USOIL Price Action: FVG Rebalance After Liquidity GrabUSOIL shows a classic smart money sequence starting with an impulsive bullish move, followed by distribution near premium prices. Price tapped into a bearish Fair Value Gap (FVG) near the highs, which acted as a strong institutional supply zone, triggering a sharp sell-off.

After the rejection, the market delivered a clean liquidity sweep below previous equal lows, trapping late sellers. Price is now consolidating inside a discount demand zone, forming a base — a strong indication of accumulation by smart money.

The lower FVG below price remains unfilled, suggesting a potential dip to rebalance inefficiency before continuation. The projected path highlights a stop-hunt → higher low → impulsive bullish leg, targeting the previous premium imbalance zone.

Market structure remains bullish on higher timeframes, and current price action favors a buy-the-dip strategy rather than chasing shorts.

🎯 Key Levels to Watch

Demand Zone: 60.00 – 61.00

Liquidity Sweep Area: Below 61.00

Bullish Target: 64.80 – 65.50

Invalidation: Clean break below 59.80

🧠 Smart Money Insight

✔ Liquidity grab completed

✔ Discount pricing achieved

✔ FVG magnet above price

✔ Structure favors upside

This setup aligns perfectly with SMC, ICT, and price action traders looking for high R:R reversal trades.

Ict

BUY XAUUSDGold is approaching a key demand zone around 4672 after an extended short-term sell-off, where price previously reacted and liquidity is likely resting. This area sits near structural support and comes after bearish momentum that looks stretched, making it a logical place for buyers to step in if rejection appears. If price slows into the zone and prints bullish reaction candles or a short-term structure shift on lower timeframes, it would support a corrective rebound toward the higher resistance area marked above, favoring a tactical long setup rather than chasing the breakdown lower.

SELL XAUUSDGold is showing short-term bearish signs after being rejected from a key supply zone and failing to break above a descending trendline. Price is forming lower highs, struggling around the moving averages, and the recent bounce from support looks corrective rather than impulsive, suggesting sellers remain in control. With multiple technical factors aligning—trendline resistance, EMA rejection, and weak bullish momentum—the probability favors a short-term continuation lower unless price can reclaim those resistance levels decisively.

USDJPY FREE SIGNAL|SHORT|

✅USDJPY taps into a premium supply PD array after a strong rally. Bearish displacement and rejection suggest distribution, with downside continuation toward sell-side liquidity below recent lows.

—————————

Entry: 157.04

Stop Loss: 157.95

Take Profit: 155.76

Time Frame: 5H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

NZDUSD BEARISH BREAKOUT|SHORT|

✅NZDUSD strong bearish displacement breaks below the prior supply PD array, confirming market structure shift. Expect a shallow retracement into the breakout zone before continuation toward sell-side liquidity. Time Frame 2H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

GBPUSD – Community Update (H4 Perspective)

his move didn’t happen overnight.

For almost two weeks, we’ve been breaking this structure down on H4, step by step, before price ever delivered what you’re seeing now.

Here’s the progression 👇

• We identified the H4 pivot high as our first point of interest

• From there, we tracked price respecting internal range structure

• Liquidity was clearly sitting below, and price kept reacting exactly as anticipated

• Entry was refined on H4, not emotion, not patterns alone

Fast forward to now 👇

Price is currently trading inside discount, aligned with:

✔️ Weekly discount

✔️ H4 internal range liquidity

✔️ Daily internal range liquidity

This is not randomness — this is context + patience + execution.

---

What we expect next

From this discount zone, we’ll be watching how price reacts to:

• Internal liquidity objectives

• Short-term retracements vs continuation

• Whether displacement confirms continuation or redistribution

No rush. No forcing trades.

We let price prove itself, just like it has been doing for the past two weeks.

---

Reminder to the community

Everyone sees the market differently.

Some wait. Some act early.

What matters is having a reason, not following the crowd.

Simple. Patient. Disciplined.

— Dr Algo

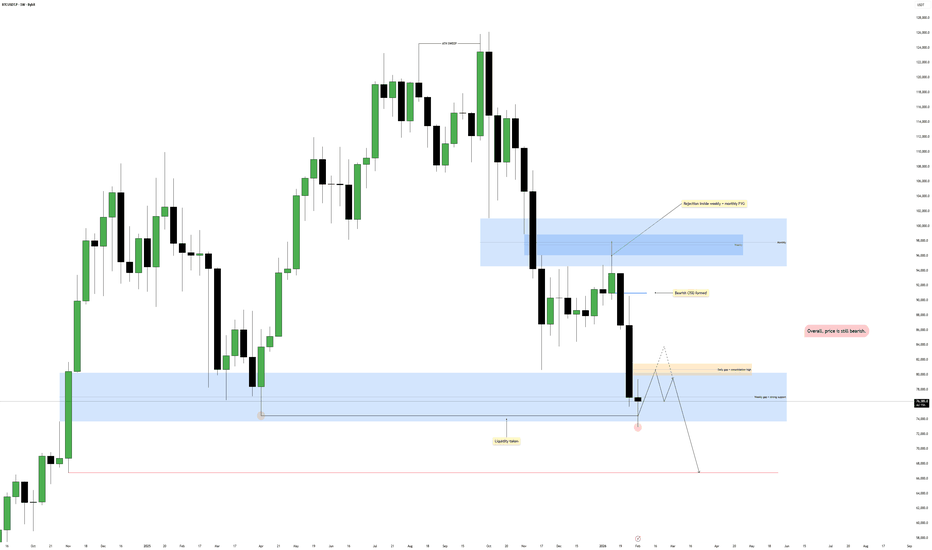

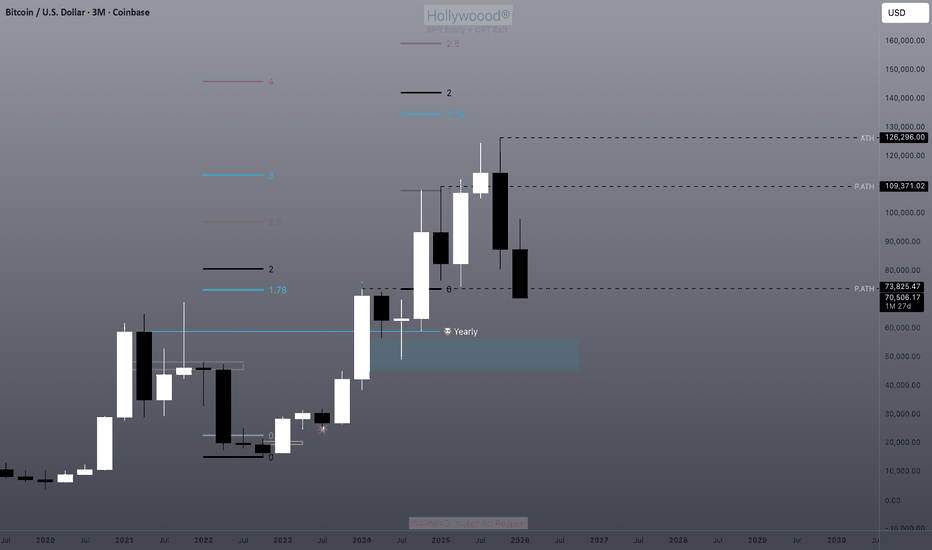

Bitcoin - Sweep, Reclaim, Then Continuation Lower?Higher Timeframe Context

Price continues to respect a broader bearish structure, with lower highs forming after the previous distribution phase. The recent downside expansion did not occur randomly, it aligned with higher timeframe weakness and persistent sell-side pressure. Even though support has reacted before, the overall order flow still favors sellers until proven otherwise. This keeps any upside move categorized as corrective rather than a true shift in trend.

Liquidity Event and Support Reclaim

The key technical development here is the sweep of a weekly low followed by a close back above it and inside a strong weekly support zone. This type of behavior often signals engineered liquidity rather than genuine acceptance below the level. When price quickly reclaims support after taking stops, it typically creates the fuel for a relief move, as trapped shorts begin to cover and responsive buyers step in.

Short-Term Repricing Potential

With liquidity now collected from below, price has room to rotate higher in the near term. The path above contains inefficiencies that remain unfilled, particularly the daily imbalance that sits overhead. Markets tend to revisit these gaps as part of delivery, especially after a sweep and reclaim sequence. In addition, a cluster of lower timeframe consolidation rests in that same region, making it an attractive draw for price before any larger directional decision.

Confluence With Lower Timeframe Targets

The projected push higher is not expected to mark a bullish reversal, but rather a controlled retracement into areas where liquidity is resting. A sweep of the intraday consolidation would effectively reset positioning and potentially provide higher timeframe sellers with improved entry locations. When corrective rallies move into imbalance while the macro structure remains bearish, they often transition into continuation legs once the rebalancing is complete.

Why The Bearish Bias Remains Intact

Despite the strong reaction from support, nothing in the current structure suggests a confirmed shift in market direction. The broader pattern still points downward, and rallies should be viewed through the lens of distribution until market structure decisively changes. If price delivers into the overhead targets and begins to show rejection, it would reinforce the idea that the recent reclaim was simply a setup for continuation rather than accumulation.

Conclusion

The sweep and reclaim of weekly support opens the door for a temporary move higher, primarily driven by imbalance fills and liquidity resting within nearby consolidations. However, with the higher timeframe structure still leaning bearish, the expectation is for this relief rally to eventually exhaust itself and transition into another leg lower.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

No NFP TomorrowHi, I’m Maicol, an Italian trader.

I study Gold since 2019.

I need your support.

Leave a like and follow me.

It’s a small thing for you, but important for my work.

Please read the description to understand the trading plan.

Don’t focus only on the chart. Thanks.

Live today at 14:00 CET (Rome time).

🌞 GOOD MORNING EVERYONE 🌞

Gold can’t close the daily above the main shift.

At this point, the chance of a move back to lower zones is high.

So I’ll look to target those areas.

We have three TF — D, H4, H1 — all with a bearish setup.

It makes sense to follow that for now.

See you live later today.

🔍 Reminder 🔍

I avoid trading during the Asian and London sessions.

I focus on the 14:30 news and the New York open at 15:30.

🔔 Turn on notifications so you don’t miss anything.

📬 If you have any questions, message me. I’ll reply.

🔍 NEXT APPOINTMENTS 🔍

As usual, we’ll be live at 14:00 to follow the market in real time.

In the meantime, have a good day.

-GOOD TRADING

-MANAGE RISK

-BE PATIENT

GOLD 05/02 – SMC H2 MAP | FILL LIQUIDITY 47XX NOW!Gold had a strong drop to the Fib 0.382 area and then quickly rebounded. Gold prices are reacting at the Fib 0.5 H2 + FVG confluence area. The next direction will depend on whether the price is accepted or rejected at these key areas.

BRIEF CONTEXT

The market remains sensitive to USD and interest rate expectations, so intraday liquidity sweeps occur frequently. Macroeconomic instability helps gold avoid a direct collapse, but it's not strong enough to reverse the short-term structure.

➡️ This explains why there are quick drops – quick rebounds – but the range remains locked.

TECHNICAL STRUCTURE H2

The larger structure is still bearish after CHoCH from the peak. The current upward movement is considered a pullback in the downtrend. Fib 0.5 H2 is acting as a balance area, not a trend confirmation area.

ROUTE MAP – PRICE AREAS TO WATCH

🔴 UPPER AREA

👉 5000 – 5050

Fib 0.5 → 0.618 H2

FVG H2

Technical retracement area in the downtrend structure

➡️ If the price retraces here but is not accepted, the upward movement is just a retracement to continue the decline.

👉 5200 – 5250

Fib 0.786 H2

FVG above

Only if the price breaks and holds above this area will the intraday downtrend structure be invalidated.

🟢 LOWER AREA

👉 4920 – 4950

Fib 0.5 H2 + FVG

Balance area, prone to two-way tug-of-war

👉 4800 – 4820

Fib 0.382 H2

Area where the drop and rebound just occurred

👉 4650 – 4700

FVG + demand H2

Next support area if bearish returns

👉 4550 – 4600

Liquidity low

Only activated when the downward momentum expands strongly

HOW WE READ & TRADE ON 05/02

Scalp: according to price reaction at 0.382 – 0.5 – FVG H2, especially during the European session.

Do not FOMO with the rebound – strong reaction does not mean reversal.

Swing: only follow structure acceptance, do not predict emotions.

Let the market speak the truth when it hits important areas. LucasGrayTrading will continue to update when the price gives clearer signals during the day.

— LucasGrayTrading

Smart Money Are Hedging While Seasonality Turns BearishThe Nasdaq is entering a technically delicate phase where positioning, seasonality, and price structure are beginning to converge toward a potential corrective scenario rather than trend continuation.

Starting with the Commitment of Traders, a configuration is emerging that deserves close attention. Non-commercial traders — typically speculative money — remain net long with 89,479 long contracts versus 61,324 shorts, confirming that the broader positioning is still structurally bullish. However, the latest weekly change highlights a reduction in risk exposure, with an increase in short positions alongside a contraction in total open interest. This is not yet an outright bearish signal, but it clearly reflects de-risking behavior following an extended bullish cycle.

Even more significant is the positioning of commercial hedgers, who are heavily net short (170,046 shorts vs 128,486 longs). Historically, when commercials expand downside hedges near elevated price zones, it tends to reflect institutional protection rather than directional speculation, a dynamic typically associated with the mature stages of a trend.

Seasonality further reinforces this cautious tone. February often shows strength in the early part of the month, followed by weakness into the mid-to-late period, and the multi-year composite currently projects negative average performance. After the strong fourth-quarter rally, supported by election-cycle liquidity and continued leadership from the technology sector, the market is now entering a statistically softer window where pullbacks become more likely than impulsive breakouts.

Shifting to the daily chart, price has recently lost the lower boundary of the ascending channel, suggesting early signs of momentum exhaustion. The rejection from the upper structure followed by an impulsive decline confirms that buyers no longer have full control of the market.

The key technical area now sits within the 23,800–24,000 demand zone, which also aligns with trendline support visible on higher timeframes. This is the level where institutional participation is most likely to re-emerge.

Until strong bullish acceptance returns, rebounds may increasingly offer tactical short opportunities rather than breakout entries.

Operational bias: bearish in the short term / bullish in the medium term as long as the broader structure remains intact.

QQQ - 4 Feb 2026 Update - Sweeps completed - Observation Mode

Hey everyone, JP Quintero here

Over the past few weeks, I’ve been sharing some of my personal ideas, key levels, and structures on a few tickers and ETFs.

Quick background: I’ve been studying and trading the markets for about 5 years now. Over the past couple of years, I went through 2 solid mentorships, and after that my focus became much clearer. Today, I base most of my trading, especially options, on liquidity concepts, order flow, ICT principles, and market structure. I don’t trade news, indicators, or classic chart patterns. I only use those to understand where retail liquidity is likely sitting and to understand a bit the retail Psychology.

What I actually trade is institutional sweeps, absorption, and follow-through with intent.

Back to my January 28th QQQ post

That day, I mentioned I had closed my remaining positions, both bull put spreads structured around the 600 area. These were trades I had put on a couple of weeks before, and one about a week prior to the 28th.

The reason I stepped aside was simple. After a strong multi-day rally, I started seeing clear signs of deceleration around 635–636, along with a wick and liquidity sweep at the last all time highs. Typical behavior after extended moves, price often leaves imbalances behind and then price comes back to fix those gaps.

So I closed the trades and decided to observe. And that’s exactly what played out. Price pulled back and swept the zones I had highlighted on my last post:

The 626 imbalance / FVG

The 616 imbalance

The 607–608 liquidity zone

Today, price finally tagged 600, right where my previous trades were structured. After the market close, i saw price bounce back toward the 609 afterhours, but it will most probably retrace a bit back tomorrow at opening.

At the moment, there’s no strong bearish conviction, but also no clear bullish conviction either.

If we had closed decisively below 600, I’d be leaning much more bearish. For now, this still looks like a range and rebalancing phase after the strong run-up.

I’m still not convinced enough to put on any position right now BUT

If I had to choose something, it would be a bull put spread around the 580 area (sell 580 / buy 575 or 570), but I’m far from 100% on that idea.

Over the next couple of sessions Thursday and Friday I’m watching two main scenarios:

A clear buying reaction at 600 (rejection candle, volume, higher low forming), which could create a reasonable setup around 580

Or a continued drift lower with no real defense, pointing to a slower range or mild bearish bias

Nothing is clear at this point. There’s no high-probability edge in either direction.

Plan is straightforward to Wait and Observe.

as i always this is not a recommendation. This post is part of my personal trading journal.

It’s also worth mentioning that there’s a clear sector rotation happening, capital moving out of large cap tech, growth, and AI names into energy, industrials, value, and small caps. That rotation is adding extra pressure to the Nasdaq and the Qs

Bottom line: Sweep down to 600 completed, No clear direction yet, Full observation mode!

i have a couple alerts already in place

Thanks a lot for taking the time to read my post, really appreciate it! Over the next few weeks, I’m planning to start sharing ideas in VIDEO format here on TradingView. I’ve been asked a few times what indicators or systems I use, and honestly, I use very few indicators. My trading is simple and uncluttered, focused primarily on liquidity. I’ll be explaining this more in short videos soon.

If you have any questions, feedback, or want to understand my approach in more depth, feel free to reach out. I answer to all questions every time for FREE your feedback helps me grow, and we both learn in the process. likes(boosts) and comments supper appreciated also :D

See you in the next update.

Stay clear and disciplined.

God bless

MNQ Daily Analysis - Tuesday February 3 2026 part 2solid again. 3-1-1 / +$336.

all 1 MNQ trades.

------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis - Tuesday February 3 2026 part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis - Monday February 2 2026 part 2bangarang. 3-1 / +$375.

all 1 MNQ trades.

-----------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis - Monday February 2 2026 part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

SILVER FREE SIGNAL|LONG|

✅SILVER taps into a key demand PD array after a sharp sell-off, followed by bullish displacement. Structure shift suggests smart money defending discounted levels, targeting buy-side liquidity above recent highs.

—————————

Entry: 86.00$

Stop Loss: 82.67$

Take Profit: 90.30$

Time Frame: 1H

—————————

LONG🚀

✅Like and subscribe to never miss a new idea!✅

CHFJPY BULLISH BREAKOUT|LONG|

✅CHFJPY strong bullish displacement breaks above the prior demand zone, confirming market structure shift. Expect a shallow retracement into the breakout area before continuation toward premium liquidity. Time Frame 3H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅