of the $98,000 level in the coming weeks.

DXY DOLLAR INDEXThe DXY, or U.S. Dollar Index, measures the value of the U.S. dollar against a basket of six major foreign currencies. A rising DXY signals dollar strength, while a falling index indicates weakness.

DXY Composition

The index weights currencies as follows: euro (57.6%), Japanese yen (13.6%), British pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), and Swiss franc (3.6%). Created in 1973 by the Federal Reserve, it uses a geometric average formula to track dollar performance relative to these trade partners.

Impact on Gold

DXY and gold prices show a strong inverse correlation, often 73-95% negative. When DXY rises, a stronger dollar makes gold pricier for foreign buyers, reducing demand and pushing prices down; a falling DXY has the opposite effect.

Impact on Forex

DXY directly influences USD pairs like EUR/USD and GBP/USD, where a higher index weakens these pairs as the dollar strengthens. It also affects USD/JPY positively and serves as a gauge for overall market risk sentiment and Fed policy effects.

#DXY #DOLLAR

ASTRUSDT Forming Falling WedgeASTRUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range after the recent decline, suggesting that selling pressure is steadily weakening while buyers are quietly stepping in to regain control. With consistent volume confirming accumulation at these lower levels, the setup is pointing toward a potential bullish breakout in the near term. If the price breaks decisively above the wedge resistance, the projected move could deliver an impressive gain of around 90% to 100% from the breakout point.

This falling wedge pattern is typically seen at the end of downtrends or during corrective phases, and it serves as a strong sign that market sentiment may be shifting from bearish to bullish. Traders closely watching ASTRUSDT are observing a similar strengthening momentum as it approaches its own breakout zone. The healthy trading volume supporting the pattern adds real confidence, showing that market participants are getting positioned early in anticipation of a reversal.

The growing interest in ASTRUSDT is fueled by increasing belief in the project’s long-term fundamentals combined with this attractive technical structure. A confirmed breakout backed by sustained volume could trigger the start of a fresh bullish leg. Traders might view this as a compelling setup for medium-term gains, especially once the wedge pattern fully resolves and buying pressure starts to accelerate.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ZKCUSDT Forming Falling WedgeZKCUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range after the earlier decline, suggesting that selling pressure is steadily weakening while buyers are quietly stepping in to regain control. With consistent volume confirming accumulation at these lower levels, the setup is building toward a potential bullish breakout in the near term. If the price breaks decisively above the wedge resistance, the projected move could deliver an impressive gain of around 90% to 100% from the breakout point.

This falling wedge pattern is typically seen at the end of downtrends or during corrective phases, and it serves as a strong sign that market sentiment may be shifting from bearish to bullish. Traders closely watching ZKCUSDT are seeing a similar strengthening momentum as it approaches its own breakout zone. The solid trading volume supporting the pattern adds real confidence, showing that market participants are getting positioned early in anticipation of a reversal.

The growing interest in ZKCUSDT is driven by increasing optimism about the project’s long-term fundamentals combined with this attractive technical picture. A confirmed breakout backed by sustained volume could mark the beginning of a fresh bullish leg. Traders might view this as a high-quality setup for medium-term gains, especially once the wedge pattern fully completes and buying momentum starts to accelerate.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

GBP/USD likely to drop from the Fair Value Gap levels.The GBP/USD pair has paused its recent bullish momentum after rallying sharply from the 1.3380–1.3400 region and reaching the 1.3660 area, where selling pressure has begun to emerge. At the time of writing, the pair is trading slightly below 1.3650, consolidating beneath a well-defined resistance zone following an impulsive upside move.

The recent rally appears to be largely corrective in nature, driven by temporary US Dollar weakness and short covering, rather than a sustained shift in the broader trend. As price approaches higher-timeframe supply, upside momentum is showing signs of exhaustion, increasing the probability of a pullback.

Technically, GBP/USD remains within a broader bearish-to-neutral market structure, despite the recent impulsive rally. The pair has rallied directly into a clearly defined resistance zone between 1.3660 and 1.3720, an area that previously acted as supply. Price has also entered a Fair Value Gap (FVG) created during the last impulsive bearish move, which often acts as a magnet for institutional selling. The market is currently printing consolidation candles beneath resistance, signaling distribution rather than continuation. Momentum indicators (price action–based) suggest bullish exhaustion, with price failing to make meaningful continuation highs after the initial impulse.

GBP/USD is trading into a high-probability sell zone, supported by a confluence of technical resistance, Fair Value Gap rejection, and weakening bullish momentum. A corrective decline toward lower support levels is favored in the near term. We expect the price to rebound from the FVG level at 1.3657 and drop towards the 1.3564 level.

XAUUSD#XAUUSD 30M Outlook!

Gold maintains bullish structure after BOS with strong impulsive move.

Price is consolidating above the FVG, indicating continuation potential after mitigation.

Best Buy Zone: 5,055–5,065 (FVG support)

Target: 5,140 → 5,170

SL: Below 5,030

Waiting for bullish confirmation from the FVG before continuation higher.

NASDAQ Will the 2-month Resistance hold and cause a correction?Nasdaq (NDX) opened lower today but quickly recovered as it hit its 1D MA50 (blue trend-line). With last week's Low being on the 1D MA100 (green trend-line), the level that has caused the last two major rebounds since November 21 2025, the market focus shifts again on Resistance 1 (almost 2 months intact), which has caused the last 4 top rejections.

With the Lower Highs trend-line also since its All Time High holding and a huge 1D RSI Lower Highs Bearish Divergence since September 22 2025, as long as the market doesn't close a 1D candle above Resistance 1, we expect a bearish reversal first to 24900 (just above Support 1) and if Support 2 breaks, bearish extension targeting the 1D MA200 (orange trend-line) around 24200.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇