#ICP/USDT Ready for a Breakout — Double Digits Possible#ICP

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 3.70. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 3.74

First target: 3.82

Second target: 3.90

Third target: 4.00

Don't forget a simple principle: money management.

Place your stop-loss below the green support zone.

For any questions, please leave a comment.

Thank you.

ICPUSD

#ICP/USDT Ready for a Breakout — Double Digits Possible#ICP

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 4.04. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 4.12

First target: 4.22

Second target: 4.37

Third target: 4.55

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#ICP/USDT Ready for a Breakout — Double Digits Possible#ICP

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at the 4.90 price, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 5.05

First target: 5.20

Second target: 5.42

Third target: 5.70

Don't forget a simple money management tip:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#ICP/USDT wakes up from the dead!#ICP

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at the 5.70 price level, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 6.30

First target: 6.70

Second target: 7.23

Third target: 7.97

Don't forget a simple money management tip:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

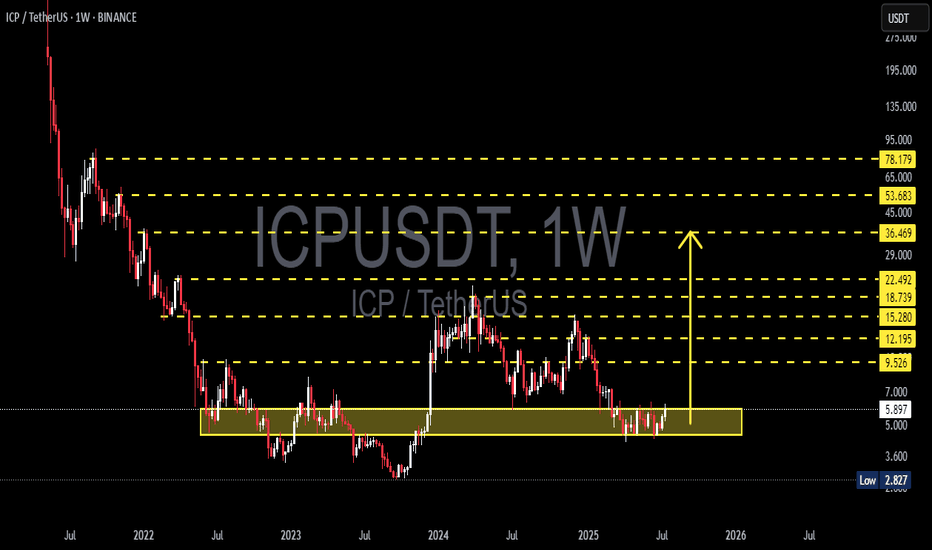

ICPUSDT - many positive indicators!The coin ICP has pumped nearly 160% in just one week, and believe it or not — all that move happened without even breaking out of the accumulation range it’s been forming for over 275 days.

So imagine what will happen once it finally breaks out!

The high volume and bullish indicators on the chart suggest that this coin’s minimum target is around $30, meaning roughly a 5x potential from the current level.

It has already broken above the 0.618 Fibonacci resistance, broken the main trendline (marked in blue), and even formed a Golden Cross pattern.

It’s still inside the accumulation zone for now, so this is your early entry opportunity — because once it breaks out, you won’t catch it again.

Mark my words.

Best Regards:

Ceciliones🎯

ICP wakes up from the dead!#ICP / USDT

After being useless for several months this coin made a similar movements like the one in late 2023

Price dropped below the most important S/R zone in chart taking the liquidity and after that massive volume started to enter the coin

Such movement in late 2023 ends up in X5 increase in its price in next months (after restoring the S/R)… price can make the similar movement here … ICP is waking up from the dead !

icp NEAR TO BREAKOUTIf ** CRYPTOCAP:ICP ** breaks the trendline and turns it into upper support, it can move around $60.

CRYPTOCAP:ICP just smashed through the trendline with a massive breakout and has now flipped it into solid upper support! It's confidently holding above this previous resistance (now turned support). If volume and momentum stay strong, a move around $60 is very realistic. Short & sweet:

CRYPTOCAP:ICP → Trendline break → Flipped to support → Next target ~$60 Bulls are fully in control. Hold tight!

MR - ICP Deep DiveHello again!!!

I do remember when I got my airdrop

I dumped it all the way down even though it was tiny amount

so many tried to guess ICP Difnity bottom and got rekt literally there are people bought it above 20$ and ofc early buyers bought at around 200+.

however there might be a very interesting opportunity for buyers between 0.7 and 1.4$ if it goes to there

based on my counting we are in wave 5

this is an L1 protocol not a metaverse nor a defi shit token

so even a small amount near 0.7 could make it decent amount in the next bull run

so prepare your money for the next round

thanks bye.

ICPUSDT – Major Reversal Setup Forming! Ready for Breakout Move?The ICP/USDT chart is currently displaying a highly critical structure as price continues to compress within a Falling Wedge pattern that has been developing since early 2025.

This formation is often seen as a bullish reversal signal — typically marking the end of a prolonged downtrend and the start of an accumulation or reversal phase.

At the current price level around $4.09, selling pressure has started to weaken, while buying pressure is gradually building up. Price is reacting positively from the lower wedge boundary and is now challenging the upper trendline resistance.

A confirmed breakout above this zone, especially with strong volume, could spark a major bullish momentum — opening the door for a move toward the next resistance targets at $4.65, $6.05, and $6.90.

However, if the price faces rejection once again from the upper wedge boundary, consolidation or another retest of the $3.10–$2.60 support zone remains possible.

This area marks a decisive moment for ICP’s mid-term direction.

---

Pattern Description

A clear Falling Wedge (Bullish Reversal Pattern) is visible through two downward-sloping and converging trendlines.

Key characteristics: lower lows are slowing down, highs continue to descend, and trading volume decreases over time.

Technical implication: selling pressure is fading, and accumulation is likely occurring before a potential reversal.

---

Bullish Scenario

A confirmed bullish breakout would occur once the price closes decisively above the upper wedge line and the $4.65 resistance on the 3-day timeframe, accompanied by a surge in trading volume.

If validated, upside targets could include:

Target 1: $6.05 (initial resistance and profit-taking area)

Target 2: $6.90 (mid-range wedge resistance)

Target 3: $9.75 (major resistance zone and possible momentum expansion)**

Breakouts from large falling wedges on higher timeframes often trigger strong mid- to long-term reversals, particularly when supported by high volume.

---

Bearish Scenario

If the breakout attempt fails and price gets rejected around the $4.65–$4.80 region, selling pressure could drag ICP back down toward the $3.10 – $2.60 support zone.

A breakdown below this area would invalidate the bullish setup and likely resume the macro bearish trend.

The $3.10 level is the key structural support — losing it would confirm renewed weakness.

---

Overall Outlook

ICP is currently at a make-or-break level, where a confirmed breakout could shift market sentiment from bearish to neutral–bullish.

The technical structure favors a potential trend reversal, but confirmation is crucial before positioning aggressively.

False breakouts remain possible, so risk management and patience are essential.

Psychologically, reclaiming $4.65 would be the first sign of a sentiment shift, potentially leading to renewed investor confidence in ICP’s mid-term recovery.

---

Summary

Pattern: Falling Wedge (Bullish Reversal Pattern)

Status: Approaching breakout area

Bullish Trigger Zone: Above $4.65

Bullish Targets: $6.05 → $6.90 → $9.75

Critical Support Zone: $3.10 – $2.60

Dominant Bias: Neutral turning bullish upon breakout confirmation

---

#ICP #ICPUSDT #ICPTether #CryptoAnalysis #TechnicalAnalysis #FallingWedge #ReversalPattern #BreakoutSetup #SwingTrade #CryptoChart #AltcoinWatch #MarketStructure

ICP Main Trend 10 2025Logarithm. Timeframe: 1 week. I'm updating my previous trading idea for the primary and secondary trends (it achieved its goals with pinpoint accuracy), published 2.5 years ago.

A patient and consistent person will be rewarded, while a restless person will not.

Locally, this reversal zone is after a futures long takeout:

Low-liquidity instruments and huge leverage (targeted by the main information traffic of "easy money" lures) are incompatible... logically... But, it's profitable for exchanges to create such futures trading instruments, as people will leave their money there. There's no real supply or demand, and exchange algorithms completely control the price (volatility), which is why "traders" are doomed.

That's why we've recently seen cascading collapses in futures liquidity and mass liquidations, which have been reflected in the spot market. Spike prices on many instruments reached -40-80%, practically in a completely empty order book.

It's quite easy to direct the price to such a massive liquidation up or down on a large exchange by manipulating the entire trading volume, given low supply and demand. However, this is impossible (considered blatant manipulation) on a single instrument, and there will be many questions and lawsuits. But if this is done on hundreds of cryptocurrencies simultaneously and across all exchanges, under a correspondingly negative news backdrop, everything is fine; it's the market and the negative news.

Is #ICP Ready to Make a Bullish Move? Watch it Closely Bulls Yello Paradisers! Will #ICP finally break out of this long-standing downtrend, or is a brutal shakeout brewing just below the surface? Let’s dive deep into #InternetComputer setup:

💎#ICPUSDT has been stuck inside a falling wedge since mid-July, bouncing precisely between descending resistance and support. Currently, the price is coiling right beneath that descending resistance line, and the squeeze is getting tighter. A breakout from this zone would significantly increase the probability of a bullish reversal, especially with the 50EMA right above acting as dynamic resistance-turned-support if the breakout is confirmed.

💎The support zone around $4.0 has already triggered multiple bounces in recent sessions, showing strong buyer interest. If bulls can hold this level and push through the channel resistance, the first key upside target is the moderate resistance at $5.96.

💎A successful break above $5.96 would open the door to the strong resistance at $7.27, where we expect significant selling pressure. For the #ICPUSD, volume confirmation on the breakout will be crucial, and without it, any move may turn into a bull trap.

💎On the flip side, if #ICP fails to hold the $4.00 support and breaks below the demand zone at $3.42, the bullish scenario will be invalidated. That would likely lead to a continuation of the downtrend with a sharp leg lower, potentially printing new short-term lows. This is the final line of defense — if lost, we expect stop-hunts and heavy liquidations to follow.

Strive for consistency, wait for clear confirmations, and remember that discipline always beats chasing quick profits.

MyCryptoParadise

iFeel the success🌴

ICPUSDT — Retesting Demand Zone: Capitulation or Major Reversal?Weekly Overview

Internet Computer (ICP) is now entering a critical test phase at its long-standing historical demand zone between 2.80 and 4.53 USDT — an area that has repeatedly acted as the last line of defense for buyers since mid-2022.

This zone is not just another technical level. It represents a multi-year accumulation range where institutional money has historically shown interest, triggering two major reversals in the past (early 2023 and early 2024).

Now, the market is testing it for the third time, and the outcome of this retest may decide ICP’s direction for the next several months — or even years.

---

Structure and Pattern Context

Since its peak in 2021, ICP has been in a long-term structural downtrend, forming a sequence of consistent lower highs.

However, it’s also built a horizontal accumulation base below 5 USDT.

The 2.80–4.53 zone acts as a compressed demand layer, where selling pressure weakens every time this range is revisited.

On the weekly timeframe, recent candles show:

Smaller body sizes,

Long lower wicks,

And declining bearish volume — clear signs of seller exhaustion.

In short, the market stands at a crossroads between “the final breakdown” and “the birth of a long-term reversal.”

---

Bullish Scenario — Potential Reversal Phase

If this demand zone holds once again, ICP could enter a medium-term reversal cycle.

Here’s what would confirm a bullish structure shift:

1. Bullish Reversal Candle — a weekly engulfing, hammer, or morning star pattern appearing inside 2.80–4.53.

2. Volume Confirmation — a noticeable increase in bullish volume, signaling smart money accumulation.

3. Structure Break — a successful weekly close above 5.98 USDT, forming a new higher high.

If these confirmations occur, ICP could initiate a gradual expansion phase toward key resistance targets:

Target 1: 5.98 USDT – structure validation

Target 2: 6.90 USDT – breakout confirmation

Target 3: 9.53 USDT – major swing resistance

Mid-term target: 15.28–18.73 USDT if momentum persists

Each step upward will depend on overall crypto sentiment and volume strength across the market.

---

Bearish Scenario — Breakdown & Capitulation Risk

If bearish pressure continues and ICP closes a weekly candle below 2.80, the accumulation base built over the last two years would become invalidated.

Such a breakdown could trigger final capitulation, characterized by panic selling and heavy volume.

Below 2.80, there’s no major historical support, meaning the price could enter a free-fall zone toward 2.00 or lower before stabilizing.

Ironically, such capitulation events often mark the true bottom of a cycle — a classic pattern seen before every major crypto bull run.

---

Structural Perspective — End of the Downtrend?

Some longer-term signals suggest ICP may be approaching trend exhaustion:

Weekly RSI has remained in oversold territory for a prolonged time, while price fails to make new lows — indicating bullish divergence.

Major distribution phases occurred between 2022–2023, implying most selling pressure is likely done.

Price action resembles a late-stage accumulation phase, where smart money prepares for long-term positions (12–24 months ahead).

If this demand holds, the 2.80–4.53 range could become ICP’s legendary bottom, much like ETH’s 2020 base or ADA’s 2020–2021 accumulation.

---

Conclusion

ICP stands at a make-or-break point — the most decisive level it has seen in two years.

Holding 2.80–4.53 → opens the door for a potential major reversal.

Breaking below 2.80 → signals a final capitulation phase before a new cycle emerges.

Until proven otherwise, the reaction and weekly close inside this demand zone remain the key factor to watch.

As long as 2.80 holds, the bullish probability still exists.

#ICP #ICPUSDT #InternetComputer #Crypto #TechnicalAnalysis #PriceAction #DemandZone #SwingTrade #CryptoMarket #WeeklyChart #ReversalSetup #CryptoTA #Accumulation

ICP/USDT — Major Demand Zone Retest: Rebound or Breakdown Ahead?At the moment, ICP is standing at a very critical crossroads. The weekly chart shows the price retesting the historical demand zone around $4.10 – $4.79. This area has repeatedly acted as a strong accumulation base in the past, triggering significant rallies. However, the more often this zone gets tested without a breakout to the upside, the higher the risk of a breakdown.

---

🔎 Key Technical Structure

1. Long-Term Trend: ICP remains in a broad downtrend since launch, with failed mid-term rallies along the way.

2. Demand Zone $4.1 – $4.8: A psychological and historical support area, holding the price since 2022.

3. Layered Resistances: Key levels to watch are $5.98, $6.90, $9.53, followed by $15.28, $18.74, and $22.49. Breaking through these would confirm a larger bullish reversal.

4. Final Support Below: If breakdown occurs, the next major level sits at $2.827 — a historical low.

---

📈 Bullish Scenario

Validation: A strong weekly bullish close within or above $4.1–$4.8, supported by rising volume, would signal potential accumulation.

Short-Term Target: $5.98 – $6.90 → reclaiming this range could push ICP toward $9.53.

Mid-Term Target: If momentum continues, ICP could revisit $15.28 – $18.74, and even $22.49.

Potential Pattern: A double bottom / W pattern would form if price closes above the $6.9 neckline.

---

📉 Bearish Scenario

Breakdown Confirmation: A weekly close below $4.10 = strong bearish continuation signal.

Downside Target: Price may slide toward $2.827 (historical low).

Seller Dominance: A breakdown with rising sell volume would confirm extended bearish control.

Risk Factor: Losing this demand zone would likely extend ICP’s bear cycle significantly.

---

📊 Price Action & Patterns

Sideways Range in Demand Zone: Currently, price is moving sideways within demand → this is a classic setup for accumulation or distribution.

Breakout Above: Signals accumulation → start of a potential uptrend.

Breakdown Below: Signals distribution → likely deeper decline.

---

⚖️ Conclusion

ICP is at a make-or-break zone:

Holding above $4.1–$4.8 could spark a strong reversal rally back toward $6.9 – $9.5, with higher targets possible.

A breakdown below $4.1 would expose ICP to a retest of the $2.8 low, keeping the long-term bearish structure intact.

📌 For traders, this is the time to wait for weekly candle confirmation & volume before committing.

📌 For long-term investors, this zone offers a high-risk but high-reward accumulation area — strict stop losses are essential.

---

#ICP #ICPUSDT #CryptoAnalysis #WeeklyChart #SupportResistance #TechnicalAnalysis #SwingTrading #Altcoins #CryptoStrategy

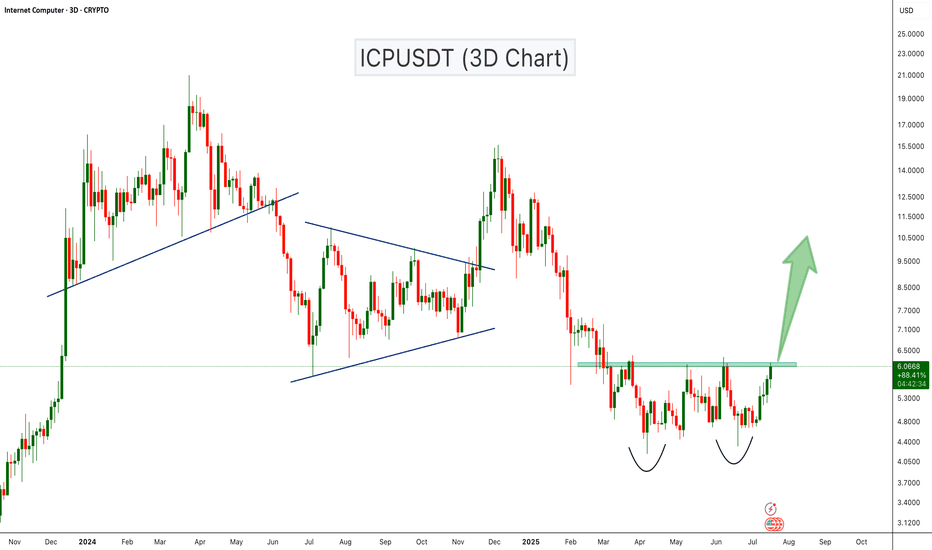

ICPUSDT Double Bottom Breakout Loading?ICPUSDT is showing a strong bullish setup with a classic double bottom pattern forming on the 3-day chart. The price has tested the support zone twice and is now approaching the neckline resistance around the $6.10 level. A confirmed breakout above this resistance could trigger a strong bullish move toward the next key resistance levels near $9.50 and $15.

Cheers

Hexa

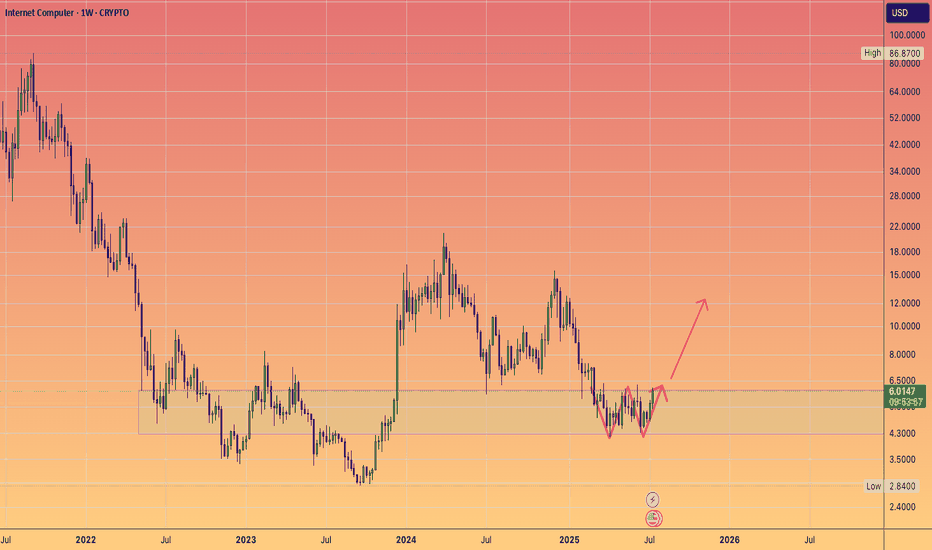

ICP/USDT Weekly Analysis: Multi-Year Accumulation Base🔍 Macro Outlook & Context:

ICP has been in a prolonged downtrend since its initial listing, dropping over 95% from its all-time high. However, since late 2022, ICP has been forming a strong and well-defined accumulation base between the $3.00 – $6.00 range.

Currently, price action and structure indicate that a potential breakout from this multi-year base is imminent. The setup is beginning to mirror a Wyckoff Accumulation Phase, where smart money accumulates quietly before launching into the next markup phase.

📐 Technical Structure & Pattern Breakdown:

✅ Accumulation Zone

Over 80 weeks of consolidation within a tight horizontal range.

This forms a strong foundation for a powerful breakout move if confirmed.

✅ Multiple Bottom Formation

Repeated failures to break below $3.50 suggest growing bullish pressure and seller exhaustion.

✅ Bullish Compression

Higher lows forming inside the range.

Resistance at $6.00 is being tested more frequently, indicating a breakout buildup.

✅ Volume Profile

Declining volume during sideways action = typical of supply exhaustion.

Surge in volume during breakout would confirm entry into markup phase.

🚀 Bullish Scenario (Primary Setup):

If price breaks and closes above $6.00 on the weekly timeframe:

Key Resistance Targets:

$9.52 → $12.19 → $15.28 → $18.73 → $22.49

Extended Bull Market Targets:

$29 → $36 → $45+

Potential ROI from base zone: +200% to +600%

Bullish Confirmation Signals:

Strong weekly candle close above $6.00

Volume breakout

RSI crossing 50 and MACD bullish crossover

🐻 Bearish Scenario (Alternative):

If the breakout fails and rejection occurs at $6.00:

Possible retracement back to lower support zones:

$4.50 → $3.00

A breakdown below $3.00 would invalidate the bullish structure and open risk for new lows.

Bearish Red Flags:

Long upper wick near resistance without volume

RSI drops back under 40

Breakdown of $3.50–$4.00 support zone

📊 Trading Strategy & Risk Management:

Entry Type Price Range

Breakout Entry $6.20–$6.50

Conservative SL $5.20

Aggressive SL $4.70

TP Range $9.5 to $22.4

Long-Term TP Up to $45+

Use scaled take-profits to secure gains gradually and reduce risk.

🧠 Market Sentiment & Psychology:

Sentiment is slowly shifting from fear to anticipation. Long-term accumulators and institutional players often target setups like this — low prices with solid structure and untapped upside. If breakout confirms, ICP could become one of the top-performing altcoins of the next cycle.

> “Accumulation is where smart money buys. Breakout is where the public chases.”

📌 Final Thoughts:

ICP/USDT is at its most critical point in over two years. A confirmed breakout from this long-standing base could be the launchpad for a multi-stage rally. This is a setup worth watching closely — or acting on with tight risk control.

#ICPUSDT #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #WyckoffAccumulation #LongTermSetup #CryptoReversal #BullishCrypto #ICPAnalysis #AltcoinSeason #BreakoutTrade #Cryptocurrency

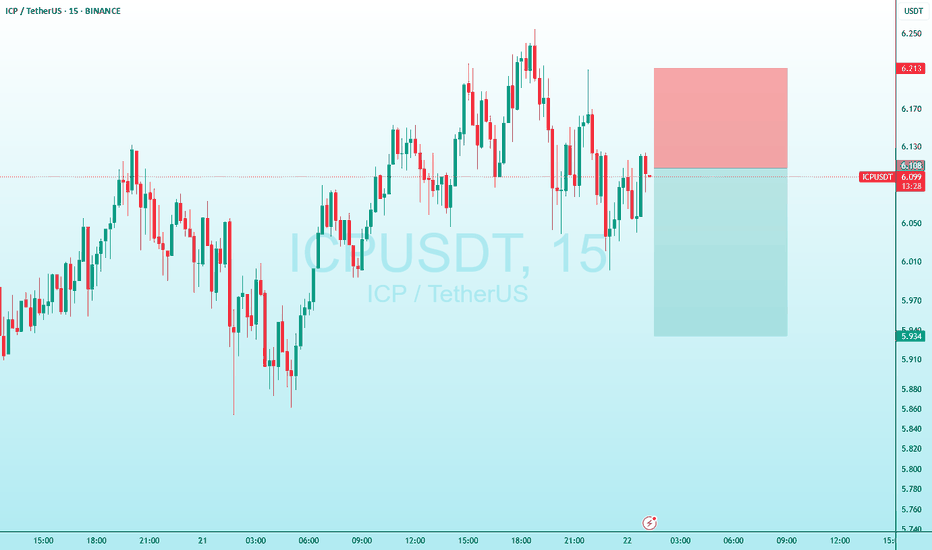

#ICP/USDT#ICP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 5.85.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 6.04

First target: 6.13

Second target: 6.28

Third target: 6.50